-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI EUROPEAN MARKETS ANALYSIS: NASDAQ Futures Push Higher On Big Tech Earnings

- Regional equities are mostly lower, apart from some pockets of strength in HK related to firmer tech related equities. US futures are higher, largely thanks to better earnings guidance from Alphabet and Microsoft late in Tuesday trade in the US.

- AUD was pressured on softer than expected trimmed mean CPI prints.

- the latest Riksbank decision headlines in Europe. Further out we have U.S. durable goods orders and the minutes from the Bank of Canada's latest meeting. ECB speak will also be eyed.

US TSYS: Curve Flattens In Asia

TYM3 deals at 115-22+, -0-03, with a 0-05+ range observed on volume of ~90k.

- Cash tsys sit 2bps cheaper to 1bp richer across the major benchmarks. The curve has twist flattened pivoting on 20s.

- Firmer US Equity Futures which was linked to strong earnings from Alphabet & Microsoft, as well as encouraging deposit stabilisation at PacWest saw tsys cheapen in early dealing.

- Softer than expected CPI data from Australian facilitated a recovery off session lows in tsys.

- Narrow ranges with little follow through on moves were observed for the remainder of the session.

- On the flow side 4 block buys in the FVM3 111.00 calls (+10K in total) headlined.

- In Europe today Riksbank’s Monetary Policy Decision headlines. Further out we have Durable Goods Orders and the latest 5 Year Supply.

JGBS: Futures Pushing Back Towards Overnight Highs After Lunch

JGB futures move back towards Tokyo morning bests, +33 compared to settlement levels, but remain below the overnight high of 148.16. At 148.07, JBM3 sits comfortably above the range of 147.40-147.92, which it has traded in since early April. Moreover, the recent move above the 20-day EMA at 147.65 now draws attention towards the Mar 22 high of 149.53, according to MNI's technical analyst.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined comments from BoJ Governor Ueda re: the government’s debt servicing costs.

- Cash JGBs are 0.1 cheaper to 3.7bp richer across the curve with the 1-year zone the weakest and the 20-30-year zone the strongest. The benchmark 10-year yield is 1.9bp richer at 0.460%.

- A lack of enticing value and uncertainty re: BoJ monetary policy outlook appears to have weighed on today’s 2-year auction with the cover ratio slipping to its lowest level since August’s auction.

- Swaps twist flattening in the morning session gives way to a curve flattening in the afternoon session. Swap spreads are mixed out to the 10-year zone with spreads wider beyond.

- Looking ahead, the local calendar is light until Friday’s release of Tokyo CPI, Retail Sales and Industrial Production data, ahead of the BoJ Policy Decision on the same day.

AUSSIE BONDS: Sharply Stronger After Core CPI Prints Below Estimates

ACGBs are trading strongly higher (YM +18.0 & XM +13.5), just off their intraday highs, after trimmed mean CPI prints below consensus estimates. Although the headline inflation rate was slightly higher than anticipated, the market is likely to interpret the data as a sign that inflation has peaked, reducing the likelihood of the RBA resuming its tightening cycle at the May meeting. However, persistent domestically driven inflation, which indicates excess demand in the economy, implies that further tightening by the RBA may be required down the line.

- Cash ACGBs are 14-19bp richer on the day and 3-6bp stronger than pre-data levels. The 3/10 cash curve is 5bp steeper with the AU-US 10-year yield differential -4bp at -10bp.

- Swap rates are 13-16bp lower with EFPs 2bp wider.

- Bills are 12-21 richer with the strip flatter.

- RBA dated OIS pricing is 4-9bp softer versus pre-data levels with a daily softening of 17-21bp for meetings beyond July.

- The local calendar sees second-tier releases for the remainder of the week with Export and Import Prices tomorrow and Private Sector Credit and PPI data on Friday.

- The local market is therefore expected to concentrate more closely on the fluctuations in US Tsys as it continues to navigate US corporate earnings.

