-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Familiar Mood Music As Copper Flies And Fixed Income Struggles

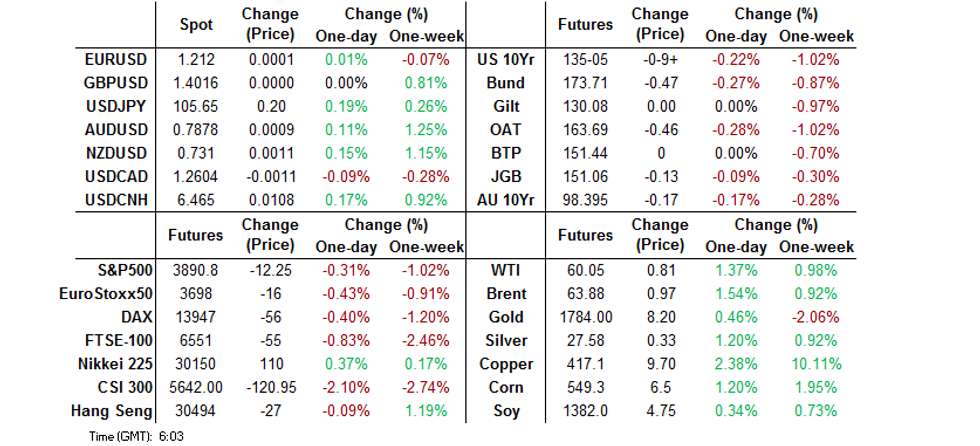

- Copper & core fixed income yields extend on recent moves higher with the reflation narrative dominating in Asia.

- Little in the way of market moving matters headline wise over the weekend, with moves in Asia seen as extensions of Friday trade.

BOND SUMMARY: No Let Up

Spillover from Friday trade and incrementally positive news flow surrounding the Pfizer COVID vaccine helped weigh on the Tsy complex in Asia-Pac hours, while comments from senior Chinese diplomats/ministers offered little new re: Sino-U.S. tensions/de-escalation. Weakness in T-Notes has taken the contract below downtrend support drawn off the August 28 low, with bears now looking to projections off the Jan 4-12 sell off vs. the Jan 27 high, layered in at 135-00 and 134-22. Contract last trades -0-10 at 135-04+, lows of 135-02 registered thus far, volume running at a very solid and above average ~430K (albeit artificially boosted by ~70K of roll activity). Longer dated yields marched to fresh cycle highs in Asia, with cash 7s & 10s trading the best part of 4.5bp cheaper on the day at typing. Flow wise, the highlight came in the form of the TYJ1 1x2 134.50/133.50 put spread which saw 8.0K given via block. Fedspeak from Messrs Bowman & Kaplan is due on Monday, as are a couple of regional Fed economic activity indicators.

- JGB futures lacked any real follow through during Tokyo trade, even as they threatened a meaningful break below the overnight lows, retracing from worst levels back into the overnight session range to finish -13 on the day. Cash JGBs were little changed out to 20 years, but biased marginally cheaper, 10s at ~0.115%, with eyes on the March '20 vol high at 0.125%. Ultra-long swap spreads were wider on the day, while 20s provided the weak point in cash trade. Local news flow remained light, with the BoJ leaving the purchase sizes of its 10-25+ Year Rinban ops unchanged, with offer to cover ratios nudging higher, but not meaningfully so. Japan will observe a market holiday on Tuesday.

- Aussie bonds have succumbed to the broader round of weakness in core FI, with YM closing -4.0, XM -17.0, albeit with a brief pause as the RBA stepped in to enforce its 3-Year yield target, although markets ultimately overpowered the impact from the announcement, resuming the move lower. Technically, XM has moved below the 50% retracement of the jump from the March trough to the April high. Re: the Aussie/U.S. 10-Year yield spread, recent weeks have seen many chopped around by the crosswinds created by the U.S. fiscal impulse/reflation trade narrative, RBA policy and the Aussie bond space's high beta status. This has resulted in most sell-side names reverting to a play the range mantra. The recent range has now broken, with the spread hitting the widest levels seen since October '20 during Monday trade. On the sovereign rating front Fitch affirmed Australia at AAA; Outlook Negative on Monday. The local COVID vaccine rollout is now underway, with PM Morrison receiving his shot over the weekend. Prelim trade data headlines the local docket on Tuesday.

