-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI US MARKETS ANALYSIS: Europe Reacts to Powell & EUR CPI, BoE Eyed

- Europe digests the FOMC & Eurozone CPI, while looking ahead to the imminent BoE decision.

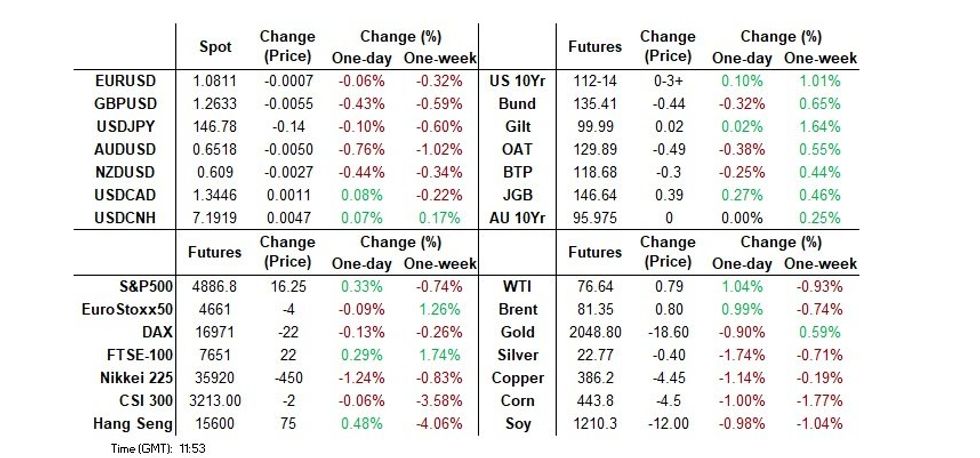

- Core global FI markets soften a touch, while the broader USD is marginally firmer on the day.

- The BoE decision, ECB speak & U.S. data headline from here.

MNI Fed Review - Jan 2024: Powell Sets High Bar To March Cut

EXECUTIVE SUMMARY

- The January FOMC meeting formally put an end to the tightening bias which had persisted for 16 meetings, shifting to a more neutral stance as it held rates for the 5th time in 6 meetings.

- But those were unsurprising outcomes - our preview indicated that the main question for this meeting would be the degree to which the FOMC kept the door open to a rate cut as soon as March. MNI had expected the Committee to be wary of signaling a March cut, instead re-emphasizing a patient approach, with the 50% market-implied probability for a March reduction looking too high.

- In that regard, the main headline from the January FOMC was that Chair Powell appeared to come into the press conference deliberately intending to push back against expectations that the FOMC would make its first cut in March.

- Powell didn’t rule out a March cut – but he set a high bar, implying that it would require significant surprises in the “totality” of the data between now and then for them to ease.

- Markets responded accordingly by pricing out a March cut from the 50/50% implied probability entering the meeting, and analysts pushed back their expectation for the first cut by one or two meetings, with May now looking like the central case. However, the total easing expected in 2024 didn’t change much (still 140+bp), mirroring Powell’s optimism on the disinflation outlook while being wary of pulling the trigger too early.

- FOR FULL ANALYSIS INCLUDING 24 SELL SIDE SUMMARIES:FedReviewJan2024.pdf

BOE Due at Midday GMT / 13:00CET / 7:00ET: Vote split

The MPC is due to release its policy decision, Monetary Policy Statement, Minutes and Monetary Policy Report at midday GMT with the press conference due to start 30 minutes later at 12:30GMT.

- The February MPC meeting will almost certainly see Bank Rate left on hold at 5.25% but there are three significant aspects of the decision that will be closely watched by markets – the vote split, the guidance and the forecasts.

- Just over half (10/19) of the analyst previews that we read look for a 9-0 unanimous vote but many have low conviction.

- The range of analyst expectations range from 8-1 with Dhingra voting for a cut (HSBC, MS) to an unchanged 6-3 vote with hawkish dissent (NatWest Markets). BofA and RBC both look for a 3-way split as their base case (1-7-1 and 1-6-2 respectively).

- The MNI Markets Team still look for 1-2 hawkish dissenters and assign a 40% probability to Dhingra voting for a cut at this meeting.

- We think that both Haskel and Greene are closer to 50-50 in our view so we on balance would probably expect one to continue to vote for a hike and one to vote for unchanged rates – but we would not be surprised if both voted for unchanged rates here. We think Mann will continue to vote for a 25bp hike.

- For the full MNI BOE Preview click here.

US TSYS: Modest Retracement Of Wednesday's Significant Rally, Further Labor Data Ahead

Cash Tsys trade 2-3bp cheaper, with the sell-off led by 7s. It’s only a modest paring of yesterday’s large rally seen driven by a melting pot of soft data, NYC Bancorp news and month-end extension-related flow underpinning Tsys yesterday, even during Powell-/FOMC-inspired pullbacks.

