-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Little Respite For Risk Appetite

EXECUTIVE SUMMARY

- U.S. TRIES TO HOBBLE CHINA CHIP INDUSTRY WITH NEW EXPORT RULES (RTRS)

- PUTIN ACCUSES UKRAINE OF CRIMEA BRIDGE BLAST, CALLS IT TERRORISM (RTRS)

- LOCKDOWN WORRIES RETURN TO SHANGHAI AS CHINA COVID TALLY CLIMBS (BBG)

- XI CONVENES FINAL PARTY MEETING BEFORE LEADERSHIP CONGRESS (SCMP)

- KIM JONG UN TOUTS NEW MISSILE, CALLS RECENT TESTS WARNING TO US (BBG)

- CHINA SEP SERVICES PMI FALLS INTO CONTRACTIONARY TERRITORY

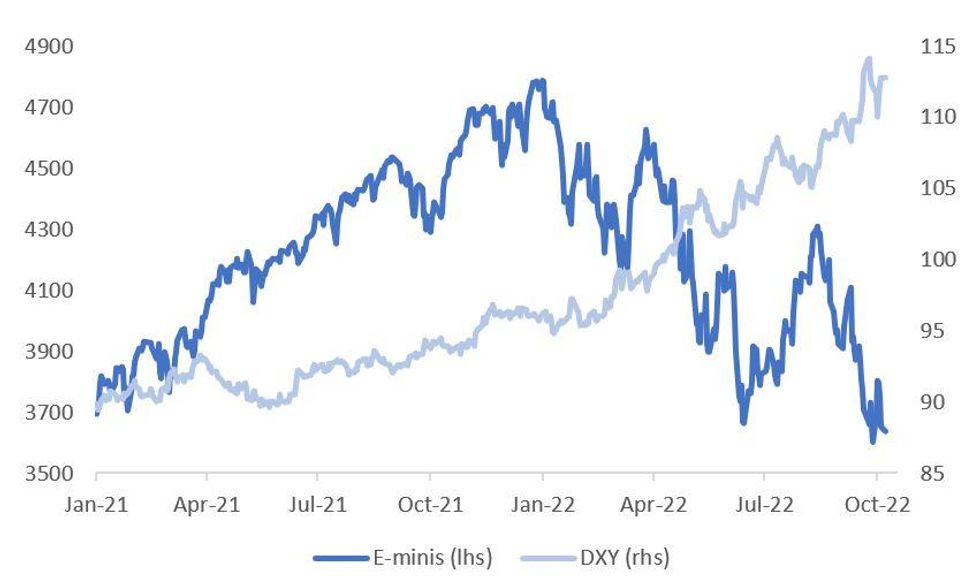

Fig. 1: E-Minis V. DXY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Liz Truss is preparing for battle with her ruling Conservative Party as she gears up for crunch meetings with backbench MPs and her cabinet in a bid to quash any attempt at rebellion just one month into her UK premiership. (BBG)

POLITICS: British lawmaker Greg Hands was appointed as the minister of state in Department for International Trade, the prime minister's office said in a statement on Sunday. (RTRS)

ENERGY: Senior Cabinet Office minister Nadhim Zahawi on Sunday said it is "extremely unlikely" Britain would have planned power cuts over winter, responding to a National Grid warning that the country could face blackouts if it cannot import enough energy. (RTRS)

EUROPE

GERMANY: A regional election in Lower Saxony delivered mixed fortunes for German Chancellor Olaf Scholz's national ruling coalition on Sunday, with his Social Democrats scoring a clear win but the Free Democrats barely on track to scrape into parliament. (RTRS)

GERMANY: Germany's expert commission charged with drawing up plans to ease the impact of soaring gas prices on consumers favors a one-off payment this year and a price break from next March or April, a draft of a key paper seen by Reuters showed. (RTRS)

GERMANY: German police said it had not excluded political motives in the suspected sabotage of communication cables on Germany's rail network on Saturday but that there was no sign of any involvement by a foreign state or terrorism. (RTRS)

