-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese PMIs Disappoint

EXECUTIVE SUMMARY

- FED'S MESTER NOT READY TO ACCEPT RECENT INFLATION SURGE AS MEETING CENTRAL BANK'S GOAL (RTRS)

- ECB'S HOLZMANN SEES LONG-TERM TRENDS LOWERING INFLATION AGAIN (BBG)

- CHINA AUG M'FING PMI SLOWS; NON-MFING FALLS BELOW 50

- CHINA TO CURB DISORDERLY CAPITAL EXPANSION IN ENTERTAINMENT (BBG)

- U.S. ENDS 20-YEAR WAR IN AFGHANISTAN WITH FINAL EVACUATION FLIGHTS OUT OF KABUL (CNBC)

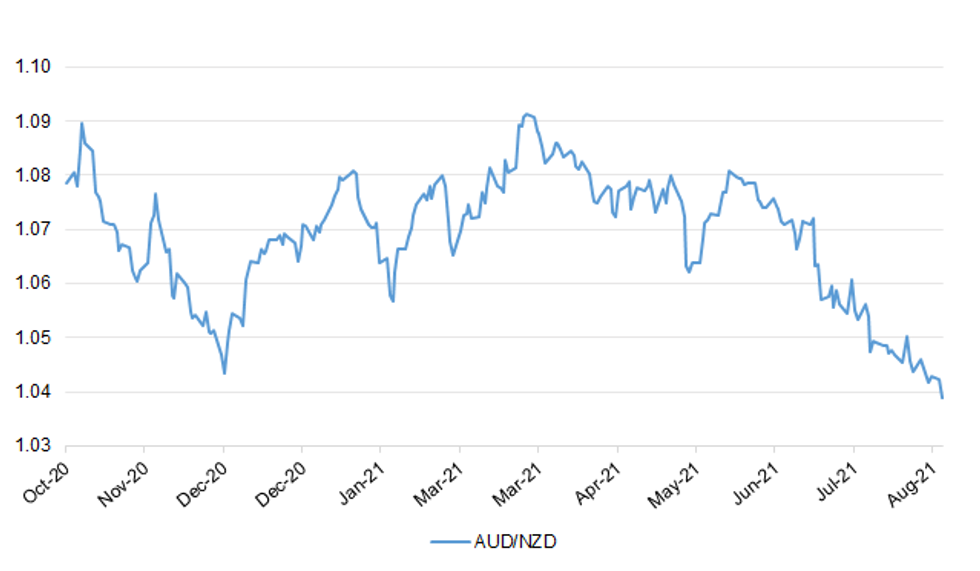

Fig. 1: AUD/NZD

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Hundreds of schools will be forced to reintroduce tougher Covid measures within weeks, teaching unions claimed as pupils begin to return to the classroom. With many schools restarting this week after the summer holidays, families have been warned to expect significant disruption to learning by the end of September because of a rise in cases. The country's largest education unions said the removal of many of the mitigations in place in classrooms last year, including bubbles and face masks, will fuel the surge. Some have also expressed concern that headteachers could face significant pressure from anxious parents to reimpose measures should large numbers of pupils test positive. (Telegraph)

CORONAVIRUS: Up to 700,000 vaccine passports have been affected by NHS blunders, locking many people out of foreign travel, after the wrong data was recorded by health officials, the Telegraph can reveal. Ministers have said Covid passes – already used for travel to dozens of countries – will become compulsory for entry to nightclubs and large venues by the end of next month. But hundreds of thousands of vaccine records have now been found to contain errors, including those which have left double-jabbed people without the proof they need. (Telegraph)

ECONOMY: Britons are facing a multibillion savings shortfall, despite many putting away extra cash during the pandemic, according to a new report. The Yorkshire Building Society says the difference between people's current savings and the amount they would need to feel financially secure totals £371bn. That's despite the UK household savings rate more than doubling to 16% in 2020. With lockdown restrictions reducing outgoings such as commuting costs, some people have found they had an opportunity to save more over the past year and a half. But Nitesh Patel, strategic economist at Yorkshire Building Society, said there were "still pockets of society who have been more significantly impacted." (BBC)

EUROPE

ECB: Long-lasting trends remain intact and will help sink inflation next year compared with 2020, ECB Governing Council member Robert Holzmann says in an interview with Austrian public broadcaster. Says 4th wave of the coronavirus will probably have a marginal impact on economic output in Austria. (BBG)

FISCAL: Austria's government is stepping up its efforts to urge fellow European Union nations to quicken a return to cautious budget policies, as the latest wave of the pandemic will require less stimulus. Finance Minister Gernot Bluemel said further measures to support economies were unlikely despite an increase in infections, as higher vaccination rates allowed governments to avoid lockdown measures. Instead, EU member states should look ahead and start rebuilding state financial coffers to prepare for future crises. They should step back and allow market mechanisms take back their role as the drivers of investment and expansion. (BBG)

U.S.

