-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI EUROPEAN MARKETS ANALYSIS: Tech Weakness Spoils Chinese Market Return

- With a number of markets closed in the region today, including Japan and South Korea, coupled with US Columbus Day this evening, macro news flow has been light. Still, the carry over from Friday's session of a firmer USD, weaker equities has persisted for the most part. Focus will be on whether the S&P500 can hold above 3600, with key event risk this week (US FOMC Minutes and September CPI).

- China markets have returned, with tech equity names slumping, as the US administration looks to curb technology access exports further. Aggregate China equity indices are trading resiliently though, despite a very poor Caixin services PMI print from the weekend. Rising Covid case numbers will also need to be monitored. We are now back to early September highs.

- AUD/USD has sunk to fresh cyclical lows in the FX space. The pair is now eyeing a break sub 0.6300. Onshore yields have lagged the core move higher from late last week (likely owing to RBA dovishness).

US TSYS: Risk-Negative Headlines Help T-Notes Edge Higher, Within Tight Range

T-Notes traded with a marginal bullish bias, holding a tight 0-05 range. Market closures in Japan, South Korea, Malaysia and Taiwan limited regional activity, while the U.S. will observe the Columbus Day.

- The weekend brought some risk-negative headlines, but they failed to generate any substantial buying interest in T-Notes. North Korea resumed its missile tests involving a nuclear operation unit, an apparent attack damaged a heavily guarded bridge connecting mainland Russia to the Crimean Peninsula, while China's Caixin Services PMI unexpectedly dipped into contractionary territory.

- Market pricing for the next FOMC meeting is little changed from today's opening levels with swaps implying a ~91% chance of another 75bp rate hike in November. The strong NFP report released last Friday reinforced expectations of continued aggressive tightening.

- T-Notes last trade +0-01+ at 111-17. Eurodollar futures run -2.0 to +1.5 tick through the reds.

- Fed Vice Chair Lael Brainard and Chicago Fed President Charles Evans will speak at the annual NABE conference today.

AUSSIE BONDS: Overhang Bear-Steepening Impetus Dissipates, Futures Edge Higher

Aussie bond futures inched higher in tandem with T-Notes, while initial bear-steepening impetus in cash ACGB space moderated as the session progressed.

- The yield curve bear steepened as Sydney trade re-opened, with local players digesting the reaction in U.S. Tsys to above-forecast U.S. jobs data released last Friday. The report fanned hawkish Fed bets.

- The start to the new week brought some stability, with markets in Japan, South Korea, Malaysia and Taiwan closed for holidays, limiting regional activity. Cash ACGBs trimmed initial moves and last sit 2.3-4.3bp higher across a slightly steepened curve.

- Futures ground higher, with YM -3.5 & XM -4.0 versus prior settlement. Bills sit 2-6 ticks lower through the reds.

- In Australia, the OIS strip prices an ~86% chance of a 25bp hike to the cash rate target at the November meeting. This stands in contrast with the Fed and RBNZ, which are expected to tighten by 75bp and 50bp respectively.

- Risk-negative headlines from over the weekend may have lent some support to ACGBs today, as North Korea resumed missile tests, while China's Caixin Services PMI dropped sharply into contractionary territory.

AUSTRALIA DATA: Higher Petrol Prices Risk For Upcoming Consumer Data

Retail petrol prices were down less than a cent as of October 9, as measured by the Australian Institute of Petroleum, but month average prices to date have seen an increase of 8.4% due to the return of the full fuel excise at the end of September.

- This trend could impact this week’s consumer data with both consumer confidence and inflation expectations tending to move with petrol prices this year. As a result, sentiment could turn down again after last month’s tick up and inflation expectations could rise after three consecutive months of declines.

- Wholesale petrol prices rose more than 13 cents over the last week, which could put upward pressure on prices at the pump, according to the Australian.

- Crude oil prices are so far lower today (-0.9%) but both WTI and Brent are holding above $90/barrel after prices rose strongly last week on news that OPEC+ would cut production 2mn bpd.

Source: MNI - Market News, Australian Institute of Petroleum, Refinitv

Fig 2: Petrol prices and consumer confidence

Source: MNI - Market News, Australian Institute of Petroleum, Refinitv

FOREX: Greenback Tad Firmer, Antipodean Divergence Unfolds

The greenback firmed at the margin amid a number of closures across Asian financial centres. Markets were shut in Japan, South Korea, Taiwan and Malaysia, while the U.S. and Canada will also observe public holidays today. The BBDXY wavered, having a look above the prior trading day's high as it printed its best levels since Sep 29, before easing off. Swaps markets are still pricing ~73bp worth of tightening at the next FOMC meeting after the latest round of U.S. labour market data beat expectations.

- USD/JPY ran as high as to Y145.67 versus the recent cyclical high of Y145.90, with anything above Y145.00 deemed territory of heightened intervention risk. Some participants may have been taking the opportunity provided by a local holiday, as it would be unusual for Japanese officials to step in during a day off.

