-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI Gilt Week Ahead

MNI ASIA OPEN: Tsy Bid, Little React to PMIs

EXECUTIVE SUMMARY

US

FED: Ahead of the February 1 FOMC decision, MNI has published our summary of Fed speakers' views since the December meeting. This will be included in our full FOMC meeting preview, which will be published later this week. Link:

US: Tuesday's day's rally in nominal Treasury yields (10Y -5bps) is carried fully in real yields (-6bps) with breakevens firming modestly (+1bp).

- Potential macro drivers for the day's move in the breakeven were mixed, with the PMI showing an acceleration in prices paid but selling prices with the joint-slowest increase since Oct'20.

- The 10Y breakeven has twice struggled to push down to 2.1% in the past two months but is still relatively low compared to the past two years at 2.27%.

- Further material downward developments here are likely to require signs of continued supply chain improvements, with the NY Fed's GSCPI significantly off prior highs but still showing disruption at more than 1 standard deviation from average.

US TSYS: Bonds Regain Footing, Near Late Highs

Tsys holding firmer, near top end session range after extending lows around midmorning, yield curves extend inversion (2s10s -3.299 at -75.263) with Bonds outperforming (30YY -.0638 at 3.6167%).

- Short end weighed down due to moderate deal-tied rate locks and pre-auction short sets ahead today's $42B 2Y note auction (91282CGG0).

- Tsy futures regained upward momentum after strong $42B 2Y note auction (91282CGG0) stops through: 4.139% high yield vs. 4.150% WI; 2.94x bid-to-cover vs. 2.71x prior.

- Cross-market: while Tsys tracked German Bunds around the NY open, the midmorning bounce off lows appeared to be tracking Italian bonds w/ BTP 10Y yld -.11 at 3.92. No obvious headline driver for move in BTPs though ECB hike pricing has receded slightly on recent ECB Panetta comments:

- ITALY’S FISCAL POLICY HAS REMAINED PRUDENT .. CAN AFFORD TO BE `ANXIOUSLY OPTIMISTIC' ON INFLATION .. WE SHOULD REASSESS SITUATION IN MARCH, Bbg -- but not enough to justify such a rally.

- Underlying theme - market depth remains thin and relatively easily moved on smaller orders.

OVERNIGHT DATA

- US JAN PHILADELPHIA FED NONMFG INDEX -6.5

- US REDBOOK: JAN STORE SALES +5.0% V YR AGO MO

- US REDBOOK: STORE SALES +4.6% WK ENDED JAN 21 V YR AGO WK

- US S&P GLOBAL JAN MANUF. PMI FLSH 46.8 (FCST 46.0); DEC 46.2

- US S&P GLOBAL JAN SERVICES PMI FLSH 46.6 (FCST 45.0); DEC 44.7

- US S&P GLOBAL JAN COMPOSITE PMI FLSH 46.6 (FCST 46.4); DEC 45.0

- US JAN. RICHMOND FED FACTORY INDEX -11; EST. -5

- US JAN. RICHMOND FED REGIONAL BUSINESS CONDITIONS AT -10

US DATA: Richmond Fed Mfg Misses As Regional Surveys At Odds With PMI. The Richmond Fed manufacturing index fell more than expected in January, from +1 to -11 (cons -5), surpassing October's -10 for a new low since the depths of the pandemic.

- The average of the three regional Fed surveys available for January shows the same trend, falling from -8 to -17.6, with two of the three falling on the month and led by Empire down from -11 to -33 (other two being Philly & Richmond).

- The combination is at odds with today's manufacturing PMI surprisingly nudging up from 46.2 to 46.8, but in both cases they continue to imply downside risk to the ISM manufacturing survey due to be released on Feb 1 (FOMC decision day).

- Reduced inflationary pressures: "January survey results indicated continued easing of supply chain constraints...The average growth rates of both prices paid and prices received decreased in January. Expectations for both price growth measures over the next 12 months also decreased to a level much lower than last year."

