-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Fresh China Stimulus Talks Fails To Lift Risk Appetite

- Japan CPI came out close to expectations. Early USD/JPY weakness hasn't been sustained the pair back above 140.00 this afternoon. There was two-way trade in JGB futures, with JBU3 dealing in the middle of the day’s range at 147.60, -24 compared to settlement levels.

- Elsewhere, NZGBs closed on a weak note with benchmark yields 7-8bp higher. Without domestic drivers, the local market has drifted cheaper through the day in line with development in US tsys and ACGBs.

- Fresh talk of China consumption stimulus gave a mild boost to regional risk appetite, but it wasn't sustained. Mainland equities are tracking modestly lower, while the KRW and TWD have weakened in the FX space amid fresh tech related equity headwinds.

- In Europe Retail Sales from the UK headline an otherwise thin docket.

MARKETS

US TSYS: Marginally Richer In Asia

TYU3 deals at 112-05+, +0-01, a range of 0-04 has been observed on volume of ~45k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- In early trade Asia-Pac participants faded the cheapening seen in NY, tsys were pressured after the Initial Jobless Claims print was less than expected, perhaps using the opportunity to close short positions/enter fresh longs.

- Flow wise a block seller in FV (3,512 lots) helped cap early gains.

- Narrow ranges were observed for the remainder of the session and little meaningful macro news flow crossed.

- In Europe Retail Sales from the UK headline an otherwise thin docket.

STIR: $-Bloc Markets Firm

In recent days, $-Bloc markets have firmed, boosted by positive economic data. NZ reported higher-than-expected CPI data, Australia showed stronger-than-expected employment figures, and the US reported lower-than-expected jobless claims data. Later today, Canada's retail sales data for May will be released, adding to the market's focus on economic indicators in the $-Bloc. The chances of a 25bp hike at the next policy meeting sit at:

- 95% for July 26 (FOMC);

- 37% for Sep 6 (BoC);

- 62% for Aug 1 (RBA); and

- 24% for Aug 16 (RBNZ).

Figure 1: $-Bloc STIR

Source: MNI – Market News / Bloomberg

JGBS: Futures Cheaper, Two-Way Trade In Tokyo Session

The two-way trade in JGB futures has continued in the Tokyo afternoon session with JBU3 dealing in the middle of the day’s range at 147.60, -24 compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined June national CPI which printed broadly in line with expectations.

- Accordingly, local participants appear to have been content to be on headlines and US tsys watch. Us tsys are holding richer in the Asian session today, however, they have ticked away from session highs. Ranges remain narrow with few follow-on moves. Cash tsys sit 1-1.5bps richer across the major benchmarks, light bull steepening is apparent. There is a dearth of US economic data over the next two sessions, awaiting the latest FOMC policy announcement next Wednesday, July 26.

- Cash JGBs are cheaper across the curve out to the 20-year zone, with the benchmark 10-year the underperformer. The 10-year yield is 1.9bp higher at 0.486%, below BoJ's YCC limit of 0.50%.

- Swaps have shifted weaker in the afternoon session with rates 0.2bp to 0.8bp higher. Swap spreads narrower out to the 20-year and wider beyond.

- On Monday the local calendar sees Jibun Bank PMI and Department Store data. The focus next week will be the BoJ policy decision on Friday.

JAPAN DATA: Headline CPI A Touch Higher, Core Measures In Line With Market Expectations

Japan June national CPI has printed broadly in line with market expectations. The headline was at 3.3%, a touch above market expectations of 3.2% (and 3.2% prior). The ex fresh food measure was in line at 3.3% (prior 3.2%), while ex fresh food and energy was also as expected at 4.2% (prior 4.3%).

- Headline CPI y/y has held sticky above 3.0% in recent months, although base effects turn more favorable as we progress through Q3, which may at least prevent a re-acceleration in y/y momentum as we progress through H2 (if not some further downside).

- The core measure (ex fresh food) is showing a similar trajectory, while the measure which excludes energy as well is just a touch off recent highs at 4.2% y/y.

