-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese Equities Bid, Focus On U.S. CPI

- Firmer Chinese equities and stagnant U.S. yields allowed the USD to tick lower vs. its G10 peers during Asia-Pac dealing.

- Wider headline flow was limited overnight, with focus on the impending event risk.

- Focus is on the heavily awaited CPI report from the U.S. Separately, Germany will release its final CPI figures. Wednesday's central bank speaker slate includes various ECB members, headlined by President Lagarde. Elsewhere, Fed's Bostic ('24 voter) is also set to make an address.

US: MNI US CPI Preview: Strong Core On Smaller Autos Drag

EXECUTIVE SUMMARY

- CPI inflation for April is released May 11 at 0830ET.

- Consensus has core inflation firming to +0.4% M/M from the +0.32% M/M in March, driven by a smaller decline or possibly a rise in used autos after sliding nearly 4%.

- Headline is seen weaker at +0.2% M/M as large declines in gasoline weigh on energy whilst food inflation maintains its recent strong pace.

- FOMC consensus appears increasingly set on 2x50bp hikes in Jun/Jul but implications further along the rate path will depend on the usual breadth of inflationary pressure and what happens to stickier rent components.

- Click the following link for the full publication:USCPIPrevMay2022.pdf

US TSYS: Limited Pre-CPI Trade

Tsys have coiled during Asia-Pac hours, with a lack of meaningful macro headline flow and the proximity to the impending CPI print limiting price action during overnight dealing. Meanwhile, slightly firmer than expected Chinese inflation data and an uptick in Chinese equities capped the space.

- TYM2 sits +0-01+ at 118-26+, holding within the confines of a narrow 0-05+ on limited volume of ~65K. Cash Tsys are little changed across the curve, twist flattening, pivoting around 5s, with yields between -/+1.0bp vs closing levels. This comes after Tuesday’s frenetic session, which ended with the space pulling back from best levels into the bell, aided by a late and modest uptick in U.S. equities.

- Asia-Pac flow was headlined by a block buyer of TUM2 futures (+3K).

- The aforementioned CPI print headlines the docket on Wednesday (see our full preview of that release here), with 10-Year Tsy supply and Fedspeak from Bostic (’24 voter) due. Note that Bostic has made several appearances in recent days, expressing his preference for 50bp hikes at the next 2-3 Fed meetings.

JGBS: JGBs Marginally Firmer, 30-Year Supply On Horizon

The JGB space was devoid of any meaningful input on Wednesday, resulting in very limited Tokyo dealing. JGB futures sit 10 ticks higher on the day ahead of the close, operating in line with late overnight session levels after sticking to a narrow range. Elsewhere, cash JGB trade has generally seen some light richening, with the major cash JGB benchmarks little changed to 1.5bp richer on the day, led by 7s on the back of the bid futures, with some spill over from Tuesday’s richening in longer dated U.S. Tsys lending support.

- Looking ahead to tomorrow’s local docket, 30-Year JGB supply will provide the focal point, with BoP data also due.

AUSSIE BONDS: Futures Hold Higher In Tight Trade

A muted Sydney session for the space has seen the overnight bull flattening in futures give way to a more parallel move, with YM +6.5 & XM +7.0 at typing, as both contracts stick to narrow ranges ahead of Wednesday’s notable offshore event risk (namely U.S. CPI).

- Cash ACGB trade sees some light outperformance for the 5- to 10-Year zone of the curve.

- EFPs are a touch wider on the day, although the 3-/10-Year box has seen some light flattening.

- The IR strip is -1 to +6 through the reds, with relatively limited Sydney dealing observed.

- The latest round of ACGB Jun-51 supply went smoothly enough (there were some worries evident among desks ahead of supply), with the cover ratio holding above 2.00x and the weighted average yield comfortably through prevailing mids, to the tune of 1.86bp, per Yieldbroker. Note that the high yield was only 0.24bp above the weighted average yield, perhaps revealing some domestic demand for yield in the wake of the latest sell off, given the previously outlined worry of international investors re: market vol.

