-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Unveils Bond Issuance Plans Post Weaker Credit Data

- JGB futures have maintained a firm downside bias in Monday Asia Pac trade. Sentiment has remained weak since the BoJ bond buying op curtailed purchases in the 5-10yr tenor space compared with the late April operation (by ¥50bn). US Treasury futures ticked higher in early morning trading, before the long-end pared gains with weakness in JGBs contributing to the move.

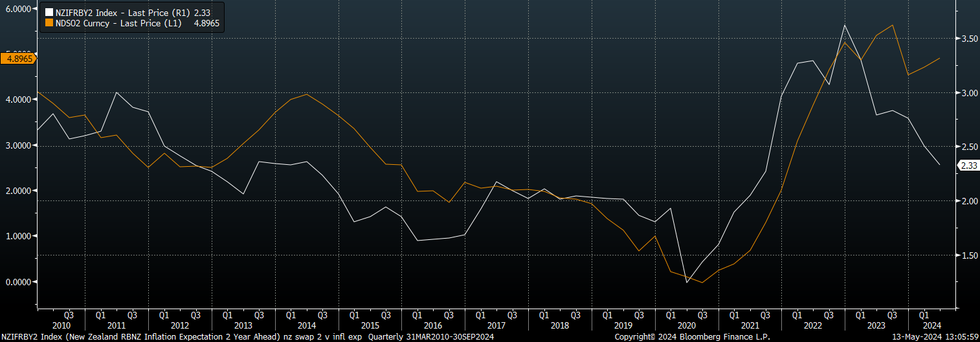

- In NZ, inflation continued to trend in the right direction with RBNZ 2-year business inflation expectations moderating to 2.3% in Q2 from 2.5%, the lowest since Q3 2021. NZD/USD is weaker, but there has been little impact on onshore yields.

- USD/CNH has pushed higher, while local bond yields are lower. Quite weak April credit data from the weekend has raised prospects for easier policy settings. US planned tariffs on certain sectors is also a headwind. China has also unveiled plans for ultra-long bond issuance (which kicks off this Friday).

- Later the Fed’s Mester and Jefferson discuss central bank communications. In terms of data there is just US NY Fed 1-year inflation expectations for April. The Eurogroup meeting is being held and the ECB’s Buch is scheduled to speak. The focus this week will be on Wednesday’s US April CPI release.

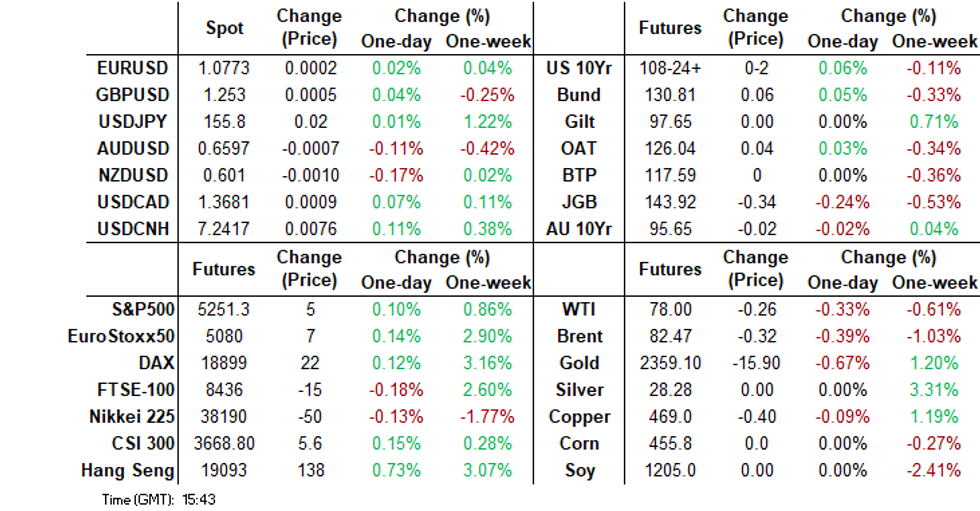

MARKETS

US TSYS: Treasuries Little Changed, Ranges Tight Ahead of US CPI Later This Week

- Treasury futures ticked higher in early morning trading, before the long-end pared gains with weakness in JGBs contributing to the move. The 10Y contract is up (+ 01+) at 108-24, with intraday highs of 108-25+, while the 2Y contract is has held up throughout the day now trade near intraday highs, up ( + 00⅜) at 101-20.75.

