-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: NFP Fallout & BoJ Whispers Dominate

EXECUTIVE SUMMARY

- BOOMING JOB GAINS COULD FUEL FED DEBATE OVER WHETHER MORE IS NEEDED TO CORRAL INFLATION (WSJ)

- ECB'S VISCO SAYS CAUTION WARRANTED IN POLICY TIGHTENING (RTRS)

- ECB MAY REACH TERMINAL RATE BY THIRD QUARTER, HOLZMANN SAYS (BBG)

- ECB INTEREST RATES APPROACHING RESTRICTIVE TERRITORY, VASLE SAYS (BBG)

- FRENCH PM OFFERS CONCESSION IN BATTLE OVER PENSION REFORM (BBG)

- JAPANESE GOV’T PUSHES BACK AGAINST NIKKEI ARTICLE WHICH SUGGESTED SOUNDING OUT OF AMAMIYA AS BOJ GOVERNOR

- U.S. FIGHTER JET SHOOTS DOWN SUSPECTED CHINESE SPY BALLOON (RTRS)

- SAUDI ARABIA’S OIL CHIEF SAYS HE’LL STAY CAUTIOUS ON OUTPUT (BBG)

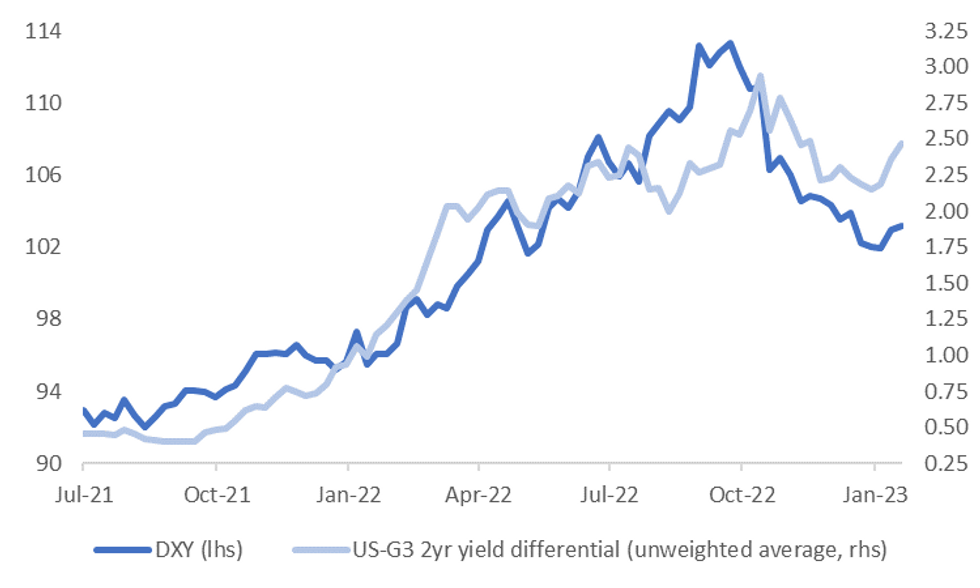

Fig. 1: U.S. Dollar Index (DXY) vs. U.S./G3 2-Year Yield Differential

Source: MNI - Market News/Bloomberg

UK

ENERGY: Britain will be vulnerable to gas shortages and high energy prices next winter because of the failure of the government and Centrica to reach agreement on expanding the UK’s largest gas storage site, energy experts and MPs have warned. (FT)

FISCAL: The UK Treasury is exploring a significant increase in the bonds it sells to retail investors, a move that analysts say may draw in as much as £70 billion ($85.8 billion) for financing deficits in the coming years. (BBG)

FISCAL/ENERGY: Chancellor Jeremy Hunt has rejected calls to prevent sharp rises in domestic energy bills for all households in his March budget – meaning millions of users will see costs soar by about 40% from April. (Guardian)

FISCAL/POLITICS: Boris Johnson has said the Government should reduce the tax burden to trigger economic growth, a move that puts pressure on Rishi Sunak. (Telegraph)

