-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Fade Keeps Majors on Cusp of Breakout

Highlights:

- Tsy curve sits bear steeper ahead of PPI, jobless claims

- Implied Fed rate path still trades heavy post-CPI

- GBP through bull trigger ahead of MNI Event with BoE Chief Econ Pill

US TSYS: Bear Steepening With PPI, Jobless Claims and 30Y Supply Ahead

- Cash Tsys have reversed an earlier rally to sit cheaper on the day, more notably so at the long end with the curve bear steepening as the long end underperforms core EU FI.

- PPI inflation is in focus with its implications for core PCE inflation and weekly claims are also likely looked at closely after last week’s seasonal adjustment revision last a notably different trend. Elsewhere, 30Y supply rounds out the docket after yesterday’s 10Y tail.

- 2YY +2.1bp at 3.979%, 5YY +3.1bp at 3.493%, 10YY +4.1bp at 3.432% and 30YY +3.5bp at 3.659%.

- TYM3 trades 4 ticks lower at 115-18+ still well within yesterday’s range on fairly subdued volumes of 210k. It watches support at the 20-day EMA of 115-05 just below yesterday’s low of 115-08, whilst resistance remains at 116-08 (Apr 12 high).

- Data: PPI Mar (0830ET), Weekly jobless claims (0700ET)

- Note/bond issuance: US Tsy $18B 30Y re-open (912810TN8) - 1300ET

- Bill issuance: US Tsy $60B 4W, $50B 8W Bill auctions – 1130ET

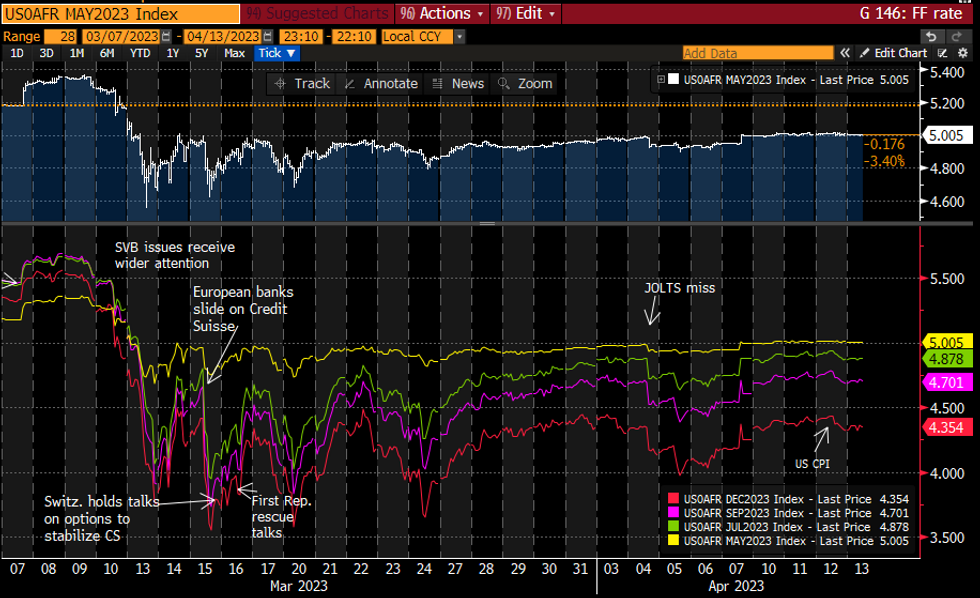

STIR FUTURES: Fed Rate Path Still Slightly Weighed By CPI

- Fed Funds implied rates sit fractionally lower for the May 3 FOMC with a 17.5bp hike.

- Rates for subsequent meetings have pushed higher overnight but remain below levels pre-FOMC minutes and more notably so pre-CPI. For example, the 48bp of cuts from current levels to 4.35% for the Dec FOMC is +3.5bp on the day, -2bp since just prior to the minutes and -6bp since CPI. The first full cut from current levels is still seen in Nov at -30bps.

- No Fedspeak scheduled (Gov Waller next slated for tomorrow) but data in focus with PPI and weekly jobless claims.

Source: Bloomberg

Source: Bloomberg

MNI US Inflation Insight, Apr'23: Moderating But Some Way To Go

EXECUTIVE SUMMARY

- Core CPI inflation was broadly as expected in March, easing from 0.45% to 0.385% M/M for the fourth month with a 0.4% reading to 1 decimal place, i.e. stubbornly high.

