-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI EUROPEAN MARKETS ANALYSIS: DXY Offered & Equities Bid As Chinese Cities Unwind Some COVID Restrictions

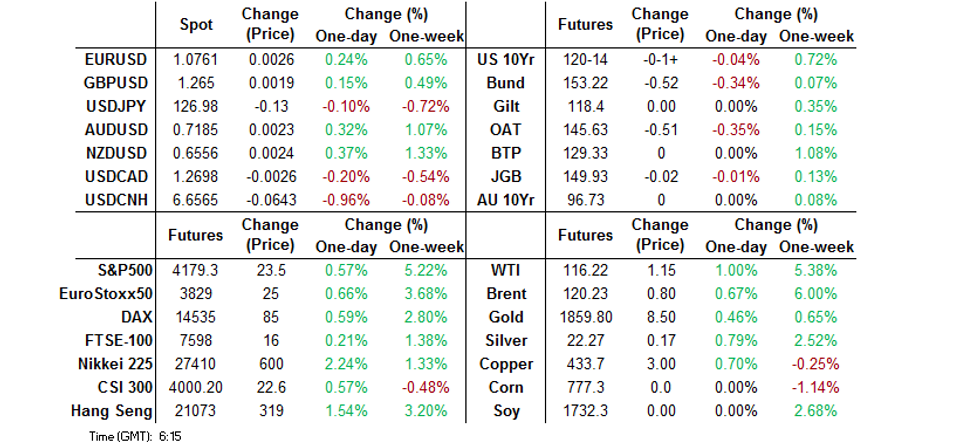

- The combination of positive spill over from Friday’s U.S. equity trade (whereby the S&P 500 added 2.5% on the day, providing the firmest weekly gains observed for the index since late ’20), the unwind of some COVID-related restrictions in the Chinese cities of Beijing & Shanghai and the deployment of fresh support measures for Shanghai’s economy buoyed risk appetite in Asia. This extended what some perceive to be a bear market rally, while month-end rebalancing flows provide another potential supportive factor for U.S. equities.

- The U.S. dollar struggled to find poise and the BBDXY index showed at its worst levels in more than a month, probing the water below its 50-DMA for the first time since the outbreak of Russia's war on Ukraine on Feb 24.

- German CPI, as well as speeches from Fed's Waller and ECB's Centeno & Nagel take focus from here. Elsewhere, EU leaders will begin their two-day special summit devoted to Ukraine, energy, defence & food security. The U.S. Memorial Day holiday will impact wider liquidity on Monday.

US TSYS: Tight Overnight, Memorial Day Limits Activity With Cash Closed

Tsy futures clung to extremely tight ranges in Asia, with cash markets closed and liquidity thinned owing to the observance of the Memorial Day holiday in the U.S.

- The previously outlined risk-positive backdrop, which largely focused on the unwind of some COVID restrictions in the Chinese cities of Shanghai & Beijing (in addition to a raft of economic support unveiled for the former) failed to have a meaningful impact on Tsy futures (granted the S&P 500 is only +0.5% vs. settlement levels), although some light pressure has been observed as European traders start to file in.

- That leaves TYU2 -0-01+ at 120-03, with that level representing the base of the 0-05 overnight range. Note that the contract is operating on very light volume, with under 40K lots changing hands thus far.

- German CPI data and the continuing discussions re: the next round of EU sanctions on Russian oil exports will likely garner most of the interest on Monday.

- A quick reminder that cash Tsys will not be open until Tuesday’s Asia-Pac session, while Tsy futures will be subjected to holiday-curtailed hours on Monday.

JGBS: Tight Start To The Week

Cash JGBs are little changed across the curve, sitting within -/+0.5bp boundaries vs. Friday’s closing levels. Meanwhile, JGB futures nudged lower during the Tokyo morning as domestic equities firmed on the wider global impetus, with the former unwinding its modest overnight gains, before recovering some poise in the afternoon, to last deal at unchanged levels.

- Comments from Japanese PM Kishida & BoJ Governor Kuroda failed to unveil any fresh, market-moving information.

- Meanwhile, participants chose not to react to trivial movements in the offer/cover ratios observed in today’s BoJ Rinban operations, although the presence of the ops may have helped limit losses during the morning.

