-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI US MARKETS ANALYSIS - USD/JPY Crests at New Multi-Decade High

Highlights:

- USD/JPY uptrend extends, touches new multi-decade high

- US curve trades steeper pre-PPI, 30y sale

- NZD crumbles on 'dovish' 50bps rate hike

US TSYS: Twist Steepening Ahead Of PPI Inflation, 30Y Re-Open

- Cash Treasuries sit with a twist steepening, albeit steepening at a more subdued pace compared to the recent trend.

- Concerns had mounted earlier of further disruption from China lockdowns, the latest being iPhone maker Pegatron halting Shanghai production, but the sell-off has been unwound.

- Brainard yesterday on the potential timeline for QT: "We'll decide as soon as May to start reducing the size of the balance sheet in which case those reductions could come as soon as June".

- 2YY -1bps at 2.395%, 5YY -0.5bps at 2.684%, 10YY +0.8bps at 2.729%, 30YY +1.3bps at 2.823%.

- TYM2 is down just 1+ tick at 120-14+ after a recent rally, in what appears a corrective bounce. Support is at yesterday’s low of 119-10+ after which it eyes at 119-04+ (low Dec 3 2018 cont), whilst resistance is 121-06+ (Apr 7 high).

- Data: PPI inflation with added focus after yesterday’s miss in CPI. Core PPI seen +0.5% M/M after +0.2% M/M.

- Fedspeak: Waller (voter) speaking to CNBC at 1530ET.

- Bond issuance: US Tsy $20B 30Y Bond auction re-open (912810TD0) at 1300ET after the 10Y tailed yesterday.

STIR FUTURES: Fed Hikes Grind Higher Beyond May

- Fed Funds implied hikes are unchanged for May at 48.5bps, whilst June unwinds some of the CPI drop at 94bps and Dec recovers more slowly to sit at 212bps.

- Recapping yesterday’s Fedspeak: Brainard gave a tweaked potential timeline for QT: "We'll decide as soon as May to start reducing the size of the balance sheet in which case those reductions could come as soon as June".

- Followed by Bullard (’22 voter) ‘fantasy’ to think modest hikes will tame CPI, Harker (’23) “we need to take action [on inflation] but be careful at the same time” and Barkin (‘24) best path is to move rapidly to neutral rate range, raising rates beyond neutral likely part of process.

Cumulative hikes implied by FOMC-dated Fed FundsSource: Bloomberg

Cumulative hikes implied by FOMC-dated Fed FundsSource: Bloomberg

EGB/GILT SUMMARY: Bounce off the lows post supply

- EGB's led Bond lower this morning led by heavy supply out of Italy.

- Bonds have since bounced off their lows since, with full reversal of this morning's price action with Supply out of the way.

- Bund closed the overnight opening gap, but Futures trades in red territory.

- Peripherals are all tighter against the German 10yr, with Italy in the lead by 1.7bps.

- Gilt have underperformed following this morning's UK CPI beat.

- Gilt printed a 118.54 low just ahead of support at 118.42 Low Apr 12.

- Gilt/Bund spread has widened, and looked to have found a base circa 100.00/99.91bps for now, trades at 103.8, 2.8bps wider.

- Looking ahead, sees US PPI as the notable release, and supply from the US with $20bn 30yr.

- Gilt futures are down -0.47 today at 119.02 with 10y yields up 4.4bp at 1.846% and 2y yields up 3.1bp at 1.530%.

- Bund futures are down -0.12 today at 155.24 with 10y Bund yields up 1.7bp at 0.805% and Schatz yields up 1.7bp at 0.086%.

- BTP futures are up 0.16 today at 134.25 with 10y yields up 0.3bp at 2.409% and 2y yields up 1.1bp at 0.461%.

EUROPE ISSUANCE UPDATE

ITALY AUCTION RESULTS: 3/7/10/20/30-year BTPs:- E3.75bln of the new 1.20% Aug-25 BTP, Average Yield 1.32% (Prev. 0.570%), bid-to-cover 1.52x (Prev. 1.52x)

- E1.50bln of the 0.45% Feb-29 BTP, Average Yield 2.04% (Prev. 1.47%), bid-to-cover 1.69x (Prev. 1.39x)

- E1.00bln of the 3.00% Aug-29 BTP, Average Yield 2.04%, bid-to-cover 1.89x

- E0.75bln of the 3.10% Mar-40 BTP, Average Yield 2.69%, bid-to-cover 1.75x

- E1.00bln of the 2.15% Sep-52 BTP, Average Yield 2.89%, bid-to-cover 1.68x

Germany allots E3.274bln (Prev. 3.427bln) in 0% 10y Bunds, bid/cover 1.3(Prev. 1.3), Average Yield 0.83% (Prev. 0.38%)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXM2 150/145ps 1x2 vs RXK2 154/151ps 1x2, bought the June for 28 in 3.2k

SX5E (16th Sep) 3700/3300/2800p fly, bought for 44.00 in 4.5k

SX7E 15th Dec 23 85p bought for 14.15 in 6k, that strike has traded in 10k total

UK:

