-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBA In No Hurry To Switch To Easing Bias

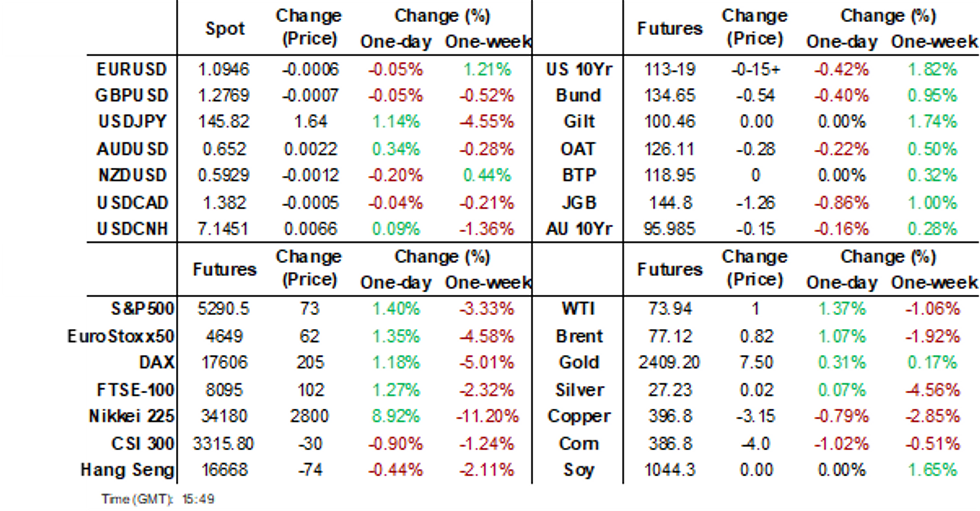

- Focus was on broader risk trends today, which stabilized after Monday's sharp losses. Japan equities, led by tech and a weaker yen, rebounded (+8%). Japan wages data was stronger than expected, but didn't impact market sentiment. Along with weaker yen trends, the CHF also lost some ground.

- JGB futures are sharply cheaper, -136 compared to the settlement levels, but slightly off session cheaps. US Tsys futures sold off during the morning session, but has spent the remainder of the session trading sideways in tight ranges.

- The RBA left rates on hold, as widely expected, but pushed back on market pricing of an easing before year end. This has aided A$ outperformance on crosses.

- Later US June trade data, German June factory orders and euro area June retail sales print.

MARKETS

US TSYS: Tsys Futures Steady Post Morning Sell-Off, Fed Funds Pricing Cools

- Tsys futures sold off during the morning session, but has spent the remainder of the session trading sideways in tight ranges. TUU4 is currently - 04 ⅞ at 103-13, while TYU4 is - 03 at 113-21+.

- Volumes are well down on Monday's levels, although we are still about double the average for this time of the day.

- Cash treasury curve has bear-flattened, there is slightly better selling occurring through the belly, yields are 3-6bps higher. The 10yr yield is +4.7bps at 3.833% vs 3.665% lows, we still trade 10bps lower than pre NFP and 22bps lower than Thursday jobs report.

- Fed funds futures were at one point overnight pricing in 60bps of cuts at the September meeting, they have since cooled and are now pricing 47.5bps for the next meeting.

JGBS: Massive Cash Curve Bear-Steepener After Poor 10Y Auction, BoJ Rinban Operations Tomorrow

JGB futures are sharply cheaper, -136 compared to the settlement levels, but slightly off session cheaps.

- Outside of the previously outlined cash earnings data, there hasn't been much in the way of domestic data drivers to flag.

- That said, today’s 10-year auction showed poor demand metrics. The low price failed to meet wider expectations, the cover ratio fell to 2.975x from 3.277x and the tail exploded to 0.5 from 0.02 in July. The result defied the fact that sentiment towards global long-end bonds is at the most favourable level this year. A sharply lower outright yield and flatter 2/10 curve appeared to significantly impact the level of demand at today’s auction.

- Cash US tsys are 4-6bps cheaper in today’s Asia-Pac session, extending the reversal in the direction seen yesterday. Today's US calendar will see Trade Balance data and a 3-year tsy note sale. There is no scheduled Fed speak.

- The cash JGB curve has sharply bear-steepened, with yields flat to 19bps higher. The benchmark 10-year yield is 11.5bps higher at 0.907% after today’s supply.

