-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Index Cements Bullish Break

Highlights:

- USD Index cements first break and close above 100-dma since 2021

- CAD vols on front foot ahead of expected conditional pause from BoC

- Front-end Treasury yields take step nearer '07 highs

US TSYS: Front Yields Pull Back After Step Nearer 2007 Peak With Solid Docket Ahead

- Cash Tsys sit cheaper on yesterday’s close but it masks intraday moves after front yields touched fresh cycle highs of 5.080% in Asia hours in a continuation of moves after Powell opened the door to a 50bp hike at the March meeting. They have subsequently rallied to 5.038%, with some pull from richer EGBs, but the move has more closely set sights on the ’07 peak of 5.128%.

- Ahead, labour data of note ahead of Friday’s payrolls, plus a second appearance from Powell and 10Y supply.

- 2YY +3bp at 5.038%, 5YY +1.8bp at 4.329%, 10YY +0.6bp at 3.970% and 30YY +0.4bp at 3.876%

- TYM3 trades just 1 tick lower at 110-29+ off overnight lows of 110-20+ came closer to the bear trigger of 110-12+ (Mar 2 low), with volumes modestly above average despite easing after an active Asia session.

- Fedspeak likely to have less impact today but still notable. Barkin (’24) at 0800ET, Powell gives round two at the House at 1000ET and the Fed Beige Book at 1400ET.

- Data: ADP (0815ET) and JOLTS (1000ET, plus annual revision) and international trade (0830ET) plus weekly MBA mortgage data (0700ET).

- Note/bond issuance: US Tsy $32B 10Y Note auction re-open (91282CGM7) – 1300ET

- Bill issuance: US Tsy $36B 17W Bill auction – 1130ET

US 2y Tsy yieldSource: Bloomberg

US 2y Tsy yieldSource: Bloomberg

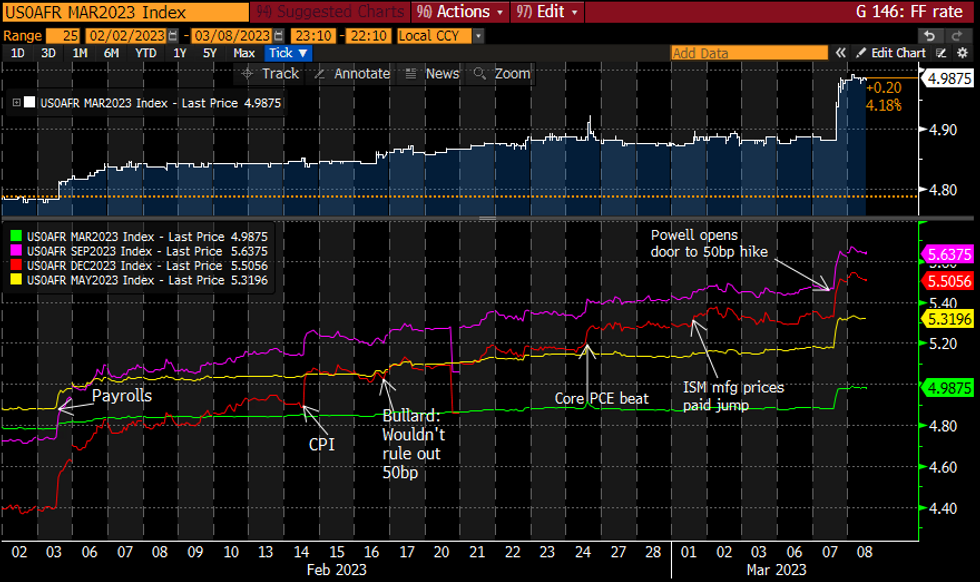

STIR FUTURES: Fed Rate Path Holding Higher Push Overnight Post-Powell

- Fed Funds implied hikes have faded from overnight highs but remain above yesterday’s close after Powell opened the door to a 50bp hike.

- 41bp for Mar (+0.5), cumulative 74.5bp for May (+1bp), 106bp to 5.64% terminal in Sep (+1.5bp) before 13bp of cuts to 5.51% year-end (+0.5bp). The parallel shift higher in 2H rates has held that half a cut priced since the core PCE beat.

- GS expect the median dot will rise by 50bp to 5.5-5.75% in 2023 in the March meeting and see the same rate for their terminal call (+25bps).

- Fed: Powell round two at the House (1000ET) plus Barkin (’24 voter) at 0800ET having on Mar 3 called for a shallower/more deliberate rate path to give more flexibility and the Fed Beige Book (1400ET).

FOMC-dated Fed Funds implied ratesSource: Bloomberg

FOMC-dated Fed Funds implied ratesSource: Bloomberg

CHINA: Xi-Must Systematically Improve Capacity To Address Strategic Risk

MNI (London) - Wires carrying comments from Chinese President Xi Jinping speaking to a plenary meeting of the delegation of the People's Liberation Army and the Armed Police Force: "Must systematically improve China's capability to address strategic risk, uphold strategic interests, and achieve strategic goals....to consolidate and improve the integrated national strategic system and capacity."

- Link to CCTV article (in Mandarin):https://content-static.cctvnews.cctv.com/snow-book...