FISCAL/POLITICS: Nurses leaders have issued a direct appeal to Prime Minister Rishi Sunak to intervene in their pay dispute. (Sky)

POLITICS: Rishi Sunak is facing problems on multiple fronts as the row over his appointment of Dominic Raab as justice secretary deepens and his two predecessors as prime minister seek to tell him how to do his job. (FT)

POLITICS: Former prime minister Liz Truss has said she was never given a "realistic chance" to implement her radical tax-cutting agenda and blamed what she called a "powerful economic establishment" for removing her from Downing Street. (Sky)

BREXIT: Eurosceptic Tories and Democratic Unionists are to force a parliamentary debate on controversial plans for new border control posts at Northern Ireland’s ports. (Telegraph)

BREXIT: Rishi Sunak’s plan to scrap thousands of EU laws by the end of this year risks triggering a full-scale trade war between the UK and Brussels, senior figures in the European Union have warned. (Observer)

BREXIT/POLITICS: Rishi Sunak has been warned by senior Conservatives that he would face a significant rebellion and certain defeat in the House of Commons if he tried to take Britain out of the European Convention on Human Rights. (FT)

CRYPTOCURRENCY: The Bank of England and Britain's finance ministry think that the UK is likely to need to create a central bank digital currency later this decade, the Telegraph newspaper reported on Saturday, citing an unreleased government report. (RTRS)

EUROPE

ECB: The European Central Bank (ECB) can take a cautious approach to raising interest rates given that short-term inflation expectations have dropped sharply and longer-term ones remain under control, a top Italian policymaker said on Saturday. (RTRS)

ECB: European Central Bank interest rates may peak around the middle of the year or by the third quarter at the latest, which can lead to renewed reductions over the coming years, Governing Council member Robert Holzmann says on public broadcaster ORF. (BBG)

ECB: “Additional interest rate hikes will be needed if we want to curb inflation this year,” European Central Bank Governing Council member Bostjan Vasle said Friday. (BBG)

FRANCE: Emmanuel Macron’s government may offer another concession on plans to raise France’s retirement age from 62 to 64, seeking to secure a parliamentary majority amid a massive public backlash. (BBG)

GERMANY: A German labor union called on Deutsche Post AG employees to strike on Monday and Tuesday ahead of wage talks in which the workers are seeking a 15% pay rise. (BBG)

CYPRUS: Former Cypriot Foreign Minister Nikos Christodoulides led the first round of voting for the country’s presidency on Sunday and faces a runoff next week against second-place finisher Andreas Mavroyiannis, a career diplomat. (POLITICO)

RATINGS: Rating reviews of note from after hours on Friday included:

- Fitch affirmed Estonia at AA-; Outlook Negative

- Fitch affirmed Latvia at A-; Outlook Stable

- S&P affirmed the European Stability Mechanism at AAA; Outlook Stable

- DBRS Morningstar confirmed Belgium at AA, Stable Trend

- DBRS Morningstar confirmed Sweden at AAA, Stable Trend

U.S.

FED: Federal Reserve Bank of San Francisco President Mary Daly said officials’ December projections for interest rates were still a good signal of where borrowing costs are headed after an impressive jobs report Friday. (BBG)

FED: Fresh signs of a hot U.S. labor market leave the Federal Reserve on course to raise interest rates by a quarter percentage point at its meeting next month and to signal another increase is likely after that. (WSJ)

ECONOMY: U.S. Tsy Secretary Yellen tweeted the following on Friday: "The labor market remains exceptionally strong while inflation continues to moderate. Inflation has fallen for six consecutive months, over 2.5 percentage points from its peak, while this historic job growth continues." (MNI)

ECONOMY: A U.S. services surge in January will likely prove durable as new orders will continue to drive growth, Institute for Supply Management chair Anthony Nieves told MNI Friday, adding that further interest rate hikes are likely needed to tame price growth. (MNI)

