-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China PMIs Mixed, As EU CPI & US PCE Come Into Focus

- China shares are weaker led by real estate stocks, despite two China mega cities easing mortgage rules in the past day. The official PMI prints were mixed for August, with manufacturing recovering further to 49.7, while services eased more than expected to 51.0. There was an initial bout of USD selling, but USD/CNH is back closer to 7.3000 this afternoon and the BBDXY is up from session lows.

- US Cash tsys sit ~0.5bps richer across the major benchmarks. In the Tokyo afternoon session, JGB futures are holding a small gain, +5 compared to the settlement levels, after trading in a narrow range during the Tokyo session.

- More broadly, July was a mixed month for global inflation after moderating for almost a year. We have started to see disinflationary factors turn up again but remain negative, see below for more details.

- Later the Fed’s Bostic and Collins speak and there are US jobless claims, August Challenger job cuts, July income/spending, PCE and August MNI Chicago PMI. The ECB’s Schnabel and de Guindos speak, ECB meeting accounts, preliminary August euro area CPI and July unemployment rate are published.

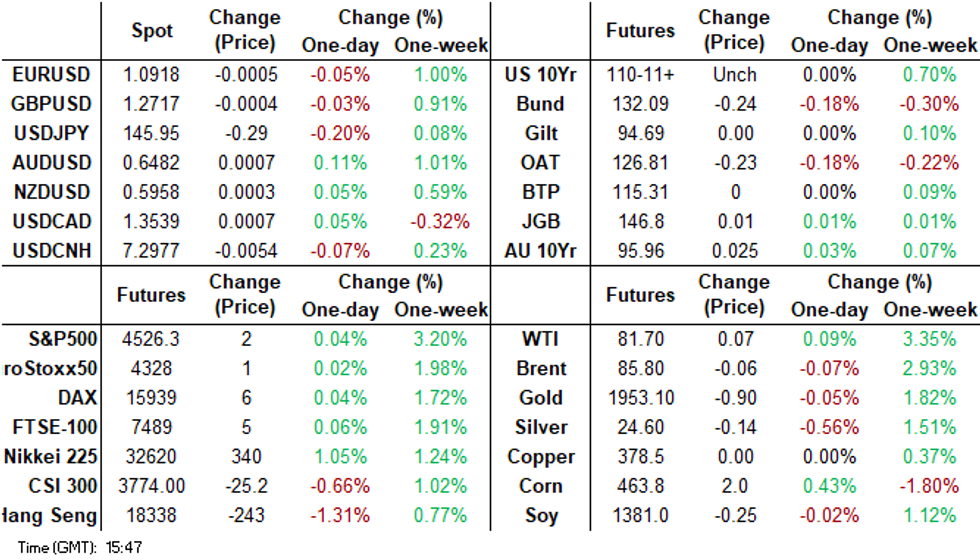

MARKETS

GLOBAL: Inflation Moderation Slows In July

July was a mixed month for global inflation after moderating for almost a year. We have started to see disinflationary factors turn up again but remain negative. OECD price pressures continue to be well above Asia’s consistent with the latter’s central banks on hold while most advanced central banks retain a tightening bias.

- OECD headline CPI rose to 5.9% from 5.7% predominantly due to the US and core to 6.8% from 6.6% with it being sticky in a number of countries, including the euro area.

- Non-Japan Asian CPI rose to 2% in July from a low 1.7% in June, which was the lowest since early 2021. The uptick was due to higher inflation in India because of rising food prices, the rest of the region saw it moderate. But increasing rice prices and the impact of El Nino on food are a concern in a number of countries. Core ticked up to 1.4% from 1.2% due to China, but remains not only contained but also very low. Excluding China it eased 0.3pp to 3.1%, the lowest since April 2022.

Global core CPI y/y%

Source: MNI - Market News/Refinitiv/IMF

GLOBAL: Disinflationary Pressures Turning

We have started to see factors that have been disinflationary become less so recently, such as supply chain pressures, shipping and some commodities. While oil and some food prices, such as rice, are rising again. It will be important to monitor these indicators as July was a mixed month for inflation developments (see MNI Inflation Moderation Slows In July), and preliminary August Spanish CPI inflation rose to 2.4% from 2.1% due to higher fuel prices.