AUSTRALIA: Inflation Easing But Domestic Components Could Push RBA To Hike

Australian Q1 CPI inflation was close to expectations with headline slightly above but trimmed mean below. CPI rose 1.4% q/q to be up 7% y/y after 1.9% and 7.8% in Q4, thus confirming that inflation peaked in Q4 2022. Trimmed mean eased to 6.6% y/y from 6.9% while rising 1.2% q/q down from Q4’s 1.6%. However, both the quarterly and annual rates remain elevated, which is likely to continue concerning the RBA. The strong rises in domestically-driven inflation alongside recent data showing no easing in the labour market make a 25bp rate hike on May 2 a distinct possibility.

Fig. 1: Australia CPI y/y%

Source: MNI - Market News/Refinitiv

- The ABS noted that headline and trimmed mean CPI rose at their slowest pace since Q4 2021 and that while most components continue to increase “many of these increases were smaller than they have been”.

- Inflation was driven by medical services (+4.2%), tertiary education (+9.7%), gas & other household fuels (+14.3%) and domestic holiday travel & accommodation (+4.7%). Food prices rose 1.6%. Goods prices eased to 7.6% y/y from 9.5%, as retailers discounting saw some goods prices fall.

- The domestically-driven components didn’t show signs of easing in Q1 with non-tradeables rising to 7.5% y/y from 7.4%, a new series high, and services up 6.1% y/y from 5.5%, the highest since 2001. Cost of living pressures remain acute with non-discretionary inflation above headline at 7.2% y/y.

- The RBA has highlighted in the past the risk to price stability from energy and rents. These components rose strongly in Q1 with rents up 4.9% y/y from 4% nationally and gas & electricity up 26.2% y/y (17.4%) and 15.5% (11.7%) respectively.

- The monthly CPI for March moderated for the third consecutive month to 6.3% from 6.8% helped by lower auto fuel prices and an easing of new dwelling costs to 11.1% y/y from 13%, but ex volatile items it was steady at 6.9% y/y. But seasonally adjusted it rose 0.5% m/m after 0.6%.

Source: MNI - Market News/Refinitiv

AUSTRALIA: SEEK Salaries Another Signal That Labour Market Remains Tight

The SEEK advertised salaries index rose 0.4% m/m in March to be up 4.7% y/y. February rose 0.3% m/m and 4.7% y/y. Q1 rose 0.9% q/q down from Q4’s 1.3% but higher than 2019’s average of 0.5%. Q1 WPI prints on May 17. The index shows that employers continue to offer higher-than-usual salaries to attract people with the right skills.

- March posted the highest monthly rise since November 2022 and the annual rate of 4.7% is not far off December’s peak of 5%. Offered wages remain elevated signalling that demand for labour is still strong and that the labour market remains tight.

- Today’s Q1 CPI data will be important for expectations for the May 2 RBA meeting (see Q1 CPI Data To Ease, Watch Domestic Components for more detail). But the SEEK wages data is currently another piece of information likely to mean rates are increased again.

Source: MNI - Market News/SEEK/ABS

NZGBS: Richer But Underperforms $-Bloc

NZGBs strengthened 10-13bp at the close, resulting in a 3bp steeper 2s10s cash curve. NZGBs caught up with the two-day richening in US Tsys since the local market close before yesterday's ANZAC day holiday. Although morning strength waned, NZGBs rebounded to close near session highs after ACGBs strengthened in response to lower-than-expected core CPI data. However, NZGBs underperformed in comparison to the $-Bloc with the 10-year yield differentials for NZ/US and NZ/AU both 5bp wider compared to Monday's close.

- Swap rates closed 12-13bp lower with implied swap spreads marginally tighter at the long-end.

- RBNZ dated OIS closed with pricing 5-10bp softer for meetings beyond May with terminal OCR expectations at 5.48% versus 5.52% at Monday’s close.

- The local calendar sees ANZ Business scheduled for release tomorrow and Consumer Confidence on Friday.

