-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - French Assets Pricing Election Risk

Highlights:

- French assets pricing election risk premium, Macron lead narrows

- EUR/AUD at fresh five-year lows on hawkish RBA hold

- US, Canadian trade data due, with more Fedspeak scheduled

US TSYS SUMMARY: Treasuries Bear Steepen With European Sell-Off

- Cash Tsys have bear steepened in a continuation of a move that has largely been one directional since open. The sell-off reverses yesterday’s rally at the short end whilst longer tenors clear yesterday’s range with the 10Y back to Mar 29 levels.

- Drivers are unclear but Treasuries lag moves seen in Europeans aside from Bunds.

- 2YY +5.1bps at 2.473%, 5YY +6.9bps at 2.619%, 10YY +7.4bps at 2.469% and 30YY +7.2bps at 2.528%, pushing 2s10s almost back to zero having been inverted since payrolls on Friday.

- TYM2 sits 13 ticks lower at 121-22 with volumes again sluggish after yesterday’s subdued session. A bearish theme dominates with the bear trigger at 120-30+ (Mar 28 low) whilst initial resistance is eyed at 123-04 (Mar 31 high).

- Fedspeak: Brainard (voter), Daly (2024) and Williams (voter) all speak today, with Brainard for the first time since the March FOMC.

- Data: International trade (0830ET) before the finalised Service/Comp PMI (0945ET) and the fresh ISM Services (1000ET) for March. The Eurozone service PMI was stronger than expected but also with record highs for both input costs and output prices.

- No issuance.

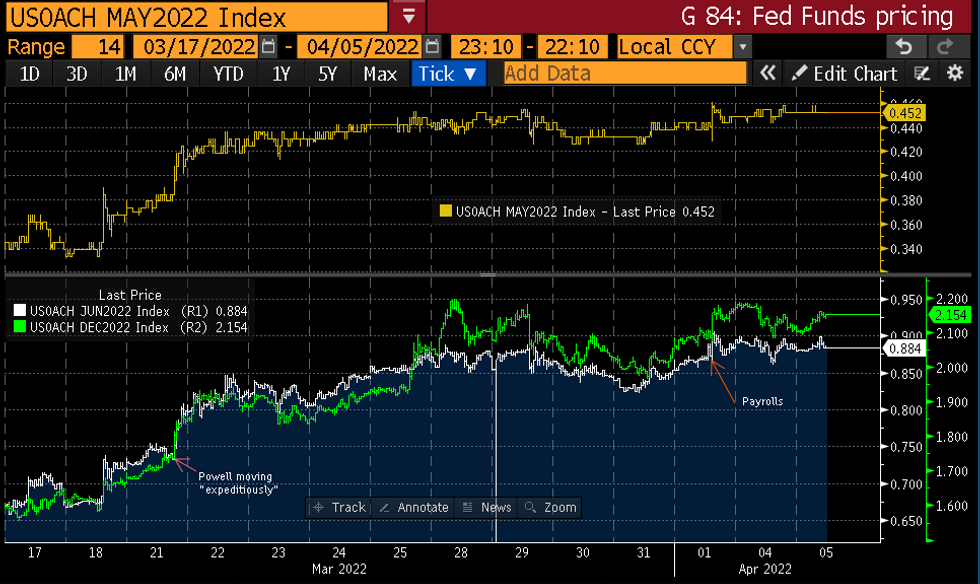

STIR FUTURES: Fed Hike Expectations Steady With Fedspeak Ahead

- Hike expectations are little changed from yesterday, especially over the immediate meetings with 45bps for May and 88bps for June in FOMC-dated Fed Funds futures.

- Dec’22 has firmed from overnight but at 215bps is in the middle of yesterday’s range.

- Fedspeak: Brainard (voter), Daly (2024) and Williams (voter) all speak today. Set to be Vice Chair when eventually confirmed by the Senate, Brainard speaks in a moderated discussion on the unequal impacts of inflation, with text and moderated Q&A.

- Her last comments from Feb 18 are now stale but noted that she believed it appropriate to begin a series of rate hikes in March with b/s runoff starting in the next few FOMC meetings.

FOMC-dated Fed Funds futures implied cumulative hikesSource: Bloomberg

FOMC-dated Fed Funds futures implied cumulative hikesSource: Bloomberg

EUROPE ISSUANCE UPDATE:

Austria allots 10/25-year RAGBs:

- E800mln 0.90% Feb-32 RAGB, Avg yield 1.013% (Prev. 0.569%), Bid-to-cover 2.08x

- E500mln 1.50% Feb-47 RAGB, Avg yield 1.146% (Prev. 0.569%), Bid-to-cover 1.66x (Prev. 1.63x)

Germany sells 0.50% Apr-30 ILB / 0.10% Apr-46 ILB

- E432mln 0.50% Apr-30 ILB, Avg yield -2.30% (Prev. -2.74%), Bid-to-cover 1.36x (Prev. 1.32x)

- E47mln 0.10% Apr-46 ILB, Avg yield -1.87% (Prev. -1.60%), Bid-to-cover 1.34x (Prev. 1.74x)

- Maturity: 04-Feb-2043

- Size set earlier at E6bln (no grow)

- Books in excess of E57bln (excl JLM)

EUROPE OPTION FLOW SUMMARY:

Eurozone:

OEM2 127.50/126.50 1x1.5 put spread sold at 9.5 in 2.5k. Hearing unwinding position - this was sold Monday as well. Recall, this was bought at 11.5/12.0/12.5 last week in 40k.