ECONOMY: High frequency U.S. pay data collected by Homebase shows "promising" signs of slowing through the first month of the year and suggests wage growth could cool to pre-Covid levels by early next year, Federal Reserve Bank of St. Louis economist Max Dvorkin told MNI Friday. (MNI)

ECONOMY: U.S. consumers are expecting the economy to slip into recession this year, though labor market strength suggests the downturn may not be deep or long-lasting, Conference Board chief economist Dana Peterson told MNI. (MNI)

FISCAL: A White House economic adviser said negotiations over raising the US debt ceiling are an “absolute nonstarter” for President Joe Biden, though he’s ready to discuss spending with congressional Republicans. (BBG)

POLITICS: President Biden and former president Donald Trump may have each drawn a record number of votes in 2020, but at this early stage in the 2024 election cycle, Americans show little enthusiasm for a rematch between the two well-known yet unpopular leaders, according to a Washington Post-ABC News poll. (Washington Post)

POLITICS: The Democratic National Committee on Saturday approved President Joe Biden's shakeup of the party's 2024 primary calendar, giving Black voters a greater say in the nominating process and carving an easier path for Biden's expected re-election bid. (RTRS)

IMF: A US debt default would cause a spike in borrowing costs that squeezes American consumers as well as significant harm to the world economy, International Monetary Fund Managing Director Kristalina Georgieva said. (BBG)

EQUITIES: President Biden plans to call for tougher regulation of Silicon Valley in Tuesday’s State of the Union, leveraging the prime-time spotlight to galvanize Republicans and Democrats against industry abuses and signaling a new priority for his administration in its third year. (Washington Post)

OTHER

GLOBAL TRADE: France and Germany’s economy ministers will ask the US to lay off making “aggressive” overtures to European companies in a bid to lure their green investments across the Atlantic, French officials said ahead of a visit to Washington this week. (FT)

U.S./CHINA: A U.S. military fighter jet shot down a suspected Chinese spy balloon off the coast of South Carolina on Saturday, a week after it first entered U.S. airspace and triggered a dramatic -- and public -- spying saga that worsened Sino-U.S. relations. (RTRS)

U.S./CHINA: Beijing denounced the US’s destruction of the Chinese balloon that passed over American territory last week as a “clear overreaction,” saying that it reserved the right to respond. (BBG)

U.S./CHINA: China downplayed Secretary of State Antony Blinken canceling a visit to Beijing in the wake of a suspected spy balloon flying over the U.S., saying that a meeting between the two countries had never been formally announced. (Axios)

U.S./CHINA: China previously sent high-altitude surveillance balloons over the U.S. that went undetected until after leaving American airspace, Biden administration officials said, as the military salvaged debris Sunday from the downed balloon in a bid to learn more about the Chinese operation. (WSJ)

U.S./CHINA: The U.S. is considering new sanctions on Chinese surveillance companies over sales to Iran’s security forces, officials familiar with the deliberations said, as Iranian authorities increasingly rely on the technology to crack down on protests. (WSJ)

GEOPOLITICS: A second Chinese spy balloon was reportedly flying over Latin America, according to the Pentagon. (Guardian)

BOJ: Japan's government has approached Bank of Japan Deputy Gov. Masayoshi Amamiya as a possible successor to central bank chief Haruhiko Kuroda, people familiar with the matter said, as Tokyo prepares for the first change of leadership at the BOJ in a decade. Government and ruling coalition officials said the subject had been discussed with Amamiya. The 67-year-old career central banker is the architect of most BOJ policies under Kuroda. (Nikkei)

BOJ: In a news conference on Monday, Deputy Chief Cabinet Secretary Yoshihiko Isozaki said there was no truth to the report the government had sounded out Amamiya for the top BOJ job. (RTRS)

BOJ: When asked about the Nikkei report, Finance Minister Shunichi Suzuki told reporters he had not heard that the government offered Amamiya the job. The prime minister's office and the BOJ were not immediately available to comment. Jiji news agency said Amamiya did not comment to reporters, when asked whether he has been sounded out about becoming BOJ governor. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Monday that the BOJ must firmly support the economy with easy policy in order to achieve its 2% price target accompanied with wage hikes in a stable and sustainable manner. (MNI)

