-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA OPEN: Mixed House Price Data, Consumer Conf Rises

- MNI US: VP Harris Strengthens In Polling Ahead Of Trump Debate

- MNI US DATA: Labor Differential Continues To Imply Upward Pressure On U/E Rate

- MNI US DATA: Richmond Mfg At 2008/09 Levels But ISM Seen Increasing

- MNI US DATA: Mixed House Prices, Still Somewhat Resilient To Relative Supply Build

US TSYS Extending Late Session Highs

- Initially led by the short end after London went home, shorts continue to unwind in late trade after the decent Treasury 2Y auction stopped through .6bp.

- The Sep'24 10Y contract trades at a session high of 113-19 (unch) compared to 113-30.5 early overnight. Initial technical resistance at 114-03/114-16 (High Aug 6 / 76.4% of the Aug 5 - 8 pullback).

- Curves twist steeper with the short end outperforming, 2s10s currently +4.328 at -7.860 after dis-inverting briefly on August 5 to +1.475. The 5s30s curve currently +3.032 at 46.715.

- In conjunction with the creeping short end bid -- projected rate cut pricing through year end has gained vs. early Tuesday levels: Sep'24 cumulative -34.1bp (-31.8bp), Nov'24 cumulative -67.4bp (-64.7bp), Dec'24 -104.6bp (-99.2bp).

- Heavy session Tsy futures volumes tied to Sep'24/Dec'24 roll efforts, 2s near 80% complete, 10s 70% complete.

- Looking ahead to Wednesday: data limited to MBA Mortgage Applications at 0700ET. US Treasury auctions include $28B 2Y FRN re-open (91282CLA7) and 17W Bill sales at 1130ET, $70B 5Y note sale (91282CLK5) at 1300ET.

- Scheduled Fed speak includes Fed Gov Waller at a payments conf in Mumbai (text, Q&A) at 0115ET while Atl Fed Bostic will discuss his economic outlook (no text, Q&A) later in the evening at 1800ET.

NEWS

US (MNI): Harris Strengthens In Polling Ahead Of Trump Debate

NPR has published analysis of swing state polling averages, finding that Vice President Kamala Harris has now taken "a consistent though narrow lead" in Wisconsin, Michigan, and Pennsylvania. NPR notes that Trump holds a slight lead in Georgia, with North Carolina, Nevada, and Arizona all within a 1-point margin. Harris' polling has received a slight bump from the Democratic National Convention. The New York Times national polling average shows Harris now leads Trump by three points nationally. In other polling averages, including 538, DDHQ, and Nate Silver's - Harris leads in national polling by around four points.

US (MNI): Tight Polling In Maryland And Texas Broadens Senate Map

A string of new state-level polls suggest that the race for control of the Senate may be scrambled by tighter-than-expected races in Maryland and Texas. A bipartisan AARP poll found that former Maryland governor Larry Hogan (R) is tied with Democrat Angela Alsobrooks (D) in the race for the open Maryland Senate seat of outgoing Senator Ben Cardin (D-MD).

UK (MNI): PM Starmer-"Things Will Get Worse Before They Get Better":

Prime Minister Sir Keir Starmer is currently delivering a televised addressin the Downing St. rose garden, under the heading of 'fixing the foundations' of the United Kingdom. Starmer is using the address as an opportunity to set the political landscape before what is expected to be an autumn of tough economic decisions for the gov't.

FRANCE (MNI): Macron To Resume PM Talks After Ruling Out Leftist Gov't:

President Emmanuel Macron is set to resume talks today (27 Aug) with political leaders as he seeks to find a way through an extremely difficult political situation.

UKRAINE (MNI): Russia Pulling Troops To Kursk, But Crucial Povrovsk Could Fall Soon:

Wires carrying comments from Ukraine's Commander-in-Chief Oleksandr Syrskyi regarding the situation both in the Donbas and in Russia's Kursk oblast. Syrskyi claims that Russia has 'decreased activity in the south as it pulled troops to Kursk'.

RUSSIA (MNI): Belgorod Gov. Reports Ukrainian Troops Trying To Break Through In Region:

Vyacheslav Gladkov, Governor of Russia's Belgorod oblast posted a statement on 27 Aug claiming "There is information that [Ukrainian forces are] trying to break through the border of the Belgorod region.

