-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Soft inflation drives EGBs higher

Highlights:

- Soft German state CPI data and Spanish HICP data has reduced market pricing for upcoming ECB hikes

- China to vaccinate elderly earlier

- BOE to hold its first operation to sell its "temporary" long-dated/linker gilt holdings

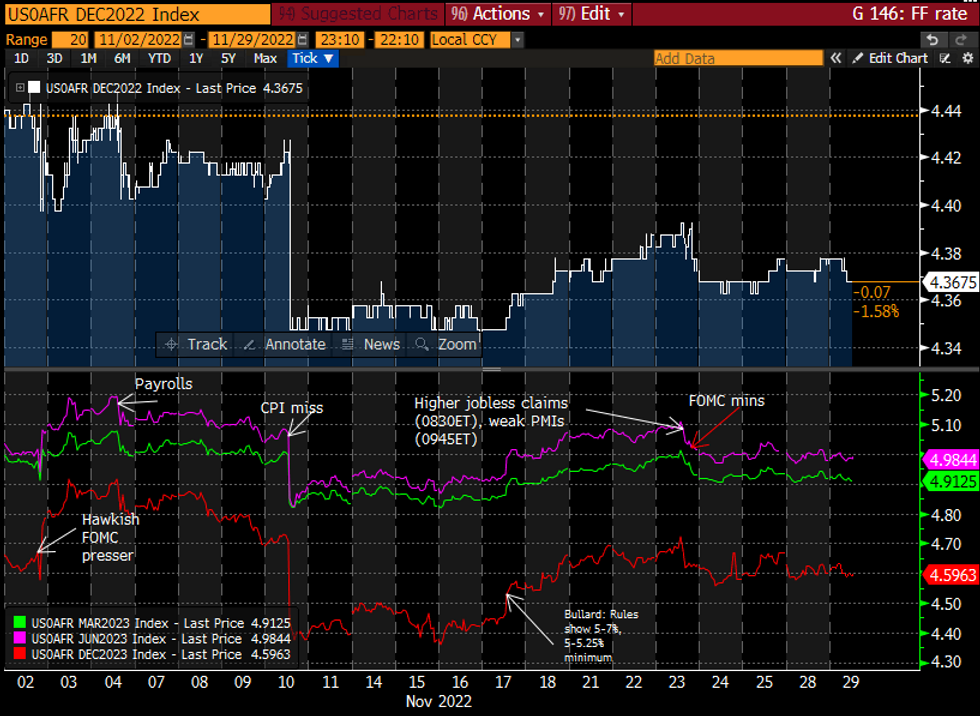

STIR FUTURES: Fed Rate Path Within Yesterday’s Range

- Fed Funds implied hikes see 53.5bp for Dec, cumulative 92bp to 4.75% for Feb’23, terminal 4.98% in Jun’23 and 4.59% for Dec’23.

- The terminal hovered either side of 5% yesterday, boosted by Fedspeak including unscheduled Brainard late on (updating prior remarks to say drawn-out sequences of negative supply shocks call for tighter policy) before fading.

- No Fedspeak scheduled for today before Powell in focus tomorrow.

FOMC-dated Fed Funds implied rateSource: Bloomberg

FOMC-dated Fed Funds implied rateSource: Bloomberg

USTs: Treasuries Rally As Bund Spillover Trumps Relative Covid Optimism

- The opposite to the start of yesterday’s session, Treasuries cheapened through Asia-Pac hours on optimism surrounding the Chinese Covid situation before seeing a bid in spillover from weaker than expected German state CPI inflation pointing to a miss for the upcoming national print.

- 2YY -0.2bps at 4.436%, 5YY -2.1bps at 3.854%, 10YY -2.2bps at 3.659%, and 30YY -0.6bps at 3.715%.

- TYH3 now takes the front month with higher volumes than the Dec contract. It trades 9+ ticks higher at 113-17+, in the middle of yesterday’s range, the top end of which provides initial resistance at 113-27 whilst support is seen at the 50-day EMA of 112-24.

- Data: Second tier releases with FHFA and S&P CoreLogic house prices plus Conference Board consumer confidence.

