-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Reverse Friday's Safe Haven Bid

- MNI BRIEF: Fed's Williams Still Sees Rate Cut This Year

- MNI US/CHINA: Yellen Says Nothing "Off The Table" In Response To Overcapacity

- MNI US: House To Vote On Legislation Countering Iran-China Oil Transactions

- MNI US DATA: Another Strong Beat For Retail Sales, Doubly So With Upward Revisions

US TSYS Off Early Lows, Curves Steepen, Remain Sensitive to Middle East Tension

- Treasury futures remain sensitive to Middle East tensions Monday, bouncing off lows late morning after headline fromAxios that Israel has "no choice but to retaliate against Iran.

- Futures had extended session lows this morning (TYM4 107-18.5) more than reversing Friday's risk-off rally tied to tensions in the Middle East before rebounding to 108-00 - trading sideways through the close. Several factors at play:

- Rates rallied with a strong safe-haven bid last Friday amid simmering Middle East tensions going into the weekend. Iran did indeed retaliate against Israel with some 200 drone attacks targeting military sites, many were repelled with few casualties.

- Tsy yields also gained as US$ bounced against the Yen, the latter falling to lowest lvl since 1990 as Japan said they would take steps (intervene) to counter.

- Tsy curves bear steepened, 2s10s +7.184 at -30.529, short end still weaker as projected rate cut pricing recedes: May 2024 at -4.7% w/ cumulative -1.2bp at 5.317%; June 2024 at -19.8% vs. -22.6% (compares to -55.1% pre-CPI) w/ cumulative rate cut -6.1bp at 5.286%. July'24 cumulative at -14.4bp vs -16.9bp earlier, Sep'24 cumulative -25.9bp vs. -28.8bp.

- Look ahead: Tuesday's data calendar includes Building Permits, IP/Cap-U, and Fed Speak with Chairman Powell moderating a Q&A session with BoC head Macklem.

US

FED BRIEF (MNI): NY Fed Williams Still Sees Rate Cut This Year: New York Federal Reserve President John Williams said Monday interest rate cuts will likely start this year, but for the time being rates should stay steady so that inflation reaches target.

- "With inflation continuing to gradually come down -- gradually is the operative word here -- and with the economy remaining strong, I do think that given where the level of rates are -- real interest rates are now considerably higher than where they were because inflation has come down quite a bit -- we will need to start a process to bring interest rates down to more normal levels," he said in an interview with Bloomberg TV. "My own view is that process will likely start this year."

NEWS

US/CHINA (MNI): Yellen Says Nothing "Off The Table" In Response To Overcapacity: Treasury Secretary Janet Yellen told CNN yesterday that the US wouldn’t take “anything off the table" - including new tariffs - in response to China’s manufacturing overcapacity. “We’re concerned about the possibility of surges in Chinese exports to our markets in areas where they have a great deal of overcapacity," Yellen said.

US (MNI): House To Vote On Legislation Countering Iran-China Oil Transactions: The US House of Representatives will vote today on17 bills related to Iran and Israel in response to the Iranian attack on Israel on April 13. Of particular note to energy markets, H.R. 5923, a bill which was unanimously discharged from the House Financial Services Committee in November, would, "impose restrictions on correspondent and payable-through accounts in the United States with respect to Chinese financial institutions that conduct transactions involving the purchase of petroleum or petroleum products from Iran."

SECURITY (MNI): Iran Attack Could Hasten Passage Of US National Security Supplemental: The April 13 Iranian assault on Israel which saw the majority of over 300 drones, cruise missiles, and ballistic missiles intercepted by Israel's "Iron Done" systems could compel the Speaker of the United States House of Representatives, Mike Johnson (R-LA), to fast-track consideration of the supplemental aid package which include new aid for Israel, Ukraine, and other US allies.

