-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JGBs Adjust A Little Pre-BoJ

- GJ futures came under pressure and the wider JGB curve twist flattened, which may indicate that some were willing to reset hawkish twist flattener plays ahead of tomorrow’s BoJ meeting (after a seeming position clear out of such plays in recent sessions). We would also suggest that some pre-BoJ caution applied pressure to futures into the close, even though a clear majority expect no change in policy settings (that doesn’t prevent some hedging, particularly given the varying degrees in conviction re: that view).

- The USD is weaker in Asia-Pac today.

- There is a thin data calendar in Europe today. Further out we have Challenger Job Cuts and Initial Jobless Claims, elsewhere, comments from Fed VC Barr & BoC's Rodgers will cross. We will also hear from a couple of Riksbank speakers and ECB's Vujcic.

US TSYS: Curve Twist Steepens In Asia

TYM3 deals at 110-25+, -0-04, at the base of its 0-06 range on volume of ~65K.

- Cash Tsys sit 1bp richer to 1bp cheaper across the major benchmarks, the curve has twist steepened

- In early trade Asia-Pac participants faded the 10-Year Auction driven weakness seen late yesterday, perhaps using the opportunity to exit short positions, with one eye on Fed Chair Powell's choice of phrases on Wednesday ("data-dependent" and "not on a pre-set path") after Tuesday's hawkish warnings.

- Tsys ticked away from early best levels through the session as there was little follow through on the initial move higher.

- A TU block sale (-3.8K) headlined on the flow side.

- Northwestern University Professor Janice Eberly is the reported frontrunner in the White House search for a successor to Lael Brainard as vice chair of the Federal Reserve (Seen as the more dovish of two ofthe likely candidates touted for the role)..

- The space looked through weaker-than-forecast PPI and CPI from China.

- There is a thin data calendar in Europe today. Further out we have Challenger Job Cuts and Initial Jobless Claims, elsewhere, comments from Fed VC Barr will cross. We also have the latest 30-Year Tsy Supply.

JGBS: Curve Twist Flattens As Pre-BoJ Caution Becomes Evident

JGB futures continued to leak lower in the afternoon, initially exhibiting similar moves to U.S. Tsys. The contract showed higher before dealing on the backfoot as Thursday wore on.

- Weaker than expected final Q4 GDP data also factored into the early bid that was seen across the curve, allowing futures to spike through their overnight high, before a turnaround took place.

- The presence of liquidity enhancement supply covering 1- to 5-Year off-the-run JGBs and the lukewarm cover ratio observed at the auction meant that the front end of the curve struggled.

- Still, the long end was more resolute, which may indicate that some were willing to reset hawkish twist flattener plays ahead of tomorrow’s BoJ meeting (after a seeming position clear out of such plays in recent sessions). We would also suggest that some pre-BoJ caution applied pressure to futures into the close, even though a clear majority expect no change in policy settings (that doesn’t prevent some hedging, particularly given the varying degrees in conviction re: that view).

- 7s provided the weakest point on the curve as a result of the weakness in futures, cheapening by 3bp, while 30+-Year paper finished ~1bp richer as the curve twist flattened.

- Domestic headline flow was generally limited outside of the GDP release.

- The aforementioned BoJ decision headlines the domestic docket on Friday (see our full preview of that event here). PPI and household spending data will also cross ahead of the weekend.

JAPAN: Foreign Investors Were Small Net Sellers Of Japanese Assets Last Week

The latest round of weekly international security flow data from the Japanese MoF revealed nominal net selling of international bonds and equities on the part of Japanese investors, with the former breaking a streak of four consecutive weekly rounds of net purchases and the latter representing the sixth consecutive week of net sales.

- On the other side of the ledger international market participants recorded a second straight week of net sales of Japanese bonds as we moved towards the latest BoJ monetary policy decision, although the level of net sales observed was notably shy of that seen around the December and January policy decisions. International investors were also net sellers of Japanese equities for a second consecutive week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -168.6 | 219.7 | 3465.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -18.4 | -440.4 | -1500.8 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -800.7 | -211.4 | -841.4 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -595.4 | -403.4 | -695.6 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

AUSSIE BONDS: Weaken Into Close As Market Eyes U.S. Payrolls Friday

Futures close at session lows (YM +2.8 & XM +3.3) as U.S Tsys give up early Asia-Pac strength. Cash ACGBs close at cheaps with yields 3bp lower and the AU-US 10-year yield differential down 2bp to -28bp, after hitting a cycle low of -32bp intraday. ACGBs' recent outperformance versus NZGBs is also noteworthy with the AU/NZ cash 10-year yield differential pushing to -90bp intraday, its lowest level since 2015, before closing unchanged at -85bp.

