-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI EUROPEAN MARKETS ANALYSIS: PBoC Guesswork At The Fore Overnight

- Asia-Pac hours were dominated by speculation and guesswork surrounding the potential for further PBoC easing, while there was nothing in the way of meaningful pushback from the PBoC when it came to Monday's CNY weakness.

- Core FI markets richened, with little net movement in the G10 FX space. USD/CNH failed to breach Monday's peak.

- The German ZEW Survey, UK jobs data, U.S. industrial output & housing starts as well as Canadian CPI take focus from here.

US TSYS: Very Modest Richening In Asia

Asia-Pac hours saw another round of fairly inconsequential Tsy trade which failed to provide much in the way of fresh, meaningful information, with Monday’s richening move consolidated and tight ranges observed.

- Speculation surrounding further support for the Chinese economy garnered most of the attention, with little in the way of alternative, meaningful macro headlines observed.

- That left TYU2 to trade in a 0-06 range, last +0-03 at 119-25+, with volume sitting at ~49K as the contract stuck within the confines of Monday’s range.

- Cash Tsys sit 0.5-1.5bp richer across the curve, with only the 2- & 3-Year tenors having a look through Monday’s richest levels during Asia dealing, with those moves being limited in nature.

- Looking ahead, Tuesday’s NY docket sees the release of housing starts and building permits data, as well as industrial production.

JGBs: Firmer, With Long End Leading The Way

JGB futures added to overnight session gains during the Tokyo afternoon after a fairly limited round of morning trade saw the contract consolidate its overnight advance, last dealing +23 on the session, a touch shy of best levels.

- Cash JGBs are 0.5-3.5bp richer on the day, flattening, while 7s outperform surrounding tenors on the bid in futures.

- There wasn’t much in the way of actionable domestic headline flow to latch on to, which left the spill over from Monday’s richening in U.S. Tsys (and subsequent, modest richening in Asia-Pac hours) at the fore.

- The latest round of 5-Year JGB supply received lukewarm demand, with the low price missing wider dealer expectations. The price tail remained narrow (having widened a little from a tail of zero at the previous auction), while the cover ratio eased to 3.40x from the previous auction’s 3.92x, coming in a little below the six-auction average of 3.46x. As flagged in our preview, the lack of meaningful outright and relative value for 5s likely contributed to reduced demand at today’s auction.

- Looking ahead, monthly trade balance data and core machine orders are due Wednesday, in addition to the latest round of BoJ Rinban operations.

AUSSIE BONDS: Firmer On Tuesday, No Headwinds From RBA Minutes

Aussie bonds ticked higher through the Sydney day, building on an overnight bid in futures which stemmed from Monday’s moves in core global FI markets (a product of wider worry re: slowdowns in global growth following disappointing U.S. and China data prints). There was little by the way of major macro headline flow observed during the session.

- Cash ACGBs run 10.5-14.0bp richer across the curve, with the 7- to 12-Year zone leading the bid. YM is +12.5 and XM is +14.0, comfortably through their respective overnight highs, while Bills run 7 to 15 ticks richer through the reds. EFPs are narrower on the day, with the 3-/10-Year box steepening a touch.

- ACGBs looked through the release of the RBA’s August monetary policy meeting minutes, with nothing by way of fresh, meaningful information noted. The release saw members emphasise that the central bank is “not on a pre-set path,” in addition to further colour re: its thoughts on the narrow path that it finds itself on when it comes to striking the correct balance between fighting inflation and allowing the economy to advance on an even keel. STIR markets currently price in ~40bp of tightening for the RBA’s Sep meeting, virtually unchanged from levels observed before the release of the minutes.

- Wednesday will see the release of the Westpac Leading Index for July followed by the Q2 wage price index. Elsewhere, there will be A$800mn of ACGB May-2032 on offer via auction.

MNI RBNZ Preview - August 2022: All Eyes On Forward Guidance

EXECUTIVE SUMMARY

- Another expectation-busting inflation report released out of New Zealand keeps pressure on the RBNZ to raise interest rates, despite reassuring data on inflation expectations and an unexpected uptick in the unemployment rate. Still, prices are growing at a pace that is well beyond the RBNZ's tolerance band, while the labour market remains extremely tight.