- The swaps curve has also bear-steepened, with rates 1-10bps higher. Swap spreads are tighter.

- Tomorrow, the local calendar will see Leading and Coincident Indices alongside BoJ Rinban Operations covering 1-5-year and 10-25-year JGBs.

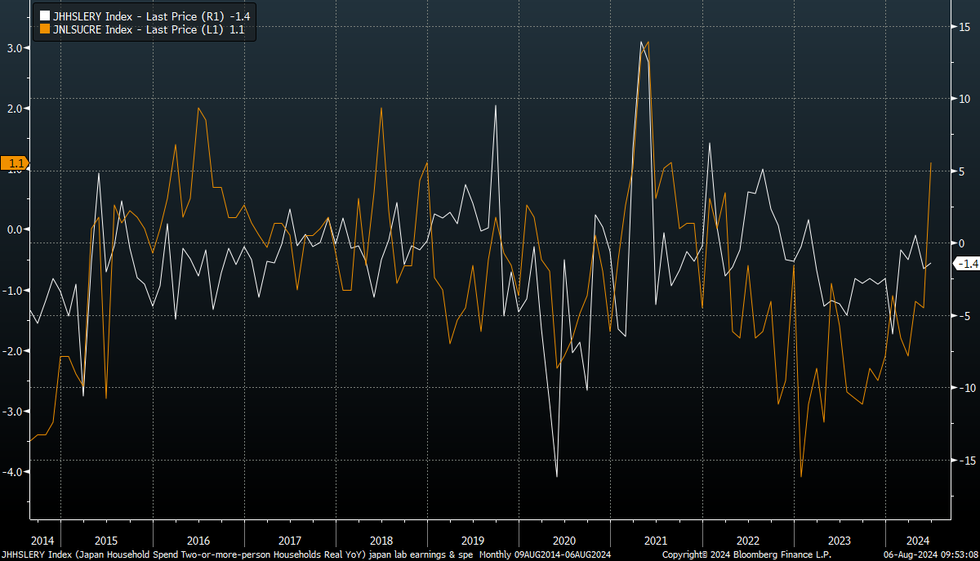

JAPAN DATA: Real Wages Surge Into Positive Territory, But Spending Still Negative

June wages data mostly strongly surprised on the upside. Headline labour nominal cash earnings were +4.5%y/y, against a 2.4% forecast and revised 2.0% gain in May. Real cash earnings were +1.1% y/y, against a -0.9% forecast and prior -1.3%. This is the is the first positive print for real wages since Q1 2022.

- The same sample base figures were a little more mixed though. Cash earnings surged 5.4%y/y, against a 3.5% forecast and 2.6% prior. Scheduled pay was slightly softer than forecast at +2.7% y/y (2.9% forecast).

- Looking at the detail, special payments rose 9.1% y/y on a same sample basis, boosting cash earnings. Bonus payments were up 7.6%y/y. Other same sample base figures were little changed from May.

- This will be the watch point going forward, as the authorities aim for continued positive real wage growth. Still, scheduled same sample base pay hit fresh cycle highs in y/y terms, with recent annual wage negotiations continued to aid this backdrop.

- Elsewhere, hours worked fell -2.8%y/y, while employment was +1.1% y/y.

- The better wage outcome didn't boost household spending in June, which fell -1.4% y/y in real terms, against a -0.8% forecast.

- The Japan authorities will be hopeful the positive real wage trend translates into better real household spending outcomes. The chart below overlays the two series, with household spending the white line.

Fig 1: Japan Real Wages & Real Household Spending Y/Y

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Slightly Cheaper After RBA Policy Decision

ACGBs (YM -24.0 & XM -16.0) have slightly extended today's cheapening after the RBA decided to leave the cash rate target unchanged at 4.35%. To summarise the accompanying statement:

- Inflation has significantly decreased since its 2022 peak, due to higher interest rates balancing aggregate demand and supply.

- However, it remains above the 2–3% target range, with underlying CPI rising by 3.9% over the year to June. Inflation has been persistent, staying above the midpoint for 11 consecutive quarters.

- Risks include high unit labour costs and weak economic activity.

- The RBA prioritises returning inflation to target and will adjust policy as needed, considering global and domestic economic trends.

