-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US MARKETS ANALYSIS - Front-End US Yields Maintain Post-CPI Reversal

Highlights:

- Front-end of US yield curve maintains post-CPI reversal

- MNI Fed Preview: September Signals In Focus

- JPY slides as concurrent BoJ reports weigh on the currency

US TSYS: Mild Twist Flattening As 2s Maintain Post-CPI Reversal

- Cash Tsys see a twist flattening, running 1bp cheaper to 1.5bp richer as spill over from weakness in Gilts kept any rally linked to dovish BoJ-speculation limited. 2 block sales in FV futures (for a total of ~6.5K lots) applied some light pressure to the belly in Asia-Pac hours.

- The move sees 2YY yields close to yesterday’s high of 4.88% having breached pre-CPI levels of just over 4.85% prior to a miss sparked an ultimately 25bp rally over two days.

- A near empty docket leaves flow/positioning in focus ahead of next week’s Fed, ECB and BoJ meetings.

- 2YY +1.1bp at 4.850%, 5YY +0.2bp at 4.104%, 10YY -0.4bp at 3.847%, 30YY -1.3bp at 3.896%.

- TYU3 trades in a particularly tight 00-6+ range, currently 112-05+ (+00-1) on particularly low volumes of just 195k despite a recent pick-up. It remains close to yesterday’s low of 112-00, an initial resistance point, after which lies 111-03+ (Jul 11 low).

- No data.

- No issuance.

Bloomberg

Bloomberg

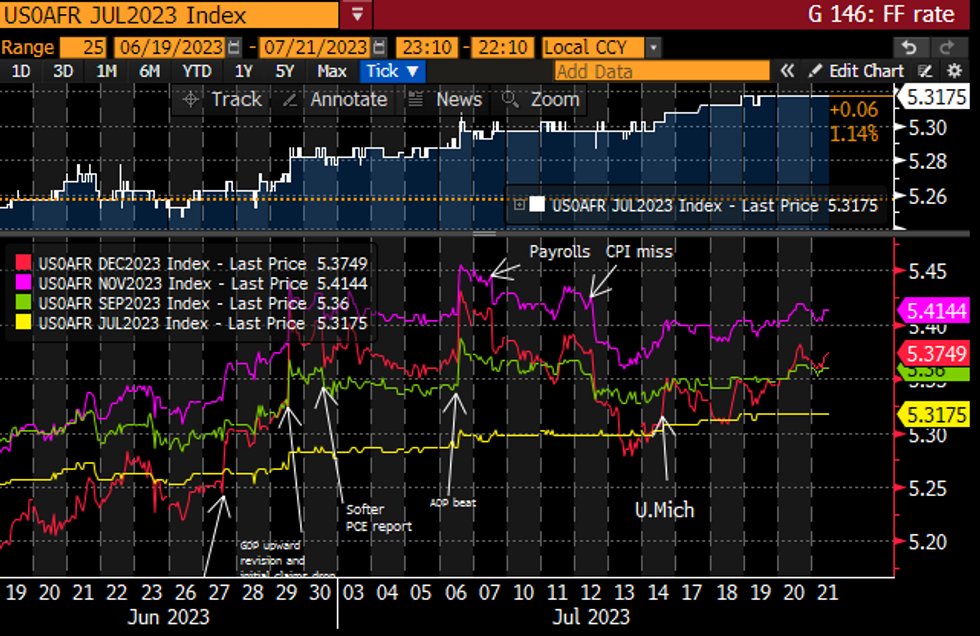

STIR FUTURES: Fed Implied Cuts Continue Return To Pre-CPI Levels

- Fed Funds implied rates have seen a small intraday lift through European hours for back unchanged out to Nov and nudging towards yesterday’s highs for later-dated meetings. Comparing close levels, the current 62bp of cuts from terminal to Jun’24 is the lowest since 60bps the day before the US CPI miss.

- Cumulative hikes from 5.08% effective: +24bp Jul (unch), +28bp Sep (unch), +33.5bp Nov to terminal 5.41% (unch).

- Cuts from terminal: 4bp to Dec’23 (from 4.5bp yesterday), 62bp to Jun’24 (from 64bp) and 133bp to Dec’24 (from 138bp, but once again the Dec’24 looks off in early trade with a 6bp lift in the rate vs 2bps for Sep-Nov’24 meetings).

- A near empty docket and continued blackout period ahead of Wednesday’s FOMC decision leaves headlines elsewhere or flow as the likely main drivers for today’s session.

Source: Bloomberg

Source: Bloomberg

MNI Fed Preview - July 2023: September Signals In Focus

We've just published our preview of the July 25-26 FOMC meeting (PDF here):

- The Fed will hike by 25 basis points and maintain its tightening bias at the July meeting.