- Tuesday’s local docket is headlined by the monthly labour market report, industrial production and retail sales prints, with 2-Year supply also due.

AUSSIE BONDS: Tight Session, Awaiting GDP Data

Aussie bond futures were happy to operate in narrow ranges on Monday, with YM unch. & XM +0.5 as we work towards the Sydney close. Note that the contracts are off worst levels of the Sydney session, even with Chinese equities and U.S. e-mini futures underpinned by the previously outlined positive developments surrounding the COVID situation in China & resultant support package announced for the Chinese city of Shanghai. Wider cash ACGB trade sees the major benchmarks running within -/+1bp of Friday’s closing levels, twist flattening, with a pivot around the 5-Year zone. 3- & 10-Year EFPs are a little wider on the day, bull flattening. Bills are -1 to +1 through the reds.

- There hasn’t been much to note when it comes to market moving domestic headline flow, with the Liberal & National parties getting new leaders after the former ruling coalition that consisted of the two parties was ousted in the federal election.

- Meanwhile, focus continues to grow on the impending RBA review, with a group of domestic economists calling for an independent overseas expert to head up the matter.

- Looking ahead to tomorrow’s docket, local matters will be headlined by the final round of Q1 GDP partials ahead of the release of the national accounts on Wednesday. Elsewhere, private sector credit and building approvals data will hit.

FOREX: China COVID Positives Support Risk, BBDXY Shows Below Its 50-DMA

The U.S. dollar struggled to find poise and the BBDXY index showed at its worst levels in more than a month, probing the water below its 50-DMA for the first time since the outbreak of Russia's war on Ukraine on Feb 24. Note that U.S. bond markets will be shut until Tuesday, in observance of the Memorial Day holiday.

- Positive market sentiment triggered light risk-on flows across G10 FX space, as regional stock indices crept higher in tandem with U.S. e-mini futures. Further easing of COVID-19 restrictions in Beijing and Shanghai, and a fresh package of economic support measures announced by the latter megacity, sparked optimism.

- The yen fared better than its safe haven peers USD and CHF, which sit at the bottom of the G10 pile. Comments from BoJ Gov Kuroda may have provided some support. The official told lawmakers that the yen has "relatively stabilised" and refused to admit that the BoJ's ultra-loose monetary policy was behind its earlier depreciation.

- Commodity-tied currencies led gains in F10 FX space amid firmer crude oil prices. The kiwi gains alongside its high-beta peers, as the RBNZ's new Chief Economist Conway expressed optimism about the Bank's ability to engineer a "soft landing" for the economy and said the MPC did not seriously consider a 75bp rate hike last week.

- Offshore yuan posted sharp gains, with USD/CNH quickly narrowing in on last week's lows. Aforementioned positives surrounding COVID-19 dynamics seemed to occupy the driving seat.

- German CPI & Swedish GDP as well as speeches from Fed's Waller and ECB's Centeno & Nagel take focus from here. Elsewhere, EU leaders will begin their two-day special summit devoted to Ukraine, energy, defence & food security.

FOREX OPTIONS: Expiries for May30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E828mln), $1.0675(E1.3bln), $1.0725(E503mln), $1.0800(E759mln)

- AUD/USD: $0.7210(A$607mln)

- USD/CNY: Cny6.7500($780mln)

ASIA FX: CNH & KRW Both Gain 1% Against The USD

All USD/Asia pairs are lower today, with CNH, KRW and TWD leading the way.

- CNH: USD/CNH quickly broke through the Friday lows as regional equity markets strengthened. Reduced covid restrictions in Beijing and Shanghai and further stimulus, announced over the weekend, has buoyed sentiment. China will also open its exchange-based bond market to some offshore investors from June 30th of this year. The pair has dropped nearly 1% since closing levels last week (last around 6.6600), with eyes on a test of 6.6500.

- KRW: USD/KRW spot has followed USD/CNH lower, dipping a further 1% to be sub 1242. We are now below the 50-day MA for the first time since late February. Broadly positive sentiment in equities also helped.

