-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Fed Repricing Sticks

Highlights:

- Markets hold bulk of Fed repricing move, keeping USD supported

- CFTC data shows markets flipped net short USD Index for first time since '21

- Fed speakers in focus, with Bowman, Williams, Mester & Daly due

TSYS: TY Bear Trigger Offers Support, JOLTS To Offer Early Labor Data Focus

- Cash Tsy yields sit 0.5-4bp higher on the day, bear steepening with 2s10s at -36.3bps (+3bp) as long end yields set fresh YtD highs.

- Yesterday’s ISM manufacturing beat, and especially prices paid at the highest level in over a year, continues to set the tone here. European spillover is mixed meanwhile, with regional prints suggesting downside risk to German headline CPI but with core inflation only slowly moderating.

- TYM4 has lifted 1-2 ticks off session lows of 109-24+ on heavy overnight volumes of 515k as regional markets catch-up with Easter Monday closures (for which the US was still open). It tests the bear trigger at 109-24+ (Mar 18 low) after which lies 109-14+ (Nov 28 low).

- JOLTS headlines today's docket before Fedspeak later on, all with an eye on tomorrow’s ISM services before Friday’s payrolls.

- Data: JOLTS report Feb (1000ET), Factory orders Feb (1000ET)

- Fedspeak: Bowman (1010ET), Williams (1200ET), Mester (1205ET) and Daly (1330ET) – see STIR bullet.

- Bill issuance: US Tsy $65B 42D Bill CMB auction (1130ET)

STIR: Fed Rate Path Holds Bulk Of Post-ISM Mfg Shift Higher

- Fed Funds implied rates hold the majority of Easter Monday’s shunt higher on a stronger ISM mfg survey and especially its prices paid component.

- Cumulative cuts from 5.33% effective: 2.5bp May, 15.5bp Jun, 24bp Jul, 41bp Sep, 68bp Dec. Yesterday briefly saw 14bp for Jun and 64bp for Dec in the initial post-ISM reaction.

- Permanent voters kickstart today’s Fedspeak but the subject matter/set-up means subsequent ’24 voters are likely more relevant from a mon pol perspective.

- Bowman (voter) on banking M&A at 1010ET, Williams (voter) moderates an economic discussion at 1200ET, Mester (’24 retiring June) speaks on the economic outlook at 1205ET incl text and Daly (’24) is in a fireside chat at 1330ET.

- These are Mester and Daly’s first appearances since the Mar 20 FOMC. Mester on Mar 7 said she was considering raising her long-term rate forecast and saw rates moving down in a “gradual” way but wasn’t very concerned that rate cuts would fuel inflation. Daly said Feb 29 that if we cut too quickly inflation could get stuck, with even risks of persistent inflation and an economic downturn.

MNI UST Issuance Deep Dive: Apr 2024

We've just published our latest US Treasury Issuance Deep Dive (PDF here):

- April is projected to see $315B in nominal Treasury coupon sales - the highest since November 2021 ($319B).

- The $368B in total sales (including $23B TIPS, $30B FRN) will mark the highest amount since October 2021 ($357B).

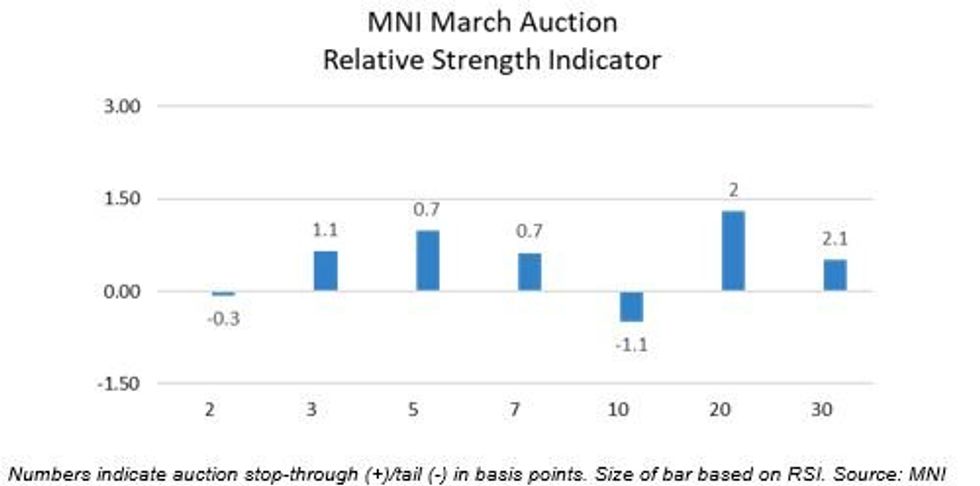

- This comes following relatively strong coupon auctions in March, in which 5 (of 7) sales traded through - each receiving a positive reading on MNI’s Relative Strength Indicator.

- Sale amounts are expected to peak in May’s refunding month, with Treasury indicating earlier this year that the Feb-Apr quarter was anticipated to be the last for auction upsizing.

EUROPE ISSUANCE UPDATE:

German Schatz auction result- A decent Schatz auction with a tight tail and the LAP coming in above the pre-auction mid-price by 0.010. The bid-to-cover and bid-to-offer were both a bit softer than last month. So there was a smaller quantity of bids, but a greater quality of accepted bids.