- The main downside surprise came from a sharp slowing in rents, whilst non-housing core services saw only varying degrees of moderation but perhaps of some comfort were propped up by volatile items that could reverse ahead.

- Dispersion measures also generally retreated somewhat although early core PCE estimates still point to a monthly acceleration.

- The market still priced a circa 18bp hike for the May 3 FOMC after the release. Still to come, Q1 GDP (Apr 27), the March PCE deflator (Apr 28) and ECI (Apr 28) along with the SLOOS update on credit conditions.

PLEASE FIND THE FULL REPORT HERE:

EUROPE ISSUANCE UPDATE:

ITALY AUCTION RESULTS: Decent auction

- That was a decent BTP auction with bid-to-covers broadly in line with recent results and with the average price at auction being a bit above the pre-auction cutoff price. All the BTPs on offer are now trading broadly in line with the average price acheived at auction, with core FI moving sligthly off its lows across the board.

GILT AUCTION RESULTS: 3.25% Jan-33 Gilt - Strong Auction

- GBP3.25bln 3.25% Jan-33 Gilt, Avg yield 3.592% (Prev. 3.495%), Bid-to-cover 3.04x (Prev. 2.42x), Tail 0.2bp (Prev. 0.4bp)

- A strong 10-year gilt auction with a bid-to-cover in excess of 3x, a tight tail of 0.2bp and the LAP in excess of the pre-auction mid-price (more in line with the prevailing price ahead of the dip into the auction cutoff). Gilts have found a bit of a footing following the strong auction and we are now trading higher post-auction.

SPAIN AUCTION RESULTS: Relatively strong auction

- E2.506bln 2.80% May-26 Bono, Avg yield 3.004% (Prev 3.433%), Bid-to-cover 1.31x (Prev 2.02x)

- E2.54bln 3.15% Apr-33 Obli, Avg yield 3.401% (Previous 3.361%), Bid-to-cover 1.38x (Prev 1.59x)

- E1.441bln 1.00% Jul-42 Green Obli, Avg yield 3.802% (Prev. 3.586%), Bid-to-cover 1.53x (Prev. 1.66x)

- E479mln 0.70% Nov-33 Obli-Ei, Avg yield 1.055% (Prev 1.164%), Bid-to-cover 1.95x (Prev 1.95x)

- That is a relatively strong Spanish auction with the highest nominal amount of conventional (non-linker) bonds sold since June 2020 (slightly surpassing that sold in January this year). Some of the bid-to-covers fell a little bit, but that was more than made up for with the larger auction sizes. In line with broader core FI moves, we are now trading lower than we were going into the auction.

GBP: Implied Pricing Tilts Higher as GBP/USD Nears Bull Trigger

- At the beginning of April, we wrote that the YTD consolidation phase for GBP/USD could give way to a more bullish medium-term view, as improving technical trends and a bottoming-out of negative newsflow open room for a correction higher. ( Full piece here )

- GBP/USD is again pressing on the early April highs and bull trigger at 1.2525, a break of which would turn focus to 1.2599, the Jun 7 2022 high. Beyond this mark, how much further could the pair run?

- Options-implied probabilities now see a 38% likelihood of GBP/USD trading above 1.2600 in mid-May (25% for above 1.27, 16% for above 1.28) – a notable improvement for the 20%, 12% and 7% implied pricing at the beginning of the month. Furthermore, the more benign price action in spot this year has depressed realised vols, feeding directly into the lowest levels for the front-end of the implied vol curve in twelve months – helping to mark down vols associated with OTM strikes, flatten the vol smile, and cheapen expressing an view via options.

- The one-month timeline now captures both the May BoE and FOMC decisions – ahead of which a 25bps rate rise is 80% priced for each bank. A divergence in pricing here could prove key for the pair, making US Michigan sentiment (Apr14), UK CPI (Apr19), US ECI/PCE data (Apr28) the key releases going forward.

- Recall – MNI hosts event today with BoE Chief Econ Pill at 1400BST – register here: https://www.eventbrite.co.uk/e/livestreamed-mni-connect-video-conference-with-boes-huw-pill-tickets-576884175097

FOREX: Fading Greenback Tilts GBP/USD Toward Bull Trigger

- The greenback remains soft against most others in G10, putting the USD Index to another monthly low and within range of the early February support at 100.82. Weakness through here would put the USD at the lowest level since late April last year, a move predicated by the waning expectations for the Fed peak rate as well as the softer details in the March US CPI release.

