-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI EUROPEAN MARKETS ANALYSIS: Risk Trades Heavily In Asia As Recession Fears Grow

- Regional headline flow further fuelled recession-related worries during Asia-Pac hours.

- This resulted in heavy trade for equities, a bid for core global FI and allowed the JPY to make its way to the top of the G10 FX performance table.

- Manufacturing PMI readings from across the globe will keep trickling in through today, with the U.S. ISM manufacturing survey headlining. Central bank speaker slate features ECB's de Cos & Panetta.

US TSYS: Richer Overnight As Recession Worries Continue To Swirl

TYU2 +0-06+ at 118-23+ ahead of London hours. We have pared back from the bullish extremes witnessed overnight, with TYU2 last operating 0-06 off its session peak, on volume of ~140K (not hindered by a holiday in Hong Kong). Cash Tsys sit 3.0-6.5bp richer across the curve, with the belly leading the bid. Recessionary worry embedded itself further as we worked through overnight dealing, after a brief early uptick in e-minis (alongside cryptocurrencies) was seen during a fairly muted start to Asia-Pac dealing. Regional stories aided wider risk-negative price action, with reports re: chip giant TSMC experiencing downward adjustments in orders from major clients and fears surrounding China Great Wall Asset M’ment missing another deadline to publish its ’21 annual report. E-minis now sit 1.0% lower on the day, This comes after softer than expected real consumer spending data fuelled its own brand of recessionary worry on Thursday (with the Atlanta Fed GDP Nowcast pointing to a technical recession).

- Asia-Pac flow was highlighted by bullish expressions in the form of a block buy of FV futures (+2K) and a block buy of the TYQ2 118.75/120.25 call spread (+5K).

- Note that the space showed nothing in the way of meaningful reaction to the release of Chinese Caixin m’fing PMI data. The print came in comfortably ahead of expectations (after the official Chinese PMI reading moved back into expansionary territory when it hit yesterday), although the text of the print pointed to continued questions re: the footing that the Chinese economy is operating on at present.

- M’fing PMI data out of Europe will be eyed ahead of NY hours (although the Eurozone and UK releases represent final readings), while Friday’s domestic docket will be headlined by the ISM m’fing survey.

- A quick reminder that the Independence Day Holiday (which will be observed on Monday) means that SIFMA recommend an early cash Tsy close on Friday (14:00 NY/19:00 London), although Tsy futures will be open for usual trading hours ahead of the weekend.

US: Independence Day Exchange Schedules

The U.S. will observe the Independence Day holiday on Monday, which will alter trading schedules across the major U.S. exchanges in the coming days. Please find a summary of operating hours for the major exchanges below:

JGBS: Belly Outperforms, Long Swaps Widen On BoJ Inaction

JGB futures pushed higher during Tokyo trade as local participants reacted to the latest deepening of recessionary worries gripping the globe. The contract deals +31 ahead of the bell, with bulls failing to force a sustainable break above the 149.00 mark as of yet. Cash JGBs are little changed to ~2bp richer across the curve, although the long-end lagged the futures-driven bid observed in 7s, perhaps on the back of inaction when it came to the BoJ simply rolling over the current size and frequency of Rinban purchases into Q3 (note that the curve bull flattened yesterday as some participants speculated that the BoJ would up the size and/or frequency of purchases covering paper with more than 10 years until maturity, with longer end swap rates higher today as a result, driving a clear widening of long swap spreads).

- Note that the latest BoJ Tankan survey’s sentiment readings were generally in line with exp. to a touch softer on net (the headline large manufacturers index was the most disappointing print, which may have added further support to JGBs), while CapEx plans at large firms provided a notable upside surprise.

- Elsewhere, the uptick in Tokyo core CPI readings for June met expectations, while there was a modest uptick in the unemployment rate in May (which hit 2.6%).

- Note that local headline flow may also be feeding into the wider bid, with Japan rumoured to have taken record tax receipts in FY21, while other reports pointed to Russian President Putin signing over the rights of the Sakhalin-2 oil & gas project to a Russian company (Japan’s Mitsubishi Corp. & Mitsui are partial owners of the original company/project).