- The kiwi dollar tops the G10 pile at typing, while the Aussie is pacing losses. AUD/NZD turned heavy again, as Australia/New Zealand 2-year swap spread faltered, after last week's policy reviews by the Antipodean central banks indicated diverging rate-hike intentions.

- The weekend brought a suite of risk-negative headlines, including the news that a North Korean nuclear operation unit was exercising under the supervision of Kim Jong-un, as well as a particularly weak Caixin Services PMI released out of China. There was nothing in the way of strong risk-off reaction in G10 FX space.

- Spot USD/CNH climbed to CNH7.1485 before pulling back into negative territory as China returned from its week-long holiday. The PBOC maintained appreciation bias in its daily yuan fixing for the 28th straight day, albeit the fixing error was narrower than in the recent days.

- Focus turns to Norwegian CPI inflation, as well as comments from Fed's Brainard & Evans, ECB's Lane, Centeno & de Cos and Riksbank's Ingves, Breman & Ohlsson.

FX OPTIONS: Expiries for Oct10 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9800-10(E1.6bln), $0.9844-45(E1.1bln), $0.9875(E556mln), $0.9950(E709mln), $1.0050(E2.4bln)

- USD/JPY: Y145.00($672mln), Y147.35($779mln)

- EUR/JPY: Y144.00(E848mln)

- AUD/USD: $0.6560(A$616mln)

ASIA FX: USD Supported In Holiday Affected Markets

With quite a few markets out today (including Japan and South Korea), along with the US holiday this evening, overall moves have been fairly muted in the Asian FX space. CNH has traded resiliently, remaining within recent ranges, but the USD has firmer elsewhere for the most part. Only Philippines trade figures print tomorrow in terms of the data calendar.

- USD/CNH spiked to 7.1500 in early trade, but this proved short lived. We are back under 7.1200 now, with the 7.1500 level likely representing resistance in the near term. The fixing bias was more modest compared to late September as well. China equities are weaker, but the housing sub-index has outperformed.

- USD/INR spike to +82.70 at the open but likely intervention flows curbed these gains. We quickly got back sub 82.40, but we are slowly creeping higher. Cross asset headwinds from weaker equities and onshore bonds are weighing.

- Spot USD/IDR has added +45 figs and last trades at 15,298 as Asia digests better-than-forecast U.S. jobs report released last Friday. Indonesia's official consumer confidence index eased to 117.2 last month from 124.7 prior. Should we get above Oct 4 cycle high of 15,309, bulls could target the Apr 23, 2020 high of 15,598.

- Spot USD/PHP trades +0.07 at 58.999, close to the record highs of 59.005. BSP Gov Medalla said after hours Friday that the central bank has been "very active" in the FX market to curb peso volatility. He said monetary policy will be guided by inflation dynamics rather than FX market developments, but Bangko Sentral "will not allow excessive changes in the exchange rate." Philippine monthly trade data will cross the wires tomorrow. Headline trade deficit is expected to have shrunk to $5.800bn in August from $5.930bn prior.

- Spot USD/THB jumped at the re-open. We last traded at 37.73, +0.90% on last week's closing levels. From a technical standpoint, bulls set their sights on Sep 28 cyclical high of 38.450. Conversely, bears look for a retreat past Oct 6 low of 37.125, followed by the 50-DMA at 36.587.

CHINA DATA: Slowing Exports Another Growth Headwind?

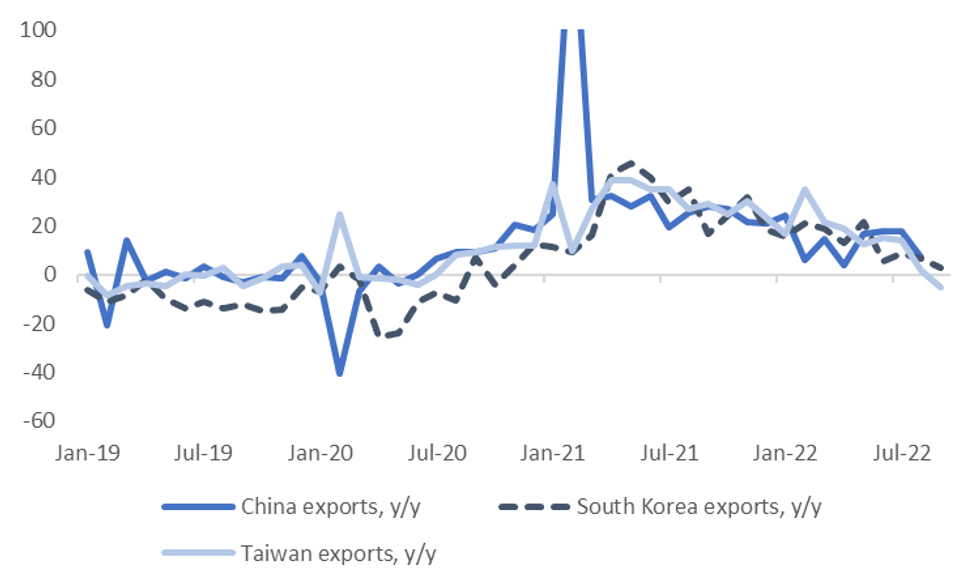

This Friday China trade figures are due. There will be a number of focus points. On the export front (market expects +4.0% y/y, versus 7.1% previously), September prints for South Korea and Taiwan already show a further slowing in external demand. The chart below overlays export growth for these two economies and China. The series are all reasonably correlated with each other, albeit not as strong in recent years, as Covid/supply chain disruptions have generated spikes/slumps in particular months.