- USD weakness has helped tip most major pairs through a number of key levels - EUR/USD now sits comfortably north of 1.10, while GBP/USD is narrowing in on the April high and bull trigger at 1.2525 - a level that, if broken, would mark the resumption of the uptrend off the March low and end the 2023 consolidation phase on a positive note.

- CHF again trades well, with USD/CHF through to new YTD lows and targeting handle support at the 0.8900 level. The pair is yet to hit technically oversold levels, but a break below the handle could tip the 30-day RSI below 30 for the first time since November.

- JPY sits softer alongside the USD despite the more moderate equity performance Thursday, while AUD outperforms on a more flattering overnight jobs release. AUD/JPY has printed a fifth consecutive higher high, narrowing the gap with resistance at 90.08.

- Weekly jobless claims data and the March PPI release take focus going forward, while the central bank speaker slate circles an MNI event with BoE Chief Economist Pill at 1400BST/0900ET and ECB's Nagel after the London close.

FX OPTIONS: Expiries for Apr13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E3.4bln), $1.0850(E1.7bln), $1.0885-90(E1.1bln), $1.0900(E6.3bln), $1.0950(E1.5bln), $1.1000(E3.1bln)

- USD/JPY: Y131.25-30($800mln), Y132.00-05($1.3bln), Y132.20-25($663mln), Y133.00($1.2bln), Y134.00-05($1bln)

- GBP/USD: $1.2360-80(Gbp1.1bln)

- EUR/GBP: Gbp0.8795-10(E595mln)

- AUD/USD: $0.6625-30(A$1.7bln), $0.6645-50(A$1.7bln)

- USD/CAD: C$1.3525($1bln)

- USD/CNY: Cny6.8785-00($500mln), Cny6.9000($852mln)

EQUITIES: Stocks Remain Firm, Retaining Bullish Trend Condition

- Eurostoxx 50 futures remain firm. The contract traded to a fresh cycle high Wednesday of 4321.00, reinforcing bullish conditions. Price has recently breached 4268.00, the Mar 6 high and a key hurdle for bulls. The break strengthens bullish conditions and opens 4324.50, the Jan 13 2022 high (cont). Moving average studies are in a bull-mode set-up and this highlights a broader uptrend. Initial firm support lies at 4199.30, the 20-day EMA.

- S&P E-minis briefly traded above 4171.75 yesterday, the Apr 4 high. Current trend conditions are bullish - price has recently breached 4119.50, Mar 6 high, reinforcing a positive theme. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension to 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key M/T resistance. Firm support lies at 4056.44, the 50-day EMA.

COMMODITIES: WTI Futures Extend Bull Cycle, Targeting $85.01 Nov 14 High Next

- WTI futures remain in a bull cycle and the contract has traded higher Wednesday, clearing resistance at $81.81, the Apr 4 high. The break confirms a resumption of the current uptrend note that an important resistance at $83.04, the Jan 23 high, has also been breached. This opens $85.01, the Nov 14 high. On the downside, key short-term support is seen at $79.00, the Apr 3 low and the gap high on the daily chart.

- Trend conditions in Gold remain bullish and last week’s resumption of the uptrend reinforced current conditions - the yellow metal cleared former resistance at 2009.7, the Mar 20 high, to post fresh YTD highs. This signals scope for a climb towards $2034.0 next, a Fibonacci projection. On the downside, key support has been defined at $1934.3, the Mar 22 low - a break would highlight a potential reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/04/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank, G20 Finance Ministers' Meetings | |

| 13/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/04/2023 | 1230/0830 | *** |  | US | PPI |

| 13/04/2023 | 1300/0900 |  | CA | Governor Macklem speaks at IMF | |

| 13/04/2023 | 1300/1400 |  | UK | BOE Pill Speaker at MNI Connect | |

| 13/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/04/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/04/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/04/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 14/04/2023 | 0600/0800 | *** |  | SE | Inflation report |

| 14/04/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 14/04/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 14/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank Spring Meetings | |

| 14/04/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/04/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 14/04/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/04/2023 | 1245/0845 |  | US | Fed Governor Christopher Waller | |

| 14/04/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/04/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 14/04/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/04/2023 | 1400/1000 | * |  | US | Business Inventories |

| 14/04/2023 | 1600/1700 |  | UK | BOE Tenreyro Panellist at the IMF Meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.