DUM2 111.20/112.50 call spread bought for 6 in 5k

FVM2 113.25 puts 5.0K lot blocked at 0-34+

ERM3 100.25/100.00 put spread sold at 21.5 in 2k

ERZ2 100.50 call bought for 1 in 5k

CROSS ASSET: French Assets Underperform, With Stocks and Bonds Lower

- Across European equity markets, France's CAC-40 is the notable underperformer, drifting around 1% against 0.2% losses for German and European markets. Banks are among the poorest performers in the index, with SocGen, Credit Agricole and BNP Paribas off 3 to 5% apiece.

- Bond markets are showing similar fluctuations, with the OAT market underperforming broader European bonds. The FR/GE 10y yield spread has cleared 50bps and is now at its widest since early 2020 and the depths of the COVID-19 pandemic.

Source: MNI/Bloomberg

- Betting odds markets show a persistent drift in the implied probability of a Macron victory, which has slipped below 80% from above 90% this time last week. Meanwhile, Marine Le Pen's implied odds have nearly doubled, rising to 20% from 11% a week previously.

Figure 2: Betting markets trim implied odds of Macron victory

Source: MNI/PredictIt

FOREX: Hawkish RBA Hold Tips EUR/AUD to Fresh 5y Low

- The RBA provided a hawkish surprise in its monetary policy decision overnight. Despite keeping the cash rate unchanged this time, the Board dropped the reference to "patience" in its interest rate outlook, setting the scene for future tightening.

- The RBA's hawkish policy hold overnight continues to push AUD to the top of the G10 table, with AUD gains most notable against NOK, JPY and EUR so far today. The move puts EUR/AUD through horizontal support drawn off the mid-2017 lows at 1.4424, with prices now at the lowest levels since late April 2017 - narrowing the proximity with the 2017 cyclical low of 1.3627.

- The greenback is on the backfoot, partially reversing several sessions of strength after the USD Index recovered off last week's lows. This keeps the DXY either side of the 99.00 handle, as markets watch the stabilisation of pricing for Fed policy ahead of the next FOMC meeting in a month's time.

- PMI data revisions across the Eurozone this morning left little mark on markets, better final readings for Germany were countered by lower Spanish releases.

- US and Canadian trade balance numbers for February are the calendar highlights, with some attention also likely paid to speeches from Fed's Brainard on inflation, Daly & Williams on the economy.

EUR/AUD: Break Lower Tips RSI Into Oversold Territory

- The RBA's hawkish policy hold overnight continues to push AUD to the top of the G10 table, with AUD gains most notable against NOK, JPY and EUR so far today.

- The move puts EUR/AUD through horizontal support drawn off the mid-2017 lows at 1.4424, with prices now at the lowest levels since late April 2017 - narrowing the proximity with the 2017 cyclical low of 1.3627.

- Policy expectations remain the key driver for AUD at this juncture, shrugging off the previously-held correlation with market volatility and allowing AUD to look through near-term geopolitical risk emanating from the Ukraine crisis (see: https://marketnews.com/cautious-rba-could-work-aga... ).

- The overnight price action has tipped the EUR/AUD RSI into oversold territory for the third time in 2022. The previous two occasions prompted a corrective recovery in the cross, followed by a resumption of the longer-term downtrend once the oversold condition was cleared.

- Sell-side analysts remain bullish on AUD. On March 10th, CIBC cited long AUD as their highest conviction view, with the commodity prices, Australian inflation expectations and a leaning hawkish RBA working in the currency's favour.

Figure 1: EUR/AUD vs. RSI

Source: MNI/BBG

FX OPTIONS: Expiries for Apr05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.0bln), $1.0915-25(E500mln), $1.1050-65(E671mln), $1.1095-10(E1.6bln)

- USD/JPY: Y122.00($656mln)

- GBP/USD: $1.3335-40(Gbp619mln)

- EUR/GBP: Gbp0.8390-00(E661mln), Gbp0.8460(E793mln)

- AUD/USD: $0.7300(A$1.6bln), $0.7500(A$1.1bln)

- USD/CAD: C$1.2510-25($599mln), C$1.2570-80($916mln)

Price Signal Summary - AUDUSD Resumes Its Uptrend

- In the equity space, the recent pullback in S&P E-Minis is still considered corrective. The bull cycle that started Mar 15, remains intact and the focus is on 4663.50, Jan 18 high. Watch initial resistance at 4633.44, 76.4% of the Jan 4 - Feb 24 downleg and an important short-term bull trigger. The 50-day EMA is key support - it intersects at 4450.00. EUROSTOXX 50 futures are in consolidation mode. A short-term bullish tone remains intact though. Last week’s gains higher confirmed a bull flag breakout on the daily chart and price traded above the 50-day EMA for a period. The focus is on 3965.50 next, the Feb 23 high. Support to watch is unchanged at 3735.00, the Mar 18 low.