- Monday’s local docket is limited at best, with no major points of interest slated.

JGBS: Foreigners Start To Short Cover As BoJ Stands Firm

Note that the latest round of weekly data released by the JPX revealed that foreign investors were net buyers of JGB futures in the week ending 24 June, breaking a string of 3 consecutive weeks of net weekly sales. Still, the 4-week rolling sum of the measure remains comfortably within negative territory. Note that last week’s net bond purchases only accounted for ~33% of the net sales observed over the previous 3 weeks. The net purchases suggest that foreigners started to undertake short covering after the BoJ stood firm against the recent challenge of its YCC parameters (which the foreign investment community clearly participated in). All indications are that the wider foreign investor base remains net short.

Fig. 1: Net Weekly Foreign Investor Flows In JGB Futures (Contracts)

Source: MNI - Market News/JPX/MNI - Market News

Source: MNI - Market News/JPX/MNI - Market News

AUSSIE BONDS: Off Best Levels

ACGBs have backed away from earlier session highs, with the cash curve running 5.0bp to 15.0bp richer, bull flattening. YM +16.0 and XM +9.5 at typing, sitting a little lower after bettering their overnight highs, while bills run 4 to 21 ticks higher through the reds.

- Aussie bonds have caught a bid in line with core FI markets on the back of wider recessionary worry, with defensively-tilted flows observed in the G10 FX space as well on the back of previously fleshed-out developments across the region such as the move lower in Taiwanese chip giant TSMC and bad debt manager China Great Wall Asset Management missing its second deadline for its ‘21 annual report. This helped to extend risk-off flows that initially stemmed from Thursday’s recessionary-induced price action.

- STIR markets continue to see little movement re: expectations for rate hikes ahead of the RBA next Tuesday, continuing to point to ~45bp of rate hikes priced in for July, with a cumulative ~229bp priced in for calendar ‘22.

- The AOFM issuance slate announced for next week provoked little reaction in the ACGB space, with the latest update headlined by AOFM fleshing out its intention to issue a new May-34 bond via syndication in Q2 of the current FY.

- Monday will see a slew of data due - Melbourne Institute Inflation, ANZ job advertisements, housing data, and building approvals, although Tuesday’s RBA meeting will provide more impetus for the space.

FOREX: Recession Risk Looms Large Driving Hunt For Safety

Participants flew to safety as recession fears resurfaced in the absence of any notable reassuring headlines. E-mini futures went offered, signalling that Thursday's Wall Street rout may not be over, with a long weekend in the U.S. drawing nearer.

- Data released out of the U.S. on Thursday fanned speculation re: inbound recession as core PCE & personal spending both printed slightly below expectations, with further data signals inbound today.

- Safe haven currencies firmed and the yen paced gains in Tokyo trade. Spot USD/JPY retreated in tandem with its 1-month risk reversal as Japan/U.S. 10-Year yield gap continued to shrink. Lower U.S. Tsy yields helped the yen become the only G10 currency to outperform the greenback.

- High-betas took a beating, with the Antipodeans leading losses. NZD/USD sank through a congestion of recent troughs near the $0.6200 mark on its way to worst levels in two years. AUD/USD also lodged two-year lows after breaching support from the low print of May 12.

- Weakness in Antipodean FX space may have been exacerbated by weak New Zealand consumer confidence figures, which came on the heels of a survey showing that local business conditions deteriorated last month.

- Offshore yuan plunged on broader aversion to risk, even as Caixin M'fing PMI came in better than expected, while the PBOC set the mid-point of permitted USD/CNY trading band nearly 30 pips below sell-side estimate.

- There was speculation that reports of another delay to the publication of China Great Wall's 2021 annual report helped weaken the redback. A similar postponement by rival Huarong last year sent Asian credit markets into a tailspin.

- Financial markets in Hong Kong were closed in observance of a public holiday, sapping regional liquidity.

- Manufacturing PMI readings from across the globe will keep trickling through today. Central bank speaker slate features ECB's de Cos & Panetta.

