-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI ASIA OPEN: Myriad Fed Speak, Rosengren Favors Longer Duration

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed's Rosengren Favors Longer QE Duration

- MNI BOSTON FED ROSENGREN: PREFER TO LENGTHEN DURATION OF TSY BUYS

- MNI BOSTON FED ROSENGREN: ADDITIONAL QE MAY BE NEEDED WITH WEAK 6 MOS AHEAD

- MNI EXCLUSIVE:US Hiring Dimmed by Skills Mismatch, Covid Worry

- MNI BRIEF: Boston Fed Rosengren Calls For Tougher Bank Regulations

- MNI EXCLUSIVE: Covid Vaccine Could Smooth Recovery-ECB Sources

- EU: Council, Parliament Reach Agreement On Budget & COVID-19 Recovery Package

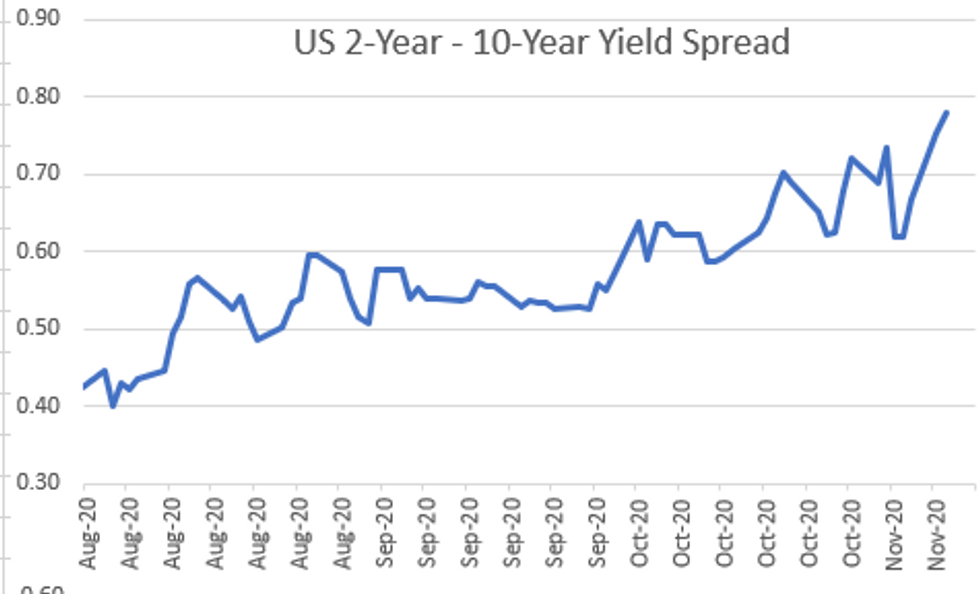

Yield Curves Continue To Steepen

US

FED: Boston Federal Reserve President Eric Rosengren told MNI Tuesday he would prefer to see the Fed lengthen the average duration of its Treasuries purchases rather than increase buying, adding that more QE overall may be "advantageous" if longer rates rise amid a challenging next six months.

US: Companies are having a harder time hiring as laid-off service workers lack the skills needed in the more stable goods-producing sector, while fear of contracting Covid-19 deters people from searching for work, recruiters and industry experts told MNI.

- Employers through October struggled to fill available positions or attract applicants, even with a lot of people still out of work, said Mike Brady, who owns a staffing company in Jacksonville, Florida. "For us, there's definitely more job openings than there are people to fill them," he said. For more see 11/10 main wire at 1327ET.

FED: Boston Fed President Eric Rosengren on Tuesday urged a more proactive supervisory and financial stability stance to prevent financial imbalances from ratcheting up the severity of economic downturns as the Fed sets to hold low rates for an extended period.

- "Easy monetary policy requires more guardrails protecting against rising financial instability risks. Without financial stability governance and tools, recessions have the potential to be more severe and fall disproportionately on those that can least afford it," Rosengren said in a speech at the UBS European Virtual Conference 2020.

EUROPE

EU: News that a Covid-19 vaccine was 90% effective in Phase 3 trials boosts confidence and could herald a smoother eurozone recovery in 2021, but will have little effect on European Central Bank preparations for additional December easing, ECB sources told MNI. For more see 11/10 main wire at 1149ET.