- Note the core measure which excludes all food and energy was +2.6% y/y, unchanged from May. It was down -0.2% in non-seasonally adjusted terms for the month.

- In terms of the sub-indices, fresh food was down -3.0% m/m, while household goods, clothing and footwear and entertainment also fell in m/m terms. In y/y terms, momentum held positive outside of utilities.

- From a BoJ standpoint, the current inflation outlook is set be revised higher at next week's BoJ policy meeting. The government raised its inflation projections higher for the current financial year yesterday, with headline projected at 2.6% (up from the 1.7% projected in January).

- No policy tweaks are expected at next week's meeting, but our policy team noted yesterday, the BoJ's longer term policy outlook is likely to be in focus (see this link).

AUSSIE BONDS: Cheaper, Narrow Range, Post-Jobs Sell-Off Continued

ACGBs (YM -7.0 & XM -8.5) are cheaper after trading in a relatively narrow range in the Sydney session. Today, there have been no local data releases for market participants to analyse, following yesterday's surprisingly strong employment data. As a result, local investors have likely been closely monitoring headlines and observing movements in US tsy yields.

- Tsys are holding richer in the Asian session today, however, they have ticked away from session highs. Ranges remain narrow with few follow-on moves.

- Cash ACGBs are 6-8bp cheaper with the AU-US 10-year yield differential unchanged at +18bp.

- Swap rates are 5-8bp higher with the 3s10s curve flatter.

- The bills strip bear steepens with pricing flat to -6.

- RBA-dated OIS pricing is 1-5bp firmer across meetings. A 62% chance of a 25bp hike is now priced for August.

- Next week the local calendar sees Judo Bank PMI data on Monday ahead of Q2 CPI on Wednesday. Bloomberg consensus expects headline CPI to print +1.0% q/q (5.5% y/y) versus +1.4% q/q (5.6% y/y) in Q1. Trimmed Mean CPI is forecast to print +1.1% q/q (6.0% y/y) from +1.2% (6.6% y/y).

- The AOFM plans to sell A$700mn of the 4.50% 21 April 2033 bond on Wednesday.

NZGBS: Closed On A Weak Note, Post-CPI Sell-Off Continued

NZGBs closed on a weak note with benchmark yields 7-8bp higher. Without domestic drivers, the local market has drifted cheaper through the day in line with development in US tsys and ACGBs. As a result, NZ/US and NZ/AU 10-year yield differentials are little changed on the day. Nevertheless, the post-CPI sell-off currently sits at a cumulative 24bp for the 2-year and 17bp for the 10-year benchmark.

- Swap rates are 2-9bp steeper with the short-end implied swap spread sharply tighter.

- RBNZ dated OIS pricing closed mixed across meetings: flat to 1bp softer out to Feb’24 and 1-3bp firmer beyond. Terminal OCR expectations sit at 5.70%, just off the highest level since early July.

- The BNZ jobs ads index falls 3.5% m/m in June following a revised 4.6% decline in May. The index is down 21.3% y/y.

- Next week the local calendar is relatively light with Trade Balance (Jun) data on Monday and ANZ Consumer Confidence (Jul) on Friday.

- Next week the NZ Treasury plans to sell NZ$225mn of the 0.5% May-26 bond, NZ$225mn of the 1.5% May-31 bond and NZ$50mn of the 2.75% May-51 bond tomorrow.

EQUITIES: Tech Sensitive Indices Lower, But Away From Worst Levels

Regional equities have been mixed today. The early tone was weaker, particularly for tech sensitive indices, but we are generally away from lows for the session. Further China stimulus headlines haven't boosted China equity sentiment a great deal. In the US futures space, we are tracking modestly higher at this stage. Eminis last near 4571, +0.11% firmer for the session. Early lows ahead of 4560 were supported. Nasdaq futures are up by a similar amount.

- The Topix sits close to flat, recouping earlier losses led by the tech sector. The Nikkei 225 is still down around 0.40% at this stage.