- Roll activity supported turnover in futures, with sellers of the rolls dominating thus far.

- Swaps bull flatten with rates 3-4bp lower and 10-year EFP slightly tighter.

- Bills closed 1-3bp firmer, flattening a touch.

- RBA-dated OIS closed flat to 3bp softer across meetings. April meeting pricing remains around a 55% chance of a 25bp hike with terminal rate pricing around ~4.07%.

- With no local data slated until next week the market will be likely guided by U.S Tsys through the release of February Non-Farm Payrolls (Fri). With Fed Chair Powell citing data dependency in his second testimony to congress, the market-moving potential of the data should not be underestimated.

- Elsewhere, a well below consensus China CPI (+1.0% y/y versus +1.9% expected) may renew calls for deeper policy easing.

AUSTRALIA: Job Ads Suggest Labour Demand Still Strong

NAB/SEEK job ads fell 1.6% m/m in February after rising 2.9% the previous month. While job ads are off of theirmid-2022 peak, they are still high and well above pre-pandemic levels. They seem to have stabilised here indicating that demand for labour remains strong, making an April rate rise more likely. A rebound is expected in the February employment data on March 16 given the January decline reflected many between jobs. This vacancy data also point to employment remaining solid.

- NAB believes that the downward adjustment in vacancies over H2 2023 reflected some normalisation of Covid-related factors, such as labour shortages in affected industries and the return of students and migrants. That process may have stalled for now but may resume as the economy continues to slow.

- While job ads are down almost 20% from their May 2022 peak, they are still 25.3% above the 2019 high. The annual growth numbers are heavily impacted by negative base effects given the strong demand for labour at the start of last year.

- Applicants per job stabilised at 91 in January, after 7 consecutive rises.

- In Q1 to date, 24 of the 28 industries had higher job ads than in December, seasonally adjusted.

Source: MNI - Market News/SEEK

AUSTRALIA: Housing Indicators Suggest Price Correction To Continue

Moody’s has reported that in February new mortgage holders needed an average 30.9% of monthly income to pay their loans up from 26.4% in May 2022 when rates first rose this cycle, according to The Australian. It expects housing affordability to continue to deteriorate over 2023 with Sydney to be the least affordable city, as the RBA indicated this week that rates need to rise further.

- Our housing affordability index (HAI) was around 28% below trend in Q4 and Q1 to date is implying that it could go to 30% below, assuming disposable income is flat. However, Q4 house prices-to-disposable income was 1% below trend, as house prices are now almost 10% off of their peak but remain above trend. This is a slight increase in affordability relative to income. Thus, the recent deterioration in the HAI has been due to rising rates but a further correction in house prices, which has been orderly to date, would help to at least partially offset higher rates in terms of affordability.

- The housing valuation index (HVI), calculated as house prices over CPI rents, is suggesting that the house price correction has further to go. While it is off of its peak, it remains elevated and 6.5% above trend. Rents are rising strongly due to very low vacancy rates but house prices need to fall further to bring the market back into balance.

- Sales transactions usually lead prices and in January new home sales fell 12.8% m/m to be down 51.1% y/y.

Source: MNI - Market News/Refinitiv

NZGBS: NZ/AU Cash Yield Differential Hits Widest Level Since 2015

NZGBs bull flatten, closing on best levels of the day, richening 4-8bp. Slightly firmer prices for U.S. Tsys in Asia-Pac trade assisted the bid but NZGBs outperformed with the NZ/US cash 10-year yield differential closing -5bp. NZGBs also outperformed ACGBs by 3bp, but only after the NZ/AU cash 10-year yield differential pushed to a new cycle high of +90bp intraday, the highest level since 2015, before closing at +85bp.

Fig 1: NZ/AU Cash 10-year Yield Differential (%)

Source: MNI - Market News / Bloomberg

- Swaps richened 4-9bp, implying flat to slightly tighter swap spreads, with the 2s10s curve -5bp. ·

- RBNZ-dated OIS are 1-2bp firmer across meetings. April meeting pricing shows ~45bp of tightening, with terminal OCR pricing nudging further above the RBNZ’s projected OCR peak of 5.50% to ~5.64%. ·

- On the data front, Cyclone Gabrielle dampened Card Spending in February with a 1.7% M/M decline recorded after an upwardly revised +3.4% M/M in January. While annual rates remain at historically high levels it is important to note that the series is nominal.