GERMANY: German Interior Minister Nancy Faeser wants to dismiss the country's cybersecurity chief due to possible contacts with people involved with Russian security services, German media reported late on Sunday, citing government sources. (RTRS)

AUSTRIA: Austrian President Alexander Van der Bellen secured a second six-year term in office on Sunday by winning a clear majority of votes in an election to avoid a runoff, according to projections based on almost all votes cast except postal ballots. (RTRS)

PORTUGAL: Portugal’s government plans to adopt new measures as it tries to mitigate rising energy costs for consumers and companies. (BBG)

US

FED: Rising U.S. interest rates have reduced demand for workers without pushing up layoffs, boding well for the soft landing sought by Federal Reserve officials, San Francisco Fed economist Nicolas Petrosky-Nadeau told MNI Friday. (MNI)

FED: Some economists fear the Federal Reserve—humbled after waiting too long to withdraw its support of a booming economy last year—is risking another blunder by potentially raising interest rates too much to combat high inflation. (WSJ)

FISCAL: The U.S. Treasury moved to preserve and expand the supply of affordable housing on Friday by finalizing a new tax credit income rule that may qualify more housing projects and extending deadlines for when they must be placed in service. (RTRS)

OTHERS

GLOBAL TRADE: The Biden administration published a sweeping set of export controls on Friday, including a measure to cut China off from certain semiconductor chips made anywhere in the world with U.S. equipment, vastly expanding its reach in its bid to slow Beijing's technological and military advances. (RTRS)

GLOBAL TRADE: Taiwanese semiconductor companies attach "great importance" to complying with the law, the island's government said on Saturday, signalling they would comply with new U.S. export controls that aim to hobble China's chip industry. (RTRS)

GLOBAL TRADE: A backup of more than 2,000 boats and barges on the Mississippi River is being cleared as two closures along the waterway reopened on Sunday. (BBG)

GLOBAL TRADE: The UK’s bid to join one of Asia’s big trade pacts will take a bit longer, according to the Canadian trade chief. Mary Ng, Canadian minister of international trade, export promotion, small business and economic development, said the 11-economy Comprehensive and Progressive Agreement for Trans-Pacific Partnership is still mulling the first new-member application. (BBG)

ECONOMY: U.S. Treasury Secretary Janet Yellen said a decision by the OPEC+ grouping to cut oil production was "unhelpful and unwise" for the global economy, especially emerging markets, the Financial Times said on Sunday. (RTRS)

U.S./CHINA: New U.S. export controls targeting Chinese chip manufacturers are an abuse of trade measures and designed to maintain the country's "technological hegemony", China's foreign ministry spokesperson Mao Ning said on Saturday. (RTRS)

U.S./CHINA/TAIWAN: President Joe Biden has been explicit in vowing to commit US forces in the event of a Chinese attack on Taiwan. The question occupying US and Taiwanese officials is the fate of the island’s flagship semiconductor industry. (BBG)

CHINA/TAIWAN: War between Taiwan and China is "absolutely not an option", Taiwan President Tsai Ing-wen said on Monday, as she reiterated her willingness to talk to Beijing and also pledged to boost the island's defences including with precision missiles. (RTRS)

JAPAN: Support for Japanese Prime Minister Fumio Kishida's government slid to the lowest of his one-year tenure on doubts about his party's disclosure of ties to the controversial Unification Church, an opinion poll showed on Sunday. (RTRS)

NORTH KOREA: South Korea said its military will strengthen security cooperation with the US and Japan, including the deployment of “US strategic assets,” after Kim Jong Un’s North Korea fired two short-range ballistic missiles Sunday. (BBG)

NORTH KOREA: North Korea's recent flurry of missile tests were designed to simulate showering the South with tactical nuclear weapons as a warning after large-scale navy drills by South Korean and U.S. forces, state news agency KCNA said on Monday. (RTRS)