- Taiwan shares are down nearly 1%, which is away from session lows, but still the worst performer in the region. TSMC downgraded its revenue outlook and delayed the start of its US investment in Arizona. The SOX was also off more than 3.3% in Thursday US trade.

- South Korea's Kospi opened weaker but now sits +0.15% higher.

- Hong Kong shares have mostly traded with a positive bias, the HSI up 0.72% at the break. More China stimulus related headlines have crossed today in relation to electronics and automobiles. The HSTECH sub index is +1.09% higher, tracking higher for the first time in 5 sessions. China mainland shares have shown less positive impetus. At the break, the CSI 300 is +0.10% higher.

- Indian stocks are tracking ~0.55% weaker in early dealings, with negative tech related sentiment weighing on the broader index.

FOREX: Narrow Ranges In Asia

The greenback has observed narrow ranges in Asia for the most part with little follow through on moves today.

- Kiwi is the weakest performer in the G-10 space at the margins. NZD/USD is down ~0.2% and is holding softer despite a recovery off session lows in regional equities and US equity futures.

- AUD/USD is a touch lower, down ~0.1%. The pair sits a touch above lows seen in yesterday's NY session and last prints at $0.6770/75. Support comes in at $0.6754, the low from 19 July.

- The Yen has pared post CPI gains and USD/JPY sits above the ¥140 handle. June's National CPI printed showing a uptick in headline CPI to 3.3% Y/Y from 3.2%. The Core measure was as expected at 3.3% Y/Y as was the core-core at 4.2% Y/Y.

- Elsewhere in G-10, EUR and GBP are marginally firmer however moves have been limited in Asia.

- Cross asset wise; US Tsy Yields are ~1bp lower across the curve. BBDXY is little changed and e-minis are a touch firmer having been down ~0.2% in early trade.

- There is a thin docket today with UK and Canadian Retail Sales providing the highlights.

JAPAN FLOWS: Pace of Inflows Into Japan Stocks Slows

Foreign buying of Japan stocks continued for the week ended July 14, see the table below. Offshore investors bought ¥238.6bn yen of local stocks. We have seen net inflows in 15 out of the last 16 weeks for offshore investors into local stocks. However, the pace of inflows in the past few weeks is down on the average pace seen through much of May and June. Offshore investors sold -¥411.4bn of local bonds last week.

- In terms of Japan outflows to the rest of the world, we saw net selling of foreign bonds (-¥77.4bn), although this was down from the prior week, in terms of pace of selling. Local investors also continued to sell offshore stocks (-¥673.2bn).

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending July 14 | Prior Week |

| Foreign Buying Japan Stocks | 238.6 | 181.7 |

| Foreign Buying Japan Bonds | -411.4 | 705 |

| Japan Buying Foreign Bonds | -77.4 | -956 |

| Japan Buying Foreign Stocks | -673.2 | -950.8 |

OIL: Brent Tracking Higher For The Fourth Straight Week

Brent crude has mostly tracked higher in the first part of Friday dealings. We were last around $80.25/bbl, slightly below session highs near $80.50/bbl. We are ~+0.70% firmer versus Thursday NY closing levels. At this stage we are tracking modestly higher for the week, +0.48% if current levels continue to hold. This would be Brent's fourth straight week of gains if realized. For WTI, we hold near $76.30/bbl, with the benchmark tracking slightly better for the week relative to Brent (+1%).

- At the margin today, further headlines around efforts to boost China consumption of both household electronics and automobiles has likely helped oil sentiment. Although other commodities, such as iron ore, are painting a less upbeat picture for the session.

- Otherwise, it is a familiar supply/demand backdrop for markets. ANZ has stated there is increased evidence of reduced supply from both Saudi Arabia and Russia. The bank suggests ship tracking data points to a 400k drop in Saudi supply through the first half of July, while Russian shipments were the lowest in 6 months for the same period.