- INR: USD/INR has opened weaker in early trade, in line with the broader USD/Asia trends. Support was seen sub 77.50, with moves above 77.65 likely to draw intervention risks. With Brent crude above $120/bbl the rupee will struggle to outperform the regional trend.

- IDR: Spot USD/IDR has faltered amid broad-based greenback weakness, with Indonesian headline flow offering little of real note. Bears looking for a dip through May 11 low of IDR14,525 before taking aim at the 50-DMA (IDR14,431).

- PHP: Spot USD/PHP is a little above earlier lows, last tracking close to 52.26. Sensitivity to oil moves could see it underperform this period of USD weakness. BSP Governor-in-waiting Medalla told Bloomberg that he is "on the same page" as outgoing Governor Diokno when it comes to the prediction that another rate hike is likely next month. Bangko Sentral will hold its next monetary policy meeting on June 23.

- THB: USD/THB has dipped lower, around 0.25% below last week's close to be close to the 34.05 level. Earlier, Thai industrial output figures were a little weaker than expected (+0.56% YoY versus +1.00% expected).

- MYR: USD/MYR is back sub 4.3700. Higher oil and a stronger CNH helping. FinMin Zafrul said Malaysia's strong economic fundamentals and prudent FX policies will help the ringgit recover from recent depreciation caused by a number of "temporary factors," such as continued tightening of global liquidity and China's weakening growth prospects.

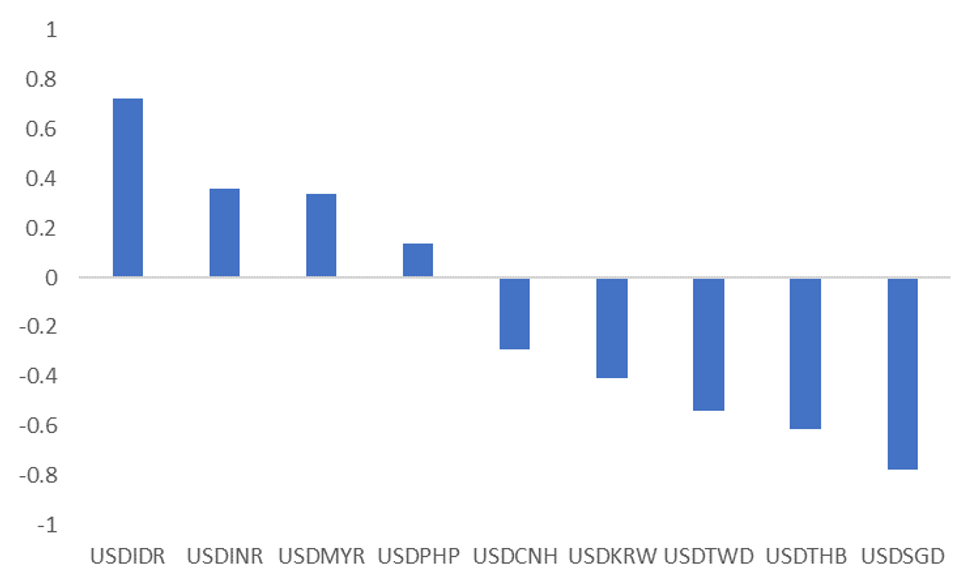

ASIA FX: Asian Currencies Outperforming Higher Energy Prices

Energy prices have started this week much the same way they ended the last one, continuing to trend higher. However, correlations between some USD/Asia pairs and energy prices are quite different now compared to the norm for 2022.

- The first chart shows the correlation between energy prices and USD/Asia pairs for the past month. For pairs like USD/SGD, USD/THB, USD/TWD and USD/KRW, they have all weakened as energy prices have trended higher.

- At the opposite end, USD/IDR, USD/INR and USD/MYR have had a positive correlation with energy prices over the past month.

