-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Treasuries a Touch Richer Pre-Biden/McCarthy Meet

Highlights:

- Treasuries sit slightly richer ahead of next set of Biden/McCarthy negotiations

- Early greenback strength fades, but focus remains higher for now

- Ample ECB, Fedspeak to keep markets busy

US TSYS: Slightly Richer With Further Debt Talks, Fedspeak Eyed

- Cash Tsys hold slightly richer after no clear progress in debt talks and the front end outperforming a touch after dovish Kashkari comments re looking towards skipping the June hike. Debt talk impasse continuation follows optimism building late last week before being dashed on Friday, and sees tense talks set for this week as cash balances start to look precarious. Biden and McCarthy are due to meet today, time unknown.

- 2YY -2.1bp at 4.245%, 5YY -2.1bp at 3.711%, 10YY -1.1bp at 3.661%, 30YY -0.8bp at 3.919%

- TYM3 trades 6+ ticks higher at 113-24+ but remains well within Friday’s range, with volumes at a low but recent average 235k. Resistance is seen at 114-05 (May 19 high) after which lies 114-27 (50-day EMA), whilst support sits at 113-08+ (Mar 15 low).

- Fedspeak headlines an otherwise bare docket, with non-current year voters Bullard (0830ET), Bostic & Barkin (1105ET) and Daly (1105ET).

- Bill issuance: US Tsy $57B 13W, $54B 26W Bill auctions (1130ET)

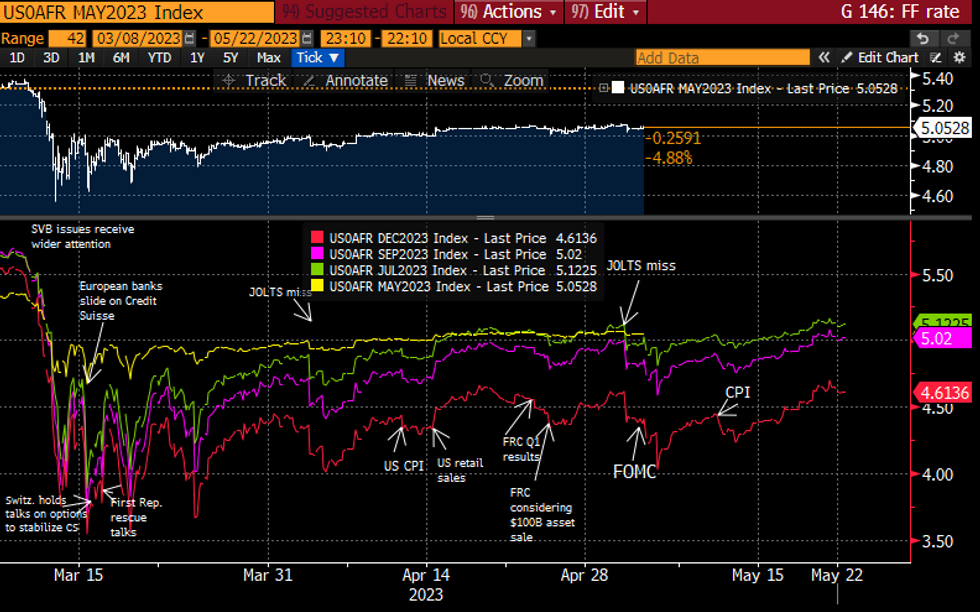

STIR FUTURES: Fed Rates See Modest Further Dip On Weekend Kashkari and Debt Ceiling

- Fed Funds implied rates have drifted lower over the weekend with no clear progress in debt talks and dovish commentary by Kashkari’s recent standards.

- Cumulative changes from current 5.08%: +3.5bp Jun (-0.5bp on Fri close), +4bp Jul (-1bp), -6bp Sep (-1bp), -25bp Nov (-1.5bp), -47bp Dec (-2bp) and -66bp Jan (-2.5bp).

- Kashkari (’23 voter) yesterday told the WSJ he was open to foregoing a June hike but would object to declaring an indefinite pause. It builds on Chair Powell on Friday not offering a hawkish steer as some had expected after Logan (’23) tilted in favour of a June hike.

- Ahead, Bullard (non-voter) with a fireside chat 0830ET, which considering the above could see any moderately less hawkish points picked up upon. He’s followed by Bostic & Barkin (both ’24) discuss technology enabled disruption and Daly (’24) in a fireside chat at a NABE/BdF symposium both at 1105ET.

