-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI EUROPEAN MARKETS ANALYSIS: PBOC To Strengthen Offshore Yuan Markets, Maintain Stability

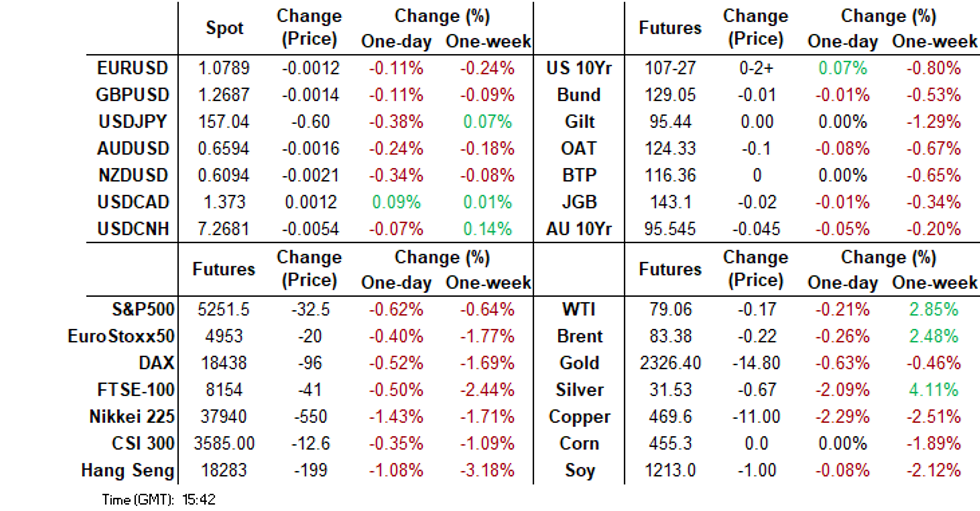

- Equity sentiment has remained on the backfoot. Key regional markets are down, while US futures are also weaker, following cash losses in Wednesday trade. This has aided USD gains, although yen is outperforming. The yuan is also trading resiliently, the PBoC vowed to keep FX stable.

- US Tsy futures have been steady, while JGB futures are cheaper but well off the session’s worst level after today’s 2-year supply showed solid demand metrics.

- The new NZ government presented its first budget and delivered the income tax cuts it promised in 2023’s election. Finance minister Willis said that the cuts worth $14.7bn over 4 years will be offset fully by “savings and revenue initiatives” thus not adding to inflationary pressure.

- Later the Fed’s Williams and Logan speak. In terms of data, there are revised US Q1 GDP, April trade and jobless claims plus Spain’s May CPI and European Commission May survey.

MARKETS

US TSYS: Treasury Future Little Changed, Ranges Tight, 10Y JGB Yield Off Highs

- Treasury futures have traded in tight ranges today, the front-end is slightly lower. TU is (- 00.125) at 101-11.625, but still safely above initial support at 101-10.625, while TY is performing slightly better trading (+ 00+) at 107-25 and holds above overnight lows of 107-21+.

- Volumes: TU 14k, FV 21k TY 30k

- Tsys Flows: Block seller of 1.8k FVU4 at 105-11

- Cash treasury curve has reversed the morning steepening and now trades flatter for the day, yields are now flat to 1bps higher with the 2Y +0.8bps to 4.981%, the 10Y +0.4bps at 4.616%.

- Across APAC rates: ACGB yields are 4-8bps higher, curve steeper, NZGB yields are flat to 3bps lower, curve twist-flattening, while JGBs are flat to 1.5bps higher, curve is mixed the 10Y trading at 1.071% post the 2Y auction after earlier hitting 1.098%

JGBS: Market Reverses Direction After A Solid 2Y Auction, Heavy Data Calendar Tomorrow

JGB futures are cheaper but well off the session’s worst level after today’s 2-year supply showed solid demand metrics.

- The low price met dealer expectations and the cover ratio increased to 3.777x from 3.481x in April. The auction tail was unchanged from last month. With today's auction occurring with an outright yield at its highest level since 2009, the current 2-year yield has been sufficient to generate demand in the face of uncertainty surrounding the outlook for BoJ policy.

- Outside of the previously outlined International Investment Flows, there hasn't been much in the way of domestic data drivers to flag.