- The RBNZ proposed changes to the LVR restrictions in a statement on its website saying that house prices have fallen to a level that is more consistent with medium-term fundamentals. Accordingly, the risk to financial stability posed by high-LVR lending has been reduced.

- The NZ Treasury announced that it plans to sell NZ$1.6bn of NZGBs in May with each weekly auction being NZ$400mn.

NEW ZEALAND: Trade Deficit Deteriorates Further As Imports Soar

The NZ trade deficit widened sharply in March to $12.73bn from $7.96bn, this left the YTD value at $16.4bn from $15.7bn.

- The Q1 seasonally adjusted trade deficit widened $354mn from Q4. This data only includes goods and with the return of tourism services exports are likely to have improved, but it is suggesting that the Q1 current account deficit is unlikely to improve significantly from Q4’s 8.9% of GDP, the highest in the OECD. Q1 exports fell 2.7% q/q and imports were little changed.

- The deterioration in the goods trade position was driven by stronger imports. Imports rose 10.2% y/y, driven by soaring petroleum and products, while exports rose only 0.6% y/y. The weak export result was due to a drop in milk powder, butter and cheese, the largest export group, and also meat.

- Exports to China fell 5.7% y/y% driven by lower milk product and wood shipments. But exports to Australia rose 30.2% y/y and to the US 4.1% y/y. Japan fell 9.6% y/y. Imports from the US rose 39% y/y but fell 13% from China.

Source: MNI - Market News/Refinitiv

FOREX: AUD Pressured As Inflation Eases

AUD is the weakest performer in the G-10 space at the margins today. Trimmed Mean CPI printed 6.6% Y/Y below the expected 6.7% easing from 6.9% in Q4 2022. March CPI rose 6.3% Y/Y below the expected 6.5% and Q1 Headline CPI was a touch firmer than expected at 7.0% easing from 7.8% in Q4 2022.

- AUD/USD prints at $0.6600/05, down ~0.3% today and the pair currently prints at session lows. Support is seen at support at $0.6590 low from 15 March.

- Kiwi is a touch softer, NZD/USD was up ~0.2% however spillover pressure from the Australian CPI print has seen the NZD pare its gains to sit a touch below yesterday's closing levels.

- Yen is a touch firmer, USD/JPY is ~0.2% softer last printing at ¥133.50/60. Yesterday's lows remain intact for now, we currently sit a touch above the 20-Day EMA (¥133.48) and the next downside support is ¥132.02 the low from Apr 13.

- Elsewhere in G-10 ranges have been narrow with little follow through.

- Cross asset wise BBDXY is little changed today and e-minis are ~0.4% firmer. 2 Year US Treasury Yields are ~2bps higher.

- In Europe today Riksbank’s Monetary Policy Decision headlines. Further out we have US Durable Goods Orders and the minutes from the Bank of Canada's latest meeting.

MNI Riksbank Preview - April 2023: Terminal rate forecast key

EXECUTIVE SUMMARY

- All of the analyst previews ahead of this week’s Riksbank meeting expect a 50bp hike. The speeches of Board members since the February meeting have all pointed to a 25bp or 50bp rate hike but the stickiness of core CPIF has led to an almost unanimous expectation of 50bp.

- The main question therefore is what does the rate path look like? Analysts think that it will show at least 25bp for the June meeting, with some expecting a terminal rate close to 4% in the path. This will be the main foreseeable determinant of the market reaction in our view.

- A terminal rate of around 3.83% should be broadly in line with consensus – anything higher than this would probably see SEK strengthen and anything lower see depreciation. The rate path is expected to remain constant after reaching its terminal rate rather than show any risk of rate cuts. If there are cuts in the forecast this would probably be taken dovishly by the market.

- With QT only beginning earlier this month there are no expectations for any changes to the bond sales programmes at this meeting.