USD: Recession Worry Intensifies

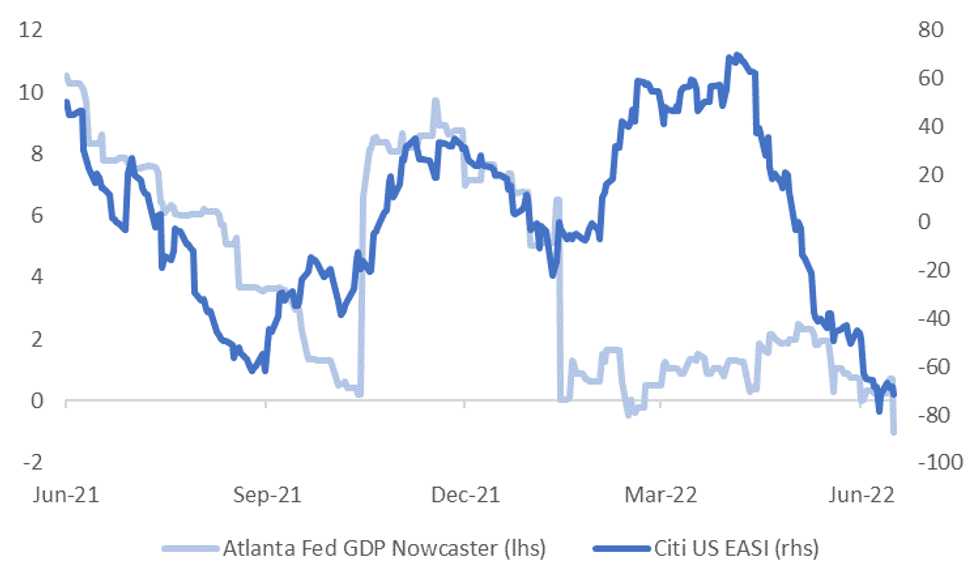

The uptick in U.S. data momentum has proven to be short-lived. The Citi US EASI has rolled back over, although remains above recent lows. Thursday saw a sharp move down in the Atlanta Fed GDP Nowcaster, to -1%, see the first chart below.

- Important data prints continue Friday, with the ISM manufacturing print in focus. Our simple estimate, based off the Philly Fed and Richmond Fed survey readings, remains sub 50 (49.3), even after the Richmond Fed was revised higher for June.

- As we noted last month, the regional Fed surveys have generally been painting a more bearish picture relative to ISM outcomes in recent months. The consensus estimate sits at 54.5. versus 56.1 last month.