- Looking at 10Y technicals, we still sit comfortably above initial support at 108-15+ (20-day EMA) a break here would open a retests of 107-04 (Apr 25 lows), while initial resistance is 109-06+/08+ (Channel top from Feb 1 high / 50-day EMA)

- Cash Treasury curve bull-steepened today, yields are about flat to 1bps lower, with the 2Y -0.9bps at 4.856%, the 10Y -0.2bp to 4.494% with the 2y10y -0.436 at -36.693.

- Looking across local rates markets: NZGBs yields are flat to 0.5bps lower, ACGBs are 1-2bps higher while JGBs are 1-4bps higher.

- The projected rate cut pricing cooled vs. late Thursday: June 2024 at -5% w/ cumulative rate cut -1.2bp (-2.5bp late Thu) at 5.307%, July'24 at -22% w/ cumulative at -6.7bp (-9bp late Thu) at 5.253%, Sep'24 cumulative -19.2bp vs. -22.4bp, Nov'24 cumulative -27.7bp -31.1bp, Dec'24 -40.9bp vs. -45bp.

- Looking Ahead: A slow start to the week, focus is on PPI and CPI on Tue/Wed

JGBS: Eyeing Downside Test Of Late Apr Lows As BoJ Reduced 5-10 JGB Purchases

JGB futures maintain a firm downside bias in afternoon dealings. We were last around 143.92, -.34. This is slightly up from session lows (143.86). April 26 lows rest back at 143.61. Beyond that lies 143.44, which is a key support point.

- Sentiment has remained weak since the BoJ bond buying op curtailed purchases in the 5-10yr tenor space compared with the late April operation (by ¥50bn). Whilst the amount purchased was still within the projected range for the current quarter it will likely sharpen focus around the likelihood of reduced purchases as we progress further into 2024.

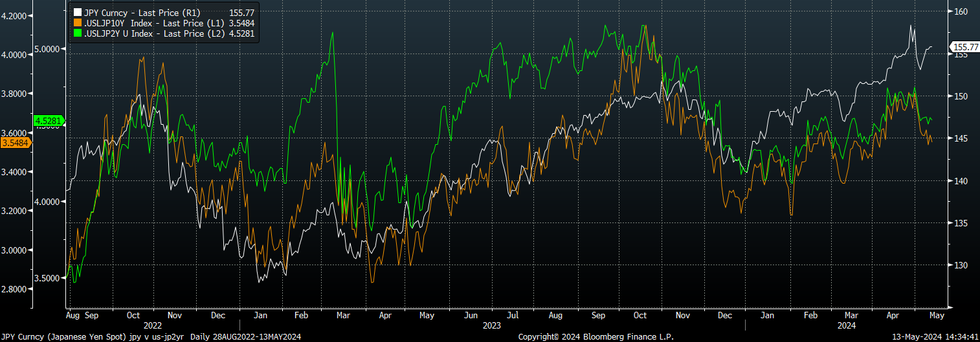

- USD/JPY dipped initially on the news, but hasn't seen any downside follow through. The latest from our Tokyo Policy team notes risks the weaker yen trend could hasten the policy tightening process (see this link).

- In the cash JGB space, the 10yr yield is above 0.94%, +3bps higher. From the 5 yr to 40yr tenor we are around 3bps in yield terms. 10yr swap is above 1.01%, while the 20 and 30yr tenors are up 5bps in yield terms.

- Tomorrow, we have the PPI for April, along with the 5yr debt auction.

