-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Weaker China Export Growth An Additional Yuan Headwind

EXECUTIVE SUMMARY

- EU CONSIDERS MANDATORY BAN ON USING HUAWEI TO BUILD 5G - FT

- RBA’s LOWE LAYS OUT FUTURE RATE HIKE FACTORS - MNI

- SLOWING ECONOMY, CREDIT FEARS WEIGH ON CHINA BANK STOCKS - MNI

- CHINA MAY EXPORTS -7.5% Y/Y IN DOLLAR TERMS; EST -1.8% - BBG

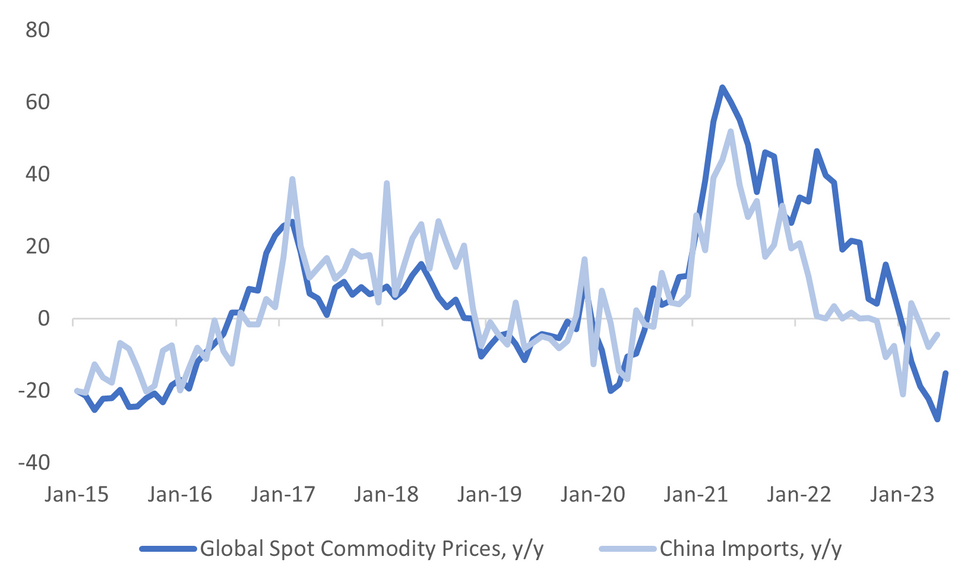

Fig. 1: China Imports & Global Commodity Prices - Y/Y

Source: MNI - Market News/Bloomberg

U.K.

ENERGY: The year is 6723, and there are finally enough onshore wind farms in England to support the UK’s 2050 net-zero target. At least that’s how long it would take at the current pace of construction, according to a report from the Institute for Public Policy Research, a London-based think tank. It’s an extreme example of how planning rules can slow renewable power development to an extent that could make climate targets impossible to reach. (BBG)

UK/US: UK Prime Minister Rishi Sunak will seek closer economic ties with the US during his first visit as leader to the White House, even as Joe Biden’s administration maintains a freeze on talks on a free-trade agreement. The two-day visit, in which Sunak will meet congressional leaders and company executives, will be his most extensive interaction with Biden — and their fourth meeting in as many months. They’re also due to discuss Russia’s war in Ukraine, Chinese aggression and the regulation of artificial intelligence. (BBG)

EUROPE

BONDS: The EU will survey the bond market on how it can improve trading and pricing of its debt, part of the blocs efforts to gain equivalent status to securities from member states. The questionnaire which is due to be sent to market participants on Wednesday will seek views on improving liquidity. (BBG)

EU/CHINA: The EU is considering a mandatory ban on member states using companies deemed to present a security risk in their 5G networks, including Chinese telecoms group Huawei, according to officials with knowledge of the discussions.The move comes as concern rises in Brussels that some national governments are dragging their feet on the issue, the officials told the Financial Times. (FT)

UKRAINE: About 42,000 people were at risk from flooding in Russian and Ukrainian controlled areas along the Dnipro River after a dam collapsed, as the United Nations aid chief warned of "grave and far-reaching consequences." (RTRS)

U.S.