- Bill issuance: US to sell $34B 52-W bills – 1130ET

EGB / GILT: European inflation driving a repricing of ECB expectations and core FI

- A repricing of ECB rate hike expectations on the back of European inflation data this morning has been the key driver of core fixed income markets this morning. Based on state CPI data from Germany so far, MNI estimates that national German CPI fell by -0.5%M/M (a 10.0%Y/Y rise). This would imply a 3-4 tenth miss versus expectations of the national CPI print (although this might not imply quite the same for HICP but the direction is likely to be the same). Spanish HICP was 5-6 tenths softer than expected too, coming in at -0.5%M/M and from from +7.3% to 6.6%Y/Y.

- Market estimates of ECB pricing for December have fallen from about 62bp to 57bp and for the terminal rate have fallen from around 152bp to around 143bp. This has seen Schatz yields move over 9bp lower on the day and the whole German curve has shifted despite some small steepening.

- Later today we will hear from BOE Governor Bailey as he testifies ahead of the Lords Economic Affairs Committee. We are due to hear from ECB's Schnabel and de Cos on non-mon pol topics.

- Today will also see the first BOE operation to sell some of its "temporary" long-dated and I/L gilt holdings that it built up through its financial stability purchases last month. The operation will be "demand-led" and has no set size - so could potentially see no sales at all.

- Bund futures are up 0.90 today at 141.32 with 10y Bund yields down -7.9bp at 1.906% and Schatz yields down -9.5bp at 2.019%.

- Gilt futures are down -0.06 today at 105.80 with 10y yields down -1.8bp at 3.102% and 2y yields down -1.7bp at 3.236%.

European Auction Results

Dutch auction result

- E1.48bln of the 0% Jul-31 DSL. Avg yield 2.075%.

Italy auction results

- E3bln of the 4.4% May-33 BTP. Avg yield 3.96% (bid-to-cover 1.47x).

- E1.25bln of the 0.75% Oct-30 CCTeu. Avg yield 3.21% (bid-to-cover 1.82x).

FI Options Update

- OEG3 117/114ps 1x2, bought for 25 in 2.5k

- DUH3 103.5p, bought for 3 in 4k

- ERZ2 98.00/98.12cs, bought for half in 5k

- ERZ2 97.75/97.625ps 1x1.5, bought for 2.25 in 5k

- TYF3 110.00/109.00ps, bought for 4 in 10k

- SFRM4 95.00/94.00/93.00p fly, bought for 11 in 7k

FOREX: Risk On keeps the lid on the Dollar

- The USD trades on the back foot during the overnight Asian session and into the morning European session.

- The driver has been the Risk On tone in Asia, with some hope that China could ease lockdown, but the main driver this morning has been the German regional and Spanish CPI, falling versus last readings.

- The Greenback is in the red across all the majors, beside the CHF, which saw a reversal off the low in USDCHF, and in EURCHF on the follow.

- CHF is up 0.12% at the time of typing against the USD.

- The Kiwi and AUD are the best performers in G10, up 1.27% and 1.23% respectively on the Risk On tone and lockdown easing hope in China.

- Looking ahead, after receiving 83.7% of the weighted state data in the national German CPI print.

- MNI calculations estimate that CPI fell -0.5%M/M, which would be equivalent to a 10.0%Y/Y increase.

- Besides the German National CPI, other data include,. US Consumer Confidence, Japan IP.

- ECB Guindos, de Cos, Schnabel, BoE Mann, Bailey, SNB Schlegel, are the speakers.

FX Option Expiries

Of note:

- USDCNY 1.45bn at 7.1992/7.20.

- EURUSD 1.02bn at 1.0300 (wed).

- USDCNY 1.37bn at 7.20 (wed).

- EURUSD 1.03bn at 1.0300 (thu).

- EURUSD: 1.0265 (574mln), 1.0380 (321mln), 1.0400 (240mln).1.0450 (324mln).

- EURGBP: 0.8600 (500mln).

- USDJPY: 137.55 (308mln) 139 (550mln). 139.70 (277mln), 140 (244mln).

- USDCAD: 1.3500 (371mln).

- AUDUSD: 0.6725 (387mln).

- USDCNY: 7.1992 (600mln), 7.20 (851mln).

German CPI Likely Beyond the Peak in November

Following the release of Saxony state data, our calculations imply a -0.49% m/m and +10.04% y/y inflation rate for Germany in November.

- This constitutes a considerable miss on the Bloomberg consensus of a -0.2% m/m fall and a +10.4% y/y increase.