RBA: Treasury Expects Inflation To Return To Target A Year Before RBA

The federal budget is announced on Tuesday at around 1930 AEST. The updated Treasury economic and fiscal forecasts will be a particular focus for market participants. There are reports today that it will forecast inflation returning to target by December 2024, a full year ahead of the RBA’s updated and upwardly revised May projections. Lower growth, especially consumption, expectations are also likely.

- Treasurer Chalmers has said that the difference between Treasury’s inflation forecasts and the RBA’s is “timing” rather than “opinion” as the latter does not include the measures in the new budget. The RBA is projecting headline at 3.8% at the end of this financial and calendar years before falling to 2.8% at the end of 2025. It has trimmed mean at 3.8% in Q2 2024, 3.4% end-2024 and 2.8% end-2025.

- The Australian is suggesting that lags from previous monetary tightening and continued rollover of mortgages from low to higher rates are the reason for the difference. It is likely that the RBA has already taken this into account but may have made different assumptions.

- Treasury estimated end FY24 CPI at 3.75% in December’s MYEFO and end FY25 at 2.75%, which was already 0.5pp below the RBA at the time. According to The Australian, inflation will be revised down to 3.5% in Q2 2024 and Q2 2025 remains at 2.75%. Growth will be brought down 0.25pp to 2% in FY25 (RBA 2.1%) and 2.25% in FY26 (RBA 2.4%).

- Tuesday will provide the details on what may have driven Treasury’s expected downward revisions, including extensions of rent and energy bill relief.

AUSSIE BONDS: ACGBs Slightly Cheaper, Federal Budget Tomorrow

ACGBs (YM 0.0 & XM -1.5) are cheaper today, earlier we had NAB Business survey's with business confidence stable at 1 in April but conditions eased further to 7 from 9, only slightly above the series average, while CBA household spending fell 1.0% m/m in Apr, from a 0.2% rise in March.

- Cross-asset moves: US equity futures are a touch lower today, while the ASX200 is down 0.24%, the BBDXY is little changed today the AUD is down 0.13%, while Iron ore is down 0.19% and now trades at $116.45/ton.

- US Tsys curve is slightly steeper today, however we have remained in very tight ranges with yields flat to 1bps lower, with the 2Y -0.9bps at 4.856%, the 10Y -0.2bp to 4.494% with the 2y10y -0.436 at -36.693.

- The ACGB curve has bear-steepened today, yields are flat to 2bps higher with the 2y10y +1.220 at 30.32, while the AU-US 10-year yield differential is 1bps lower, now -16bps

- Swap rates are 2-4bps lower.

- The bills strip is slightly richer, up 1bp

- RBA-dated OIS implied rate now pricing 2-3bps higher into the November meeting, while the market is now pricing just 7bps of easing into year-end to a terminal rate of 4.28%

- Looking ahead, Tuesday we have the Federal Budget handed down

AUSTRALIAN DATA: April Price/Cost Pressures Softer Than Q1

NAB’s measure of business confidence was stable at 1 in April but conditions eased further to 7 from 9, only slightly above the series average. Confidence has been fairly steady around 1 through 2024 but conditions have eased 3 points since December and 18 points since the September 2022 peak. The main activity components eased further with employment now below the historical average, while April price/cost components moderated compared with Q1.

- Employment fell 4.5 points to 1.9, which is still signalling positive labour demand but at a lot slower pace than it had been previously. It was the lowest reading since January 2022.

Source: MNI - Market News/Refinitiv

- Forward looking orders fell to -7.2 from -1.4, the lowest since the Covid-impacted August 2020. NAB says that the deterioration was due to large drops in mining, manufacturing and construction, while retail and wholesale are also negative.

- On a more positive note, capacity utilisation was unchanged and investment high.

- Labour costs moderated to 1.5% over 3-months from 1.7%, the lowest since September 2021 but still above the post-2000 average. Purchase costs eased to 1.2% from 1.5%, in line with average.

- Prices of final products rose 0.9% over 3-months up from March’s 0.7% but retail moderated 0.5pp to 0.9%. Both are below the Q1 average though signalling that the start of Q2 saw a moderation in price pressures.