NORTH KOREA: North Korean leader Kim Jong Un pledged further shows of his nuclear capabilities to deter the US, after two weeks of military drills in which he claimed to launch a new ballistic missile and demonstrate tactical atomic strikes. (BBG)

NORTH KOREA: The US remains ready for talks with North Korea on denuclearizing the Korean peninsula, while ensuring “that we have also the capabilities in the region and ready to go in case we need them,” National Security Council spokesman John Kirby said. (BBG)

BOC: Bank of Canada Governor Tiff Macklem said there is scope to slow the economy based on an "exceptionally high number" of job vacancies in the labor market. (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro said on Sunday that allies have suggested he increases the number of justices in the Supreme Court if he is reelected, according to remarks broadcast on social media. (RTRS)

RUSSIA: President Vladimir Putin accused Ukraine of carrying out an attack that badly damaged a key bridge linking annexed Crimea to the Russian mainland, his first comments on an episode that further highlighted the woes of his military in the eighth month of its invasion. (BBG)

RUSSIA: WNBA star Brittney Griner and former U.S. Marine Paul Whelan, who are being held in Russia, could gain release by the end of this year, said former U.S. ambassador to the United Nations Bill Richardson, who traveled to Moscow in September. (RTRS)

RUSSIA: The US warned Hong Kong that assisting sanctioned individuals could threaten its status as a financial hub, after a megayacht linked to one of Russia’s richest men docked in the city’s harbor. (BBG)

TURKEY: Turkish President Tayyip Erdogan vowed on Saturday that the central bank would continue to cut its policy interest rates every month for as long as he stayed in power, after it surprised markets by cutting rates twice in the last two months. (RTRS)

SOUTH AFRICA: Only a day after Eskom Holdings SOC Ltd. suspended rolling blackouts, the state-owned power utility announced it will bring them back again. (BBG)

METALS: Chile's mining minister announced on Friday the permanent closure of mining stopes directly related to a giant sinkhole that appeared in the northern part of the country in July. (RTRS)

ENERGY: France’s premier and more than a dozen government ministers are visiting Algeria, the latest drive to rebuild ties with the North African nation that’s a major gas supplier for Europe. (BBG)

ENERGY: TotalEnergies on Sunday offered to bring forward wage talks, in response to union demands, as it sought to end a strike that has disrupted supplies to almost a third of French petrol stations and led the government to tap strategic reserves. (RTRS)

ENERGY: French President Emmanuel Macron said in Prague that he will meet with his Spanish and Portuguese counterparts next week to discuss the cross-Pyrenees MidCat gas pipeline project and reach a "pragmatic" solution. (RTRS)

ENERGY: French energy regulator CRE said in a statement that French gas network operator GRTgaz is set to create capacity to ship up to 100 gigawatt-hour of gas towards Germany, adding it would fix the price at 367.94 euros per mwh and year. (RTRS)

OIL: The Kremlin on Sunday praised OPEC+ for agreeing production cuts that had successfully countered the "mayhem" sown by the United States in global energy markets. (RTRS)

OIL: China has issued the first batch of crude oil import quotas for 2023, mainly to independent refiners, four sources familiar with the matter said on Saturday. (RTRS)

OIL: Japan’s biggest oil refiner is drawing up plans to consolidate production as domestic demand slumps because of a shrinking population and efforts to cut emissions. (BBG)

CHINA

ECONOMY: Chinese bankers believe China’s economy is improving with the Banker Macroeconomic Heat Index rebounding in Q3 for the first time since Q2 2021, according to a nationwide banker survey released on the PBOC website. The index rose 2.1 percentage points from the previous quarter to 19.9% in Q3. (MNI)

POLITICS: President Xi Jinping kicked off the final meeting of China’s top leaders, days before the opening of a twice-a-decade Communist Party congress that’s set to hand him a landmark third term in power. The closed-door gathering of the roughly 370 members and alternate members of the Central Committee began Sunday in Beijing, according to the official Xinhua News Agency. (BBG)