FED: Cleveland Federal Reserve Bank President Loretta Mester said on Monday that the U.S. economy is recovering strongly but she is not yet convinced that recent inflation readings will be enough to satisfy the price stability goal the U.S. central bank revamped a year ago. (RTRS)

FED: Federal Reserve Chair Jerome Powell risks inflation getting out of control and his assurance that the central bank can keep it in check neglects to mention this would require traumatic surgery, said former Richmond Fed President Jeffrey Lacker. (BBG)

FED: Representative Alexandria Ocasio-Cortez and a group of fellow progressive Democrats are calling on President Joe Biden to replace Federal Reserve Chair Jerome Powell when his term expires. "We urge President Biden to re-imagine a Federal Reserve focused on eliminating climate risk and advancing racial and economic justice," the representatives wrote in the statement Monday. "This consequential appointment has the potential to remake the composition of the Board of Governors." Representatives Ayanna Pressley, Rashida Tlaib, Mondaire Jones and Chuy Garcia joined Ocasio-Cortez in urging Biden to not nominate Powell for a second term. As members of the U.S. House, none of them have a vote in confirming Biden's choice for the central bank leadership. (BBG)

CORONAVIRUS: The Biden administration is encouraging states to offer gift cards or similar incentives to low-income people on Medicaid who get the Covid-19 vaccine, in a bid to boost inoculation rates that trail the broader public. The Centers for Medicare & Medicaid Services issued new guidance Monday to state Medicaid directors, offering federal funding and other assistance to boost vaccination rates among people covered by the health plan. There's been confusion about whether federal funding can support vaccination efforts in the program, an official familiar with the matter said. (BBG)

CORONAVIRUS: A new CDC presentation says the data needed to properly evaluate Covid-19 vaccine booster shots for the general population is limited — even as U.S. President Joe Biden pressures health officials to clear the shots for wide distribution beginning the week of Sept. 20. Slides published ahead of a presentation at a Centers for Disease Control and Prevention advisory group meeting Monday suggest the panel may limit its initial endorsement of extra shots to vulnerable groups and health-care workers. (CNBC)

CORONAVIRUS: A key Centers for Disease Control and Prevention advisory group on Monday unanimously endorsed the full approval of Pfizer and BioNTech's Covid-19 vaccine for Americans age 16 and older. The endorsement by the agency's Advisory Committee on Immunization Practices comes a week after the Food and Drug Administration granted the shot full approval. The approval – the first in the United States to win the coveted designation – spurred a new wave of vaccine mandates from private corporations and schools across the nation. (CNBC)

CORONAVIRUS: There have been no reported deaths among young U.S. adults who developed a rare heart inflammation known as myocarditis after getting the Pfizer Inc/BioNTech, COVID-19 vaccine, the Centers for Disease Control and Prevention said on Monday. (RTRS)

CORONAVIRUS: New Jersey Gov. Phil Murphy issued a warning Monday to residents who haven't received a Covid-19 vaccine, advising them to register for their first doses as hospitalizations and ventilator usage climb across the state. While Covid cases appear to be leveling off in New Jersey, Murphy said hospitalizations, ICU room and ventilator use are surging across the state. New cases in New Jersey jumped 5% from a week ago to a seven-day average of 2,003 new cases as of Sunday, according to a CNBC analysis of data compiled by Johns Hopkins University. (CNBC)

CORONAVIRUS: The Education Department has launched investigations into five states whose prohibitions on universal mask mandates in schools may run afoul of civil rights laws protecting students with disabilities, federal officials announced Monday. The department's civil rights head wrote to state education leaders in Iowa, Oklahoma, South Carolina, Tennessee, and Utah,, notifying them the department's Office for Civil Rights would determine whether the prohibitions are restricting access for students who are protected under federal law from discrimination based on their disabilities, and are entitled to a free appropriate public education. (New York Times)

EQUITIES: A controversial practice that has brought in billions of dollars to brokers and high-frequency trading firms is in the crosshairs of the Securities and Exchange Commission, and could be eliminated entirely. In an interview with Barron's on Monday, SEC Chairman Gary Gensler said that a full ban of payment for order flow is "on the table." Payment for order flow is a practice where brokers send trade orders to market makers that execute those trades in return for a portion of the profits. Gensler says the practice has "an inherent conflict of interest." Market makers make a small spread on each trade, but that's not all they get, he said. "They get the data, they get the first look, they get to match off buyers and sellers out of that order flow," he said. "That may not be the most efficient markets for the 2020s." He didn't say whether the agency has found instances where the conflicts of interests resulted in harm to investors. SEC staff is reviewing the practice and could come out with proposals in the coming months. (Barron's)

EQUITIES: PayPal is exploring a possible stock-trading platform. After rolling out the ability to trade cryptocurrencies last year, the payments giant has been exploring ways to let users trade individual stocks, according to two sources familiar with the plans, and public details around a new executive hire. (CNBC)