- Still, the broad trends tend to follow each other. Taiwan's export update last Friday was particularly soft, falling to -5.3% y/y, well below expectations and the softest pace since early 2020.

- The longer run correlation between Taiwan and China export growth is 36%, slightly higher for South Korea at 41%, although as noted above these are lower in recent years.

- A weaker export picture for China, which has been a source of strength for the country earlier 2022, will put greater emphasis on the domestic recovery, particularly as we progress into 2023.

- Imports are expected to remain close to flat (0.2% y/y expected, versus 0.3% y/y previously).

Fig 1: China, South Korea & Taiwan Export Growth y/y

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Lower In Asia; U.S. Chip Curbs Sends Semiconductor Stocks Lower

Asia-Pac equity indices are entirely in the red today, tracking a strongly negative lead from Wall St. (major cash equity indices closed ~2.1-3.8% softer on Friday), with the MSCI APEX50 index sitting 1.6% worse off at typing, on track for a second straight lower daily close.

- Semiconductor stocks across the region were sharply lower across the session after the Biden administration slapped fresh restrictions on chip exports to China, with losses observed in the likes Hua Hong Semiconductor (-9.1%), and Shanghai Fudan Microelectronics (-18.0%).

- The underperformance in semiconductor stocks comes after AMD’s disappointing post-market financials last Thursday.

- The TAIEX (-1.4%) is accordingly lower as well, with bellwether and index heavyweight TSMC (-2.9%) contributing the most to drag.

- Hong Kong-listed Chinese equities struggled, with the Hang Seng China Enterprises Index dealing 2.6% softer at writing. China-based tech leads the way lower, with virtually all constituents in the HSTECH (-3.5%) trading lower at writing, underperforming the broader Hang Seng Index (-2.5%).

- Underperformance in China-based stocks comes as bearish pressure from a selloff in equities (owing to a rise in expectations for Fed hikes) has mixed with relatively muted Golden Week holiday spending.

GOLD: Holding Lower Post-NFPs As 75bp Fed Hike Increasingly Priced

Gold deals ~$2/oz softer to print ~$1,693/oz, operating a little above Friday’s worst levels at writing. The precious metal has held on to the bulk of its losses from Friday as the USD (DXY) hovers just shy of two-week highs.

- To recap, the precious metal closed ~$18 lower on Friday after falling to session lows (at $1,690.7/oz) as the release of better-than-expected U.S. NFPs saw expectations for Fed hawkishness return to the space, with the DXY and nominal U.S. Tsy yields pushing higher after.

- Nov FOMC dated OIS now price in ~72 bp of tightening at that meeting, pointing to an ~88% chance of a 75bp rate hike, operating at around its highest level since the Sep FOMC.

- Focus for gold now turns to U.S. CPI due later this week on Thursday.

- From a technical perspective, gold has breached initial support at $1,695.2 (former trendline resistance), exposing further support at $1,659.7 (Oct 3 low). On the other hand, initial resistance is seen at $1,729.5 (Oct 4 high).

OIL: Paring Recent Gains As Growth Worry Remains Elevated

WTI and Brent are ~$0.80 softer apiece, paring a little of their respective gains made on Friday as worry re: Fed hawkishness impacting economic growth (and the outlook for energy demand) has ticked higher, with equities across the Asia-Pac region struggling as well.

- To recap, both benchmarks closed ~$4 firmer apiece on Friday, hitting multi-week highs on tailwinds from continued tightness in U.S. crude and gasoline inventories, as well as OPEC+ decision to cut crude output targets by 2mn bpd on Wednesday.

- On the latter topic, WTI and Brent notched ~17% and ~11% higher weekly closes respectively, largely shrugging off the above-expectations NFPs print on Friday at the time.

- Looking ahead, participants continue to await a U.S. response to the OPEC+ decision, although some observers have stated that U.S. efforts may centre around the “NOPEC” bill for now amidst a lack of suitable, effective alternatives.

- Further out, some are watching for signs of a Q4 easing in China’s COVID-zero policy, with the country heading for the twice-a-decade party Congress on Oct 16.

- Brent’s prompt spread now sits at ~$1.97, a little shy of 13-week highs recorded last Friday.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/10/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/10/2022 | 0830/1030 | * |  | EU | Sentix Economic Index |

| 10/10/2022 | 1200/0800 |  | US | Chicago Fed's Charles Evans | |

| 10/10/2022 | - |  | EU | ECB Lagarde at IMF/World Bank Annual Meetings | |

| 10/10/2022 | 1300/1500 |  | EU | ECB Lane Opens ECB Monetary Policy Conference | |

| 10/10/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 10/10/2022 | 1735/1335 |  | US | Fed Vice Chair Lael Brainard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.