US (MNI): Biden Admin Announces USD6.4B Grant To Samsung For Chips Fab In Texas: The Department of Commerce has announced a USD$6.4 billion grant for tech giant Samsung to expand advanced semiconductor manufacturing facilities in Austin, Texas. The announcement is the second major allocation from the USD$39 billion CHIPS pot this month, following a USD$6.6 billion grant to TSMC to boost operations in Arizona.

US (MNI): Trump 'Hush Money' Trial Begins Today: Jury selection in former President Donald Trump’s ‘hush money’ criminal trial begins in Manhattan, New York today – kicking off what could be the only one of four criminal cases against Trump to go to trial before the presidential election in November. Jury selection could last up to two weeks.

ISRAEL (MNI): IDF Presents Gov't With Poss Responses To Iran Strikes Amid Global Focus: Wires reporting that the Israeli army has presented the gov't with a list of possible responses to the Iranian drone/missile strikes on Israeli territory over the weekend.

OVERNIGHT DATA

US DATA (MNI): Another Strong Beat For Retail Sales, Doubly So With Upward Revisions: Total retail sales increased 0.72% M/M (cons 0.4) in Mar after an upward revised 0.94% (initial 0.6) in Feb.

- The control group again saw a larger beat, rising 1.14% M/M (cons 0.4) after an upward revised 0.30% (initial 0.0).

- It’s the strongest single monthly increase for the nominal control group measure since Jan’23, a leap higher for retail sales having lagged the broader personal consumption data (which capture a much larger share of services) – see charts.

- In 3M/3M terms, the 3% ar for the control group is unchanged from Dec, but the latest three-month rate has jumped from 2.0% in Feb to 5.8% ar in Mar with very strong momentum heading into Q2.

US DATA (MNI): Empire Mfg Starts April Surveys With Only Limited Improvement: The Empire State manufacturing index was lower than expected in April at -14.3 (cons -5) after -20.9, but well within the survey’s usual volatility.

- A reminder that the standard deviation of the monthly change since 2021 is a huge 23pts.

- Its ISM equivalent reading increased from 45.5 to 46.0, still firmly in contraction territory but off the particularly weak 39.7 from January.

- New orders were little changed and still firmly in negative territory (-16.2, +1pt), whilst prices paid increased to 33.7 (+5pts) but there was no sign of the latest passthrough to selling prices with prices received dipping to 16.9 (-0.9pt).

- Looking ahead, confidence remains far more optimistic than the current situation, but there was an easing here to its lowest since Dec at 16.7 (-4.9pts).

- Regionally, the south (largest) fell 1pt whilst there were gains in the west (+4pts), northeast (+4pts) and midwest (+1pt).

- Back nationally, present sales and prospective buyer traffic both increased 1pt but the outlook for future sales fell 2pts.

- S&P homebuilder price to book ratios have cooled off latest highs from last month but there remains a large disconnect with the survey.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 205.85 points (-0.54%) at 37780.57

- S&P E-Mini Future down 58.75 points (-1.14%) at 5109.5

- Nasdaq down 273.6 points (-1.7%) at 15901.92

- US 10-Yr yield is up 10.2 bps at 4.624%

- US Jun 10-Yr futures are down 25/32 at 107-29

- EURUSD down 0.0018 (-0.17%) at 1.0625

- USDJPY up 0.98 (0.64%) at 154.21

- WTI Crude Oil (front-month) down $0.15 (-0.18%) at $85.54

- Gold is up $38.25 (1.63%) at $2383.09

- European bourses closing levels:

- EuroStoxx 50 up 29.47 points (0.59%) at 4984.48

- FTSE 100 down 30.05 points (-0.38%) at 7965.53

- German DAX up 96.26 points (0.54%) at 18026.58

- French CAC 40 up 34.28 points (0.43%) at 8045.11

US TREASURY FUTURES CLOSE

- 3M10Y +9.277, -78.912 (L: -92.768 / H: -75.618)

- 2Y10Y +6.787, -30.926 (L: -38.126 / H: -29.898)