- Services are facing better business conditions while retail are the “most concerning”.

- See NAB survey here.

Source: MNI - Market News/Refinitiv

AUSTRALIAN DATA: Sharp Drop In April Consumption Driven By Discretionary Spending

CBA’s household spending indicator (HSI) based on digital transactions fell 1% m/m in April to be up 2.6% y/y down from 3.9% y/y but only +1.4% y/y per person. March retail sales fell 0.4% m/m to be up only 0.8% y/y and the April CBA data suggest this is likely to moderate further given the high correlation between the two series (April retail sales due May 28). Consumption is expected to remain soft and then begin to recover in H2 2024 as tax cuts and lower inflation drive an improvement in real incomes.

- Spending increased in non-discretionary sectors such as education, utilities, insurance and health. Food, hospitality and recreation were down sharply as well as transport. The HSI is nominal and so the increase in expenditure also reflects price increases, especially for insurance. Essential spending rose 0.5%m/m to be up 4% y/y whereas discretionary fell sharply by 4.4% m/m to be up 1.8% y/y.

- Goods spending fell 0.8% m/m after -0.8% in March and services fell 1% m/m after rising 1.4%. Services spending continues to outpace goods at 7.7% y/y compared to 2.4% y/y.

- There have been updates to the HSI’s weights, seasonal adjustment factors and some more details including HSI per capita and by home ownership status.

Source: MNI - Market News/ABS/Bloomberg

NZGBs: Little Changed As Inflation Expectations Fall

NZGBs are little changed today, earlier inflation expectation data showed a drop in both the 1yr and 2yr, while food prices increased in April to 0.6% from -0.5% in March. US Tsys futures are a touch higher, while the curve has steepened slightly. Elsewhere in the rates space JGB futures gapped lower on the BoJ bond buying announcement, which reduced purchases in the 5-10 year tenor compared to the late April buying op.

- US Treasury futures have ticked up just a touch with the 10Y up (+ 01+) to 108-24, ranges have been tight while volumes have been on the lower side.

- Earlier, the Performance Services Index fell to 47.1 from 47.2 the lowest since October 2022, Food prices rose 0.6% in April from a decline of -0.5% in March, and finally the 1-year inflation expectations eased to 2.73% from 3.22% in Q1 and the 2-year expectations eased to 2.33% from 2.50% in Q1.

- NZGB yields erased the mornings moves higher to trade near best levels for the day now, with yields closing about 0.5bps richer.

- Swap rates are 1-3bps lower. The NZD 2y OIS Swap has typically traded in line with the 2yr RBNZ inflation expectation but has broken that correlation over the past year. Chart 1

- RBNZ dated OIS is 2-3bps softer out past the August meeting with a cumulative 47bps of easing is priced by year-end

- Looking Ahead: REINZ House Sales on Tuesday

Source - BBG

Source - BBG

NZ DATA: Inflation Expectations Moderate Further In Q2

Inflation continued to trend in the right direction with RBNZ 2-year business inflation expectations moderating to 2.3% in Q2 from 2.5%, the lowest since Q3 2021. 1-year out declined by more falling to 2.7% from 3.2%, the lowest in three years. Household inflation expectations have been running higher than business ones and Q2 for this survey will be published on May 20. Research by RBNZ has shown that mean 1-year ahead inflation expectations have had the best relationship with inflation. Both businesses and households are signalling that the CPI is heading to the target band.

New Zealand RBNZ core CPI y/y% vs inflation expectations %

Source: MNI - Market News/Refinitiv

FOREX: USD/JPY Dips Supported Despite Lower BoJ Bond Buying, NZD Down With Inflation Expectations

The USD BBDXY index sits just a touch higher for the session, last near 1254. We are down from earlier highs as the yen received some support after the BoJ reduced its bond buying pace modestly compared with late April.

- USD/JPY looked set to challenge the 156.00 level but the reduced pace of bond buying in the 5-10 tenor aided sentiment. The pair pulled back to 155.52, but didn't see any further follow through. We sit back at 155.75/80, unchanged for the session.

