-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI POLITICAL RISK ANALYSIS – Australia Election Preview

Executive Summary

Australians head to the polls on 21 May with incumbent Prime Minister Scott Morrison seeking to pull off a second successive upset victory to secure a fourth consecutive majority for his Liberal/National Coalition. The election campaign has been an ill-tempered affair, with little in the way of substantive policy discussion. Nevertheless, markets will be watching closely given the importance of Australia with regards to global commodity production and prices as well as its strategic position as a key US ally in the Indo-Pacific.

- The opposition centre-left Australian Labor Party (ALP) is on course to oust Prime Minister Scott Morrison’s centre-right government following nine years of Liberal/National Coalition rule.

- Opinion polls point to a relatively close race on primary votes. However, Australia’s electoral system means Labor stand a strong chance of picking up seats based on second preference votes from Green and independent candidate supporters.

- The largely centrist policy platform put forward by the ALP means there are unlikely to be any significant market shocks in the event Morrison is ousted. Similarly, should the Liberals pull off another unexpected electoral win we would expect to see broad policy continuity.

- Policy instability could result from the scenario of a minority Labor administration propped up by the Greens. The Greens could seek to extract significant concessions on taxation and spending, as well as climate change policy in exchange for their votes to put ALP leader Anthony Albanese in the prime minister’s office.

MNI POLITICAL RISK ANALYSIS – Australia Election Preview.pdf

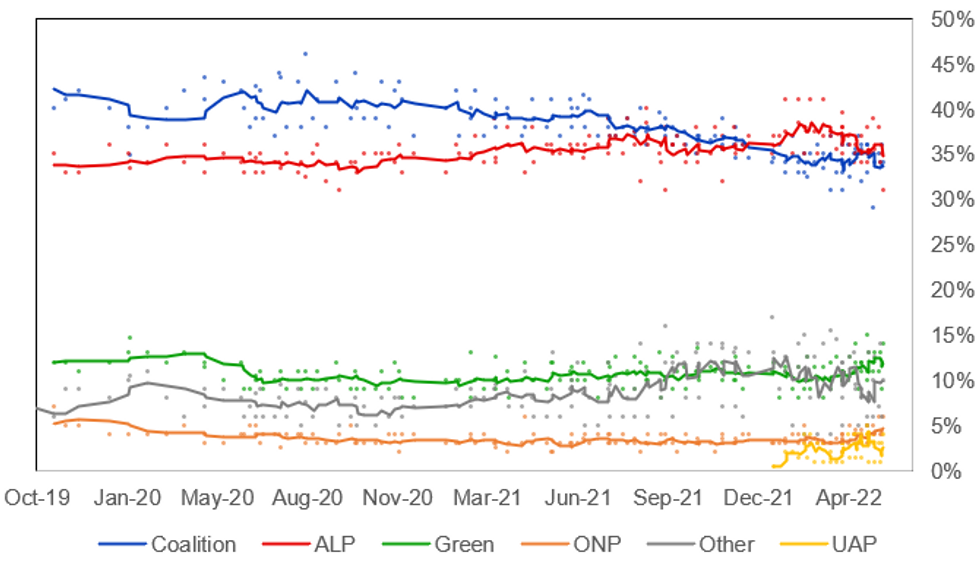

Chart 1. Australia Federal Election Opinion Polling (Primary Vote, Long-Term), % and 6-Poll Moving Average

Source: Resolve Strategic, Essential, Roy Morgan, Newspoll-YouGov, Ipsos, MNI

Source: Resolve Strategic, Essential, Roy Morgan, Newspoll-YouGov, Ipsos, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.