Source: Bloomberg

Source: Bloomberg

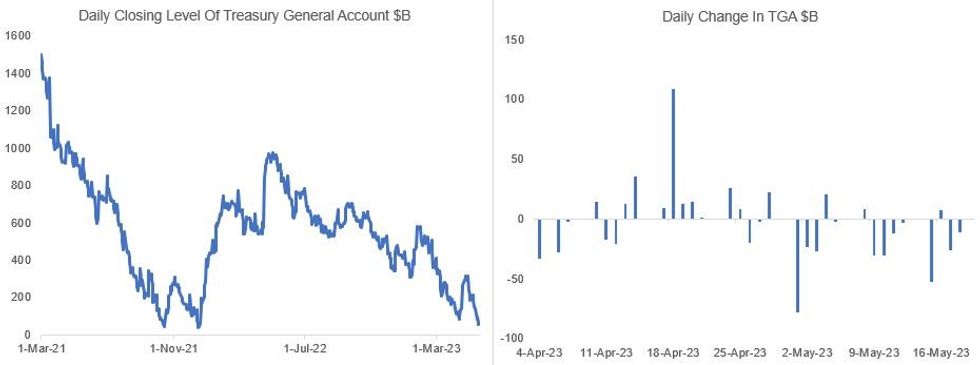

Early June Debt Limit X-Date Looms Over Negotiations

We await a meeting this afternoon between Pres Biden and House Speaker McCarthy (no time set as yet) aimed at reviving high-level debt limit negotiations which went on "pause" Friday after the Republicans and Democrats found themselves too far apart on the outlines of a deal.

- The ongoing debt ceiling impasse has seen the Treasury’s General Account (TGA) at the Fed depleted to $57.3B as of Thursday's close, the lowest amount of the year and vs $316B at the end of May.

- This is dangerous territory ahead of a key mid-June tax receipt date (the Treasury basically runs a deficit in the first half of June but a surplus in the 2nd half): Treasury Sec Yellen said Sunday that while cash flows are somewhat unpredictable, "the odds of reaching June 15 while being able to pay all of our bills is quite low.”

- That may be partly political posturing, but analysts are increasingly concerned over the potential for cash depletion by the 2nd week of June.

- The key number for the TGA is $30B, below which the Treasury could clearly signal it is on the brink of running out of cash and name a deadline.

- On top of the cash balance, the remaining extraordinary measures are seen between $87-92B as of today, but could diminish to near zero by the 2nd week of June.

Source: US Treasury, MNI

Source: US Treasury, MNI

Cash Balance Could Be Precarious By June 9

There are some signs of market distress as a result of debt default concerns, but the largest distortions appear limited to short-dated bill yields / auction dynamics and illiquid credit default swaps. There have been large intraday movements due to developments in negotiations (like Friday's talks "pause" spurring risk-off), but broader markets appear largely calm as the overwhelming expectation is that that a deal will be reached and the US will avoid default.

- An informal MNI client poll run early last week saw no respondents expect an outright US debt default, with an 80/20 split between those expecting a short-term stop gap versus a long-term debt ceiling increase. (More in our Fed Balance Sheet Tracker published Friday). That said, all respondents saw an outright default as USD-negative; none saw it pushing Tsy yields higher (vast majority saw lower yields, some saw mixed curves).

- A few analysts' takes: Wrightson ICAP saw last week's cash flow as "very bad relative to our projections" with a cash balance of <$20B in the week of June 9, though extraordinary measures / cash management bill issuance possibly providing a cushion (ie $19B of cash on hand on June 9, plus $7B of extraordinary "headroom").

- They note though that the debt limit could conceivably become "binding" by June 1, creating uncertainty about Thursday's announcements for the upcoming week's bill auctions (which would settle June 1).

- Goldman Sachs sees Treasury cash "likely" falling under $30B by June 8-9, with "even odds that the Treasury exhausts its funds entirely at that point".

- Their scenarios include a "full-fledged deal that suspends the debt limit to early 2025 along with spending caps" at 70%, a 15% chance of a short-term extension, 10% of fudging payments/borrowing caps temporarily, and 5% it revises the projected deadline to July if cash flows are better-than-expected.

US 1Y and 5Y Credit Default Swap, bpsSource: BBG pricing

US 1Y and 5Y Credit Default Swap, bpsSource: BBG pricing

FOREX: Debt Ceiling the Focus, With No Data to Distract

- Markets continue to revolve around US matters early Monday, with debt ceiling negotiations and tensions with China top of mind for traders. Ahead of another touted meeting between McCarthy and Biden later today, the greenback sits stronger - although off the best levels of the session - keeping prices within range of the multi-month highs posted last week. For the USD Index, 103.295 marks the next intraday upside level in the USD Index, ahead of 103.373 (61.8% retracement for the Thurs - Monday downleg) ahead of multi-month highs at 103.624.

- Signs of a shakier footing for US/China relations has also unsettled equities, tipping European markets into a soft early performance. As such, CHF and JPY are also faring better, as core bond yields retreat.

- Larger options rolling off at today's cut include a sizeable strike at 1.0825-40 in EUR/USD (E2.3bln), with E609mln set to roll off just above at 1.0845-50. Some interest also noted in USD/JPY near current spot rate at Y137.90-05 ($567mln) and below at Y137.50 ($825mln).