- TYH4 trades in narrow ranges around 112-13+ on large volumes of 485k. Yesterday saw a fresh high of 112-20+ in another step closer to resistance at 112-26+ (Jan 12 low), continuing to go against a bearish trend.

- Ahead, an open BoE decision could provide some spillover before attention turns to labor data with productivity watched closely. Yesterday’s softer than expected ECI is starting to ask less of productivity growth to see wage growth consistent with the 2% inflation target. Challenger job cuts also provide some interest ahead of nonfarm payrolls on Friday, as do jobless claims although the latter don’t cover a payrolls reference week coming so close to the release.

- Data: Challenger Job Cuts Jan (0730ET), Productivity/ULCs Q4 (0830ET), Weekly claims (0830ET), S&P Global Mfg PMI Jan final (0945ET), ISM mfg Jan (1000ET), Construction spending Dec (1000ET).

- Bill issuance: US Tsy $95B 4W, $90B 8W bill auctions (1130ET)

US TSY FUTURES: OI Points To Net Long Setting Across the Curve On Wednesday

The combination of yesterday’s move higher in Tsy futures and preliminary OI data points to fresh net long setting across the curve on Wednesday. Over $12.5mn of net OI DV01 equivalent was added across the curve, which is sizeable.

- A reminder that the NYC Bancorp news, data and month-end extension-related flow helped underpin the Tsy space on Wednesday, even during Powell-/FOMC-inspired pullbacks.

- The most meaningful net OI DV01 equivalent swing came in UXY futures.

| 31-Jan-24 | 30-Jan-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,945,724 | 3,921,243 | +24,481 | +915,308 |

| FV | 5,950,857 | 5,931,317 | +19,540 | +838,852 |

| TY | 4,779,771 | 4,719,247 | +60,524 | +3,905,782 |

| UXY | 2,169,537 | 2,105,683 | +63,854 | +5,898,707 |

| US | 1,425,898 | 1,421,793 | +4,105 | +564,483 |

| WN | 1,649,068 | 1,646,495 | +2,573 | +557,396 |

| Total | +175,077 | +12,680,528 |

STIR: Holding 10bp Of Cuts For March After Powell Messaging

Fed Funds implied for near-term meetings hold their shunt higher for near-term meetings, with 10bp of cuts for March after Powell suggested a March cut was not the most likely case.

- Meetings for later in 2024 have lifted overnight but keep to the dovish reaction seen from the press conference, with the net moves undoing most of the initially hawkish take on the announcement - see table.

- Cumulative cuts: 10bp for Mar, 34bp for May, 60bp for Jun and 144bp for Dec.

- Today sees potential spillover from the BoE decision plus further important labor data with productivity for Q4 and layoffs for Jan before the ISM manufacturing survey for Jan.

STIR: OI Points To Mix Of Long Setting & Short Cover In SOFR Futures On Wednesday

The combination of yesterday’s move higher in SOFR futures and preliminary OI data points to the following positioning swings on Wednesday:

- Whites: Apparent short cover across the pack, with a meaningful round of cover seemingly seen in SFRH4 helping facilitate a sizeable positioning move in the pack.

- Reds: A mix of apparent net short cover (SFRZ4 & M5) and net long setting (SFRH5 & U5), with the former dominating in net pack terms.

- Greens: A mix of apparent net long setting in SFRZ5 and net short cover elsewhere, with the former dominating in net pack terms.

- Blues: A mix of apparent net long setting in SFRZ6 and net short cover elsewhere, with the former dominating in net pack OI terms.

- A reminder that the NYC Bancorp news, data and month-end extension-related flow helped underpin SOFR futures on Wednesday, even during Powell-/FOMC-inspired pullbacks (which included pushback against the idea of a March FOMC rate cut)

| 31-Jan-24 | 30-Jan-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,197,321 | 1,201,396 | -4,075 | Whites | -178,080 |

| SFRH4 | 1,160,604 | 1,261,773 | -101,169 | Reds | -12,205 |

| SFRM4 | 1,098,090 | 1,141,453 | -43,363 | Greens | +9,850 |

| SFRU4 | 953,813 | 983,286 | -29,473 | Blues | -4,378 |

| SFRZ4 | 1,059,293 | 1,074,219 | -14,926 | ||

| SFRH5 | 560,080 | 543,910 | +16,170 | ||

| SFRM5 | 654,592 | 671,541 | -16,949 | ||

| SFRU5 | 595,129 | 591,629 | +3,500 | ||

| SFRZ5 | 659,776 | 640,409 | +19,367 | ||

| SFRH6 | 413,957 | 419,019 | -5,062 | ||

| SFRM6 | 414,073 | 417,185 | -3,112 | ||

| SFRU6 | 297,820 | 299,163 | -1,343 | ||

| SFRZ6 | 267,827 | 266,565 | +1,262 | ||

| SFRH7 | 136,713 | 138,122 | -1,409 | ||

| SFRM7 | 156,167 | 158,543 | -2,376 | ||

| SFRU7 | 146,541 | 148,396 | -1,855 |

FOREX: Attention turns to the BoE

AUD is the worst performer in G10 against the Dollar, a continuation from the Australian inflation coming below expectation, but also saw some follow through in early trade, on the broader Dollar bid, as European Equities fell, as Bank stocks came under pressure, following some of the moves in local Banks in the US open Yesterday.