Fig 1: Atlanta Fed GDP Nowcaster dips to -1%

Source: Citi, Atlanta Fed, MNI - Market News/Bloomberg

Source: Citi, Atlanta Fed, MNI - Market News/Bloomberg

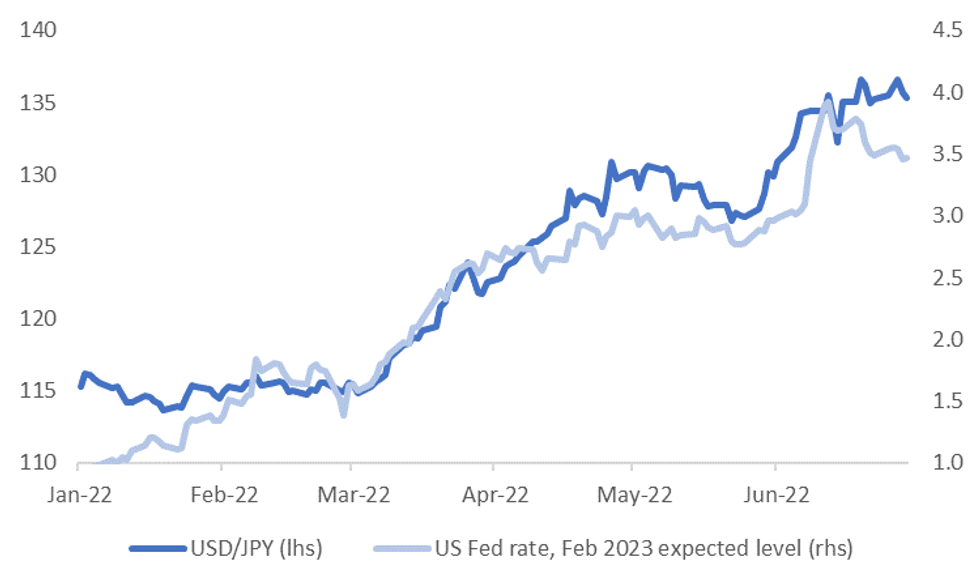

- The impact of weaker data outcomes has been quite clear for US yields. Market pricing for the Fed policy rate is shifting lower, particularly the further we get into 2023.

- Yields have also moved lower elsewhere though. EU-US 2yr spreads are down this week, while steady in terms of UK-US spreads. Not surprisingly, the differential with Japan has contracted.

- The second chart below is USD/JPY versus the expected Fed funds rate in early 2023.

- Even with USD/JPY correcting down from the 137.00 level, it still looks too elevated, at least according to this metric. JPY is outperforming against the rest of G10 FX bloc today.

Fig 2: USD/JPY & Fed Expectations

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Jul01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0350(E766mln), $1.0450(E807mln), $1.0475-80(E914mln), $1.0540-50(E1.2bln), $1.0575(E2.2bln), $1.0600-15(E2.5bln), $1.0630(E994mln), $1.0700(E1.6bln)

- USD/JPY: Y133.50($1.5bln), Y134.00($1.6bln)

- EUR/JPY: Y145.00(E545mln)

- AUD/USD: $0.6800(A$884mln), $0.6900-05(A$838mln), $0.7050(A$2.0bln)

- NZD/USD: $0.6400(N$1.2bln)

- USD/CNY: Cny6.6500($685mln), Cny6.8000($547mln)

ASIA FX: Weaker As Equities Falter

USD/Asia pairs are higher across the board, as equities falter on recession fears. Weakness in tech related stocks is quite apparent today, weighed by a softening chip demand outlook. USD/KRW and USD/TWD have climbed, while USD/CNH is back above 6.7250. USD/PHP is at fresh cyclical highs ~55.28, while USD/IDR is close to the 15000 level.

- CNH: USD/CNH is higher, last tracking +6.7250. The CNY fixing was firmer than expected, while the Caixin PMI also beat market estimates comfortably. Broader USD sentiment has been stronger though, as recession fears rise. There was also speculation that reports of another delay to the publication of China Great Wall's 2021 annual report helped weaken the currency. A similar postponement by rival Huarong last year sent Asian credit markets into a tailspin. Note HK markets were closed today.

- KRW: USD/KRW's dip at the open proved to be short lived. Spot got to 1287 before rebounding back to 1297. The Kospi tried to rally at the open but ran out of steam, we are now back down 1.6%.

- TWD: Taiwan stocks continued to fall, the TWSE down a further 3%, putting the index into bear market territory. Headwinds continue to grow for the semiconductor sector, with TSMC noting lower chip orders. Spot USD/TWD has climbed to 29.80, which is close to YTD highs.

- INR: Spot USD/INR has broken through 79.00, but didn't get much beyond 79.10. Lower oil, and a tax on gold imports (to help curb the import bill) have helped drive some INR outperformance on an intra-Asia basis. Indian equities are down sharply though. Other measures introduced, including fuel export taxes, have weighed.

- IDR: Spot USD/IDR continues to trade at elevated levels, close to the psychological barrier at IDR15,000, even as Indonesia's CPI inflation accelerated to +4.35% Y/Y in June from +3.55% prior, exceeding expectations and breaching Bank Indonesia's +2.0%-4.0% Y/Y target range. BI reiterated it is in no hurry to raise rates post the data and stated core inflation remains the focus (core printed weaker than expected at 2.63% YoY).

- PHP: USD/PHP has risen to fresh cyclical highs of 55.28. This +0.30 on the day. The local manufacturing sector grew at a slower rate as the Philippines' M'fing PMI slipped to 53.8 in June from 54.1 prior. Next week, focus turns to the Philippines CPI data, due for release Tuesday.