- Cash US tsys are little changed in today’s Asia-Pac session ahead of Q1 GDP and PCE Deflator, and Weekly Jobless Claims data later today.

- Cash JGBs are mixed, with yield movements bounded by 1.6bps lower (20-year) and 0.7bp higher (3-year). The benchmark 10-year yield is 1.2bps lower at 1.073%, after reaching a fresh cycle high of 1.101% earlier. The market had opened the session with a bear-steepening of the curve.

- The swaps curve has twist-flattened, pivoting at the 3s, with rates +1bp to -2bps. Swap spreads are mostly narrower beyond the 2-year.

- Tomorrow, the local calendar will see Jobless Rate, Job-To-Applicant Ratio, Tokyo CPI, Industrial Production, Retail Sales and Housing Starts data alongside BoJ Rinban Operations for 3-25-year+ JGBs.

JAPAN DATA: Offshore Inflows Into Local Equities Continued, But Bond Selling Resumed

Offshore investors continued purchases of local equities last week, albeit at a more modest pace. The ¥82.4bn in net inflows represented the 5th straight week of inflows into the segment. Since the start of April, we have seen just over ¥4400bn in offshore inflows into this space. In contrast, offshore investors sold local bonds, ending a 2 week run of inflows. The break higher in JGB yields in recent weeks may be weighing on sentiment in this space.

- Japan investors were net sellers of both offshore bonds and stocks last week. For local investors selling of offshore bonds may be reflective of similar drivers. The trend has been skewed towards next selling in recent months.

- For equities, the trend is close to flat over this period.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending May 24 | Prior Week |

| Foreign Buying Japan Stocks | 82.4 | 248.3 |

| Foreign Buying Japan Bonds | -789.9 | 424 |

| Japan Buying Foreign Bonds | -297.9 | 2189.6 |

| Japan Buying Foreign Stocks | -414.6 | 528.6 |

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Cheaper But Off Worst Levels, Nov-29 Supply Tomorrow

ACGBs (YM -3.0 & XM -5.0) are cheaper but off Sydney session lows.

- Outside of the previously outlined Private Capital Expenditure and Building Approvals data, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are little changed in today’s Asia-Pac session ahead of Q1 GDP and PCE Deflator, and Weekly Jobless Claims data later today.

- Cash ACGBs are 2-5bps with the AU-US 10-year yield differential at -16bps.

- Swap rates are 2-4bps higher, with the curve 3s10s steeper.

- The bills strip has bear-steepened, with pricing -1 to -4.

- (AFR) Traders are once again ramping up bets that the Reserve Bank of Australia will have to lift the cash rate to bring inflation to heel after US bond yields climbed overnight amid mounting global interest rate jitters. (See link)

- RBA-dated OIS pricing is flat to 3bps firmer across meetings. 1bp of easing is priced by year-end from an expected terminal rate of 4.39%.

- Tomorrow, the local calendar sees Private Sector Credit alongside the AOFM’s planned sale of A$700mn of the 2.75% Nov-29 bond.

AUSTRALIAN DATA: Approvals Stabilising But Still Well Below Pre-Covid Levels

Building approvals for April came in weaker than expected falling 0.3% m/m but March was revised higher to +2.7% m/m. There was weakness in the month in both houses and multi-dwelling units. With working age population growth running at 2.9% y/y and dwelling approvals almost 20% below their pre-Covid level, housing shortages are likely to persist.

- Approvals are up 3.5% y/y after -1.1% y/y in March but the series is volatile and May 2023’s 24.1% m/m rise will weigh on the annual rate next month.

- April private house approvals fell 1.6% m/m after rising 4% and are now up 9% y/y and 1.9% above February 2020. Multi-dwellings fell 1.1% m/m after increasing 5.7% in March but are still down 8.5% y/y and 45% below pre-pandemic. Also 3-month momentum remains negative.

Source: MNI - Market News/ABS

NZGBS: Richer After The Budget

NZGBs closed with a bull-steepening after yields fell 2-4bps following the release of the NZ Budget.

- The new NZ government presented its first budget and delivered the income tax cuts promised in the 2023 election. Finance minister Willis said that the cuts worth $14.7bn over 4 years would be offset fully by “savings and revenue initiatives” thus not adding to inflationary pressure. Slower growth has contributed to the deterioration in the budget position.