- Japan yields are marching higher, which is weighing on US-JP yield differentials, particularly at the back end of the curve. USD/JPY looks too high relative to such trends, see the chart below, although broader USD sentiment has mostly remained firmer today. Our Tokyo policy team notes the central bank could hasten the policy tightening process given the weak yen backdrop (see this link).

- USD/CNH has climbed above 7.2400 amid weaker data and fresh easing expectations. Higher US tariff prospects have weighed.

- NZD/USD is back close to 0.6000 post a further easing in Q2 inflation expectations. Some support was evident around this figure level though and the onshore rate impact has been limited. AUD/USD is also down, albeit outperforming NZD at the margins. The pair was last under 0.6600. We saw the AUD/NZD cross spike above 1.0990 on the weaker inflation expectations outcome but we have since lost momentum.

- Later the Fed’s Mester and Jefferson discuss central bank communications. In terms of data there is just US NY Fed 1-year inflation expectations for April. The Eurogroup meeting is being held and the ECB’s Buch is scheduled to speak. The focus this week will be on Wednesday’s US April CPI release.

Fig 1: USD/JPY & US-JP Yield Differentials

Source: MNI - Market News/Bloomberg

ASIA STOCKS: HK Continues To Outperform Mainland Stocks As Tariffs Hurt EV Names

Hong Kong and China equities are mixed today with HK equities outperforming. On Saturday, we had CPI which was slightly above expectations, while PPI missed estimates. Chinese Biotech stocks climbed this morning after the US issued a revised version of a bill aimed at blocking foreign biotech firms from acquiring US federal contracts, a provision was added that the deadline for US companies to stop working with blocked firms is now 2032, WuXi Apptec was up as much at 15% earlier before paring gains and trading up 6.70%, China EV names are lower as the US continues to mull over Tariffs. While in the property space Country Garden made payment on two onshore bonds within the grace period and Logan has proposed to suspend payment on all onshore bonds.

- Hong Kong equities are mostly higher today with the HSTech Index is up 1.05% at 4,004 we have failed to hold above 4,000 multiple times this month, the Mainland Property Index is down 0.40% today after rallying 4.20% on Friday, the China EV Index is trading down 1.30%, while the HSI is up 0.44%. China onshore markets are lower today, with the CSI300 unchanged and closed the week above the 200-day EMA, while small-cap index the CSI1000 is down 0.77% and the ChiNext off 0.61%.

- China Northbound saw a -6.2b yuan outflow on Friday, flows over the week were +4.8b yuan with equity flow momentum declining over the same period, 5-day average now at 0.95b, sitting just above the 20-day average at 0.83b and the 100-day average at 0.66b yuan.

- In the property space, Country Garden made interest payments totaling 66 million yuan ($9.1 million) for two bonds within a grace period after missing the initial deadline. Despite government support measures, the company's mounting cash strains highlight challenges in the Chinese property sector. Logan, has proposed a plan to its bondholders to suspend payment on all of its onshore public debt for 10 months, seeking to delay interest and principal payments on its yuan bonds and asset-backed securities until March or April 2025. If approved, Logan plans to develop a new restructuring plan for its onshore public debt, potentially including options like a discounted tender offer and a trust plan. Finally, China will curb land supplies and further ease restrictions on property purchases to aid the housing market, Securities Times reported.

- Over the weekend China released PPI & CPI data. CPI rose by 0.3 percent year-on-year in April, staying in positive territory for the third straight month while PPI which measures costs for goods at the factory gate, went down 2.5 percent year on year in April.

- Looking ahead, 1yr MLF on Wednesday, Industrial Production & Retail Sales on Friday

ASIA PAC STOCKS: Regional Asian Equities Lower, AU Federal Budget Tomorrow

Asian equity markets are mixed today, Taiwan equities are the top performing market led by the semiconductor sector. There isn't much on the data calendar today, earlier we have NZ Food prices which increased from the month prior and Australia's NAB business survey's which show business conditions had fallen from the month prior.