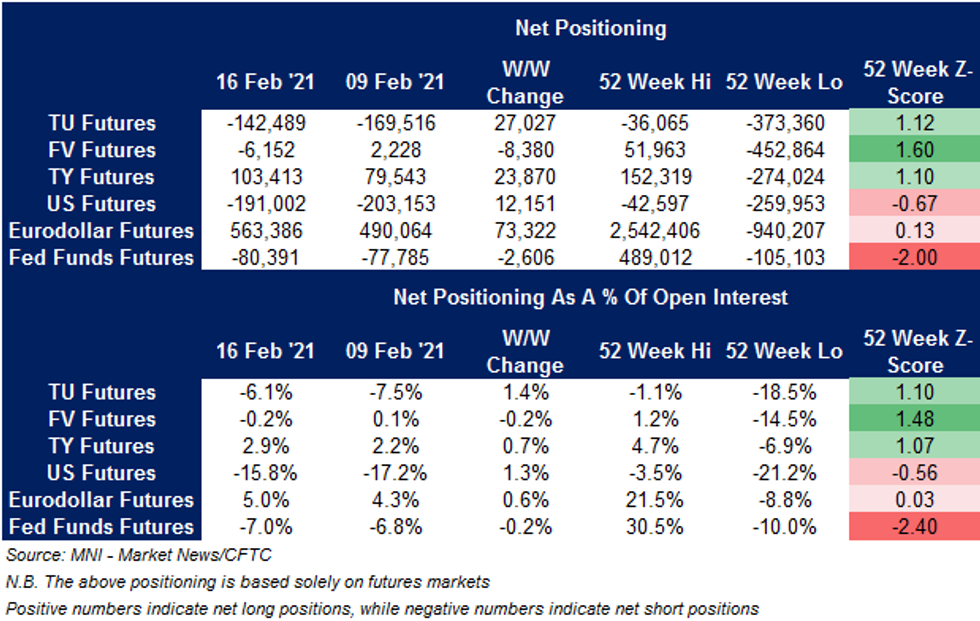

US TSY FUTURES: Not Much To See In CFTC CoT

Little to extract from the latest CFTC CoT report, with net length generally added to/shorts reduced in most bond futures contracts, FV being the exception.

FOREX: Commodity FX Pull Back From Highs Amid Moderation In Risk-On Flows

Commodity FX led the way in Asia-Pac trade as reflation trade narrative and optimistic news from the vaccine front continued to do the rounds, boosting risk appetite in the early part of the session. Initial price swings were corrected as the risk-on mood moderated somewhat, but NOK managed to remain atop the G10 pile amid renewed gains in crude oil prices. The two Antipodean currencies firmed up in tandem, each hitting their best levels since 2018 against the U.S. dollar, before they pulled back from respective highs.

- NZD caught a fresh bid as S&P raised New Zealand's credit rating to AA+ from AA (outlook changed to stable from positive), but looked through PM Ardern's announcement that Auckland will move to Covid-19 alert level 1 from level 2 at midnight. The kiwi narrowly outperformed its cousin from across the Tasman, as Fitch affirmed Australia at AAA with a negative outlook.

- Safe havens recovered from worst levels, but remained at bay with JPY & CHF lagging their G10 peers as we head for the London session. USD/JPY snapped its three-day losing streak and ground higher but rejected the prior intraday high.

- The PBOC fixed the USD/CNY mid-point at CNY6.4563, around 10 pips above sell side estimates, after delivering an expected decision to leave LPR settings unchanged over the weekend. USD/CNH wavered around neutral levels.

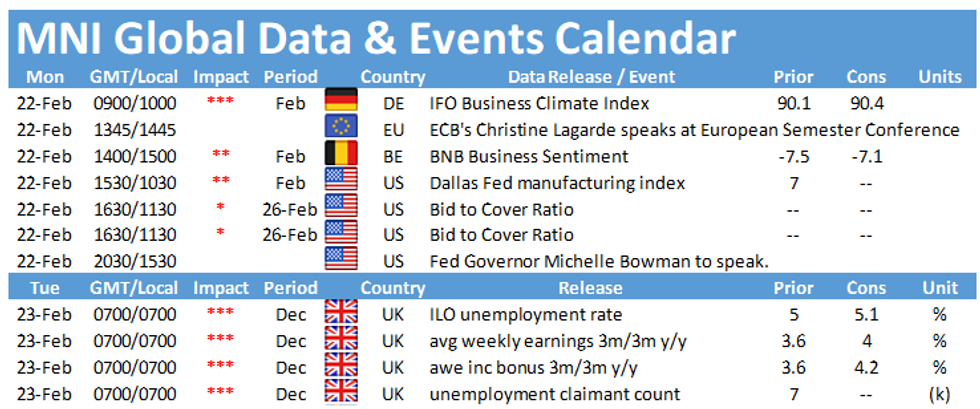

- Focus today falls on German Ifo Survey as well as speeches from Fed's Kaplan & Bowman, ECB's Lagarde, BoE's Vlieghe and Riksbank's Floden.