- E4.5bln (E3.705bln allotted) of the 2.50% Mar-26 Schatz. Avg yield 2.84% (bid-to-offer 1.90x; bid-to-cover 2.31x).

- Ireland will look to hold just one auction in Q2 on Thursday 9 May (with details announced on Tuesday 7 May).

- There is no update to the annual funding target of E6-10bln (E4bln was issue in Q1).

FOREX: USD Index at YTD Highs, Squeezing Net Short Position

- The USD Index touched the best levels of the year so far this morning at 105.100 during Asia-Pac hours. The moves comes as an extension off the Monday strength and the better-than-expected ISM Manufacturing release, which tipped prices paid to the highest level in over a year - raising questions over the sustainability of the recent slowdown in inflation. Despite this, CFTC data covering positioning as of the Tuesday close shows markets swung their net USD position short for the first time since 2021, potentially exposing the currency to corrective recoveries on flatting US economic data.

- CHF is the poorest performer in G10 early Tuesday, prompting EUR/CHF to recover well off pullback lows printed late last week. This keeps the cycle high and bull trigger within range at 0.9820 in EUR/CHF, a level that could come into play should ECB rate cut pricing follow the lead of the Fed gyrations so far this week. OIS markets currently price ~93bps of rate cuts from the ECB for this year.

- NOK is the firmest currency so far Tuesday, moving in tandem with oil prices. Brent crude futures have extended the rally off last week's lows to 4.5%, but EUR/NOK holds within range of recent cycle highs. First resistance holds at 11.7914 - a mark tested, but not topped, across both the Monday and Friday sessions. Clearance of last week's highs in EUR/NOK would open levels last seen in December and the next major upside resistance of 11.8695.

- Preliminary German CPI numbers for March are due, JOLTs job openings take the focus for the US session ahead, with final durable goods orders also on the docket. Fed speakers are plentiful, with Fed's Bowman, Williams, Mester and Daly all on the docket.

CFTC: Market is Net Short USD Index For First Time in Three Years

- Last week’s CFTC CoT release showed the market swung to a net short USD for the first time since 2021 - potentially seeing the USD further exposed to corrective rallies on strong data releases – as was the case on yesterday’s ISM Manufacturing release. This may build focus for the ISM Services index due on Wednesday, as well as the Nonfarm Payrolls report following on Friday

- NZD and CAD positions saw the most notable shifts last week, with net short positions across both currencies rising by over 10% of open interest. This puts

- The GBP net long faded off a 52-week high as markets trimmed a net of 18k contracts across the week, while the CHF short position was trimmed modestly, by 1.4% of open interest.

- This leaves the EUR and AUD positioning Z-scores as the lowest among all currencies surveyed, and the MXN the highest. Full data below:

FX OPTIONS: Demand for USD/CNY Upside Adds to Pressure on the Currency

- Following an understandably subdued series of sessions for FX hedging markets, volumes are showing busier trade earlier Tuesday, with EUR/USD and USD/CNY activity higher-than-average for this time of day.

- USD/CNY markets are holding up well, with demand for calls adding to the recent theme of concern around CNY weakness. Bloomberg wrote earlier today that some participants had been blocked from entering into specific CNY swap trades – implying that demand for USD/CNY to trade outside of trading band is building – compounding the pressure on the currency – although the piece adds that upcoming market holidays are a complicating factor for the trades.

- Elsewhere, EUR/USD hedging markets are led by demand for downside exposure, with decent notional wagered against 1.0600, 1.0650 and 1.0700 put strikes tipping today’s put/call ratio to ~3:2.

- Demand for EUR/USD downside may be picking up on the back of yesterday's USD move, as well as the further retreat for Fed rate cut pricing across 2024 - squeezing the current USD short position.

EQUITIES: Fresh Cycle High in E-Mini S&P Monday Reinforces Bullish Conditions

- A bullish trend condition in Eurostoxx 50 futures remains intact and the contract traded to fresh cycle highs last week. The climb confirms a resumption of the uptrend and maintains the price sequence of higher highs and higher lows. Moving average studies remain in a bull-mode position, highlighting positive market sentiment. Sights are on 5074.7, a Fibonacci projection. Initial firm support is at 4947.20, the 20-day EMA.

- The trend condition in S&P E-Minis is unchanged and remains bullish. Monday’s high print reinforces current conditions, confirming a resumption of the uptrend. Note that moving average studies remain in a bull-mode position reflecting positive market sentiment. Sights are on 5400.00 and 5434.54, the top of a bull channel drawn from the Jan 17 low. Initial firm support is 5240.19, the 20-day EMA. A move lower is considered corrective.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/04/2024 | 1200/1400 | *** |  | DE | HICP (p) |

| 02/04/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 02/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 02/04/2024 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/04/2024 | 1400/1000 | *** |  | US | JOLTS jobs opening level |

| 02/04/2024 | 1400/1000 | *** |  | US | JOLTS quits Rate |

| 02/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 02/04/2024 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 02/04/2024 | 1600/1200 |  | US | New York Fed's John Williams | |

| 02/04/2024 | 1730/1330 |  | US | San Francisco Fed's Mary Daly | |

| 03/04/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/04/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 03/04/2024 | 0900/1100 | ** |  | EU | Unemployment |

| 03/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/04/2024 | 1215/0815 | *** |  | US | ADP Employment Report |

| 03/04/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/04/2024 | 1600/1200 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.