-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Yields Keep On Rising

Highlights:

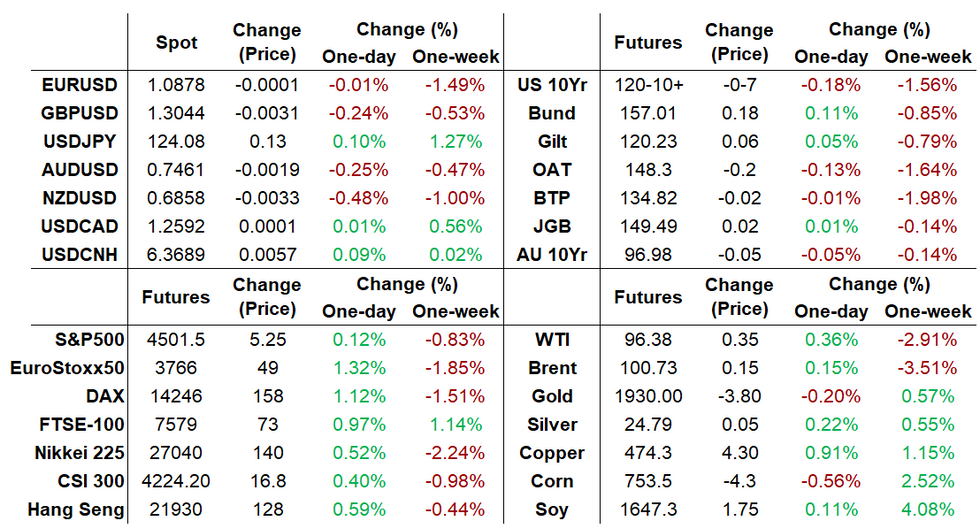

- Tsy curve bear flattens, 10Y yields hit a fresh cycle high above 2.69%

- Early USD gains fade; equities stronger

- Focus on French election, with Macron nursing narrow poll lead vs Le Pen

US TSYS: Treasuries Bear Flatten Amidst Low Volumes

- Cash Treasuries bear flatten after four consecutive days of moving steeper as Fed hike expectations firm.

- This sees 2s10s at 16bps, having been -10bps at the start of the week, despite 10Y yields earlier touching new cycle highs as QT considerations continue to weigh.

- 2YY +5.0bps at 2.509%, 5YY +2.9bps at 2.735%, 10YY +0.6bps at 2.664% and 30YY -0.1bps at 2.678%.

- TYM2 sits 7 ticks lower at 120-10+ having earlier touched a new cycle low of 120-05 amidst below average volumes. It continues to sit close to support of 120-04+ (low Dec 12/13, 2018 cont) whilst resistance is the 20-day EMA of 122-27+.

- Geopolitical headlines likely to dominate today with limited potential drivers scheduled, with no Fedspeak or issuance and only wholesale inventories/sales for data.

US 2Y yields, 10Y yields and 2s10s spread (mid, not ask yields per text)Source: Bloomberg

US 2Y yields, 10Y yields and 2s10s spread (mid, not ask yields per text)Source: Bloomberg

EGBs-GILTS: US Bonds limit upside in EGBs and Gilt

- US Treasuries kept Europe under pressure during the European morning session, but EGBs and Bund are off the low as the US starts to join the session.

- Volumes remain subdued, with focus already turning to the US CPI and ECB next week.

- Investors pricing risk of more aggressive rate hike path from the Fed, had Treasuries and short end Eurodollar under pressure, which had led EGBs.

- Peripheral spreads are all wider, with Italy leading by 3.4bps.

- Gilts have traded inline with Bund, which translate to a flat Gilt/Bund spread for the session.

- Looking ahead, there are no tier 1 of market moving data, attention is already turning to the US CPI and the ECB next week.

- Remaining speakers are ECB Panetta, Stournaras, Maklouf and Herodotou.

- Most of the focus today, will be on French Election polls, with many expected to hit throughout the day, no set times, but it's the last day polls can be published

STIR FUTURES: New Highs For Fed Hikes In Next Two Meetings

- Fed hike pricing has firmed overnight back to 221bps to year-end in Fed Funds futures.

- 47bps for May and a new high of 94bps for June as it grinds higher following the minutes on Wed showing “many” participants thinking “one or more” 50bp hikes would be appropriate at upcoming meetings if inflation pressures remained elevated.

- The next test of that will be Tuesday’s CPI report for March. Only wholesale inventories/sales today.

- No Fedspeak today. Four speakers scheduled for Monday, including two Governors, but three of the four are set to just give brief opening or closing remarks.

EUROPE ISSUANCE

UK Sells 1/3/6-month UKTBs

Decent jump in yield for the 3-month UKTB after the auction size was doubled. Note that next week the auction size of the 6-month will also be increased to GBP1.5bln from GBP1.0bln.

| Tenor | 1-month | 3-month | 6-month |

| Maturity | May 9, 2022 | Jul 11, 2022 | Oct 10, 2022 |

| Amount | GBP0.5bln | GBP1bln | GBP1bln |

| Previous | GBP500mln | GBP500mln | GBP1.0bln |

| Avg yield | 0.2382% | 0.5756% | 0.8805% |

| Previous | 0.2439% | 0.4947% | 0.8180% |

| Bid-to-cover | 2.51x | 2.27x | 2.35x |

| Previous | 3.59x | 3.36x | 3.39x |

| Next week | GBP0.5bln | GBP1.0bln | GBP1.5bln |

OPTION FLOW SUMMARY:

RXU2 145/142/139 put fly, bought for 9 in 2k

OEM2 127p bought for 48 in 3k

0RM2 98.50/98.25ps, bought for 5.5 in 14k

ERU2 100.25/100.12/99.87 broken p fly, sold at -2 in 4k

SX5E 17th June 3700^ trades 361.9 in 2k vs 3750 in VGM2

TYK2 119.50p, bought for 29 in ~6.1k

FOREX: US markets lead the way

- US markets have led the way in early European trade, with Yield higher, and in turn a supported USD, as market participants and Investors price risk of more aggressive rate hike path from the Fed.

