-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China/HK Equity Gains Moderate

EXECUTIVE SUMMARY

- FED'S MESTER SEES 3 CUTS THIS YEAR, NO NEED TO RUSH - MNI BRIEF

- FED'S HARKER SUPPORTED RATE HOLD, SEES INFLATION PROGRESS - MNI

- GAZA MEDIATORS SEARCH FOR 'FINAL FORMULA' FOR ISRAEL, HAMAS CEASEFIRE - RTRS

- UK TREASURY, BOE MUST DO QT VALUE -FOR-MONEY - TSC - MNI BRIEF

- CHINA SHARE BUYBACKS HIT THREE-YEAR HIGH AMID MARKET SLUMP - BBG

- NEW ZEALAND LABOUR MARKET PRESSURES EASE SLIGHTLY, JOBS MARKET STILL TIGHT - RTRS

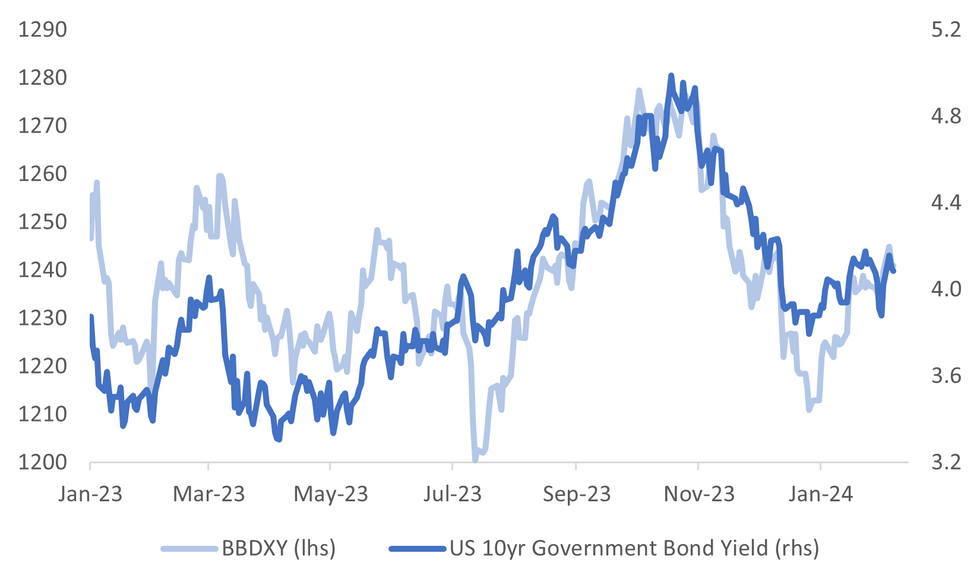

Fig. 1: USD BBDXY Versus 10yr Nominal US TSY Yield

Source: MNI - Market News/Bloomberg

U.K.

BOE (MNI BRIEF): Lawmakers have called on the Bank of England to work with the Treasury in order to factor in the scale of losses from quantitative tightening into its decision making on the pace and scales of asset sales.

ECONOMY (RTRS): British living standards will start to rise again this year but it will be 2027 before poorer households recover their pre-pandemic spending power, putting an onus on the next government to boost the country's slow economic growth, a think tank said.

EUROPE

CORPORATE (BBG): Bonds sold by Deutsche Pfandbriefbank AG are taking a record beating on Tuesday as an analyst call highlighted concerns about the German lender’s exposure to the US commercial property market.

NETHERLANDS (POLITICO): Negotiations to form the next Dutch government collapsed Tuesday night after Pieter Omtzigt, who leads the New Social Contract (NSC) party, quit the talks. Omtzigt said he was leaving the discussions due to disagreements over how to tackle the state of the government’s finances, but his party could support a minority Cabinet while remaining out of government, Dutch public broadcaster NOS reported.

NATO (POLITICO): Germany is piling pressure on Viktor Orbán to speed up approval of Sweden's NATO membership bid after the Hungarian leader's ruling Fidesz party held up ratification on Monday.

RUSSIA (ECONOMIST): Figures released on Wednesday are expected to show that GDP is growing by around 4% a year.

U.S.

FED (MNI): The Federal Reserve was right to keep rates on hold last week as evidence mounts that inflation is steadily coming down, Philadelphia Fed President Patrick Harker said Tuesday. “While inflation does remain above target, real progress is being made,” Harker said in prepared remarks that made no reference to possible rate cuts.