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 107.15 points (0.32%) at 33737.6

- S&P E-Mini Future down 2.5 points (-0.06%) at 4034.25

- Nasdaq down 28.2 points (-0.2%) at 11336.4

- US 10-Yr yield is down 4.6 bps at 3.4637%

- US Mar 10-Yr futures are up 11/32 at 115-1

- EURUSD up 0.001 (0.09%) at 1.0882

- USDJPY down 0.55 (-0.42%) at 130.12

- WTI Crude Oil (front-month) down $1.62 (-1.98%) at $80.00

- Gold is up $6.04 (0.31%) at $1937.14

- EuroStoxx 50 up 2.2 points (0.05%) at 4153.02

- FTSE 100 down 27.31 points (-0.35%) at 7757.36

- German DAX down 9.84 points (-0.07%) at 15093.11

- French CAC 40 up 18.46 points (0.26%) at 7050.48

US TSY FUTURES CLOSE

- 3M10Y -6.268, -122.19 (L: -126.937 / H: -113.936)

- 2Y10Y -3.328, -75.292 (L: -75.571 / H: -70.221)

- 2Y30Y -5.097, -59.999 (L: -60.79 / H: -53.757)

- 5Y30Y -2.558, 3.313 (L: 2.591 / H: 7.532)

- Current futures levels:

- Mar 2-Yr futures up 2/32 at 102-30.125 (L: 102-27.5 / H: 102-30.875)

- Mar 5-Yr futures up 5.75/32 at 109-17.75 (L: 109-07.25 / H: 109-20)

- Mar 10-Yr futures up 11/32 at 115-01 (L: 114-14 / H: 115-04)

- Mar 30-Yr futures up 1-03/32 at 130-30 (L: 129-16 / H: 131-02)

- Mar Ultra futures up 1-21/32 at 142-26 (L: 140-20 / H: 143-08)

US 10YR FUTURE TECHS: (H3) Pullback Extends Into 4th Session

- RES 4: 117-17+ 1.00 proj of the Nov 3 - Dec 13 - Dec 30 price swing

- RES 3: 117-06+ 2.0% 10-dma env

- RES 2: 117-00 High Sep 8 2022

- RES 1: 116-08 High Jan 19 and the bull trigger

- PRICE: 114-29+ @ 16:03 GMT Jan 24

- SUP 1: 114-14 Low Jan 24

- SUP 2: 114-11+ 20-day EMA

- SUP 3: 114-09+ Low Jan 17 and a key support

- SUP 4: 113-26+ Low Jan 10

Treasury futures remain well below last week’s high of 116-08 on Jan 19. The move lower is considered corrective and trend conditions remain bullish over the medium-term. Last week’s bullish extension maintains the positive price sequence of higher highs and higher lows. On the continuation chart, the 200-dma has recently been pierced. A clear break of it would reinforce current conditions. The focus is on 117-05. Key support to watch is 114-09+, Jan 17 low.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.010 at 94.970

- Jun 23 +0.015 at 94.885

- Sep 23 +0.015 at 94.995

- Dec 23 +0.020 at 95.340

- Red Pack (Mar 24-Dec 24) +0.030 to +0.055

- Green Pack (Mar 25-Dec 25) +0.055 to +0.055

- Blue Pack (Mar 26-Dec 26) +0.055 to +0.065

- Gold Pack (Mar 27-Dec 27) +0.065 to +0.070

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00400 to 4.30857% (+0.000343/wk)

- 1M -0.00728 to 4.50586% (-0.00728/wk)

- 3M +0.00415 to 4.82186% (+0.00629/wk)*/**

- 6M +0.01014 to 5.10857% (+0.00657/wk)

- 12M +0.00171 to 5.34400% (-0.00329/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $96B

- Daily Overnight Bank Funding Rate: 4.32% volume: $282B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.150T

- Broad General Collateral Rate (BGCR): 4.26%, $448B

- Tri-Party General Collateral Rate (TGCR): 4.26%, $425B

- (rate, volume levels reflect prior session)

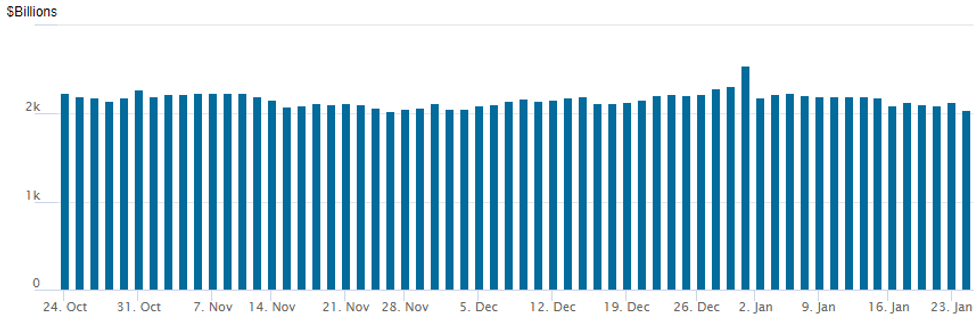

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,048.386B w/ 100 counterparties vs. prior session's $2.135.499B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $2.5B Bank of Nova Scotia Launched