- For Brent, early July highs rest near $81.80/bbl, while in the past few weeks we have spent little time sub $78/bbl. Note the 200-day EMA is close to $82.25/bbl. On the downside, the 100-day EMA is back near $78.63/bbl.

GOLD: Resilient Performance From Bullion

Gold is little changed in the Asia-Pac session, after holding up well on Thursday considering USD strength and the scale of the push higher in Treasury yields. Cash US tsys finished 7-11bps cheaper across the major benchmarks with the belly leading.

- The impetus for the move in USD and US tsys was lower-than-expected initial jobless claims data, which printed 228k versus market expectations of circa 240k. The weekly claims data was the latest print to highlight the resilience of the US economy.

- Recently, gold has been supported by indications of a slowdown in price increases, leading traders to speculate about the Federal Reserve's potential pause in interest rate hikes, despite policymakers maintaining a hawkish stance.

- FOMC hike projections gained slightly on Thursday with July running at 96% with an implied rate of +24bp to 5.318%. Terminal rate expectations are holding at 5.42% in Nov'23.

- According to the MNI technicals team, the overnight high of $1987.45 briefly cleared key resistance at $1985.3 (May 24 high), which if sustained in the near term could open $1993.8 (2.0% 10-DMA envelope).

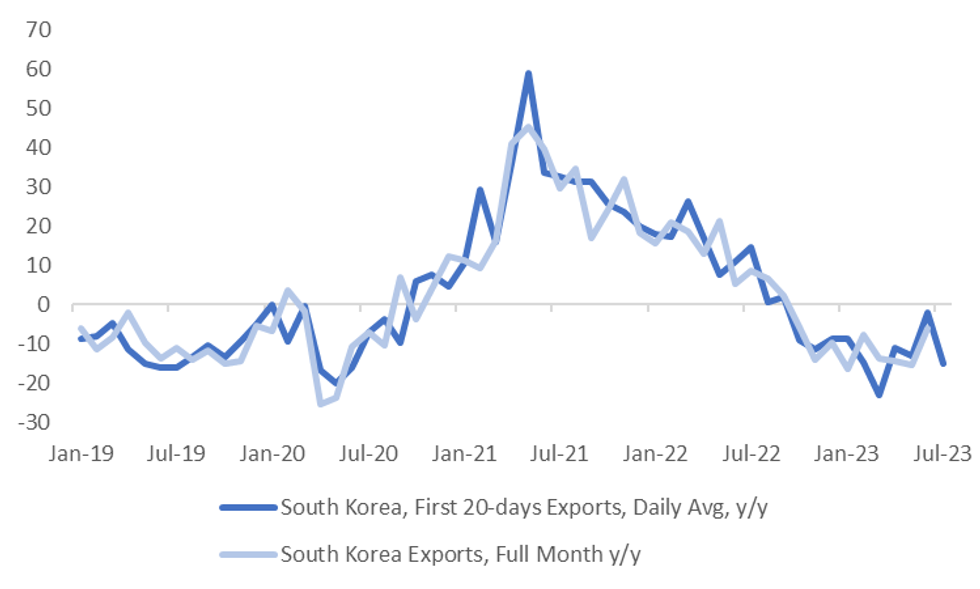

SOUTH KOREA: Exports Lose Some Momentum In First 20-days Of July

The first 20-days July trade data showed some loss of momentum for exports compared to June. Exports were down -15.2% y/y for the first 20-days of the month, which compares with +5.3% recorded for the first 20-days in June. On the import side we saw a further loss of momentum at -28% y/y, compared with -11.2% y/y for the first 20-days in June. The trade deficit stood at -$1.361bn for the first 20-days of July.

- The export y/y number doesn't change based off daily average (still at -15.2% y/y).

- In terms of the detail on the export side, export growth to China remains negative at -21.2% y/y, the equivalent number for June was -12.5%.

- Export momentum to the US fell noticeably to -7.3% y/y, from +18.4% in June, but this series has been volatile in recent months.

- Chip exports fell -35.4% y/y for the first 20-days of July, we were -23.5% in June for this sub-sector.

