-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI US MARKETS ANALYSIS - German Prelim CPI Seen Cooling in March Flash

Highlights:

- MNI projects German CPI to cool to +7.39% in March flash

- Fed speakers up next, with Barkin, Collins and Kashkari due

- Fed implied rate path holds higher

US TSYS: Modest Twist Steepening, Fedspeak & Data Ahead

- Cash Tsys sit with a modest twist steepening after two-way moves as some stronger German regional inflation data suggested some upside risk to consensus for the national print and helped pare earlier gains.

- Fedspeak and data in focus from the docket. Impact from GDP revisions could be limited by being the 3rd release (although surprises certainly can’t be ruled out), whilst weekly initial claims are likely watched for any sign of regional banking woes having any early impact.

- 2YY -2.1bp at 4.078%, 5YY -0.9bp at 3.673%, 10YY +0.0bp at 3.564% and 30YY +0.4bp at 3.763%.

- TYM3 trades just half a tick lower at 114-16+ and remains within yesterday’s range of 114-07-114-28. It doesn’t trouble technical levels with support at the 20-day EMA of 114-06 or resistance at 115-07+ (Mar 28 high).

- Data: GDP for Q4 3rd release (0830ET) plus weekly jobless claims (0830ET)

- Fedspeak: Barkin (1245ET, text), Collins (1245ET, text) and Kashkari (1300ET).

- Bill issuance: US Tsy $60B 4W, $50B 8W bill auctions (1130ET)

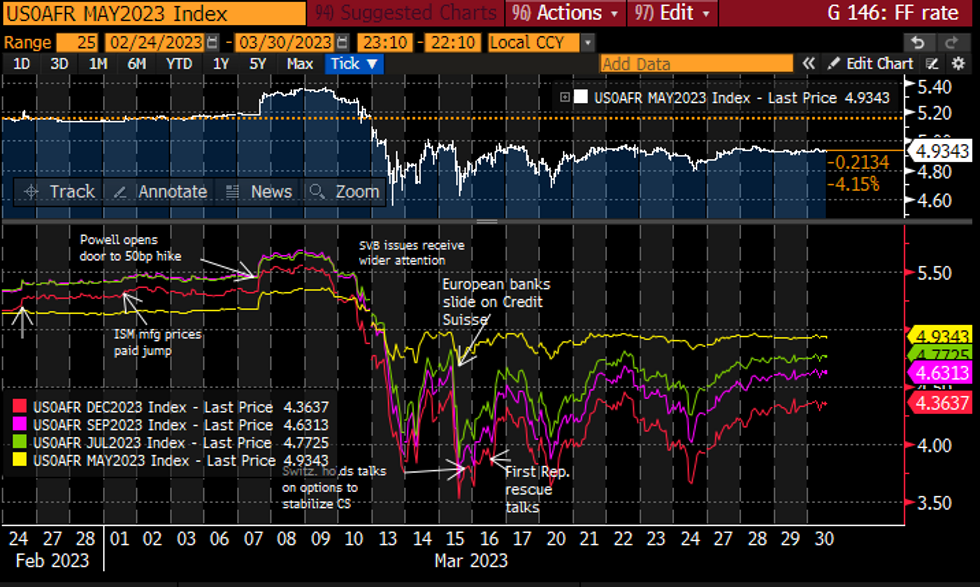

STIR FUTURES: Fed Rate Path Holds Higher, Nears High End Of Post-SVB Fallout Range

- Fed Funds implied rates have seen sizeable overnight moves but on balance hold slightly higher as they extend a move seen through late yesterday.

- 10bp hike for May (+0.5bp), 20bp of cuts for Sept to 4.63% (+2bp) and 47bp of cuts for Dec to 4.36% (+2bp), all based off an effective 4.83%. The 4.37% year-end rate is at the higher end of the 3.5-4.5 range seen since Mar 13.

- Fedspeak: Kashkari (’23 voter) in moderated town hall, Barkin (’24) with text and Collins (non-voter) with text. Kashkari and Barkin have spoken since last week’s FOMC but relatively limited - Kashkari potentially the lone 5.9% 2023 dot after Bullard ruled himself out.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FRANCE: Macron-Gov't Talks To Unions; Protests Do Not Mean Everything Must Stop

Wires carrying comments from President Emmanuel Macron regarding the ongoing industrial and social unrest in the country. States that "There is ongoing dialogue between gov't and the unions." Macron: "Pensions reform bill must be examined by France's highest court" The Constitutional Council is set to deliver its ruling on 14 April.