- The timing of measures is important to the RBNZ and the reduction in spending seems to be mainly from FY26, whereas tax policy changes will begin from FY25, which may concern them.

- The Treasury projects net debt to 41.8% of GDP by 2028 vs 37.6% in December. Concurrently, NZ is increasing its bond program by NZ$12 billion over the same period.

- The swaps curve also bull-steepened, with rates 1-4bps lower.

- RBNZ dated OIS pricing closed little changed for meetings out to Nov-24 and 2-5bps softer beyond. A cumulative 17bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty apart from the NZ Treasury’s planned sale of NZ$275mn of the 1.5% May-31 bond, NZ$175mn of the 4.25% May-34 bond and NZ$50mn of the 2.75% Apr-37 bond.

NEW ZEALAND: Government Finances Deteriorate Over Forecast Horizon

The new NZ government presented its first budget and delivered the income tax cuts it promised in 2023’s election. Finance minister Willis said that the cuts worth $14.7bn over 4 years will be offset fully by “savings and revenue initiatives” thus not adding to inflationary pressure. Slower growth has contributed to the deterioration in the budget position.

- Treasury estimates that the average per annum cost of the government’s tax package ($3.7bn) and new spending initiatives (5.4bn) is $9.1bn which will be funded with $3.8bn of spending initiatives, $1.5bn revenue raising, $0.6bn NRP/CERF and the $3.2bn budget allowance.

- The timing of measures is important to the RBNZ and the reduction in spending seems to be mainly from FY26, whereas tax policy changes will begin from FY25, which may concern them.

- Growth has been revised down 0.3pp in FY24 to -0.2% and 0.4pp to 1.7% in FY25 while the outer years are moderately higher.

- There is also little change to the inflation forecasts but they are below the RBNZ’s updated projections with FY24 at 3.4% vs 3.6% and FY25 2.2% vs 2.6%. They both expect 2% in FY26 and FY27.

- The deficit and debt profiles have deteriorated over the forecast horizon due to lower revenue both tax and other sources. The deficit is now expected to be 0.5pp larger at 2.7% of GDP in FY24, then it widens to 3.1% in FY25 before narrowing to 1.9% in FY26. The surplus is now 0.3% in FY28 whereas in the half year update a small one was forecast for FY27.

- The net core debt ratio is now expected to be above 40% of GDP over the forecast period with FY25 revised up 1.2pp to 43.5% before moderating to 41.8% in FY28 revised from 37.6%.

FOREX: Risk Off/Intervention Fears Drive Yen Outperformance

The BBDXY USD index sits off session highs, last just under 1256.10, largely thanks to a modest yen rebound.

- A risk off tone has been evident in the G10 FX space today. US equity futures sit lower, by -0.55% to -0.65%, while all the key regional equity markets are weaker as well.

- A firmer core yield backdrop has weighed on equity sentiment in recent sessions. US cash Tsy yields sit close to unchanged so far today though.

- USD/JPY sits near 157.20 in recent dealings, a yen gain of 0.30% and around session lows. The equity risk off tone is helping outperformance on crosses, with NZD/JPY down around 0.50% at this stage. Late Wednesday highs in USD/JPY came close to suspected intervention levels earlier in the month, so this may have encouraged some trimming of long USD/JPY positions as well.

- NZD/USD is back close to 0.6100, down around 0.20%.

- The NZ budget hasn't impacted FX sentiment, with focus likely to rest on whether announced tax cuts make the RBNZ inflation outlook more challenging.

- AUD/USD is close to unchanged, last around 0.6605/10. Private Capex for Q1 rose 1.0%, slightly above expectations.

- Later the Fed’s Williams and Logan speak. In terms of data, there are revised US Q1 GDP, April trade and jobless claims plus Spain’s May CPI and European Commission May survey.

ASIA EQUITY FLOWS: Foreign Investors Sell Asian Equities, Tech See Largest Outflows

- South Korean equity markets were lower on Wednesday, with both the Kospi & Kosdaq both down over 1.50%. Tech and Semiconductor names were the worst performing and saw the largest outflow, we saw an outflow of $798 on Wednesday which was the largest since March 15th taking the 5 day net outflow of $675m. The 5-day average is now -$135m, below the 20-day average of $56m, and well down on the longer term 100-day average at $146m.