US/CHINA: Secretary of State Blinken plans to visit China in the coming weeks for talks with top officials as the US looks to resume high-level communication despite continued tensions. (BBG)

POLITICS: Former New Jersey Governor Chris Christie on Tuesday launched his 2024 presidential campaign with a withering attack on the Republican front-runner, Donald Trump, calling him a "self-serving mirror hog" and faulting other rivals for avoiding direct confrontation. (RTRS)

POLITICS: Hard-right Republicans, still angry with House Speaker Kevin McCarthy's handling of the debt ceiling bill last week, sank a GOP procedural vote Tuesday in a show of strength in a razor-thin majority. In a surprise rebuke for McCarthy (R-Calif.) and the rest of GOP leadership, the Republican-led House failed to pass the rule for consideration of several bills this week. Eleven Republicans broke with their party to vote with Democrats, and the rule fell short on a 206-220 vote — the first rule vote to fail since November 2002. (Washington Post)

OTHER

AUSTRALIA: The strength of the global economy, household spending, growth in unit labour costs and overall inflation expectations will drive the Reserve Bank of Australia's future interest rate policy, according to Governor Philip Lowe. (MNI)

AUSTRALIA: Australia's economy grew at the weakest pace in 1-1/2 years last quarter as high prices and rising interest rates sapped consumer spending, and emerging signs suggest a further slowdown ahead amid a deceleration in global growth. (RTRS)

JAPAN: The Japanese government revamped its chip strategy with a goal of tripling sales of domestically produced semiconductors to more than 15 trillion yen ($108 billion) by 2030, as the nation centers chips at the heart of its economic security policy. (BBG)

CHINA

BANKING: Narrowed interest margins and fears of official calls for banks already heavily-exposed to property and local government debt to do more to prop up a slowing economy are eroding investor confidence in China’s state-owned banks despite a government drive to lift their share prices, policy advisors and analysts told MNI. (MNI)

ECONOMY: Chinese exports fell for the first time in three months in May, adding to risks in the world’s second-largest economy as global demand weakens. Overseas shipments shrank 7.5% in dollar terms from a year ago, official data showed Wednesday, far worse than the median forecast for a 1.8% drop. Imports declined 4.5%, better than an expected drop of 8%, leaving a trade surplus of $65.8 billion. (BBG)

PROPERTY: More patience is needed as the effects of policies aimed at stabilizing and helping the property market recover become more apparent, according to a commentary in Wednesday’s Economic Daily newspaper. Things are not as pessimistic as they seem, says the commentary written by Kang Shu, a journalist at the newspaper. (Economic Daily)

PROPERTY: Expectations are growing that further policies to support the property market will be rolled out this month, according to the Securities Daily, citing analysts. More supportive policies would follow the sales slump in April and May, with some of the tools “beyond the scope of what’s been used in the past”, according to Yan Yuejin, a research director at E-house China Research and Development Institute. (Securities Daily)

YUAN: Though some of the economic data may not yet be enough to support optimistic bets on the trend of the currency, there is no basis for the yuan to continue to weaken given the situation in regards to the economy, balance of payments and foreign currency reserves, according to a front-page commentary published in Wednesday’s Securities Times newspaper. (Securities Times)

ECONOMY: Economists in China called for further policies to support the economic recovery, as the Yicai Chief Economist survey index fell in May to 50.27, the third consecutive monthly contraction but still above the 50 mark. Participants said the economy showed signs of a slow recovery, but it suffered from weak demand. The economy was also transitioning from old drivers, such as real estate, towards new growth industries like consumption, high-end manufacturing and new infrastructure. (Yicai)

DEPOSIT RATES: Several state-owned banks have lowered their deposit interest rates, according to unnamed sources in the Securities Times. Some banks have cut yuan deposit rates by 5-10bp, and US dollar one-year rates to 4.3% from 5.0%, the paper said. Zou Lan, director of the Monetary Policy Department at the People's Bank of China recently stated commercial banks could adjust deposit interest rates based on market dynamics and their operating conditions. (Securities Times)