- Cash US tsys are 4-6bps cheaper in today’s Asia-Pac session.

- Cash ACGBs are 1-3bps cheaper after the RBA decision, with the AU-US 10-year yield differential at +15bps.

- Swap rates are 14-25bps higher on the day, with the 3s10s curve flatter.

- The bills strip has bear-steepened, with pricing -13 to -26.

- RBA-dated OIS pricing is 4-7bps firmer after the RBA decision across meetings. A cumulative 27bps of easing is priced by year-end.

- Tomorrow, the local calendar will see RBA Hunter, Assistant Governor (Economic), and RBA Cassidy, Deputy Head, Economic Analysis appear before the Senate Select Committee on the Cost of Living.

- Tomorrow, the AOFM plans to sell A$800mn of the 2.75% 21 June 2035 bond.

RBA: RBA Remains “Vigilant” & Flexible Given Core Has Moderated Little Recently

The RBA left rates at 4.35% as expected and maintained its language and at the margin was slightly more hawkish with inflation to return to the band by “late in 2025” rather than the “second half of 2025” and quarterly core has fallen “very little over the past year”. It added that policy will need to be “sufficiently restrictive” until the Board is “confident” inflation is “sustainably” moving towards target. It remains “vigilant to upside risks to inflation” and continues not to rule “anything in or out”. At this stage, a 2024 rate cut is looking less likely.

- The softer AUD and financial markets were mentioned.

- The RBA updated its forecasts which included not only new data points but also state and federal government stimulus. Headline inflation is down 0.8pp in Q4 2024 to 3.0% but then rises to 3.7% in Q4 2025 with the end of electricity relief and returns to the band mid-point by Q4 2026. Oil prices were revised down about $5/bbl, which would have also impacted headline forecasts.

- During this time it will be important to focus on trimmed mean inflation, which saw minimal revisions with Q4 2024 +0.1pp to 3.5% with it in the band in Q4 2025, the same as May. It is now close to the mid-point in Q4 2026, 2 quarters later than previously. The downward revision to the market-pricing of the OCR would have added upward pressure.

- Fiscal stimulus can also be seen in a sharp increase in public demand growth which is now expected to be 4.3% y/y in Q4 2024 (from 1.5%) and 4.1% in Q2 2025 (2.1%), while Q4 was unchanged at 3.0%. This has boosted domestic demand in 2024, along with stronger consumption.

- Employment growth was revised up, while the unemployment rate is 0.1pp higher across the forecast period. This is only a slight change and likely within the error band.

AUSTRALIAN DATA: Mixed Inflation Information Likely To Keep RBA “Vigilant”

In June, the RBA repeated that it needs to “remain vigilant to upside risks to inflation”. While Q2 CPI printed close to its May forecasts, other inflation indicators were mixed since the June 18 meeting. Thus, we do not expect the Board to change its tone regarding inflation risks and to maintain its flexibility by “not ruling anything in or out” today.

- Q2 headline CPI increased 3.8% y/y up from 3.6%, while the trimmed mean moderated to 3.9% from 4.0%. Domestically-driven services rose 0.2pp to 4.5% y/y but core moderated 0.2pp to 4.1%. Monthly June inflation remained elevated but key measures moderated.

- The Melbourne Institute inflation gauge for July fell to 2.8% y/y from 3.2% and is now inside the 2-3% band for the first time since December 2021. Trimmed mean eased to 2.9% from 3.4%. Inflation expectations though remain above 4% and at 4.3% in July are above May’s 4.1%.

- SEEK June advertised salaries remained elevated at 4.3% y/y but down from 2023’s 4.9% peak. The minimum wage rose 3.75% on July 1 significantly less than last year but labour costs remain cited in business surveys as adding to overall cost pressures. Strong Q2 hours worked also signal that productivity growth was likely weak.

Source: MNI - Market News/SEEK

- Surveys have also been mixed with the June NAB business survey showing a moderation in price/cost components except retail prices, but there had been a significant pick up in the 3-month rate in May.

Source: MNI - Market News/Refinitiv

- The July Judo Bank services PMI noted that selling prices picked up to their highest rate in almost a year due to increased wage, material and transport costs. Manufacturing costs also rose but weak demand meant that output inflation was unchanged. Global container rates rose strongly in July but are lower in August to date.