- With the local calendar light until Q4 Current Account (Wed) and Q4 GDP (Thu) next week, the market will likely find itself guided by U.S. Tsys through the releases of February Non-Farm Payrolls (Fri) and CPI (Tue).

FOREX: Greenback Pressured In Asia

The USD is weaker in Asia-Pac today, BBDXY is down ~0.1%, as US treasury yields tick marginally lower.

- USD/JPY sits at ¥136.75/85, ~0.4% firmer today. The downtick in US yields is boosting the yen. The final read of Q4 GDP figures were weaker than expected this morning with QoQ growth of 0.1% vs 0.8% exp.

- AUD/USD is ~0.3% firmer, last printing at $0.6610/15. The next upside target for bulls is the low from 1 March at $0.6695.

- Kiwi is also firmer, NZD/USD prints at $0.6125/30. Card Spending in NZ fell 1.7% m/m in February after the Jan print was revised upwards to 3.4%. Levels of spending remain historically high and well above pre-pandemic levels.

- EUR and GBP are benefiting from the offer in the USD, however moves have been limited and they sit ~0.1% firmer.

- Cross asset wise; S&P500 futures are ~0.1% lower although they were down as much as 0.3%. Hang Seng is ~0.3% firmer.

- There is a thin data calendar in Europe today. Further out we have Challenger Job Cuts and Initial Jobless Claims, elsewhere, comments from Fed VC Barr will cross.

AUD/JPY: Technicals Bearish, BOJ In View

AUD/JPY prints at ¥90.20/30, ~0.3% softer today. The pair is down ~2% in March, as the recent dovish tilt from the RBA has weighed.

- The technical picture is looking increasingly bearish, the 20-Day EMA has crossed over the 200-Day EMA as the pair sits above key support at ¥90.00

- Bears look to target a break of ¥90, opening up low from 20 Dec at ¥87.03.

- Bulls first look to target the 20-Day EMA at ¥91.44.

- Tomorrows BOJ meeting presents the next risk event for the pair. The consensus looks for no change in BoJ policy settings in what is Governor Kuroda's final policy meeting, our preview of the event is here.

- Only 3 of the 49 economists surveyed by Bloomberg look for a hawkish policy move this time out. We side with the majority on this. However, the Bank’s recent propensity to shock (see the surprise widening of the YCC band back in December) means that this view is held with varying degrees of conviction.

Fig 1: AUD/JPY Daily Spot, EMAs

Source: MNI/Bloomberg

FX OPTIONS: Expiries for Mar09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.1bln), $1.0530-50(E1.1bln), $1.0570-75(E1.1bln), $1.0585(E504mln), $1.0600(E1.7bln), $1.0635-50(E2.6bln)

- USD/JPY: Y136.50-55($1.0bln), Y137.00-10($1.5bln), Y138.00($810mln)

- GBP/USD: $1.1940-50(Gbp690mln)

- EUR/GBP: Gbp0.8915(E738mln), Gbp0.8950(E684mln)

- AUD/USD: $0.6755(A$570mln), $0.6785-00(A$1.3bln)

- USD/CAD: C$1.3500($1.1bln), C$1.3875($605mln)

- USD/CNY: Cny6.9000($1.3bln)

ASIA FX: USD/Asia Pairs Mostly Lower, CNH Reverses Some Recent Outperformance

USD/Asia pairs are mostly lower, but losses have been fairly modest, in line with the major dollar indices down by around -0.10%. A slight pull back in UST cash Tsy yields has also likely helped at the margins. Still to come is the BNM decision, with no change expected, although it is a close call. Tomorrow, South Korea current account figures are due, along with India IP, while China aggregate credit figures are due soon (release window is 9-15th of March).

- USD/CNH sits slightly higher, but has found selling interest above 6.9800, last near 6.9770. The CNY fixing was close to neutral, while inflation prints came in well below expectations, tilting the odds in favor of more easing, although the reaction in China government bond yields hasn't been large. Onshore equities are weaker but only modestly.

- 1 month USD/KRW is slightly higher, last close to 1318, with a 1313 to 1320 range for the session. This has kept the pair within recent ranges, with a weaker CNH and lower onshore equities weighing at the margins.