- The Federal Reserve of NY’s global supply chain pressure index rose for the second consecutive month to -0.9 in July, the highest since the start of the year. Supply chain issues continue to ease but at a slower rate.

- Shipping rates are also declining at a slower annual pace, as indicated by the Baltic Freight Index, as well as most non-energy commodity prices. The Baltic Freight Index is up over 10% m/m in August to be down around 18% y/y after -50% in July. Base metals, iron ore and wool are all down on the month in August.

- Average Brent crude prices though rose in both July and August which will add pressure to fuel prices. Australian petrol prices were their highest in over a year in the latest week. Japan has already announced it will extend its petrol subsidies to the end of the year from September to keep pump prices below JPY180/L.

OECD CPI y/y% vs Brent crude y/y%

Source: MNI - Market News/Refinitiv

US TSYS: Muted Session In Asia

TYZ3 deals at 110-28, +0-01, a 0-02+ range has been observed on volume of ~61k.

- Cash tsys sit ~0.5bps richer across the major benchmarks.

- There have been narrow ranges in Asia today with little follow on moves.

- The space looked through the Chinese PMI print, the Mfg Component was firmer than expected and the Composite measure ticked higher.

- Flow wise a TU (2.5k lots)/UXY (1k lots) steepener was the highlight.

- Flash CPI from the Eurozone provides the highlight in Europe. Further out we have Challenger Job Cuts, Initial Jobless Claims, PCE Report and MNI Chicago PMI.

- Fedspeak from Atlanta Fed President Bostic and Boston Fed President Collins crosses.

JGBS: Futures Holding A Small Gain, BoJ Nakamura Comments, Q2 GDP Partials Tomorrow

In the Tokyo afternoon session, JGB futures are holding a small gain, +5 compared to the settlement levels, after trading in a narrow range during the Tokyo session.

- In addition to the previously outlined mixed activity data for July and weekly international investment flow data that showed offshore selling of Japanese bonds, local participants have also had a speech from BoJ Member Nakamura to digest.

- That said, Nakamura’s comments were consistent with the core message from yesterday’s speech from Tamura. Nakamura stated that more time is needed before turning toward tightening policy, given the lack of conviction for achieving the BOJ’s 2% inflation goal in a stable manner. He added that Japan’s inflation is led by cost-push factors and not by wage growth. (See link ICYMI)

- Cash JGBs are mixed, with the 3-5-year zone outperforming. Yield movements range from 0.2-0.6bp lower (3-5-year) to 0.5bp higher (2-year, 20-year and 40-year). The benchmark 10-year yield is 0.1bp higher at 0.653%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- Swap rates are higher out to the 30-year, with pricing +0.3bp to +0.8bp. The 40-year swap rate is 0.2bp lower. Swap spreads are wider, apart from the 40-year.

- Tomorrow the local calendar sees Capital Spending and Company Profits for Q2, along with Jibun Bank PMI Manufacturing for August (Final).

AUSSIE BONDS: Richer, Mid-Range, Eurozone CPI and US PCE Deflator Due

ACGBs (YM +4.0 & XM +3.5) sit in the middle of the Sydney range. There hasn’t been much in the way of catalysts outside the previously mentioned strong to in-line AU capex and private sector credit data, and mixed China PMIs.

- US tsys sit flat to 1bp lower across benchmarks in Asia-Pac trade.

- Cash ACGBs are 4bp richer, with the AU-US 10-year yield differential 1bp lower at -8bp.

- Swap rates are 4-5bp lower.

- The bills strip bear-flattens, with pricing flat to +7.

- RBA-dated OIS pricing is flat to 6bp softer across meetings.

- Tomorrow the local calendar sees CoreLogic House Prices (Aug) and Housing Finance (Jul).

- Flash CPI from the Eurozone provides the highlight in Europe, after upside surprises to German and Spanish inflation yesterday.

