-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Earnings Season Starts Off Mixed

Highlights:

- Bank earnings a focus, amid mixed reports

- USD/JPY extends break lower, having taken out key support Thursday

- UMich the last data highlight of the week

US TSYS: Bank Earnings, U.Mich and Fedspeak Come Into Focus

- Cash Tsys see recent cheapening off highs to leave a twist steepening on the day, with the front end just holding richer but cheaper from the 5Y onwards. Overnight trade has been mixed, under pressure earlier as weakness in JGBs spilled over before more two-way moves in European hours.

- It leaves yields at the low end of yesterday’s post-CPI ranges having earlier extended new lows before reversing, with 2YY -0.5bps at 4.140%, 5YY +1.0bps at 3.545%, 10YY +2.7bps at 3.465% and 30YY +3.2bps at 3.609%.

- Bank/financials are kicking off the earnings season today with focus later shifting to the preliminary January survey for U.Mich and its inflation expectations. Less attention on import prices for Dec coming after CPI this month.

- TYH3 trades 3+ ticks lower at 115-04, off earlier highs of 115-15+ that extended yesterday’s late high of 115-13+ having pierced the bull trigger at 115-11+ (Dec 13 high). A clear break could open 115-26 (2.00 proj of Oct 21 – 27 – Nov 3 low).

- Data: International trade prices, Dec (0830ET), U.Mich consumer survey, Jan prelim (1000ET)

- Fedspeak: Kashkari (’23 voter) at 1000ET and Harker (’23 voter) at 1520ET with text.

- No issuance.

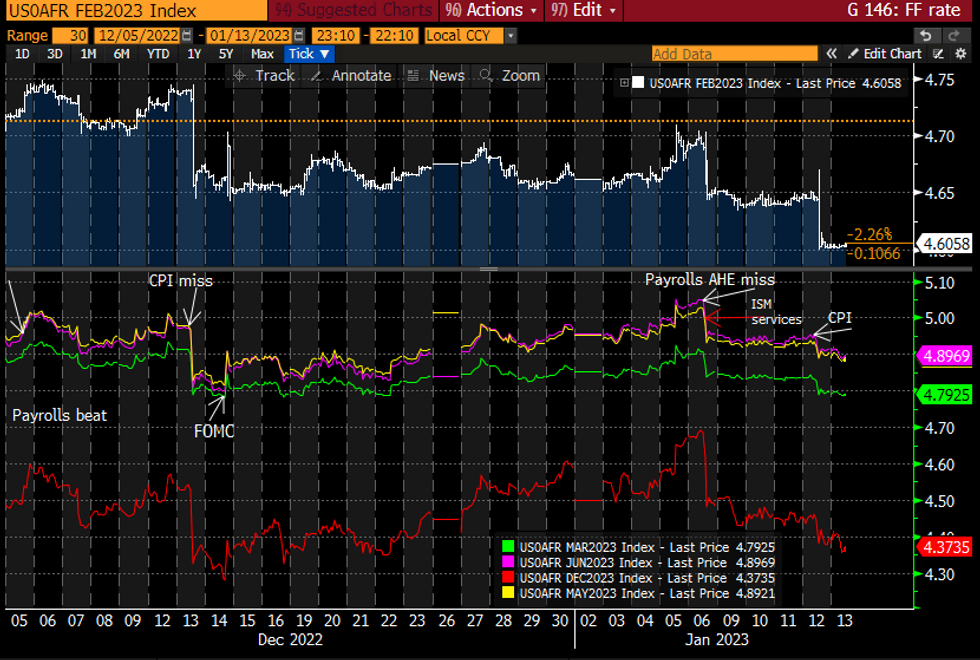

STIR FUTURES: Fed Terminal Drifting Modestly Lower

- Fed Funds implied hikes consolidate the 27.5bp for Feb 1 seen after CPI and drift a little lower for subsequent meetings.

- Cumulative 46.5bp for March (-0.5bp), 57bp to terminal 4.90% Jun (-1.5bp) and now 52.5bps of cuts to 4.37% Dec (-2.5bp). The terminal edges closer to the low 4.8s before the Dec FOMC.

- Two 2023 voters today: Kashkari gives welcoming remarks at 1000ET (last spoke Jan 4: too soon to definitely declare inflation has peaked, favors 5.4% then pausing) before Harker again after yesterday lent towards 25bp hike for “a few more times this year”.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

US OUTLOOK: Majority Of But Not All Analysts Eyeing 25bp Downshift In Feb

- The majority of the 20 analysts reviewed by MNI in the table below saw the Dec CPI report consistent with a further downshift to a 25bp hike at the Feb 1 FOMC decision.

