-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Lower US Yields Help Yen Shrug Off GDP Contraction

EXECUTIVE SUMMARY

- FED’S BARR SAYS TOO EARLY TO CALL SOFT LANDING - MNI BRIEF

- TRUMP EYES NATO MAKEOVER, HURRIED PEACE IN UKRAINE IF ELECTED - BBG

- ECB’S NAGEL SAYS HISTORY SUGGESTS WORSE TO CUT RATES TOO EARLY - BBG

- JAPAN Q4 GDP POSTS SECOND STRAIGHT CONTRACTION - MNI BRIEF

- AUSSIE UNEMPLOYMENT RISES TO 4.1% - MNI BRIEF

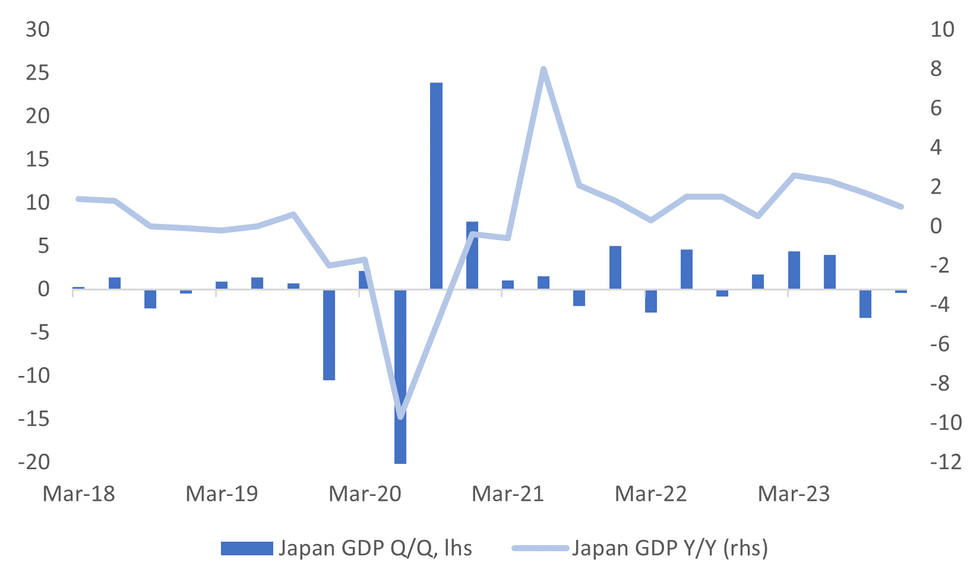

Fig. 1: Japan In A Technical Recession In H2 2023

Source: MNI - Market News/Bloomberg

U.K.

BOE (MNI BRIEF): Bank of England Governor Andrew Bailey pushed back against the idea of ending reserve remuneration while predicting that the final size of the Bank's balance sheet would be at the top end of its previous estimates.

FISCAL (BBG): UK Chancellor of the Exchequer Jeremy Hunt is considering cuts to public spending to make room for voter-friendly tax giveaways in his spring Budget, as the governing Conservative Party seeks a boost ahead of a general election expected later this year.

POLITICS (RTRS): Britain's opposition Labour Party are on course for a landslide victory at a national election later this year that would surpass Tony Blair's win in 1997, according to a projection published on Wednesday.

EUROPE

ECB (BBG): History suggests that it’s worse to loosen monetary policy too soon than too late, according to European Central Bank Governing Council member Joachim Nagel. “From past experience, it was often more painful if you lowered interest rates too early and then possibly ran into another phase in which prices rose and you then had to take countermeasures,” the Bundesbank chief told Bloomberg on the sidelines of an event in the east German city of Leipzig.

RUSSIA (BBG): Treasury Secretary Janet Yellen said she discussed the potential seizure of Russian assets with European leaders in recent days but had no progress to report on convincing key skeptics of the plan to move ahead.

GEOPOLITICS (POLITICO): The EU should prioritize other areas over developing an independent nuclear deterrent, which is an unrealistic proposal, a top German defense policymaker said Wednesday.