- Japanese equities are little changed today, the real estate sector is the worst performing. There has been little in the way of headlines out of the region, with government officials staying surprising quiet on the currency so far today, the yen continued to slip on Friday and we currently trade little changed on the day at 155.75. The Nikkei 225 is up 4.10% from the lows on Apr 19th but has failed to break back above the 20 & 50-day EMAs and trades down 0.32%, the Topix has performed slightly better over the same period up 5% and holds above all moving averages, however trades down 0.30%

- South Korean equities are lower today, earlier April household spending rose to KRW1,103.6T from KR1098.5t in March. The Kospi continues to comfortably hold above all major moving averages, while the RSI is holding above 50 and MACD indicator is holding steady, signaling buyers still remain in control, the index is down 0.32% today.

- Taiwan equities are the top performers today, flows turned positive again on Friday as investors continue buying up semiconductor stocks. It's a very quiet week on the data front for Taiwan with nothing scheduled. The Taiex opened at new all-time highs this morning, however we trade just off those levels now, up 0.83%.

- Australian equities are lower today, as investors await the federal budget that will be released on Tuesday, while earlier NAB's monthly business survey's showed that conditions eased in April, with trading, profitability and employment all back around their long-term averages. The ASX200 is down 0.25%.

- Elsewhere in SEA, New Zealand equities are down 1% with the 1yr inflation expectation falling to 2.73% from 3.22% and the 2yr falling to 2.33% from 2.50%, Indonesian equities have returned from their break and are trading up 0.10%, Philippines equities are up 1%, Malaysian equities up 0.15% and Indian equities up 0.45%

ASIA EQUITY FLOWS: Tech Stocks Continue To See Inflows, Regional Flows Mixed

- China equity market flows have been mixed recently. Friday saw an outflow of 6.3b yuan to take the total for the past 5 trading sessions to 4.84b yuan. Equity markets were little changed on Friday with the CSI300 up 1.72% over the past week, and closed the week comfortably above the 200-day EMA. Over the weekend we had CPI out coming in at 0.3% vs 0.2% expected and PPI at -2.5% vs -2.3% expected. The 5-day average is now 0.96b, slightly above the 20-day average at 0.84b and the 100-day average at 0.66b.

- South Korean equities edged higher on Friday, while foreign investors purchased stocks although at a rate below that current short term average. It was a relatively quiet session with little in the way of local headlines or data, tech names were the top performing. Flows were positive last week with a net inflow of $1.05b, the 5-day average is $210m, above the 20-day average of $70m and slightly higher than the 100-day average at $184m.

- Taiwan equities were higher on Friday, it was a quiet week for data out of Taiwan, with another quiet week to follow. Foreign investors were buyers of stocks on Friday although in less size than Thursday outflow, net flows for the past week were $950m. The 5-day average is now $190m well above the 20-day average of -$179m and the 100-day average at $67m.

- Thailand equities have been one of the worst performing markets in the region this year, the SET is currently just holding above the 20-day EMA levels, with a break below here opening up a move to retest the ytd lows. Equity flows have been negative over the short to long term, with the 5-day average now at -$16m, the 20-day average -$2.5m, while the 100-day average is -$18m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -6.3 | 2.5 | 79.1 |

| South Korea (USDmn) | 94 | 915 | 14991 |

| Taiwan (USDmn) | 532 | 811 | 777 |

| India (USDmn)** | -639 | -608 | -2007 |

| Indonesia (USDmn)*** | 0 | -240 | 144 |

| Thailand (USDmn) | -17 | -127 | -1969 |

| Malaysia (USDmn) ** | -2 | 280 | -196 |

| Philippines (USDmn) ** | -27 | -69.7 | -321 |

| Total (Ex China USDmn) | -59 | 960 | 11418 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 9th | |||

| ***Public Holiday |

OIL: Prices Lower On Soft China Data, Reports This Week Should Clarify Outlook

Oil prices are off today’s lows but are still down on the day. Brent is down 0.3% at $82.54 after falling to $82.26/bbl, while WTI is 0.2% lower at $78.08 after reaching $77.78. The latter has spent a reasonable amount of time below $78 today. With geopolitical tensions easing, markets are focused on fundamentals again and feel uncertain re the outlook. The USD index is slightly stronger.