- There are a few notable standouts with CIBC, Citi and TD still arguing for a 50bp hike, which in the case of the latter two comes with a view of a terminal 5.25-5.5%.

- Full inflation review to follow shortly.

Analyst | Summary |

ABN Amro | CPI Continues To Trend Lower, Giving Fed Confidence For 25bp Downshift |

ANZ | CPI Likely Overstates Potential Weakness, Still See Two 25bp Hikes With No Cuts This Year |

BMO | Could Tip The Odds Towards Down Shift To 25bp In Feb |

BNP | Now See Just 25bp Hike In Feb But Continue To See Terminal 5.25% |

BofA | Risks Of 25bp Hike Rising, Would Need Strong FOMC Push Back If Planning 50bp |

CIBC | Labor Tightness To See Final 50bp Hike In February Before On Hold 2023 |

Citi | Market Underappreciating Underlying Strength In Inflation Data, Still See Terminal 5.25-5.5% |

Commerz | Still Open Whether Down Shifts To 25bps, Waiting On ECI End Of Month |

Danske | Easing Pressure For Continued Aggressive Hikes |

GS | Continue To Expect Three Further 25bp Hikes |

ING | Two 25bp Hikes Still To Come Before Up To 100bps Of Cuts In Second Half |

JPM | Keeps Fed On Track To Hike 25bp In February |

MS | Continue To Expect Only One Final 25bp Hike in Feb, Eventual First Cut In December |

NatWest | Clearly Lends Support To Long-Standing Call For 25bp Hike |

Pantheon | Downshift In Core CPI Inflation Is Gathering Pace, Impossible To Time Lower Rent Trend |

RBC | Still See Two 25bp Hikes Still To Come After Inflation Moderation Green Shoots |

Scotia | Still Think Powell Will See More Upside Risk Than Downside |

TD | Market Overly Optimistic, Continue To See 50bp Hike and Terminal 5.25-5.5% |

Unicredit | Most Fed Officials Likely Feeling Comfortable Stepping Down To 25bp Hike In February |

Wells Fargo | We Doubt The FOMC Is Ready To Declare Mission Accomplished |

ECB: Early TLTRO Repayments Drop at a Sharper Pace Than Expected

- ECB announces banks made EUR 62.75bln in early TLTRO repayments, a lower repayment than sell-side forecasts of EUR 213bln.

- This marks a sharp slowdown in the pace of repayments, which totalled just shy of EUR 800bln across the November and December repayment windows.

- The ECB's December Survey of Monetary Analysts showed a median E130bln expected to be repaid in the January window, with 25th-75th percentiles of E55-250bln - but that appears to take into account survey responses before the Dec window takeup of E447.5bln came in at the high end of expectations (E236-496bln, E311bln median).

USD/JPY Break Lower Has Taken Markets by Surprise

- USD/JPY's downtick since the beginning of the year has caught markets offside: as of January 1st, option-implied probability attributed only a 26% chance of the pair trading below 128.50 at today's close, a market move that's resulted in a sharp retracement for front-end USD/JPY risk reversals, with the 3m contract now at the lowest levels since the onset of the pandemic.

Figure 1: USD/JPY 3m risk reversals are most bearish USD/JPY since COVID

- The run below Y130.00 in the pair has largely decoupled FX from short-end rates markets, with the US-Japan 2yr yield spread, with currencies clearly expressing the view that the Bank of Japan will imminently move on their YCC policy.

- Nonetheless, the gap could persist through the January 18th BoJ policy meeting, even in the event of a YCC tweak. MNI sources (piece here) this week detailed that the BoJ could shift the focus of YCC to the short-end, freeing more market movement into the 10y and longer-end of the yield curve, but keeping the short-end (MNI sources see this as 3- to 5-year maturities) under control.

Where Could USDJPY Go From Here?

Where could USD/JPY go from here?

- Analyst consensus sees the pair at 130.80 - 131.20 over a one-month horizon, but these estimates are looking increasingly stale in light of this week's moves, with downside risks building fast.

- Evidence is building of sizeable downside interest in USD/JPY via options. Across DTCC-tracked trade, close to $2 in USD/JPY put notional traded for every $1 in call notional, with short-dated downside the preferred trade. Strikes at 128.00, 127.00 and 125.00 were unsurprisingly popular, although decent downside interest was noted as low as 105.00, a relatively cheaper strike that would pick up interest on any further break lower.

