-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - CNH Fades as NPC Commits to Modest Growth Target

Highlights:

- CNH fades as NPC commits to more modest growth target

- USD recovers off overnight lows despite one-way traffic for US yields

- Quieter Monday ahead of key Japanese, Australian, Canadian CB decisions

US TSYS: Bull Flattening To New 2s10s Lows Ahead Of Light Docket

- Cash Tsys have continued Friday’s net rally (temporarily interrupted by a stronger than expected ISM Services report) despite relatively little further moderation overnight in Fed rate expectations.

- The setting of China’s annual GDP growth (“around 5%”) at the less optimistic end of the spectrum of potential outcomes has helped provide support. There has been little change since then at the front end but the longer end continues a bid as it reverses the cheapening after the surprise jump in ISM mfg prices paid earlier in the week, with the combination seeing 2s10s touch fresh multi-decade lows of -92.5bps.

- 2YY -1.7bp at 4.840%, 5YY -3.2bp at 4.214%, 10YY -3.9bp at 3.913% and 30YY -3.8bp at 3.838%.

- TYM3 trades 9 ticks higher at 111-12 just off session highs of 111-14 back at pre-ISM mfg levels. The bounce is deemed corrective with resistance at 111-23+ (Feb 28 high) and support at the bear trigger of 110-12+ (Mar 2 low).

- Data: Factory orders/final durable goods Jan (1000ET)

- Bill issuance: US Tsys $57B 13W, $48B 26W bill auctions (1130ET)

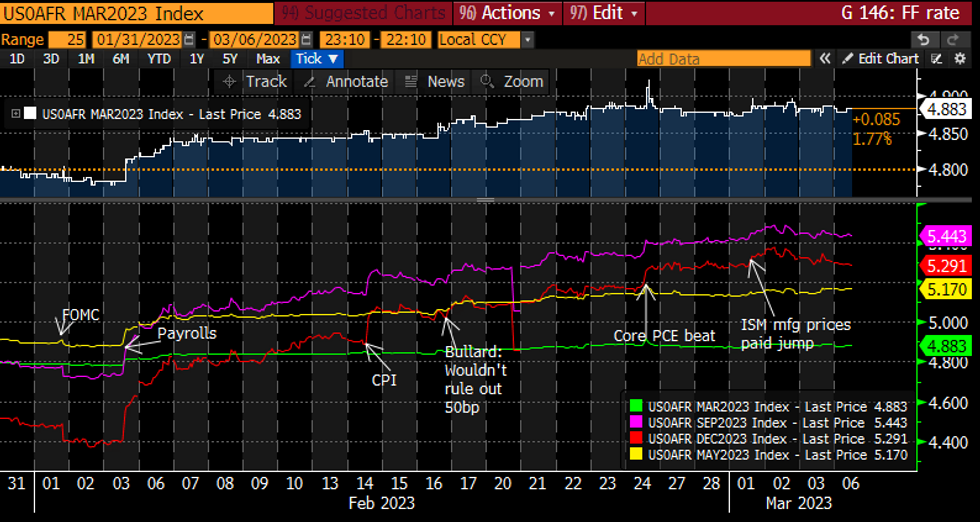

STIR FUTURES: Fed Rate Path Consolidates Easing Off Highs

- Fed Funds implied hikes little changed overnight after pulling back from highs mid-last week.

- 30.5bp for Mar (-0.5bp), cumulative 59bp for May (unch), 87bps to terminal 5.44% Sep (unch) before 15bp of cuts to 5.29% year-end (-1.5bp).

- Fedspeak: Daly (’24) on Sat said work is far from done on lowering inflation and latest data are not necessarily an indicator that the trend has changed. No commentary scheduled today with Powell’s semi-annual report to the Senate tomorrow next up.

FOMC_dated Fed Funds implied hikesSource: Bloomberg

FOMC_dated Fed Funds implied hikesSource: Bloomberg

ECB: Holzmann Calls for Four Further 50bps ECB Hikes

Full Holzmann article here: https://www.handelsblatt.com/finanzen/geldpolitik/...

Article highlights:

- He calls for four sharp interest rate hikes by the summer and faster balance sheet reductions by the central bank.

- He calls for interest rates to be raised by 50 basis points at each of the next four meetings

- Holzmann believes that a restrictive level of interest rates that would slow down the economy would only be reached from a deposit interest rate of four percent.