- Further out we have July PCE deflator, MNI Chicago PMI, Challenger Job Cuts and weekly Jobless Claims data, along with Fedspeak from Bostic and Collins. US Non-Farm Payrolls data is due on Friday.

AUSTRALIAN DATA: Capex Booming, FY24 Growth Solid But Slower

Q2 Australian capital expenditure was stronger than expected rising 2.8% q/q after an upwardly revised 3.7% the previous quarter. This left annual capex growth at 10.8% y/y up from 7.2% and the strongest since Q2 2021. Both building and machinery & equipment investment are robust but the former is driving the strength. Investment is needed to try and boost productivity.

- Building capex rose 3.5% q/q to be up 15% y/y after 3.2% and 8.3% in Q1, consistent with the Q2 construction data. This component has been boosted by both mining, especially related to lithium, and non-mining projects.

- Machinery & equipment rose 1.9% q/q to be up 6.4% y/y following 4.2% and 5.9% in Q1. The Q1 quarterly rise was revised up 0.5pp, but that is likely to have a negligible impact on GDP revisions. The ABS noted that machinery & equipment capex has been boosted by the easing in supply chain pressures improving availability especially of vehicles, and the expiry on June 30 of a “full expensing tax incentive”. So there could be payback in H2 2023.

- Investment intentions for FY2024 were revised up 14.5% to be 7.1% higher than the same estimate for FY2023. Building was revised up 13.6% to be up 8.7% y/y and machinery & equipment +15.9% to 4.6% y/y.

Source: MNI - Market News/ABS

NZGBS: Outperforms The $-Bloc, Consumer Confidence Tomorrow

NZGBs closed at or near session bests, with benchmark yields 4-6bp lower, despite an improvement in business sentiment. With US tsys little changed in Asia-Pac dealing, the catalyst for afternoon strengthening appears to have been solid digestion of weekly supply. Cover ratios across the lines showed a 2.00x to 3.00x range with the longer-dated (May-31 and May-41) issues leading, albeit slightly less than the last time out. The bond lines are 1-2bp richer in post-auction trade.

- The local market’s resilience sees NZGBs outperform the $-bloc with the NZ-US and NZ-AU 10-year yield differentials respectively 3bp and 2bp tighter.

- Swap rates are 4-5bp lower.

- RBNZ dated OIS pricing is flat to 3bp softer across meetings, with May'24 leading.

- The business confidence index rose to -3.7 in August, its highest since June 2021, from -13.1 in July, according to ANZ Bank NZ. Business activity outlook rose to 11.2 from 0.8 in July. Inflation expectations eased to 5.06% from 5.14%. “Many firms appear to have been pleasantly surprised at how well demand has held up' and the Reserve Bank has stopped raising the OCR, which may be creating a sense that the worst is over”: ANZ

- Tomorrow the local calendar sees ANZ Consumer Confidence data.

NEW ZEALAND DATA: Business Positive While Inflation Components Slowly Trend Down

ANZ business confidence rose to -3.7 in August from -13.1. Business activity outlook rose to +11.2 from +0.8, the third straight positive, and suggests GDP growth recovered further in Q3. These were the highest readings in over two years and 19 months consecutively. All current and forward components also improved while prices/costs continued to ease, so no concern for the RBNZ here yet. The pause in monetary tightening, continued solid demand and increase in labour supply are all supporting business sentiment.

- Cost expectations moderated to 75.3 from 80.6, while still high they continue to trend lower. Capacity utilisation rose to its highest since November 2021, which may add to inflation pressures going forward. Inflation expectations eased to 5.06% to be down 1pp over the last year and pricing intentions fell to 44 from 48.1 but ANZ says that needs to fall below 30. 54% of retailers expect to increase prices in the next 3 months, the lowest since March 2021. Costs are expected to rise more than prices over the next 3 months.

- Employment intentions returned to positive territory for the first time since late last year driven by the services sector. Wage expectations eased to 80.2 from 81.8 with past wage rises up 0.1pp to 5.6% but expectations for 12 months ahead eased to 3.7% from 4.1%.

- Export intentions rose to 7.5 from 1.5 despite disappointing demand from China. Domestically both residential and commercial construction continued to recover, and investment intentions rose.

