-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI EUROPEAN MARKETS ANALYSIS: Brent Atop $100, Equities Hit, FI Bid As Russia Launches Ukraine Operation

- Equities hammered, bonds bid and Brent futures move above $100 as Russian President Putin announces a special military operation to demilitarise Ukraine. U.S. President Biden has pointed to severe sanctions on Russia as a result, with U.S. allies set to implement coordinated sanctions.

- JPY was the clear outperformer in FX trade, as you would expect.

- The second reading of U.S. GDP, local jobless claims and new home sales headline the data docket today. Comments are due from Fed's Daly, Mester, Bostic & Barkin, BoE's Bailey, Broadbent & Pill, ECB's Schnabel & Riksbank's Jansson.

SNAPSHOT: Russian Special Operation In Ukraine Underway

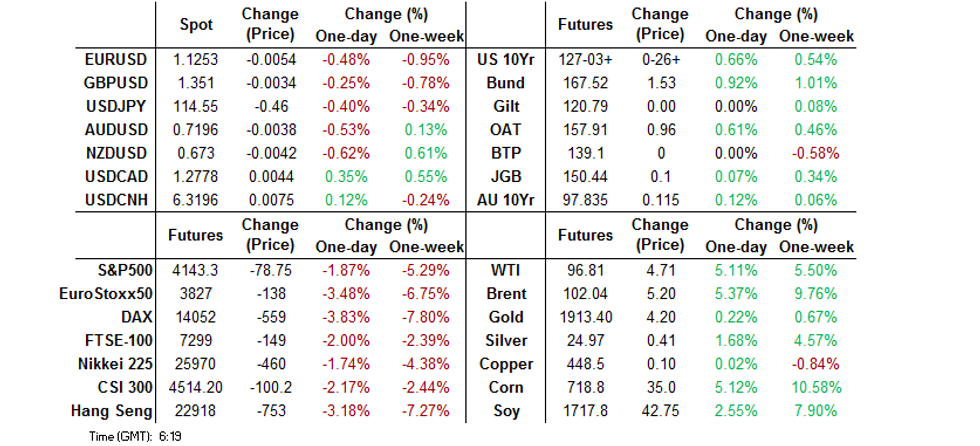

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 503.19 points at 25946.42

- ASX 200 down 215.085 points at 6990.6

- Shanghai Comp. down 52.174 points at 3436.972

- JGB 10-Yr future up 13 ticks at 150.47, yield down 0.7bp at 0.190%

- Aussie 10-Yr future up 11.5 ticks at 97.835, yield down 11.2bp at 2.158%

- U.S. 10-Yr future +0-28 at 127-05, yield down 11.45bp at 1.877%

- WTI crude up $4.84 at $96.94, Gold up $28.19 at $1937.2

- USD/JPY down 42 pips at Y114.59

- RUSSIA LAUNCHES SPECIAL MILITARY OPERATION TO DEMILITARIZE UKRAINE, BIDEN POINTS TO INCOMING SEVERE SANCTIONS

- FED'S DALY: NEED MORE 'URGENCY' ON POLICY TIGHTENING (RTRS)

- ECB’S LANE: DATA SIGNAL INFLATION MAY NEAR MEDIUM-TERM GOAL (FAZ)

- DE COS: ECB SHOULD ONLY RAISE RATES AFTER STIMULUS PLAN END (BBG)

- BANK OF KOREA FLAGS COMMODITY, INFLATION RISKS OF UKRAINE CRISIS (BBG)

BOND SUMMARY: Russian Special Military Operation In Ukraine Supports Bonds

Russian President Putin announced a special operation to demilitarise Ukraine overnight. Russian troops advanced within the LPR & DPR separatist regions, while wider spread missile and air-based attacks on Ukrainian military installations across the country were noted. U.S. President Biden has flagged impending severe sanctions on Russia, with U.S. allies also set to move to implement similar sanctions.