First comments we've seen from Holzmann on rates specifically in about a month - he stated in early February that he sees the ECB terminal rate being hit around the middle of the year, or Q3 by the latest. Back then he also stated that he cannot tell where the terminal rate will be - so appears we're getting some more clarity over his view here.

FOREX: Dollar Off European Morning Lows - But Only Just

- After a softer start to the session across Asia-Pac trade and the European morning, the dollar is off lows, dragging the EUR/USD rate off overnight highs at 1.0657. While the USD is inching more favourably, the USD Index is still in close proximity to the intraday supports at 104.345 and 104.093 for the USD Index.

- At the top end of the table, CHF outperforms following a higher-than-expected outturn for February CPI. M/M inflation rose to 0.7% vs. Exp. 0.5%, while Y/Y rose to 3.4% vs. Exp. 3.1%. EUR/CHF slipped to 0.9924 in response, putting the cross at the lowest level since Feb28.

- AUD, NZD trade to the bottom end of the G10 table, prompting AUD/USD to fade ahead of the test on the 200-dma resistance at 0.6789, mimicking the moderation US equity futures ahead of the Monday open. Moves in commodity-tied currencies follow the decision on China's GDP growth target for this year - a more conservative 5% relative to expectations.

- Focus Monday shifts to the January Factor Order release from the US as well as the final durable goods orders report for the same month. Canadian interest lies in the Ivey PMI for February.

- Outside of Monday, risk events and activity pick up later in the week, with rate decisions due from the Australian, Canadian and Japanese central banks before Friday's Nonfarm Payrolls report.

FX OPTIONS: Expiries for Mar06 NY cut 1000ET (Source DTCC)

Larger options rolling off at today's cut - NZD/USD slippage over past hour or so puts spot within range of sizeable expiry today:- EUR/USD: $1.0630-50(E864mln)

- USD/JPY: Y135.00-10($547mln), Y135.75-00($615mln), Y137.00-24($1.5bln)

- GBP/USD: $1.1874-91(Gbp2.3bln), $1.2050-60(Gbp2.7bln)

- AUD/USD: $0.6735(A$582mln), $0.6760-65(A$644mln), $0.6775-85(A$1.2bln)

- NZD/USD: $0.6180-00($1.0bln)

- USD/CAD: C$1.3600($562mln)

- USD/CNY: Cny6.9500($1.0bln)

EQUITIES: Eurostoxx Futures Test 4323.00 - Feb 16 High and Bull Trigger

- Eurostoxx 50 futures have recovered from recent lows and importantly, this has left a key support intact - the base of a bull channel drawn from the Oct 13 low. The line intersects 4211.90. While channel support holds, the broader uptrend remains intact. Today’s gains have resulted in a test of 4323.00, the Feb 16 high and bull trigger. A clear would resume the uptrend. On the downside, a breach of the channel base would alter the picture.

- S&P E-Minis trend conditions are bearish, however, the strong bounce late last week has eased bearish pressure. Note that the contract has traded above both the 20- and 50-day EMAs. An ability to hold on to the latest gains would signal scope for a recovery towards 4100.20, a Fibonacci retracement. On the downside, key support has been defined at 3925.00, the Mar 2 low. A break of this level would reinstate the recent bearish theme.

COMMODITIES: WTI Futures Breach 50-Day EMA, Opening $80.78 Feb 13 High

- WTI futures remain bullish following last week’s appreciation. The contract cleared resistance at the 50-day EMA which intersects at $77.99 today. The breach reinforces short-term bullish conditions and paves the way for a climb towards $80.78, the Feb 13 high and $82.89, the Jan 23 high and a key resistance. On the downside, a breach of support at $73.80 is required to reinstate the recent bearish theme.

- Trend conditions in Gold remain bearish, however, the metal traded higher last week and traded through resistance at $1846.4, the 50-day EMA. A clear break of this hurdle would strengthen short-term bullish conditions and signal scope for an extension - this would open $1870.5, the Feb 14 high. On the downside, key short-term support has been defined at $1804.9, the Feb 28 low. A break would resume recent bearish activity.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/03/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/03/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/03/2023 | 1000/1100 |  | EU | ECB Lane Lecture at Trinity College | |

| 06/03/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/03/2023 | 1500/1000 | ** |  | US | Factory New Orders |

| 06/03/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 06/03/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/03/2023 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/03/2023 | 0030/1130 | ** |  | AU | Trade Balance |

| 07/03/2023 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 07/03/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/03/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 07/03/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/03/2023 | - | *** |  | CN | Trade |

| 07/03/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/03/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 07/03/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 07/03/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/03/2023 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.