- See ANZ report here.

Source: MNI - Market News/Refinitiv

EQUITIES: Mixed Trends, China Bourses Weighed By Weaker Real Estate Index

Asia Pac equities are mostly lower in Thursday trade to date. Japan markers are the main positive, with most other major indices tracking lower, or close to flat. US futures are a touch higher, Eminis last near 4529, +0.10% firmer and holding close to recent highs. Nasdaq futures are also tracking firmer, last near 15515,

- China shares are weaker at the break. The CSI 300 down 0.54%, with the real estate sub index off 4.37%, nearly unwinding all of the gains seen over the prior 3 sessions. In the past day, 2 China mega cities have eased mortgage rules (see this link) but this hasn't aided sentiment today. Weekend news from the SCMP suggested Shanghai was unlikely to relax restrictions much.

- The official PMI prints were mixed for August, with manufacturing recovering further to 49.7, while services eased more than expected to 51.0.

- The HSI is also down at the break, off by 0.26%. The HSTECH is up by 0.40%, by well down on earlier highs. The authorities reportedly approved public AI rollout for a number of companies. PBoC Governor Pan also vowed further funding support for the private sector.

- Japan stocks are firmer, the Topix last +0.75%, the Nikkei up by a similar amount. Toyota July output was a record and the firm expects to make over 10m cars this year.

- Despite positive tech leads through Wednesday US trade, the Kospi (-0.40%) and Taiex (-0.35%) are both weaker.

- Philippine stocks are also down, by just over 1%., unwinding some of the recent rebound. This market is tracking over 5% lower for August.

FOREX: Narrow Ranges In Asia

The greenback is marginally pressured in Asia today, ranges have been narrow for the most part with little follow through on moves.

- AUD/USD is ~0.2% firmer, last printing at $0.6485/90. The pair briefly firmed above the $0.65 handle after stronger than forecast Chinese Mfg PMI & Q2 Capex before paring gains through the session.

- Kiwi is marginally firmer, however ranges remain narrow in NZD/USD. AUD/NZD is marginally firmer and is consolidating a touch below the $1.09 handle.

- Yen is up ~0.2%, marginally lower US Tsy Yields are weighing on USD/JPY which is dealing in a tight range below ¥146.

- Elsewhere in G-10 GBP and EUR are little changed from opening levels.

- Cross asset wise; BBDXY is down ~0.1% and US Tsy Yields are marginally lower across the curve. E-minis are up ~0.1%.

- Flash CPI from the Eurozone provides the highlight in Europe.

OIL: Crude Unphased By Better China PMIs, Waiting For US Data

Oil prices have been range trading during the APAC session today. Both Brent and WTI are off their intraday lows but little changed on the day. The slight improvement in the August China manufacturing PMI failed to boost crude as it remained in contractionary territory. Friday’s US payroll data is important for the market for direction on Fed policy. The USD index is slightly lower.

- Brent has held above $85 during the APAC session and is trading around $85.23/bbl off the low of $85.09. It reached a high of $85.40 earlier. It is currently slightly higher on the month. WTI is steady around $81.62 after a low of $81.48 and high of $81.81.

- The market appears to be treading water ahead of US data particularly Friday’s payrolls (+170k forecast) but OPEC+ supply cuts and low inventories continue to provide support that has been limited by ongoing concerns re US and China demand. Saudi Arabia is expected to announce an extension to October of its voluntary output reduction soon.

- Barclays revised up its 2024 Brent forecast to $97 and others, including CBA, see upside risks to their forecasts as the market tightens, according to Bloomberg.

- See the MNI Commodity Weekly for more details on energy developments this week.

- Later the Fed’s Bostic and Collins speak and there are US jobless claims, August Challenger job cuts, July income/spending and August MNI Chicago PMI. The ECB’s Schnabel and de Guindos speak, ECB meeting accounts, preliminary August euro area CPI and July unemployment rate are published.

GOLD: Slightly Higher As USD & Yields Slip After Weak US Data

Gold is slightly higher in the Asia-Pac session, after closing +0.2% on Wednesday as the USD and US tsy yields slipped after weaker-than-expected data.