- Says that it is "Normal that unions express themselves, their demonstrations were calm.'

- Macron: "There is a social protest [regarding the] reform, but that does not mean that everything has to stop."

- The gov't remains under significant pressure to backtrack on the pension reforms. Macron finds himself in a difficult position, with a backtrack stripping him of significant political capital in his inability to pass one of his key reforms. However, if he holds out and protests and strikes continue it will continue to damage France's economic prospects and risk further social instability.

GERMAN DATA: MNI Projects CPI to Cool to +7.39% in March Flash

We have now received state data that equates to 88.0% weighting of the national German CPI print.

- MNI calculations estimate that CPI rose by +0.77% m/m, and a +7.39% y/y increase. This is based on the published index values for available state data. This implies a 1.3pp deceleration on the annualised figure from +8.7% y/y in February, as German headline inflation distances itself further from the October/November peak of +8.8% y/y.

- For both m/m and y/y, our forecast is around 0.1pp above the current Bloomberg consensus forecast which looks for +0.7% m/m and +7.3% y/y.

- Note: this is in relation to the national CPI print - not the HICP print (which feeds into the Eurozone HICP print that the ECB targets). The magnitude of surprises to consensus can sometimes be different due to the different methodologies and weights used in national CPI vs HICP - but the direction of the surprise is normally the same.

- This data follows a downside surprise in Spanish flash CPI this morning, which came in at +3.3% y/y (+3.1% y/y HICP).

| M/M | Mar (reported) | Feb (reported) | Difference | Weighting 2023 |

| North Rhine Westphalia | 0.6% | 1.0% | -0.4% | 21.10% |

| Hesse | 0.8% | 0.6% | 0.2% | 7.70% |

| Bavaria | 0.7% | 0.8% | -0.1% | 16.90% |

| Brandenburg | 1.0% | 0.8% | 0.2% | 2.90% |

| Baden Wuert. | 0.9% | 0.8% | 0.1% | 14.10% |

| Berlin | 0.9% | 0.9% | 0.0% | 4.00% |

| Saxony | 0.9% | 0.8% | 0.1% | 4.60% |

| Rhineland-Palatinate | 0.8% | 0.6% | 0.2% | 4.90% |

| Lower Saxony | 0.9% | 0.3% | 0.6% | 9.40% |

| Saxony-Anhalt | 0.9% | 0.8% | 0.1% | 2.40% |

| Weighted average: | +0.77% M/M | for | 88.0% |

| Y/Y | Mar (reported) | Feb (reported) | Difference | Weighting 2023 |

| North Rhine Westphalia | 6.9% | 8.5% | -1.6% | 21.10% |

| Hesse | 7.1% | 8.3% | -1.2% | 7.70% |

| Bavaria | 7.2% | 8.8% | -1.6% | 16.90% |

| Brandenburg | 7.8% | 8.7% | -0.9% | 2.90% |

| Baden Wuert. | 7.8% | 8.7% | -0.9% | 14.10% |

| Berlin | 7.7% | 9.1% | -1.4% | 4.00% |

| Saxony | 8.3% | 9.2% | -0.2% | 4.60% |

| Rhineland-Palatinate | 7.4% | 8.4% | -1.0% | 4.90% |

| Lower Saxony | 7.8% | 8.7% | -0.9% | 9.40% |

| Saxony-Anhalt | 7.9% | 8.9% | -1.0% | 2.40% |

| Weighted average: | + 7.39% Y/Y | for | 88.0% |

EUROPE ISSUANCE UPDATE:

ITALY AUCTION RESULTS: 5/10-year BTPs & CCTeus

- E3bln 3.40% Apr-28 BTP Avg yield 3.59% (Prev 3.84%), Bid-to-cover 1.49x (Prev 1.55x)

- E3.5bln 4.4% May-33 BTP Avg yield 4.12% (Prev 4.34%) Bid-to-cover 1.38x (Prev 1.34x)

- E1.25bln 0.65% Apr-29 CCTeu Avg yield 2.80% (Prev 0.85%), Bid-to-cover 1.95x (Prev 1.94x)

- E1.25bln 0.75% Oct-30 CCTeu Avg yield 3.13% (Prev 3.21%), Bid-to-cover 1.70x (Prev 1.82x)

FOREX: USD Sits Softer as German Regional CPIs Send Mixed Messages

- The greenback is softer headed through to the NY crossover, with the USD Index holding close to mid-March lows. German regional CPI data has been in focus, sending mixed signals over the sustainability of the decline in headline inflation.