EU: Following four months of talks, negotiators for the European Council and the European Parliament have seemingly reached a deal on the next long-term budget (multiannual financial framework, MFF) and the COVID-19 recovery package contained within it.

- In order to come into force next year both the Council (formed by member state leaders) and the plenary session of the European Parliament will have to approve the deal.

- The centre-right European People's Party, the largest political grouping in the Parliament tweeted that it had achieved its following objectives: "More money for flagship programmes, Binding commitment from EU countries to introduce own resources, Rule Of Law conditionality, EP has say on Next Generation EU [MFF] spending".

- Level of strictness on rule of law provisions will be interesting to see. If they are watered-down it will seem that Poland and Hungary's threat of a veto proved effective in getting the EU to back down. If they are robust then it would seem both nations viewed the securing of EU funds as more important than pursuing some current domestic policies that have resulted in deteriorating relations with Brussels.

OVERNIGHT DATA

US BLS: JOLTS OPENINGS RATE 6.436M IN SEP

US BLS: JOLTS QUITS RATE 2.1% IN SEP

US REDBOOK: NOV STORE SALES -1.2% V OCT THROUGH NOV 07 WK

US REDBOOK: NOV STORE SALES +1.1% V YR AGO MO

US REDBOOK: STORE SALES +1.1% WK ENDED NOV 07 V YR AGO WK

MARKETS SNAPSHOT

- DJIA up 262.95 points (0.9%) at 29368.14

- S&P E-Mini Future up 2.25 points (0.06%) at 3545.5

- Nasdaq down 159.9 points (-1.4%) at 11628.69

- US 10-Yr yield is up 3.4 bps at 0.9578%

- US Dec 10Y are down 2.5/32 at 137-16

- EURUSD down 0.0004 (-0.03%) at 1.182

- USDJPY down 0.08 (-0.08%) at 105.32

- WTI Crude Oil (front-month) up $1.1 (2.73%) at $41.09

- Gold is up $9.98 (0.54%) at $1880.77

- European bourses closing levels:

- EuroStoxx 50 up 34.71 points (1.02%) at 3442.62

- FTSE 100 up 110.56 points (1.79%) at 6296.85

- German DAX up 67.14 points (0.51%) at 13163.11

- French CAC 40 up 82.65 points (1.55%) at 5418.97

US TSY SUMMARY: Tsy Bounce Off Boston Fed Rosengren Duration Comments

Another heavy volume session (TYZ near 2mm), Tsys only marginally mixed, however, long end bounced off late session lows on Boston Fed Rosengren exclusive interview comments after the bell: MNI: FED'S ROSENGREN: PREFER TO LENGTHEN DURATION OF TSY BUYS; ADDITIONAL QE MAY BE NEEDED WITH WEAK 6 MOS AHEAD.

- Yield curves in shorts to intermediates held steeper profiles even as long end futures outperformed. Myriad other Fed speakers issued more prosaic statements (Dal Fed Kaplan: lack of fiscal stimulus to hurt economy, next 2 quarters to be "very difficult".

- Second day of decent high-grade corporate issuance, $12B Verizon 5pt lion's share.

- Massive selling short end Eurodollar futures from EDH1 to EDU3, Mar'21 volume over 360k after the bell, over 3.5x 20D avg.

- Another modest stop-through, US Tsy $41B 10Y note auction (91282CAV3) awarded 0.960% rate (0.765% last month) vs. 0.962% WI; 2.47 bid/cover (2.32 previous). The 2-Yr yield is up 1.2bps at 0.1827%, 5-Yr is up 2.6bps at 0.4538%, 10-Yr is up 3.6bps at 0.9595%, and 30-Yr is up 3.9bps at 1.7479%.