- Overall, the data suggests caution around extrapolating a dramatically improving trend in South Korean export growth for H2 (see the chart below). The MNI policy team noted in an interview yesterday that while exports should drop by less in H2, weak chip sales to China are a potential downside risk.

Fig 1: South Korea First-20 Exports & Full Month Trend

Source: MNI - Market News/Bloomberg

ASIA FX: KRW & TWD Underperform Amid Tech Equity Headwinds

USD/Asia pairs are mostly higher, albeit to varying degrees. Losses have been prominent in KRW and TWD amid fresh tech equity headwinds. USD/THB has rebounded sharply, partly due to catch up with Thursday's USD rebound, but political uncertainty also continues. Next Monday we have Singapore CPI on tap and then on Tuesday the BI decision in Indonesia. No change is expected.

- USD/CNH couldn't sustain an earlier downside move sub 7.1650. We last sit slightly above Thursday NY closing levels, tracking close to 7.1780. The CNY fixing was again on the firm side of expectations, whilst further stimulus talk for consumption didn't have a lasting positive impact on sentiment. Earlier highs were just above 7.1800.

- 1 month USD/KRW has continued to push higher, last above 1282, which is fresh highs for the session and around the 20-day EMA. Onshore equities have been resilient but this hasn't helped the won much. Offshore investor outflows have been noticeable. Earlier the first 20-days trade data for July showed softer export momentum compared to June.

- Spot USD/TWD sits close to session highs, last near 31.22. This is around +0.45% above Thursday closing levels. We are above all key EMAs (the 20-day is the nearest around ~31.07). Early July highs sit around the 31.40 region, while mid-month lows come in around the 30.83 level. The 1 month NDF sits below spot, last at 31.18. TWD is seeing negative spill over from weaker TWSE levels, although the index has been steadily recovering from earlier lows (last -0.80%). TSMC was weaker after the company cut its revenue guidance and delayed a start to its US project.

- The Rupee is a touch weaker in early trading on Friday, USD/INR sits at 82.02/05 ~0.1% firmer from yesterday's closing levels. Strong inflows by foreign investors into Indian equities have continued with $636mn net inflow through the week to Wednesday. India, the worlds biggest rice exporter, has banned shipments of non-basmati white rice to maintain domestic prices at comfortable levels. A reminder that the data calendar is empty until 31 July when June Fiscal Deficit INR and Eight Infrastructures Industries Index cross.

- The Ringgit is pressured in early dealing as it continues to pare its post US CPI gains last week. USD/MYR is up ~0.2%, and last prints at 4.5505/45 and sits ~1% above its low printed last Thursday post the US CPI print. Bulls target the low from 13 July (4.6237). Bears first target the 200-Day EMA (4.4990). The June Trade Balance printed yesterday, the surplus was firmer than forecast at MYR25.81bn vs MYR16.65bn expected. Looking ahead; on Monday June CPI is due. CPI is expected to tick lower to 2.4% Y/Y from 2.8% Y/Y.

- The SGD NEER (per Goldman Sachs estimates) is little changed in early dealing, the measure sits a touch off cycle highs and is ~0.2% below the top of the band. USD/SGD rose ~0.2% yesterday, unwinding early losses as the pair found support ahead of the $1.32 handle as broader USD trends dominate flows on Thursday. We sit unchanged from yesterday's closing levels in early trade and USD/SGD last prints at $1.3260/70. Looking ahead, the next data of note is Monday's June CPI print, the headline print is estimated to come in at 4.4% Y/Y and the prior readings were 5.1% Y/Y (headline) and 4.7% Y/Y (core).

- USD/THB is back to 34.30, +0.90% firmer for the session. Dips in the pair sub 34.00 have been supported in recent sessions. As expected, Move Forward has stepped aside for Pheu Thai to form government.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/07/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/07/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/07/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/07/2023 | 0645/0845 | * |  | FR | Retail Sales |

| 21/07/2023 | 1230/0830 | ** |  | CA | Retail Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.