EQUITIES: Lower In Asia Amidst Broad Risk Aversion

Major Asia Pac equity indices are mostly lower at typing, tracking a negative lead from Wall St. The MSCI Asia Pacific on track for second straight lower close, with broader risk appetite during the Asian session sapped by fresh worry re: recessionary risks. A note that Hong Kong markets are closed for a holiday today.

- The Taiwanese Taiex leads the way lower, dealing 2.7% weaker, operating around session lows at typing. Index heavyweight TSMC (-3.8%, >25% weightage on the index) leads the way lower, with broader weakness in microchip-related sectors across the region observed after the release of Micron Technology’s lowered forecasts on Thursday.

- The CSI300 deals 0.3% worse off at typing, sitting a little below four-month highs made on Thursday. Shallow gains in the utilities and materials sectors were countered by weakness in the virtually every other sector, with risk sentiment sapped by broader worry during the session re: economic slowdown fears and potentially over concerns re: the health of the country’s bad debt managers (specifically on news of China Great Wall Asset management missing a second deadline to publish its ‘21 annual report).

- The ASX200 narrowly bucked the broader trend of losses, dealing 0.2% firmer at typing. Tech leads the bid, countering weakness in materials and energy-related names, with the S&P/ASX All Technology Index sitting 0.8% better off at typing.

- U.S. e-mini equity index futures sit 1.0% to 1.2% worse off at writing, on track to end the week sharply lower.

GOLD: Weaker In Asia; $1,800 Eyed

Gold trades $2/oz lower to print $1,805/oz, operating a little above Thursday’s troughs at typing. The precious metal is on track for its third straight weekly decline, with the USD (DXY) and U.S. real yields remaining within sight of cycle highs made around mid-June.

- To recap, gold hit seven-week lows mid-way through Thursday’s session on a surge in the USD (DXY) to its own two-week highs, ultimately closing ~$10/oz lower on Thursday for a fourth consecutive daily loss.

- July FOMC dated OIS price is ~65bp of tightening for that meeting, with odds of a 75bp hike for that meeting pulling to its lowest levels in two weeks. The shift lower comes after the revision in the Atlanta Fed GDPNow (implying a technical recession in 1H22), likely feeding into well-documented debate re: a Fed-led economic slowdown.

- Looking ahead, U.S. m’fing PMIs and the ISM m’fing survey are due ahead of the NY session.

- From a technical perspective, the move lower in gold on Thursday has broken initial support at $1,805.2/oz (Jun 14 low), with a clearer break of the level potentially exposing further support at $1,787.0/oz (May 16 low and bear trigger).

OIL: Back From Best Levels; Tight Supply Factors Abound

WTI and Brent sit a little above neutral levels after paring an earlier, light bid, leaving both benchmarks operating around the bottom of Thursday’s range at writing.

- To recap, WTI and Brent closed ~$3-4 lower on Thursday, falling to session lows after OPEC+ announced no change to its output targets for August, adding to worry re: slowing economic growth after the release of weaker than expected consumer spending data and the previously-flagged Atlanta Fed GDPNow pointing to a technical recession in H1 ‘22.

- Thursday’s move lower in oil markets also comes despite wider, persistent tightness in the outlook for global crude supplies, with a few participants pointing to the squaring of positions ahead of the upcoming extended weekend in the U.S. (Independence Day) as a potential driver.

- Looking to the U.S., President Biden has stated that he will ask all Gulf states to increase crude production ahead of a closely-watched three-stop visit to the Middle East later this month, although Nigeria and French President Macron have previously pointed out a lack of spare capacity from the likes of the UAE and Saudi Arabia.

- Elsewhere, Libya has declared force majeure over the Asidra and Ras Lanuf terminals (>500K bpd capacity, as well as the El-Feel oilfield (~90K bpd capacity).

- A previously-flagged worker’s strike in Norway’s oil & gas sector is expected to affect ~4% (~83K bbpd) of the country’s capacity.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/07/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 01/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 01/07/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/07/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/07/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 01/07/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/07/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/07/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.