-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Easing Call & BoJ Speculation The Main Drivers In Asia

- Core FI markets were jolted by some misinterpretation surrounding the latest BoJ leadership race source report from BBG, with the hawkish knee-jerk quickly unwound. The report noted that “Japan’s ruling party members see the possibility of division within the party if Prime Minister Fumio Kishida’s choice for the new Bank of Japan chief is someone who is unlikely to follow the current path of monetary easing.” The piece highlighted that there would be at least some opposition if PM Kishida selects former BoJ Deputy Governor Hirohide Yamaguchi (the most hawkish major candidate) as outgoing BoJ Governor Kuroda’s successor.

- The Antipodeans are outperforming in the FX space , there was no overt headline driver for the move although a Bloomberg piece from a top Chinese Economist noted potential for easier policy settings in Q2 aiding risk sentiment in the equity and commodity space.

- German CPI, BoE communique and the latest Riksbank monetary policy decision headline today.

US TSYS: Early Cheapening Holds In Asia

TYH3 deals at 113-14, +0-01, a touch off the base of its 0-07+ range on volume of ~106K.

- Cash Tsys sit 1-2bps cheaper across the major benchmarks.

- Asia-Pac participants faded yesterday's late NY bid, with the latter aided by a report noting the G7 is mulling sanctions for Chinese firms aiding the Russian military, as well as more attractive entry points after a pullback from previous highs which were registered after the latest 10-Year Tsy auction stopped through.

- The early cheapening held through the session.

- A block buy of TU futures (+5.5K) did little to generate wider demand in the space.

- Pressure briefly extended late in the session as JGBs spiked lower on headlines from Japan noting that the ruling LDP would be divided if Kishida seeks a BOJ pivot.

- National CPI from Germany and an appearance by BoE figures at a Treasury committee provide the highlights in Europe today. Further out, Initial Jobless Claims headlines a thin NY docket, we also have the latest 30-Year Tsy Supply.

JGBS: BoJ Chatter-Induced Vol. Jolts Previously Sedate Session

JGB trade had been fairly sedate until a burst of volatility ahead of the Tokyo close, with futures now -10 and the major cash benchmarks running 0.5bp cheaper to 2bp richer. 5s are the only major benchmark sitting cheaper on the day, while the 20- to 30-Year zone outperforms in the curve. The swap curve has twist flattened, although the moves in those benchmark rates was even more limited than that seen in JGBs.

- The source of late vol. seemed to centre on some misinterpretation surrounding the latest BoJ leadership race source report from BBG, with the hawkish knee-jerk quickly unwound.

- The report noted that “Japan’s ruling party members see the possibility of division within the party if Prime Minister Fumio Kishida’s choice for the new Bank of Japan chief is someone who is unlikely to follow the current path of monetary easing.” Elsewhere, it suggested that there would be at least some opposition if PM Kishida selects former BoJ Deputy Governor Hirohide Yamaguchi (the most hawkish major candidate) as outgoing BoJ Governor Kuroda’s successor.

- Futures now sit marginally below pre-story levels, comfortably off session cheaps.

- Looking ahead, Friday will see the release of Japanese PPI data.

AUSSIE BONDS: Weaker As RBA Repricing Continues

Aussie bonds weakened more than their U.S. Tsy counterparts, leaving the AU/U.S. 10-Year yield spread near the +5bp mark. Cash ACGBs were 5-8bp cheaper, with the 7- to 12-Year zone lagging the broader weakness on the curve. YM finished -7.0, XM was -5.5.

- Short end flow aided the move, with terminal rate pricing on the RBA-dated OIS strip back above 4.00% as participants continued to adjust to Tuesday’s hawkish tweaks in the post-meeting statement. Bills finished 1-10bp cheaper through the reds as that strip steepened.

- Local headline flow was limited, outside of a BBG report which noted that “the first Australian coal shipment to China in more than two years is on the verge of docking.”