Fig 1: USD/Asia FX & Energy Price Correlations - Past Month

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

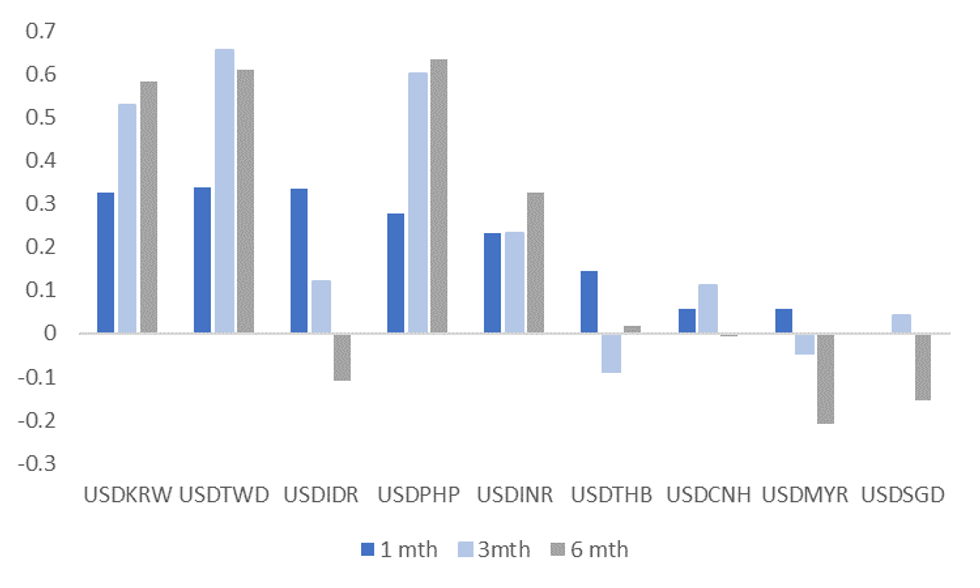

- The second chart plots the average correlations between USD/Asia pairs and energy prices for 2022. We do this for 1 month periods, but also 3 and 6 month.

- USD/KRW and USD/TWD have usually had negative correlations with energy prices in 2022. This is likely to reflect the negative terms of trade for these countries from rising energy prices and the feedback loop such rises have to Fed expectations. This hasn't occurred during the most recent run up in energy prices, with Fed expectations staying fairly flat.

- It may be the case that we need to see Fed expectations being biased higher by rising energy prices before the correlation with such USD/Asia pairs turns more positive.

- MYR and SGD look reasonably well placed to maintain their historical correlations. Malaysia has a positive terms of trade relationship with energy, while the SGD may benefit from expectations that the MAS has more tightening work to do the higher energy prices rise.

- INR and PHP may not fare as well, at least on a relative value basis, particularly given weaker starting positions for trade balances compared to the rest of the region.