- Taiwan equities were lower on Wednesday, and we saw a $930m outflow marking the largest outflow in about a month. Net flows over the past 5 trading sessions is now flat, later today we have GDP data. The 5-day average is now $1.2m, below the 20-day average at $266m while the 100-day average is $81m.

- Thailand equities were lower on Tuesday. The SET is now trading just below support at 1,350, a prolonged break below here would see us test the Apr 19 lows of 1,330.24. We have now marked 6 straight session of selling, with the past 5 days seeing a net outflow of $222m. Focus this week will be on BoP Current Account Balance on Friday. The 5-day average is now -$44m, below the 20-day average at -$13m and the 100-day average at -$20m.

- Indian equities marked two straight days of inflows on Tuesday although equity flows have been mixed recently although we have seen a $710 inflow over the past 5 trading sessions. This week we have GDP on Friday. The 5-day average is now $142m, below both the 20-day average at -$134m and the 100-day average at $20m.

- Indonesian equities have seen 5 straight sessions of outflows for a total outflow of -$322m, equities have been mixed and continue trading sideways in tight ranges. The 5-day average is -$64m, 20-day average -$49m both below the 100-day average at $4.2m .

- Philippines equities were down over 1% Wednesday and is now testing the yearly lows made on Apr 19th. Equity flow momentum has been slightly negative recently with a net outflow of $27m over the past 5 trading sessions. The 5-day average is -$5.5m, below the 20-day average at -$3.5m and the 100-day average at -$3.3m.

- Malaysian equities were lower on Tuesday and is now testing the 20-day EMA, we have now marked three straight session of net selling from foreign investors although still positive flow over the past 5 sessions for an inflow of $3.9m. The 5-day average now $0.8m, below the 20-day average at $32m but in line with the longer term 100-day average at $0.60m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -798 | -675 | 14626 |

| Taiwan (USDmn) | -930 | 6 | 5228 |

| India (USDmn)* | 257 | 710 | -2371 |

| Indonesia (USDmn) | -102 | -322 | -258 |

| Thailand (USDmn) | -97 | -222 | -2132 |

| Malaysia (USDmn) * | -38 | 4 | 29 |

| Philippines (USDmn) | -13 | -27.2 | -320 |

| Total | -1722 | -526 | 14801 |

| * Data Up To Apr 28th |

ASIA STOCKS: China & Hong Kong Equities Lower, Property The Worst Performer

Hong Kong & Chinese equities are mixed today. Hong Kong equities have track US markets lower as rising US yields weigh on market sentiment, Chinese equity markets are faring slightly better today with tech names the top performing, continued effort and policy updates to support the struggling property market don't seem to be helping support equity prices as regional real estate indices are the worst preforming today, although contracted sales look to stabilizing after rising an average 3% sequentially for 48 cities in the first 23 days of May. Elsewhere, Chinese chips stocks are higher after Samsung labor union said they will continue with planned strikes. The local calendar is empty today, Chinese PMI and Hong Kong Retail Sales are expected on Friday.

- Hong Kong equities are lower today, with property indices the worst performing, the Mainland Property Index is down 2.66%, while the HS Property Index is down 2.09%, elsewhere HSTech Index is faring better down just 0.40%, while the wider HSI is down 1.22%, the HSI has now fallen 7.40% from recent highs and has broken below the 20-day EMA, next support is the 50-day EMA at 17,891.

- In China onshore markets, the CSI300 is down just 0.16%, CSI 300 Real Estate Index is down 3%, small cap indices the CSI1000 is unchanged, CSI2000 is down 0.40%, while the ChiNext is up 0.14%

- (MNI): MNI China Press Digest May 30: PBOC, Electric Vehicles, ESG - (See link)

- In the property space, Logan Group faces a crucial deadline to pay or refinance a $1.3 billion loan for The Corniche project in Hong Kong, risking loss of control if it fails. Despite nearly two years of negotiation, the restructuring lacks finalized terms, adding complexity to the process. Additionally, Logan's offshore debt restructuring involves various challenges, including falling property prices and delays in bond repayments, highlighting the broader difficulties in China's real estate sector. Another city has relaxed down payment rules with Tianjin a northern Chinese city adjusting the required down payment for first-time homebuyers to no less than 15% from May 29, while the mortgage interest rate floor has been scrapped.