JOBS: China will launch a major recruitment campaign to assist up to 10 million recent graduates to find work, the Ministry of Human Resources and Social Security announced on its website. One expert said the Government should improve supply and demand connectivity in the labour market, and use incentives such as tax cuts and subsidies to help firms expand employment. China faced a shortage of general workers, such as forklift truck drivers, and also skilled workers like CNC machine programmers. (21st Century Herald)

CHINA MARKETS

PBOC Net Drains CNY11 Bln Via OMOs Wednesday

The People's Bank of China (PBOC) conducted CNY2 billion via 7-day reverse repos on Wednesday, with the rates unchanged at 2.00%. The operation has led to a net drain of CNY11 billion after offsetting the maturity of CNY13 billion reverse repo today, according to Wind Information.

- The operation aims to keep banking system liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9748% at 09:40 am local time from the close of 1.7499% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 47 on Tuesday, compared with the close of 44 on Monday.

PBOC SETS YUAN CENTRAL PARITY RATE AT 7.1196 WED VS 7.1075 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 7.1196 on Wednesday, compared with 7.1075 set on Tuesday.

OVERNIGHT DATA

AU Q1 GDP Q/Q 0.2%; MEDIAN 0.3%; PRIOR 0.6%

AU Q1 GDP Y/Y 2.3%; MEDIAN 2.4%; PRIOR 2.6%

CHINA EXPORTS Y/Y USD -7.5%; MEDIAN -1.8%; PRIOR 8.5%

CHINA IMPORTS Y/Y USD -4.5%; MEDIAN -8.0%; PRIOR -7.9%

CHINA TRADE BALANCE $65.81bn; MEDIAN $95.45bn; PRIOR $90.21bn

JAPAN APR P LEADING INDEX CI 97.6; MEDIAN 98.2; PRIOR 97.7

JAPAN APR COINCIDENT INDEX 99.4; MEDIAN 99.0; PRIOR 98.8

MARKETS

US TSYS: Curve Marginally Flatter In Asia

TYU3 deals at 114-01, +0-08, a 0-04 range has been observed on volume of ~56k.

- Cash tsys sit 1bp cheaper to 1bp richer across the major benchmarks, the curve has twist flattened pivoting on 10s.

- Tsys were marginally pressured as spillover from ACGBs, in lieu of RBA Gov Lowe's remarks this morning as he noted further tightening may be needed due to wage gains and persistent service price pressures.

- A bid in JGBs and the Yen, which saw pressure on Japanese equities, facilitated a recovery off session lows. The move didn't follow through and tsys respected narrow ranges for the remainder of the Asian session.

- FOMC dated OIS price ~6bps of hikes into next week's meeting, a terminal rate of ~5.25% is seen in July with ~30bps of cuts priced for 2023.

- German Industrial Production and ECB-speak from de Guindos headlines the European session. Further out we have US Trade Balance and the latest monetary policy decision from the Bank of Canada.

JGBS: Light Calendar, Narrow Range, JGB Curve Twist Flattens

In afternoon Tokyo trading, JGB futures are holding in the middle of a narrow range, +9 compared to settlement levels.

- With the local calendar light, local participants are likely on headlines watch and monitoring US tsys after the US cash curve twist flattened on Tuesday. The cash tsy curve has twist flattened further in Asia-Pac trade with yields +2.1bp to -0.5bp, pivoting at the 10s.

- BoJ Governor Ueda states in parliament that how the exit from easy policy could affect BoJ’s finances will depend on economic, price and financial developments – Reuters.

- The cash JGB curve has maintained the morning’s twist flattening in Tokyo afternoon trade, pivoting at the 4-year zone. Yields are however lower in line with US tsys moving away from Asia-Pac session cheaps. The benchmark 10-year yield is 0.8bp lower at 0.418%.

- Swaps curve twist flattens as well with swap spreads wider apart from the 10-year zone.

- The local calendar is heavy tomorrow with the release of GDP (Q1 final), Trade Balance (Apr), Bank Lending (May), International Investment Flows (June 2) and Tokyo Office Vacancies (May).