EQUITIES: PayPal Holdings Inc. is weighing bids from companies including Apex Fintech Solutions LLC and DriveWealth LLC as it seeks to offer stock-trading capabilities to its nearly 400 million users. The payments giant is still soliciting bids from potential partners and other companies could still be chosen to power the trading offering, according to people familiar with the matter. Spokespeople for PayPal and Apex Fintech Solutions declined to comment, while representatives for DriveWealth didn't have an immediate comment when reached by email. (BBG)

OTHER

GLOBAL TRADE: Suzuki will reduce vehicle production in Japan in September by ~20% to ~77,000 units from its initial plan because of chip shortages, Nikkan Kogyo reports, without attribution. The Japanese automaker notified its suppliers of the plan. Suzuki had earlier planned to increase production for the month to make up for output halts to date but seeing delays in recovery. (BBG)

GEOPOLITICS: U.S. climate envoy John Kerry will travel to China and Japan this week "to engage with international counterparts on efforts to address the climate crisis," the State Department said in a statement on Monday. The former secretary of state has led U.S. efforts to convince the global community of the threat of climate change and urge the acceleration of efforts to curb carbon emissions. On his trip to China, Kerry will look to build on commitments he helped secure during his visit in April, when the two countries, the world's two biggest carbon polluters, agreed to cooperate to curb climate change with urgency. In Japan, Kerry "will meet with counterparts to discuss efforts to drive collective climate action" ahead of the COP26 U.N. climate conference, which will be held in Scotland later this year, the statement said. (BBG)

CORONAVIRUS: European Union countries voted to reimpose restrictions on non-essential travel from the U.S. amid a surge in new coronavirus cases, dealing a fresh blow to the tourism industry. The U.S. had 588 new Covid-19 cases per 100,000 inhabitants in the two weeks ending Aug. 22, according to the European Centre for Disease Prevention and Control, well above the limit of 75 set out in the EU guidelines. The guidance from the bloc is a recommendation and any decision on who to let in, and what restrictions to impose, ultimately rests with the governments of each member state. Countries can also choose to accept proof of vaccination to waive travel restrictions. (BBG)

CORONAVIRUS: The U.S. State Department told residents to reconsider travel to Germany and Canada amid a "high level" of Covid-19 in the two countries. It raised their travel advisories, separately, by one notch to Level 3. (BBG)

BOJ: MNI INSIGHT: BOJ Watching Auto Part, Semiconductor Shortages

- Bank of Japan officials are increasingly concerned over the economic recovery timetable and may tweak or lower next month's assessments for industrial production and exports as automobile and related industries face continued shortages of semiconductors and parts, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Asahi Shimbun reports that PM Suga considers allowing lawmakers to serve out their full terms and holding a general election on October 17. The newspaper also says that the Premier is working on the appointment of key LDP executives ahead of the election. The article echoes Monday's report circulated by Kyodo, which cited unnamed government sources as noting that "under the scenario, Suga would not dissolve the lower house and official election campaigns would start on October 5". Kyodo sources said that some LDP members fear that the plan would involve a postponement of party leadership poll, currently slated for September 29. Many within the ruling party reportedly want to pick the new leader before the general election. Japanese media suggested that PM Suga is planning to replace LDP Secretary General and influential power broker Toshihiro Nikai. The octogenarian has reportedly accepted the move and continues to back Suga in party leadership contest. The imminent reshuffle of LDP executives comes alongside an expected retirement of some veteran LDP MPs. A number of party heavyweights are expected not to seek re-election and instead give way to younger candidates. (MNI)

JAPAN: Japanese Prime Minister Yoshihide Suga is considering a cabinet reshuffle in addition to changes of key positions within his leading Liberal Democratic Party, TV Asahi reports, without attribution. Changes to party leadership positions will be implemented next week, Kyodo reports separately, citing an unidentified person. (BBG)

AUSTRALIA: Australia's months-long outbreak of delta variant cases is worsening, despite half the nation's population being in Lockdown. New South Wales state, the nation's largest, recorded its fourth straight day of over 1,000 cases. More than 21,200 people have been infected since mid-June after authorities failed to contain a surge seeded from an unvaccinated chauffeur who was transporting flight crew in Sydney. Australia's capital Canberra extended its lockdown by two weeks until at least Sept. 17, after recording 13 cases on Tuesday. The tiny territory, located inside New South Wales state, issued stay-at-home orders on Aug. 12 after finding its first virus case in over a year. Victoria state will deliver on Wednesday a plan to introduce "modest changes" to begin reopening after a monthlong lockdown, with specific thresholds on vaccination and how many infections it will tolerate, state Premier Daniel Andrews said. (BBG)

NEW ZEALAND: New Zealand added another 49 new cases, bringing the total in a community outbreak to 612, the health ministry said. It's the second straight day the number of new infections has fallen, giving hope to the government's lockdown to pursue a zero-Covid policy. Yesterday, Prime Minister Jacinda Ardern said restrictions will be partially eased outside of Auckland, the epicenter of the outbreak, amid signs that the spread of the virus is being brought under control. (BBG)