- USD/TWD has tracked to fresh highs for the year, with spot above 30.80. Similar headwinds to the won have been noted.

- Rupee is slightly firmer, with USD/INR down around 81.85/90, +0.25% higher in INR terms so far for the session. Interestingly, Reuters reported earlier that the RBI was buying dollars, paying forwards. The rupee is the best performing Asian currency month to date, so the RBI may be using the more favorable flow backdrop to accumulate fresh reserves. Elsewhere in the region intervention risks are skewed the other way, with a number of USD/Asia pairs close to YTD highs.

- USD/THB is holding above the 35.00 level, last in the 35.05/10 region. This is little changed for the session and in line with relatively steady trends in terms of the USD indices. The simple 100-day MA for USD/THB is close by at 35.03, while the 200-day is higher at 35.51. The pair remains above all key EMAs, with the 200-day coming in at 34.74.

- The SGD NEER, reflected in sell side measures, was marginally firmer yesterday and sat ~0.8% from the top of the band. The latest MAS survey, released yesterday noted that 76.2% of respondents expect an unchanged MAS policy next month. MAS Managing Director Menon said this morning that the view that tightening by major central banks (the Fed/ECB etc) will end soon is "extremely optimistic", link here. Outside of offshore developments, the next CPI print, due on 23 March, presents a crucial input. The Jan data surprised on the downside, but core inflation pressures remain sticky (+5.5% y/y). USD/SGD is down a touch, last near 1.3530.

ASIA FX: Intervention Risks Growing With YTD Lows Within Sight?

The ADXY index (J.P. Morgan) is currently hovering around the 100.00 level, just a touch above YTD lows. The table below presents current spot levels for USD/Asia pairs, against YTD highs for 2023. To varying degrees pairs are within striking distance of 2023 highs. This creates the risks of intervention from the respective authorities to curb the rate of depreciation pressures.

- There appears to be some reluctance to let USD/CNY weaken through 7.00 in the near term. yesterday's CNY fixing was comfortably on the strong side of expectations, while Bloomberg also reported exporters were offloading USDs.

- The South Korean authorities have also been more pro-active in verbal jawboning around what they deem herding behavior in FX markets.

- Yesterday the Indonesian authorities intervened in the FX markets. The authorities continue to view the exchange as cheap relative to fair value.

- USD/INR has not breached above the 83.00 level either, although that is some distance from current spot levels.

- FX intervention is unlikely to change the trend of currencies but is something to be mindful of, particularly in terms of intra-day/daily volatility.

Fig 1: USD/Asia Pairs Current Spot Versus YTD Highs

| CCY | Spot | YTD High |

| CNH | 6.9796 | 6.9971 |

| KRW | 1320.3 | 1326.65 |

| TWD | 30.808 | 30.827 |

| SGD | 1.3540 | 1.3566 |

| MYR | 4.5235 | 4.5317 |

| INR | 81.876 | 82.9512 |

| PHP | 55.265 | 56.125 |

| IDR | 15429 | 15638 |

| THB | 35.07 | 35.388 |

Source: MNI - Market News/Bloomberg

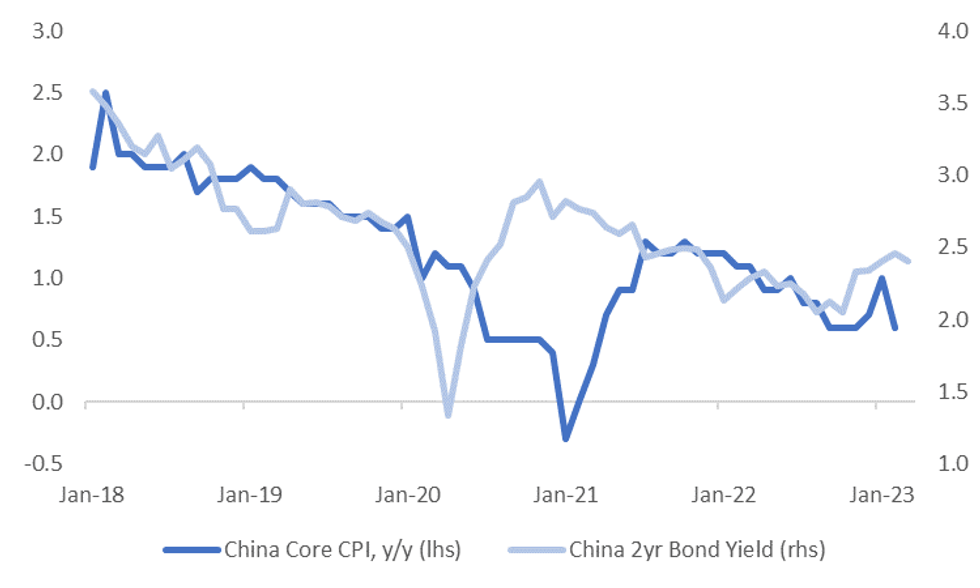

CHINA: Muted Inflation Pressures Still Suggest Some Room For Easier Financial Conditions