BOJ: The Bank of Japan's confidence in the achievement of its 2% inflation target could firm significantly as soon as April, paving the way for the new governor to consider an exit from yield curve control, a former BOJ chief economist said. (MNI)

JAPAN: Japanese Deputy Chief Cabinet Secretary Seiji Kihara on Sunday stressed the need to achieve an economy where inflation rises stably and sustainably, when asked whether the next central bank governor should maintain ultra-easy monetary policy. (RTRS)

RBA: There is no sign of mortgage relief on the horizon, according to the nation’s leading economists, with the Reserve Bank of Australia not expected to lower the official interest rate anytime this year. A snap poll of 24 economists conducted by The Australian Financial Review on Friday showed 23 tipped a ninth straight rate rise at the RBA’s board meeting on Tuesday, with 22 pencilling in a quarter-percentage point rise. (AFR)

AUSTRALIA: Treasurer Jim Chalmers has sought to dampen expectations of handouts in the coming budget in May, amid signs of a return to surplus, and says the cost of living measures must not further exacerbate inflation and interest rates. (AFR)

AUSTRALIA/CHINA: Australia trade minister Don Farrell said on Monday he had agreed to an in-person meeting with Chinese counterpart Wang Wentao in Beijing in the near future, in the latest sign that relations between the two countries are thawing. (RTRS)

SOUTH KOREA: Vice Finance Minister Choi Sang-dae will meet with an official at FTSE Russell Wednesday in the UK to demonstrate South Korea’s efforts to improve its bond market environment for foreign investors and to stress South Korea’s will to join the World Government Bond Index. (BBG)

ASIA: Nuclear weapons have entered political debate in South Korea as moves by China and North Korea push Seoul to consider all of its options -- even one that could transform the security landscape in Asia. (Nikkei)

CANADA: Canadian Finance Minister Chrystia Freeland on Friday said new spending on healthcare and ramping up clean technologies would be in this year's budget, but she added it was her goal not to fuel inflation. (RTRS)

TURKEY: A major earthquake of magnitude 7.9 struck central Turkey and northwest Syria on Monday, killing scores of people and injuring hundreds as buildings collapsed, and triggering searches across the snowy region for survivors trapped in rubble. (RTRS)

BRAZIL: Brazil’s Luiz Inacio Lula da Silva and members of his economic team were dismayed by the harsh statement published by the country’s central bank this week, three people with knowledge of the matter said, a signal that tensions between the independent central bank and the left-wing president are far from over. (BBG)

BRAZIL: Brazil's finance ministry sees room for leftist President Luiz Inacio Lula da Silva to raise the minimum wage as of May at a cost of up to 5 billion reais ($975 million) to the government, two sources in the ministry told Reuters on Friday. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy said in a video address on Saturday that the situation on the front lines was getting tougher and Russia was throwing more and more troops into battle. (RTRS)

RUSSIA: Ukraine's outgoing defence minister has said the country is anticipating a new Russian offensive later this month. (BBC)

RUSSIA: China is providing technology that Moscow’s military needs to prosecute the Kremlin’s war in Ukraine despite an international cordon of sanctions and export controls, according to a Wall Street Journal review of Russian customs data. (WSJ)

RUSSIA: France and Italy have finalised technical talks for the joint delivery of a SAMP/T-MAMBA air defence system to Ukraine in spring 2023, the French Defence Ministry said. (RTRS)

RUSSIA: The European Union's next package of sanctions against Russia will hit the trade and technology that supports its war against Ukraine, European Commission President Ursula von der Leyen said on Friday. (RTRS)

RUSSIA/IRAN: Moscow and Tehran are moving ahead with plans to build a new factory in Russia that could make at least 6,000 Iranian-designed drones for the war in Ukraine, the latest sign of deepening cooperation between the two nations, said officials from a country aligned with the U.S. (WSJ)

