-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities & Bond Yields Tracking Lower

- US Tsy futures remained rangebound most of the day, before breaking the overnight highs of 111-23. Technical resistance is at 112-01+ (High Jan 17). This extends the moves from Monday US trade, as the US Treasury cuts its borrowing estimate.

- The USD is marginally lower, but more so against Asia FX than the G10. NZD has outperformed marginally following earlier hawkish RBNZ comments. RBNZ dated OIS pricing closed flat to 3bps firmer across meetings, with July-August leading.

- China and Hong Kong equities have been under pressure, with concerns putting Evergrande into liquidation will set a dangerous precedent for the rest of China's troubled property names. China government bond yields were lower as well.

- Looking ahead, EU GDP prints later, while in the US, JOLTS data, house prices and consumer confidence are on tap.

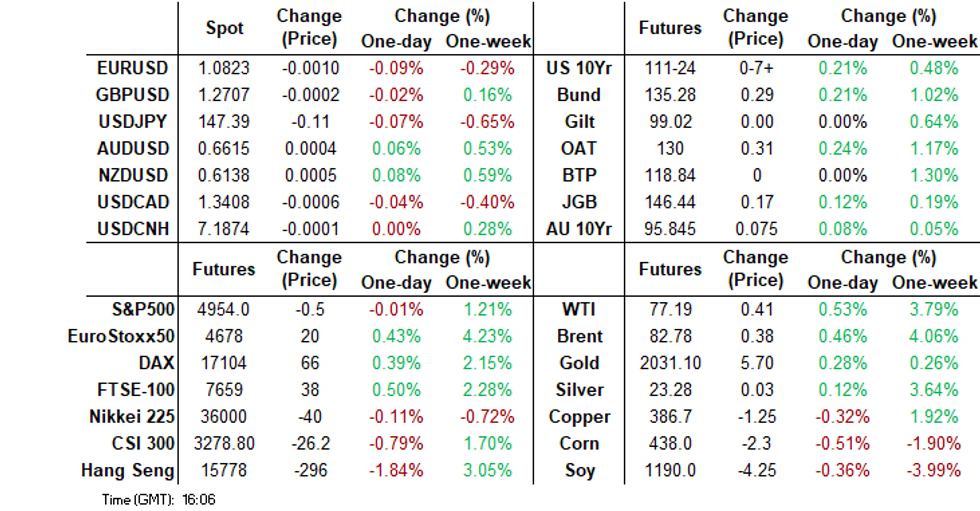

MARKETS

US TSYS: Yields Lower, Market Awaits Response On Troop Attack

TYH4 is trading at 111-24, + 07+ from NY closing levels.- Tsy futures remained rangebound most of the day, before breaking the overnight highs of 111-23 and is currently holding above it. Technical resistance at 112-01+ (High Jan 17).

- Cash yields have seen the curve move lower today trading in a 1-3bps range, the 2Y now trading 0.6bp lower, while the 10Y is currently 2.3bps lower.

- News flow has been reasonably light so far today, with markets waiting for the US response following the attack on its troops stationed in Jordan over the weekend.

- Data Tonight: House Price Index, Consumer Confidence, Job Openings

JGBS: Futures Stronger, Sitting Mid-Range, US JOLTS Data Later Today

In the afternoon session, JGB futures are holding in positive and in the middle of the session’s range, +15 compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined somewhat mixed December jobs data.

- Cash JGBs have ground out a slight bull-flattening of the curve in the afternoon session, with yields flat to 1.4bps lower. The benchmark 10-year yield is 0.8bp lower at 0.715% versus the Nov-Dec rally low of 0.555%.

- The 2-year is unchanged after today’s supply. The 2-year auction demonstrated mixed demand metrics, as the low price failed to meet dealer expectations but the cover ratio increased to 3.742x from 3.340x in December. It was the highest cover ratio for a 2-year auction since July last year. The auction tail was also shortened.

- Unlike recent JGB auctions, today’s result appears to indicate that the current outright yield adequately accounts for uncertainties surrounding the BoJ policy outcome.

- Swap rates are flat to slightly lower, with swap spreads mixed.

- Tomorrow, the local calendar sees Retail Sales and Industrial Production data for December, along with the BoJ Summary of Opinions (Jan. MPM).

- Attention turns to US JOLTS job openings data later today.

