-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Shipping Costs Not Threatening Global Inflation Yet

- US cash bonds are dealing 1-3bps richer in today’s Asia-Pac session. This has weighed on the USD, but only marginally. JGB futures remain in negative territory, -37 compared to the settlement levels, but slightly above the session’s worst levels. This comes post a poor 20-yr JGB auction.

- AUD/USD largely shrugged off weaker jobs data. USD/CNH has been immune to further sharp falls in China onshore equities. Oil prices are marginally higher as Middle East tensions remain in focus. The US launched further strikes on Yemen, while Pakistan struck 'terrorist' positions in Iran in response to attacks from Iran earlier this week.

- Global shipping rates are on the rise but currently don’t look likely to cause inflation pressures on the scale seen in 2021/2022 due to tighter fiscal and monetary policy but also container costs remain well below the 2021 peaks, see below for more details.

- Later the Fed’s Bostic speaks twice on the economic outlook at 1230 and 1705 GMT, there will be Q&A at the second appearance. He will be a FOMC member in 2024. On the data front, there are US housing starts/permits, jobless claims and Philly Fed. The ECB December meeting accounts are published and President Lagarde appears.

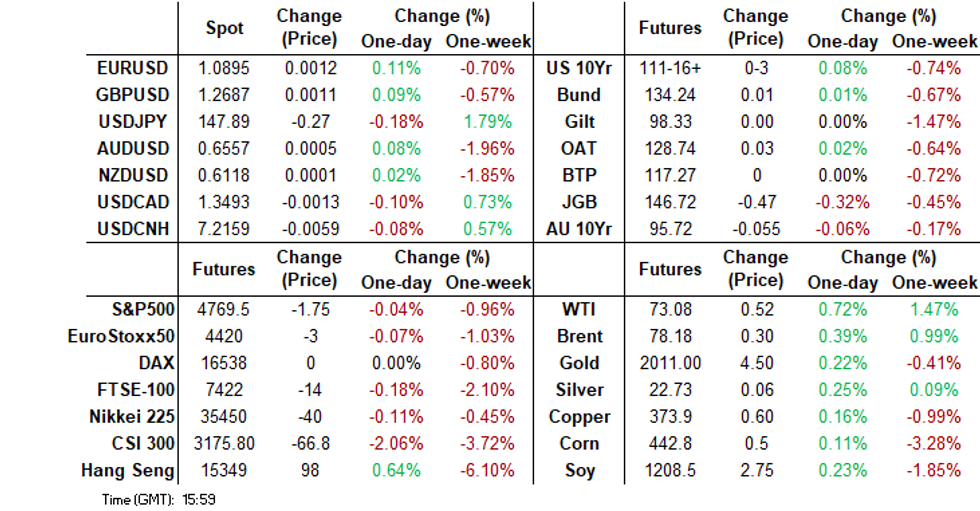

MARKETS

GLOBAL: Shipping Costs Not Threatening Global Inflation Yet

Global shipping rates are on the rise but currently don’t look likely to cause inflation pressures on the scale seen in 2021/2022 due to tighter fiscal and monetary policy but also container costs remain well below the 2021 peaks. But with tensions in the Red Sea unlikely to ease soon and more vessels being rerouted, shipping costs need monitoring and could add to inflation pressures, especially in Europe, after helping to bring it down.

- The Panama Canal, which carries around 5% of global seaborne trade, has reduced shipping traffic due to drought, and the Suez Canal, which sees around 10%, is being heavily impacted by ships avoiding the Red Sea due to Iran-backed Houthi rebels firing missiles at merchant shipping in the Strait of Bab el-Mandeb. As a result there has been a sharp rise in shipping rates, but they remain low and don’t yet seem to be threatening global inflation.

- FBX global container rates have risen 169% since October 7 but the China/east Asia to Mediterranean route has soared 353%. Just in January to date they are 116% and 180% higher respectively.