- This shunted core global fixed income markets higher, with TYH2 through initial resistance levels to last print +0-30 on the day, sitting at 127-07, 0-10+ back from best levels of the day. TYH2 volume has topped 500K (90K of which was roll related). Cash Tsys run 8-12bp richer on the session, with 7s leading the bid. Looking ahead, regional Fed activity indices, weekly claims data, updated Q4 GDP prints and new home sales will hit. We will also hare from Fed’s Barkin, Bostic, Daly & Mester. On the supply front, Tsy will come to market with 7s.

- The JGB curve twist steepened today, with the long end leading the weakening observed during the Tokyo morning (on the back of the post-holiday catch up), while super-long paper failed to return to neutral territory during the Tokyo afternoon, even with clear, widespread risk-off price action in play. JGB futures have moved into positive territory, more than paring early losses, to close +10. Local headline flow saw BoJ Governor Kuroda reaffirm the Bank’s on hold stance (as he has done on many occasions in recent weeks), while the latest round of BoJ Rinban operations (covering 3- to 10-Year JGBs and JGBis) saw offer/cover ratios in the low 2s (upticks for cover in the conventional JGB ops conducted today, but still holding at low levels, and a moderation in JGBi cover).

- Aussie bonds traded at the whim of broader risk sentiment, looking through local Capex data. That left YM +9.5 & XM +11.5 come the bell, with shift in the 7+-Year zone of the cash ACGB curve being fairly parallel in nature. The IB strip also richened, with a 15bp RBA rate hike now not fully priced until July.

JGBS AUCTION: Japanese MOF sells Y2.7566tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7566tn 6-Month Bills:

- Average Yield -0.0766% (prev. -0.0907%)

- Average Price 100.038 (prev. 100.045)

- High Yield: -0.0766% (prev. -0.0866%)

- Low Price 100.038 (prev. 100.043)

- % Allotted At High Yield: 71.6600% (prev. 27.7941%)

- Bid/Cover: 4.087x (prev. 3.547x)

FOREX: Risk Gets Battered On Russian Invasion

Risk sentiment crumbled as Russia launched a full-scale invasion of Ukraine, with multiple cities across the country coming under heavy missile fire amid reports that Russian ground troops were crossing the borders from several directions. Ukraine confirmed that the Russian forces struck a number of its military targets, while Belarussian troops and Donbas separatists joint the attack. When this summary is being written, reports are doing the rounds of Russian strikes at targets as far west as near the city of Lutsk, with Ukraine's air force picking up the fight.

- The announcement of a military strike against Ukraine by Russian President was preceded by reports of explosions in several locations across Ukraine, with Russia implementing a ban on all civilian flights in airspace across its border with Ukraine.

- Heavy buying of safe haven currencies commenced as President Putin went live with his pre-recorded announcement of invasion. The yen outperformed in G10 FX space, closely followed by USD and CHF.

- Selling pressure hit Scandi FX owing to their exposure to the Russo-Ukrainian conflict. The Antipodeans lost ground on the broader flight to safety. CAD suffered the least severe wounds among high-beta currencies as crude oil prices surged.

- The Russian rouble collapsed and printed an all-time low against the greenback as Western leaders rushed to pledge announcements of a powerful barrage of sanctions. Interfax reported that trading in the rouble, stocks and futures was virtually halted after quote hit trading band limits.

- The second reading of U.S. GDP, local jobless claims and new home sales headline the data docket today. Comments are due from Fed's Daly, Mester, Bostic & Barkin, BoE's Bailey, Broadbent & Pill, ECB's Schnabel & Riksbank's Jansson.