INDIA: Indian policy makers and regulators stepped in over the weekend to calm frayed nerves over concerns the turmoil surrounding billionaire Gautam Adani’s conglomerate would spill over into the local economy and affect global investor sentiment toward the country. (BBG)

SOUTH AFRICA: South African Deputy President David Mabuza resigned, clearing the way for Paul Mashatile, the new deputy leader of the governing African National Congress, to succeed him. (BBG)

SOUTH AFRICA: South African energy utility company Eskom Holdings SOC Ltd. says it will remove 3,000 megawatts from the national grid during the day from Monday, after two units taken offline for repairs on Saturday were delayed in returning to service.(BBG)

IMF: China's finance minister and its central bank governor will attend a roundtable with other creditors and some borrowing countries in February in India, IMF Managing Director Kristalina Georgieva said in a CBS' 60 Minutes interview on Sunday. (RTRS)

EQUITIES: Hedge funds wrongfooted by a sharp surge in stocks this week rushed to exit losing bets on falling markets at the fastest pace in years. (FT)

EQUITIES: Adani Enterprises Ltd. has shelved a plan to raise as much as 10 billion rupees ($122 million) via its first-ever public sale of bonds following a market rout, according to people familiar with the matter. (BBG)

EQUITIES: Standard Chartered Plc. has stopped accepting bonds of Adani Group firms as collateral on margin loans, ET Now television channel reported, without saying where it got the information. (BBG)

ENERGY: Russian Foreign Minister Sergei Lavrov will arrive in Baghdad on Sunday to discuss boosting bilateral relations and energy cooperation, Iraqi Foreign Ministry spokesman said in a statement. (RTRS)

ENERGY: Talks to send more US natural gas to Europe have stalled as the continent’s climate goals deter buyers from making long-term fossil fuel supply commitments, according to two US energy executives. (FT)

OIL: Saudi Arabia’s energy minister reiterated that the kingdom will remain cautious about raising oil production, even as several prominent analysts say rising demand will soon trigger a jump in prices. (BBG)

OIL: The Group of Seven nations and the European Union member states have agreed to impose a cap of $100 per barrel on sales of Russian diesel to third countries as part of an effort to limit Moscow’s revenues. (BBG)

OIL: U.S. Treasury Secretary Janet Yellen said on Friday that new price caps by the West on Russian oil products would build on the crude oil cap set in December and further limit Russian oil revenues while keeping global energy markets supplied. (RTRS)

OIL: Indian refiners have begun paying for most of their Russian oil purchased via Dubai-based traders in United Arab Emirates dirhams instead of U.S. dollars, four sources with knowledge of the matter said. (RTRS)

OIL: Russia plans to boost diesel exports in February in attempt to cope with a European Union embargo, price cap and lack of tankers, data from traders and Refinitiv showed. (RTRS)

OIL: Saudi Energy Minister Prince Abdulaziz bin Salman warned on Saturday Western sanctions against Russia could result in a shortage of energy supplies in future. (RTRS)

OIL: The G7 price cap on Russian oil products that went into force on Feb. 5 will likely lead to "on-the- water stock buildup" as buyers, sellers, insurers, shipowners and banks await clarity on the legality of dealing with these supplies, the head of Vitol Asia said Feb. 5. (S&P Global)

OIL: Oil producers may have to reconsider their output policies following a demand recovery in China, the world's second-largest oil consumer, the International Energy Agency's Executive Director Fatih Birol said on Sunday. (RTRS)

OIL: State firms from Iran and Venezuela will start in the coming weeks a 100-day revamp of the South American nation's largest refining complex to restore its crude distillation capacity, four sources close to the plan said. (RTRS)

CHINA

POLICY: China's policymakers plan to show more support for domestic demand this year but are likely to stop short of splashing out big on direct consumer subsidies, keeping their focus mainly on investment, three sources close to policy discussions said. (RTRS)

ECONOMY: Chinese banks are touting a wide variety of retail lending products as authorities need a pickup in consumer spending to create a more solid foundation for the world’s second largest economy. (BBG)