- Data from China over the weekend have made oil markets wary re demand prospects. Lending data was disappointing and CPI inflation remained low.

- On the supply side, attention has shifted to the June 1 OPEC+ meeting where existing output cuts are expected to be extended into H2. Iraq said earlier that it wouldn’t agree to deeper cuts but then later confirmed it would abide with what OPEC+ decides. OPEC and the IEA release monthly reports this week with updated outlooks.

- Later the Fed’s Mester and Jefferson discuss central bank communications. In terms of data there is just US NY Fed 1-year inflation expectations for April. The Eurogroup meeting is being held and the ECB’s Buch is scheduled to speak. The focus this week will be on Wednesday’s US April CPI release.

GOLD: Off Recent Highs But Technical Backdrop Supportive

Gold is down a touch, last near $2355. We are off intra-session highs from Friday last week (which came in near $2380). At this stage we are 0.20% lower for Monday trade, after gaining 2.55% last week.

- A more stable USD backdrop, coupled with higher core yields, led by the US, is likely weighing on gold sentiment at the margins. Onshore analysts in China last week were also cautioning local investors around lofty gold price levels. We have key US CPI data later this week as well.

- The technical backdrop for gold remains supportive though. The end of the corrective leg lower has unwound the overbought condition and allows markets to focus on next resistance at $2431.50 - the bull trigger. Any return lower would eye $2255.0, the 50-day EMA.

ASIA FX: USD/CNH Up On Multiple Headwinds, PHP Slumps Ahead Of BSP Later This Week

USD/Asia pairs are mostly higher today, albeit to varying degrees, CNH has weakened modestly post a slump in credit data (released over the weekend), which is raising growth concerns. Fresh US tariffs are another potential headwind. PHP has fallen sharply, we have the BSP meeting later this week, although no changes are expected. Still to come today is the Indian CPI print for April.

- USD/CNH has firmed back through 7.2400, only a modest loss but we are back above the simple 200-day MA and continue to unwind losses from early May. Weekend credit data was noticeably weak and raises the prospect of fresh easing measures. Plans around US tariff announcements were also discussed and will be reportedly released by the US this week. We also had plans announced around ultra-long bond issuance today, which kicks off this Friday. Still, the weaker credit data from the weekend has outweighed. The 10yr bond yield is down a further 3bps.

- 1 month USD/KRW found selling interest above 1370 in earlier trade. We last tracked around 1366, +0.20% stronger in won terms versus levels from the end of last week. Onshore equities are weaker, the Kospi off 0.40%. We did have the first 10-days of trade data for May print, which showed export growth at +16% y/y, so this may have provided some offset at the margin.

- Spot PHP is around 0.60% weaker. USD/PHP was last in the 57.75/80 region. We aren't too far away from late April highs near 58.00. There may be some speculation of a dovish tilt from the BSP this week, given last week's lower domestic growth figures and modest downside CPI surprise. Our sense is that it's too soon for such a shift.

- USD/IDR spot has drifted higher, up around 0.20% to be last in the 16080/85 region. This is line with regional trends. Earlier the April consumer confidence print came in at 127.7, up firmly from March levels, but still sub mid 2023 highs.

- Elsewhere, the USD is mostly firmer but gains have been modest at this stage.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/05/2024 | 0700/0900 |  | EU | ECB's Cipollone in Eurogroup meeting | |

| 13/05/2024 | 1230/0830 | * |  | CA | Building Permits |

| 13/05/2024 | 1300/0900 |  | US | Cleveland Fed's Loretta Mester | |

| 13/05/2024 | 1300/0900 |  | US | Fed Vice Chair Philip Jefferson | |

| 13/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.