- See the full document for summaries of more than 15 sellside previews: MNI Riksbank Preview - 2023-04.pdf

FX OPTIONS: Expiries for Apr26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0835-55(E2.4bln), $1.0900(E2.7bln), $1.0930-50(E4.8bln), $1.0955-60(E1.2bln), $1.0970-75(E1.2bln), $1.1000(E1.5bln), $1.1035-45(E1.7bln)

- USD/JPY: Y130.00($1.1bln), Y132.25-30($585mln), Y133.00($585mln), Y135.00($1bln), Y135.30-50($747mln)

- GBP/USD: $1.2400-10(Gbp670mln)

- AUD/USD: $0.6650-60(A$1.1bln)

- USD/CNY: Cny6.90($558mln), Cny6.9250($553mln)

ASIA FX: CNH & KRW Stabilize, THB Outperforms

USD/CNH has edged lower today, while 1 month USD/KRW has moved off recent highs. THB has been an outperformer thanks to a bumper trade surplus result. Trends are mixed elsewhere. Tomorrow early on we get South Korean business sentiment readings, followed by China Mar Industrial Profits later. Singapore's unemployment rate also prints.

- USD/CNH has spent most of the session sub 6.9400. We did spike following a firmer than expected USD/CNY fix, but this was short lived. Better HK equity sentiment has helped at the margins, while North Bound stock connect flows are positive so far today, the first inflow since last Thursday if it is maintained. Lows were at 6.9275, we last track at 6.9320/30.

- 1 month USD/KRW has stayed away from NY session highs above 1340, but has failed to see much downside, beyond the 1334/35 region. The focus remains on Yoon's US trip, while earlier consumer sentiment continued to recover and inflation expectations eased.

- Indonesian markets have returned from a 5-day break. The early impetus to spot USD/IDR is to the topside. After closing last Tuesday at 14845, we pushed to 14920/25 in the first part of trade, around 0.50% weaker in IDR terms, before selling interest emerged. The pair was last back close to 14890. In terms of drivers of this weaker IDR trend, most other USD/Asia pairs are higher in the period Indonesian markets have been shut, so USD/IDR will also be seeing some spill over from that.

- The SGD NEER (per Goldman Sachs estimates) printed its lowest level since 15 March this morning, post the April MAS meeting the measure continues to move lower dealing in narrow ranges. We now sit ~1.2% below the top of the band. USD/SGD continues to follow broad USD trends. The pair printed its highest level since March 21 yesterday and has marginally pared gains to sit at $1.3375/85. Mar IP was stronger than expected, -4.2% y/y (-6.1% forecast).

- USD/MYR prints just above 4.4600, the pair printed its highest level since March 22 (4.4653) in early dealing before moderating gains. Falling Palm Oil prices have weighed on the ringgit in recent trading, with prices down ~5% since April 18th. The pair now sits above its 20- and 200-Day EMAs as the technical picture becomes bullish. Bulls can target year to date highs at 4.5317. Bears first look to break the 20-Day EMA (4.4299) to turn the tide.

- March Thai trade figures have come in much stronger than expected from a trade surplus standpoint. We printed at +$2.72bn versus -$1.00bn forecast. The range of estimates was -$2.9bn to $169mn. The upside surprise puts the trade surplus back to Q3 2020 levels. In turn this may reinforce THB's outperformance theme, particularly with clouds still over the global outlook. USD/THB has moved lower post the release of the trade figures, but remains within recent ranges, last at 34.26/27.

- USD/PHP is range bound in the first part of trade today, last tracking in the 55.55/60 region, slightly above yesterday's closing levels (55.54). Some support was evident sub 55.50 late yesterday, although PHP has been fairly immune to the recent USD rebound, as the authorities have renewed their focus on the FX rate in recent sessions. We sit comfortably below recent highs, with the 200-day MA at 56.11. Comments from the BSP Governor have crossed the wires today, with the Governor stating BSP has the FX reserves to use if the local FX market overreacts. Medalla also stated that the BSP won't cut rates faster than the Fed as we progress through 2023.