SOUTH KOREA: South Korea on Tuesday proposed a record high budget of 604.4 trillion won (US$519 billion) for next year as it plans to maintain expansionary fiscal spending to cement the economic recovery and narrow social gaps caused by the pandemic. The proposed budget, endorsed by the Cabinet, marks an 8.3 percent on-year rise from this year's 558 trillion-won budget, according to the Ministry of Economy and Finance. The increase is lower than the 8.9 percent increase for this year. The government plans to submit the budget proposal to the National Assembly on Friday for approval. (Yonhap)

SOUTH KOREA: Talks about the Federal Reserve's tapering of asset purchases have had limited impacts on South Korea's financial market, but the country will monitor the situation with "extra" vigilance, a senior government official said Tuesday. Fed Chairman Jerome Powell said in a Jackson Hole speech Friday (U.S. time) that the Fed may begin to taper bond purchases this year, but he took a cautious stance about an early tapering of asset buying or a hike in interest rates. First Vice Finance Minister Lee Eog-weon said Powell's "dovish" stance has had limited impacts on global and local financial markets, but the government will closely monitor potential market volatility. (Yonhap)

CANADA: MNI DATA PREVIEW: Canada Q2 GDP Seen 2.5% Annualized vs Q1 5.6%

- Canada's GDP likely slowed to an annualized 2.5% pace in the second quarter as new pandemic lockdowns took effect, with investors wondering if momentum will rebound as businesses balance reopening plans with delta concerns - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MEXICO: Mexico's public debt chief, who designs the country's bond issuances, is stepping down as Finance Minister Rogelio Ramirez de la Orearranges his team after taking over the job. Jose de Luna Martinez is leaving the Mexican government's public credit unit after two years in the position, a person familiar with the decision said, declining to be named as the departure wasn't announced yet. The Finance Ministry didn't immediately comment. Ramirez de la O, a longtime confidant of President Andres Manuel Lopez Obrador, was ratified by congress as finance minister in early August and has already begun to make his mark, by working with the central bank to use about $12 billion from new International Monetary Fund reserves to repay debt. (BBG)

BRAZIL: President Jair Bolsonaro contemplates a new round of Covid cash handouts for low-income Brazilians as his popularity sinks ahead of next year's elections, according to five officials with knowledge of the matter. The idea is being pushed by close political advisers to the president, who worry about a delay in government plans to bolster and rebrand the country's permanent cash transfer policy, the people added, requesting anonymity because the discussion isn't public. (BBG)

BRAZIL: Senate president Rodrigo Pacheco said that by Tuesday he will seek a meeting with lower house speaker Arthur Lira and Supreme Court justice Luiz Fux to discuss a solution for court-ordered payments. It is possible that mediation will be carried out by National Justice Council to find a solution, Pacheco said, alongside Economy Minister Paulo Guedes to journalists in Brasilia. Brazil's Supreme Court solution for court-ordered payment is efficient, Guedes said. (BBG)

BRAZIL: Brazil became the latest major country to pass the U.S. in the percentage of its citizens who have had at least one dose of coronavirus vaccine as the government's inoculation campaign picks up speed and resistance to the shots fades away. About 63% of Brazilians have now received at least one dose, versus 62% of people in the U.S., according to Bloomberg's Covid-19 Vaccine Tracker. Countries including Germany, France and the U.K. have vaccinated at least 65% of the population with one shot, the data show. (BBG)

BRAZIL: Brazil's central government reported a primary budget deficit of 19.8 billion reais ($3.8 billion) in July, the Treasury said on Monday, more than the 17.3 billion reais deficit forecast in a Reuters poll of economists. (RTRS)

SOUTH AFRICA: Eskom Holdings SOC Ltd., which supplies almost all South Africa's electricity from coal-fired power plants, is considering spending 106 billion rand ($7.2 billion) on wind and solar energy by 2030. The investment plan, which Eskom could carry out by itself or in partnerships, is the most detailed demonstration yet of the utility's ambition to move away from coal by taking advantage of the nation's abundant wind and solar resources. The state-owned company envisages spending 61.75 billion rand on wind power and 44.25 billion rand on solar energy by the end of the decade, a company presentation seen by Bloomberg shows. Some of the projects are planned on the sites of coal-fired plants that are scheduled to close. Eskom confirmed the presentation and the costs without giving further detail. (BBG)

SOUTH AFRICA: A planned overhaul of South Africa's retirement-fund rules is primarily aimed at encouraging people to save more and will provide very limited scope for them to access their pensions early, a senior National Treasury official said. The reforms have been on the agenda for almost a decade, but gained momentum after the coronavirus pandemic upended the economy and pushed the unemployment rate to a record high. That's led to mounting calls on the government to make retirement provisions more readily accessible -- a step that could have dire socio-economic consequences if mishandled and pensions are frittered away. (BBG)