CORONAVIRUS: Tourism spending during the week-long National Day holiday in China was only 40% of the pre-pandemic level, with hotel and air ticket prices falling to a five-year low as renewed Covid-19 infections spread to 177 cities in 31 provinces, Caixin reported. (MNI)

CORONAVIRUS: China is stepping up efforts to contain Covid-19 outbreaks ahead of the Party Congress, with national cases climbing to the highest in almost two months and concerns about widening lockdowns rippling across the financial hub of Shanghai. (BBG)

YUAN: The People’s Bank of China will promote a comprehensive opening of China’s financial markets for investors and improve the liquidity of yuan assets, according to an article published by the PBOC’s Macroprudential Policy Bureau on its social media account. This will be achieved by further simplifying entry processes for foreign investors, widening the assets that can be traded, and facilitating the holding of yuan assets by central banks. (MNI)

PROPERTY: China’s latest property policy package pushed out before a week-long holiday hasn’t ignited a sales turnaround, underscoring the challenge to arrest the country’s flailing real estate sector. (BBG)

PROPERTY: Chinese new home sales by floor area fell 37.7% year-on-year over the week-long National Day holiday starting from Oct. 1, a private survey showed on Saturday, as tough COVID-19 curbs further dented fragile demand. (RTRS)

EQUITIES: Dual-class shares, which have converted to primary listings in Hong Kong, can be included in the cross-border Stock Connect scheme, Shanghai and Shenzhen stock exchanges said on Saturday, potentially channeling fresh money into eligible stocks. (RTRS)

OVERNIGHT DATA

CHINA SEP CAIXIN SERVICES PMI 49.3; MEDIAN 54.4; AUG 55.0

CHINA SEP CAIXIN COMPOSITE PMI 48.5; AUG 53.0

The Caixin China General Services PMI in September dropped 5.7 points from the previous month to 49.3. Although the Covid situation improved in Hainan province, the severity of outbreaks worsened in many other areas, ending a three-month expansion of business activities in the services sector. (Caixin)

MARKETS

SNAPSHOT: Little Respite For Risk Appetite

Below gives key levels of markets in the second half of the Asia-Pac session:

- Japanese markets are closed.

- ASX 200 down 78.169 points at 6684.60

- Shanghai Comp. down 11.806 points at 3012.584

- Aussie 10-Yr future down 4 ticks at 96.09, Aussie 10-Yr yield up 3.7bp at 3.885%

- US 10-Yr future +0-01+ at 111-17, cash Tsys are closed.

- WTI crude down $0.82 at $91.82, Gold down $7.37 at $1687.48

- USDJPY up 19 pips at 145.44

- U.S. TRIES TO HOBBLE CHINA CHIP INDUSTRY WITH NEW EXPORT RULES (RTRS)

- PUTIN ACCUSES UKRAINE OF CRIMEA BRIDGE BLAST, CALLS IT TERRORISM (RTRS)

- LOCKDOWN WORRIES RETURN TO SHANGHAI AS CHINA COVID TALLY CLIMBS (BBG)

- XI CONVENES FINAL PARTY MEETING BEFORE LEADERSHIP CONGRESS (SCMP)

- KIM JONG UN TOUTS NEW MISSILE, CALLS RECENT TESTS WARNING TO US (BBG)

- CHINA SEP SERVICES PMI FALLS INTO CONTRACTIONARY TERRITORY

US TSYS: Risk-Negative Headlines Help T-Notes Edge Higher, Within Tight Range

T-Notes traded with a marginal bullish bias, holding a tight 0-05 range. Market closures in Japan, South Korea, Malaysia and Taiwan limited regional activity, while the U.S. will observe the Columbus Day.

- The weekend brought some risk-negative headlines, but they failed to generate any substantial buying interest in T-Notes. North Korea resumed its missile tests involving a nuclear operation unit, an apparent attack damaged a heavily guarded bridge connecting mainland Russia to the Crimean Peninsula, while China's Caixin Services PMI unexpectedly dipped into contractionary territory.