Source: MNI - Market News/Refinitiv

- The levels and rate of increase though remain well below the 2021 highs that helped to drive recent inflation problems and subsequent monetary tightening. Global container rates are 75% lower than the September 2021 peak and the Mediterranean route 50% lower. They rose 435% y/y and 597% y/y in August 2021, well above current increases.

- Falling shipping costs have contributed to reducing G20 CPI inflation from 9.5% in September 2022 to 5.8% in November 2023, this is unlikely to continue through at least the first half of 2024. Shipping contracts tend to be agreed in March and so the Red Sea risks and the costs of rerouting away from the region, which can take 14 days longer, have not been fully priced into shipping costs yet. Watch PMI reports for signs this is impacting producers’ costs.

Source: MNI - Market News/Refinitiv

US TSYS: Cash Bonds Unwind Some Of Wednesday’s Bear-Flattening

TYH4 is trading at 111-16+, 0-02+ from NY closing levels.

- Cash bonds are dealing 1-3bps richer in today’s Asia-Pac session.

- There has been little meaningful newsflow in today's session, apart from the continuation of China's equity market weakness. At this stage, it is largely isolated to onshore markets with limited spillover to other regional equities, or other asset classes.

- Later today will see US Housing Starts, Building Permits, Philadelphia Fed Business Outlook and Weekly Initial Jobless Claims data.

- ECB's Lagarde speaks at the WEF panel in Davos and Fed's Bostic Speaks on the Economic Outlook.

JGBS: Bear-Steepening Strengthens In Post-20Y Auction Trading, National CPI Tomorrow

JGB futures remain in negative territory, -37 compared to the settlement levels, but slightly above the session’s worst levels.

- In addition to the morning’s Core Machinery Orders and Weekly Investment Flows data, Industrial Production (F) data for November printed in line at -0.9% m/m (-1.4% y/y). Capacity Utilization for November showed 0.3% versus 1.5% prior.

- The domestic driver for today’s session however has been the poor 20-year JGB auction. The 20-year yield is 2bps cheaper in post-auction trading after the auction low price failed to meet dealer expectations. On a positive note, the cover ratio did increase and the auction tail shortened materially. Today’s auction followed on the heels of suboptimal results at January’s 5-, 10- and 30-year JGB supply.

- The bear-steepening in the cash JGB curve has intensified in post-auction dealings, with yields flat to 9bps higher. The benchmark 10-year yield is 2.2bps higher at 0.640% versus the Nov-Dec rally low of 0.555%.

- The swaps curve has also bear-steepened, with swap spreads mixed.

- Tomorrow, the local calendar sees National CPI data and the Tertiary Industry Index.

AUSSIE BONDS: Cheaper, Post-Jobs Data Richening Largely Unwound

ACGBs (YM -7.0 & XM -5.5) sit cheaper and are situated in the middle of the Sydney session range. This follows a reversal of the post-employment data richening. Currently, futures are trading 1bp higher compared to pre-data levels.

- December new jobs came in well below expectations at -65.1k after an upwardly revised 72.6k but the unemployment rate was stable at 3.9%.

- The unwinding of post-data strength most likely reflected the understanding that a single month's data doesn't establish a definitive trend. The ABS has highlighted a shift in the timing of employment growth. Consequently, when observing trends over several months, the labour market is still characterised as tight, albeit gradually showing signs of easing.

- Apart from employment data, local participants have likely eyed the 1-3bps richening in US tsys in today’s Asia-Pac session.

- Cash ACGBs are 5-6bps cheaper on the day, with the AU-US 10-year yield differential 2bps wider at +18bps.

- Swap rates are 5bps higher on the day, with EFPs slightly tighter.

- The bills strip has maintained its bear-steepening, with pricing -1 to -8.