- Excerpt from article (translated into English): "It is necessary to strengthen the orientation of defense science and technology industry to serve a strong army and win wars, optimize the system layout, innovate development models, and enhance the resilience of the industrial chain and supply chain."

- The focus on the resilience of supply chains is likely a response to Western efforts - led by the US - to limit China's access to high-tech components and semiconductors that would allow the development of advanced military capabilities.

FOREX: Greenback Tops Key Tech Mark For First Time Since '21

- As the dust settles following the hawkish appearance from Fed's Powell yesterday, the USD Index built on recent gains overnight, confirming a key bullish break of the 100-dma. Markets broke and closed above this mark (today at 105.466) for the first time since June 2021 - a move which presaged a multi-year rally for the currency amid the Fed's post-pandemic tightening drive.

- AUD and NZD trade more favourably, partially reversing the Tuesday weakness to rally against most others.

- In her first public speech since being appointed to the BOE MPC in August last year, BoE's Dhingra confirmed her place on the dovish side of the bank board, voicing her preference for unchanged policy in the near-term for the Bank of England - raising further the risk for split votes at the MPC going forward.

- JPY trades on the backfoot, keeping the week's best levels in EUR/JPY under pressure ahead of NY hours. A break above 145.57 would mark a significant bullish break for the cross - putting prices at the best levels since December. The equity backdrop remains supportive, with outperformance again noted in the Nikkei 225 overnight - futures traded clear of the Q4 2022 highs Wednesday.

- Focus Wednesday turns to the Bank of Canada rate decision, at which the Bank are seen keeping policy rates unchanged at 4.50% for the first time since their tightening drive kicked off in 2021. USD/CAD prints a new YTD high at 1.3774 ahead of the NY crossover.

USD/CAD: Overnight Implied Vols Bid Ahead of BoC Decision

- USD/CAD sits just below the YTD high printed overnight at 1.3774, with overnight vols suitably bid ahead of the BoC decision later today (on which, our full preview is found here: https://roar-assets-auto.rbl.ms/files/51694/BOCPre... ).

- The pair made a convincing break higher Tuesday, taking out the bull trigger at the Dec 16 high of 1.3705, and clears the way for a test on the 1.3800 Fibonacci retracement and above. An ATM straddle is priced to break-even on a ~65 pip swing in the pair today, with implied vols showing north of 12 points for the first time since mid-Feb today.

FX OPTIONS: Expiries for Mar08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-05(E797mln), $1.0560-65(E2.5bln), $1.0600(E902mln), $1.0645-60(E1.5bln), $1.0670-90(E2.3bln), $1.0715-35(E1.5bln), $1.0745-55(E1.5bln)

- USD/JPY: Y135.00($1.2bln), Y137.00($1.6bln)

- USD/CAD: C$1.3550-60($623mln)

- USD/CNY: Cny6.8650($1.1bln)

EQUITIES: E-Mini S&P Trades Below 4000.00 Following Post-Powell Move Lower

- Eurostoxx 50 futures remain above key support - the base of a bull channel drawn from the Oct 13 low. The line intersects at 4230.60. While channel support holds, the broader uptrend remains intact. Monday’s gains resulted in a test of 4323.00, the Feb 16 high and bull trigger. A clear break would resume the uptrend. On the downside, a breach of the channel base alters the picture.

- The S&P E-Minis trend condition is bearish and yesterday’s move lower signals the end of the recent corrective bounce. A continuation lower would pave the way for weakness towards the next key support at 3925.00, Mar 2 low. This level is a bear trigger and a breach would confirm a resumption of the bear leg that started on Feb 2. For bulls, a break of 4082.50, the Mar 6 high, is required to reinstate a bullish theme.

COMMODITIES: Gold Erases March Gains, Trend Conditions Bearish

- A sharp sell-off in WTI futures Tuesday has defined a key near-term resistance at $80.94, the Feb 7 high. A break above this hurdle is required to reinstate the recent bullish theme that would open $82.89, the Jan 23 high and a key resistance. On the downside, support to watch lies at $75.83, the Mar 3 low. A continuation lower and a breach of this level would strengthen a bearish case and open $73.80, the Feb 22 low.

- Trend conditions in Gold remain bearish and yesterday’s strong sell-off reinforces this theme. The move lower signals the end of the recent corrective bounce and attention is on support and the bear trigger, at $1804.9. A break of this level would confirm a resumption of the downtrend and open $1787.3, a Fibonacci retracement. The yellow metal needs to breach $1858.3, the Mar 6 high, to signal scope for a stronger reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/03/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/03/2023 | 1300/0800 |  | US | Richmond Fed's Tom Barkin | |

| 08/03/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 08/03/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 08/03/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 08/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 08/03/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 08/03/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/03/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 08/03/2023 | 1900/1400 |  | US | Fed Beige Book | |

| 09/03/2023 | 0130/0930 | *** |  | CN | CPI |

| 09/03/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/03/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 09/03/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 09/03/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/03/2023 | 1500/1000 |  | US | Fed Vice Chair Michael Barr | |

| 09/03/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/03/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/03/2023 | 1840/1340 |  | CA | BOC's Rogers "Economic Progress Report" speech |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.