- Q2 PPI remained robust rising 1.0% q/q bringing the annual rate to 4.8% y/y from 4.3%. Import prices rose 1% q/q to be up 1.1% y/y after three negative quarters.

NZGBS: Sharply Cheaper Ahead Of Tomorrow’s Q2 Labour Market Data

NZGBs closed sharply cheaper but slightly off the session’s worst levels, with benchmark yields 6-9bps higher.

- Swap rates closed 5-8bps higher, with the belly of the curve underperforming.

- (Bloomberg) “Investors and some economists now expect New Zealand’s central bank to start cutting interest rates next week as markets globally ramp up bets on imminent monetary policy easing.”

- The RBNZ will cut the OCR by 25 basis points to 5.25% in its Aug. 14 Monetary Policy Statement and deliver two further reductions to 4.75% by the end of the year, Bank of New Zealand Head of Research Stephen Toplis predicted. Investors expect even more rapid action, with the OCR falling from 5.5% to 4.5% by November, swaps data show. (See link)

- RBNZ dated OIS pricing closed 2-9bps cheaper across meetings. A cumulative 98bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Q2 Labour Market Data. With increasing easing expectations ahead of the RBNZ decision on August 14, this labour market data will be closely watched.

- If it is weaker than expected, there’s likely to be further rate cut calls. Bloomberg consensus expects the unemployment rate to rise 0.4pp to 4.7%, the highest since the Covid-impacted Q4 2020, and for wage pressures to ease.

FOREX: Safe Havens Underperform, A$ Rises On Crosses Post RBA Hold

The main focus today has been on FX weakness in safe havens yen and CHF. The BBDXY USD index sits marginally higher at 1247, up 0.1%.

- USD/JPY rallied from early lows of 143.63 to 146.36, as regional equities rose and US yields firmed. Some comments from the Fed's Daly around not reading too much into Friday's labour market report likely aided US yields at the margin (we are +4-5.5bps firmer across the benchmarks).

- We last tracked near 145.20, still 0.70% weaker in yen terms for the session. CHF is down around 0.35%, last 0.8550.

- Japan June wages data was stronger than expected (real wages back into positive territory for the first time in 27 months) and the authorities expect the positive trends to continue.

- Japan equities have rebounded 8-9%, not offsetting yesterday's falls. The BOJ MOF and FSA will get together in a little under an hour to discuss recent volatility.

- AUD/USD is holding near 06500, with limited post RBA gains, but is outperforming on crosses. AUD/NZD was last 1.0970, fresh multi session highs. AUD/JPY last near 94.60, still off earlier highs of 95.50, but up for the session.

- The RBA left rates on hold as widely expected, but left generally hawkish language around the rate outlook (nothing ruled in or out, will be vigilant to upside inflation risks).

- NZD/USD sits 0.20% lower, last near 0.5930.

- Later US June trade data, German June factory orders and euro area June retail sales print.

ASIA EQUITY FLOWS: Foreign Investors Dump Asian Equities As Stock Rout Continues

- South Korea: South Korean equities experienced an outflow of $711m yesterday the 2nd session in a row of greater than $700m in outflows, we have now seen a net outflow of $1.279b over the past five trading days. The 5-day average outflow is $256m, compared to the 20-day average outflow of $80m and the 100-day average inflow of $86m. Year-to-date, South Korea has had substantial inflows totaling $17.271b.

- Taiwan: Taiwan saw an outflow of $1.984b yesterday, leading to a net outflow of $5.505b over the past five trading days. It has been the worst quarter for Taiwan equities since Q2 2022. The 5-day average outflow is $1.101b, compared to the 20-day average outflow of $791m and the 100-day average outflow of $198m. Year-to-date, Taiwan has experienced outflows totaling $11.244b.

- India: Indian equities had an outflow of $402m Friday, resulting in a net outflow of $1.193b over the past five trading days. The 5-day average outflow is $239m, compared to the 20-day average inflow of $120m and the 100-day average outflow of $51m. Year-to-date, India has seen inflows totaling $3.513b.

- Indonesia: Indonesian equities recorded an outflow of $31m yesterday, leading to a net inflow of $129m over the past five trading days. The 5-day average outflow is $26m, below the 20-day average inflow of $16m and close to the 100-day average outflow of $13m. Year-to-date, Indonesia has had inflows totaling $37m.