- Looking ahead: China PMI and Hong Kong Retail Sales of Friday

ASIA PAC STOCKS: Asian Equities Extend Losses As US Yields Head Higher

Asian equities have extended declines as the trading day has progressed and now look on track to mark three straight session of losses following moves made overnight in the US after another weak bond auction saw US treasury yields head higher. South Korean equities are the worst performing today after Samsung fell on reports of union strikes, while in Japan JGB yields continue to creep higher and the yen trades close to where it was suspect the BoJ intervened about a month ago. Earlier, Australia Building Approvals missed estimates, while NZ just released their budget.

- Japanese equities have gapped lower this morning, there has been no major headlines out so far this morning while it is also a quiet day for economic data in the region. Moves are being driven by higher US yields. The Nikkei 225 has tapped the 100-day EMA at 37,679, and now trade just above at 38,089 to be down 1.20% for the day, while the Topix is performing slightly better, the index did earlier break below the 50-day EMA but has managed to trade back above that post the break and currently trades down 0.45% for the day.

- Taiwan equities are lower today, while foreign investor selling hit a 1 month high on Tuesday. The largest contributor to Taiex moves, TSMC is down 1.20% while the Taiex is down about 1% today, although still holds above all major moving averages. The 14-day RSI is out of overbought territory falling to 60 from 75, while the MACD indictor is showing decreasing green bars. Later today we have GDP for 1Q with consensus at 6.50%, down slightly from prior reading of 6.51%.

- South Korean equities are lower today, Samsung is the largest contributor to the fall today after strikes continue to drag on. The Kospi is the worst performing index in the region today, we have broken below the 100-day EMA and trade down 1.30% while the small-cap Kosdaq is faring slightly better trading off just 0.65%.

- Australian equities are lower today although have been slowly grinding higher since the open. Earlier, Private Capital Expenditure for 1Q come in slightly above consensus at 1% vs 0.7%, while Building Approvals were below consensus at -0.3% vs 1.8% for April, and down from a revised 2.7% in March. Australian agriculture stocks are higher on the back of China lifting the ban on Australian beef, while BHP is the largest contributor to the fall today, with The ASX200 is down 0.48% and has just broken below the 100-day EMA.

- Elsewhere in SEA, New Zealand equities are down 1%, the NZ Budget has just been released however there has been little reaction by local markets, Indonesian equities are 1.25% lower, Indian equities are 0.50% lower, Singapore equities are 0.30% lower, Philippines equities are 0.70% lower while Malaysian equities are up 0.15%.

OIL: Crude Range Trading Ahead Of US EIA Data & OPEC Meeting

Oil prices have range traded during today’s APAC session after selling off on Wednesday ahead of today’s EIA data and Sunday’s OPEC meeting. WTI is little changed at $79.24/bbl following a low of $79.09 and high of $79.42. Brent is around $83.63/bbl after a high of $83.77. The USD index is up 0.1% after rising 0.5% yesterday.

- Prices look likely to fall in May and this will probably be taken into account at the June 2 online OPEC+ meeting when it considers whether to extend the full 2mbd output cut into H2. US demand and supply and China’s demand will also be important factors. It is expected to extend the reductions but could still surprise on the details of how long and how much.

- Bloomberg reported a 6.49mn drop in crude inventories, according to people familiar with the API data. Gasoline stocks fell 452k while distillate rose 2.05mn. The official EIA data are released today.

- Later the Fed’s Williams and Logan speak. In terms of data, there are revised US Q1 GDP, April trade and jobless claims plus Spain’s May CPI and European Commission May survey.

GOLD: Weaker Ahead Of Key US Data

Gold is 0.2% lower in the Asia-Pac session, after closing 1.0% lower at $2338.12 on Wednesday.

- Wednesday’s softness can be linked to a bear-steepening of the US Treasury curve as global bonds reacted to higher than expected German CPI.

- Overall, the precious metal continues to consolidate after hitting an all-time high of $2,450 last week ahead of a batch of key US economic indicators including Q1 GDP and Weekly Jobless Claims on Thursday and April’s PCE Deflator, the Fed’s preferred inflation gauge, on Friday.