AFGHANISTAN: The United States finished its withdrawal efforts from Kabul's airport, the Pentagon said Monday, effectively ending a 20-year conflict that began not long after the terrorist attacks of Sept. 11, 2001. The last C-17 military cargo aircraft departed Hamid Karzai International Airport Monday afternoon, according to U.S. Marine Corps General Kenneth McKenzie, commander of U.S. Central Command, completing a massive evacuation effort that flew more than 116,000 people out of Afghanistan over the past two weeks. "While the military evacuation is complete, the diplomatic mission to ensure additional U.S. citizens and eligible Afghans who want to leave continues," added McKenzie, who oversees the U.S. military mission in the region. (CNBC)

AFGHANISTAN: The Taliban needs to attract foreign investment, including building infrastructure, to use Afghanistan's vast mineral wealth to keep the country's economic system afloat, the Global Times said in a commentary reacting to western media reports that China eyes nation's mineral resources under the excuse of helping rebuild the country. As the U.S. and the West threaten to cut off funding, if Afghanistan cannot cash in on its mineral wealth, it will turn to the drug economy, causing its neighbours to suffer, the newspaper said. A thriving mineral and mining sector lifts up ordinary Afghanis while also creating a pathway for the country to become a productive and stable regional actor, the state-owned newspaper said. (MNI)

MIDDLE EAST: The Saudi-led coalition in Yemen said on Tuesday that it intercepted a Houthi drone that was targeting Saudi Arabia's Abha International Airport, state media reported. (RTRS)

MARKETS: Hong Kong's central bank and top financial regulator are developing a system to track dangerously concentrated exposures to stocks as part of efforts to prevent an Archegos Capital-style blow-up, according to two people familiar with the matter. The project, which was launched in the wake of the debacle at the family office run by Bill Hwang, will use centralised trade databases to identify excessive risk-taking by banks and investment funds trading derivatives on Hong Kong markets. The people familiar with the matter said the project had garnered the attention of regulators in the US, where the collapse of Archegos in April was one of the most spectacular on Wall Street in a decade. (FT)

OIL: Oil production in the U.S. Gulf of Mexico on Monday remained largely halted in the aftermath of Hurricane Ida, with 1.72 million barrels of output suspended, according to offshore regulator the Bureau of Safety and Environmental Enforcement (BSEE). The powerful storm on Sunday tore through the central Gulf, forcing the evacuation of hundreds of oil and gas production platforms and drilling rigs, a U.S. tally showed. Oil companies on Monday were beginning to assess their facilities, several said. (RTRS)

OIL: Refineries clustered around the city of New Orleans, Louisiana, are taking stock and assessing the impact Hurricane Ida had on their plants and surrounding infrastructure, with nearly 75% of Louisiana refining capacity offline as of Aug. 30. The storm made landfall as a Category 4 hurricane on Aug. 29, about 100 miles south of New Orleans, near Port Fourchon. According to estimates from S&P Global Platts Analytics, about 2.2 million b/d of refining capacity was offline from the storm as of Aug. 30, with the majority of plants without power from outside supplier Entergy. (Platts)

OIL: More than a dozen U.S. House members are asking President Joe Biden to intervene in the construction of the Enbridge Line 3 pipeline in northern Minnesota. The federal government has a responsibility to uphold treaties and engage with Tribal nations, whose rights appear to have been violated by state agencies and local law enforcement, the lawmakers write in a letter to Biden. (BBG)

OIL: Mexican state oil firm Petroleos Mexicanos (Pemex) said on Monday that its has resumed 421,000 barrels per day in oil production and brought back online 125 wells following a deadly fire at an offshore platform on Aug. 22. The accident in the southern Gulf of Mexico at the offshore platform that is part of Pemex's most productive oil field Ku-Maloob-Zaap, knocked out about 25% of Mexico's total production. (RTRS)

CHINA

POLICY: China's top leadership called for strengthening anti-monopoly measures and further implementing fair competition policies, including increasing supervision on platform economy, technological innovation and information security, according to a statement by Xinhua News Agency following a Monday meeting on reform chaired by President Xi Jinping. The leadership also emphasized that China must have national reservers befitting a large nation, improve the strategy and emergency material reserve system, as well as enhance commodity reserves to help stabilize the market, Xinhua said. (MNI)

POLICY: China will curb disorderly capital expansion in the entertainment industry, which is against the socialist values, the Communist Party's discipline commission says in a commentary on website. Statement mentioned film stars' scandals and fans' spendings as example of disorderly actions. Capitalists must not seek improper political interest, the commentary says, without identifying anyone. Monopoly in some online platforms and after-class tutoring burdens are also caused by exessive capital expansion. (BBG)

FISCAL: China is likely to accelerate the sales of local government special bonds and increase fiscal spending to boost the growth in H2, while reserving some quotas for use in December to help Q1 growth, the Shanghai Securities News reported citing analysts. The PBOC will moderately inject long-term funds to support infrastructure investment, especially providing precise support to SMEs, agriculture and manufacturing sectors, the newspaper said. Meanwhile, short-term and long-term measures to promote employment are important for an internal demand-driven economy, the newspaper said citing Guan Tao, the global chief economist of BOC Securities. (MNI)