Still waiting for Republic of Colombia, M&T Trust to launch

- Date $MM Issuer (Priced *, Launch #)

- 01/24 $2.5B #Bank of Nova Scotia $1.25B 3Y +93 (SOFR leg dropped, $1.25B 7Y +135

- 01/24 $1.5B #BNY Mellon $750M 6NC5 +97, $750M 11NC10 +125

- 01/24 $1B #NY Life 10Y +110

- 01/24 $750M #Ashtead Capital +10Y +212.5

- 01/24 $600M *IFC +3Y SOFR+28

- 01/24 $500M #Turk Eximbank (Turkiye Ihracat Kredi Bankasi) 3Y 9.6%

- 01/24 $Benchmark Republic of Colombia 11Y 7.65%a

- 01/24 $Benchmark M&T Trust (MTB) 3Y +85, 5Y +115, 11NC10 +160

EGBs-GILTS CASH CLOSE: Gilts Outperform Bunds As PMIs Diverge

Gilts outperformed Bunds Tuesday as flash PMI outcomes diverged, while periphery EGBs outperformed their core counterparts as ECB hike pricing moderated.

- The flash Eurozone composite PMI was in positive territory in January for the first time since June, while the UK's contracted more than expected, led by a weak services reading.

- There was no particular trigger for the very strong afternoon rally across EGBs (especially given the US PMIs surprised to the upside), which brought yields to session lows, from their session highs mid-afternoon.

- However, it came as ECB hike pricing slid a few basis points with Exec Board's Panetta saying there was not necessarily a commitment to another 50bp hike in March. BTPs outperformed alongside that repricing.

- UK PPI and German IFO are Wednesday's early releases.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.4bps at 2.544%, 5-Yr is down 5.2bps at 2.189%, 10-Yr is down 5.1bps at 2.155%, and 30-Yr is down 6.2bps at 2.111%.

- UK: The 2-Yr yield is down 8.7bps at 3.378%, 5-Yr is down 9.7bps at 3.172%, 10-Yr is down 8.3bps at 3.277%, and 30-Yr is down 9bps at 3.622%.

- Italian BTP spread down 6.1bps at 176.1bps / Spanish down 2.2bps at 94.6bps

FOREX: Post US PMI Greenback Strength Reverses

- Firmer than expected US Manufacturing and Services PMI’s prompted a decent pop in the US dollar on Tuesday. However, this strength quickly reversed course and the USD index looks set to post around a 0.2% decline approaching the APAC crossover.

- USDJPY, once again, had the most significant price action following the data. The pair rallied from 1.3060 to fresh weekly highs of 131.12 but fell short of touted resistance at 131.58, the Jan 18 high. The lack of bullish momentum above the 131 handle dented any optimism and over the course of the US session the pair fell substantially to lows of 129.87 aided by weaker Richmond Fed data, before consolidating around 130. The JPY is the strongest performer in G10, rising 0.5% against the greenback.

- At the other end of the G10 rankings, GBP (-0.35%) is among the poorest performer following a particularly weak set of UK data. Services and composite PMI both fell short of expectations, signalling six consecutive months of contraction across the services sector, with business activity now declining at the fastest pace since the COVID pandemic.

- Markets are now within range of next support at 1.2215/2083, marking the 20-day EMA and Low Jan 9 respectively.

- NOK is also among the session's poorest performers so far, led lower by softer oil prices. Nonetheless, USD/NOK failed to break resistance at the 50- and 200-dmas at 9.9360 and 9.9484 respectively.

- New Zealand and Australia CPI highlight Wednesday’s APAC docket before the focus turns to the Bank of Canada rate decision and press conference.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/01/2023 | 0030/1130 | *** |  | AU | CPI inflation |

| 25/01/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 25/01/2023 | 0700/0800 | ** |  | SE | PPI |

| 25/01/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 25/01/2023 | 0800/0900 | ** |  | ES | PPI |

| 25/01/2023 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/01/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/01/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 25/01/2023 | 1500/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 25/01/2023 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 25/01/2023 | 1600/1100 |  | CA | Bank of Canada Governor press conference | |

| 25/01/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.