FED (MNI BRIEF): Cleveland Fed President Loretta Mester said Tuesday she supports three interest rate cuts for the year, unchanged from her projection in December, and said "there's no need to rush" to lower rates when the labor market and consumption data are so strong.

FED (MNI BRIEF): U.S. inflation is falling in a way that makes it appear likely the Federal Reserve can achieve a timely return to its 2% target, Minneapolis Fed President Neel Kashkari said Tuesday.

REAL ESTATE (MNI BRIEF): U.S. Treasury Secretary Janet Yellen said Tuesday she has concerns about commercial real estate, adding that banking supervisors are working closely with banks to build up loan loss reserves.

RATINGS (BBG): New York Community Bancorp’s credit grade was cut to junk by Moody’s Investors Service less than a week after the regional lender alarmed shareholders by slashing payouts and stockpiling reserves to cover troubled loans tied to commercial real estate.

POLITICS (RTRS): Donald Trump does not have immunity from charges he plotted to overturn his 2020 election defeat, a federal appeals court ruled on Tuesday, bringing the former U.S. president a step closer to an unprecedented criminal trial.

POLITICS (RTRS): The U.S. House of Representatives delivered a blow to Republican Speaker Mike Johnson when it voted on Tuesday against impeaching Democratic President Joe Biden's top border official.

OTHER

MIDEAST (RTRS): U.S., Qatari and Egyptian mediators prepared a diplomatic push to bridge differences between Israel and Hamas on a ceasefire plan for Gaza after the Palestinian group responded to a proposal for an extended pause in fighting and hostage releases.

SAUDI ARABIA (RTRS): Saudi Arabia has told the U.S. its position stands that there will be no diplomatic relations with Israel unless an independent Palestinian state is recognised on the 1967 borders with East Jerusalem, and Israeli "aggression" on the Gaza Strip stops, the Saudi foreign ministry said in a statement on Wednesday.

JAPAN (BBG): The Bank of Japan may scrap its negative interest-rate policy as soon as March and make multiple hikes this year, adding to the bearish outlook for the nation’s government bonds, according to Pacific Investment Management Co.

CANADA (MNI BRIEF): Bank of Canada Governor Tiff Macklem said Tuesday his focus remains on the target for headline inflation during a time of elevated housing prices, and reiterated discussion of cutting borrowing costs will emerge only when it's clear price stability is being restored.

NEW ZEALAND (RTRS): New Zealand labour pressures have eased slightly but the country's job market remains tight despite some cooling of the broader economy, according to data released by Statistics New Zealand on Wednesday. New Zealand's jobless rate rose to 4.0% in the fourth quarter, but was below expectations of a 4.2% unemployment rate, while employment increased 0.4%.

BRAZIL (MNI INTERVIEW): Brazil's Central Bank seems "comfortable" with a market consensus that sees the official Selic rate ending the year at 9.00%, the former head of BCB Department of Economic Research Marcelo Kfoury told MNI Tuesday, after the release of January meeting minutes.

CHINA

MARKETS (BBG): Chinese companies are ramping up share buybacks, playing their part in a widening rescue campaign to stem a $7 trillion rout in the world’s second-biggest stock market.

YUAN (21st CENTURY BUSINESS): More overseas long-term capital will buy the yuan should China’s stock market gradually rebound and the Chinese economy maintains a steady recovery, 21st Century Business Herald reported citing market insiders. The yuan strengthened against the rising U.S. dollar index which rebounded to 104.54 on Tuesday, due to the rally in Chinese stocks.

SHIPPING (YICAI): China’s exporters could face a shortage of containers should the Red Sea crisis continue, according to Chen Youwei, director of Robinson International Freight, adding that current supply was sufficient but decreasing rapidly.

REAL ESTATE (NAFR): All commercial banks must take the initiative to conduct timely reviews of recommended real-estate projects in the “whitelist” and accelerate credit approval to ensure that all reasonable financing needs are met, according to a statement by the National Administration of Financial Regulation on its website.

LOANS (CSJ): China’s January new loan figure could jump to about 4.5 trillion yuan, China Securities Journal reported, citing analysts.

CHINA MARKETS

MNI: PBOC Drains Net CNY148 Bln Via OMO Weds; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY396 billion via 14-day reverse repo on Wednesday, with the rates unchanged at 1.95%. The reverse repo operation has led to a net drain of CNY148 billion reverse repos after offsetting CNY544 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9305% at 09:30 am local time from the close of 1.9722% on Tuesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 43 on Tuesday, compared with the close of 51 on Monday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1049 on Wednesday, compared with 7.1082 set on Tuesday. The fixing was estimated at 7.1858 by Bloomberg survey today.