- Almost all states reported deflationary month-on-month rates (9 of the available 10) and slowing year-on-year rates (8/10). This implies that October was indeed likely to have been the national peak CPI month.

| M/M | Nov (Reported) | Oct (Reported) | Difference | Weighting |

| North Rhine Westphalia | -0.8% | 1.2% | -2.0% | 21.70% |

| Hesse | 0.4% | 1.1% | -0.7% | 7.70% |

| Bavaria | -0.3% | 0.7% | -1.0% | 16.80% |

| Brandenburg | -0.5% | 1.1% | -1.6% | 2.60% |

| Baden Wuert. | -0.2% | 0.8% | -1.0% | 14.10% |

| Berlin | -0.9% | 0.7% | -1.6% | 3.90% |

| Saxony | -0.3% | 1.2% | -1.5% | 4.40% |

| Rhineland-Palatinate | -0.2% | 0.6% | -0.8% | 5.10% |

| Lower Saxony | -0.6% | 0.8% | -1.4% | 9.40% |

| Saxony-Anhalt | -0.3% | 0.8% | -1.1% | 2.40% |

| Weighted average: | -0.49% | for | 88.1% |

| Y/Y | Nov (Reported) | Oct (Reported) | Difference | Weighting |

| North Rhine Westphalia | 10.4% | 11.0% | -0.6% | 21.70% |

| Hesse | 9.7% | 9.9% | -0.2% | 7.70% |

| Bavaria | 10.9% | 11.0% | -0.1% | 16.80% |

| Brandenburg | 10.5% | 10.8% | -0.3% | 2.60% |

| Baden Wuert. | 9.6% | 9.8% | -0.2% | 14.10% |

| Berlin | 9.1% | 9.9% | -0.8% | 3.90% |

| Saxony | 9.9% | 10.1% | -0.2% | 4.40% |

| Rhineland-Palatinate | 9.8% | 9.7% | 0.1% | 5.10% |

| Lower Saxony | 10.0% | 10.5% | -0.5% | 9.40% |

| Saxony-Anhalt | 10.5% | 10.5% | 0.0% | 2.40% |

| Weighted average: | +10.04% y/y | for | 88.1% |

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/11/2022 | 1235/1235 |  | UK | BOE Mann Panels The Conference Board Conference | |

| 29/11/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/11/2022 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 29/11/2022 | 1330/1430 |  | EU | ECB Schnabel Speech at Frankfurter Konjunkturgespraech | |

| 29/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/11/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/11/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 29/11/2022 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 29/11/2022 | 1500/1500 |  | UK | BOE Bailey at Lords Economic Affairs Committee | |

| 29/11/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/11/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 30/11/2022 | 2350/0850 | ** |  | JP | Industrial production |

| 30/11/2022 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/11/2022 | 0030/1130 | *** |  | AU | Quarterly construction work done |

| 30/11/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 30/11/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 30/11/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 30/11/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 30/11/2022 | 0730/0730 |  | UK | DMO Publishes FQ4 Issuance Calendar | |

| 30/11/2022 | 0745/0845 | *** |  | FR | HICP (p) |

| 30/11/2022 | 0745/0845 | ** |  | FR | PPI |

| 30/11/2022 | 0745/0845 | ** |  | FR | Consumer Spending |

| 30/11/2022 | 0745/0845 | *** |  | FR | GDP (f) |

| 30/11/2022 | 0800/0900 |  | ES | Retail Sales | |

| 30/11/2022 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/11/2022 | 0830/0830 |  | UK | BOE Pill Speech at ICAEW Summit | |

| 30/11/2022 | 0855/0955 | ** |  | DE | Unemployment |

| 30/11/2022 | 0900/1000 | *** |  | IT | GDP (f) |

| 30/11/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 30/11/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 30/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 30/11/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 30/11/2022 | 1330/0830 | *** |  | US | GDP (2nd) |

| 30/11/2022 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 30/11/2022 | 1350/0850 |  | US | Fed Governor Michelle Bowman | |

| 30/11/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 30/11/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 30/11/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 30/11/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 30/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 30/11/2022 | 1735/1235 |  | US | Fed Governor Lisa Cook | |

| 30/11/2022 | 1830/1330 |  | US | Fed Chair Jerome Powell | |

| 30/11/2022 | 1900/1400 |  | US | Fed Beige Book | |

| 01/12/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.