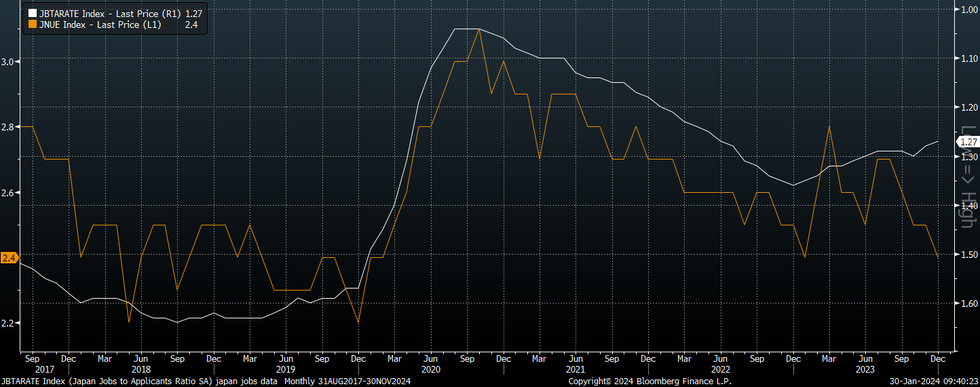

JAPAN DATA: Unemployment Rate Dips, But Detail Mixed

Japan Dec jobs data was somewhat mixed. The jobless rate ticked down to 2.4% versus an expected 2.5% (2.5% was also the prior print). The job to applicant ratio ticked down though to 1.27, versus an expected 1.28 (1.28 was also the prior outcome).

- The dip in the unemployment rate is a little at odds with the fall in the job-to-applicant ratio, (see the chart below, note the job-to-applicant ratio is inverted on the chart). However, the dip in the unemployment rate was driven by a fall in the participation rate, down to 62.8% from 63.1% in Nov.

- The total labor force fell by 220k in Dec, versus a 300k rise in Nov. Employed people dipped -120k after a 260k rise m/m in Nov.

- In terms of job offers, there were up 0.2% m/m, while new job offers rose 3.0% m/m. This comes after falls in Nov in m/m terms. The y/y trend for both series remains negative though (-3.1% for job offers).

Fig 1: Japan Job-Less Rate & Job-To-Applicant Ratio (Inverted)

AUSSIE BONDS: Futures Richer But Off Post-Retail Sales Highs, Q4 CPI Tomorrow

ACGBs (YM +3.0 & XM +6.5) sit stronger but below session highs sparked by the release of weaker-than-expected December Retail Sales data. The move away from the session’s best levels likely reflected the fact that at least a part of December’s weakness was related to shifting spending patterns between December and November.

- Notably, afternoon weakness in ACGBs comes despite an extension of yesterday’s US tsys rally in today’s Asia-Pac session. Cash US tsys are currently dealing flat to 3bps richer, with a flattening bias.

- Cash ACGBs are 3-6bps richer on the day, with the AU-US 10-year yield differential 1bp wider at +10bps.

- Swap rates are 1-5bps lower, with the 3s10s curve flatter.

- The bills strip is dealing mixed, with pricing -1 to +2.

- RBA-dated OIS pricing is little changed across meetings. A cumulative 44bps of easing is priced by year-end.

- Tomorrow, the local calendar sees Q4 CPI print. This will be a crucial input into deliberations at next week's RBA meeting. Bloomberg consensus is expecting headline CPI to print +0.8% q/q and 4.3% y/y versus +1.2% and 5.4% prior. Trimmed Mean CPI is expected to show +0.9% q/q and 4.3% y/y versus +1.2% and 5.2% prior.

- Tomorrow, the AOFM plans to sell A$800mn of 3.75% 21 May 2034 bond.

NZGBS: Richer, Closed Mid-Range, Hawkish Comments From Officials

NZGBs closed flat to 4bps richer, with the 2/10 curve flatter.

- Bloomberg reported that NZ Finister Minister Willis responds to questions in parliament stating that annual inflation of 4.7% in Q4 is an improvement but “is still far too high”. She added that on tradables inflation has stayed stubbornly high indicating domestic factors rather than global factors are playing the greatest role in driving inflation.

- (Bloomberg) ANZ forecasts the RBNZ will start cutting interest rates from August but doesn’t rule out the chance of a rate hike next month, following comments from the central bank’s chief economist today.

- ICYMI, RBNZ Chief Economist Conway said in a speech today in Wellington that “we still have a way to go to get inflation back to the target midpoint.”

- Swap rates closed 1bp higher to 3bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed flat to 3bps firmer across meetings, with July-August leading. A cumulative 92bps of easing is priced by year-end.

- Tomorrow, the local calendar sees ANZ Business Confidence. Australia sees the release of Q4 CPI data.

RBNZ: RBNZ Chief Economist Conway Strikes A Hawkish Tone

RBNZ Chief Economist Paul Conway delivered a speech earlier this morning. Whilst the main area covered was around research and data quality, Conway gave a few updates on recent NZ economic developments. The comments struck a hawkish tone, particularly in light of the recent Q4 CPI data, see the full speech here.