OVERNIGHT DATA

CHINA AUG M'FING PMI 50.1; MEDIAN 50.2; JUL 50.4

CHINA AUG NON-M'FING PMI 47.5; MEDIAN 52.0; JUL 53.3

CHINA AUG COMPOSITE PMI 48.9; JUL 52.4

JAPAN JUL, P INDUSTRIAL OUTPUT +11.6% Y/Y; MEDIAN +11.2%; JUN +23.0%

JAPAN JUL, P INDUSTRIAL OUTPUT -1.5% M/M; MEDIAN -2.5%; JUN +6.5%

JAPAN JUL UNEMPLOYMENT 2.8%; MEDIAN 2.9%; JUN 2.9%

JAPAN JUL JOB-TO-APPLICANT RATIO 1.15; MEDIAN 1.12; JUN 1.13

JAPAN JUL HOUSING STARTS +9.9% Y/Y; MEDIAN +5.3%; JUN +7.3%

JAPAN JUL ANNUALISED HOUSING STARTS 0.926MN; MEDIAN 0.869MN; JUN 0.866MN

JAPAN AUG CONSUMER CONFIDENCE INDEX 36.7; MEDIAN 36.0; JUL 37.5

AUSTRALIA Q2 BOP CURRENT ACCOUNT BALANCE +A$20.5BN; MEDIAN +A$21.4BN; Q1 +A$18.9BN

AUSTRALIA Q2 NET EXPORTS OF GDP -1.0PP; MEDIAN -1.0PP; Q1 -0.6PP

AUSTRALIA JUL BUILDING APPROVALS -8.6% M/M; MEDIAN -5.0%; JUN -5.5%

AUSTRALIA JUL PRIVATE SECTOR HOUSES -5.8% M/M; JUN -10.1%

AUSTRALIA JUL PRIVATE SECTOR CREDIT +4.0% Y/Y; MEDIAN +3.5%; JUN +3.1%

AUSTRALIA JUL PRIVATE SECTOR CREDIT +0.7% M/M; MEDIAN +0.5%; JUN +0.9%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 101.8; PREV. 101.6

Consumer confidence rose 0.2% last week despite rising COVID case numbers. Sentiment in Sydney gained 0.9%, as daily case numbers rose above 1,000 for the first time. Confidence fell in Brisbane (-1.6%), Melbourne (-1.9%), Adelaide (-8.6%) and Perth (-0.8%). The overall steady outlook may reflect the increasing vaccination rates across the country and the hope that this will eventually bring lockdowns and border closures to an end. (ANZ)

NEW ZEALAND AUG ANZ BUSINESS CONFIDENCE -14.2; JUL -3.8

NEW ZEALAND AUG ANZ ACTIVITY OUTLOOK 19.2; JUL 26.3

This month we divide the survey into before and after lockdown. The two samples account for roughly 75% and 25% of the responses respectively. While it's obviously very early days, some key themes are evident: The inevitable lockdown impact is clear. But it's worth noting that many activity indicators, including own activity and investment intentions, were easing (from high levels) before lockdown. Employment intentions are so far looking robust, but time will tell. Inflation pressures remain intense. (ANZ)

NEW ZEALAND JUL BUILDING PERMITS +2.1% M/M; JUN +4.0%

SOUTH KOREA JUL INDUSTRIAL OUTPUT +7.9% Y/Y; MEDIAN +7.2%; JUN +11.5%

SOUTH KOREA JUL INDUSTRIAL OUTPUT +0.4% M/M; MEDIAN -0.5%; JUN +2.3%

SOUTH KOREA JUL CYCLICAL LEADING INDEX CHANGE -0.2; JUN +0.3

UK AUG LLOYDS BUSINESS BAROMETER 36; JUL 30

CHINA MARKETS

PBOC NET INJECTS CNY40BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) conducted CNY50 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation injected net CNY40 billion into the market due to the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2070% at 09:24 am local time from the close of 2.3298% on Monday.

- The CFETS-NEX money-market sentiment index closed at 46 on Monday vs 39 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4679 TUES VS 6.4677

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4679 on Tuesday, compared with the 6.4677 set on Monday.

MARKETS

SNAPSHOT: Chinese PMIs Disappoint

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 321.03 points at 28113.99

- ASX 200 up 44.464 points at 7548.9

- Shanghai Comp. down 26.611 points at 3501.54

- JGB 10-Yr future down 2 ticks at 152.19, yield up 0.1bp at 0.023%

- Aussie 10-Yr future up 0.5 tick at 98.860, yield down 0.5bp at 1.155%

- U.S. 10-Yr future +0-02+ at 133-19+, yield down 0.34bp at 1.275%

- WTI crude down $0.21 at $69.00, Gold up $4.48 at $1814.86

- USD/JPY down 2 pips at Y109.90

- FED'S MESTER NOT READY TO ACCEPT RECENT INFLATION SURGE AS MEETING CENTRAL BANK'S GOAL (RTRS)

- ECB'S HOLZMANN SEES LONG-TERM TRENDS LOWERING INFLATION AGAIN (BBG)