FOREX OPTIONS: Expiries for Feb24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200-15(E1.8bln), $1.1225(E627mln), $1.1245-55(E1.5bln), $1.1265(E548mln), $1.1290-00(E3.4bln), $1.1315-35(E2.3bln), $1.1345-50(E752mln), $1.1385-00(E1.4bln), $1.1425-35(E1.0bln)

- USD/JPY: Y113.50($715mln), Y114.30-50($592mln), Y115.25-30($781mln), Y116.40($1.4bln)

- EUR/GBP: Gbp0.8335-55(E807mln)

- EUR/JPY: Y128.65-70(E591mln)

- AUD/USD: $0.7225-35(A$2.7bln), $0.7270(A$541mln)

- USD/CAD: C$1.2645-50($1.5bln), C$1.2695-10($827mln), C$1.2800-10($849mln)

- USD/CNY: Cny6.3700($675mln)

EQUITIES: Sharp Declines In Asia As War Breaks In Ukraine

Most major Asia-Pac equity indices are over 2% softer at typing, while similar declines were observed in regional EM equity indices. The broad move lower was facilitated by a sharp deterioration in the Russia-Ukraine situation during Asian trading hours, culminating in Russian President Putin announcing the commencement of a “special military operation” into separatist regions of Ukraine. There have since been reports of Russian incursions into Ukraine and explosions being heard across several Ukrainian cities, although the Russian military continues to emphasize that they are avoiding civilian targets in an effort to demilitarise Ukraine.

- The Hang Seng brings up the rear among regional peers, sitting 3.4% lower at typing. More granularly, the Hang Seng Tech Index leads losses being 4.0% worse off, as worry over China-based tech company performance mounts ahead of Alibaba’s earnings call later on Thursday (the company is widely expected to report a ~60% decline in earnings following a continued crackdown on Chinese internet companies throughout 2021).

- U.S. e-mini equity index futures trade 2.1-2.3% lower at typing.

GOLD: Higher In Asia On Russia-Ukraine Escalation

Gold has caught a bid from an ongoing deterioration in the Russia-Ukraine situation, dealing ~$25/oz firmer to print ~$1,935.0/oz at typing (back from fresh cycle highs of $1,949.0/oz). Russian President Putin announced a special military operation re: the LPR and DPR separatist regions of Ukraine, supporting the separatists. Note that explosions have been heard across many Ukrainian cities in the wake of the announcement, with the Russian army pointing to a surgical strike on Ukrainian military facilities, playing down any threat to civilians.

- Looking to technical levels, gold has broken through key resistance and the top of the bull channel drawn from the Aug 9 ’21 low, with bulls now focused on $1,959.4, the Jan 6 ‘21 high.

OIL: Brent Breaches $100

WTI and Brent trade over $4.00 above their respective settlement levels, ~$1.00 shy of their session peak, with Brent futures now comfortably above $100.00bbl.

- The move higher was catalysed by Russian President Putin announcing military operations in the Donbas to “demilitarise” Ukraine, while stating that conflict between both countries was “inevitable” and a “question of time”. A statement in response from U.S. President Biden that the “world will hold Russia accountable” also fed into the bid.

- From a technical perspective, the uptrend has extended. The earlier rally has seen WTI and Brent clear resistance at $95.38 (2.764 proj. of the Dec 2-9-20 price swing) and $101.49 (3.00 proj of the Dec 2-9-20 price swing) respectively, with $97.91 (3.00 proj. Of the Dec 2-9-20 price swing) for WTI and $104.04 (3.236 proj. of the Dec 2-9-20 price swing) for Brent now in focus.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/02/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 24/02/2022 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 24/02/2022 | 0900/1000 | * |  | IT | industrial orders |

| 24/02/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/02/2022 | 1315/1315 |  | UK | BOE Bailey Intro at BEAR Research Conference | |

| 24/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 24/02/2022 | 1330/0830 | *** |  | US | GDP (2nd) |

| 24/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/02/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 24/02/2022 | 1500/1000 | *** |  | US | new home sales |

| 24/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 24/02/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 24/02/2022 | 1600/1700 |  | EU | ECB Schnabel panels BOE BEAR conference on Unwinding QE | |

| 24/02/2022 | 1600/1600 |  | UK | BOE Broadbent moderates panel at BEAR Conference on QE | |

| 24/02/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 24/02/2022 | 1610/1110 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/02/2022 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 24/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 25/02/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.