FRANCE (BBC): France fears Israeli offensive in Rafah could lead to a humanitarian disaster “of a new magnitude.”

U.S.

FED (MNI BRIEF): Federal Reserve Governor Michael Barr on Wednesday said it is too early to call a soft landing in the U.S. as there is still much work to do to bring inflation down further, but there are signs there will be continued, albeit bumpy, disinflation.

FED (MNI): Federal Reserve Governor Michael Barr on Wednesday said he's confident inflation is on a path to the central bank's 2% target, but more data is needed before interest rates can be lowered.

FED (MNI INTERVIEW): U.S. inflation could stumble at higher levels given a strong economy, booming services and persistent housing inflation, making it harder for the Federal Reserve to cut interest rates, Fannie Mae chief economist Doug Ducan told MNI.

FED (MNI BRIEF): Chicago Federal Reserve President Austan Goolsbee said the U.S. economy could also be at risk of a recession if China experiences a major downturn, during an armchair talk Wednesday where he emphasized policymakers remain in a position to cut interest rates as inflation slows.

GEOPOLITICS (BBG): Donald Trump is considering scaled-back commitments to some NATO members and a push for Ukraine to negotiate an end to the war with Russia if he returns to power next year, according to people familiar with the matter.

POLITICS (RTRS): The special counsel prosecuting Donald Trump on federal charges involving the former president's efforts to overturn his 2020 election loss urged the U.S. Supreme Court on Wednesday to reject Trump's bid to further delay trial proceedings as he presses his claim of immunity.

GEOPOLITICS (RTRS): The United States has told Congress and allies in Europe about new intelligence related to Russian nuclear capabilities that could pose an international threat, a source briefed on the matter told Reuters on Wednesday. The new capabilities, related to Russian attempts to develop a space-based weapon, do not pose an urgent threat to the United States, the source said.

CORPORATE (RTRS): Cisco Systems said it would cut 5% of its global workforce, or more than 4,000 jobs, and lowered its annual revenue target as the company navigates a tough economy that has led to thousands of layoffs by tech firms this year.

OTHER

MIDEAST (BBG): Israeli Prime Minister Benjamin Netanyahu has opted not to send a delegation to Cairo for follow-up talks aimed at securing a cease-fire with Hamas, again dismissing the militant group’s demands as “delusional.”

MIDEAST (BBG): Tensions between Israel and Hezbollah intensified on Wednesday when Israeli towns and an army base came under what appeared to be the fiercest attacks from Lebanon since the confrontation began four months ago.

CANADA (MNI BRIEF): Bank of Canada Deputy Governor Rhys Mendes reiterated Wednesday that official debate is shifting to how long to hold interest rates as inflation slows.

JAPAN (MNI BRIEF): Japan's economy contracted 0.1% q/q, or 0.4% annualised, over Q4 2023, the second straight quarterly decline, due to weak private consumption and capital investment, preliminary GDP data released by the Cabinet Office showed Thursday.

JAPAN (RTRS): Japan unexpectedly slipped into a recession at the end of last year, losing its title as the world's third-biggest economy to Germany and raising doubts about when the central bank would begin to exit its decade-long ultra-loose monetary policy.

AUSTRALIA (MNI BRIEF): Australian unemployment in January rose to 4.1% m/m from December’s 3.9%, higher than the 4.0% expectation, while employment grew by 500, lower than the 25,000 market estimate, data from the Australian Bureau of Statistics showed.