- Market pricing for the next FOMC meeting is little changed from today's opening levels with swaps implying a ~91% chance of another 75bp rate hike in November. The strong NFP report released last Friday reinforced expectations of continued aggressive tightening.

- T-Notes last trade +0-01+ at 111-17. Eurodollar futures run -2.0 to +1.5 tick through the reds.

- Fed Vice Chair Lael Brainard and Chicago Fed President Charles Evans will speak at the annual NABE conference today.

AUSSIE BONDS: Overhang Bear-Steepening Impetus Dissipates, Futures Edge Higher

Aussie bond futures inched higher in tandem with T-Notes, while initial bear-steepening impetus in cash ACGB space moderated as the session progressed.

- The yield curve bear steepened as Sydney trade re-opened, with local players digesting the reaction in U.S. Tsys to above-forecast U.S. jobs data released last Friday. The report fanned hawkish Fed bets.

- The start to the new week brought some stability, with markets in Japan, South Korea, Malaysia and Taiwan closed for holidays, limiting regional activity. Cash ACGBs trimmed initial moves and last sit 2.3-4.3bp higher across a slightly steepened curve.

- Futures ground higher, with YM -3.5 & XM -4.0 versus prior settlement. Bills sit 2-6 ticks lower through the reds.

- In Australia, the OIS strip prices an ~86% chance of a 25bp hike to the cash rate target at the November meeting. This stands in contrast with the Fed and RBNZ, which are expected to tighten by 75bp and 50bp respectively.

- Risk-negative headlines from over the weekend may have lent some support to ACGBs today, as North Korea resumed missile tests, while China's Caixin Services PMI dropped sharply into contractionary territory.

EQUITIES: Lower In Asia; U.S. Chip Curbs Sends Semiconductor Stocks Lower

Asia-Pac equity indices are entirely in the red today, tracking a strongly negative lead from Wall St. (major cash equity indices closed ~2.1-3.8% softer on Friday), with the MSCI APEX50 index sitting 1.6% worse off at typing, on track for a second straight lower daily close.

- Semiconductor stocks across the region were sharply lower across the session after the Biden administration slapped fresh restrictions on chip exports to China, with losses observed in the likes Hua Hong Semiconductor (-9.1%), and Shanghai Fudan Microelectronics (-18.0%).

- The underperformance in semiconductor stocks comes after AMD’s disappointing post-market financials last Thursday.

- The TAIEX (-1.4%) is accordingly lower as well, with bellwether and index heavyweight TSMC (-2.9%) contributing the most to drag.

- Hong Kong-listed Chinese equities struggled, with the Hang Seng China Enterprises Index dealing 2.6% softer at writing. China-based tech leads the way lower, with virtually all constituents in the HSTECH (-3.5%) trading lower at writing, underperforming the broader Hang Seng Index (-2.5%).

- Underperformance in China-based stocks comes as bearish pressure from a selloff in equities (owing to a rise in expectations for Fed hikes) has mixed with relatively muted Golden Week holiday spending.

OIL: Paring Recent Gains As Growth Worry Remains Elevated

WTI and Brent are ~$0.80 softer apiece, paring a little of their respective gains made on Friday as worry re: Fed hawkishness impacting economic growth (and the outlook for energy demand) has ticked higher, with equities across the Asia-Pac region struggling as well.

- To recap, both benchmarks closed ~$4 firmer apiece on Friday, hitting multi-week highs on tailwinds from continued tightness in U.S. crude and gasoline inventories, as well as OPEC+ decision to cut crude output targets by 2mn bpd on Wednesday.

- On the latter topic, WTI and Brent notched ~17% and ~11% higher weekly closes respectively, largely shrugging off the above-expectations NFPs print on Friday at the time.

- Looking ahead, participants continue to await a U.S. response to the OPEC+ decision, although some observers have stated that U.S. efforts may centre around the “NOPEC” bill for now amidst a lack of suitable, effective alternatives.