- Headwinds to growth are intensifying and may eventually force policymakers to reconsider their aggressive approach to inflation-fighting. The 2-year/10-year segment of NZGB yield curve recently flirted with inversion for the first time since 2015 as the economy is hitting speed bumps.

- With a 50bp OCR hike seen as a done deal this week, the focus will fall on the Reserve Bank's forward-looking comments, with particular emphasis on the OCR track. The tone of this MPS will be set by the combination of hints on how policymakers are planning to handle the inflation/growth dilemma further down the road.

- Click here to see the full preview:MNI RBNZ Preview August 2022.pdf

FOREX: Tight Ranges

G10 currency pairs respected tight ranges in muted Asia-Pac trade, with participants assessing the economic outlook in light of latest data.

- Light selling pressure hit USD/JPY in early hours but the pair recouped losses over the Tokyo fix, returning to neutral levels.

- The rebound in USD/JPY coincided with an uptick in U.S. Tsy yields. The pair clung onto gains even as yields pulled back and sit in negative territory across the curve.

- USD/JPY one-year risk reversal oscillated within a narrow range, holding above par.

- The kiwi dollar underperforms its G10 peers ahead of tomorrow's Monetary Policy Statement from the RBNZ.

- AUD/NZD remained above its 100-DMA after probing the water below that moving average on Monday.

- German ZEW Survey, UK jobs data, U.S. industrial output & housing starts as well as Canadian CPI take focus from here.

FX OPTIONS: Expiries for Aug16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000(E1.3bln), $1.0048-50((E563mln), $1.0070-75(E1.3bln), $1.0100-10(E1.0bln), $1.0125-40(E1.3bln), $1.0250(E932mln), $1.0300(E949mln)

- USD/CNY: Cny6.89-90($859mln)

ASIA FX: CNH Steadies

CNH has consolidated today after yesterday's -1.15% dip, the largest daily fall since 2019, when the currency fell through 7.00. This, along with a modestly better equity tone for the region, has helped FX sentiment stabilize elsewhere.

- CNH: USD/CNH edged down slightly today. The pair is around 0.2% sub NY closing levels. Dips below 6.8000 have been supported (last at 6.8030), but we have moved away from a test above 6.8200 for now. Onshore equity sentiment has been better, while aggregate gains are limited, property companies are up on a report a state backed insurer will guarantee onshore bonds issues by some developers. The CNY fix also came in a touch firmer than expected.

- KRW: 1 month USD/KRW is back below 1310, stepping away from a test of 1315/16 for now. Onshore equities are grinding higher, giving some support.

- IDR: USD/IDR 1-month NDF last +12 figs at IDR14,772. Bulls look to a move through Aug 5 high of IDR14,990, while bears eye Aug 12 low of IDR14,14,654 for initial support. Indonesia's 5-year CDS premium is hovering just above two-month lows printed last week. It now sits at around 98bp. President Jokowi has stated that Indonesia's economic fundamentals remain sound in his annual budget speech today.

- PHP: Spot USD/PHP continues to gravitate higher, with spot back close to 56.00, around 0.25% firmer through the session. Most analysts expect Bangko Sentral ng Pilipinas to raise the key policy rate by 50bp this week as the Monetary Board is set to decide between the expected outcome and a more modest 25bp hike.

- THB: Spot USD/THB last deals -0.12 figs at 35.383. The BoT Gov told TNN that Q2 GDP showed economic recovery has started, even as the print was lower than expected, mostly due to inventory and private investment. However, tourism performed better than anticipated. Global funds bought a net $162.7mn in Thai equities on Monday, which was the largest net inflow since the last day of May. The recent uptick in equity inflows coincides with a move higher in the benchmark SET Index.