- There are no data releases set to distract markets Monday, keeping focus on a busy calendar of central bank speak. ECB's Vujcic, de Guindos, Holzmann, Lane, Villeroy and de Cos make up a frantic European calendar, while Fed's Bullard, Bostic, Barkin and Daly represent the FOMC.

FX OPTIONS: Expiries for May22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-10(E1.6bln), $1.0720-25(E678mln), $1.0825-40(E2.3bln), $1.0845-50(E609mln)

- USD/JPY: Y136.00($1.3bln), Y137.50($825mln), Y137.90-05($567mln)

BONDS: Constructive Start With Debt Limit Talks And CenBank Speakers In Focus

Global core FI has had a constructive start to a week that begins quietly in terms of data (nothing of note in either the European or US calendars), with US debt limit intrigue and central bank speakers the primary focus Monday.

- UK and German curves are trading mildly bull flatter (yields down 1-2bp), with the US outperforming in a bull steepening move (2-5Y yields down 3+bp, 10-30Y down 1-2bp). Terminal central bank pricing is a little softer (ECB/BoE down 2 to 2.5bp, Fed off 1.1bp).

- Periphery spreads are tighter. Greek bonds are easily outperforming following a market-favorable outcome in Sunday's legislative elections (GGBs/Bunds 13bp narrower).

- The session's focus will be the debt limit talks between Pres Biden and House Speaker McCarthy which are set for this afternoon ET, no time specified as yet.

- Over the weekend, Tsy Sec Yellen warned that the odds of getting to June 15 without running out of cash were "quite low"; staff-level talks resumed Sunday.

- With no key data to be released, central bank speakers highlight the docket, including ECB's Lane, Villeroy, and Holzmann.

- For the FOMC, Bullard, Bostic, Barkin, and Daly are ahead - Kashkari over the weekend floated the idea of a "skip" of hiking at a meeting "to get more information", but not "any kind of declaration that we're done".

EQUITIES: US, European Equity Futures Ease Off Friday Cycle Highs

- Eurostoxx 50 futures traded higher again Friday and the contract remains just below its recent highs. Price has cleared resistance at 4363.00, the Apr 21 high and a bull trigger. The break confirms a resumption of the bull cycle from Mar 20 and a continuation of the medium-term uptrend. This opens 4409.50, the Nov 18 2021 high on the continuation chart and a key resistance. Firm support is at 4257.80, the 50-day EMA.

- S&P E-minis traded higher last week and the contract breached key short-term resistance and the bull trigger at 4206.25, the May 1 high. Clearance of this level confirms an extension of the bull trend from Mar 13. This opens 4244.00, the Feb 2 high and the next important resistance. Key support is at 4062.25, the May 4 low. A move through this level would highlight a bearish threat.

COMMODITIES: Gold Remains in Bearish Cycle Despite Recovery From Last Week's Lows

- A short-term bearish threat in WTI futures remains present and initial resistance at $73.81, the May 10 high, is intact. A resumption of weakness and a break of $69.39, the May 15 low, would strengthen near-term bearish conditions. The recent print below $64.67, the Mar 20 low and a key support, is a key bearish development. A clear break of it would resume the broader downtrend.

- Gold remains in a bearish cycle and is trading closer to its recent lows. The yellow metal last week cleared support at $1976.3, the 50-day EMA and $1969.3, the Apr 19 low. A clear break of this support zone highlights a stronger bearish threat and opens $1934.3, the Mar 22 low. Key resistance and the bull trigger is at $2063.0, the May 4 high. Initial firm resistance is at $2022.6, the May 12 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/05/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 22/05/2023 | 0900/1100 |  | EU | ECB de Guindos Opens ECB/EIOPA Workshop | |

| 22/05/2023 | 0900/1100 |  | EU | ECB Elderson Guest Lecture Utrecht University | |

| 22/05/2023 | 1230/0830 |  | US | St. Louis Fed's James Bullard | |

| 22/05/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/05/2023 | 1415/1615 |  | EU | ECB Lane Panels OeNB Economics SUERF Conference | |

| 22/05/2023 | 1430/1530 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 22/05/2023 | 1500/1100 |  | US | Fed's Tom Barkin, Raphael Bostic | |

| 22/05/2023 | 1505/1105 |  | US | San Francisco Fed's Mary Daly | |

| 22/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 22/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/05/2023 | 1600/1700 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 23/05/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 23/05/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 23/05/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/05/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/05/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0715/0915 |  | EU | ECB de Guindos Address at European Financial Integration Conf | |

| 23/05/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/05/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/05/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/05/2023 | 0915/1015 |  | UK | BOE Bailey, Pill, Tenreyro, Mann at MPR Hearing | |

| 23/05/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 23/05/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/05/2023 | 1300/0900 |  | US | Dallas Fed's Lorie Logan | |

| 23/05/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/05/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/05/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 23/05/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/05/2023 | 1445/1545 |  | UK | BOE Haskel Panellist at Richmond Fed Conference | |

| 23/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.