ECONOMY: International organizations and investment banks intensively raised their projections for China's economic growth in 2023 following impressive recovery of the country's consumption market during the Spring Festival holidays. Some economists on an optimistic note predicted China's GDP may post strong 6 percent year-on-year growth at most this year, buoyed by the country's optimized epidemic response and effective pro-growth policies, injecting confidence and impetus into the global economic recovery. (Global Times)

PBOC: The People’s Bank of China will deliver more innovate financial products to reduce carbon emissions and support the green transition of the economy, Governor Yi Gang said on Saturday. (MNI)

POLICY: Both fiscal and monetary policy should focus on stabilising employment, especially in the service sector, small businesses and self-employed groups, Economic Daily said in a commentary. (MNI)

PROPERTY: China's property market is expected to bottom out as early as the second quarter should a series of stimulus moves be implemented promptly and effectively, Securities Times reported citing analysts on Monday. (MNI)

PROPERTY: China’s unprecedented housing slump and construction halt led to the worst earnings for real estate developers in at least seven years, according to Bloomberg estimates. (BBG)

EQUITIES: Money is flowing into mainland Chinese and Hong Kong stocks in ways not seen since 2018, according to research firm EPFR Global. Active foreign fund managers put $1.39 billion into mainland Chinese stocks in the four weeks ended Jan. 25, EPFR data showed. Active fund inflows into Hong Kong stocks were even greater during that time, at $2.16 billion. (CNBC)

CHINA MARKETS

PBOC NET DRAINS CNY373 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) conducted CNY150 billion via 7-day reverse repos with the rates unchanged at 2.00% on Monday. The operation has led to a net drain of CNY373 billion after offsetting the maturity of CNY523 billion reverse repos today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0000% at 9:29 am local time from the close of 1.8210% on Friday.

- The CFETS-NEX money-market sentiment index closed at 55 on Friday, compared with the close of 45 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7737 MON VS 6.7382 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7737 on Monday, compared with 6.7382 set on Friday.

OVERNIGHT DATA

AUSTRALIA Q4 RETAIL SALES EX-INFLATION -0.2% Q/Q; MEDIAN -0.5%; Q3 +0.3%

AUSTRALIA JAN MELBOURNE INSTITUTE INFLATION +6.4% Y/Y; DEC +5.9%

AUSTRALIA JAN MELBOURNE INSTITUTE INFLATION +0.9% M/M; DEC +0.2%

MARKETS

US TSYS: Early Cheapening Holds In Asia

TYH3 deals at 114-08, -0-05+, in the middle of its 0-08+ range on heavy volume of ~162K

- Cash Tsys sit 1-5bps cheaper across the major benchmarks with the curve bear flattening.

- Tsys opened cheaper as Asia-Pac participants digested Friday's stronger-than-expected NFP print, as well as a piece from WSJ's Timiraos which noted "fresh signs of a hot U.S. labor market leave the Federal Reserve on course to raise interest rates by a quarter percentage point at its meeting next month and to signal another increase is likely after that."

- BoJ matters were also in focus. Japan's Deputy Chief Cabinet Secretary Isozaki noted there was no truth to a Nikkei report re: BoJ Deputy Gov Amamiya being approached to head up the central bank. Finance Minister Suzuki earlier said he hasn’t heard such discussions, although he conceded that he is “out of the loop” on the matter. Isozaki's comments resulted in some light screen selling of TY, however the momentum quickly faded.

- The early cheapening has held through the session, although Tsys have ticked away from session lows.

- It has been a particularly heavy volume session for both Tsys and STIR futures. Early flow was dominated by sellers and exposure to downside, although flows have been more mixed since then. TU blocks headlined on the Tsy side (-3,393 & +3.5K), while a block buy of SFRU3 (+5.3K) and some chunky screen flow in SFRH3 headlined in the shorter end.

- European focus will fall on Eurozone retail sales and BoE speak from Pill & Mann. Further out, lower tier data is all that we get on the NY docket. Fed Chair Powell's first remarks since the Fed meeting (Tuesday) provide the highlight this week.