- Hedging surrounding the pricing of A$1bn of new SAFA-38 paper would have applied some pressure. Elsewhere, there may have been some background pressure on reports that Virgin Australia is considering taking on new debt ahead of its potential IPO. In addition, pricing of A$1.5bn of EIB’s 5.5-Year climate awareness bond would have added further pressure, while Westpac mandated for 3- & 5-Year senior unsecured paper. Weakness in NZGBs will also have weighed.

- Looking ahead, the release of the RBA’s SoMP (with focus on the underlying inflation forecasts) & A$500mn of ACGB May-28 supply headline on Friday.

NZGBS: Curve Bear Flattens, Uncovered Auction & Trans-Tasman Dynamic Weighs

The NZGB curve bear flattened, with the major benchmarks running 3-8bp cheaper at the close.

- NZGBs were already on the defensive ahead of today’s auctions, with global core FI markets coming under modest cheapening pressure, allowing the space to unwind the early, modest richening which had represented catch up to NY Tsy trade.

- That was before an uncovered NZGB-27 auction applied further pressure to the front end of the curve, while solid enough demand in the NZGB-34 auction (1.64x cover) and strong demand at the NZGB-51 auction (2.96x cover) promoted curve flattening.

- Swap rates were ~8bp higher across the curve, leaving swap spreads flat to wider.

- That came alongside RBNZ-dated OIS showing ~60bp of tightening for this month’s meeting, while terminal OCR pricing ticked back above 5.30%, aided by another uptick in RBA-dated OIS. That seemingly aided payside swap flows (with higher for longer central bank worry probably contributing to the weakness in the aforementioned NZGB-27 auction).

- Local headline flow was fairly limited.

- Corporate issuance saw NZ$500mn of Feb-28 paper from ANZ priced.

- The latest manufacturing PMI print and card spending data headline the domestic docket on Friday.

FOREX: Antipodeans Outperforming, Greenback Pressured

The Antipodeans are outperforming today, there was no overt headline driver for the move although a Bloomberg piece from a top Chinese Economist noted potential for easier policy settings in Q2 aiding risk sentiment in the equity and commodity space.

- Kiwi is the strongest performer in the G-10 space at the margins, up ~0.6%. NZD/USD dealt through its 50-day EMA ($0.6337), and last prints at $0.6340/50.

- AUD/USD is ~0.4% firmer, last printing at $0.6950/60. Strength in copper (up ~0.6%) and iron ore (~1.2% firmer) are aiding the bid at the margins, along with the better tone in some equity markets.

- Yen is little changed from yesterday's closing levels. The pair was firmer in early trade, before meeting resistance at ¥131.80 before paring gains through the session.

- NOK and SEK are both ~0.3% firmer, benefiting from the improving risk sentiment.

- EUR and GBP are ~0.1% firmer vs USD.

- Cross asset flows show an improving equity picture; US equity futures are firmer (e-minis up ~0.3%) as are HK and Chinese Equities (CSI300 up ~0.7%, Hang Seng up ~0.4%). BBDXY is ~0.2% softer. 10 Year US Treasury Yields are marginally higher.

- National CPI from Germany and an appearance by BOE figures at a Treasury committee provide the highlight in Europe today. Further out Initial Jobless Claims highlight a thin NY docket.

NZD: Supported Below $0.63, But NZD Looks Too Elevated Relative To Narrowing Rate Differentials

NZD/USD has fallen ~3.5% off multi-month highs having printed its highest level since early June last week.

- The pair has found support below $0.63 in recent dealing. The NZ-US 2-year swap rate differentials is up from recent lows of around +20bps to +34bps, which has likely helped stabilize kiwi sentiment to a degree.

- However, the NZD/USD spot rate is elevated, when compared to the narrowing in swap rate differentials which are ~60bps tighter versus recent highs in mid December last year.

- Bears look to sustain a break of the 200-day EMA ($0.6292) and 50-Day EMA ($0.6260) to target $0.6146 the 38.2% retracement from February highs.

- Bulls first target the 20-day EMA at $0.6397 to regain the upper hand.