- Local data saw a tumble in the monthly Westpac consumer confidence reading, with tighter RBA policy & higher inflation the main drivers there.

- Looking ahead to tomorrow’s session, we will get consumer inflation expectations data.

FOREX: Sentiment Improves As Covid Community Transmission In Shanghai Grinds To Halt

Market sentiment turned positive in Asia hours as Shanghai declared zero new infections in the community, which triggers countdown to easing restrictions. Under the current guidance, the megacity could relax curbs after three consecutive days of no community transmission.

- Glimmers of hope provided by Shanghai Covid numbers generated light risk-on flows across G10 FX space. The Antipodeans pace gains as we type, while the greenback brings up the rear.

- AUD/NZD oscillated around neutral levels after finding support near the 50% Fibo retracement of its Apr 25 - May 4 rally at NZ$1.0987 over the past two days.

- Offshore yuan regained poise as China's inflation figures topped expectations. Spot USD/CNH pulled back to a session low of CNH6.7318 before unwinding some of its data-inspired losses.

- Focus turns to the much awaited consumer inflation report from the U.S. Separately, Germany will release its final CPI figures.

- The central bank speaker slate abounds with ECB members, including President Lagarde. Fed's Bostic is also set to make an address.

FOREX OPTIONS: Expiries for May11 NY cut 1000ET (Source DTCC)

- USD/CAD: C$1.2765($1.2bln), C$1.2950($1.9bln), C$1.3000($1.4bln)

ASIA FX: Yuan Finds Poise, Baht Declines In Defiance Of Regional Trend

Most USD/Asia crosses traded on the back foot, as the region digested Chinese inflation data ahead of the release of a corresponding report out of the U.S.

- CNH: Spot USD/CNH climbed to CNH6.7618 before above-forecast inflation data knocked it on its head. The rate pulled back into negative territory as both CPI and PPI grew faster than expected. The yuan drew additional support from daily Shanghai Covid-19 numbers, as the city declared no new community infections. Three consecutive days of no community transmission would allow the authorities to relax restrictions in the city.

- KRW: Wednesday brought a fresh cycle high for spot USD/KRW but the rate failed to punch through the KRW1,280 mark and erased gains. South Korea's exports grew 28.7% Y/Y in the first 10 days of the month, but daily shipments rose just 8.9%. Elsewhere, South Korea's unemployment rate stayed at 2.7%, printing below the median estimate of 2.8%.

- IDR: The rupiah started on a firmer footing before trimming gains. Bank Indonesia's consumer confidence jumped to 113.1 in April from a six-month low of 111.0 recorded in March.

- MYR: Spot USD/MYR operated in close proximity to recent cycle highs ahead of today's monetary policy decision from Bank Negara Malaysia. Most analysts expect the central bank to keep the Overnight Policy Rate unchanged, but 5 out of 19 of those surveyed by Bloomberg call for a 25bp hike.

- PHP: Spot USD/PHP extended its move away from key resistance at PHP52.500 amid ongoing debate about the policy priorities of the Philippines' next President.

- THB: The baht lodged fresh cycle lows and underperformed all of its peers from the Asia EM basket. The government is debating an extension to the excise-tax reduction on diesel fuel, which is due to expire on May 20.