- CHINA AUG M'FING PMI SLOWS; NON-MFING FALLS BELOW 50

- CHINA TO CURB DISORDERLY CAPITAL EXPANSION IN ENTERTAINMENT (BBG)

- U.S. ENDS 20-YEAR WAR IN AFGHANISTAN WITH FINAL EVACUATION FLIGHTS OUT OF KABUL (CNBC)

BOND SUMMARY: Core FI Off Best Levels In Tight Asia Trade

A softer than expected non-manufacturing PMI out of China saw a contractionary print for the first time since Feb '20 (and was accompanied by a largely in line with exp. manufacturing print) provided some support for T-Notes, although the contract stuck to a thin 0-04+ range in Asia dealing. The contract last deals +0-03 at 133-20, 0-02 off highs, while the major cash Tsy benchmarks trade little changed to ~0.8bp firmer on the day. The PMI data represent the latest round of disappointing economic releases out of China, with worry evident re: the country's growth trajectory and expectations building for increased fiscal support (via an uptick in local government bond issuance) in the coming months. Tuesday's U.S. docket will be headlined by the latest MNI Chicago PMI print and consumer confidence reading.

- A lacklustre Tokyo session saw JGB futures add incrementally to their modest overnight uptick, before some cheapening was witnessed, with the contract last -2. Cash JGB trade has seen 7s outperform, richening by ~1.0bp with the remainder of the curve printing somewhere between little changed and ~0.5bp richer on the day. Speculation surrounding budget requests for next FY and a potential cabinet reshuffle did the rounds. 2-Year JGB supply passed smoothly, especially when you consider the perceptions around a lack of onshore demand, with the cover ratio ticking higher and price tail narrowing vs. the prev. auction. Elsewhere, the low price topped broader dealer exp. (which stood at 100.26, per the BBG dealer poll). Offshore interest likely aided the takedown of today's auction.

- Aussie bond futures stuck to tight ranges, leaving YM +0.5 & XM unch. at typing. Local data was mixed, with private sector credit topping exp., building approvals missing and a slightly narrower than exp. Q2 BoP current a/c surplus observed alongside an as exp. net export contribution to GDP reading (-1.0ppt). The space also looked through the previously flagged Chinese PMI readings and today's NSW COVID case count, which was a little shy of yesterday's record print. Elsewhere on the COVID front, Canberra extended its lockdown through mid-Sep.

JGBS AUCTION: Japanese MOF sells Y2.4373tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.4373tn 2-Year JGBs:

- Average Yield -0.129% (prev. -0.126%)

- Average Price 100.269 (prev. 100.263)

- High Yield: -0.127% (prev. -0.122%)

- Low Price 100.265 (prev. 100.255)

- % Allotted At High Yield: 43.1236% (prev. 3.3441%)

- Bid/Cover: 4.504x (prev. 4.185x)

EQUITIES: China Leads The Way Lower

A mostly negative session for markets in the Asia-Pac region, shaking off a positive lead from the US where major indices once again hit record highs. Bourses in China lead the way lower with losses of around 1.4%; PMI data fell with non-manufacturing in contractionary territory while the regulatory crackdown continues. The CSRC said it will target private equity funds that are sold to the general public instead of targeted investors in a bid to address embezzlement of assets. Chinese President Xi said China must strengthen anti-monopoly work and will push forward reform. Markets in Japan are also lower, Japanese media suggested that PM Suga considers a plan to hold the general election on Oct 17. In South Korea markets managed to stay in positive territory after the government announced plans for another expansionary budget that is 8.3% bigger than the current year. In the US futures are higher, the S&P 500 recorded a record high yesterday – the 12th in August. Markets look ahead to CPI and GDP data from around Europe later today and will have one eye on US NFP figures later this week.

OIL: Crude Futures Set For Worst Month Since Oct 2020

Oil is lower in Asia-Pac trade, losing ground amid risk off sentiment in the region. Crude futures finished with slight gains yesterday after recovering from session lows hit in the European morning. On a monthly basis futures are on track to finish around 6% lower, the worst week since October 2020. Markets continue to weigh the restoration of production in the Gulf of Mexico as the threat from Hurricane Ida recedes, while looking ahead to the latest OPEC+ meeting Wednesday. The group will assess the impact on demand from the spread of the delta variant and its implications for plans to return 400k bpd of supply to the market.

GOLD: Stable In Asia

Bullion has consolidated in Asia, with spot last dealing little changed just above $1,810/oz. This comes after the broader USD and U.S. real yields stabilised on Monday, after coming under pressure in the wake of Fed Chair Powell's comments on Friday. In turn, bullion edged away from its Asia-Pac highs during the first trading session of the week, leaving a familiar technical overlay in play.