- Tuesday’s CPI data in the US provides the next macro risk event, however tomorrow NZ PMIs are out, while in the U of Mich Inflation expectations will be closely watched.

Fig 1: NZ US 2 year Swap Rate Differentialsv NZDUSD Daily Spot

Source: Market News International (MNI)/Bloomberg

MNI Riksbank Preview - February 2023: 50bp or shock

- This week’s Riksbank meeting is widely expected to culminate in a 50bp hike, despite the prior forward guidance strongly guiding towards 25bp and data for the first time in months not showing upside inflationary pressures relative to the Riksbank’s forecasts.

- There are more uncertainties than expected in the upcoming meeting as we have a new Governor for the first time in almost two decades in Erik Thedéen as well as a new Deputy Governor, Aino Bunge.

- A couple of potential curve balls that could potentially be discussed over the next few months for the Riksbank: first, the frequency of monetary policy meetings and second discussion of active sales of longer-dated government bonds.

- For the full document including summaries of 15 sell side views see:MNI Riksbank Preview - 2023-02.pdf

FX OPTIONS: Expiries for Feb09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-06(E719mln), $1.0760-80(E2.2bln), $1.0800(E1.8bln), $1.0840-50(E1.7bln), $1.0885-00(E1.1bln)

- USD/JPY: Y128.00($1.3bln), Y129.00($645mln), Y130.45($500mln), Y131.25-30($727mln), Y131.45-55($821mln), Y133.00($718mln)

- GBP/USD: $1.1950(Gbp581mln), $1.2145-50(Gbp533mln)

- EUR/GBP: Gbp0.8835-50(E599mln), Gbp0.8925-50(E1.4bln)

- EUR/JPY: Y141.00(E519mln)

- AUD/USD: $0.6955(A$581mln), $0.7000($707mln), $0.7025-30(A$643mln)

- NZD/USD: $0.6375-90(N$510mln)

- USD/CAD: C$1.3350($647mln), C$1.3395($711mln)

ASIA FX: Asia FX Underperforms Higher Beta G10 Trends

Asian FX hasn't seen much positive spill over from the stronger higher beta G10 FX tone (AUD, NZD & NOK) against the USD through today's session. Spot markets sit mostly higher in USD/Asia terms versus yesterday's closing levels. Cross asset signals have been mixed, although China/HK equities have firmed. Tomorrow the focus is on China CPI and PPI prints for Jan. Malaysian Q4 GDP prints, as does Indian IP.

- USD/CNH found selling interest above 6.8000, and last tracked near 6.7900, little changed for the session. Local equities are doing better, with Northbound flows returning for the first time in 5 days. A report from a prominent China economist that policy rates could be cut in Q2 has aided such sentiment. There may be less follow through on the FX side though.

- 1 month USD/KRW found selling interest close to 1265 in early trade. We last track near 1261, still above NY closing levels from Wednesday. Equity losses have been curbed during the session, with some spill over likely from China/HK moves.

- The SGD NEER (per Goldman Sachs estimates) is marginally firmer this morning, although it is below highs seen earlier this week. NEER sits ~0.7% below the upper end of the band at present levels. USD/SGD is little changed from yesterday's closing levels in today's dealing. The pair has traded in tight ranges in recent sessions as the broad based USD strength seen post the NFP print has faded. It last printed 1.3255/65

- USD/THB has tracked slightly higher in the first part of trade today. We are around 33.56 currently, +0.25% for the session. This leaves us within recent ranges for the pair. Signals from the equity space remain a headwind, with the SET off a further 0.50% today. The index is back close to its simple 50-day MA (1658.16). Yesterday, offshore investors sold a further $118.6mn of local equities, continuing the recent outflow trend. On the data front, consumer confidence for Jan rose to 51.7 from 49.7. This is highs back to late 2020. For the economic situation, confidence was at 46.0 versus 43.9 prior.