- RBA-dated OIS pricing is 1-5bps firmer for meetings beyond March. A cumulative 37bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

AUSTRALIAN DATA: Trends Signal Tight Labour Market Is Gradually Easing

December new jobs came in well below expectations at -65.1k after an upwardly-revised 72.6k but the unemployment rate was stable at 3.9%. It is worth noting that one-month doesn’t make a trend and that there has been a shift in the timing of employment growth which the ABS notes. So it is worth looking at trends over several months and these don’t change the view that the labour market remains tight but is gradually easing.

- Summer school holidays started in December and recently people have tended to change jobs during this time and have a break before starting a new one. The December participation rate fell 0.4pp and the number of unemployed declined by 1k.

- 51.7k new jobs were created in Q4 2023 a slowdown from Q3’s 72.5k with the growth driven by part-timers. The number of unemployed was also higher at 51.9k compared with 12.8k but the labour force grew 104k in Q4 compared to 85k in Q3. The labour market couldn’t keep up in the final quarter of 2023 as the working-age population increased another 145k (Q3 +176k).

Source: MNI - Market News/ABS

- December was the largest drop in full-time (FT) employment since Covid. FT jobs fell 106.6k with part-time (PT) rising 41.4k. Comparing the first half of 2023 with the second half, there was a clear shift to PT new jobs likely signalling less certainty re the outlook. H2 2023 PT jobs rose 222.4k whereas FT fell 98.3k.

- The underemployment rate was unchanged at 6.5%, only 0.1pp higher than June. But hours worked fell 0.5% m/m, the 4th decline in 6 months, with FT down 0.8%m/m but PT up 0.7%. PT is now +6.9% y/y compared with 0.1% for FT, consistent with the view that employers are more cautious.

Source: MNI - Market News/ABS

NZGBS: Heavy Session, US Tsys Richen In Asia-Pac Dealings

NZGBs closed at the session’s worst levels, 8-10bps cheaper, with the 2/10 curve flatter. Today’s data drop (REINZ Home Sales and Food prices) failed to provide much of a directional catalyst for the local session.

- NZGBs held by international investors jumped to 61.3% in December from 60.5% in November.

- After the negative lead-in from a heavy NY session for US tsys, the local market then moved away from morning cheaps in line with the 1-3bp richening by US tsys in today’s Asia-Pac session. However, the improvement in NZGBs proved short-lived, with cash bonds finishing at their cheaps.

- Swap rates closed 3-6bps higher, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed 1-8bps firmer across meetings, with November leading. A cumulative 91bps of easing is priced by year-end.

- Bloomberg reported that ANZ expects the RBNZ to deliver a steady sequence of 25bp rate cuts starting in August, which will take the Official Cash Rate to 3.5% over 12 months. (See link)

- Tomorrow, the local calendar sees BusinessNZ Manufacturing PMI and Net Migration data.

EQUITIES: China Indices Hit Fresh Multi Year Lows Before Stabilizing Somewhat

Regional equities are mixed in Asia Pac markets for Thursday trade. China onshore markets sit down at the break, after hitting fresh multi-year lows in earlier trade. US equity futures sit modestly lower after cash losses in Wednesday trade. Eminis were last near 4766, off a little over 0.1%, Nasdaq futures are down by a similar amount.

- China onshore equity weakness continues. The Shanghai Composite off more than 2% at one stage, but now at -1.59% at the break. This put the index at fresh lows back to early 2020 and through 2800.

- The move lower looks more flow/technically driven than any fresh fundamental catalyst. Still, there is disappointment over lack of fresh stimulus with the MLF held steady earlier in the week and recent comments by Premier Li in Davos that growth targets can be achieved without massive stimulus.

- The CSI 300 is off 0.63% at the break, also up from session lows. We are still back at 2019 levels from an index standpoint though.

- Sentiment elsewhere is more mixed. Japan stocks are modestly higher, the Nikkei 225 last +0.40%. The Taiex is up 0.40%, after officials called for calm in light of recent falls. The Kospi is also up around 0.30% at this stage.