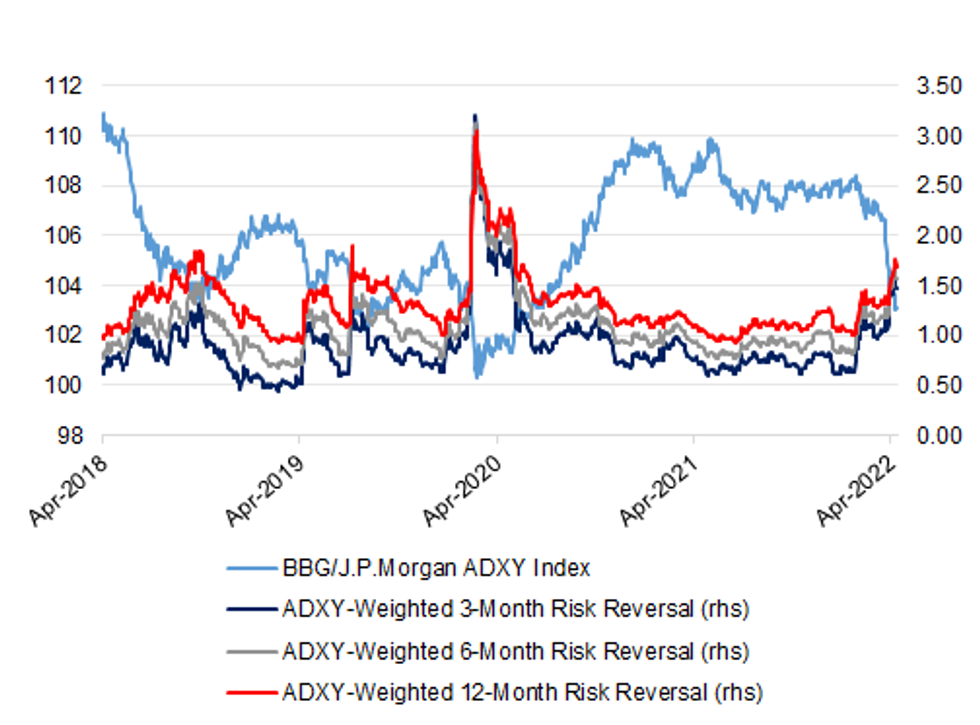

ASIA FX: Risk Reversals Move Higher, But Not Beyond U.S./China Trade-War Levels

A quick look at the wider USD/Asia risk reversal space in recent months reveals that upside hedging demand has dominated when it comes to the major USD/Asia crosses. Our 3-, 6- & 12-month ADXY-weighted risk reversal measures have pushed higher during ’22, which is understandable given the spot market moves (the BBG-J.P.Morgan ADXY currently sits at the lowest level observed since July ’20) and wider fundamental dynamics observed at present.

- Those moves come against the wider backdrop of USD strength, while the recent run weaker in the Chinese yuan has drawn most of the focus from a USD/Asia perspective.

- Even though risk reversals are elevated on a short-term horizon, we note that the 3 measures that we monitor operate well shy of their respective COVID outbreak peaks and haven’t really been able to push through their U.S.-China trade war highs.

- Nonetheless, regional authorities will be on the lookout for excessive one-way market positioning targeting further currency weakness, with the well-documented global inflationary pressures adding further focus on this front.

- Some notable regional intervention headline flow observed in recent days includes: the RBI seemingly stepping in to intervene against further INR weakness (after USD/INR touched a fresh record high earlier this week); Bank Indonesia reiterating that it will stabilise the IDR if necessary; Korean officials remaining wary of the potential need to stabilise markets/KRW; the PBoC deploying a modest bias against further CNY weakness via its USD/CNY mid-point fixing over the last 7 days, as well as touted state-owned bank activity in the FX forwards space.

- We also reiterate that all of the notable USD/Asia FX pairs are comfortably above their respective 200-DMAs.