- Like elsewhere in the region, USD/IDR is fairly range bound today. Spot is slightly higher in USD/IDR terms, last around 15120/25 (+0.15% for the session). Support is still evident around the 15100 levels, whilst both the 20 (15109.6) and 200-day (15129.65) EMAs are nearby. We may stick to broad ranges ahead of next week's important US CPI release. In terms of cross asset drivers, the Citi terms of trade proxy continues to trend lower, while the 5yr CDS is up off recent lows, post the US non-farm payrolls report. Encouragingly for IDR bulls, flows have continued into Indonesian government bonds post the payrolls report, with a further $245.1mn so far this week.

CHINA: CPI & PPI On Tap Tomorrow, Consumer Inflation Expected To Tick Higher

A reminder that China CPI and PPI for January print tomorrow. The market expects a 2.1% Y/Y for CPI, versus 1.8% prior. Note the range of forecasts is 1.9-2.7% for CPI. For the PPI, we are expected to remain in deflation at -0.5% Y/Y (prior -0.7%, while the forecast range is -0.1% to -1.0%).

- There is likely to be more focus on CPI trends. Outside of food prices, domestic price pressures have been benign owing to a weak domestic demand backdrop. China core inflation ran comfortably below 1% y/y through the second half of last year.

- These trends likely started to change in January amid reports of stronger spending and recreational activity, particularly over the LNY period.

- So, the market may look at these trends for a sign of how firm domestic demand was in the first month of the year.

- It may also be a factor in thinking about any further easing steps from the authorities. A prominent China economist was on the wires today stating policy rates could be lowered in Q2 (see this link for more details).

- For PPI we are expected to remain in deflation, with China related commodity prices divergent in the first month of the year.

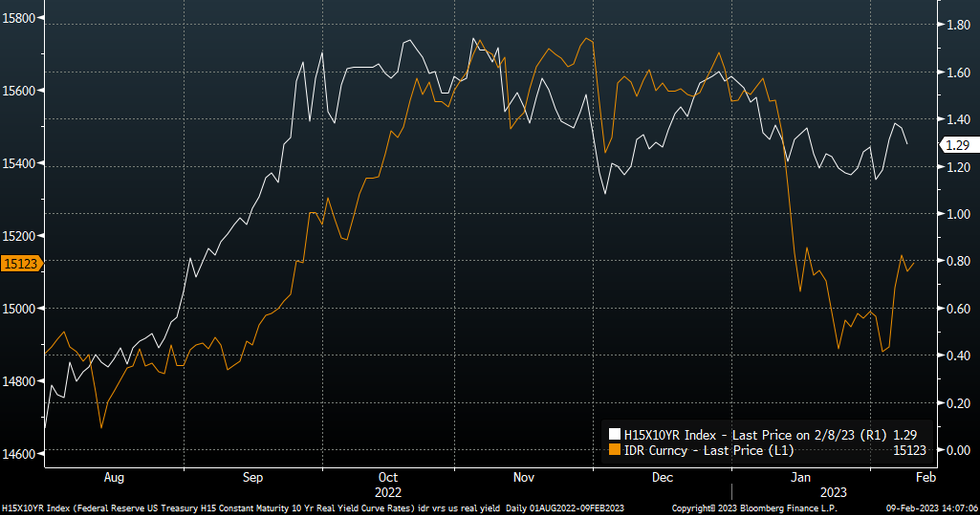

IDR: USD/IDR Close To Recent Highs, But Inflows Into Bonds Have Continued Post US Payrolls

Like elsewhere in the region, USD/IDR is fairly range bound today. Spot is slightly higher in USD/IDR terms, last around 15120/25 (+0.15% for the session). Support is still evident around the 15100 levels, whilst both the 20 (15109.6) and 200-day (15129.65) EMAs are nearby.

- We may stick to broad ranges ahead of next week's important US CPI release. IDR still has a reasonable correlation with US real yields, see the chart below.

- In terms of cross asset drivers, the Citi terms of trade proxy continues to trend lower, while the 5yr CDS is up off recent lows, post the US non-farm payrolls report.