MARKET DATA

NZ 4Q JOBLESS RATE 4.0%; EST. 4.3%; PRIOR 3.9%

NZ 4Q EMPLOYMENT RISES 0.4% Q/Q; EST. +0.3%; PRIOR -0.1%

NZ 4Q EMPLOYMENT RISES 2.4% Y/Y; EST. +2.1%; PRIOR +2.7%

NZ 4Q NON-GOVT. ORDINARY TIME WAGES RISE 1.0% Q/Q; PRIOR 0.8%

NZ 4Q AVERAGE HOURLY EARNINGS RISE 0.5% Q/Q; PRIOR 2.0%

JAPAN DEC. PRELIM LEADING INDEX 110.0; EST. 109.3; PRIOR 108.1

JAPAN DEC. PRELIM COINCIDENT INDEX 116.2; EST. 116.1; PRIOR 114.6

SOUTH KOREA DEC. CURRENT ACCOUNT SURPLUS WIDENS TO $7.415B; PRIOR $3.89B

SOUTH KOREA DEC. GOODS TRADE SURPLUS WIDENS TO $8.037B; PRIOR $6.878B

MARKETS

US TSYS: Tsys Hold Steady Ahead Of 10Y Auction Later

TYH4 is currently trading at 110-10+, + 01 from New York closing levels.

A slow day in Asia as cash yields move 1-2bps lower across the curve in early morning trading and have held there throughout the day.

- Mar'24 10Y futures tested the highs from the US session of 111-11+ early, to then settle in a very tight range throughout the rest of the session, currently holding just below at 111-10.

- Cash yields are 1-2bps lower, the 2y now trading at 4.393%, 1bp lower, while the 10Y is 1.3bps lower at 4.086% to trade just above Tuesday lows of 4.080%.

- Pimco see multiple BOJ rate hikes coming as soon as March (BBG). Fed speak from Harker noted: “While inflation does remain above target, real progress is being made,” Harker said in prepared remarks that made no reference to possible rate cuts (MNI).

- Tonight's data focus includes ongoing attention to Fed speakers, Mortgage Applications, Trade Balance, and the 10-year Treasury sale.

JGBS: Richer After 30Y Supply, BoJ Rinban Operations Tomorrow

JGB futures are holding an uptick, +4 compared to settlement levels, after dealing in a relatively tight range in the Tokyo session.

- With the domestic calendar light today, Leading and Coincident Indices for December (Preliminary) are due later, the local market’s focus was likely on today’s 30-year supply.

- The auction showed solid demand metrics, with the low price meeting dealer expectations, the cover ratio increasing to 3.181x and the tail shortening.

- Today's auction result fell in line with last week’s 10-year supply, which bucked recent trends and showed solid demand metrics.

- As highlighted in the MNI Preview, today’s auction took place with an outright yield that was 15bps higher than the early January offering. Moreover, the 2/30 yield curve was 15bps steeper and the 10/30 curve was 5bps steeper than the levels observed in early January.

- US tsys are 1-2bps richer in today’s Asia-Pac session after finishing richer on Tuesday.

- Cash JGBs are dealing richer across the curve, with the 20-40-year zone leading (1.4-1.8bps richer). The benchmark 10-year yield is 1.3% lower at 0.710% versus the Nov-Dec rally low of 0.555%.

- The swaps curve has bull-flattened, with rates flat to 1.9bps lower. Swap spreads are generally wider.

- Tomorrow, the local calendar sees weekly International Investment Flows, BoP Current Account Balance, Bank Lending and Tokyo Avg Office Vacancies data, along with BoJ Rinban Operations covering 1-25-year JGBs.

AUSSIE BONDS: Richer, Mid-Range, Year-End Easing Expectations Back To 43bps

ACGBs (YM +3.0 & XM +3.0) are richer and sit in the middle of the Sydney session’s ranges. With the domestic calendar light today, local participants have been focused on US tsys after yesterday’s bounce back after two heavy days of selling. US tsys are ~1bps richer in today’s Asia-Pac session after finishing 4-7bps richer across benchmarks on Tuesday.

- The local market's movement today is also likely to have reflected the continuing digestion of yesterday’s less dovish RBA statement and a possible spillover from the sharp sell-off in NZGBs following stronger-than-expected Q4 Employment and Wages data.

- Cash ACGBs are 3bps richer, with the AU-US 10-year yield differential 1bp wider at +1bp.

- The latest round of ACGB Nov-28 supply saw the weighted average yield print 1.53bp through prevailing mids (per Yieldbroker), extending the recent trend of firm pricing at ACGB auctions.