Fig. 1: ADXY-Weighted 3- 6- & 12-Month Risk Reversals

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

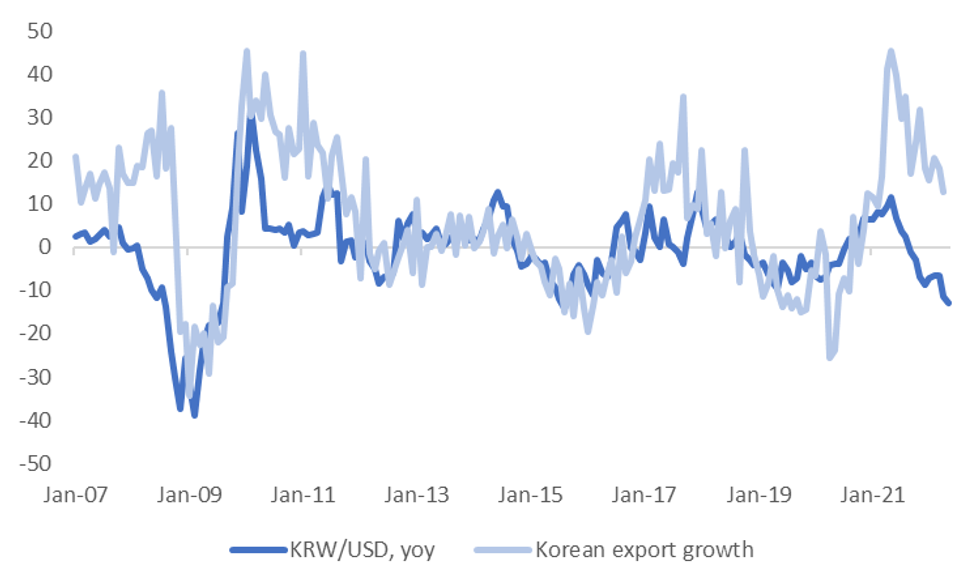

KRW: KRW Looks Cheap Relative To Export Growth, But There Are Important Offsets

KRW has fallen too much relative to export growth, but there are factors that suggest this divergence can persist

- The chart below plots KRW/USD YoY versus Korean export growth. Historically, the correlation has been a tight one. However, YoY momentum for KRW looks far too weak relative to the current export trend, even assuming export growth slows further in May.

- There are a number of potential factors driving this divergence. The first is that the market is pricing in a sharp slowdown in export growth for Korea in the months ahead, hence weaker won levels.

- However, it's also important to highlight the trade deficit, which we did in an earlier post. The last meaningful trade deficit period for Korea was in 2007/2008 period, which also coincided with a breakdown in the relationship between exports and KRW performance.

- The Korean authorities may also be keeping an eye on export competitiveness, given JPY has fallen nearly 12% YTD, versus the won's fall of 7%.

- Domestic investors (both retail & institutional) continue to pressure the KRW from a capital flows perspective, particularly the National Pension Service, which is allocating more assets offshore. Such 'recycling' outflows will weaken the won all else equal, as the funds typically leave Korea on an FX-unhedged basis.

- Such factors could keep the divergence between KRW & export growth in play for sometime yet, although we would still expect the directional correlation between KRW and export growth to remain fairly strong.

Fig 1: KRW Looks Too Weak Relative To Export Trend

Source: MNI/Bloomberg

Source: MNI/Bloomberg

EQUITIES: Mixed Ahead Of U.S. CPI; Chinese Stocks Catch A Bid On COVID Relief, Renewed Easing Hopes

Major Asia-Pac equity indices are mixed at writing, tracking a similar performance from Wall St on Tuesday.

- The Hang Seng Index sits 1.7% better off at typing, on track to break a four-session streak of lower daily closes. The index’s Commerce & Industry sub-index was the only benchmark in the green, powered by gains in China-based tech such as BYD (+6.8%), Tencent (+4.4%), and Meituan (8.2%). The Hang Seng Tech Index correspondingly trades 4.6% higher at typing, largely unwinding Tuesday’s losses in the process.

- The CSI300 outperformed major equity index peers, dealing 2.0% higher at typing on broad strength across nearly all sub-indices. Chinese tech was notably bid, with the tech-heavy ChiNext sitting 4.3% better off.

- The strength in Chinese and Hong Kong-listed equities comes as the Chinese PPI print earlier in the session came in at a one-year low, with debate re: sufficient room for policy easing later doing the rounds in Asia. Falling COVID cases and a steady elimination of closely-watched community spread figures in the city of Shanghai also lent support to the positive mood, adding to support from additional remarks by the Biden administration re: the possible lifting of Trump-era tariffs on Chinese exports in the “coming weeks”.