MARKET DATA

AUSTRALIA JAN. EMPLOYMENT RISES +0.5K; EST. +25.0K; PRIOR -62.7K

AUSTRALIA JAN. FULL-TIME EMPLOYMENT RISES 11.1K; PRIOR -109.4K

AUSTRALIA JAN. PART-TIME EMPLOYMENT FALLS -10.6K; PRIOR +46.7K

AUSTRALIA JAN. JOBLESS RATE 4.1%; EST. 4.0%; PRIOR 3.9%

AUSTRALIA JAN. PARTICIPATION RATE 66.8%; EST. 66.9%; PRIOR 66.8%

AUSTRALIA MI FEB. INFLATION EXPECTATIONS 4.5%; PRIOR 4.5%

AUSTRALIA JAN. HOUSEHOLD SPENDING RISES 3.6% Y/Y; PRIOR 3.6%

AUSTRALIA JAN. HOUSEHOLD SPENDING RISES 3.1% M/M; PRIOR -3.5%

NEW ZEALAND SIX-MONTH BUDGET DEFICIT NZ$2.74B

NZ SIX-MONTH BUDGET DEFICIT IS NZ$1.24B NARROWER THAN FORECAST

NZ DEC. NET MIGRATION ESTIMATE +7,260; PRIOR +6,870

JAPAN 4Q GDP -0.1% Q/Q; EST. 0.2%; PRIOR -0.8%

JAPAN 4Q NOMINAL GDP RISES 0.3% Q/Q; EST. 0.8%; PRIOR -0.1%

JAPAN 4Q PRIVATE CONSUMPTION -0.2% Q/Q; EST. 0.0%; PRIOR -0.3%

JAPAN 4Q NET EXPORTS ADDS 0.2 PPTS TO Q/Q GDP; EST. 0.3 PPTS; PRIOR 0.0 PPTS

JAPAN 4Q INVENTORY CONTRIBUTION TO GDP IS ZERO; EST. 0.0 PPTS; PRIOR -0.5 PPTS

JAPAN 4Q BUSINESS SPENDING -0.1% Q/Q; EST. 0.2%; PRIOR -0.6%

JAPAN FINAL DEC. INDUSTRIAL OUTPUT RISES 1.4% M/M; PRIOR 1.8%

JAPAN FINAL DEC. INDUSTRIAL OUTPUT FALLS 1.0% Y/Y; PRIOR -0.7%

JAPAN DEC. CAPACITY UTILIZATION FALLS 0.1% M/M; PRIOR +0.3%

MARKETS

US TSYS: Treasury Futures Rise On Low Volume Ahead of Busy US Data Calendar

TYH4 is currently trading at 110-04+, up + 04 from New York closing levels.

Treasury futures are just off highs of the day as we head into the Asia lunch break, there has been very little in the way of notable market headlines.

- Mar'24, 10Y futures opened near lows of the day at 110-00+, and have been grinding higher throughout the Asia Session, hitting highs of 110-07+, as we break for Asia lunch we trade just off the highs at 110-04+, while volumes still remain on the lower side.

- Key levels to watch heading into a busy US session for Data include initial support at 109-17 (50.0% of the Oct 19 - Dec 27 bull phase). A break below here could open up new yearly lows and a test of 109-05+ (lows of Nov 28). To the upside, initial resistance lies at 110-16 (the lows from Feb 9th), while a break above opens up a move to 111-06 (20-day EMA).

- Cash yields are 1-3bps richer across the curve, as the bear flattening theme continues from the US session. The 2Y yield is -1.0bp lower at 4.569%, while the 10Y yield is -2bp lower at 4.236%.

- Post the US Close, Fed's VC Barr discussed the economy and recent data, noting that January's data was stronger than expected. High-interest rates are dampening both sales and purchases of homes. However, he emphasized that the data is on a good path, but it is still too early to determine if there will be a soft landing.

- Later today weekly Claims, Retail Sales, Imp/Exp$, IP/Cap-U, TIC Flows are due out. While Fed speak includes Fed Gov Waller on the US$ international role at 13:15 ET, and Atlanta Fed Bostic on monetary policy (text, Q&A) later in the evening at 19:00 ET.

JGBS: Futures Holding Post-GDP Gains

In afternoon dealings, JGB futures remain sharply richer and close to session highs, +39 compared to settlement levels.

- Outside of the previously outlined Q4 GDP data, which printed weaker than expected and signalled a technical recession, the local calendar showed Industrial Production (Final) and Capacity Utilization data for December. IP was revised down to 1.4% m/m (-1.0% y/y) versus 1.8% and -0.7% prior. Meanwhile, Capu printed -0.1% versus +0.3% prior.