- The MoF plans to sell Y500bn of JGBs with 5-15.5 years until maturity in a liquidity enhancement auction tomorrow.

AUSSIE BONDS: Q1 GDP Misses But Productivity & ULCs Will Be A Concern For The RBA

ACGBs are sitting cheaper (YM -6.0 & XM -1.5) as local participants consider RBA Governor Lowe's speech, a Q1 GDP miss and troubling productivity and unit labour costs (ULC) updates.

- Cash ACGBs are 2-5bp cheaper with the AU-US 10-year yield differential 4bp higher at +16bp.

- Swap rates are 1-5bp higher on the day.

- The bills strip is lower with pricing -2 to -10, late whites leading.

- RBA dated OIS pricing is 1-5bp firmer across meetings after the data with December leading.

- While Q1 GDP undershot expectations, it also revealed a 4.5% y/y fall in productivity, the lowest annual rate since the series began in 1979. Moreover, ULCs rose from 6.9% y/y in Q4 to 7.9%, the highest annual rate since 1990 outside the pandemic. This data is only going to increase inflation risks and the RBA’s concerns.

- Goldman Sachs has raised its terminal rate hike expectation for the RBA (to 4.85% from 4.35%) after RBA Lowe's speech earlier today. The bank now expects hikes in July, August and September. Previously it had expected a 25bp hike in July.

- The global economic calendar is light today, with the highlight being the BoC Policy Decision. The market has assigned a 46% probability of a 25bp rate hike.

NZGBS: Twist Flattening, Local Market Weighs ACGB & US Tsy Movements

NZGBs closed with the 2s10s cash curve bear flattening. This occurred as the local market considered the negative impact stemming from an ACGB sell-off triggered by yesterday's surprise 25bp rate hike, which took place after the local market had closed. However, the positive performance of longer-dated US tsys overnight provided a contrasting influence. These divergent factors have persisted during Asia-Pac trading today.

- As a result, NZGBs have shown weaker performance compared to US tsys, with the NZ/US 10-year yield differential +5bp. Conversely, NZGBs have exhibited stronger performance when compared to ACGBs, resulting in a 5bp point narrowing of the NZ/AU 10-year yield differential.

- Swap rates closed 2-4bp higher with the curve flatter and implied swap spreads slightly wider.

- RBNZ dated OIS closed flat to 4bp firmer across meeting with Feb’24 leading.

- The local calendar sees Mfg Activity (Q1) and the NZ Government’s 10-month Financial Statement tomorrow.

- The global economic calendar is light today, with the highlight being the BoC Policy Decision. The market has assigned a 46% probability of a 25bp rate hike.

- The NZ Treasury announced that they plan to sell NZ$200mn of the 4.50% May-30 bond, NZ$150mn of the 3.50% Apr-33 bond and NZ$50mn of the 2.75% Apr-37 bond tomorrow.

FOREX: Yen Moderately Firmer In Asia

The yen is the best performer in the G-10 space at the margins on Wednesday. USD/JPY was offered as Japanese equities fell, there was no obvious headline driver for the move, and the Yen held its gains through the session.

- USD/JPY prints at ¥139.20/30 down ~0.3%, however Tuesday's lows remain intact for now. Support comes in at the low from June 1 at ¥138.45.

- AUD is marginally firmer, the pair rose ~0.3% briefly breaching post Tuesday's RBA highs as RBA Gov Lowe noted that further tightening may be needed due to wage gains and persistent service price pressures. Gains were pared as Q1 GDP was softer than expected and AUD/USD sits at $0.6675/80.

- Kiwi is little changed in Asia, NZD/USD prints at $0.6075/80. A narrow ~20 pip range has been observed thus far today.

- Elsewhere in G-10 SEK is pressured, however liquidity is generally poor through the Asia session. EUR and GBP are little changed and were unable to follow through on an early move higher.

- Cross asset wise; E-minis are marginally firmer and BBDXY is a touch softer. US Treasury Yields are little changed.