- USDJPY's break of support at 129.52 yesterday was significant. The move also hastened the swift formation of a death cross (50-dma < 200-dma) for the first time since 2020. This sequence highlights the clear downtrend, making further weakness likely. The focus going forward is on 127.53, the May 31, 2022 low.

- Significantly, this week's downtick is yet to trigger any technically oversold signals, with the 14-day RSI holding above levels that would suggest momentum has gone too far.

FOREX: USD/JPY Extends Losses After Key Break of Support

- JPY is the strongest currency in G10 for a second session, with USD/JPY extending the break lower after yesterday's support at 129.52 gave way. The move has hastened the swift formation of a death cross (50-dma < 200-dma) for the first time since 2020.

- This sequence highlights the clear downtrend, making further weakness likely. The focus going forward is on 127.53, the May 31, 2022 low. Significantly, this week's downtick is yet to trigger any technically oversold signals, with the 14-day RSI holding above levels that would suggest momentum has gone too far.

- The greenback is moderately weaker as markets continue to react to yesterday's CPI print, with Fed hike expectations for February waning further. Around 5 bps of tightening has been knocked off market pricing after yesterday's release, helping keep the USD Index on the backfoot.

- UK GDP data came in ahead of expectations for November, with activity around the World Cup helping boost growth. The surprise growth in the month works against expectations of an imminent recession in the UK, and has helped GBP/USD recover well off the post-CPI lows on Thursday.

- Focus turns to the imminent beginning of earnings season, with banks and financials starting proceedings today. Reports are due from Bank of America, BNY Mellon, Blackrock, Citigroup, JPMorgan and Wells Fargo, among others.

FX OPTIONS: Expiries for Jan13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.5bln), $1.0600(E1.8bln), $1.0645-60(E2.0bln), $1.0670-80(E2.6bln), $1.0685-00(E2.3bln), $1.0750(E2.4bln), $1.0770-75(E1.2bln), $1.0800(E1.5bln), $1.0820-25(E740mln), $1.0850(E1.5bln)

- GBP/USD: $1.2000(Gbp1.1bln)

- EUR/GBP: Gbp0.8900(E791mln)

- USD/JPY: Y131.00($597mln), Y131.95-00($776mln), Y133.85-00($1.0bln), Y134.40($542mln)

- AUD/USD: $0.6950(A$1.5bln), $0.7000(A$1.3bln), $0.7125(A$1.9bln)

- USD/CAD: C$1.3295-05($560mln)

EQUITIES: E-Mini S&P Futures Clear 4000.0 Handle, Targeting 4043.0 Dec 15 High Next

- EUROSTOXX 50 futures bullish conditions remain intact and the contract traded higher again yesterday. Futures have cleared resistance at 4043.00, the Dec 13 high and a bull trigger. The break represents a key short-term positive development and paves the way for gains towards 4175.50 next, the Feb 16 high (cont). Moving average studies are in a bull-mode condition, reinforcing the current positive trend condition. Initial support lies at 3944.00.

- S&P E-Minis traded higher again Thursday. The contract has this week cleared resistance at the 50-day EMA and this has strengthened the short-term bullish condition. Price has also traded above the 4000.00 handle to open 4043.00, the Dec 15 high. Key support and the bear trigger has been defined at 3788.50, the Dec 22 low. A reversal lower and a break of this level would resume bearish activity.

COMMODITIES: Bullish Gold Targets 1919.9 Apr 29 High

- WTI futures traded higher Thursday, extending the recent recovery. A continuation higher would signal scope for a test of resistance at $81.50, the Jan 3 high and a bull trigger. Clearance of this hurdle is required to strengthen a bullish theme. The broader trend outlook still appears bearish. A reversal lower would expose the bear trigger that has been defined at $70.31, the Dec 9 low.

- Trend conditions in Gold remain bullish and the yellow metal traded higher Thursday, extending the current uptrend. This week’s climb maintains the positive price sequence of higher highs and higher lows and note that moving average studies are in a bull mode position - reflecting the current uptrend. The yellow metal has traded above $1900.00, this opens $1919.9, the Apr 29, 2022 high. Support to watch lies at $1835.4, the 20-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/01/2023 | - | *** |  | CN | Trade |

| 13/01/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 13/01/2023 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 13/01/2023 | 1500/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 13/01/2023 | 1520/1020 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.