-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys, Eqs Near Highs, Geopol Risk Remains

- MNI: Fed’s Jefferson-Higher Bond Yields Can Affect Policy Path

- MNI: Logan Says Higher Term Premium Could Mean Fewer Fed Hikes

- MNI: Fed's Barr Defends Proposal To Raise Capital Requirements

US

FED: Rising yields on long-dated U.S. bonds should factor into policymakers’ deliberations about whether to tighten monetary policy further, Fed Vice Chair Philip Jefferson said Monday. “I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy,” Jefferson said in a keynote speech to the National Association for Business Economics.

- Jefferson offered a balanced view of risks, emphasizing both the threat of more persistent inflation than expected as well as the possibility of a sharper growth slowdown than is currently on investors’ radars.

- “I am particularly attentive to upside risks to inflation, such as those associated with the economy and labor market remaining too strong to achieve further disinflation, as well as risks associated with unexpected increases in energy prices,” said Jefferson. For more see MNI Policy main wire at 1330ET.

FED: Dallas Fed President Lorie Logan said Monday there could be less of a need to raise interest rates further if long-term interest rates remain elevated because of higher term premiums. "However, to the extent that strength in the economy is behind the increase in long-term interest rates, the FOMC may need to do more," she said in prepared remarks.

- The Dallas Fed president said recent inflation developments have been encouraging but "it is still too soon to say with confidence that inflation is headed to 2% in a sustainable and timely way." The labor market is still very strong, and output, spending and job growth are beating expectations, she said. She also suggested the need to see more softening in labor conditions than what was seen in 2019.

- "I expect that continued restrictive financial conditions will be necessary to restore price stability in a sustainable and timely way. I remain attentive to risks on both sides of our mandate. In my view, high inflation remains the most important risk. We cannot allow it to become entrenched or reignite." For more see MNI Policy main wire at 0900ET.

FED: Raising large banks' capital requirements will help the financial system weather unexpected stress without necessarily hurting lenders' profitability or market valuation over the long run, Michael Barr, the Federal Reserve's top banking regulator said Monday in defense of the Basel III "endgame" proposal that's come under attack from banks and lawmakers.

- The effective rise in capital requirements related to lending is a small portion of the overall capital increase and would only increase funding costs by up to 3 basis points, Barr noted. The bulk of the rise has to do with trading and other activities that have generated outsized losses in the past.

- Those private costs must be weighed against the social benefits of a more resilient financial system, because increased overall capital will reduce the likelihood of a costly financial crisis, he said in remarks prepared for the American Bankers Association's annual convention.

- "The proposal is projected to raise capital for large banks. This may result in higher funding costs. But this is only half the story. Capital also enables banks to absorb more losses without risking their ability to repay their creditors," he said. For more see MNI Policy main wire at 0915ET.

US TSYS Rates, Stocks Near Highs, Different Reasons on Same Event Risk

- Safe haven sentiment dominated markets early Monday following the surprise attack by Hamas against Israel over the weekend, tempered by a partial absence of US market participants due to the Columbus Day Holiday.

- Treasury futures extended session highs in late trade (TYZ3: 107-29 high, +1-02 on light volume: 775k) after balanced comments from Fed Vice Chair Philip Jefferson emphasizing both the threat of more persistent inflation than expected as well as the possibility of a sharper growth slowdown than is currently on investors’ radar.

- “I am particularly attentive to upside risks to inflation, such as those associated with the economy and labor market remaining too strong to achieve further disinflation, as well as risks associated with unexpected increases in energy prices,” said Jefferson.