SOUTH KOREA: Headline Consumer Sentiment Improves Further, Inflation Expectations Ease Again

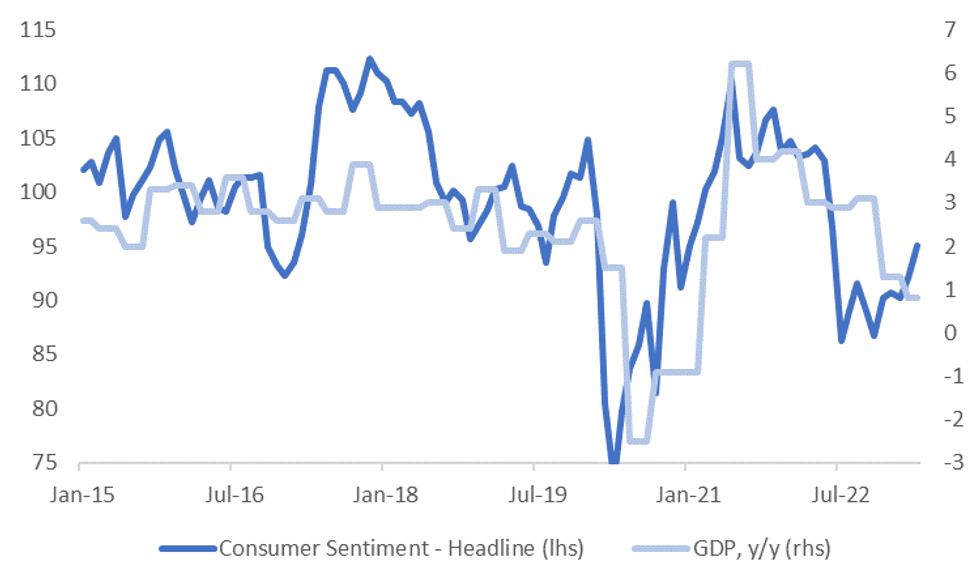

South Korea consumer sentiment rose again in April. The headline index now back to 95.1. This is highs back to mid last year. The index is plotted below (in level terms) against South Korean GDP y/y growth. It is suggesting better y/y momentum, albeit from low levels as we progress into H2. Of course, other headwinds, particularly on the external side may dominate.

- Most of the sub components rose in terms of the domestic economy, and employment, while interest rates nudged down (in terms of changes) which is in line with the recent on hold BoK stance.

Fig 1: South Korea Consumer Sentiment Versus GDP Y/Y

Source: MNI - Market News/Bloomberg

- The employment situation was steady, while wage expectations rose a touch but remain within recent ranges.

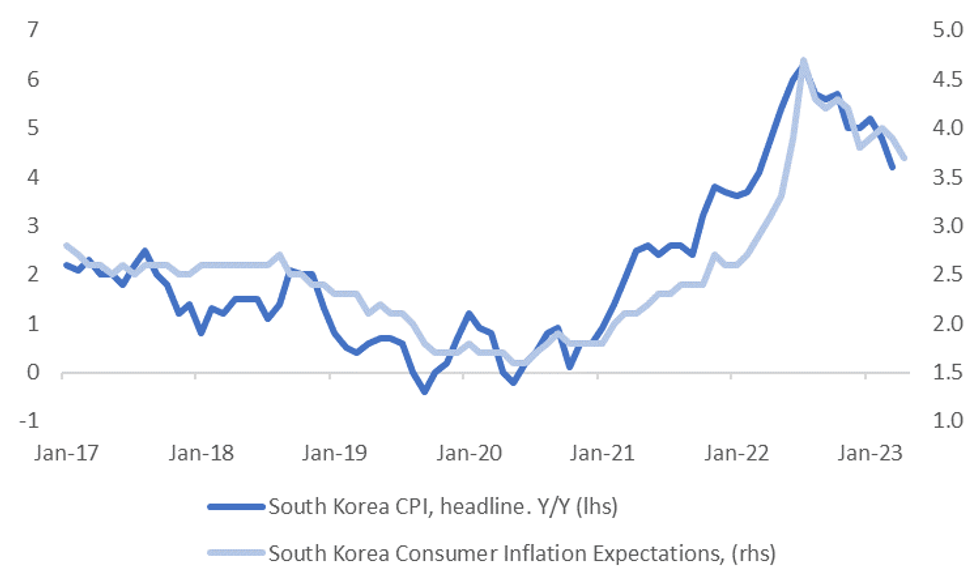

- Other price related expectations nudged down. The second chart below is expected inflation levels versus CPI y/y for South Korea. Expected inflation is now back to lows from May last year.