- US economic data was generally softer than expected. Q2 GDP rose at a revised 2.1% annual rate which was below the previous estimate of 2.4%. There were also downside revisions to the GDP deflator, from 2.2% to 2.0%, and core PCE price index from 3.8% to 3.7%. ADP also missed estimates (177k versus 195k expected), albeit with a caveat of an upward revision.

- Near-term Fed Funds implied rates show +3bp for Sept and a cumulative +12bp for Nov to 5.45% terminal, down by 5.5bp from pre-JOLTS levels on Tuesday. Cuts from the terminal are seen at 52bp to Jun’24 and 121bp to Dec’24.

- The focus now turns to the release of the July PCE deflator, MNI Chicago PMI, Challenger Job Cuts and weekly Jobless Claims data later today, along with Fedspeak from Bostic and Collins. US Non-Farm Payrolls data is due on Friday.

- Bullion hit a high of 1949.05 yesterday. This just cleared resistance at $1948.3, the 61.8% retrace of the Jul 20-Aug 21 bear leg, according to MNI's technicals team. A more concerted push higher will now be needed to test the next resistance at $1963.3 (76.4% retrace).

CHINA DATA: August PMIs Mixed, Price Indices Recover Further, Employment Indices Still Weak

The modest upside surprise on manufacturing (49.7, 49.2 forecast and 49.3 prior) was driven by a firmer output sub-index, which rose to 51.9 from 50.2, along with new orders, 50.2 from 49.5.

- Other indicators were more mixed. Inventories ticked higher, leaving the new orders to inventory ratio slightly lower at 1.06, versus 1.07 in July. Notably the employment sub index edged down to 48.0 from 48.1 in July.

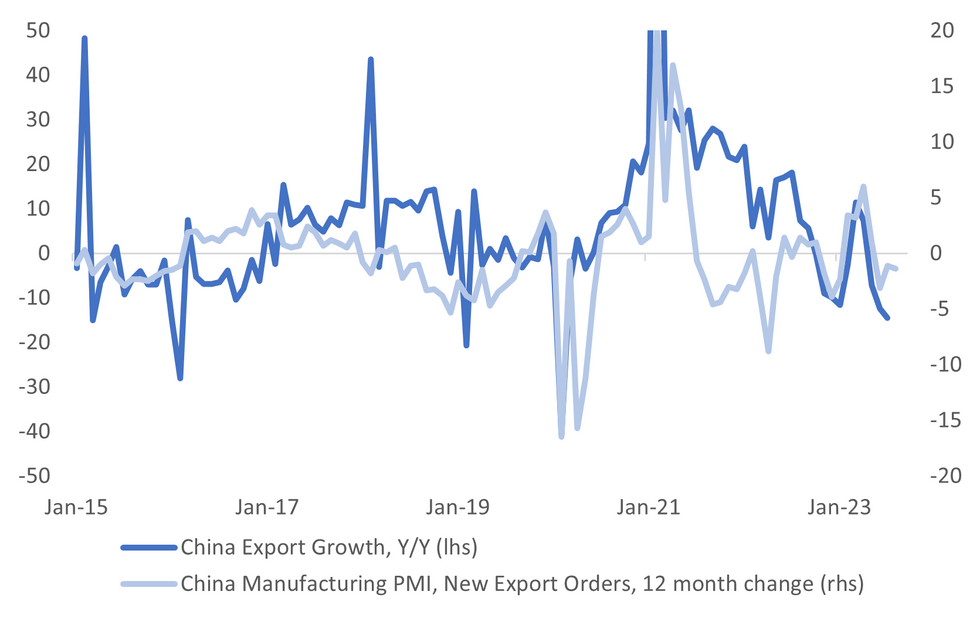

- New export orders ticked slightly higher, but at 46.7, remains comfortably in contractionary territory. This still suggests a challenging export growth backdrop, albeit with some scope for y/y improvement, see the chart below.

- By size of enterprise, there was improvement across the board, although small enterprises remain weaker at 47.7, versus 50.8 for large.