- At face value, today’s data should diminish BoJ prospects for a near-term shift away from NIRP (say at the March meeting).

- (DJ) Japan dropped a rank to become the world's fourth-largest economy after a weak end to 2023, as growth in tourism spending failed to offset sluggishness in domestic private consumption and capital spending. (See link)

- Cash JGBs are richer beyond the 1-year, with the futures-linked 7-year leading (yield is 2.7bps lower). The benchmark 10-year yield is 2.6bps lower at 0.727% versus yesterday’s high of 0.765%

- The swaps curve has bull-flattened, with rates 1-3bps lower. Swap spreads are mostly tighter across maturities.

- Tomorrow, the local calendar is relatively light, with Weekly International Investment Flows and the Tertiary Industry Index as the only releases. The MoF will also conduct an Auction for Enhanced-Liquidity 15.5-39-years.

AUSSIE BONDS: Sitting At The Session’s Best Levels After Jobs Data Miss

ACGBs (YM +11.0 & XM +12.5) have richened 7bps since January’s Employment Report disappointed with a jobs gain of just 481 versus expectations of +25k. The Unemployment Rate also rose to 4.1% versus 4.0% est. and 3.9% prior.

- The January labour data showed more convincing signs that the labour market is easing, but the ABS had some holiday-related caveats. To add to the generally softer tone of the report, hours worked fell 2.5% m/m to be up only 0.7% y/y, the lowest in 4 years ex-COVID.

- Accordingly, the data is likely to confirm that the RBA is on hold for now but services inflation will need to show significant moderation as it is delaying the target return.

- Meanwhile, Melbourne Institute Consumer Inflation Expectations for February printed at 4.5%. Expectations have been at 4.5% for the last 3 months.

- Cash ACGBs are 6-7bps richer after the data and 12bps richer on the day.

- The AU-US 10-year yield differential is 5bps lower at -9bps versus a pre-data level of -4bps.

- Swap rates are 10-12bps lower on the day.

- The bills strip has bull-flattened, with pricing +1 to +12.

- RBA-dated OIS pricing is 4-11bps softer for meetings beyond May, with a cumulative 38bps of easing priced by year-end.

- Tomorrow, the local calendar is empty.

NZGBS: Closed On A Strong Note, RBNZ Gov. Orr Speaks Tomorrow

NZGBs concluded the trading day on a robust note, marked by a 13-14bp decrease in benchmark yields. US tsys have provided a favourable backdrop for the local session after yesterday’s rally and the extension of that strength in today's Asia-Pac session. Cash US tsys are 2-3bps richer across benchmarks.

- Moreover, the strength in local bonds was reinforced by two key factors: a more favourable-than-anticipated Operating Deficit for the Government and a decline in Net Migration.

- The positive momentum extended with support from ACGBs following disappointing Employment data, which bolstered buying interest.

- Additionally, strong demand was evident in the weekly NZGB supply, reflected in cover ratios ranging from 3.15x to 3.80x.

- Swap rates closed 8-14bps lower, with the implied short-end swap spread wider.

- RBNZ dated OIS pricing flat to 4bps softer across meetings. A cumulative 48bps of easing is priced by year-end.

- Tomorrow, the local calendar sees BusinessNZ Manufacturing PMI, along with a speech by RBNZ Governor Orr about “the changing drivers of inflation over the past couple of years and the shift from transitory to more stubborn underlying inflation” at the NZ Economics Forum.

FOREX: Lower US Yields Help Yen Shrug Off GDP Contraction

The BDDXY sits little changed for the first part of Thursday trade. We were last near 1247.8. Yen strength has been evident, particularly at the expense of AUD, although AUD/JPY is up from session lows.

- Yen shrugged off an earlier Q4 GDP miss, which left the country in a technical recession for the second half of last year. USD/JPY got to highs of 150.58 but we now sit back at 150.15 close to session lows.