- Swap rates are 2bps lower.

- The bills strip has slightly bull-flattened, with pricing flat to +3.

- RBA-dated OIS pricing is dealing mixed across meetings, with a cumulative 43bps of easing priced by year-end compared to 48bps going into yesterday’s decision.

- Nevertheless, terminal rate expectations have softened to 4.30% versus the prevailing effective cash rate of 4.32%.

- Tomorrow, the local calendar is empty.

NZGBS: Closed At Session Cheaps After Stronger Than Expected Employment & Wages Data

NZGBs closed on a weak note, with benchmark yields 8-13bps higher and the 2/10 curve flatter, after Q4 employment and wages data printed stronger-than-expected across the board: Employment Change 2.4% q/q vs 2.1% est. and an upwardly revised 2.7% prior, Unemployment Rate 4.0% vs 4.3% est. and 3.9% prior and Private Wages Including Overtime 1.0% q/q vs 0.8% est and 0.9% prior.

- Ahead of the data drop, NZGBs were little changed, ignoring the strength in US tsys overnight. US tsys have slightly extended the overnight rally, with yields ~1bp lower in today’s Asia-Pac session after yesterday’s 4-8bps drop across benchmarks.

- Swap rates are 8-12bps higher on the day, with the 2s10s curve flatter.

- RBNZ dated OIS pricing 8-16bps firmer for meetings beyond April. A cumulative 73bps of easing is priced by year-end compared to 96bps last Friday.

- Tomorrow, the local calendar is empty.

- Tomorrow, the NZ Treasury plans to sell NZ$275mn of the 1.5% May-31 bond, NZ$150mn of the 3.5% Apr-33 bond and NZ$75mn of the 2.75% Apr-37 bond.

FOREX: USD Close To Unchanged, NZD Aided By Jobs Data

The USD is relatively steady in Wednesday trade to date. The BBDXY last near 1240.80, down a touch from end Tuesdya levels in NY. Cross asset moves have been muted, with US yields a touch lower, while US equity futures have shown some volatility but since unchanged this afternoon.

- Early focus was on NZ Q4 employment data, which came out stronger than expected across all the indicators. NZD/USD rose to 0.6107 but had little follow through, we eventually got to 0.6112 but sit back closer to 0.6100 in recent dealings.

- Positive HK/China equity sentiment aided NZD and AUD gains, but markets are away from best levels this afternoon.

- AUD/USD sits near 0.6530 this afternoon against earlier highs of 0.6540. AUD/NZD has seen dips towards 1.0690 supported, the pair last near 1.0705. Sentiment is skewed lower in the pair given relative yield differentials and relative commodity prices, as we noted earlier (see this link).

- USD/JPY sits near 147.90 little changed for the session and having tracked a tight range overall (less than 30pips).

- Looking ahead, before industrial production and Swiss currency reserves are out. US and Canadian trade balance data also crosses, as well as further Fed Speak, with expected comments from Fed’s Kugler, Collins, Barkin and Bowman all due.

CHINA EQUITIES: Equity Rally Runs Out of Steam, Share Buy-Backs Reach Record High

After a strong start to trading in Asia today, Chinese and Hong Kong equities seem to have run out of steam, as tech names weigh on performance, this could be somewhat attributed to poor earning from SNAP late in the US session. Hong Kong equities trade in negative territory, while mainland China stock still hold onto gains for the day.

- As trading got underway in Asia, equity markets again ripped higher, HSI was at one point 2.4% higher but the gain were short lived and we quickly reversed the HSI is currently trading flat, while HS Tech is lower by 0.80% and mainland property index is 2.36% lower. China Mainland indices are faring slightly better today, with CSI 300 still holding onto gains to be 0.46% higher.

- Chinese companies have been ramping up their share buybacks after government authorities have pushed for companies to help support the slumping market, Chinese and Hong Kong listed companies spent 14b yuan repurchasing shares last month, the highest on record (BBG)

- In sector specific news, property names see further support after another government funding push, as the financial regulators call for a prompt implantation of financing coordination mechanism (BBG). While Chinese Vice Commerce minister held calls with US officials around concerns about US semiconductor control measures. This follows the meeting between China Vice Premier He Lifeng and US Treasury officials in Beijing on Tuesday (BBG). The talks included industrial policies and US concerns around over capacity

Asia Pac Equities: Equities Trade Higher, As Yields Trend Lower

Regional Asia Equities are mostly higher this afternoon, following on from the US trading session as yields moved lower and continued that trend in Asia trading, there has been little in way on news flow today.

