-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Curve Sits Richer Pre-PPI

Highlights:

- Treasury curve sits richer ahead of PPI inflation

- Focus turns to central bank speak, with Fed, BoE, ECB, BoC and RBA representatives all due Thursday

- AUD shakes off jobs numbers, with underlying labour market strength a driver

US TSYS: Broadly Richer Ahead Of PPI, Fedspeak and 30Y TIPS

- Cash Tsys sit richer across the curve except the very long end where 20-30Y tenors buck the trend with 30Y yields +1bp but still outperforming core EU FI.

- The bid at the front end started with an unexpected uptick in Australian unemployment and has largely continued since then, helped more recently by China announcing sanctions against US defense companies. It sees 2Y yields through yesterday’s low but still almost 10bps higher than levels shortly before US CPI on Tue. PPI follows today with implications for core PCE inflation (released Feb 24) plus Fedspeak and 30Y TIPS supply.

- 2YY -4.4bp at 4.587%, 5YY -3.9bp at 3.998%, 10YY -1.7bp at 3.788% and 30YY +1.2bp at 3.853%.

- TYH3 trades 6 ticks higher at 112-07+ off earlier session highs of 112-11+, for the most part remaining within yesterday’s range aside from an overnight low of 111-29+ that now forms initial support. Resistance sits at the 50-day EMA of 114-00+.

- Data: PPI Jan, building permits/housing starts Jan and weekly jobless claims all at 0830ET.

- Fedspeak: Mester (0845ET), Bullard (1330ET), Gov Cook (1600ET), Mester (1815ET)

- Bond issuance: US Tsy $9B 30Y TIPS auction (912810TP3) – 1300ET

- Bill issuance: US Tsy $75B 4W, $60B 8W bill auctions – 1130ET

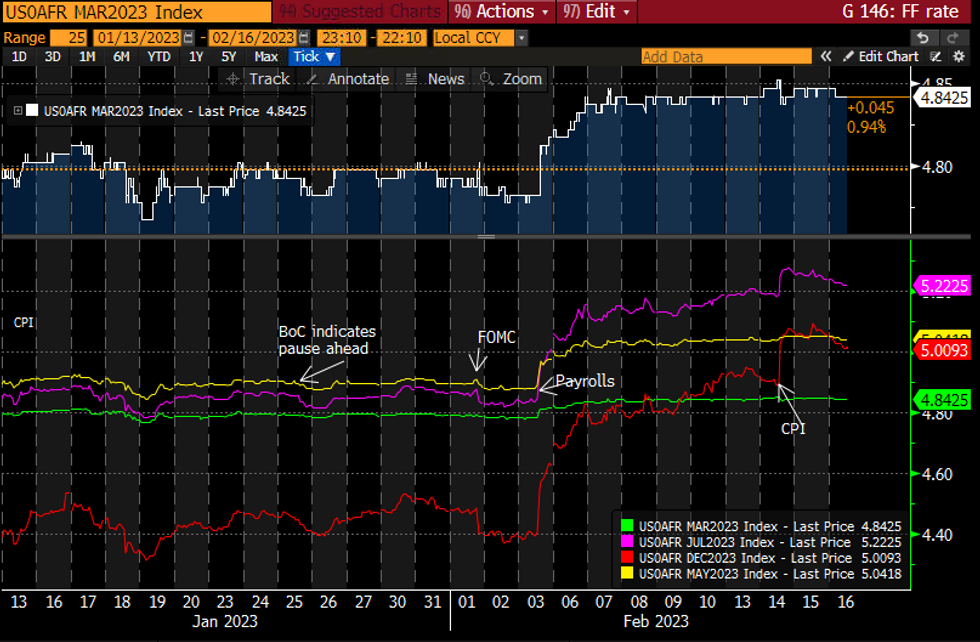

STIR FUTURES: Fed 2H23 Rates Continue Drift Lower Off Highs

- Fed Funds implied hikes have drifted lower overnight as the terminal continues to pull back from post-CPI highs of 5.29% and tilt nearer pre-CPI levels of 5.18%.

- 26bp for Mar (-0.5bp), cumulative 46bp for May (-1bp), 64bp to a 5.22% terminal in Jul (-1.5bp) before holding a similarly limited 21bps of cuts to 5.01% for Dec (-4bp).

- Three separate Fed speakers today all with text. Mester (’24 voter) and Bullard (non-voter) for the first time since the Feb FOMC, payrolls and CPI whilst the only current voter is Gov. Cook late on at 1600ET who said Feb 8 the strength of payrolls was a surprise but can’t put too much weight on one data point.

Source: Bloomberg

Source: Bloomberg

CHINA: Politburo: Covid Prevention Situation In China Is Good Overall

MNI London: Reuters reporting comments from the Chinese Politburo Standing Committee stating that China's Covid prevention situation is "good overall."

- The Standing Committee says that Beijing "will increase vaccination rate for the elderly," and "strengthen supply and production of medical goods."

- SCMP, citing Moody’s, reported this week that China’s 2023 “growth outturn” is likely to be stronger than previously expected with growth in the first quarter is expected to beat the final three months of 2022 because of the border’s reopening and Lunar New Year holiday activity, .

- Ker Gibbs, former president of the American Chamber of Commerce in Shanghai, said: “The end of zero-Covid is huge for the foreign business community in China. I’m expecting the Chinese economy to bounce back quite well in 2023, with a lot of pent-up consumer demand,” he said. “Foreign companies want to be in position to share the benefits from that.”

