-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Japan Wages Beat Helps Fuel BoJ Expectations

EXECUTIVE SUMMARY

- FED’S POWELL - NEED MORE DATA CONFIDENCE TO CUT - MNI BRIEF

- FED’S KASHKARI SEES 1 OR 2 RATE CUTS THIS YEAR - MNI BRIEF

- CHINA SHOULD SUPPORT DEVELOPERS CONTINUED OPERATION - MNI BRIEF

- SOME JAPAN GOVERNMENT OFFICIALS SUPPORT NEAR-TERM BOJ RATE HIKE - BBG

- STEADY MOVES NOTED TOWARD 2% - BOJ’S NAKAGAWA - MNI BRIEF

- JAPAN REAL WAGE NARROWS TO -0.6%, BEATS EXPECTATIONS - MNI BRIEF

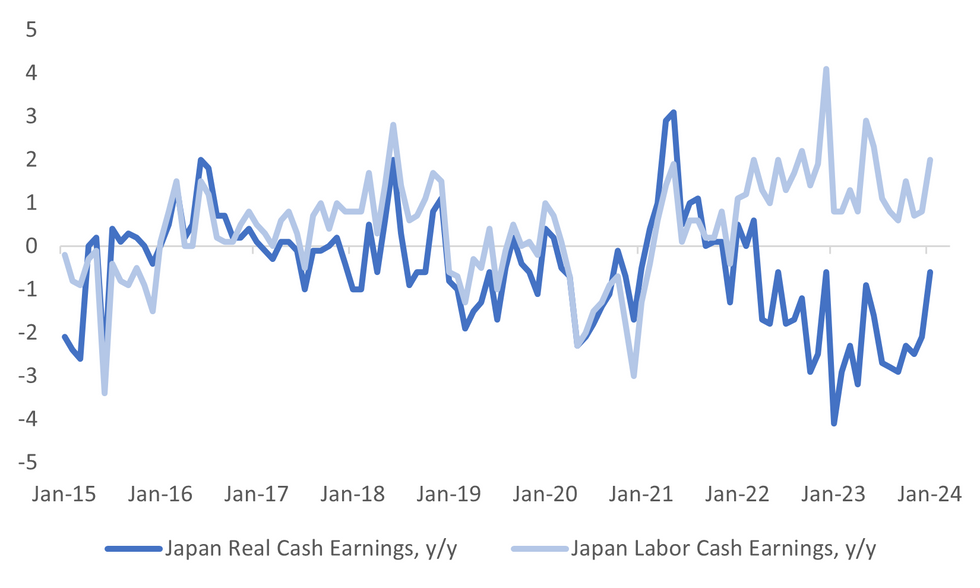

Fig. 1: Japan Real & Nominal Cash Earnings Y/Y

Source: MNI - Market News/Bloomberg

U.K.

POLITICS (BBG): Chancellor of the Exchequer Jeremy Hunt handed millions of British workers a £10 billion ($12.7 billion) a year tax cut paid for by stealing Labour’s flagship policies and squeezing public services as he drew political battle lines for the upcoming election.

EUROPE

HUNGARY (MNI INTERVIEW): Hungary’s debt management agency will sell Japanese and Chinese currency bonds worth up to EUR500 million later this year, but is unlikely to add to planned benchmark euro or dollar issuance for the moment as it leaves room for any shortfall in future domestic demand, its head Zoltan Kurali told MNI.

ECB (BBG): European Central Bank officials meeting to discuss interest rates are now also attempting to stem a mounting spat over freedom of thought at the institution. Two statements were issued to staff on Wednesday, according to postings on its intranet seen by Bloomberg, days after a panel representing employees declared itself “shocked” at remarks about views on climate change cited by media from an internal meeting.

CZECH (POLITICO): The Czech government of Prime Minister Petr Fiala has scrapped a tradition of informal joint cabinet meetings with its Slovak counterpart, with whom it sharply disagrees over policy toward Russia.

U.S.

FED (MNI BRIEF): Federal Reserve Chair Jerome Powell said Wednesday policymakers need "a little bit” more data to gain confidence that inflation is coming down sustainably to 2%, which will allow the central bank to lower interest rates at some point this year.