China CPI for Feb came in well below expectations, rising just 1.0% y/y, versus 1.9% expected. The detail looked soft (see this link for more details), while the core measure eased back to 0.6% y/y from 1.0% in Jan.

- The first chart below overlays the core print against the 2yr government bond yield. At face value this suggests downside pressure on yields, but the general theme from the NPC has been fresh stimulus may not materialize in the near term. This was hinted at by the modest growth target and in recent PBoC commentary (see this link). The NDRC stated CPI will within the target of around 3% this year.

- Today's outcome may reinforce calls that the authorities have some space to ease from an inflation standpoint. The authorities may want to see further prints though, particularly given the March PMIs pointed to rising inflation pressures.

Fig 1: China Core CPI & 2yr Bond Yields

Source: MNI - Market News/Bloomberg

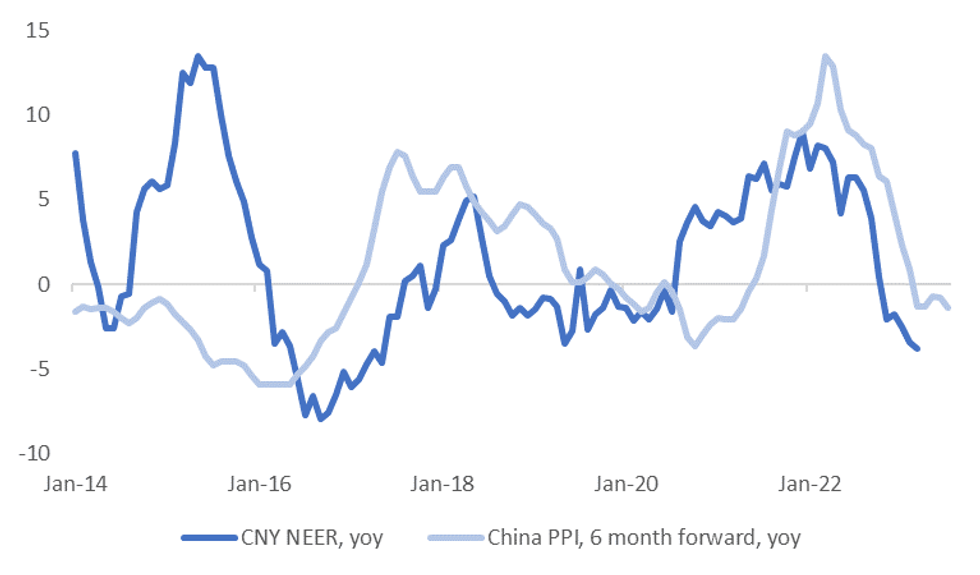

- The PPI also printed lower than expected, -1.4% y/y, versus -0.8% forecast. The second below overlays this metric (6 months forwards) against y/y changes in the CNY NEER.

- Lack of a sharp rebound in upstream price pressures doesn't point to the need for any sharp tightening in China financial conditions.

- USD/CNH has moved higher post the release, last near 6.9800, although broader USD sentiment has also found a firming footing.

Fig 2: China PPI Versus CNY NEER Y/Y

Source: MNI - Market News/Bloomberg

ASIA: Inflation Easing Across Most Of The Region

Most of non-Japan Asia has published February CPI data and generally there was an easing in price pressures. As a result the regional aggregate moderated to 3.1% y/y from 3.8% in January and the core to 1.5% from 1.9%. Excluding China there was still an easing in inflation to 5.6% (-0.1pp) and 4% (-0.2pp) respectively.

- China’s CPI eased to 1.0% y/y from 2.1% the previous month while core was down to +0.6% y/y from 1% despite several months since reopening. See this link for more details.

- Korea saw a moderation in headline CPI to 4.8% from 5.2%, the lowest since April 2022, and to 4.8% from 5% in core, but this was driven by agriculture and oils. Private services and non-industrial goods rose strongly.