ISRAEL (MNI): Situation On Lebanese Border Appears To Recede From All-Out War:

A major escalation in drone, rocket, and missile exchanges between Israel and Hezbollah along the Lebanese border on 25 August risked the outbreak of a potentially devastating all-out war between the two sides.

THAILAND (MNI): New Gov't Will Not Include Military-Linked PPRP-PTP Spox:

Pheu Thai Party (PTP) spox Sorawong Thienthong has said that the right-wing military-backed Palang Pracharath Party (PPRP) will not sit as part of PM Paetongtarn Shinawatra's new coalition gov't. The PPRP has sat as part of gov't since its foundation prior to the 2019 legislative elections, the first since the 2014 military coup d'etat.

OVERNIGHT DATA

US DATA (MNI): Mixed House Prices, Still Somewhat Resilient To Relative Supply Build

FHFA house prices surprisingly dipped -0.07% M/M (SA, cons 0.1) in June after a marginally upward revised 0.02% (initial -0.02%). Prices have on balance flatlined in the latest two months to June and have seen M/M declines twice in the past six months (although 1H24 also saw a 1.3% jump in Feb).

- S&P CoreLogic house prices in the 20-city measure meanwhile increased by more than expected with 0.42%M/M (SA, cons 0.30) after an upward revised 0.39% (initial 0.34) in May.

- The two series show some further moderation in Y/Y growth (FHFA 5.2% Y/Y from a recent peak of 6.9%, CoreLogic 6.4% Y/Y from a recent peak of 7.5%) but both are holding up well considering the increase in relative supply over the past twelve months back to pre-pandemic levels for existing home sales and more broadly for new home sales.

- Recent trends are however showing a little more cooling, especially for the FHFA at 3.2% annualized (3m/3m) compared to the 5.1% in the 20-city S&P CoreLogic.

US DATA (MNI): Labor Differential Continues To Imply Upward Pressure On U/E Rate

The Conference Board consumer survey saw overall confidence surprise higher again, this time to 103.3 (cons 100.9) in August after an upward revised 101.9 (initial 100.3) for its highest since Feb. However, its labor differential fell further to 16.4 from a downward revised 17.1 (initial 18.1) – of added significance considering the latest dialing up of attention on labor data.

- The July decline had forewarned an increase in the unemployment rate back in July and this further decline sets a fresh low since Mar 2021 (back at 2017 levels for a pre-pandemic comparison).

- We’d caution trying to directly read what it means for the unemployment rate, but on its own it doesn’t make the step higher to 4.25% in July look overly out of place.

- Within the details, the share seeing jobs as hard to get was little changed at 16.4% after an upward revised 16.3 (initial 16.0%), whilst the perception seeing plentiful jobs fell to 32.8% from 33.4 (initial 34.1) for also a fresh low since Mar 2021.

US DATA (MNI): Richmond Mfg At 2008/09 Levels But ISM Seen Increasing

The Richmond Fed manufacturing index fell from -17 to -19 in August, disappointing a sample of just four analysts looking for -14. By nudging lower, it set a fresh low since Apr/May 2020 and before that 2008/09.

- New orders fell from -23 to -26 to push below -23/-24 readings from late 2022/1H23 for also back at levels only seen in the pandemic or 2008/09.

- This release rounds out a month of mixed regional Fed mfg surveys: Philly sharply corrected lower after spiking in July (-7.0 after +13.9), Richmond maintained prior weakness (-19 after -17), Empire has been unusually stable in the last three months (-4.7 after -6.6) whilst Kansas (-3 after -13) and Dallas (-9.7 after -17.5) both improved from weak July readings.

- Taken together, they imply that the ISM mfg’s decline from 48.5 to 46.8 looks outsized, and indeed consensus look for a partial recovery to 47.9 for the Sep 3 release.

- Looking at new orders across regions, Richmond sees stand out weakness (possibly at least partly linked to Boeing’s cancellation in June, although national aircraft orders did bounce in latest July durable goods data) but equally the Philly Fed strength also looks in isolation.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 8.57 points (0.02%) at 41248.8

- S&P E-Mini Future up 8.25 points (0.15%) at 5645

- Nasdaq up 40.7 points (0.2%) at 17765.91

- US 10-Yr yield is up 1.3 bps at 3.8292%

- US Sep 10-Yr futures are down 2/32 at 113-17

- EURUSD up 0.0022 (0.2%) at 1.1184

- USDJPY down 0.51 (-0.35%) at 144.02

- WTI Crude Oil (front-month) down $1.75 (-2.26%) at $75.67

- Gold is up $5.97 (0.24%) at $2524.12

- European bourses closing levels:

- EuroStoxx 50 up 2.09 points (0.04%) at 4898.78

- FTSE 100 up 17.68 points (0.21%) at 8345.46

- German DAX up 64.79 points (0.35%) at 18681.81

- French CAC 40 down 24.59 points (-0.32%) at 7565.78

US TREASURY FUTURES CLOSE

- 3M10Y +4.103, -128.15 (L: -138.063 / H: -125.322)

- 2Y10Y +4.773, -7.415 (L: -12.573 / H: -6.846)

- 2Y30Y +5.063, 21.873 (L: 16.059 / H: 22.863)

- 5Y30Y +2.935, 46.618 (L: 43.174 / H: 47.518)

- Current futures levels:

- Sep 2-Yr futures up 1.75/32 at 103-12.5 (L: 103-09 / H: 103-12.875)

- Sep 5-Yr futures up 1/32 at 109-5.75 (L: 108-31.25 / H: 109-07)

- Sep 10-Yr futures down 2.5/32 at 113-16.5 (L: 113-08.5 / H: 113-20.5)

- Sep 30-Yr futures down 11/32 at 124-6 (L: 123-20 / H: 124-21)

- Sep Ultra futures down 14/32 at 132-17 (L: 131-25 / H: 133-06)

US 10YR FUTURE TECHS: (U4) Bullish Trend Structure

- RES 4: 115-30+ 2.764 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 115-17 2.618 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 115-03+ High Aug 5 and the bull trigger

- RES 1: 114-03/114-16 High Aug 6 / 76.4% of the Aug 5 - 8 pullback

- PRICE: 113-14 @ 11:04 BST Aug 27

- SUP 1: 113-00+ 20-day EMA

- SUP 2: 111-31 50-day EMA values

- SUP 3: 111-06+ Low Jul 29

- SUP 4: 110-18+ Low Jul 22

A bullish theme in Treasuries remains intact and the contract continues to trade above support. Note that moving average studies are in a bull-mode position and this highlights bullish sentiment. The recent breach of 111-01, Jun 14 high, confirmed a resumption of the uptrend, maintaining the price sequence of higher highs and higher lows. Sights are on 115-17, a Fibonacci projection. Support to watch is 113-00+, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 +0.015 at 95.093

- Dec 24 +0.035 at 95.795

- Mar 25 +0.040 at 96.310

- Jun 25 +0.035 at 96.615

- Red Pack (Sep 25-Jun 26) +0.010 to +0.030

- Green Pack (Sep 26-Jun 27) -0.005 to +0.005

- Blue Pack (Sep 27-Jun 28) -0.015 to -0.005

- Gold Pack (Sep 28-Jun 29) -0.025 to -0.015

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00050 to 5.25213 (-0.08017 total last wk)

- 3M +0.00088 to 5.06109 (-0.06732 total last wk)

- 6M -0.00549 to 4.74244 (-0.09176 total last wk)

- 12M -0.02341 to 4.23762 (-0.12757 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.01), volume: $2.039T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $787B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $766B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $94B

- Daily Overnight Bank Funding Rate: 5.33% (+0.01), volume: $264B

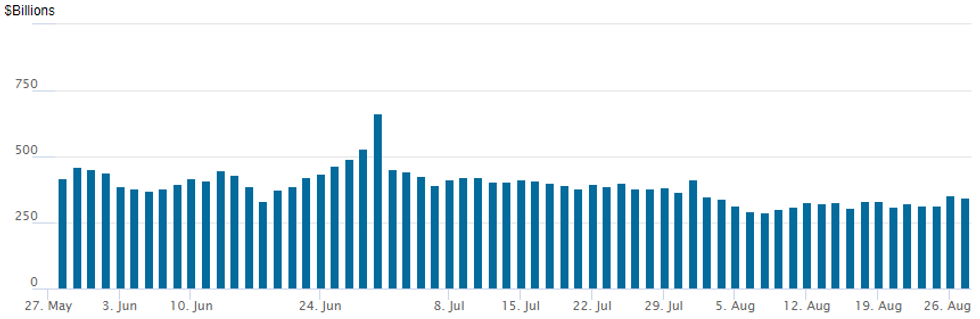

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes to $344.045B from $353.557B Monday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties at 68 from 63 prior.