- Further out, some are watching for signs of a Q4 easing in China’s COVID-zero policy, with the country heading for the twice-a-decade party Congress on Oct 16.

- Brent’s prompt spread now sits at ~$1.97, a little shy of 13-week highs recorded last Friday.

GOLD: Holding Lower Post-NFPs As 75bp Fed Hike Increasingly Priced

Gold deals ~$2/oz softer to print ~$1,693/oz, operating a little above Friday’s worst levels at writing. The precious metal has held on to the bulk of its losses from Friday as the USD (DXY) hovers just shy of two-week highs.

- To recap, the precious metal closed ~$18 lower on Friday after falling to session lows (at $1,690.7/oz) as the release of better-than-expected U.S. NFPs saw expectations for Fed hawkishness return to the space, with the DXY and nominal U.S. Tsy yields pushing higher after.

- Nov FOMC dated OIS now price in ~72 bp of tightening at that meeting, pointing to an ~88% chance of a 75bp rate hike, operating at around its highest level since the Sep FOMC.

- Focus for gold now turns to U.S. CPI due later this week on Thursday.

- From a technical perspective, gold has breached initial support at $1,695.2 (former trendline resistance), exposing further support at $1,659.7 (Oct 3 low). On the other hand, initial resistance is seen at $1,729.5 (Oct 4 high).

FOREX: Greenback Tad Firmer, Antipodean Divergence Unfolds

The greenback firmed at the margin amid a number of closures across Asian financial centres. Markets were shut in Japan, South Korea, Taiwan and Malaysia, while the U.S. and Canada will also observe public holidays today. The BBDXY wavered, having a look above the prior trading day's high as it printed its best levels since Sep 29, before easing off. Swaps markets are still pricing ~73bp worth of tightening at the next FOMC meeting after the latest round of U.S. labour market data beat expectations.

- USD/JPY ran as high as to Y145.67 versus the recent cyclical high of Y145.90, with anything above Y145.00 deemed territory of heightened intervention risk. Some participants may have been taking the opportunity provided by a local holiday, as it would be unusual for Japanese officials to step in during a day off.

- The kiwi dollar tops the G10 pile at typing, while the Aussie is pacing losses. AUD/NZD turned heavy again, as Australia/New Zealand 2-year swap spread faltered, after last week's policy reviews by the Antipodean central banks indicated diverging rate-hike intentions.

- The weekend brought a suite of risk-negative headlines, including the news that a North Korean nuclear operation unit was exercising under the supervision of Kim Jong-un, as well as a particularly weak Caixin Services PMI released out of China. There was nothing in the way of strong risk-off reaction in G10 FX space.

- Spot USD/CNH climbed to CNH7.1485 before pulling back into negative territory as China returned from its week-long holiday. The PBOC maintained appreciation bias in its daily yuan fixing for the 28th straight day, albeit the fixing error was narrower than in the recent days.

- Focus turns to Norwegian CPI inflation, as well as comments from Fed's Brainard & Evans, ECB's Lane, Centeno & de Cos and Riksbank's Ingves, Breman & Ohlsson.

FX OPTIONS: Expiries for Oct10 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800-10(E1.6bln), $0.9844-45(E1.1bln), $0.9875(E556mln), $0.9950(E709mln), $1.0050(E2.4bln)

- USD/JPY: Y145.00($672mln), Y147.35($779mln)

- EUR/JPY: Y144.00(E848mln)

- AUD/USD: $0.6560(A$616mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/10/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/10/2022 | 0830/1030 | * |  | EU | Sentix Economic Index |

| 10/10/2022 | 1200/0800 |  | US | Chicago Fed's Charles Evans | |

| 10/10/2022 | - |  | EU | ECB Lagarde at IMF/World Bank Annual Meetings | |

| 10/10/2022 | 1300/1500 |  | EU | ECB Lane Opens ECB Monetary Policy Conference | |

| 10/10/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 10/10/2022 | 1735/1335 |  | US | Fed Vice Chair Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.