- Headline inflation in Indonesia rose in February to 5.5% y/y from 5.3% driven by higher food prices, which should moderate after Ramadan. Core eased to 3.1% from 3.3%, which is BI’s preferred measure, due to a broad based easing in price pressures.

- Thai inflation fell significantly to 3.8% y/y from 5% driven by food prices and core components. Core eased to 1.9% from 3%. Disinflation is broad based which could make BoT’s tightening even more gradual.

- While headline inflation in the Philippines moderated 0.1pp to 8.6%, core rose 0.4pp to 7.8%, the highest since end-2000. BSP will need to continue tightening given the broad based price pressures and robust demand.

- India’s February CPI is released March 13, Singapore March 23 and Malaysia March 24. Inflation for these countries was kept constant in the regional aggregates.

Source: MNI - Market News/Refinitiv

EQUITIES: China Shares Testing 200-Day Break To The Downside, Japan Stocks Higher

Regional equities are tracking mixed, although Japan stocks continue to outperform. Gains and losses across the region are under +/-1%, so ranges have been more modest compared to earlier in the week. US futures are lower, with Eminis off by around -0.1% at this stage, although we were -0.3% at the lows. Nasdaq futures are slightly weaker.

- China stocks are lower with the CSI 300 off by around -0.30% at this stage. Telecommunication stocks are weaker, which follows reports from yesterday that the Netherlands will introduce rules to restrict semiconductor exports. The downside miss on CPI for Feb didn't do much to boost equity sentiment (via the easing channel).

- The CSI 300 is close to its simple 200 day MA (4035), with current index levels near 4020.

- The HSI is slightly firmer but remains within recent ranges. The tech sub-index is finding some support ahead of the 100-day MA.

- The Nikkei 225 is +0.50% higher, while the Topix is up 0.75%. Bank stocks are outperforming, with the sector potentially seen as a hedge if we see another BOJ surprise tomorrow (which drives local yields higher).

- Elsewhere the Kospi and Taiex are slightly weaker, despite positive tech leads from US trade on Wednesday. In SEA, trends are mixed.

GOLD: Bullion In Narrow Ranges Ahead Of US Employment Report

Gold has been trading sideways for most of yesterday and today as expectations for an outsized Fed March hike grow. The key to the meeting outcome is likely to be Friday’s US employment report. After reaching a high of $1824.31/oz on Wednesday, it closed at $1813.80. Currently it is trading in a tight range and around $1813.15, close to the intraday low of $1812.01 which followed a high of $1816.54. The USD index is also flat during the APAC session.

- Since bullion is unchanged so far today it remains close to the bear trigger at $1804.90, the February 28 low. It continues to approach the 100-day simple moving average.

- Later today the Fed’s Barr speaks on crypto. The data calendar is light with US jobless claims and February Challenger job cuts. The main focus over the rest of the week is February US payrolls on Friday, which are expected to rise a solid 225k with the unemployment rate steady at 3.4%.

OIL: Crude Trading Sideways Ahead Of Key US Jobs Data

Oil prices fell around a percent on Wednesday as Fed Chairman Powell’s hawkish comments continued to impact the market. During APAC trading they are in a very narrow range and maintaining yesterday’s losses. WTI is around $76.65/bbl between the intraday high of $76.75 and the low of $76.41. Brent is about $82.68. The USD index is also flat during the APAC session.

- Both Brent and WTI broke through their 50- and 100-day simple moving averages during Wednesday’s sell off. Both are back above their Mar 3 lows but the break lower opened up key short-term support of $80.25 and $73.80 respectively.

- The decline in EIA inventories in the latest week hasn’t provided any support to crude. The market continues to juggle optimism regarding greater demand, especially from China, and increased concerns of a US recession with Russian supply an uncertain variable.

- Powell mentioned during his comments to the House that China’s reopening could increase commodity prices such as oil, but wouldn’t be material for US inflation.

- Later today the Fed’s Barr speaks on crypto. The data calendar is light with US jobless claims and February Challenger job cuts. The main focus over is February US payrolls on Friday, which are expected to rise a solid 225k with the unemployment rate steady at 3.4%.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/03/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 09/03/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 09/03/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/03/2023 | 1500/1000 |  | US | Fed Vice Chair Michael Barr | |

| 09/03/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/03/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/03/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/03/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/03/2023 | 1840/1340 |  | CA | BOC's Rogers "Economic Progress Report" speech |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.