- Indian shares have opened weaker. The Nifty off 1%, weighed by the banking sector post HDFC results.

- In SEA, trends are mixed. Malaysia and Philippines are down, but positive trends are evident elsewhere.

JAPAN DATA: Offshore Investors Step Up Purchases Of Local Equities & Bonds

Japan weekly investment flows were strong across the board in the week ending Jan 12. Offshore investors bought over ¥1200bn in local stocks, while a pick up was evident in terms of local bonds (¥980bn). The inflows into local stocks nearly brings net inflows back to flat since the start of Dec last year. Bond flows remain a net negative though for this period.

- In terms of Japan offshore buying, we saw a sharp rise in bond purchases. Since the start of the year we have seen over ¥2000bn in net outflows to this space by local investors.

- Buying of offshore equities was also positive for the third straight week.

| Billion Yen | Week ending Jan 12 | Prior Week |

| Foreign Buying Japan Stocks | 1202.6 | 296.8 |

| Foreign Buying Japan Bonds | 980.2 | -401.6 |

| Japan Buying Foreign Bonds | 1642.8 | 545.2 |

| Japan Buying Foreign Stocks | 783.3 | 190.7 |

Source: MNI- Market News/Bloomberg

FOREX: Dollar Softens On Lower Yields, A$ Shrugs Off Jobs Miss

The USD has been slightly offered in the first part of Thursday trade. The BBDXY sits close to 0.10% weaker, but is up from session lows, last near 1237.40 (session lows at 1236.64).

- AUD/USD dipped close to Wednesday session lows of 0.6526, post a sharp fall in Dec jobs, which was much weaker than expected. We climbed from there though, last near 0.6560, just off session highs (0.6567).

- The ABS noted that there has been a shift in the timing of employment growth, which may have impacted today's figures, while the unemployment rate was steady at 3.9% as well. A further sharp fall in China equities hasn't impacted sentiment for the AUD.

- NZD/USD has drifted a little higher, last near 0.6120/25 within recent ranges. Food prices fell 0.1% m/m in Dec. House sales improved for Dec, but from a low base.

- USD/JPY has been supported on dips sub 148.00. Core machine orders for Nov were weaker than expected, down 4.9% m/m, placing question marks over the Capex outlook. Still, with little expected from the BoJ next week, yen has traced familiar ranges.

- Some moderation in US Tsy yields, albeit unwinding only a fraction of Wednesday's gains has likely helped at the margin. US equity futures are lower but only modestly.

- Looking ahead, focus will turn to US jobless claims and Philly fed manufacturing data. Wires will continue to be monitored for any significant headlines emanating from officials at the World Economic Forum in Davos.

OIL: Crude Higher As Red Sea Conflict Shows No Signs Of Abating

Oil is moderately higher during APAC trading today helped by another round of US strikes on Houthi positions, a lower greenback (USD index -0.1%) and more mixed risk sentiment. WTI is off its intraday low of $72.65 to be approaching $73 and is up 0.5% to $72.93/bbl. Brent is 0.2% higher at $78.08 after a low of $77.77. Prices are up moderately so far this year driven by Middle East Tensions.

- The US struck Houthi missile launchers in Yemen after another merchant vessel was hit on Wednesday. Tensions in the Red Sea are not abating and more vessels are avoiding the waterway including oil and gas carriers with shipping costs rising sharply as a result. The UK has appealed to Iran to stop arming the group.

- Iran has sent missiles into other countries this week, including Iraq and Pakistan. Pakistan is reported to have now struck Iran in retaliation, adding significantly to the potential for conflict to spread in the region.

- Bloomberg reported a US crude inventory build of 483k barrels in the latest week, according to people familiar with the API data. Gasoline rose 4.86mn and distillate +5.21mn. The official EIA data is out later today.