- 2Y30Y +7.145, -19.784 (L: -29.691 / H: -18.72)

- 5Y30Y +2.105, 9.205 (L: 3.173 / H: 10.004)

- Current futures levels:

- Jun 2-Yr futures down 3/32 at 101-19 (L: 101-14.75 / H: 101-22.75)

- Jun 5-Yr futures down 13.25/32 at 105-5 (L: 104-28.5 / H: 105-18.5)

- Jun 10-Yr futures down 25/32 at 107-29 (L: 107-18.5 / H: 108-22)

- Jun 30-Yr futures down 1-29/32 at 114-10 (L: 113-29.0016000000001 / H: 116-01)

- Jun Ultra futures down 2-25/32 at 120-17 (L: 120-09 / H: 123-01)

US 10Y FUTURE TECHS: (M4) Southbound

- RES 4: 110-12+ 50-day EMA

- RES 3: 110-06 High Apr 4

- RES 2: 109-02/26+ Low Apr 8 / High Apr 10

- RES 1: 108.25+ High Apr 12

- PRICE: 107-20 @ 15:10 BST Apr 15

- SUP 1: 107-16+ 2.50 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 2: 107-07+ 76.4% of the Oct - Dec ‘23 bull leg (cont)

- SUP 3: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 106-08 3.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

The sharp sell-off in Treasuries last week and today’s extension, reinforces the current bearish cycle. The move down has confirmed a resumption of this year’s downtrend. Support at the 109-00 handle and 108-25, the 2.00 projection of Dec 27 - Jan 19 - Feb 1 price swing, has been breached. Sights are on 107-16+ nxt, a Fibonacci projection. Initial resistance has been defined at 109-25+, Apr 12 high. Key S/T resistance is 110-06, the Apr 4 high.

SOFR FUTURES CLOSE

- Jun 24 -0.025 at 94.745

- Sep 24 -0.035 at 94.905

- Dec 24 -0.050 at 95.090

- Mar 25 -0.060 at 95.285

- Red Pack (Jun 25-Mar 26) -0.095 to -0.065

- Green Pack (Jun 26-Mar 27) -0.13 to -0.11

- Blue Pack (Jun 27-Mar 28) -0.145 to -0.14

- Gold Pack (Jun 28-Mar 29) -0.145 to -0.145

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00305 to 5.31624 (+0.00083 total last wk)

- 3M -0.01059 to 5.31707 (+0.03427 total last wk)

- 6M -0.02153 to 5.28184 (+0.08303 total last wk)

- 12M -0.03703 to 5.17201 (+0.17797 total last Wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.805T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $701B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $687B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $243B

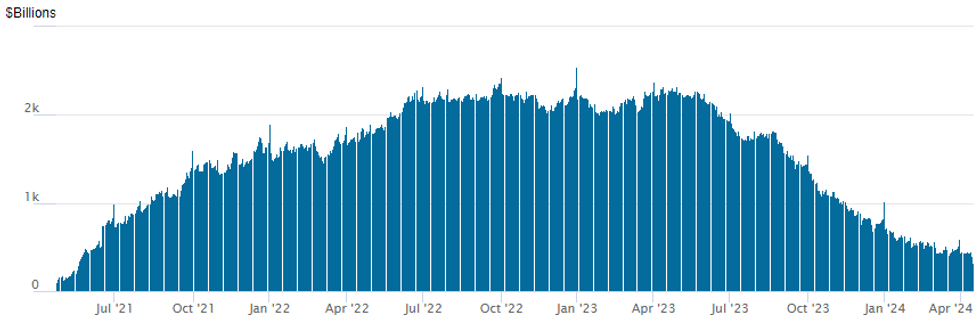

FED Reverse Repo Operation: Tax Deadline Spurs New Low Usage

NY Federal Reserve/MNI

- RRP usage falls well below $400B for the first time since mid-May 2021 to $327.066B vs. $407.322B last Friday, desks citing today's Federal tax deadline for the drop.