- AUDUSD has now broken the January and the December low, and targets 0.6500, which is the 61.8% retrace of the Oct/Dec rally.

- USD is up against all G10s, besides the Yen that sits just 0.07% up, but JPY has retained gains of 0.58% in the past 5 days.

- NOK is the second worst performer, but continues to find support at the 10.5643, the January high in USDNOK, printed a 10.5673 high.

- The broader base bid in the Dollar, pushed EURUSD through its initial support of 1.0793, but has bounced off 1.0780, as Equities recovered from their lows.

- Looking ahead, BoE and Presser are due, and out of the US, sees US IJC, ISM.

FX OPTIONS: Expiries for Jan01 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0775 (445mln), 1.0800 (783mln), 1.0845 (298mln), 1.0850 (336mln), 1.0860 (830mln).

- GBPUSD: 1.2630 (307mln), 1.2670 (224mln).

- USDJPY: 146.00 (431mln), 146.50 (333mln), 147.00 (200mln). 147.50 (449mln).

- AUDUSD; 0.6590 (659mln), 0.6605 (302mln), 0.6640 (724mln), 0.6650 (583mln).

- USDCNY: 7.1500 (479mln), 7.1510 (615mln).

EUROPEAN ISSUANCE UPDATE

Spain auction results:

- A rather average auction for Spain.

- The middle of the E5.5-6.5bln nominals target range was sold (E6.053bln).

- The low price exceeded the pre-auciton mid-price for the new 10-year (which was reopened for the first time after its January syndicated launch) and the 5-year but not the 0.10% Apr-31 Obli.

- The price of all the nominals moved lower post-auction below the stop price at the auction, but this was in line with a general move lower in EGBs.

- E1.751bln of the 1.45% Apr-29 Obli. Avg yield 2.69% (bid-to-cover 1.65x).

- E1.775bln of the 0.10% Apr-31 Obli. Avg yield 2.868% (bid-to-cover 1.4x).

- E2.527bln of the 3.25% Apr-34 Obli. Avg yield 3.17% (bid-to-cover 1.76x).

- E516mln of the 2.05% Nov-39 Obli-Ei. Avg yield 1.518% (bid-to-cover 1.83x).

France auction results:

- Strong demand seen at the French LT OAT auction.

- The bid-to-covers were generally strong, particularly for the 10-year OAT. Note that this was a larger French auction than usual with a combined E13.0bln sold.

- The 10-year 3.50% Nov-33 OAT saw the highest volume of bids for a 10-year OAT since July 2020 and the E7.454bln of accepted bids was the highest for at least the last 5-years.

- There were decent premiums between stop prices and pre-auction mid-prices.

- E7.454bln of the 3.50% Nov-33 OAT. Avg yield 2.7% (bid-to-cover 1.94x).

- E2.296bln of the 0.50% May-40 OAT. Avg yield 3.07% (bid-to-cover 1.99x).

- E1.812bln of the 2.50% May-43 OAT. Avg yield 3.16% (bid-to-cover 2.12x).

- E1.426bln of the 3.00% May-54 OAT. Avg yield 3.27% (bid-to-cover 2.89x).

BONDS: Lower To Start Thursday Trade

In line to slightly-firmer-than expected European CPI data, the continued burden of supply (average demand at Spanish offering, well-received French supply), local digestion of yesterday’s FOMC decision and some marginally hawkish comments from the usually dovish ECB Governing Council member Herodotou (“we must not start easing very early because then inflationary pressures might come back... but should not delay it either because then it will affect growth”) combine to apply some pressure to EGBs this morning.

- Bund futures sit a little off worst levels of the day, last -53. German cash yields are 4-5bp higher across the curve, with the wings leading the move.

- 10-Year EGB spreads to Bunds are wider given the weakness in core global FI markets and most of the global equity benchmarks in the time since yesterday’s close. Tepid/average demand at the latest round of Spanish auctions also did little to support the space.

- Gilts also soften but outperform German peers across the curve. That outperformance is likely aided by a slightly-softer-than-flash final domestic manufacturing PMI print and the previously covered fiscal commentary from the Chancellor pointing to less headroom when it comes to fiscal easing.