- Conway commented on the recent downward GDP revisions: "the recent GDP revisions do not necessarily mean that capacity pressures in the economy are much lower than previously assumed." "Private demand in the economy, which is more interest-rate sensitive, has mostly been revised up, with stronger consumption and business investment than first reported "

- On immigration: "While GDP has been revised down, net inward migration continues to be revised up."

- On inflation: "...However, annual non-tradable inflation, which is a rough approximation of inflation generated within the New Zealand economy, came in at 5.9 percent, which is higher than we estimated."

- "To sum up, monetary policy is working, with the economy slowing and inflation falling. But we still have a way to go to get inflation back to the target midpoint."

FOREX: Dollar Up From Earlier Lows, NZD Marginally Outperforms On Hawkish RBNZ Comments

The BBDXY sits up from earlier lows, last close to 1235.8, down only slightly for the session. We have seen generally tight ranges for most pairs in the G10 space, albeit with modest NZD outperformance.

- In early trade, NZD spiked on hawkish comments from RBNZ Chief Economist Conway. Notably he noted Q4 non-tradables was stronger than they expected and that there is still some way to go to achieve the inflation target.

- NZD/USD got to 0.6144 on the initial move higher, before pulling back to 0.6125/30. This afternoon we have pushed higher though, back to 0.6140/45. The 20 and 50-day EMAs sit slightly higher, rough 0.6150/60, which may be in focus on further upside in the pair.

- USD/JPY dipped to 147.20, sub Monday lows, before support emerged. The pair was last near 147.35, slightly firmer in yen terms for the session. Dec jobless data was mixed, with the unemployment rate ticking down, but the job to applicant ratio also fell.

- US yields are mostly lower, more so at the back end of the curve. Yen hasn't reacted much to these moves though.US equity futures are steady.

- AUD/USD sits unchanged, last near 0.6610. The Dec retail sales was weaker than expected , but the initial market reaction was muted. Earlier highs were at 0.6625. Weaker China/HK equity sentiment is likely weighing at the margin.

- Looking ahead, EU GDP prints later, while in the US house prices and consumer confidence is on tap.

EQUITIES: Regional Equities Mixed, China Down On Property Concerns

Asia equities are mixed today with Australia and Japan the standouts. US Equity Futures have been very uneventful today, trading flat but holding onto the late rally post the Treasury cut Jan-March borrow estimates from $816B to $760B, and estimates April-June at $202bn. Hong Kong and Mainland China stocks are sending clear signs that last weeks rescue package wont be enough to support the market and more needs to be done, to support them.

- Japan equity indices are trading higher today. Japan job data was out earlier and was somewhat mixed with the jobless rate ticking lower at 2.4% vs 2.5% est, Nintendo hit all time highs and there has been positive bank earnings numbers. The Topix is 0.26% higher, while the Nikkei is 0.30% higher.

- Hong Kong indices are much lower today as the market continues to react to the China Evergrande news that was out yesterday, traders now believe putting China Evergrande into liquidation will set a dangerous precedent for the rest of Chinas troubled property names, Hong Kong also unveiled details of a new planned security laws, which is weighing on stocks. Currently the Hang Seng is lower by 2.00%, Hang Seng tech index is 2.70% lower, while the Mainland China Property index is down 3.5%.

- Mainland China equities, much like Hong Kong are being dominated by China Evergrande, Chinese builder Radiance holdings has announced it's intention to hold meetings with bond holders of its march 2024 bond, which was last trading 65c on the dollar. China Yields have move to levels not seen since 2002, with the 10Y now trading at 2.46%. Equity Indices are all lower CSI 300 down 0.90%, while ChiNext is 1.10% lower.

- Taiwan is lower today, largely being pulled down by negative sentiment in the region, currently the Taiex is lower by 0.20%.

- South Korea, is flat today with no notable headlines to note.

- Australia had retail sales data out earlier, dropping 2.7% vs expectations of just a 1.7% fall, however the market has brushed that off and is continuing its winning run today, with the ASX 200 trading another 0.45% higher, all sectors are in the green today with tech names leading the way.

- In SEA today, most market are trading higher with the exception of Malaysia and Thailand. Poor results from Indian Banks has been weighing on the market, however the Nifty 50 are clinging onto gains today, currently up 0.15%

OIL: Marginally Higher, Market Awaits US Response To Jordan Attack

Brent is higher versus end Monday levels, although has largely tracked sideways in the first part of Tuesday trade. We were last around $82.65/bbl, around 0.30% firmer, but this follows Monday's 1.38% drop. WTI was last just above $77/bbl, showing a similar trajectory to Brent so far today.