- Later the Fed’s Bostic speaks twice on the economic outlook at 1230 and 1705 GMT, there will be Q&A at the second appearance. He will be a FOMC member in 2024. On the data front, there are US housing starts/permits, jobless claims and Philly Fed. The ECB December meeting accounts are published and President Lagarde appears.

GOLD: Another Significant Drop As USD & Yields Move Higher

Gold is little changed in the Asia-Pac session, after closing 1.1% lower at $2006.25 on Wednesday. Bullion is close to testing the $2,000 an-ounce level, after holding above that threshold since mid-December.

- Wednesday’s move can be attributed to USD strength and higher US Treasury yields. The US Treasury curve bear-flattened, with yields 2-14bps higher, after US Retail Sales printed stronger than expected in December. The control group, which feeds into GDP, was the clear standout, jumping 0.76% m/m (cons 0.2%) after a slightly upward revised 0.47% (initial 0.40%).

- Industrial Production also fared slightly better than expected in December, rising 0.05% m/m (cons -0.1%) but the beat was offset by a downward revised 0.0% m/m (initial 0.2%) in November.

- From a technical standpoint, the precious metal pushed through supports at $2017.3/2013.4 (50-day EMA/Jan 11 low), opening a key support at $1973.2 (Dec 13 low).

ASIA FX: CNH Steady Despite Further Equity Weakness, KRW & TWD Rise Marginally

USD/Asia pairs have had a quieter session today, with some modest selling interest emerging in the USD/Asia NDF space. Overall moves have been fairly modest though. Regional equity market sentiment has been mixed, with China markets under pressure but with little spill over to CNH at this stage. KRW and TWD have firmed marginally post a step up in official rhetoric. Tomorrow, Malaysia trade figures are due, along with Philippines BoP figures.

- CNH hasn't responded to fresh multi year lows in China equity indices. The Shanghai composite off more than 2% to sub 2800, back to early 2020 levels. To be sure, the move looks more flow/technically driven, rather than a decline in fundamentals, but market disappoint around lack of fresh stimulus is likely still in play. For USD/CNH we sit under 7.2200 in latest dealings, little changed for the session.

- 1 month USD/KRW drifted sub 1340, hitting lows of 1337.2, but we sit back at 1341 now. Onshore equities are back close to flat, largely reversing earlier modest gains. Officials have warned around the pace of won falls though, so a sharp break above 1350 in the pair may be difficult to achieve in the near term.

- USD/TWD has seen a similar backdrop, post official calls for calm around the FX and local equity backdrops. Spot USD/TWD is back under 31.60, the 1 month NDF down through 31.50. We are still within striking distance of recent highs, while yesterday saw the largest equity outflow since March 2022.

- Spot USD/INR sits close to recent highs, last near 83.15. We have recovered strongly from recent lows at 82.77, with the simple 200-day MA still intact (82.73). The INR's low vol and carry still leave it appealing against low yields (per Barclays). A slightly weaker onshore equity tone is likely weighing at the margins on rupee today.

- Other pairs are mostly lower in USD/Asia terms. The exception being USD/THB. Dips in the pair have been supported and we sit near 35.64 in recent dealings. Onshore Thailand equities aren't too from mid Dec lows, while offshore investors have been net sellers of local equities in 2024 to date, with a chunky $161.3mn in outflows yesterday.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/01/2024 | 0900/1000 | ** |  | EU | EZ Current Account |

| 18/01/2024 | 1000/1100 | ** |  | EU | Construction Production |

| 18/01/2024 | 1230/0730 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/01/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 18/01/2024 | 1330/0830 | *** |  | US | Housing Starts |

| 18/01/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/01/2024 | 1445/0945 | *** |  | US | MNI Chicago Business Barometer Seasonal Adjustment |

| 18/01/2024 | 1515/1615 |  | EU | ECB's Lagarde participates in Stakeholder Dialogue at WEF | |

| 18/01/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 18/01/2024 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 18/01/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/01/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/01/2024 | 1705/1205 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/01/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/01/2024 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.