- A further pull back in US yields, led by the back end (10yr -2bps to 4.23%) has aided the yen. US equity futures are little changed.

- AUD/USD was weighed down by weaker Jan jobs data, which showed the unemployment rate ticking higher to 4.1%. We got to 0.6478, but now sit at 0.6485, only marginally weaker for the session.

- NZD/USD has remained rangebound today, currently trading at down 0.04% to 0.6084. Heading into a busy US session for data, important levels to watch are, 0.6040 (lows from Feb 5th) a break below here could signal further weakness, potentially opening a move to 0.6000 (lows from Nov 22nd). Currently, the 20 and 50-day EMAs are positioned at 0.6115/6135.

- The AUD/NZD cross was supported on dips to 1.0650, the pair last near 1.0660.

- Looking ahead, the Fed’s Waller speaks on the US dollar, ECB’s Lagarde and Lane and BoE’s Mann and Greene also speak. Retail sales, trade prices, Philly & Empire indices, jobless claims, IP and NAHB housing index all print in the US. UK Q4/December GDP, IP and trade are released.

CHINA/HK EQUITIES: Hong Kong Equities Rebound, As Investors Bank On Equity Market Support

Hong Kong equities opened lower today, that was met with buyers as most Indices now trade higher for the day, investors taking the view China will look to deliver stronger measures to help repair investor confidence.

- Equities markets in Hong Kong opened lower today, however early jitters quickly evaporated to see indices trade higher. Investors are banking on China policy makers announcing further market positive policies over the coming week, as has been the case over the past few trading session any signs of market weakness have been quickly met with swift buying and support. The Hang Seng is 0.45% higher after down as much as 0.80% earlier, HS tech is up 0.65%, while the mainland property index trades 1.88% lower after being down as much as 3.50% earlier.

- In other China & Hong Kong equity news, Michael Burry, made famous from the movie "The Big Short", has been adding to his exposure to Chinese Tech stocks recently betting on a recovering, while China's state media have reported that hotel sales at major e-commerce platforms have surged more than 60% from a year earlier and finally, Chinese property developer Redsun received a wind-up notice in Hong Kong, in what is not unexpected news as their debt has been trading at about 1c since October.

ASIA PAC EQUITIES: Regional Asian Equities Higher, Taiwan Hits All-Time Highs

Regional Asian Equities are mostly higher today, with Taiwan outperforming post-break. There have been little in the way of market headlines today, apart from Indonesian Defence Minister Prabowo Subianto claiming victory in the presidential elections.

- Japan equities are higher today after tech and exporter names push higher as the weaker yen and falling yields benefit both sectors. The Nikkei 225, has hit 3 year highs relative to the Topix on the back of strong results and performance from the tech sector, while the Topix lags largely due to an under performance in banks stocks with links to US commercial real estate exposure. Earlier today, Japan Q4 GDP was released and was weaker than expected, with the economy now in a technical recession, annualized q/q GDP fell -0.4% versus a +1.1% forecast. Q3 was also revised lower, to -3.3% (from -2.9%). Currently the Nikkei 225 is 0.% higher, while the Topix is 0.10% higher.

- Taiwan equities surged to all-time highs on growing demand for AI tech. Taiwan Semiconductor Manufacturing Co (TSMC) leads, up 7.90% as January sales rise 7.9% YoY. Taiex trades 2.93% higher.

- South Korea equities slightly lower as individuals and foreign investors withdrew $149m from equities markets today. There has been little in the way market headlines, potential profit-locking due to SK equities' recent out-performance in Asia could be the catalyst. The Kospi is 0.20% lower today.

- Australia equities closed higher today up 0.77%, after the unemployment rate edged higher to 4.1% from 3.9% previously, highlighting the nations cooling labor markets and prompting bets of an earlier rate cut as traders bought forward bets of the first rate cut to September from November. Financials have led the move higher, while Wesfarmers earnings beat pushed their shares 4.67% higher.