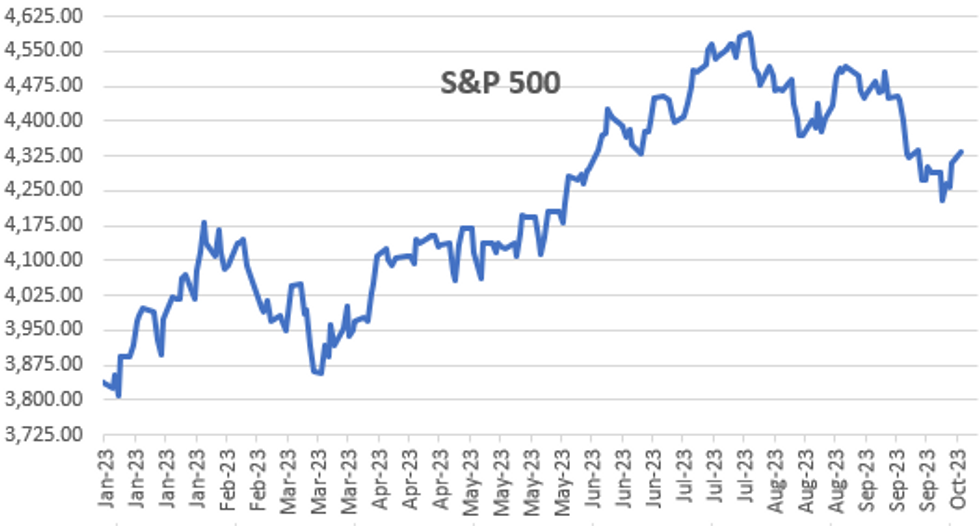

- Meanwhile, cross assets continued to gain: crude prices remain well bid (WTI +3.5 at 86.29), stocks recovering from early losses to near highs after hte bell (SPX Eminis +24.5 at 4366.0) led by oil and gas shares as well as defense stocks on the back of the Hamas surprise attack on Israel over the weekend.

- Rate hike projections into early 2024 continue to moderate as rates head higher: November at 11.9% (22.2% this morning vs. 30.5% late Fri) w/ implied rate change of +3bp to 5.358%, December cumulative of 6.9bp (9.9bp this morning vs. 12.4bp late Fri) at 5.398%, January 2024 3.9bp (11.9bp Fri) at 5.368%. Fed terminal slips to 5.395% in Jan'24.

OVERNIGHT DATA

Cash Treasurys closed for Columbus Day holiday, no data scheduled Monday.

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA up 180.22 points (0.54%) at 33586.15

- S&P E-Mini Future up 27.75 points (0.64%) at 4369

- Nasdaq up 60.8 points (0.5%) at 13492

- US 10-Yr yield is unchanged 0 bps at 4.8009%

- US Dec 10-Yr futures are up 33.5/32 at 107-28.5

- EURUSD down 0.0017 (-0.16%) at 1.0569

- USDJPY down 0.83 (-0.56%) at 148.49

- WTI Crude Oil (front-month) up $3.59 (4.34%) at $86.38

- Gold is up $29.21 (1.59%) at $1862.20

- European bourses closing levels:

- EuroStoxx 50 down 31.86 points (-0.77%) at 4112.57

- FTSE 100 down 2.37 points (-0.03%) at 7492.21

- German DAX down 101.66 points (-0.67%) at 15128.11

- French CAC 40 down 38.75 points (-0.55%) at 7021.4

US TREASURY FUTURES CLOSE

- 3M10Y +0, -71.391 (L: -71.391 / H: -71.391)

- 2Y10Y +0, -28.46 (L: -28.46 / H: -28.46)

- 2Y30Y +0, -11.783 (L: -11.783 / H: -11.783)

- 5Y30Y +0, 20.747 (L: 20.747 / H: 20.747)

- Current futures levels:

- Dec 2-Yr futures up 9.375/32 at 101-18.25 (L: 101-11.25 / H: 101-18.25)

- Dec 5-Yr futures up 24/32 at 105-17.25 (L: 104-30.5 / H: 105-17.5)

- Dec 10-Yr futures up 1-01.5/32 at 107-28.5 (L: 107-02.5 / H: 107-29)

- Dec 30-Yr futures up 1-19/32 at 112-2 (L: 110-11 / H: 112-05)

- Dec Ultra futures up 1-24/32 at 116-01 (L: 113-29 / H: 116-10)

US 10Y FUTURE TECHS (Z3) Post-NFP Recovery Builds

- RES 4: 109-24+ 50-day EMA

- RES 3: 108-26+ High Sep 22

- RES 2: 108-12 20-day EMA

- RES 1: 107-29 High Oct 9

- PRICE: 107-28 @ 1525 ET Oct 9

- SUP 1: 106-03+/00 Low Sep 4 / Round number support

- SUP 2: 105-17 2.0% lower 10-dma envelope

- SUP 3: 105-14+ 3.0% Lower Bollinger Band

- SUP 4: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Markets are on a more stable footing early Monday, building the post-NFP recovery. Last week’s lows are yet to be re-tested, and a further stabilisation in prices could show signs of a near-term reversal. For now, a bear trend in Treasuries remains intact, with the pressure going through on the back of the NFP release making for a strong negative close. Last week’s fresh cycle lows confirm a resumption of the downtrend and maintain the price sequence of lower lows and lower highs. Support at 107-07, the Sep 28 low, has been cleared signalling scope for the 106-00 handle next.