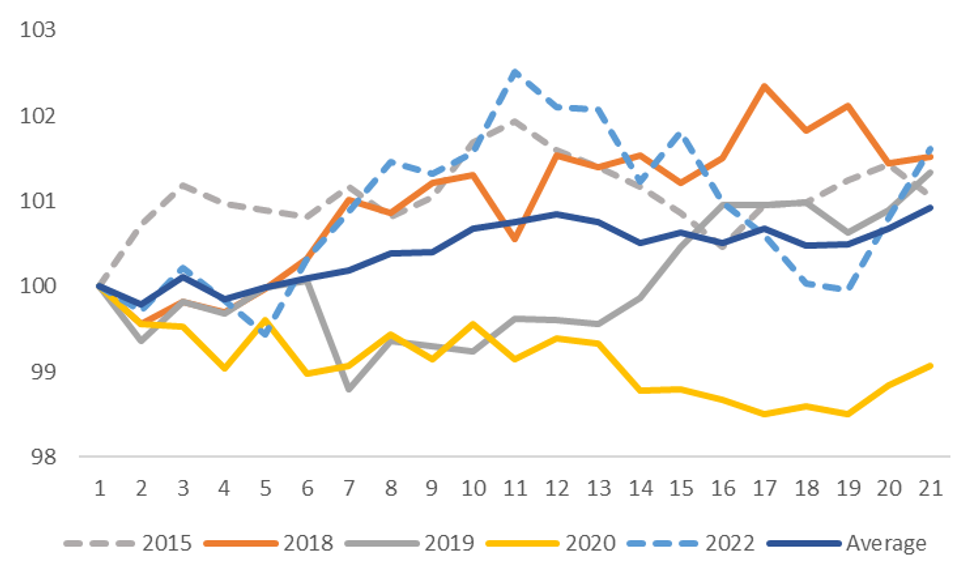

CNH: CNH Tends To Consolidate After Sharp Sell-Off Days

As we highlighted earlier, USD/CNH moves of greater than 1% in a single session (using reported Bloomberg closing levels) are fairly rare events. Indeed, going back to 2015 there have only been 6 trading days, including yesterday's outcome, where USD/CNH has risen by 1% or more in a single session.

- The chart below plots the performance of USD/CNH in the 1 month (21 trading days) after we have seen these daily moves of 1% or larger.

- We have the devaluation episode in 2015, the US-China tariff hike episode in 2018, the break above 7.00 in 2019, the Covid pandemic in early 2020 and then in April of this year as the USD surged and China was in the midst of another Covid wave.

- The dark blue line is the average of these 5 episodes. Interestingly, outside of the 2015 deval period, USD/CNH was slightly lower in the 4-5 sessions post a +1% daily gain. Even including the 2015 episode we are still lower over this period on average.

- These moves are modest, with average losses in the range of -0.40-0.50% for USD/CNH over this 4-5 day period. This is likely to reflect potential profit taking flows on long USD/CNH positions post a dramatic surge higher.

- The China authorities could also work against aggressive follow up moves in the currency, to work against shifting onshore expectations and curb domestic capital outflow pressures.

- Beyond this 5 day period though, higher USD/CNH levels typically follow. On average the pair is still nearly 1% higher in these episodes, with only the 2020 Covid period an outlier.

- If history repeats, we might see USD/CNH enter a consolidative range in the near term, but dips could still be supported by the market. This would fit with the broader macro backdrop around US-China monetary policy divergences.

Fig 1: USD/CNH Performance Post Days Of +1% Gains

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

KRW: USD/KRW 1 Month Back Below 1310, Empire Survey Tech Outlook Not As Bearish As Headline Drop

1 month USD/KRW has spent most of today's session drifting lower, although some support was evident in the low 1308/high 1307 region. We are now back close to 1310, but for now we are avoiding a test of the 1315/16 zone.

- Onshore equities are modestly higher, with the Kospi up a little over 0.3% at this stage, while the Kosdaq is trailing slightly (+0.28%).