US TSY FUTURES CLOSE: Off Late Lows, Boston Fed Rosengren Favors Longer Duration

Futures bouncing off session lows just after the bell, apparently in reaction to Boston Fed Pres Rosengren comments preferring lengthening of duration after the bell. Volumes heavy again, TYZ>1.925M. Yield curves mostly steeper, update:

- 3M10Y +3.512, 85.978 (L: 80.257 / H: 87.517)

- 2Y10Y +2.249, 77.14 (L: 73.332 / H: 78.879)

- 2Y30Y +2.306, 155.538 (L: 149.997 / H: 157.59)

- 5Y30Y +0.697, 128.626 (L: 124.773 / H: 130.085)

- Current futures levels:

- Dec 2Y down 0.25/32 at 110-11.125 (L: 110-11 / H: 110-12)

- Dec 5Y down 1.25/32 at 125-7.5 (L: 125-06.25 / H: 125-12.75)

- Dec 10Y down 2/32 at 137-16.5 (L: 137-13.5 / H: 137-29.5)

- Dec 30Y up 4/32 at 170-10 (L: 169-30 / H: 171-14)

- Dec Ultra 30Y up 14/32 at 211-4 (L: 210-12 / H: 213-17)

US EURODLR FUTURES CLOSE: Steady To Weaker, Massive Front-End Sellers

Futures trading steady to mildly weaker, at or near session lows after massive selling in Mar'21 through Sep'22. Mar'21 total volume >350k, appr 3.5% 20D avg. Lead quarterly traded weaker since 3M LIBOR set +0.00863 off Mon's all-time low to 0.21363% (+0.00775/wk). Latest levels:- Dec 20 -0.005 at 99.760

- Mar 21 -0.005 at 99.780

- Jun 21 steady at 99.785

- Sep 21 steady at 99.780

- Red Pack (Dec 21-Sep 22) -0.005 to steady

- Green Pack (Dec 22-Sep 23) -0.005 to steady

- Blue Pack (Dec 23-Sep 24) steady

- Gold Pack (Dec 24-Sep 25) steady

US DOLLAR LIBOR

Latest settles

- O/N +0.00375 at 0.08488% (+0.00225/wk)

- 1 Month +0.01025 to 0.14013% (+0.01238/wk)

- 3 Month +0.00863 to 0.21363% (+0.00775/wk)

- 6 Month +0.00125 to 0.24300% (-0.00038/wk)

- 1 Year +0.00563 to 0.33813% (+0.00475wk)

US TSY: Short End Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $57B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $152B

- Secured Overnight Financing Rate (SOFR): 0.10%, $904B

- Broad General Collateral Rate (BGCR): 0.08%, $344B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $318B

- (rate, volume levels reflect prior session)

- Tsy 1Y-7.5Y, $2.399B accepted vs. $4.401B submission

- Next scheduled purchases:

- Thu 11/12 1010-1030ET: Tsys 7Y-20Y, appr $3.625B

- Fri 11/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Fri 11/13 Next forward schedule release at 1500ET

PIPELINE: $12B Verizon 5Pt Lion's Share Tue's Issuance

As expected, Verizon 5pt jumbo launched after the Tsy 10Y auction

- Date $MM Issuer (Priced *, Launch #)

- 11/10 $12B #Verizon 5pt: $2B 5Y +40, $2.25B +10Y +85, $3B 20Y +115, $2.75B 30Y +115, $2B 40Y +130 (issued $3.5B on March 17: $750M 7Y +215, $1.5B 10Y +225, $1.25B 30Y +250. Verizon still holds record for largest multi-tranche jumbo issuance w/ $49B back in August 2013)

- 11/10 $1.25B #Standard Chartered 15.25NC10.25 +230

- 11/10 $1.25B #Allianz PNC5.4 3.5%

- 11/10 $700M *EUROFIMA 3Y Reg S +10

- 11/10 $650M #L3Harris 10Y +85

FOREX: Sterling Stronger Across the Board

Markets consolidated slightly Tuesday, with equity markets mulling over the sharp rally (and sharp retracement) on Monday. Equities in Europe posted decent gains, with the EuroStoxx50 closing higher by just over 1%. US cash markets, however, traded either side of unchanged. Volumes were, unsurprisingly, lacklustre relative to the activity seen Monday.

- GBP was the best performer Tuesday, getting some support as markets rush to price out the likelihood of lower rates in the UK next year (driven by Monday's vaccine-induced rally), and could be benefitting from resistance in the House of Lords late Monday to the government's Internal Markets Bill, which could make including the elements that run against international law more difficult. EUR/GBP slipped below the 200-dma for the first time since May.