JGBS: Contained Vol. On BoJ Speculation & Subsequent Gov’t Rebuttal

JGBs have moved away from worst levels into the Tokyo close, leaving futures -19, while cash JGBs run 0.5bp richer to 2bp cheaper as the curve twist steepens, with a pivot around 5s. 10-Year JGB yields hover just below the upper limit permitetd under the BoJ’s current YCC parameters.

- An early bid triggered by a Nikkei article pointing to the government tapping current BoJ Deputy Governor Amamiya as outgoing Governor Kuroda’s successor was quickly unwound, before the richening into the bell was observed.

- While Amamiya is considered the most dovish of the three assumed candidates for the role, the Nikkei piece reiterated that policy normalisation will be the key focus for the next Governor (which allowed the initial richening to be unwound).

- Government pushback then came to the fore, as the lunch break saw Deputy Chief Cabinet Secretary Isozaki note that there is no truth to the Nikkei report. This came after Finance Minister Suzuki said he hasn’t heard such discussions, although he conceded that he is “out of the loop” on the BoJ governor matter.

- The BoJ & Amamiya issued ‘no comment’ responses to questions surrounding the article.

- Looking ahead, tomorrow will see the latest round of 30-Year JGB supply, in addition to household wage and spending data.

AUSSIE BONDS: Off Worst Levels At The Bell, RBA Up Next

Aussie bonds were fairly unreactive to the latest round of comments pointing to a further thawing of Sino-Aussie relations (see earlier bullet for more colour on that matter), seeing an incremental uptick post-headlines, but they were already moving away from cheapest levels of the day alongside U.S. Tsys.

- That left YM –9.0 & XM -8.0 at the close, with wider cash ACGBs running 5-9bp cheaper across the curve, as the early bear flattening bias was maintained, albeit moderating from session extremes.

- Aussie 10s have outperformed their U.S. counterpart in the time since Friday’s Sydney close, given the impulse derived from U.S. data & Fedspeak (and WSJ Fed report Timiraos’ latest article), with the spread between the two compressing by a little over 9bp, hovering just above -10bp.

- Bills are 4-13bp cheaper through the reds.

- EFPs finished around session wides.

- The latest RBA monetary policy decision headlines tomorrow’s domestic docket, with a 25bp hike the consensus view, as well as being an outcome that is essentially fully priced by markets. Terminal cash rate pricing has pushed back above 3.70%, in lieu of repricing surrounding the Federal Reserve post-NFPs. Expect the usual early release of the key SoMP projections to be embedded into the post-meeting statement. Our full RBA preview will be published shortly.

EQUITIES: Soft Start To The Week, Japan Stocks Outperform

Regional equities are mostly on the backfoot, with Japan bourses the exception. Headwinds have come from the negative Wall St lead on Friday, along with lower US futures through the first part of the Monday session. Eminis and Nasdaq futures are off by -0.35% to -0.45% at this stage.

- China and Hong Kong markets have again seen decent losses. The HSI is off by 2.3% at this stage, with the tech sub-index down 3.70%. The China Golden Dragon index fell sharply in US trade on Friday (-3.87%).

- The CSI 300 is off 1.67%, the Shanghai Composite -1%. Northbound stock connections flows have been negative for the second straight session. Tensions with US over the downing of an alleged spy balloon have weighed, although China comments don't suggest any further near term escalation.

- The China authorities also disagreed with the IMF on the China housing outlook and called the organization's 5.2% growth forecast this year too conservative.

- Japan stocks are higher, with the Nikkei 225 up 0.75% at this stage. Reports that the government have approached Deputy Governor Amamiya as a potential successor to Kuroda has likely helped, as Amamiya is seen as more on the dovish side relative to other candidates.

- The Kospi & Taiex are lower (-1.25% & -0.95% respectively). The ASX 200 is down -0.25%, with lower commodity prices note helping.