FOREX: AUD Recoups Jobs-Inspired Losses

- AUD saw early pressure in Asia-Pac trade on the back of a poorer-than-expected January jobs data release, with employment change dropping 11.5k vs. an expected gain of 20k positions. AUD/USD dropped to 0.6868 upon release, before the pair stabilised well through the European open as markets coined the stronger underlying tone in the jobs release, with seasonal factors helping contribute to the outsized portion of the workforce falling into the 'unemployed with a job to go to' cohort.

- As a result, AUD/USD has staged a near 50 pip recovery off the lows, although the Wednesday highs remain a way off for now.

- The USD trades softer headed through to the NY crossover, but has only faded slightly off yesterday's highs, which marked the strongest level for the USD Index since early January. The 50-dma remains carefully watched for direction, currently moderating its downtrend at 103.365.

- GBP trades slightly firmer, as markets close off positions after yesterday's CPI-inspired downtick. EUR/GBP is back in negative territory after a solid rally on Wednesday. 0.8816 marks first support ahead of 0.8804 and vol-band based support at 0.8790.

- US PPI for January is the data highlight Thursday, released alongside weekly jobless claims and housing starts/building permits. The speaker slate will likely garner more attention, with Fed's Mester, Bullard & Cook all due as well as ECB's Nagel, Lane, Makhlouf & Stournaras and BoE's Pill.

FX OPTIONS: Expiries for Feb16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750-60(E540mln)

- USD/JPY: Y128.50($550mln)

- EUR/GBP: Gbp0.8930-50(E976mln)

- NZD/USD: $0.6200(N$671mln)

- USD/CAD: C$1.3435-50($1.1bln), C$1.3550($906mln)

FOREX: Price Signal Summary – EUR/GBP Snaps Losing Streak, Eyes Turn Higher

- EURGBP trend conditions remain bullish, with prices reverting higher on the back of the UK CPI release. Wednesday saw the first higher close in eight sessions for the cross, helping partially reverse a large part of the modest pullback.

- EURJPY is recovering further off support headed through the Wednesday close, marking a third consecutive session of the cross closing at a session high. The next upside level sits at 144.00 handle resistance ahead of 144.53.

- GBPUSD maintains a sell-on-rallies theme as price failed to retain upside momentum after the 1.2269 print Tuesday. Recent weakness reinforces a S/T bearish theme and signals scope for a continuation.

EQUITIES: Eurostoxx Futures Continue Uptrend, Prints 4323.0 Fresh Cycle High

- EUROSTOXX 50 futures are tilted higher through the Thursday open, with a late US rally persisting across Asia hours. This puts prices north of first resistance at 4303.20, the 2.382 proj of the Sep 29 - Oct 4 rise from Dec 20 low, the last week to breach 4265.00, the Feb 3 high. Note that the trend is overbought. A pullback would represent a healthy correction. Key support lies at 4097.00, the Jan 19 low. Initial support is at 4167.50, the 20-day EMA.

- The S&P E-Minis trend condition is bullish and the latest pullback is considered corrective. The contract has pierced initial support at 4069.52, the 20-day EMA. Firmer support lies at the 50-day EMA, at 4006.63. A clear break of this average would signal scope for a deeper pullback and potentially highlight a reversal. Key resistance and the bull trigger intersect at 4208.50, the Feb 2 high. A breach would resume the uptrend.

COMMODITIES: WTI Futures Consolidate Recent Recovery

- WTI futures showed above the Friday high ahead of the Monday close, marking an extension of the recovery from $72.25, the Feb 6 low. The rally has confirmed a break of the 50-day EMA, at $78.34, strengthening the current bull cycle. Prices have faded slightly since, however the medium-term view remains unchanged. Key resistance remains at $82.66, the Jan 18 high. On the downside, initial firm support has been defined at $76.52, the Feb 9 low.

- Trend conditions in Gold are bearish for now, and the yellow metal remains in a corrective cycle. This follows the strong sell-off on Feb 2 / 3 as well as the break of support at the 50-day EMA early Wednesday. A clear break here would strengthen a bearish case and suggest scope for a deeper pullback - towards $1825.2, the Jan 5 low. On the upside, key resistance and the bull trigger is at $1959.7, the Feb 2 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 16/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/02/2023 | 1330/0830 | *** |  | US | PPI |

| 16/02/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 16/02/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/02/2023 | 1345/0845 |  | US | Cleveland Fed's Loretta Mester | |

| 16/02/2023 | 1500/1600 |  | EU | ECB Lane Dow Lecture at NIES London | |

| 16/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 16/02/2023 | 1600/1100 |  | CA | BOC Governor Macklem at House of Commons hearing | |

| 16/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 16/02/2023 | 1700/1700 |  | UK | BOE Pill Fireside Chat at Warwick University Think Tank | |

| 16/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 16/02/2023 | 1830/1330 |  | US | St. Louis Fed's James Bullard | |

| 16/02/2023 | 1945/2045 |  | EU | ECB de Guindos Students Discussion | |

| 16/02/2023 | 2100/1600 |  | US | Fed Governor Lisa Cook | |

| 16/02/2023 | 2255/1755 |  | CA | BOC Deputy Beaudry speaks on "The importance of the Bank of Canada’s 2% inflation target" | |

| 16/02/2023 | 2315/1815 |  | US | Cleveland Fed's Loretta Mester | |

| 17/02/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 17/02/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 17/02/2023 | 0700/0800 | ** |  | DE | PPI |

| 17/02/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 17/02/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 17/02/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/02/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 17/02/2023 | 1330/0830 |  | US | Richmond Fed's Tom Barkin | |

| 17/02/2023 | 1345/0845 |  | US | Fed Governor Michelle Bowman | |

| 17/02/2023 | 1500/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.