PIPELINE $1.25B Allianz Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 8/27 $1.25B #Allianz 30NC10 5.6%

- 8/27 $500M #BOC Aviation 7Y +105

- Expected Wednesday:

- 8/28 $Benchmark Osterreichische Kontrollbank (OKB) 5Y SOFR+44a

- 8/28 $Benchmark Export Development Canada (EDC) 3Y SOFR+33a

- 8/28 $Benchmark Province of Quebec 10Y +90a

BONDS: EGBs-GILTS CASH CLOSE: Long-End Fully Reverses Jackson Hole Rally

European curves bear steepened Tuesday, as last Friday's rally continued to reverse.

- Weakness across European FI had no single obvious catalyst, with higher natural gas prices and bond issuance cited as factors.

- UK yields jumped from the open in the return from Monday's holiday closure, with Bunds weakening in steady fashion throughout the day, continuing the prior session's weakness.

- This left longer-end yields above levels seen just before last Friday's dovish Jackson Hole speech by Fed Chair Powell.

- Short-end yields have retained some of their fall, however: BoE Gov Bailey's comments at Jackson Hole last Friday pointed to a "steady" course, seemingly downplaying potential for sequential cuts.

- Periphery EGB spreads widened. BTPs were notable underperformers, with supply apparently weighing (Short-Term sales today, M-T/L-T auction Thursday).

- Wednesday's schedule includes French consumer confidence data and the ECB's monthly Eurozone monetary developments report, as well as a speech by BoE's Mann.

- The main focus of the week remains Eurozone inflation data on Thu/Fri.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at 2.404%, 5-Yr is up 2.4bps at 2.186%, 10-Yr is up 4bps at 2.288%, and 30-Yr is up 5.4bps at 2.537%.

- UK: The 2-Yr yield is up 4.3bps at 4.109%, 5-Yr is up 5.4bps at 3.911%, 10-Yr is up 5.9bps at 3.998%, and 30-Yr is up 6.1bps at 4.51%.

- Italian BTP spread up 3.2bps at 138bps / Spanish up 1.9bps at 81.8bps

FOREX: USD Index Loses Ground as US Front-End Yields Drop

- The US dollar steadily edged lower across Tuesday’s US session, mirroring the move seen in front-end yields in the US. As such, USDJPY has dipped below the 144 handle, extending its pull lower to around 125 pips from the earlier session highs.

- USDJPY conditions remain bearish, with the market seemingly willing to continue to sell dollar rallies and supports remained well defined at 143.45 and 141.70, the Aug 5 low.

- EURUSD sees some late strength, extending above the European peak to print a 1.1191 high, although daily ranges remain much more contained here.

- GBP continues to be among the best performers in G10, with GBP/USD's 1.3265 print today the highest since March 2022. GBP/USD's bull run sees higher highs printed in 12 of the past 14 sessions and spot has bridged the gap to its next target at 1.3261. Above here, attention will be on 1.3328, the 76.4% retracement of the Jun 2021 - Sep 2022 bear leg.

- Elsewhere, strength has also been seen for the likes of the Swiss Franc and Kiwi, which outperform in G10, amid the path of least resistance remaining lower for the greenback and the continued stable backdrop for major equity benchmarks.

- Australian CPI data is the major data point Wednesday, before Eurozone inflation data takes focus later in the week.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 28/08/2024 | 0130/1130 | *** |  AU AU | Quarterly construction work done |

| 28/08/2024 | 0130/1130 | *** |  AU AU | CPI Inflation Monthly |

| 28/08/2024 | 0600/1400 | ** |  CN CN | MNI China Liquidity Index (CLI) |

| 28/08/2024 | 0645/0845 | ** |  FR FR | Consumer Sentiment |

| 28/08/2024 | 0800/1000 | ** |  EU EU | M3 |

| 28/08/2024 | 0900/1000 | * |  GB GB | Index Linked Gilt Outright Auction Result |

| 28/08/2024 | 1100/0700 | ** |  US US | MBA Weekly Applications Index |

| 28/08/2024 | 1430/1030 | ** |  US US | DOE Weekly Crude Oil Stocks |

| 28/08/2024 | 1530/1130 | ** |  US US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/08/2024 | 1700/1300 | * |  US US | US Treasury Auction Result for 5 Year Note |

| 28/08/2024 | 2200/1800 |  US US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.