GOLD: Prices Stabilise After Sinking On Payrolls

Gold prices fell 2.5% on Friday following extremely strong payrolls data. The 517k rise in jobs plus the drop in the unemployment rate increased the prospects of more Fed tightening and boosted Treasury yields and the USD. Gold prices are up 0.6% during APAC trading to $1876.50/oz, close to the intraday high. The USD DXY is up 0.2% today.

- Gold was down 3.3% on the week and fell through the 20-day EMA of $1907.40 and the January 11 low of $1867.20 on Friday. It is currently holding above that support again.

- There is little scheduled later with January euro area retail sales the most significant release. It is a relatively quiet week in the US with Tuesday’s trade balance and Fed Powell’s speech the likely highlights.

OIL: Crude Trading Sideways After Friday’s Sharp Drop

Oil prices have been trading sideways during Monday’s APAC session after falling sharply on Friday. Prices were down on fears that China’s recovery would not be as robust as expected and the prospect of further US rate hikes while stockpiles are high. WTI is currently trading around $73.50/bbl and Brent $80.15.

- WTI broke through support at $74.97, the February 2 low, on Friday and now the level to watch is $72.74, the January 5 low. The bear trigger is at $70.56, the December 9 low. For Brent, watch support at $77.77, the January 5 low.

- The G7 and EU and Australia agreed to introduce a price cap of $100/bbl on Russian seaborne exports of high quality products such as diesel and $45 for the lower end ones such as fuel oil. The market expects other countries to import Russian product thus there’s unlikely to be a supply disruption. The Saudi energy minister warned that sanctions against Russia could result in an energy shortage but that they remain very cautious about increasing output despite this and the improved oil demand outlook from China.

- There is little scheduled later with January euro area retail sales the most significant release. It is a relatively quiet week in the US with Tuesday’s trade balance and Fed Powell’s speech the likely highlights.

FOREX: JPY Pressured on BoJ Speculation, AUD Outperforming

JPY was pressured through the Asian session today as BoJ matters were in focus.

- USD/JPY gapped higher at the open in thin liquidity as a Nikkei report noted BoJ Deputy Gov Amamiya being approached to head up the central bank. USD/JPY climbed as much as 1% before paring gains as Japan's Deputy Chief Cabinet Secretary Isozaki noted there was no truth to the Nikkei report. Finance Minister Suzuki earlier said he hasn’t heard such discussions, although he conceded that he is “out of the loop” on the matter.

- USD/JPY pared gains through the day to sit ~0.4% firmer at ¥131.65/70.

- AUD is the standout performer in G-10 space at the margins, despite weaker commodities (Iron Ore ~1% softer). AUD/USD firmed as Trade Minister Farrell noted he will travel to Beijing revealing a call with his counterpart struck an agreement for enhanced dialogue at all levels of government. A $17bn offer for miner Newcrest also potentially aided AUD at the margins.

- AUD/USD prints $0.6940/50, ~0.3% firmer today.

- NZD/USD was range bound for the majority of the session (onshore markets were closed for a local holdiay). The early bid in USD/JPY weighed, before support ahead of the 200-day EMA saw the pair par losses to last print $0.6330/35, little changed from opening levels.

- EUR and GBP are flat, having mostly observed tight ranges through the Asian session.

- Cross asset wise; e-minis are down ~0.3% and BBDXY is ~0.1% firmer. US 10 Year Treasury Yields are ~2bps firmer.

- Eurozone Retail Sales headlines an otherwise limited docket today.

FX OPTIONS: Expiries for Feb06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E623mln), $1.0875-80(E1.0bln), $1.0900(E745mln)

- USD/JPY: Y130.25-50($1.5bln), Y131.00($1.1bln)

- AUD/USD: $0.6940($1.4bln)

- USD/CAD: C$1.3350($545mln), C$1.3500($690mln)

- USD/CNY: Cny6.7500($500mln)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/02/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/02/2023 | 0840/0840 |  | UK | BOE Mann at Lamfalussy Lectures Conference | |

| 06/02/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/02/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/02/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 06/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 06/02/2023 | 1700/1700 |  | UK | BOE Pill Monetary Policy Report Live Q&A |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.