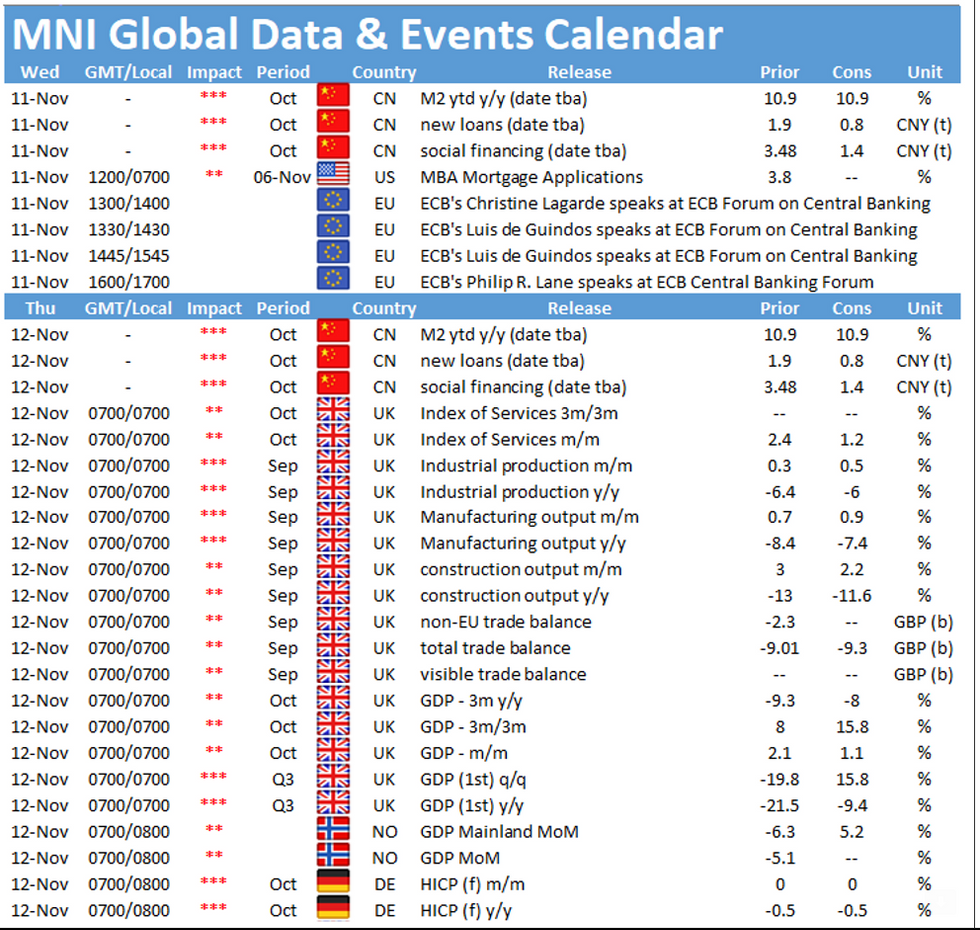

- Market activity and volumes could prove slightly muted Wednesday, with US markets (notably fixed income) seeing a partial close for the Veterans Day holidays. This will leave focus on the RBNZ rate decision, where the bank are seen keeping policy rates unchanged as well as a speech from ECB President Lagarde, who kicks off the ECB forum on central banking.

EGBs-GILTS CASH CLOSE: Bunds And Gilts Hit Again

A generally risk-on session - with UK equities and Sterling outperforming in their respective asset classes - saw Bunds and Gilts yields rise for a second consecutive day, with periphery spreads tightening slightly.

- Our positioning indicator suggests longs were reduced yesterday across most EGB/Gilt contracts amid the sell-off, however to this point, only OATs hold structural shorts.

- A quiet schedule lies ahead Wednesday, with ECB's Lagarde speaking, and Gilt linker and German 2050 Bund supply.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 1.8bps at -0.711%, 5-Yr is up 2.4bps at -0.698%, 10-Yr is up 2.4bps at -0.485%, and 30-Yr is up 2.6bps at -0.045%.

- UK: The 2-Yr yield is up 1bps at 0.006%, 5-Yr is up 2bps at 0.045%, 10-Yr is up 2.9bps at 0.401%, and 30-Yr is up 2.9bps at 0.992%.

- Italian BTP spread down 1.9bps at 124.7bps

- Spanish bond spread down 2.4bps at 67.1bps

- Portuguese PGB spread down 2.6bps at 63.4bps

- Greek bond spread down 5.2bps at 132.7bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.