- Elsewhere, NZ equities closed down 0.18%, Philippines equites climb higher ahead of BSP meeting later today, while Indonesia rises by 1.57% after Defence Minister Prabowo Subianto claims victory in the presidential elections.

OIL: Crude Continues Fall Following Large US Crude Stock Build, IEA Report Later

Oil prices have continued falling during the APAC session after declining around 1.5% on Wednesday following a large crude inventory build in the US. WTI is down 0.6% to $76.20/bbl, close to the intraday low. Brent is down 0.5% to $81.22. The USD index is little changed.

- The EIA reported a larger-than-expected 12.02mn barrel inventory build in the US but with refining capacity dropping 1.8pp to 80.6% gasoline stocks fell 3.66mn and distillate -1.92mn. Product destocking provided some support to prices.

- Market signals, such as timespreads and refining margins, are implying tighter supply, according to Bloomberg. The IEA monthly report with supply and demand projections is published today. Earlier this week its chief Birol said that markets should remain “comfortable” as output rises and demand eases.

- There is a swathe of US data which will be important for dollar moves and the Fed outlook with markets shifting to a “higher for longer” view, which impacts the energy consumption outlook.

- Later the Fed’s Waller speaks on the US dollar, ECB’s Lagarde and Lane and BoE’s Mann and Greene also speak. Retail sales, trade prices, Philly & Empire indices, jobless claims, IP and NAHB housing index all print in the US. UK Q4/December GDP, IP and trade are released.

GOLD: Holding Below $2000

Gold is steady in the Asia-Pac session, after closing unchanged at $1992.33 on Wednesday.

- Bullion saw little respite from a weaker USD and lower US Treasury yields after yesterday’s CPI-induced rout.

- US Treasuries recouped some of Tuesday’s post-CPI sell-off. US Treasuries bull-steepened, with yields 2-8bps lower. Comments from the Fed's Goolsbee, downward revisions to December PPI data, a rethink of the CPI data, and a lack of follow-through selling presented a buying opportunity for the bond bulls.

- Chicago Fed’s Goolsbee (’25 voter) stuck to his dovish guns: “As I always say, especially about inflation, one month is no months. Let’s not get amped up when you get one month of CPI that was higher than what you expected it to be.”

- US PPI data for December was revised down from -0.1% to -0.2%.

- Looking ahead, Thursday brings a heavy US data calendar with weekly Claims, Retail Sales, Imp/Exp, IP/Cap-U, and TIC Flows.

- Fed speak includes Fed Gov Waller on the USD's international role at 13:15 ET, and Atlanta Fed Bostic on monetary policy (text, Q&A) later at 19:00 ET.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2024 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 15/02/2024 | 0700/0700 | ** |  | UK | Trade Balance |

| 15/02/2024 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 15/02/2024 | 0700/0700 | ** |  | UK | Index of Services |

| 15/02/2024 | 0700/0700 | *** |  | UK | Index of Production |

| 15/02/2024 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 15/02/2024 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/02/2024 | 0800/0900 |  | EU | ECB's Lagarde statement at ECON hearing | |

| 15/02/2024 | 1000/1100 | * |  | EU | Trade Balance |

| 15/02/2024 | 1200/1300 |  | EU | ECB's Lane seminar at Florence School | |

| 15/02/2024 | 1300/1300 |  | UK | BOE's Greene fireside chat with Fitch Ratings | |

| 15/02/2024 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 15/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/02/2024 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/02/2024 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 15/02/2024 | 1330/0830 | *** |  | US | Retail Sales |

| 15/02/2024 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/02/2024 | 1350/1350 |  | UK | BOE's Mann panellist at 40th NABE Conference | |

| 15/02/2024 | 1415/0915 | *** |  | US | Industrial Production |

| 15/02/2024 | 1500/1000 | * |  | US | Business Inventories |

| 15/02/2024 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 15/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 15/02/2024 | 1815/1315 |  | US | Fed Governor Christopher Waller | |

| 15/02/2024 | 2100/1600 | ** |  | US | TICS |

| 15/02/2024 | 0000/1900 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.