- The weaker USD backdrop and softer EUR post-CPI data has helped GBP find favour in early trade, keeping GBP/USD within range of 1.2362 - the highest print since early Feb. Little options interest near current levels into month-end (nearest notable expiry rolls off tomorrow at 1.2100), but more significant interest next week noted at 1.2250, with $1.1bln rolling off on Apr04, which could anchor any near-term rally.

- CHF is the furtive outperformer, snapping weakness seen earlier in the week. The currency's safe haven status remains surpressed for now, with stronger equities doing little to pin back the currency.

- Focus turns to the confirmation for preliminary German CPI for March, as well as the weekly US jobless claims. Tertiary Q4 GDP from the US is unlikely to move the needle, but Fed speakers will be eyed. Fed's Barkin, Collins and Kashkari are on the docket just after the London close.

FX OPTIONS: Expiries for Mar30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-80(E1.3bln), $1.0700(E2.8bln), $1.0825-40(E784mln), $1.0950(E1.5bln), $1.1000(E1.9bln)

- USD/JPY: Y130.00($1.1bln), Y130.40-50($658mln), Y131.00($1.6bln), Y131.50($1.2bln), Y132.00($1.4bln), Y132.90-10($1.1bln), Y134.19-20($647mln)

- AUD/USD: $0.6600(A$834mln), $0.6650(A$850mln), $0.6745(A$530mln)

- USD/CAD: C$1.3312($1bln)

- USD/CNY: Cny6.8630($601mln), Cny6.8805($568mln)

EQUITIES: E-Mini S&P Futures Pierce 4073.75 Mar 22 Resistance Level

- Eurostoxx 50 futures traded higher Wednesday. The contract has cleared resistance at 4164.00, the Mar 22 high. This cancels a recent bearish threat and confirms a resumption of the bull cycle that started Mar 20. A continuation higher would open key resistance at 4268.00, Mar 6 high. Moving average studies are in a bull-mode set-up and this suggests the broader uptrend is intact. Initial firm support lies at 4034.00, the Mar 24 low.

- S&P E-Minis traded higher Wednesday and the contract has once again moved to levels above the 50-day EMA. The average intersects at 4021.12. Attention is on resistance at 4073.75, the Mar 22 high. A break of this hurdle would strengthen bullish conditions and signal scope for a climb towards 4119.50, the Mar 6 high. On the downside, key short-term support lies at 3937.00, the Mar 24 low. A break of this support would be bearish.

COMMODITIES: WTI Futures Trade Close to This Week's Highs, Exposing 74.96 50-Day EMA

- WTI futures continue to trade closer to this week’s highs. Price has breached resistance at the 20-day EMA which intersects at $72.64. The break is a short-term bullish development and a continuation higher would expose the 50-day EMA, at $74.96. This average represents the next key resistance point. On the downside, initial firm support lies at $66.82, the Mar 24 low. A break of this level would be bearish.

- Trend conditions in Gold remain bullish and the recent short-term pullback is considered corrective. Note too that price action since Mar 20 appears to be a pennant - a continuation pattern. This reinforces bullish conditions and signals scope for an extension higher near-term. The recent test above $2000.0 opens $2034.0 next, a Fibonacci projection. $1918.3 marks a firm support, the Mar 17 low - a break would signal scope for a deeper pullback.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/03/2023 | 0900/1100 | ** |  | IT | PPI |

| 30/03/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/03/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/03/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 30/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/03/2023 | 1230/0830 | *** |  | US | GDP |

| 30/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/03/2023 | 1645/1245 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2023 | 1645/1245 |  | US | Boston Fed's Susan Collins | |

| 30/03/2023 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 30/03/2023 | 1945/1545 |  | US | Treasury Secretary Janet Yellen | |

| 31/03/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/03/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 31/03/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 31/03/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/03/2023 | 0630/0830 | ** |  | CH | retail sales |

| 31/03/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/03/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/03/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/03/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 31/03/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/03/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/03/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 31/03/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/03/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 31/03/2023 | 1500/1700 |  | EU | ECB Lagarde Q&A with Students | |

| 31/03/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/03/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2023 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 31/03/2023 | 1900/1500 |  | US | New York Fed's John Williams | |

| 31/03/2023 | 2145/1745 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.