- Gilt futures show -21 last, while cash gilt yields are 1-3bp higher, with the curve a touch steeper on the day.

- The BoE decision, ECB speak and U.S. data headline through the remainder of the day.

EUROZONE: Marginal Upside HICP Surprise Includes Unchanged Y/Y Services

Eurozone flash inflation for January printed at +2.8% Y/Y (vs +2.7% cons; +2.9%prior) while core (ex-energy/food) was +3.3% Y/Y (vs 3.2% cons; +3.4% prior). Monthly NSA prints were -0.4% for headline and -0.9% for core.- The unrounded prints were 2.752% Y/Y, -0.379% M/M for headline inflation, and 3.275% Y/Y for core - in line with MNI's pre-release tracking estimates of 2.7-2.8% and 3.2-3.3% respectively, and suggesting a more marginal upside surprise vs the consensus coming into the week.

- The national releases over the past two days have been in line with analyst expectations on aggregate, though an Italy print (released alongside the EZ figure) slightly on the firmer side nudged the Eurozone print toward the higher end of expectations.We await the ECB's seasonally-adjusted series due out later today for a better indication of sequential momentum.

- Of the core components, non-energy industrial goods were +2.0% Y/Y (vs +2.5% prior) while services were +4.0% (vs +4.0% prior). Monthly NSA rates were negative for both (-2.4% for NEIG, -0.1% for services), despite stronger German services prices on the back of a hike in restaurant VAT. Food, alcohol, and tobacco inflation was 5.7% Y/Y (vs 6.1% prior), with the disinflation trend continuing.

- At a country level, the November Y/Y prints were lower (or the same) in 11/20 countries (with no public data yet in Slovenia). On a monthly basis, 5 countries saw M/M NSA deflation.

EQUITIES: Corrective Pullback In S&P E-Minis

A broader uptrend in S&P E-Minis remains intact and the latest pullback is considered corrective. This week’s fresh cycle highs, reinforce current trend conditions. Note too that moving average studies remain in a bull-mode condition, highlighting positive market sentiment. A resumption of gains would open 4982.62 next, a Fibonacci projection. Initial support to watch lies at 4855.89, the 20-day EMA. Key support is 4757.66, the 50-day EMA.

- EUROSTOXX 50 futures remain firm and the contract is holding on to its recent gains. Key resistance at the Dec 14 high has recently been cleared. The break confirms a resumption of the medium-term uptrend and sights are on the 4700.00 handle next. Initial firm support lies at 4560.60, the 20-day EMA. Key trend support has been defined at 4402.00, the Jan 17 low. A short-term pullback would be considered corrective.

CHINA STOCKS: Vice Finance Minister Facilitates Broader Bid, Which Fades From Best Levels

MNI (London) - Comments from the Chinese Vice Finance Minister promoted some outperformance vs. global peers, although the CSI 300 & Hang Seng finished shy of best levels, +0.1% & +0.5%, respectively.

- The chip sector and broader tech sub-indices benefitted from the Vice Finance Minister’s focus on continued development/investment in that space. The Hang Seng Tech index extended away from the 3,000 level as a result.

- More widely, his comments re: the continued deployment of fiscal policy (at the “necessary intensity”) with the aim of facilitating a recovery in domestic demand helped buoy wider sentiment, before questions surrounding the efficacy of already deployed policy support/a want for more remerged and pushed the benchmarks away from best levels.

- Caixin manufacturing PMI data met wider expectations, with the expectation seen in January matching the December reading, providing little impulse for markets.

- Some tourism-related names benefitted from a positive brokerage move.

- Mainland property developers struggled, with Y/Y sales data for January weighing, although HK’s equivalent sub-index recovered from lows despite news of a jump in “underwater mortgages.”

- Net HK-China Stock Connect flows remained in minor positive territory (~CNY2.7bn).

- After market news of another uptick in PSL lending in January may provide some support on Friday.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2024 | 1130/1230 |  | EU | ECB's Lane remarks at EIEF | |

| 01/02/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 01/02/2024 | 1230/1230 |  | UK | BoE Press Conference | |

| 01/02/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 01/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/02/2024 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 01/02/2024 | 1400/1400 |  | UK | DMP Data | |

| 01/02/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2024 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 01/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 01/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/02/2024 | 1630/1130 |  | CA | BOC Governor Macklem testifies at House finance committee. | |

| 02/02/2024 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 02/02/2024 | 0745/0845 | * |  | FR | Industrial Production |

| 02/02/2024 | 1215/1215 |  | UK | BOE's Pill- MPR National Agency briefing | |

| 02/02/2024 | 1330/0830 | *** |  | US | Employment Report |

| 02/02/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 02/02/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 02/02/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.