Fig 1: China Export Growth Versus Manufacturing PMI New Export Orders Index

Source: MNI - Market News/Bloomberg

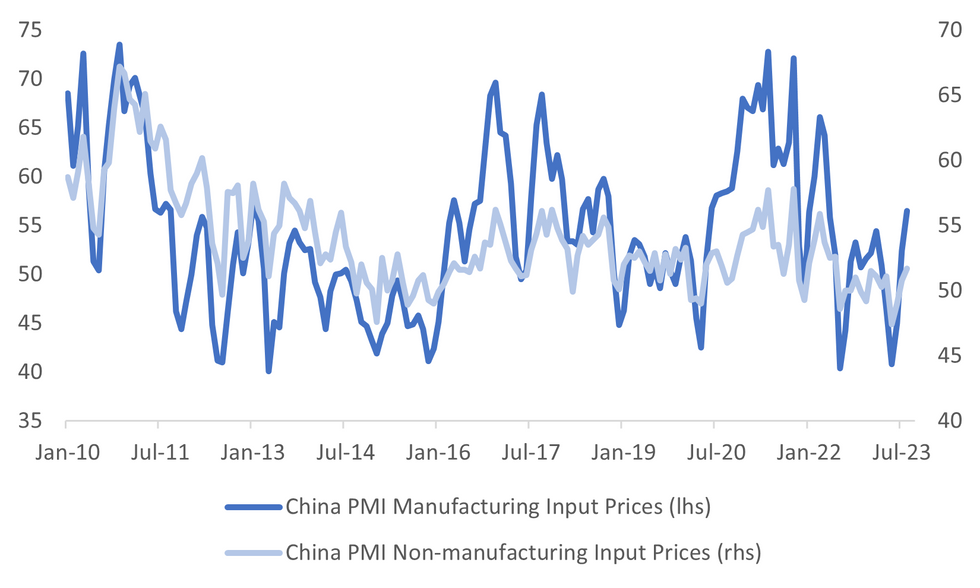

- In terms of prices, input prices rose to 56.5, from 52.4 in July. Output prices also rose to 52.0, from 48.6. The second chart below plots the input price measure for both the manufacturing and services PMI, with both measures trending higher in recent months. This suggests a less adverse deflationary backdrop all else equal for China.

- On the services PMI side, the headline move lower (51.0 from 51.5 prior and 51.2 forecast) was driven by declining new orders to 47.5 from 48.1. The employment sub-index was relatively steady at 46.8, prior was 46.6. As per above price pressures firmer on the input side. Note as well output selling prices rose to 50.0 from 49.7.

Fig 2: China PMI Input Price Measures

Source: MNI - Market News/Bloomberg

THAILAND: Manufacturing Output Remains Weak, PMI Tomorrow

Thai July manufacturing production improved to -4.4% y/y from -5% which was revised up from -5.2%, the ninth consecutive contraction. This was slightly lower than consensus. Capacity utilisation fell 1pp to 58.2%, the third consecutive monthly decline. Weak merchandise exports continue to weigh on manufacturing output. The weakness hasn’t reflected recent moves in the manufacturing PMI which reached a high of 60.4 in April and have been above 50 since end 2021. July was only just in expansionary territory at 50.7. The August PMI prints on Friday.

Thailand manufacturing

Source: MNI - Market News/Bloomberg/Refinitiv

ASIA FX: Little Follow Through On Early USD/Asia Downside

USD/Asia pairs are mixed today, with a firmer USD tone unfolding as the session progressed, although pairs remain very much within recent ranges. USD/CNH sits back close to 7.3000, a mixed PMI backdrop offset by lower onshore equities. THB is a clear outperformer the other way. India Q2 GDP is still to come today. Tomorrow the China Caixin manufacturing PMI prints, along with South Korean trade data. PMIs print elsewhere in the region.

- USD/CNH is holding near 7.3000 currently, earlier lows were just under 7.2870. We remain very much within recent ranges. The mixed PMI results, with manufacturing surprising on the upside, versus a modest downside surprise from services hasn't shifted the sentiment needle a great deal. We did see some initial USD selling (on the manufacturing beat), but there wasn't any follow through. Local equities are struggling for positive traction at this stage (CSI down around -0.55%), with the real estate index a notable drag, despite eased mortgage restrictions in some mega cities.