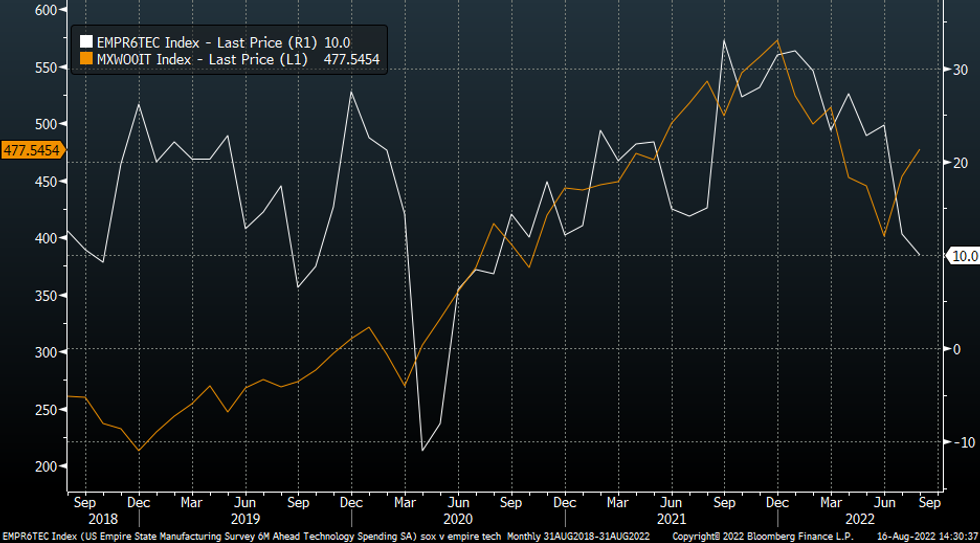

- Overnight the slump in the empire manufacturing survey (-31.3 versus +5.0 expected) cast a fresh cloud over the US/global growth backdrop. Most of the detail of the survey painted a bearish outlook, although one of the sub components of the survey looks at intentions around the tech spending outlook for the next 6 months. This sub-index also fell, but much more modestly, down to +10 from +12 in July.

- The chart below overlays this sub-index against the MSCI IT equity market index. The weakness in the tech spending outlook is a little at odds with the recent rebound in IT equity performance.

Fig 1: Empire Survey Tech Spending Intentions & MSCI IT Equities

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

- The resilient equity picture should be helping KRW sentiment at the margin. As we highlighted previously there is already a decent wedge between onshore Korean equities and USD/KRW performance. All else equal the won should be stronger based off current equity levels.

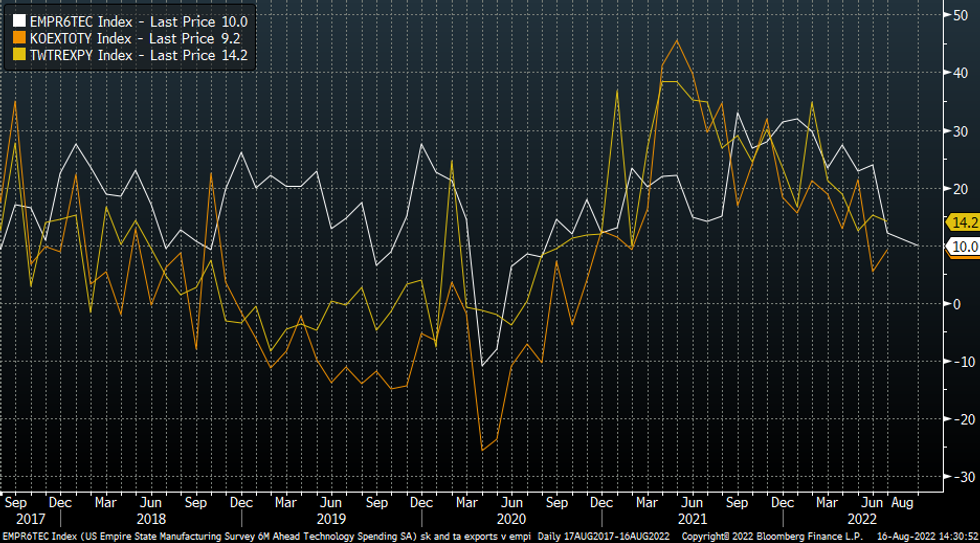

- The other point to note is that the slowing in South Korea export growth is also already reflected to some degree in terms of the tech spending outlook, see the second chart below. This also applies for Taiwan export growth, (which is the yellow line on the chart).