- The Bank of Canada's monetary policy decision provides the highlight of today's docket, the bank is expected to hold rates steady at 4.50%.

EQUITIES: Japan Equity Rally Loses Momentum, China Property Stocks Still Pushing Higher

Regional equities are mixed. Japan equity weakness was a feature early, but these markets have pared losses. China and HK are showing contrasting trends, with further chat in onshore media of China property market support. Most SEA markets are lower. US futures have largely been on the sidelines. Eminis last around 4294, +0.10% so far for the session.

- The early weakness in Japan stocks didn't appear fundamentally driven, with some consoldiation evident after an impressive 4 day rally. The Nikkei 225 last sat around 32270, against early lows of 32000. This is still around 0.75% sub yesterday's closing levels.

- The headline CSI 300 is down by 0.36% at the break, although the property sub index is up 0.92%. A local media report highlighted that further stimulus may come for the sector in June.

- The HSI is up nearly 1% at the break, the HS TECH index up 2%, with a potential Blinken trip to China in coming weeks a sign of some thawing in US-China tensions, a positive catalyst.

- The Taiex is +0.80% following the positive lead from the SOX in Tuesday US trade, while the Kospi is around 0.30% firmer as South Korean markets return from yesterday's holiday.

- In SEA, only the Philippines bourse is higher at this stage.

OIL: Prices Keep Falling As Demand Worries Outweigh Saudi Output Cut

Oil prices are down a further 0.4% after falling on Tuesday, as demand concerns came to the fore again following weak China export data. Gains following the further OPEC output cut were brief. WTI is down 0.4% to $71.44/bbl, close to the intraday low of $71.32. Brent is 0.5% lower to $75.94 just off the low of $75.83. The USD index is down 0.1%.

- China’s export growth fell 7.5% y/y in May and while it was impacted by base effects, it signals that global demand is soft. Import growth was better than expected at -4.5% y/y and crude imports rose 6.2% y/y. Also on the demand side, the US expects its 2023 oil consumption to be half of 2022’s.

- Russian output in May only fell to 9.66mbd from 9.67mbd after it promised a 500kbd reduction and now Saudi Arabia is telling Russia to be more transparent.

- Later there is US EIA crude inventory data trade data for April and earlier Bloomberg reported that API US crude inventories fell 1.71mn barrels in the latest week after a 5.2mn build, according to people familiar with the data.

- US trade and consumer credit data for April are due. German April IP prints and the ECB’s De Guindos, Fernandez-Bollo and Panetta speak. The Bank of Canada meeting is also coming up and rates are expected to be held at 4.5%.

GOLD: Treads Water As Market Considers Next Week’s FOMC Outcome

Gold is unchanged in the Asia-Pacific session, after treading water on Tuesday. The precious metal closed +0.1% at 1963.52 as the US tsy yield curve twist flattened and the market considered the Federal Reserve’s interest rate path, ahead of next week’s FOMC meeting.

- Traders have shown a growing inclination towards the belief that the US central bank will maintain interest rates at their current level at the upcoming June meeting while remaining open to the possibility of future rate hikes. The pricing of FOMC-dated OIS contracts has an expectation of approximately 6bp of rate hikes factored in for next week's meeting, with a projected terminal rate of around 5.25% by July. Additionally, the market has priced in approximately 25bp of rate cuts for 2023.

- In a quiet day data-wise, tsys were pressured to session lows on spillover from EGBs, rate locking tied to incoming corporate debt issuance early in the NY session. Higher US tsy yields are typically negative for non-yielding bullion.

- However, cash tsys finished the NY session 1bp cheaper to 4bps richer across the major benchmarks with the curve twist flattening, pivoting on 3s.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/06/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 07/06/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/06/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/06/2023 | 0750/0950 |  | EU | ECB de Guindos Speech at EC/ECB Conference | |

| 07/06/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 07/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/06/2023 | 0910/1110 |  | EU | ECB Panetta Moderates EC/ECB Conference Panel | |

| 07/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/06/2023 | - | *** |  | CN | Trade |

| 07/06/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 07/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/06/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.