- News flow has been reasonably light so far today, with markets waiting for the US response following the attack on its troops stationed in Jordan over the weekend. The most likely outcome is a strike on Iranian assets in the Middle East, but not within Iran itself (see this link).

- A number of US officials have stated that the US will respond but is not seeking to escalate the conflict.

- Elsewhere, the US administration may re-instate sanctions on Venezuela's energy sector if the country does not allow the opposition leader to run for President (see this BBG link).

- For Brent, recent lows rest near $82/bbl. Note the simple 200-day MA is near $81.70/bbl. On the topside, focus is likely to rest on whether we can test the $85/bbl.

GOLD: Helped Higher By Lower Bond Yields, Focus On Wednesday’s FOMC Meeting

Gold is slightly lower in the Asia-Pac session, after closing 0.7% higher at $2033.23 on Monday.

- Bullion was boosted on Monday by lower US Treasury yields, as investors turned their focus towards the Federal Reserve policy decision on Wednesday that could provide fresh clues on when the US monetary easing cycle will start.

- Fed speakers have been in a blackout ahead of this week’s FOMC meeting.

- The market is currently assigning around a 40% chance to a 25bp rate cut in March. This compares to the near 70% chance seen a couple of weeks ago.

- Lower interest rates are typically positive for non-interest-bearing gold.

- Resistance is seen at $2039.4 (Jan 19 high), according to MNI’s technicals team.

ASIA FX: Most USD/Asia Pairs Lower, Aided By US Yield Pull Back

USD/Asia pairs are mostly trading with a softer tone, although CNH is steady, with weaker local equities and a further downtick in yields in focus. PHP has also bucked the broader trend. A softer US yield backdrop has helped elsewhere though, as has some pockets of equity strength. Steadier oil prices have also been evident. THB has been the strongest performer, while IDR has benefited from hawkish official comments around the local FX. Tomorrow is a busy data day for the region, headlined by China official PMIs for Jan.

- USD/CNH has tracked recent ranges, the pair last around 7.1880, little changed for the session. Earlier lows were at 7.1810. Onshore equity weakness has been in focus amid fears that the Evergrande liquidation could spill over elsewhere. Local bond yields are also lower. The 10yr yield back to 2.46% per Bloomberg. This multi decade lows, as further easing bets persist.

- The won has traded with a positive bias, although within contained ranges. The 1 month NDF is back 1330. A further North Korea cruise missile test hasn't disrupted positive sentiment. local equities opened up around +1%, amid a positive lead from US markets, but we have slipped back to +0.15% now. Tomorrow, IP and the cyclical leading index print.

- THB is firmer, with USD/THB pair pulling back to 35.30. This is around 0.75% stronger in baht terms. We are now back to mid Jan levels, with a softer US yield backdrop likely helping. This continues the baht's volatile run as recent highs rest back at 35.88. Domestic pressure for the BoT to cut continues, while local equities are mostly tracking sideways.

- USD/IDR is back below 15800, last near 15785, around 0.15% stronger in IDR terms. Comments from both the BI and the FinMin are a likely stronger trend for IDR as 2024 progresses has helped. Later on, the BI stated that it will continued to intervene in the FX market to make the rupiah stable. Last week's break out higher came as we moved above 15700, so this level could be watched on a further downside correction.

- PHP has underperformed, once again not showing a strong correlation to broader USD/Asia directional trends. USD/PHP sits back above 56.40, around 0.20% weaker in PHP terms. We remain within recent ranges though, with recent highs coming in the 56.50/55 region.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/01/2024 | 0630/0730 | ** |  | FR | Consumer Spending |

| 30/01/2024 | 0630/0730 | *** |  | FR | GDP (p) |

| 30/01/2024 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/01/2024 | 0800/0900 | *** |  | ES | GDP (p) |

| 30/01/2024 | 0800/0900 | ** |  | CH | KOF Economic Barometer |

| 30/01/2024 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/01/2024 | 0900/1000 | *** |  | IT | GDP (p) |

| 30/01/2024 | 0900/1000 | ** |  | IT | PPI |

| 30/01/2024 | 0900/1000 |  | EU | ECB's Lane on 'a year with the euro in Croatia' | |

| 30/01/2024 | 0900/1000 | *** |  | DE | GDP (p) |

| 30/01/2024 | 0930/0930 | ** |  | UK | BOE M4 |

| 30/01/2024 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/01/2024 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 30/01/2024 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 30/01/2024 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 30/01/2024 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/01/2024 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/01/2024 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/01/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 30/01/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 30/01/2024 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/01/2024 | 1500/1000 | ** |  | US | housing vacancies |

| 30/01/2024 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 30/01/2024 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 30/01/2024 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 30/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 31/01/2024 | 2350/0850 | * |  | JP | Retail sales (p) |

| 31/01/2024 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.