- Chair Powell is likely to suggest that a follow-up hike is possible at the next meeting in September, but will emphasize that no decision has yet been made, and will depend on the substantial inflation and jobs data in the interim.

- That messaging would retain the optionality to hike at consecutive meetings if the next two inflation prints between now and then warrant a (likely final) hike. The market impact of this messaging is likely to be modestly hawkish.

- Two key, related debates will be in focus at this meeting and until the September meeting: how long are the lags between policy tightening and the impact on the economy, and to what degree banking sector stress will take the place of further hikes – if at all.

Spanish Paper Awaits Election Results

Spanish paper presents little in the way of meaningful pre-election jitters, at least intraday, but do lag the rest of the peripheral space at the margin (based on 10-Year benchmarks).

- Spanish 10s have lagged their BTP equivalent during the recent round of tightening vs. Bunds. Some have pointed to political worry ahead of the national vote as a key driver of the relative underperformance vs. BTPs, but we wouldn’t be so sure, given that the move in Portuguese paper is very similar to that seen in Spanish paper over the last 10 or so sessions.

- The same theme holds true in the time since the Spanish regional elections (the 10-Year PGB/Bono Spread is little changed to slightly in Spanish paper’s favour over that horizon).

- Still, the 10-Year BTP/Bono spread has narrowed to Q1/Q222 levels, while the 10-Year PGB/Bono spread operates within touching distance of cycle extremes reached around the time of the local Spanish elections (PGBs trade ~30bp through the Spanish equivalent at typing).

- Several sell-side outlets have outlined a preference for various SPGB/EGB tighteners ahead of the election, with an eye on taking advantage of any pre-election jitters that may creep in to gain exposure to positive Spanish fiscal dynamics.

- Click for our political risk team’s full preview of the Spanish election.

Fig. 1: 10-Year BTP/Bono & PGB/Bono Spreads (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

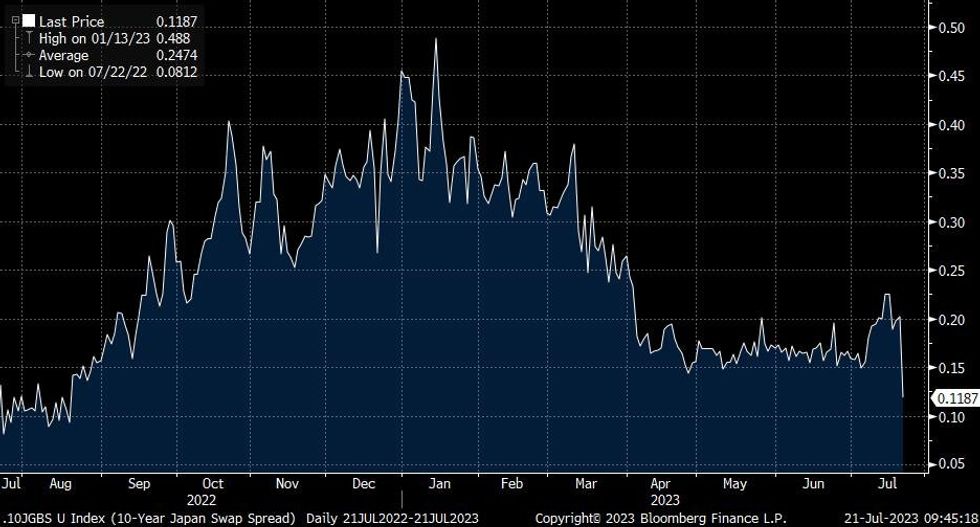

JAPAN: 10-Year Swap Spread On Track For Tightest Close In Nearly 1 Year As YCC Tweak Speculation Pared

The previously covered BoJ source pieces from BBG & RTRS leave the Japanese 10-Year Swap/JGB spread on target to close at the tightest level since August of last year as market pricing surrounding the potential for a hawkish YCC tweak from the BoJ is unwound. A quick reminder that BoJ Governor Ueda’s comments, made Tuesday, had already helped the spread (which is a proxy for BoJ YCC tweak speculation) sway from recent wides, which in themselves fell well short of the wides seen during previous instances of speculation surrounding potential YCC tweaks.

Fig. 1: Japan 10-Year Swap/JGB Spread (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

Erdogan: Putin Talks Could Lead To Restoration Of Black Sea Grain Deal

Wires carrying comments from Turkish President Recep Erdogan stating that he believes, "planned talks with [Russian President Vladimir] Putin could lead to restoration of Black Sea grain initiative," and urging the West to take action "according to Russia's demands."