- Thailand: Thai equities saw an outflow of $2m yesterday, resulting in a net outflow of $49m over the past five trading days. The 5-day average outflow is $10m, better than the 20-day average outflow of $2m and the 100-day average outflow of $25m. Year-to-date, Thailand has had significant outflows amounting to $3.338b.

- Malaysia: Malaysian equities had an outflow of $76m yesterday, resulting in a 5-day net outflow of $19m. The 5-day average outflow is $4m, which is better than the 20-day average inflow of $7m and the 100-day average outflow of $1m. Year-to-date, Malaysia has experienced inflows totaling $58m.

- Philippines: The Philippines had an outflow of $11m yesterday, resulting in a net outflow of $25m over the past five trading days. The 5-day average outflow is $5m, compared to the 20-day average inflow of $2m and the 100-day average outflow of $7m. Year-to-date, the Philippines has seen outflows totaling $482m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -711 | -1279 | 17271 |

| Taiwan (USDmn) | -1984 | -5505 | -11244 |

| India (USDmn)* | -402 | -1193 | 3513 |

| Indonesia (USDmn) | -31 | 129 | 37 |

| Thailand (USDmn) | -2 | -49 | -3338 |

| Malaysia (USDmn) | -76 | -19 | 58 |

| Philippines (USDmn) | -11 | -25 | -482 |

| Total | -3218 | -7941 | 5816 |

| * Up to 2nd August |

OIL: Crude Finds Support From Geopolitics And Improved Risk Sentiment

Oil prices rose early in the session on news that an American base in Iraq had been attacked and better risk sentiment. While they are still up on the day, they are off their intraday highs. WTI is up 1.6% to $74.08/bbl after a peak of $74.56, and Brent is 1.3% higher at $77.27/bbl after rising to $77.85. The USD index is up 0.1%.

- The market is watching developments in the Middle East closely as Iran is expected to retaliate for Israel’s killing of Hamas’ political leader in Tehran. Iran is the 7th largest global oil producer plus it controls the Strait of Hormuz which is important for oil and gas shipments.

- Through the geopolitics the market is still watching fundamentals closely. It has been concerned about the strength of China’s demand for some time and is now worried about the US. Supply developments also remain important and the US has recorded 5 straight weekly crude inventory drawdowns. Industry stock data is released later today with the official EIA on Wednesday.

- Also, output at Libya’s largest oil field has been stopped due to the continued conflict between the country’s two governments.

- Later US June trade data, German June factory orders and euro area June retail sales print.

ASIA PAC STOCKS: Japanese Equities Bounce As Yen Falls, Tech Stocks Top Performers

Asian markets have seen a strong rebound today, after a historic plunge on Monday. The MSCI Asia Pacific Index gained as much as 3.9%, driven by recoveries in Japanese, South Korean, & Taiwan markets. There were no major headlines for the sharp bounce, although the yen did fall over 1% which has helped Japanese exporters, and the VIX is well off overnight highs of 65.

- Japanese stocks have surged higher this morning, recovering from the previous day's historic 12% collapse. The Nikkei 225 and Topix indices jumped more 10%, marking their biggest gains since October 2008 we currently trade about 8% higher. This rebound was led by exporters such as Toyota Motor and Hitachi, they were also helped by a weaker yen which fell about 1.5%. The Topix Bank Index dropped 17.45% on Monday, although has only recovered 3.50% today.

- South Korean stocks have also jumped today, following the previous session's nearly 9% crash. Earlier there was a halt on program trading after the KOSPI rose over 5% in a minute, this was the first halt for program buying since June 2020. Samsung is currently trading 2.80% higher, after initially opening up over 5%. The KOSPI is 3% higher, while the KOSDAQ is 5.75% higher.

- Taiwan equities opened 4% higher, before giving all gains up and trading back below the 200-day EMA, we have since recovered again to trade 3% higher. Foreign investors have been heavy sellers of stocks recently and could have used the gap high on the open as a liquidity window.

- Australia equities are only slightly higher today, the RBA kept rate and hold and didn't chance their stance much, the ASX 200 is 0.30% higher. In New Zealand the NZX 50 is 0.30% lower after largely ignoring the sell-off on Monday.

- In the EM space markets are mostly higher, with Malaysia's KLCI up 2%, Philippines PSEi up 0.5%, Indonesia's JCI up 1.10%, while Singapore's Straits Time is 0.70% lower.