- Encouragingly for IDR bulls, flows have continued into Indonesian government bonds post the payrolls report, with a further $245.1mn so far this week.

- On the data front, retail sales rose +0.7% y/y in Dec, with a +1.7% estimate for Jan, although this appears to reflect base effects, with the m/m estimate at -2.1% for Jan.

- The next major data release is trade figures out next Wed. So offshore drivers are likely to remain key for IDR sentiment.

Fig 1: USD/IDR v US Real 10yr Yield

Source: MNI - Market News/Bloomberg

EQUITIES: China/HK Markets Outperform As Northbound Flows Return

Outside of gains for China and Hong Kong equities, most regional markets are down. This is line with a weaker tone from Wall St on Wednesday, although higher US futures today (Eminis +0.20%, Nasdaq +0.25%), has likely helped curb losses.

- China and Hong Kong indices started off lower, but have pushed higher as the session progressed. The HSI is +0.34% at this stage, with the tech sub-index +0.55% after opening lower.

- The CSI 300 is +0.75%, pushing the index back above 4100. The authorities warned of speculation around the tech sector, particularly in relation ChatGPT.

- Potential for easier policy settings in Q2, as touted by top China economist, is also likely to have helped sentiment at the margins. Northbound stock connect flows have returned, with +7.43bn yuan coming back so far today. The first positive flows in 5 days.

- Elsewhere, the Nikkei 225 is -0.25%, while the Kospi (-0.10%) and Taiex (-0.15% are down slightly. Both indices are outperforming the tech sell-offs from Wednesday trade in the major markets.

- SEA markets are mostly lower, with JCI the exception.

GOLD: Bullion Higher Again Today After Fed Comments Wiped Wednesday’s Gains

Bullion is up today after giving up its gains on Wednesday in the wake of Fed comments affirming that rates will need to go up further to get inflation back to target. Gold prices are 0.2% higher during APAC trading reaching a high of $1880.33/oz and are now trading around $1879.00. The USD is slightly lower.

- Gold is trading above its 50-day simple MA but trend conditions remain bearish. It has been trading between its resistance at $1897.40, the 20-day EMA, and support at $1861.40, the February 3 low.

- Later today there is little in the US with no Fed officials scheduled to speak and only jobless claims on the data calendar.

OIL: Crude Range Trading Following Fed Comments Point To More Hikes

Commodity prices are generally stronger during APAC trading today but oil is down slightly after rallying on Wednesday following hawkish Fed comments. Oil prices continue to trade in a very narrow range with Brent currently at $85.05/bbl after a high of $85.27 and a low of $84.81. WTI is trading around $78.40 with a high of $78.62 following the $78.27 low. The USD is down slightly.

- WTI is still below its 100-day simple MA, while Brent has exceeded it. On Wednesday both WTI and Brent cleared the 50-day EMAs which has opened up $80.49 and $86.21 respectively.

- Optimism around demand from China drove the market yesterday, as Bloomberg reported that its largest refineries should reach peak levels in Q1 this year. Also oil shipments from Turkey remain disrupted following Monday’s tragic earthquake.

- The 2.423mn build in US crude stocks reported by the EIA on Wednesday didn’t dent the market’s optimism. This is the highest since July 2021. There was also a 5.01mn build in gasoline inventories.

- Later today there is little in the US with no Fed officials scheduled to speak and only jobless claims on the data calendar. The Riksbank is expected to hike 50bp and German preliminary January CPI is out.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/02/2023 | 0700/0800 | *** |  | DE | HICP (p) |

| 09/02/2023 | 0830/0930 | ** |  | SE | Riksbank Interest Rate |

| 09/02/2023 | 0945/0945 |  | UK | BOE Bailey, Pill, Tenreyro & Haskel at Treasury Select Committee Hearing | |

| 09/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 09/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/02/2023 | 1800/1900 |  | EU | ECB de Guindos Speech at Foro Economia y Humanismo | |

| 09/02/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/02/2023 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.