FED (MNI BRIEF): Federal Reserve Bank of Minneapolis President Neel Kashkari said Wednesday his base case includes two interest rate cuts this year, same as his projection in December, but he could mark that down to just one cut by the time the FOMC submits fresh projections later this month.

FED (MNI BRIEF): U.S. consumers are becoming increasingly resistant to price increases, making it harder for businesses to pass on higher costs, according to the latest Federal Reserve Beige Book report released Wednesday.

CORP (BBG): Commercial real estate lender New York Community Bancorp received an equity investment of more than $1 billion, gaining a vote of confidence in the struggling lender from investors including former US Treasury Secretary Steven Mnuchin.

OTHER

MIDEAST (BBG): A missile strike on a commercial ship in the Gulf of Aden resulted in the first confirmed deaths of crew members since Houthi militants began a wave of attacks against commercial shipping in one of the world’s busiest sea lanes.

JAPAN (BBG): The Bank of Japan has a tacit greenlight from some government officials to end its negative interest rate either in March or April as prospects for wage hikes look promising, according to people familiar with the matter.

JAPAN (MNI BRIEF): The y/y drop of inflation-adjusted real wages, a barometer of households' purchasing power, narrowed to 0.6% in January from a 2.1% fall in December, beating the market's -1.5% forecast, preliminary data released by the Ministry of Health, Labour and Welfare on Thursday showed.

JAPAN (MNI BRIEF): Bank of Japan board member Junko Nakagawa said on Thursday that Japan has made steady progress toward the achievement of the bank’s 2% price target as corporate wage-setting behaviour changes.

JAPAN (BBG): Japan’s UA Zensen says early results from this year’s spring wage negotiations for its union members show full-time workers secured average pay increases of 6.7%.

CANADA (MNI BRIEF): Bank of Canada Governor Tiff Macklem on Wednesday deflected questions about whether he could provide forward guidance before cutting interest rates and how fast he could move once he begins, saying it's premature to discuss after holding borrowing costs amid upside inflation risks.

CHINA

ECONOMY (SECURITIES TIMES): Analysts said they are optimistic about the outlook for China’s capital market following a rare joint briefing by senior financial and economic officials during the National People’s Congress in Beijing, Securities Times reports.

TRADE (MNI BRIEF): China's exports registered a 7.1% y/y increase in the first two months of 2024, leading a strong start to the year, data released by Customs on Thursday showed.

EQUITIES (CSJ): China should step up crackdown on major illegal stock market activities such as earnings statement falsification and fund misappropriation by listed companies’ board directors, senior executives or controlling shareholders, China Securities Journal reported, citing Sha Yan, president of the Shenzhen Stock Exchange and a delegate to the National People’s Congress.

CPI (YICAI): Authorities should prioritise ensuring CPI levels reach about 2% this year to guide social expectations and increase consumption and investment, according to Zhang Bin, NPC member and senior researcher at the China Finance Forum 40.

PROPERTY (MNI BRIEF): Authorities must focus on supporting the continued and stable operation of most real-estate companies, especially leading private developers, by easing their access to liquidity to ensure the delivery of unfinished housing projects, said Yi Gang, former governor of the People’s Bank of China on Thursday.

CAPITAL FLOWS (MNI BRIEF): Policymakers should make efforts to increase the proportion of foreign investment in China’s capital markets while also ensuring financial and economic security, Yi Gang, former PBOC governor has recommended in a speech at the National People’s Congress.

AI (21st CENTURY BUSINESS HERALD): The Ministry of Industry and Information Technology will focus on future industry such as general AI, humanoid robots, brain-computer interfaces and the metaverse to accelerate key technological breakthroughs, said Liu Bochao, deputy director at the ministry's Science and Technology Department.

CHINA MARKETS

MNI: PBOC Drains Net CNY107 Bln Via OMO Thurs; Rates Unchanged

The People's Bank of China (PBOC) conducted CNY10 billion via 7-day reverse repo on Thursday, with the rates unchanged at 1.80%. The reverse repo operation has led to a net drain of CNY107 billion reverse repos after offsetting CNY117 billion maturity today, according to Wind Information.