- In FX, EURUSD traded lower Monday and started this week off on a bearish note. The pair has recently failed to remain above the 50-day EMA, and the subsequent sell-off highlights a developing bearish threat. Key support to watch is at 1.0945, the Mar 28 low. A break would signal scope for an extension lower. GBPUSD remains vulnerable following the pullback from 1.3298, the Mar 23 high. The focus is on 1.3000 next, the Mar 15 low and a bear trigger. Key resistance is unchanged at the 50-day EMA - it intersects at 1.3285 today. A break would signal a reversal. USDJPY is unchanged and remains in a corrective cycle following the pullback from the 125.09 trend high (Mar 28). Initial support lies at 121.28, the Mar 31 low. A break of this level would trigger a deeper pullback and open 120.95, Mar 24 low ahead of the 120.00 handle. Initial resistance is seen at 123.20, Mar 30 high. The AUDUSD continues to climb. Today’s gains confirm a resumption of the uptrend and a bull flag breakout on the daily chart. This signals scope for a climb towards 0.7716, the Jun 16 2021 high.

- On the commodity front, Gold is still range bound but remains vulnerable. The yellow metal found support last week at $1890.2 on Mar 29 and this level represents the short-term bear trigger. Initial resistance is at $1966.1, Mar 24 high. In the Oil space, WTI futures have recovered from yesterday’s low. This leaves the 50-day EMA at $97.61 intact - a key pivot support. Initial resistance is at $108.75, the Mar 30 high. For bears, a break of the 50-day EMA would suggest potential for a deeper retracement.

- In the FI space, the Bund futures primary trend remains down and recent gains are considered corrective. Key near-term resistance is seen at 160.15, the 20-day EMA. A resumption of weakness would open the 156.00 handle. Gilts traded higher Monday and breached its 20-day EMA. Key resistance is at 122.72, the Mar 18 high. The broader trend direction is bearish and the bear trigger is at 119.86, the Mar 28 low.

EQUITIES: Momentum on Chinese Equities Remains Firm

- Momentum in Chinese equities has been firmed since the middle of March; the Hang Seng Index is up nearly 25% from its low reached on March 15.

- The momentum started after reporters were told that regulatory authorities were ‘mulling measures to jointly crackdown on malicious short sellers’, which officials have viewed as one of the factors behind equity weakness.

- Even though the ‘zero-Covid policy’ continues to dramatically weigh on growth expectations, the easing policy in China could support ‘cheap’ equities in the medium term.

- Next resistance to watch on the topside stands at 22,804.30 (50DMA), followed by 23,181.60, which corresponds to the 38.2% Fibo retracement of the 18,235.50 – 31,183.40 range.

- Interestingly, renewed inflows in Chinese equities have not been supporting the Yuan, with USDCNH currently trading slightly above its 100DMA (6.3624).

- Key resistance to watch on USDCNH stands at 6.4063, which corresponds to the 200DMA (rejected in mid-March).

Source: Bloomberg/MNI

COMMODITIES: Oil And Gas Continue To Regain Ground

- WTI Crude up $1.07 or +1.04% at $105.06

- Natural Gas up $0.16 or +2.77% at $5.872

- Gold spot down $2.27 or -0.12% at $1933.01

- Copper up $6.25 or +1.31% at $484.1

- Silver up $0.15 or +0.63% at $24.6867

- Platinum down $1.57 or -0.16% at $989.07

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2022 | - |  | EU | ECB's de Guindos attends Ecofin | |

| 05/04/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 05/04/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/04/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2022 | 1400/1000 |  | US | Minneapolis Fed's Neel Kashkari and Fed Governor Lael Brainard | |

| 05/04/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 05/04/2022 | 1800/1400 |  | US | New York Fed's John Williams | |

| 06/04/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/04/2022 | 0600/0800 | ** |  | DE | manufacturing orders |

| 06/04/2022 | 0700/0900 |  | EU | ECB VP de Guindos speaks | |

| 06/04/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/04/2022 | 0900/1100 | ** |  | EU | PPI |

| 06/04/2022 | 0900/1100 |  | EU | ECB Schnabel Panel Moderation at ECB/EC Conference | |

| 06/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/04/2022 | 1145/1345 |  | EU | ECB Philip Lane panel appearance | |

| 06/04/2022 | 1330/0930 |  | US | Philadelphia Fed's Patrick Harker | |

| 06/04/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 06/04/2022 | 1800/1400 | * |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.