Fig 2: Empire Survey Tech Spending Intentions Versus South Korea & Taiwan Export Growth

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

EQUITIES: Mixed In Asia; ASX200 Hits 10-Week High

Major Asia-Pac equity indices are broadly off their extremes, operating little changed to 0.5% better off at writing, with a positive lead from Wall St. mostly taking a back seat to domestic developments in the respective markets.

- Chinese developers drew a bid after several source reports pointed to regulators acting to secure onshore bond issuance guarantees for specific private property developers, with the Hang Seng Mainland Properties Index (+6.4%) surging by as much as 10.5% earlier.

- The main Hang Seng Index is +0.1%, operating around session lows as a strong showing in the Properties (+2.5%) sub-index was countered by underperformance in the finance and consumer/industrial sub-gauges.

- The Nikkei 225 sits a shade below neutral levels at writing, facing headwinds above the 28,900 mark. Softbank Group (-2.0%) contributed the most to losses in the index, sliding to session lows after FT source reports pointed to U.S. hedge fund Elliott Management selling off nearly all of its positions in the company earlier this year, adding to negative showings from industrials and energy-related equities.

- The Australian ASX200 is 0.5% better off, sitting a little below freshly-made 10-week highs. CSL Ltd (+1.3%) and BHP Group (+4.5%) contributed the most to gains, with the latter rallying after reporting its second-highest annual profit on record, while announcing its highest dividend payout ever.

- E-minis are flat to 0.1% weaker at writing, operating shy of their respective, recently made multi-month highs.

GOLD: A Little Higher In Asia

Gold sits ~$2/oz firmer to print ~$1,782/oz at typing, steadying a little above one-week lows made on Monday amidst a limited downtick in nominal U.S. Tsy yields and the USD (DXY).

- To recap, the precious metal closed ~$23/oz weaker on Tuesday, declining by the most in a month. The move lower was facilitated by a rise in the USD (DXY), with the DXY hitting fresh one-week highs as disappointing U.S. economic data added to prevailing global growth worries, after soft Chinese economic activity indicators printed earlier in the Asian session.

- Gold has so far seen little relief from rising worry surrounding China’s restart of military drills in the Taiwan Strait (in response to an unannounced visit to Taiwan by a U.S. Congressional Delegation), with the scale of the Chinese exercises so far appearing to be more limited than during the visit of U.S. House Speaker Pelosi, with a seeming step down in the intensity of official rhetoric as well.

- Focus for gold will likely remain on the Fed’s July meeting minutes, due for release on Wednesday.

- Looking to technical levels, initial support is seen at ~$1,771.2/oz (20-Day EMA), while a break of that level will expose further support at $1,754.4/oz (Aug 3 low, key short-term support). On the other hand, resistance is located at $1,807.9/oz (Aug 10 high and the bull trigger).

OIL: Lower On Demand Worry, Supply Outlook Improvements

WTI is ~-$0.50 and Brent is ~-$0.80, operating within the lower end of their respective ranges established on Monday, with WTI remaining below the $90 mark at typing.

- To recap, WTI and Brent closed lower for a second consecutive session on Monday, shedding ~$3 apiece amidst rising worry re: softer global growth after disappointing economic data prints out of the U.S. and China (note that Chinese oil demand was shown to have fallen ~10% Y/Y as well), with WTI recording fresh six-month lows during the session.

- Optimism surrounding a U.S.-Iran nuclear deal has surged after a source report by the Iranian Students’ News Agency stated that Iran’s position on the EU’s “final draft” had been sent to the EU, with a reply expected later this week. Elsewhere, the Iranian FM stated that an agreement could be reached within days, dependent on the U.S. (note that this does not differ from official statements in prior months before negotiations were effectively halted).

- Iranian crude output prior to U.S. sanctions in ‘17 suggests that a lifting of sanctions could return >1mn bpd of crude to global markets.

- Brent’s prompt spread sits at ~$0.73 at typing, having closed below the $1.00 mark on Monday for the first time since Apr ‘22, reflecting easing worry re: tightness in near-term global crude supplies.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/08/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/08/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/08/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 16/08/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 16/08/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/08/2022 | 1230/0830 | *** |  | CA | CPI |

| 16/08/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 16/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/08/2022 | 1315/0915 | *** |  | US | Industrial Production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.