- The seven-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.8300% at 09:28 am local time from the close of 1.8351% on Wednesday.

- The CFETS-NEX money-market sentiment index, measuring interbank money-market liquidity, closed at 49 on Wednesday, compared with the close of 44 on Tuesday. A higher reading points to tighter liquidity condition, with 50 representing an equilibrium.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 7.1002 on Thursday, compared with 7.1016 set on Wednesday. The fixing was estimated at 7.1905 by Bloomberg survey today.

MARKET DATA

NZ 4Q MANUFACTURING SALES FALL 0.7% Q/Q; PRIOR -2.8%

NZ 4Q MANUFACTURING VOLUMES FALL 0.6% Q/Q; PRIOR -3.2%

AUSTRALIA JAN. HOME-LOAN VALUES FALL 3.9% M/M; EST. +2.0%; PRIOR -4.1%

AUSTRALIA JAN. OWNER-OCCUPIED HOME LOAN VALUES FALL 4.6% M/M; PRIOR -5.6%

AUSTRALIA JAN. INVESTOR LOAN VALUES FALL 2.6% M/M; PRIOR -1.6%

AUSTRALIA JAN. TRADE SURPLUS A$11.027B; EST. +A$11.500B; PRIOR A$10.743B

AUSTRALIA JAN. EXPORTS RISE 1.6% M/M; PRIOR +1.5%

AUSTRALIA JAN. IMPORTS RISE 1.3% M/M; PRIOR +4.0%

CHINA JAN.-FEB. EXPORTS IN USD TERMS RISE 7.1% Y/Y; EST. +1.9%; DEC. -4.6%

CHINA JAN.-FEB. IMPORTS IN USD TERMS RISE 3.5% Y/Y; EST. +2.0%; DEC. -5.5%

CHINA JAN.-FEB. TRADE SURPLUS $125.16B YTD; EST. +$106.80B

CHINA JAN.-FEB. EXPORTS IN YUAN TERMS RISE 10.3% Y/Y; DEC. +0.6%

CHINA JAN.-FEB. IMPORTS IN YUAN TERMS RISE 6.7% Y/Y; DEC. -0.3%

CHINA JAN.-FEB. TRADE SURPLUS CNY890.87B YTD

JAPAN JAN. LABOR CASH EARNINGS RISE 2.0% Y/Y; EST. +1.2% ; PRIOR +0.8%

JAPAN JAN. SAME BASE REGULAR FULL-TIME PAY +2.0% Y/Y; EST. +2%; PRIOR +2.1%

JAPAN JAN. CASH WAGES FROM SAME SAMPLE +2.0% Y/Y%; EST. +1.9%; PRIOR +2.0%

JAPAN JAN. REAL CASH EARNINGS FALL 0.6% Y/Y; EST. -1.5%; -2.1%

MARKETS

US TSYS: Treasury Futures Edge Lower, Kashkari Sees 2 Cuts, Powell Day Two Later

- Jun'24 10Y futures are weaker and near session lows, moves lower by JGB futures could be having a part in the move, after BoJ Board Member Nakagawa indicated the timing for an interest rate increase is coming closer. Ranges remain tight and well within Wednesdays, we trade just off the daily lows of 111-11+ at 111-12 down - 03 + from NY closing levels.

- Looking at technical levels, Initial technical resistance is 111-23 (High Mar 6), a break above would open 111-27 (50% retracement of the Feb 1 - 23 bear leg). To the downside, levels to watch include 110-05+/109-25+ (Low Mar 1 / Low Feb 23 and bear trigger), below there 109-14+ (Low Nov 28)

- Treasury yields are 1-2bps higher today, with the 2Y yield up +1bps to 4.564%, 10Y yield up +1.7bps to 4.119%, while the 2y10y is +0.705 higher to -44.664.

- Post US Close, Fed's Kashkari spoke at a WSJ Event, his statements suggest a cautious approach to monetary policy, with the base case indicating no further rate hikes, while keeping with his December projections case of 2 cuts. However, he acknowledges that if inflation becomes more entrenched, the Fed may prolong its current stance, and if inflation flares again, a rate hike could be justified. See MNI piece (here)

- Thursday's data calendar includes Weekly Claims, Unit Labor Cost, and day two of Chairman Powell's testimony.