FOREX OPTIONS: Expiries for Feb22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2135-45(E408mln-EUR puts), $1.2295-1.2300(E506mln-EUR puts)

- USD/JPY: Y103.25($750mln), Y104.00($600mln)

- AUD/USD: $0.7715(A$640mln)

- NZD/USD: $0.7175-85(N$515mln)

- USD/CAD: C$1.2600($420mln)

ASIA FX: Greenback Reverses Weakness As Yields Rise

US yields climbed to the highest levels in a year which saw the greenback reverse some of its earlier declines as the session wore on. Metals and commodities rose.

- CNH: Offshore yuan weakened, retaking the 6.46 handle. The pair fell as low as 6.4450 pre-fix but reversed as the session wore on and equities sold off.

- SGD: Singapore dollar is slightly stronger, USD/SGD has oscillated around neutral levels amid a lack of local catalysts.

- TWD: Taiwan dollar gained alongside local equity markets. Taiwan's Statistics Bureau increased its estimates for growth and exports on Saturday.

- KRW: The won opened higher but dropped into negative territory as equity markets sold off on the back of weakness in mainland China's equity markets.

- INR: The rupee has strengthened again, USD/INR last at 72.5412. Markets look ahead to the release of RBI minutes later in the session.

- IDR: Rupiah is weaker following weekend news that movement curbs in Java & Bali will be prolonged. The rupiah has found little to no reprieve in the issuance of the implementing rules of Indonesia's investment law overhaul.

- MYR: Ringgitt is stronger, the first batch of Covid-19 jabs arrived in Malaysia on Sunday, allowing the country to begin its inoculation campaign on Feb 24, two days ahead of schedule.

- PHP: Peso is weaker, cementing its reputation as worst performer in Asia for the last two weeks. Pres Duterte will speak this evening and may make an announcement re: easing lockdown restrictions in Manila.

- THB: Baht is weaker, the PM and nine of his ministers survived votes of no-confidence in parliament. But the narrow win has been cited as sign of a looming cabinet reshuffle.

EQUITIES: Mixed Day As Early Gains Reversed

A mixed day for Asia-Pac equities; Japan and Taiwan have seen gains, while mainland China, South Korea and Australia see markets under pressure. Positivity surrounding global vaccination programmes initially supported equity markets, but the bid dissipated with the arrival of China. The PBOC drained a net CNY 40bn via OMOs, after a net drain of CNY 270bn last week, while repo rates were broadly unmoved markets interpreted this as an indication of tighter policy settings in China which sparked some equity outflows.

- Losses in South Korea were tempered by reports that Hyundai Mipo Dockyard won a KRW 101.1bn order to build two LPG carriers, while gains across the commodity complex also helped limit losses in Australia. Copper hit the highest in more than nine years while WTI eyed the $60/bbl.

- Futures in the US and Europe are lower.

GOLD: Narrow To Start A New Week

Gold has looked through the latest uptick in U.S. Tsy yields. Spot benefitted from the reflation mantra in Asia hours, last +$10/oz at ~$1,795.oz after the bounce from session lows on Friday, which left the July '20 lows intact.

OIL: Rally Resumes

Crude is higher on Monday in Asia, resuming its recent rally after dropping sharply on Friday. WTI sits $0.80 better off on the day, with Brent $1.00 firmer.

- The drop last week was due to capacity coming back on line after the big freeze affected US production, the pickup today is being attributed to progress on global coronavirus vaccinations and hopes for a pick-up in global activity.

- Meanwhile, an Iranian foreign ministry official said the US needs to remove its sanctions before talks can begin to revive the nuclear deal. Iran is expected to bring as much as 1m bpd of supply back to the market by the end of this year.

- Goldman Sachs have increased oil price estimates, the bank now expects Brent will reach $70/bbl in Q2 and $75/bbl in Q3.

- Elsewhere, markets look ahead to the OPEC+ meeting on March 4, observers expect a difference of opinions from Saudi Arabia and Russia.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.