Fig 2: South Korea Inflation Expectations Versus CPI Y/Y

Source: MNI - Market News/Bloomberg

EQUITIES: Regional Markets Tracking Lower, Firmer US Tech Futures Provide Some Offset

Regional equities are mostly lower, apart from some pockets of strength in HK related to firmer tech related equities. US futures are higher, largely thanks to better earnings guidance from Alphabet and Microsoft late in Tuesday trade in the US. Nasdaq futures lead the way, +1.25%, although we are slightly away from best levels. Eminis are also higher, +0.40% at this stage. Still, regional financial/banking stocks are weaker following sharp falls in this space during the US Tuesday session.

- The HSI is up around 0.60% at this stage, with the tech index up 1.34%. This would be the sub-index's first gain in 7 sessions. Some positive spill over from the US futures move is likely at play. Recent lows also came close to mid-March lows, so technical related support may also be evident.

- Onshore China equities are down modestly, while north bound stock connect flows are +2.27bn yuan, on track for the first lot of inflows since Thursday last week. Onshore media reported that housing curbs may be eased further, and that deposit rate cuts are unlikely to hurt investors. Neither story appeared to shift equity sentiment though.

- Japan stocks have been underperformers, the Topix off 1.15%, with the bank sub-index down as much as 2.4%. This is likely carry over from weakness in US bank stocks on Tuesday.

- The Kospi and Taiex are tracking modestly lower, with some offset likely coming from higher US tech futures.

- Indonesian stocks are higher, +0.55% for the JCI, one of the few bright spots.

GOLD: Bullion Benefiting From Growth Fears

Gold prices are down 0.1% during the APAC session after rising 0.4% on Tuesday on lower US yields. It has benefited this week from global growth related flight to quality flows. Bullion has been trending down today after reaching a peak of $2002.56/oz earlier and are now $1995.54, close to the intraday low. They have been struggling to hold breaks above $2000. The USD index has been trading sideways.

- Resistance remains at $2015.10, the April 17 high.

- The market is waiting on some clarification on what the Fed is likely to do at its May 3 meeting from Q1 GDP (Thursday), PCE data and employment cost index (Friday), all due before the end of the week. Better gold prices indicate that market participants feel that the Fed is close to pausing.

- Later there are preliminary US durable goods orders for March. The headline is expected to rise 0.7% m/m while the core orders should fall slightly.

OIL: Prices Higher, Waiting For Key Information Later In The Week

Oil prices are moderately higher during APAC trading after falling sharply on Tuesday, as growth concerns came to the fore. WTI is up 0.4% to $77.48/bbl and Brent +0.4% to $81.07. The USD index has been trading sideways.

- Almost the entire post-OPEC+ output cut announcement has been unwound on US recession fears and disappointing demand from China. WTI is holding above $77 with today’s intraday low at $77.01 and the high at $77.54. Brent has moved above $81 following an intraday low of $80.57 and is close to its high of $81.14.

- The market is waiting on some clarification on what the Fed is likely to do on May 3 from Q1 GDP, PCE data and employment cost index, all due before the end of the week. Analysts currently expect a further 25bp hike. Also large oil companies report Q1 earnings on Friday.

- Later there is EIA official US inventory data. The API reported a large crude drawdown of 6.1mn barrels, according to Bloomberg. There are also preliminary US durable goods orders for March.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 26/04/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/04/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 26/04/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/04/2023 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 26/04/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/04/2023 | 1200/1400 |  | EU | ECB de Guindos Panels Delphi Economic Forum | |

| 26/04/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/04/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/04/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/04/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.