- Turkey remains the key third-party player in the grain deal despite a recent 'handshake' deal with Sweden on NATO membership which was seen as nudging Ankara closer to the West.

- AP reports: "Some observers in Moscow speculate that Russia agreed to extend the grain deal for two months in May to help Erdogan win reelection but was appalled to see his pro-Western shift afterward."

- Although Moscow initially left the door open to returning to the deal, a sustained aerial bombardment of Ukrainian gain infrastructure has significantly dampened market expectation that the deal can be salvage.

- Putin is, however, expected to be under pressure from African partners, exposed high grain prices, to restore the deal or outline an alternate plan.

- Putin is scheduled to visit Ankara in August but Erdogan said this week that they will likely hold a call before then to discuss the grain deal.

BONDS: Gilts the biggest movers again

- Gilts have been the biggest movers again this morning, with 10-year yields up 2.3bp at writing as gilt futures continue their grind lower after hitting a high of 97.84 post-UK CPI on Wednesday. Futures are now more than 150 ticks lower but remain above Tuesday's closing levels. Moves have been more limited for 2-year gilts, leading to a bear steepening of the gilt curve.

- Moves in USTs and Bunds have been very limited this morning - with moves generally around 1bp or less across curves.

- Today's calendar sees no further data releases outside of Canadian data releases and with the FOMC/ECB meetings next week and the BOE the week after there are no scheduled speakers.

FOREX: EURJPY Surges Toward Bull Trigger as YCC Seen Intact Next Week

- JPY is offered solidly across G10 headed into the NY crossover, with concurrent BoJ sources reports raising expectations that the BoJ's yield curve control programme will be unchanged at next Friday's decision. Both Bloomberg and Reuters cited sources in reporting that the board were leaning toward no change in approach, countering recent building speculation that a policy switch would be imminent.

- USD/JPY rallied solidly on the report, rising well through the recent highs to trade at the best levels since July 10th. JPY implied vols are well bid, with the one-week contract now capturing the BoJ decision and crossing 16 points to trade at the best levels since March.

- EUR/JPY was similarly dragged higher, bringing prices back into range of the bull trigger at the Jun 28 high of 158.00, a break above which could signal the beginning of an upside reversal in the cross.

- NOK is the firmest performer across G10, gaining alongside the slightly firmer oil price. EUR/NOK remains just above yesterday's lows of 11.1273, but a break below would open the 200-dma at 11.0739 - last broken in September last year.

- The Canadian retail sales release is the sole data due Friday, with markets expecting sales to have risen 0.5% on the month, and 0.2% ex-autos. There are no central bank speakers of note, with the Fed remaining inside their pre-decision media blackout period.

FX OPTIONS: USD/CAD, AUD/NZD Trade Inline With Sizeable Strikes

EUR/USD's modest morning pullback keeps spot pinned between two larger strikes rolling off at today's cut, while AUD/NZD and USD/CAD spot is closely glued to sizeable expiries:- EUR/USD: $1.1100(E551mln), $1.1150-60(E535mln), $1.1200-05(E783mln)

- USD/JPY: Y141.50($704mln)

- EUR/GBP: Gbp0.8600(E651mln)

- AUD/USD: $0.6700(A$862mln)

- AUD/NZD: N$1.0900(A$1.0bln)

- USD/CAD: C$1.3145-55($1.1bln)

EQUITIES: E-mini Short-Term Consolidates, But Underlying Uptrend Intact

- E-mini S&P finished lower Thursday, consolidating a solid rally this week and helping to alleviate the overbought conditions present in the most recent bout of strength. Prices have topped the bull channel drawn off the March 13th low at 4608.50, marking another positive shift for S/T momentum.

- Eurostoxx 50 futures traded higher last week. The rally resulted in a move above the 50-day EMA at 4335.00 and price is through 4371.00, the Jul 6 high. Clearance of this latter level highlights a potentially stronger bull cycle.

COMMODITIES: Gold Circling Below Cycle Highs

- Gold shows at a new cycle high early Thursday, adding to recent gains and topping key resistance at 1985.3, the May 24 high. A close above here could presage a stronger reversal higher.

- WTI futures prices bounced well off the Monday lows and are adding to the underlying uptrend early Friday. The current bull cycle remains intact after the recent breach of $72.72, the Jun 21 high. Last Wednesday’s move higher resulted in a break of key resistance at $75.70, the Jun 5 high as well as the 200-dma.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/07/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/07/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/07/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/07/2023 | 0700/0900 | ** |  | ES | PPI |

| 24/07/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/07/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/07/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/07/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/07/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/07/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/07/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/07/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/07/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/07/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/07/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/07/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/07/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.