- The Dollar saw some broader base upside continuation, but has faded somewhat off its best level.

- Worst performer in G10 is the Kiwi versus the Greenback, and the NZDUSD cross has now lost just over 2.5% in the past three sessions.

- Pound and the EUR were under pressure against the Dollar, but are off their worst levels.

- Looking ahead, there are no tier 1 of market moving data, attention is already turning to the US CPI and the ECB next week.

- Remaining speakers are ECB Panetta, Stournaras, Maklouf and Herodotou.

- Most of the focus today, will be on French Election polls, with many expected to hit throughout the day, no set times, but it's the last day polls can be published

FX OPTION EXPIRY

FX OPTION EXPIRY (closest ones)

Of note:

EURUSD ~1.33bn at 1.0825/1.0850- EURUSD; 1.0825 (711mln), 1.0850 (617mln)

- USDJPY: 124.00 (936mln)

- USDCAD; 1.2650 (975mln)

Price Signal Summary - S&P E-Minis Find Support At The 50-Day EMA

- In the equity space, S&P E-Minis traded lower Wednesday/Thursday. The contract arrived at its key support area - the 50-day EMA. This average intersects at 4455.32 and marks a key pivot level. A clear break would strengthen a bearish case and allow for a deeper pullback that would open 4425.96 initially, 38.2% retracement of the Feb 24 - Mar 29 rally. The EMA has thus far provided support. Resistance is at 4588.75, the Apr 5 high. EUROSTOXX 50 futures also traded lower this week. Price has moved below the 20- and 50-day EMAs and probed support at 3735.00, the Mar 18 low. The move lower undermines the recent bull theme and highlights a developing bearish threat. An extension lower would open 3626.50, 50.0% of the Ma r 7 - 29 rally. The contract is attempting a recovery from recent lows. Key S/T resistance has been defined at 3944.00, the Mar 29 high.

- In FX, EURUSD is trading lower. The recent failure at 1.1185, Mar 31 high, and more importantly, a failure above the 50-day EMA highlights a bearish threat. This week’s move lower has reinforced this theme and attention is on 1.0806, the Mar 7 low and a bear trigger. GBPUSD remains vulnerable and the focus is on 1.3000 next, the Mar 15 low and the near-term bear trigger. Key resistance is unchanged at the 50-day EMA - it intersects at 1.3261 today. USDJPY remains above last week’s low of 121.28 (Mar 31) and below its key resistance of 125.09, the Mar 28 trend high. A corrective cycle is still in play despite recent gains. A break of 121.28 would allow for an extension lower and open 120.95, Mar 24 low ahead of 120.00. For bulls, clearance of 125.09 would confirm a resumption of the primary uptrend.

- On the commodity front, Gold remains inside its range. The yellow metal recently found support at $1890.2, on Mar 29, and this level still represents the short-term bear trigger. Initial resistance is at $1966.1, Mar 24 high. In the Oil space, WTI futures traded lower this week, resulting in a breach of the 50-day EMA. The print below this average suggests scope for a continuation lower near-term. The focus is on the next key support at $92.20, Mar 15 low. Initial firm resistance has been defined at $105.59, the Apr 5 high.

- In the FI space, Bund futures traded lower again yesterday. Key near-term resistance is seen at 159.79, the Apr 4 high. The focus is on the bear trigger at 156.05, Mar 29 low where a break would confirm a resumption of the downtrend. Gilts traded to a fresh trend low yesterday of 119.83. This reinforces bearish conditions and scope is for weakness towards 119.36, the Oct 10 2018 low (cont). Resistance is at 122.35, Monday’s high.

EQUITIES: Energy Names Lead European Equity Gains

- Japan's NIKKEI closed up 97.23 pts or +0.36% at 26985.8 and the TOPIX ended 3.89 pts higher or +0.21% at 1896.79. China's SHANGHAI closed up 15.155 pts or +0.47% at 3251.85 and the HANG SENG ended 63.03 pts higher or +0.29% at 21872.01.

- European equities are higher, with the German Dax up 171.63 pts or +1.22% at 14282.16, FTSE 100 up 64.91 pts or +0.86% at 7640.14, CAC 40 up 60.57 pts or +0.94% at 6574.78 and Euro Stoxx 50 up 47.48 pts or +1.25% at 3859.66.

- U.S. futures are gaining, with the Dow Jones mini up 100 pts or +0.29% at 34590, S&P 500 mini up 8.75 pts or +0.19% at 4504.75, NASDAQ mini up 22.75 pts or +0.16% at 14559.

COMMODITIES: Copper Pushes Higher

- WTI Crude up $0.57 or +0.59% at $97.06

- Natural Gas up $0.09 or +1.46% at $6.381

- Gold spot up $1.69 or +0.09% at $1930.85

- Copper up $4.4 or +0.94% at $475.8

- Silver up $0.08 or +0.32% at $24.6865

- Platinum up $1.42 or +0.15% at $964.82

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/04/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/04/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/04/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.