JGBS: No Recovery From BoJ Nakagawa-Induced Sell-Off

JGB futures are weaker and near session lows, -25 compared to settlement levels after BoJ Board Member Nakagawa indicated the timing for an interest rate increase is coming closer. He noted progress toward achieving the bank’s price target. “Japan’s economy and inflation are steadily making progress toward meeting the stable 2% inflation target,” Nakagawa said in a speech to local business leaders in Shimane, western Japan. (See Bloomberg link)

- Outside the above domestic driver, Japan's January wages data was stronger than expected, as previously outlined, and 30-year supply saw poor demand metrics. The low price failed to meet dealer expectations, the cover ratio declined to 2.934x from 3.181x in February and the auction tail widened.

- Cash US tsys are 1-2bps cheaper in today’s Asia-Pac session after yesterday’s post-Powell bull-flattening. Later today sees Weekly Claims, Unit Labor Cost, and day two of Chair Powell's testimony.

- The cash JGB curve bear-steepened, with yields flat to 3bps higher. The benchmark 10-year yield is 1.5bps higher at 0.732% versus the February high of 0.772%.

- The swaps curve has also bear-steepened, with rates 1-2bps higher. Swap spreads are wider apart from the 7-year and 20-year.

- Tomorrow, the local calendar sees Household Spending, BoP Current Account, Bank Lending and Leading & Coincident Indices data.

- Tomorrow will also see BoJ Rinban operations covering 1- to 10-year JGBs.

AUSSIE BONDS: Cheaper, Near Session Lows, Powell Part II Later Today

ACGBs (YM -1.0 & XM flat) sit in negative territory and near session lows. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Home Loan Values and Trade Balance data.

- (MT Newswires) "The economy remains weak but looks consistent with positive jobs growth and despite an improvement in productivity, unit labour cost growth (a proxy for services inflation) remains robust," Morgan Stanley said, adding that it still expects the RBA to hold interest rates steady through the course of this year, before cutting rates in early 2025.

- Cash US tsys are 1-2bps cheaper in today’s Asia-Pac session after yesterday’s post-Powell bull-flattening. News flow has so far been light today. Later today sees Weekly Claims, Unit Labor Cost, and day two of Chair Powell's testimony, ahead of Non-Farm Payrolls on Friday.

- Cash ACGBs are flat to 1bps cheaper after being flat to 2bps richer earlier in the session. The AU-US 10-year yield differential is 3bps higher at -11bps.

- Swap rates are flat to 1bp lower, with the 3s10s curve flatter.

- The bills strip is slightly cheaper, with pricing flat to -1.

- RBA-dated OIS pricing is unchanged across meetings. A cumulative 43bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

NZGBS: Bull-Flattening After Mixed Results From Weekly Auctions

NZGB curve closed with a bull-flattening (flat to 2bps richer) after today’s weekly supply saw mixed results across the lines. The May-32 and May-41 lines saw cover ratios over 3.00x, while the Apr-27 bond saw cover at a poor 1.69x (3.80x previously).

- In addition to the previously outlined Manufacturing Volume data, the RBNZ published new credit flow figures for January. Total New Lending fell 2.1% y/y, while New Residential Lending rose 9.2%y/y.

- Cash US tsys are 1-2bps cheaper in today’s Asia-Pac session after yesterday’s post-Powell bull-flattening. Later today sees Weekly Claims, Unit Labor Cost, and day two of Chair Powell's testimony, ahead of Non-Farm Payrolls on Friday.

- Swap rates closed 2-3bps lower, with the 2s10s curve flatter and implied swap spreads narrower.

- RBNZ dated OIS pricing is 1-5bps softer across meetings beyond July. A cumulative 52bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

- RBNZ Governor, Adrian Orr and Chief Economist, Paul Conway will speak about the February Monetary Policy Statement at separate events over 12-14 March 2024.

FOREX: USD Index Testing Sub Wednesday Lows, Yen The Outperformer

The BBDXY is testing below Wednesday lows in recent dealings, last under 1235. We are around 0.15% weaker for the session so far, with yen the clear outperformer, up nearly 0.65% against the USD.