GOLD: Steady After Yesterday’s Sharp Dump

Gold is slightly weaker in today’s Asia-Pac session, after closing 1.3% lower at $2410.79 to start the week, despite the seemingly favourable risk-off environment.

- "Bullion was pulled into Monday’s global rout, as some traders cut holdings to cover potential margin calls." (per BBG)

- Gold remains around 17% higher this year after hitting an all-time high in July, mainly supported by bets the US Federal Reserve will pivot to monetary easing. Lower borrowing costs are positive for bullion as it doesn’t pay interest.

- Today’s price action saw the yellow metal pierce the first support at $2,405.4/oz, the 20-day EMA, exposing $2,353.2 next, the July 25 low, according to MNI’s technicals team.

- The overall trend structure remains bullish though, with a clear breach of the 50-day EMA at $2,374.4/oz needed to signal scope for a deeper retracement.

ASIA FX: USD/Asia Pairs Mostly Higher, MYR & THB Unwind Some Recent Outperformance

Most USD/Asia pairs are showing an upside bias in the first part of Tuesday trade. MYR and THB have faltered the most, which unwinds some of the recent outperformance for both currencies. MYR is down nearly 1%. Losses elsewhere are more modest, while the likes of IDR are relatively steady, with the regional equity bounce aiding broader risk appetite.

- USD/CNH has been relatively steady, finding selling interest above 7.1500. We last tracked near 7.1400, little change for the session. This is outperforming the softer yen trend, which is down around 0.80% against this USD at this stage. Local equities are off modestly, maintaining a low beta with respect to broader regional moves.

- Spot USD/KRW has firmed, pushing back towards intra-session highs from Monday, the pair last near 1373.5, around 0.30% weaker in won terms. Onshore equities have rebounded over 4%, but the won is taking greater cues from yen and CNH trends at this stage.

- USD/MYR is back to 4.4650, up from oversold conditions sub 4.4000 yesterday. This is around 0.90% weaker in MYR terms. Still we sit comfortably off mid July highs near 4.6900.

- USD/THB is also higher, by around 0.50%, last near 35.40. Monday lows in the pair were at 35.06. The nearest EMA resistance point is back near 35.94, the 20-day. We did have consumer confidence data earlier for July. The headline eased to 57.7 from 58.9 prior. Economic confidence fell to 51.3 from 52.6. Both measures are well above 2021/22 lows but the roll over in confidence since the start of the year is not a domestic demand positive. Politics was cited as a factor. The government will be hoping the digital wallet roll out turns sentiment/spending higher.

- USD/IDR has been relatively steady (last near 16180), not showing the same upside bias as other USD/Asia pairs. It has been a laggard in SEA compared to the likes of MYR and THB, so positioning may be less of a factor. The regional equity bounce today may also be providing a positive risk appetite offset. Indonesia 5yr CDS has edged down off recent highs today (last 80bps).

CHINA RATES: Next Step A RRR Cut?

- Onshore reports suggest a challenging month ahead in August for liquidity in the onshore market in China.

- The Medium-Term Lending facility, so intrinsic to the domestic economy, has a reported CNY400bn of maturities in August.

- Following the completion of the Plenum, regions have been given some additional autonomy to drive their economies and this is expected is set to spur bond issuance in August and beyond.

- Analysts suggest that CNY1 trillion of issuance is possible to fund expansion targets and meet the needs of maturities.

- Post plenum a combination of a cut in the reverse repo rate and a reduction in the 5- and 1-year Loan Prime Rate were announced to support liquidity.

- With banks holdings of government bonds down in recent trading sessions, this may be symptomatic of the challenges they face with liquidity and could foreshadow a potential cut in the RRR by authorities.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/08/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 06/08/2024 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/08/2024 | 0630/0830 | ** |  | CH | Retail Sales |

| 06/08/2024 | 0730/0930 | ** |  | EU | S&P Global Final Eurozone Construction PMI |

| 06/08/2024 | 0830/0930 | ** |  | UK | S&P Global/CIPS Construction PMI |

| 06/08/2024 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/08/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/08/2024 | 1100/1200 |  | UK | APF Quarterly Report | |

| 06/08/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 06/08/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/08/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/08/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 06/08/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/08/2024 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.