Fig 2: USD/Asia & Energy Price Correlations - Averages For 2022

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

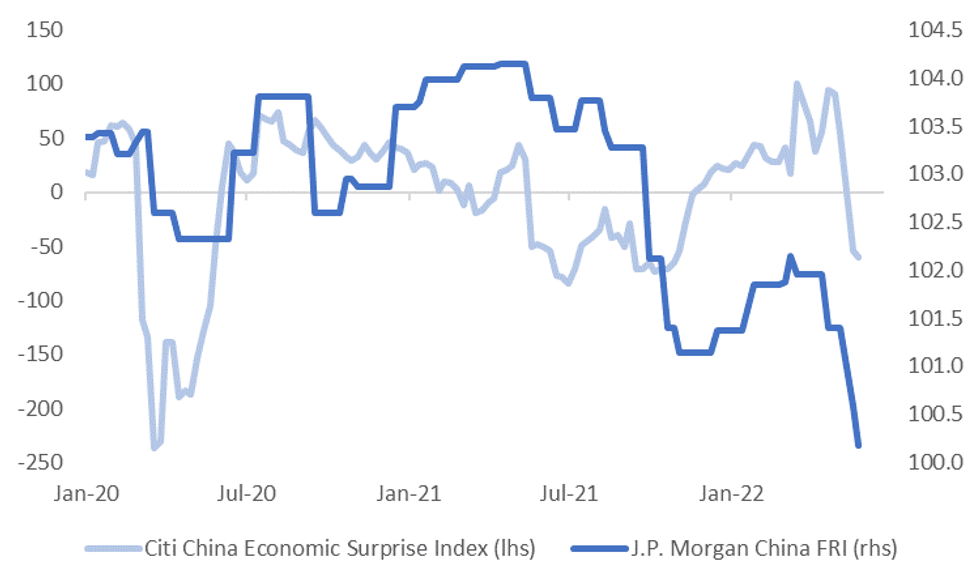

CHINA: PMIs On Tap This Week

China PMIs for May are the main data prints in focus for this week. The official PMIs print tomorrow, with manufacturing expected to print at 48.9, versus 47.4 in April. For non-manufacturing, the consensus is 45.0, versus 41.9 last month. For the Caixin manufacturing print (out Wednesday), the market expects a 48.8 outcome, from 46.0 previously.

- It is noteworthy the consensus estimate for the Caixin survey has come down. In the middle of last week, it was above 50.0, but we are comfortably below that level now.

- Last week we noted the PMI prints may have downside risks, relative to expectations of sequential improvement, as Standard Chartered's SME survey deteriorated further in May. This survey has a reasonable correlation with the manufacturing PMIs.

- Premier Li comments around 2022 being worse, in some respects, relative to 2020, also hit sentiment.

- Still, we have seen a meaningful adjustment lower in the Citi China economic surprise index, while the J.P. Morgan China growth forecast revision index (FRI) has also come down quite sharply, see the chart below.

- Hence the bar for further downgrades could be high. The market may also be encouraged by loosening Covid restrictions for Beijing and Shanghai and further stimulus measures, which potentially points to the worse of the growth headwinds being behind us.

Fig 1: Citi China EASI and J.P. Morgan China Forecast Revision Index

Source: Citi/J.P. Morgan/MNI- Market News/Bloomberg

Source: Citi/J.P. Morgan/MNI- Market News/Bloomberg

EQUITIES: The Bid Extends

The combination of positive spill over from Friday’s U.S. equity trade (whereby the S&P 500 added 2.5% on the day, providing the firmest weekly gains observed for the index since late ’20), the unwind of some COVID-related restrictions in the Chinese cities of Beijing & Shanghai and the deployment of fresh support measures for Shanghai’s economy buoyed risk appetite in Asia. This extended what some perceive to be a bear market rally, while month-end rebalancing flows provide another potential supportive factor for U.S. equities. The Hang Seng & the Nikkei 225 added ~2.0% against this backdrop, while e-mini futures print 0.2-1.0% firmer on the day, with the NASDAQ 100 contract leading the bid there.

GOLD: Bounces On USD Weakness

Gold has spiked higher this afternoon, regaining the $1860 handle, around 0.35% above closing levels form last week.

- The early trend for gold was very benign. We spent the early part of the day oscillating around the $1850 level.

- This early tone was weighed down by firmer risk appetite as stronger equities for Asia Pac, and a further recovery in US equity futures, dampened flows into the safe haven asset.

- However, this turned around on the back of USD weakness. To be fair, the DXY is only down modestly (-0.10%) from closing levels at the end of last week. The tone in USD/Asia pairs has been much weaker though, led by the China currency (USD/CNH down -0.90% at the time of writing to 6.6600).

- Like last week, the bulls will be eyeing a test of $1865/$1870, while support should emerge between the $1845/$1850 level in the near term.

OIL: Crude A Touch Firmer In Asia

A mix of the easing of COVID restrictions in both Shanghai & Beijing, firmer equities, a softer USD and continued focus on tight U.S. product markets as the U.S. driving season gets underway, supported crude on Monday. WTI sits $1.00 higher on the day at typing as a result.

- Elsewhere, progress when it comes to EU sanctions on Russian crude exports remains elusive, although talks on the matter are set to continue on Monday. RTRS sources have suggested that the current proposal on the table involves “a ban on Russian oil delivered to the EU by sea by the end of the year, but foresees an exemption for oil delivered by the Russian Druzhba pipeline, which supplies Hungary, Slovakia and Czechia.”

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/05/2022 | 0600/0800 | *** |  | SE | GDP |

| 30/05/2022 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/05/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/05/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/05/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/05/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/05/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 30/05/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/05/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 30/05/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/05/2022 | 1230/0830 | * |  | CA | Current account |

| 30/05/2022 | 1500/1100 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.