- Meanwhile, the latest number of counterparties falls to new low of 62 vs. 65 Friday.

PIPELINE $9B JP Morgan 4Pt Debt Issuance Launched Late

Oversized $9B 4pt issuance from JPM led Monday's corporate bond issuance, $16.7B total.

- Date $MM Issuer (Priced *, Launch #)

- 4/15 $9B #JP Morgan $2.5B 4NC3 +80, $750M 4NC3 SOFR+92, $2.75B 6NC5 +95, $3B 11NC10 +115

- 4/15 $4.25B #Wells Fargo $3.25B 4NC3 +95, $1B 4NC3 SOFR+107

- 4/15 $2.05B #EDF (Electricite de France) $650M 5Y +105, $650M 10Y +135, $750M 40Y +185

- 4/15 $1.4B #Eversource Energy $700M 7Y +120, $700M 10Y +135

FOREX USDJPY Surges Above 154.00 Amid Further Hot US Data

- Higher-than-expected retail sales data in the US prompted further upward pressure on US yields to start the week, maintaining an underlying bid for the greenback and further weighing on a struggling Japanese Yen.

- USDJPY had already rallied in Asia as risk sentiment stabilised amid the ongoing concerns in the middle east. This saw the pair extend its impressive advance to around 153.80, following the prior clean break above 152.00.

- Aided by the US data, the pair then cleared 154.00 and printed fresh cycle highs at 154.45. Japan’s top currency official said that the MOF is in frequent contact with FX officials abroad, however, the fundamental backdrop and widening yield differentials continue to drive USDJPY higher.

- Further defying the Japanese authorities’ warnings of intervention against outsized moves in the currency, CFTC data shows the JPY net short position growing to 50% of open interest – leaving markets outright short by 162,151 contracts, the largest net short since the onset of the Global Financial Crisis in 2007.

- Elsewhere, G10 ranges were more subdued with EURUSD briefly matching Friday’s lows around 1.0622 in the aftermath of the US data release. The moderate pull lower for equities leaves NZD as the underperformer, falling 0.4% against the greenback.

- The high frequency of UK risk events this week has prompted a solid rally in the front-end of the vol curve, with 1-week vols touching new multi-month highs today. This leaves the one-week breakeven on a GBP/USD straddle at ~100 pips, leaving support at 1.2427 – last week’s GBP/USD low - exposed ahead of 1.2364, seen as firmer support.

- Chinese activity data will be the highlight of Tuesday’s Asia-Pac session, before focus turns to employment data in the UK. The latter half of the session will have Canada CPI for March.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/04/2024 | 0000/2000 |  | US | San Francisco Fed's Mary Daly | |

| 16/04/2024 | 0200/1000 | *** |  | CN | GDP |

| 16/04/2024 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 16/04/2024 | 0200/1000 | *** |  | CN | Retail Sales |

| 16/04/2024 | 0200/1000 | *** |  | CN | Industrial Output |

| 16/04/2024 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 16/04/2024 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/04/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/04/2024 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/04/2024 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/04/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 16/04/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 16/04/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 16/04/2024 | 0915/1015 |  | UK | BOE's Lombardelli TSC pre-appointment hearing | |

| 16/04/2024 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/04/2024 | 1230/0830 | *** |  | CA | CPI |

| 16/04/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 16/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/04/2024 | 1300/0900 |  | US | Fed Vice Chair Philip Jefferson | |

| 16/04/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 16/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/04/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 16/04/2024 | 1630/1230 |  | US | New York Fed President John Williams | |

| 16/04/2024 | 1700/1800 |  | UK | BoE's Bailey Interview On IMF Today | |

| 16/04/2024 | 1700/1300 |  | US | Richmond Fed's Tom Barkin | |

| 16/04/2024 | 1715/1315 |  | US | Fed Chair Jerome Powell | |

| 16/04/2024 | 2000/1600 |  | CA | Canada federal budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.