- The ASX200 is 0.2% worse off at typing, back from worst levels (~0.8% lower), but continuing to operate a little above three-month lows made on Tuesday. Financial names lead losses in the index with the Big Four banks underperforming the ASX200 at typing, neutralising gains in the major mining stocks.

- U.S. e-mini equity index futures trade 0.2% to 0.8% higher at writing, extending a move higher from their respective multi-month lows made on Tuesday.

GOLD: Three-Month Lows Ahead Of U.S. CPI

Gold sits a little below neutral levels to print $1,837/oz at typing, operating a little above fresh 3-month lows made earlier in the session amidst an uptick in U.S. real yields.

- To recap, gold closed ~$16/oz lower on Tuesday, notching a second consecutive daily loss. The move lower came amidst a flurry of mildly hawkish Fedspeak, with officials continuing to voice support for back-to-back rate 50bp hikes in June and July while broadly refusing to rule out 75bp hikes later in ‘22, flagging data-dependence.

- To elaborate, Cleveland Fed Pres Mester (with her and NY Fed Pres Williams being the only “first-time” post-FOMC speakers on Tuesday) stated that back-to-back 50bp hikes for June and July made “perfect sense”, but cautioned that “we don’t rule out 75 forever”.

- July FOMC dated OIS now price in a shade under 2 x 50bp hikes for the next two meetings (~98bp), largely consistent with growing Fed consensus for the same. U.S. dated OIS markets are pricing in a cumulative ~190bp of tightening for calendar ‘22, with the probability re: 3 x 50bp hikes for the year continuing to edge downwards since the May FOMC held last week.

- Looking ahead, U.S. CPI will cross later on Wednesday (1330 BST).

- From a technical perspective, gold has broken immediate support at $1,848.8/oz (76.4% retracement of the Jan28-Mar8 rally), exposing further support at $1,821.1/oz (Feb 11 low).

OIL: Off Lows In Asia; EU Sanctions On Russia See Little Progress

WTI is ~+$1.60 and Brent is ~+$1.70 at typing, rising above their respective two-week lows made earlier in the session. Both benchmarks nonetheless sit ~$8 lower for the week so far, with concern re: reduced Chinese energy demand and global stagflation worry remaining front and centre.

- Doubt re: the imminence of EU sanctions of Russian oil continues to do the rounds, with Hungarian officials continuing to indicate that little progress has been made in discussions with the EU.

- Looking to China,sharp inter-day declines in fresh daily case counts were observed in Shanghai and Beijing, with Shanghai officials declaring that half of the city’s districts have reached “basically no community spread”. Worry re: reduced industrial activity remains elevated however, with automakers Toyota and Tesla recently flagging supply chain disruptions due to ongoing pandemic control measures nationwide, with participants continuing to watch for the effectiveness of ongoing “closed loop” measures in Chinese factories for now.

- Turning to the Middle East, Libyan Parliament-elect PM Bashagha tweeted on Wednesday that government efforts to lift a protestor-led blockade on Libyan oil fields has been successful, noting that Libya had previously reported a half-million bpd decline in production over the issue.

- Elsewhere, the latest round of U.S. API inventory estimates crossed late on Tuesday, with reports pointing to a build in Cushing, crude, gasoline, and distillate stocks, coming as WSJ median estimates for EIA inventory figures later on Wednesday (1530 BST) have called for declines in the latter three stockpiles.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/05/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 11/05/2022 | 0600/0800 |  | EU | ECB Elderson Fireside Chat with Sonja Gibbs | |

| 11/05/2022 | 0800/1000 |  | EU | ECB Lagarde Speech at 30th anniversary of Banka Slovenije | |

| 11/05/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/05/2022 | 1220/1420 |  | EU | ECB Schnabel Keynote Speech at Austrian National Bank | |

| 11/05/2022 | 1230/0830 | *** |  | US | CPI |

| 11/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 11/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/05/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 11/05/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.