SOFR FUTURES CLOSE

- Dec 23 +0.065 at 94.595

- Mar 24 +0.115 at 94.740

- Jun 24 +0.150 at 94.975

- Sep 24 +0.180 at 95.270

- Red Pack (Dec 24-Sep 25) +0.190 to +0.20

- Green Pack (Dec 25-Sep 26) +0.185 to +0.190

- Blue Pack (Dec 26-Sep 27) +0.175 to +0.180

- Gold Pack (Dec 27-Sep 28) +0.150 to +0.165

EGBs-GILTS CASH CLOSE: Bunds Lead Rally

Core European instruments rallied strongly Monday, as the Israel-Hamas conflict over the weekend helped boost safe havens.

- An early geopolitical-related bid in Bunds and Gilts faded over the course of the morning.

- While trading in cash Treasuries was closed for holidays, global yields dropped sharply in mid-afternoon on Dallas Fed Pres Logan's comment that higher market yields may mean less need for the Fed to raise rates.

- Just before those headlines crossed, EGBs benefited from a Reuters sources story pointing to little urgency at the ECB to curtail PEPP purchases ahead of schedule.

- Peripheries benefited from the latter in particular, with 10Y BTP yields falling 10+bp in the last 3 hours of European cash trade, but still finished wider of Bunds on the day.

- Bunds and Gilts leaned bull flatter, with some modest outperformance in the curve bellies, German yields down in double-digits across the curve.

- Looking ahead, Tuesday brings another quiet session for European data. BOE's Mann speaks later this evening, with Tuesday morning bringing the minutes of the BOE's financial policy meeting.

FOREX USD/JPY Pullback Opens Further Gap With Cycle High

- Amid unrest in the Middle-east, a rallying oil price and the partial absence of US market participants, a risk-off feel dominated currency markets into the Monday close. USD/JPY fell comfortably back below the Y149.00 handle, opening a more sizeable gap with the recent cycle high at 150.16.

- Oil-tied currencies saw a solid tailwind on the back of the rallying Brent and WTI crude price. Resultingly, NOK remained the G10 outperformer, while the uncertain geopolitical backdrop dragged SEK, which traded along with the EUR as the session's poorest performer. After finding support at parity last week, NOKSEK eyes the 200-day EMA at 1.0200 as the next key level. Above this, the 50-day EMA at 1.0247 is the bull trigger.

- The EUR traded poorly, falling against all others as a core EGB rally took. Short-term momentum across the German front-end prompted the downtrend in Schatz and Bobl futures to be reversed, prompting a ~10bps move lower in the German front-end. Resultingly, EUR lagged all others, helping EUR/GBP finish lower for a sixth consecutive session.

- Focus Tuesday turns to Australian consumer confidence, Italian industrial production and final US wholesale inventories data for August. The NY Fed also release their 1yr inflation expectations survey later in the session. Central bank speakers include Fed's Perli, Bostic, Waller, Kashkari & Daly as well as ECB's Villeroy.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/10/2023 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 10/10/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 10/10/2023 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 10/10/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 10/10/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 10/10/2023 | 0930/1030 |  | UK | BOE PFC minutes | |

| 10/10/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/10/2023 | - | *** |  | CN | Money Supply |

| 10/10/2023 | - | *** |  | CN | New Loans |

| 10/10/2023 | - | *** |  | CN | Social Financing |

| 10/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/10/2023 | 1300/0900 |  | US | New York Fed's Roberto Perli | |

| 10/10/2023 | 1330/0930 |  | US | Atlanta Fed's Raphael Bostic | |

| 10/10/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 10/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 10/10/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 10/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 10/10/2023 | 1700/1300 |  | US | Fed Governor Christopher Waller | |

| 10/10/2023 | 1730/1330 |  | US | Fed Governor Christopher Waller | |

| 10/10/2023 | 1900/1500 |  | US | Minneapolis Fed's Neel Kashkari | |

| 10/10/2023 | 2200/1800 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.