- Cross asset sentiment in terms of lower US equity futures, coupled with a slight rise in US yields hasn't mattered much for the USD today. Regional equity sentiment has softened somewhat as well.

- The rise in the gold price to fresh record highs above $2160 has been a positive, although how much of this is just reflective of USD weakness is difficult to say.

- Yen strength has come down to a number of factors, stronger Jan wages data, a large union announcing larger pay increases this year versus last year, while BBG noted some Japan government officials are in favor of a near term BoJ shift (although Mar versus Apr wasn't specified). BoJ speak also noted steady progress towards the 2% inflation goal. Governor Ueda is before parliament this afternoon.

- USD/JPY tracks near session lows in recent dealings, close to 148.40. This is just under the 50-day EMA (148.51). Note as well a chunky option strike at 148.25 for notional 1.13 bn (USD call, JPY put) expires on the 12th of March. The Feb 7 low came in at 147.63, which may come into play if we can break lower.

- AUD/USD is also higher, along with NZD. The A$ last near 0.6590 around 0.35% stronger. NZD/USD up 0.30%, tracking close to 0.6150. Firmer commodity prices have likely helped both currencies, as other cross-asset drivers haven't been supportive.

- Later Fed Chair Powell testifies before Congress and Mester speaks on the economic outlook. In terms of US data, there are February Challenger job cuts, jobless claims and January trade. The ECB decision is announced including updated forecasts and press conference.

ASIA EQUITIES: China & HK Equities Lower As US Look To Block Foreign Biotech Firms

Hong Kong and China equities are lower today, with Biotech names the worst-performing sector after the US advanced a bill that would block them from accessing US Federal contracts, while property names are also lower after China Overseas Land's sales declined 69% in February.

- Hong Kong Equities are lower today with the HS Biotech Index down 4.60%, while property names are again under pressure with the Mainland Property Index down 1.10%. Tech names have been performing well in the wider APAC region today however the HSTech Index is now down 0.90%, JD.com is the outlier up 6.00% after strong earnings, while the HSI is down 0.60%. China Mainland equities are faring slightly better however still lower with the CSI300 down 0.50%, now out-performing the CSI1000 down 1.00% and the ChiNext down 1.50%

- China Northbound flows were -1.5b yuan on Wednesday, with the 5-day average to 0.85b, while the 20-day average sits at 2.6b yuan.

- JD.com soared 8% after beating estimates, while also approving a $3B buyback program and hiking it's annual dividend payout by 23%

- The CSRC has pledged to "act decisively" in extreme cases to address market failures and contain turmoil in the stock market at the NPC on Wednesday. They outlined scenarios prompting intervention, including severe deviations from fundamentals, irrational fluctuations, liquidity drying up, and indications of market panic. This move comes as Beijing seeks to restore confidence in the $9 trillion stock market after three years of losses, with the regulator focusing on improving regulations, preventing systemic risks, cracking down on market manipulation, and enhancing fairness in trading.

- The US Senate Homeland Security Committee advances a bill that would block certain foreign biotech companies from accessing US federal contracts. While the US government is also pressing allies including the Netherlands, Germany, South Korea, and Japan to further tighten restrictions on China’s access to semiconductor technology, the move is drawing resistance in some countries.

ASIA PAC EQUITIES: Asia Equities Mostly Higher, Stronger Yen Weighs On Japan Equities

Regional Asian equities are mixed today with Japan being the under-performer in the region, the stronger yen has offset moves higher in technology names. Markets have been higher after Powell's testimony they rate cuts are expected to be seen later in the year.

- Japan equities are mostly lower today, as the stronger yen offset moves in tech names, while banking names opening up 2% after increasing expectations that the BoJ will scrap it's negative interest rate policy in the coming months, the Topic Bank Index is up 1.25%. The stronger yen isn't helping the wider market as it rallied to its highest level in a month, the Topix is down 0.26%, while the Nikkei 225 with a higher exposure to tech names is down 0.85%n

- South Korean equities are slightly higher today, tech names have led the way higher with Samsung SDI is the top performer after it was reported the EV battery maker will start mass producing an all solid state battery in 2027. While foreign investors have been better sellers with paper and paper products and non metallic mineral names seeing the most of the outflows The Kospi is up 0.15%

- Taiwan equities are the top performing region today, semiconductor names again are leading the way higher after the Philadelphia semiconductor Index closed up 2.42% on Wednesday. The Taiex is currently 1.20% higher.