FOREX: AUD/NZD Dips Amid Broken Barrier Chatter, Loonie Lags G10 Pack

AUD/NZD plunged to its lowest point since Apr 2020 amid talk of broken barrier option at NZ$1.0400, with BBG trader source pointing to poor liquidity in the NZD leg. The Kiwi dollar remained comfortably the best G10 performer and modest improvement in the local Covid-19 situation may have helped it cling onto the bulk of gains registered on the back of the aforementioned downswing in AUD/NZD. New Zealand reported 49 new cases today, the lowest number in six days and all of them in Auckland. The alert level in all areas south of Aotearoa's largest city will be moved down a notch at midnight today.

- Other commodity-tied currencies traded on a softer footing as crude oil cheapened. The loonie suffered the largest loss amid uncertainty surrounding the outcome of PM Trudeau's political gambit, with the Premier set to fight an uphill re-election battle after calling a snap poll.

- Spot USD/CNH crept higher before giving away most gains. The rate showed a muted reaction to a miss in China's official Non-M'fing PMI, which unexpectedly flipped into contraction.

- The greenback struggled for any momentum and the DXY printed its worst levels in two weeks while testing its 50-DMA.

- London trading reopens after a UK bank holiday, with U.S. MNI Chicago PMI & consumer confidence, German unemployment and EZ CPI set to take focus on the data front today. Central bank speaker slate includes ECB's Holzmann, Knot & Lane as well as Riksbank's Floden.

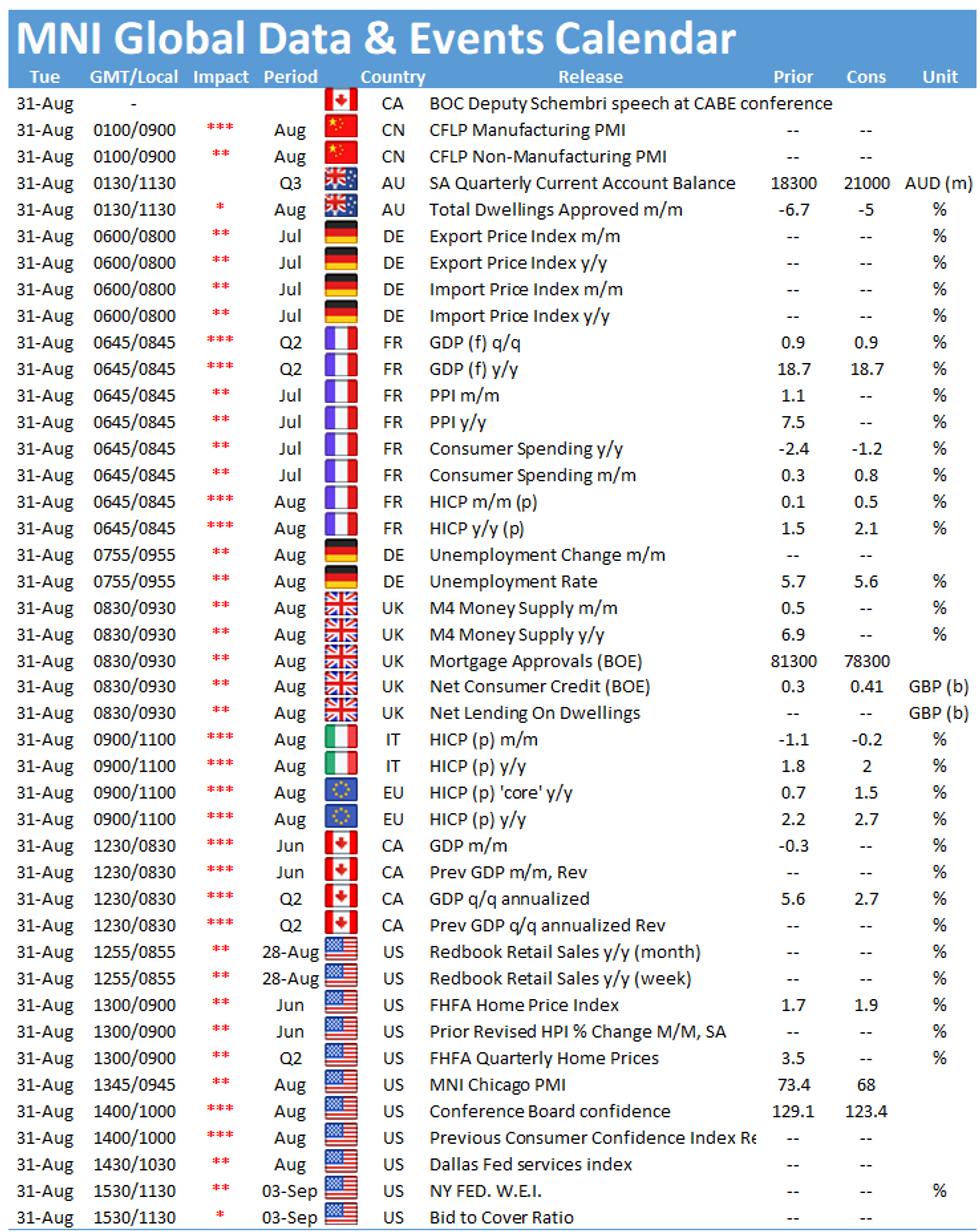

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.