- According to MNI’s technicals team, the medium-term trend structure remains bullish, and a resumption of gains would open $2452.5 next, a Fibonacci projection. The 50-day EMA, at $2305.8, represents a key support.

- In contrast, silver has edged up by 0.1% today to $32.1/oz, within sight of last week’s 11-year high at $32.5. A break of this level would open $33.887 next, a Fibonacci projection.

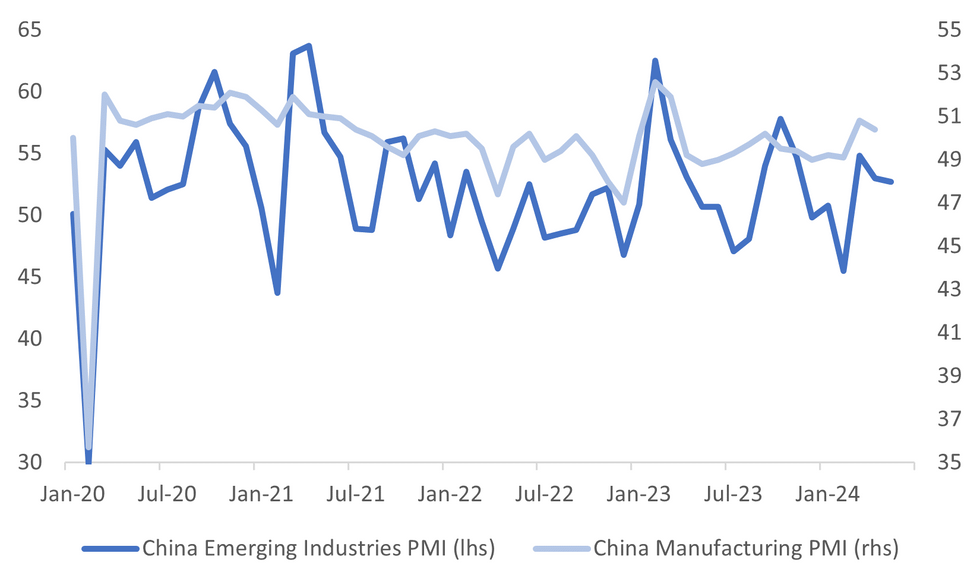

CHINA DATA: Official PMIs Out Tomorrow, Manufacturing & Services Forecast To Tick Higher

China's official PMIs for May print tomorrow. The market expects a slight improvement in both the manufacturing and non-manufacturing outcomes.

- For manufacturing the consensus sits at 50.5, versus 50.4 prior. The survey range is 50.1 to 51.9. Manufacturing/industry has been a bright spot over recent months for the China economy. The April IP print came in comfortably above expectations, while the manufacturing PMI moved back into expansion territory in March.

- The Emerging Industries PMI has already printed for May and it was down slightly but still above earlier 2024 lows. The chart below overlays this PMI against the official manufacturing PMI. There is some directional correlation, albeit with the Emerging Industries PMI much more volatile.

- On the services or non-manufacturing side, the consensus is for a 51.5 outcome, versus 51.2 prior. The survey range is 51.0 to 52.3.

- This side of the economy has generally been under more pressure, with consumer spending softening and property related activity remaining depressed. In recent months we have seen efforts to boost property sentiment clearly step up though.

Fig 1: China Official Manufacturing PMI Versus Emerging Industries PMI

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Higher On Equity Weakness, CNH Outperforms As PBoC Vows Stability

Outside of the yuan, USD/Asia pairs sit higher across the board. Carry over USD strength and equity risk off have been clear headwinds for FX in the region, as we approach month end. The KRW, IDR and THB have fallen the most in spot terms. Still to come today is Taiwan Q1 GDP revisions. Tomorrow, we have the official PMI prints for May in China. Also out is South Korean IP, Thailand trade data and Indian GDP figures.

- USD/CNH has drifted sub 7.2700 today, a modest gain in CNH terms. The USD/CNH fix was set a touch higher, while onshore equities are down modestly. Still, we heard from Tao Ling, deputy-Governor of the PBoC. She stated the central bank will support the growth of the offshore yuan (see this link for more details). She also noted that the exchange rate should be basically stable and easy to use (borrowing off President Xi's 'powerful currency' concept per BBG).