- Australian equities are slightly higher today, as Banking and Industrial names edge higher, Metals & Mining names are lower. The ASX has closed up 0.37%

- Elsewhere in SEA, NZ closed up 0.07%, Indonesia is up 0.62%, India up 0.06%, while Singapore down 0.20% and Philippines down 0.80% being the worst performer.

OIL: Crude Holds Onto Gains On US Demand Hopes

Oil prices have held onto most of Wednesday’s gains due to further greenback weakness and continued US gasoline stock drawdown, but gave up increases from early in the APAC session. WTI is flat at $79.12/bbl after reaching an intraday high of $79.36, and Brent is at $82.92 after a high of $83.17. The USD index is down another 0.1%, which should help to put a floor under crude. Markets will be looking to Friday’s US payrolls now for direction.

- Better-than-expected January-February China trade data failed to boost oil prices. Its crude import volumes rose 5.1% y/y YTD and refined oil +35.6% y/y YTD.

- Oil has continued to find support during today’s session from the EIA reported 4.46mn gasoline inventory drawdown last week. This fifth decline is signalling robust demand ahead of the driving season.

- A Barbados-flagged bulk carrier was hit by Houthi rebels in the Gulf of Aden on Wednesday killing two crew members for the first time. The US and UK reiterated that it will act to protect shipping in the area.

- Later Fed Chair Powell testifies before Congress and Mester speaks on the economic outlook. In terms of US data, there are February Challenger job cuts, jobless claims and January trade. The ECB decision is announced including updated forecasts and press conference.

GOLD: Slightly Higher After A New Record High On Wednesday

Gold is slightly higher in the Asia-Pac session, after closing 0.9% higher at $2148.18 on Wednesday. Earlier in yesterday's session bullion achieved a new record high of $2152.25.

- The precious metal was buoyed by continued Houthi attacks plus the sizeable depreciation of the USD after there were no hawkish surprises in ADP employment, the JOLTS report or Fed Chair Powell’s testimony.

- Fed Chair Powell reiterated in front of Congress the Fed’s view of cutting interest rates "at some point this year" but not until it becomes more confident that inflation will keep falling.

- US Treasuries finished with yields flat to 5bps lower.

- The next resistance is $2177.6 (Fibonacci projection of Oct 6 – 27 – Nov 13 price swing), according to MNI's technicals team.

- (Bloomberg) Citigroup Inc. raised its gold forecast for the next three months to $2,200 an ounce, and upgraded the projection to $2,300 for the next six to 12 months. It cited recession risks in the second quarter, which can favour gold, “especially given the recent equity and credit market rallies.”

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/03/2024 | 0645/0745 | ** |  | CH | Unemployment |

| 07/03/2024 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 07/03/2024 | 0930/0930 |  | UK | BOE's Monthly Decision Maker Panel Data | |

| 07/03/2024 | - | *** |  | CN | Trade |

| 07/03/2024 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 07/03/2024 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 07/03/2024 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 07/03/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 07/03/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/03/2024 | 1330/0830 | * |  | CA | Building Permits |

| 07/03/2024 | 1330/0830 | ** |  | US | Trade Balance |

| 07/03/2024 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 07/03/2024 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/03/2024 | 1345/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 07/03/2024 | 1500/1000 |  | US | Fed Chair Jay Powell | |

| 07/03/2024 | 1500/1600 |  | EU | ECB Podcast - Lagarde presents latest monpol | |

| 07/03/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 07/03/2024 | 1630/1130 |  | US | Cleveland Fed's Loretta Mester | |

| 07/03/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/03/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/03/2024 | 1700/1200 |  | US | BLS webinar on CPI rent and OER | |

| 07/03/2024 | 2000/1500 | * |  | US | Consumer Credit |

| 08/03/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.