- After making fresh highs in late NY trade on Wednesday (near 7.8480), USD/HKD has seen more two-way price action today. The pair pulled back towards 7.8440, before settling back closer to 7.8460 in recent dealings. Spot dips sub 7.8440 have generally been supported in recent sessions. Hibor 1 month fixed lower today, back under 3.72%, we did fix slightly higher yesterday (3.76%). The 3 month was also fixed lower, 4.45%, versus 4.48% yesterday. US-HK short end yield differentials have started to stabilize though, with US 3 month edging down this past week, weighed by weaker US data outcomes.

- USD/PHP is sticking to recent ranges in the first part of dealing today. The pair is back close to 56.75 (earlier lows were at 56.575), little changed on closing levels from yesterday. The pair is above all key EMAs, with the 20-day closest on the downside near 56.31. Mid-August highs rest close to ~57.00, although in recent weeks we have capped out around 56.90. PHP is tracking comfortably lower for August. Outside of broader USD trends, the weaker local equity backdrop has also likely weighed on PHP. The PSEi is down 5.5% for August with weaker economic activity and signs of slowing bank lending headwinds.

- The Rupee has opened dealing marginally firmer on Thursday, USD/INR is down ~0.1% and last prints at 82.6750/82.68. The pair was little changed yesterday as narrow ranges continue to persist, see-sawing around the 20-Day EMA (82.6868). Q2 GDP is on the wires today, a rise of 7.8% Y/Y is expected this is the largest increase since Q2 2022 with growth ticking higher from 6.1% in Q1. Economists say lower commodity prices helped manufacturers increase margins and offset the impact of 250 basis points of cumulative interest rate increases since May 2022.

- USD/MYR printed its lowest level since 17 August yesterday as the pair continues to trim August's gain. The pair closed dealing at 4.6385, after falling ~0.2% yesterday. A reminder that onshore markets are closed today for the observance of a national holiday.

- Baht is the strongest performer in the Asian FX space so far today. USD/THB is down 0.50% at this stage to 34.90/95 (after closing yesterday near 35.10). Support was evident on an earlier dip to 34.89. Ther 20-day EMA is at 35.02, although recent moves sub this support level haven't been sustained. Note as well, the 50-day EMA isn't too far away at 34.87. New PM Srettha has stated the qualification/vetting process for the new cabinet should be completed by tomorrow.

- The SGD NEER (per Goldman Sachs estimates) is marginally firmer in early dealing and has consolidated August's gains in recent dealing. The measure is ~0.4% below the top of the band. Broader USD trends continue to dominate flows for USD/SGD, the pair was pressured in yesterday's NY session after the US GDP print before support came in ahead of the 200-Day EMA ($1.3480.) On the wires this morning July M1 Money Supply fell 7.9% Y/Y and M2 Money Supply rose 3.1% Y/Y.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/08/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/08/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 31/08/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/08/2023 | 0630/0730 |  | UK | DMO to publish Oct-Dec issuance calendar | |

| 31/08/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/08/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/08/2023 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/08/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/08/2023 | 0700/0900 |  | EU | ECB's Schnabel Speaks at Conference | |

| 31/08/2023 | 0715/0315 |  | US | Atlanta Fed's Raphael Bostic | |

| 31/08/2023 | 0715/0815 |  | UK | BoE's Pill speaks at South African Reserve Bank conference | |

| 31/08/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/08/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/08/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 31/08/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/08/2023 | 1130/1330 |  | EU | ECB MP Meeting Account Publication | |

| 31/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 31/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/08/2023 | 1230/0830 | * |  | CA | Current account |

| 31/08/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 31/08/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/08/2023 | 1300/0900 |  | US | Boston Fed's Susan Collins | |

| 31/08/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/08/2023 | 1345/0945 | *** |  | US | MNI Chicago Report |

| 31/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 31/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 31/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 31/08/2023 | 1600/1800 |  | EU | ECB's de Guindos Speaks at Conference | |

| 01/09/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.