- 1 month USD/KRW has spent most of the session on the front foot. We were last at 1376, 0.50% weaker in won terms, while spot was down 1%. The weaker global and local equity backdrop is weighing on FX sentiment. We aren't too far away from earlier May highs near 1380.

- USD/IDR is up a further 0.55%, last tracking near 16250, which is on session highs. We are close to late April levels above 16280, while the YTD high was at 16288. Hence, we wouldn't be surprised to see some step up in official rhetoric or actual intervention if we breach these previous highs. Cross asset headwinds continue to be evident for the rupiah. Local equity market weakness has been particularly prevalent in recent sessions. The JCI has broken sub its simple 200-day MA, off a further 1.5% today. Earlier we hit fresh lows in the index back to late November last year, although we are up from these levels in recent dealings.

- Spot USD/HKD continues to recover from earlier May lows sub the mid point of the peg band. We were last near 7.8160, above the 20-day EMA (near 7.8125), but still sub the other key EMAs (the 200-day at 7.8210 is the highest). Yield momentum has turned back in favor of the USD in recent weeks. The US-HK 3 month differential is back to +66bps up a touch from recent lows.• US 3 month yields have risen a touch while HKD Hibor rates are off recent highs (3 month back to 4.74%). The broader US yield backdrop has certainly added higher USD levels against the CNY and JPY, which will be impacting HKD to a degree.

- USD/THB has climbed a further 0.50 to be back at 36.90/95, not too far off 2024 highs above 37.00. We did have better than expected Manfacturing data, up 3.4%y/y for April (against a -1.3% forecast). This was the first positive print since Sep 2022. Still, capacity utilization fell in the month. The BoT also defended its 1-3% inflation target but stands ready to adjust policy if economic conditions change (per BBG).

Credit Update: APAC Credit Firmer, New A$ NAB T2 Top Performing Recent Issue

Regional Asian equities are lower today, Chinese property names continue their recent sell off with major indices down 2-4%. South Korean equities have been the worst performing region on the back of news that Samsung's union will continue ahead with their strike.

- Aus Corps unch to 1bps tighter, better buying in high beta names & Snr Fins unch, while are Subs 1-2bps tighter. Korean credit 1-3bps tighter, while China credit is unch.

- In the EM space, Indonesian quasi's are 2-5bps wider and EM sovs are 3-5bps wider.• Aus iTraxx CDS 1bps higher at 64.75bps & Asia Ex-J iTraxx is up 2bp at 95.50bps• Recent deals: the NAB T2, is another 4bps tighter today and now trade about 15bps tighter since issue.

- Rates: Local rates are cheaper today, US yields were lower on the back of further supply this time $44b of 7yr. US Treasury futures are little changed today with ranges extremely tight.

- Data: NZ Building Permits for Apr were -1.9% vs -0.2% in March, AU Private Capital Expenditure for Q1 was 1% vs 0.7% est & Building Approvals for Apr were -0.3% vs 1.8% est

- Primary Deals: Refinance of Torrens 2019-1 A at +95, Shangri-La Asia 3y, Krakatau Posco 3Y at +200 area & 5Y at +220 area, China Orient Asset Management 5y at +180 area. Late Wednesday Airport Authority priced a CNY 1.5b 10Y at 2.93%.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/05/2024 | 0600/0800 | *** |  | SE | GDP |

| 30/05/2024 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/05/2024 | 0700/0900 | ** |  | CH | KOF Economic Barometer |

| 30/05/2024 | 0700/0900 | *** |  | CH | GDP |

| 30/05/2024 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/05/2024 | 0900/1100 | ** |  | EU | Unemployment |

| 30/05/2024 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/05/2024 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/05/2024 | 0900/1100 | ** |  | IT | PPI |

| 30/05/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 30/05/2024 | 1230/0830 | *** |  | US | GDP |

| 30/05/2024 | 1230/0830 | * |  | CA | Current account |

| 30/05/2024 | 1230/0830 | * |  | CA | Payroll employment |

| 30/05/2024 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 30/05/2024 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 30/05/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/05/2024 | 1455/1055 |  | CA | BOC payment director gives speech in Toronto. | |

| 30/05/2024 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 30/05/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/05/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/05/2024 | 1605/1205 |  | US | New York Fed's John Williams | |

| 30/05/2024 | 2100/1700 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.