- Japan equities indices opened weaker this morning as tech names weighed on the market, after SNAP missed earnings and plunged 20% in late US trading, the tech heavy Nikkei trades 0.20% lower today, recovering some of its early losses, while the Topix is 0.35% higher. In other news, Toyota's market value breaks ¥50 trillion for the first time, while Mitsubishi shares surged after they announced a monster share buy-back program to repurchase up to 10% of their shares.

- Australia Equities are higher today, after falling for the past two days. Lower US yields are supporting the move higher so far, as the market brushed of the hawkish rate talk from the RBA yesterday. Financials and Mining names are led the move higher today, with the ASX 200 closing 0.45% better. In stock specific news the potential merger between Woodside and Santos has been called off causing Santos equity to fall over 6%.

- South Korea stocks are higher today, snapping a two-day losing streak. Data out earlier showed SK Dec Current account surplus widen to $7.415B, currently the Kospi is trading 1.00% higher. South Korean equities have seen $220.7mn in offshore inflows in Wednesday trading to date.

- Elsewhere in SEA, it has been a strong start to trading with most markets trading 0.25-1.00% higher.

OIL: Crude Little Changed As More Red Sea Trouble Offset By Higher US Inventories

Oil prices are only up moderately during APAC trading today rising almost a percent on Tuesday as geopolitical tensions persist. But a pickup in US crude inventories has kept a lid on prices. WTI is 0.2% higher at $73.47/bbl after an intraday high of $73.72 earlier. Brent has been trending lower since its high at $78.69 and is now up 0.2% to $78.71. The USD index is moderately lower.

- US Central Command reported that six missiles were fired by Houthis at shipping yesterday in the Gulf of Aden and the southern Red Sea. MV Star Nasia was hit but there was only minor damage. With no end in sight for these attacks, more ships are taking the longer route around southern Africa. This has provided support to oil prices amid concerns of excess supply.

- A ceasefire deal in Gaza would likely drive crude lower. Qatar said that a draft has been presented to Hamas and the response so far was “positive”.

- Bloomberg reported that US crude inventories rose 674k barrels, less than expected, according to people familiar with the API data. While gasoline stocks rose 3.652mn, distillate saw a drawdown of 3.7mn. The official EIA data is out later today.

- Later the Fed’s Harker, Kugler, Collins, Barkin, Bowman, Remache and Nordstrom all speak. On the data front there is December US trade and consumer credit and German IP.

GOLD: Gains Ground As Fed Rhetoric Softens

Gold is little changed in the Asia-Pac session, after closing 0.5% higher at $2036.14 on Tuesday.

- Bullion’s performance on Tuesday reflected a weaker USD and lower US Treasury yields as Fedspeak softened its rhetoric. Cash US Treasuries are dealing ~1bp richer in today’s Asia-Pac session after finishing 4-8bps richer across benchmarks on Tuesday.

- There was a muted initial reaction to Fed Mester economic outlook comments, which were largely in line with Chairman Powell's comments. However, Mester later reiterated the likelihood of three rate cuts in 2024. Fed President Kashkari also sounded more placative of late.

- Projected Fed rate cut pricing gained slightly by Tuesday's close: March 2024 chance of 25bp rate cut at 20% vs. 17% prior. May 2024 at a cumulative -20bps at 5.12%, while June 2024 back to -43bp at 4.90%.

- Yesterday’s increase moved gold away from support at $2015.0 but it remains some way off resistance at $2065.5 (Feb 1 high).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/02/2024 | 0645/0745 | ** |  | CH | Unemployment |

| 07/02/2024 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/02/2024 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/02/2024 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/02/2024 | 0840/0840 |  | UK | BoE's Breeden Speaks At Women In Economics Event | |

| 07/02/2024 | 0900/1000 | * |  | IT | Retail Sales |

| 07/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/02/2024 | 1215/1215 |  | UK | BOE's Woods et al : Treasury Select Committee 'work of the PRA' | |

| 07/02/2024 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/02/2024 | 1330/0830 | ** |  | US | Trade Balance |

| 07/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/02/2024 | 1600/1100 |  | US | Fed Governor Adriana Kugler | |

| 07/02/2024 | 1630/1130 |  | US | Boston Fed's Susan Collins | |

| 07/02/2024 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 07/02/2024 | 1830/1330 |  | CA | BOC Minutes (Summary of Deliberations) | |

| 07/02/2024 | 1900/1400 |  | US | Fed Governor Michelle Bowman | |

| 07/02/2024 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.