SFIK2 98.80/99.00cs, bought for 1.25 in 6.75k

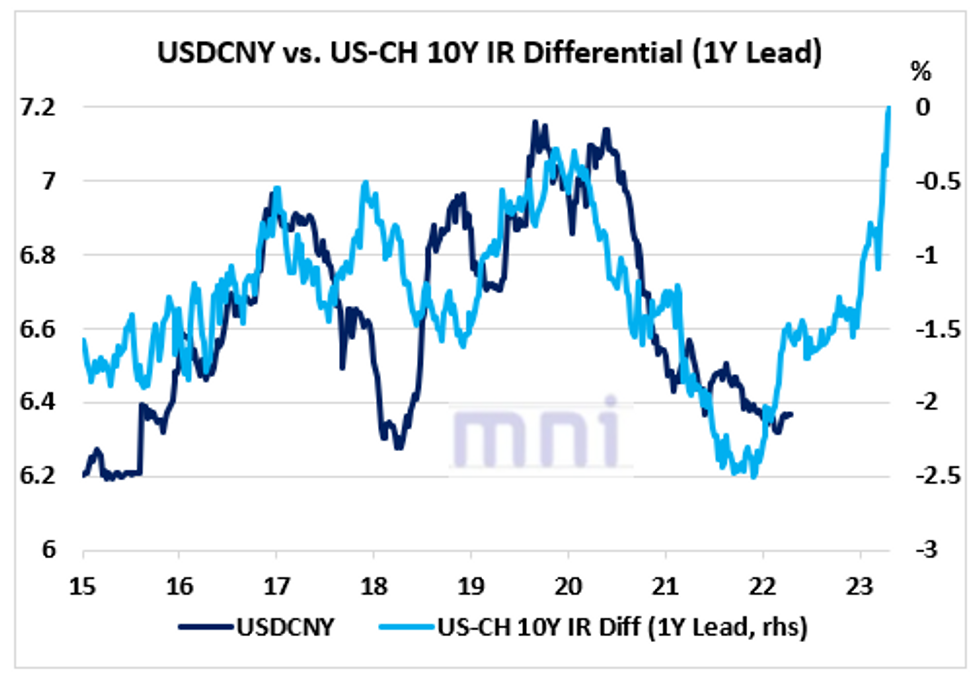

Should We Expect A Sharp CNY Depreciation In The Coming 6 to 12 Months?

- With the China 10Y bond yield premium (over US 10Y) plunging to zero, investors have been questioning if the risk reward on USDCNY is now skewed to the upside following the sharp Yuan appreciation in the past two years.

- We also saw that the premium on the 2Y yield (China vs. US) went negative in the end of March following the dramatic surge in US ST rates in the past month.

- USDCNY has been trading above the 6.35 level in the past month after testing a local low at 6.3070 in the beginning of March.

- Key resistance to watch on the topside stands at 6.4050 (200DMA).

- The chart shows that the 10Y interest rate differential (between US and China) has smoothly led the USDCNY exchange rate by 12 months.

- Hence, selling pressure on the CNY could gradually increase in the coming months as the interest rate differential keeps reaching new highs.

Source: Bloomberg/MNI

FOREX: USD/JPY Cracks to New High Despite Verbal Intervention

- NZD is the poorest performing currency in G10, falling against all others (including the JPY) after the RBNZ policy decision overnight. While the bank hiked rates by 50bps against a consensus expectation of a 25bps rise, the decision was perceived as dovish as the bank opted to bring forward the beginning of the tightening cycle, but critically stop short of raising market expectations of a higher terminal rate. The bank's minutes noted that members increased the OCR by more "now, rather than later". NZD weakness followed, putting AUD/NZD at the best levels since mid-2020.

- JPY is another underperformer, tipping USD/JPY to new cycle highs and the best levels seen since 2002. The rate cleared the highs seen earlier in the week, touching 126.32 in the process. The move coincided with a speech from BoJ's Kuroda, who doubled down on the BoJ's intent to "persistently" pursue easing. Markets volatility prompted a number of comments from government ministers - most notably economy minister Yamagiwa, who noted that FX stability is "important", adding that sharp FX moves are "undesirable". The comments had little impact on the pair.

- Focus turns to US PPI data due following the CPI release yesterday, as well as the Bank of Canada rate decision. The Bank are seen raising rates by 50bps to 1.00%. Earnings season unofficially kicks off, with BlackRock and JPMorgan due today.

FX OPTIONS: Expiries for Apr13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.0bln), $1.0720-35(E1.0bln), $1.0865-70(E985mln), $1.0900(E1.3bln), $1.0960-80(E903mln), $1.0995-05(E2.9bln)

- USD/JPY: Y123.90-00($655mln)

- EUR/JPY: Y136.00(E562mln)

- AUD/USD: $0.7300(A$682mln), $0.7380-00(A$941mln)

- USD/CAD: C$1.2485-00($593mln)

- USD/CNY: Cny6.3400($500mln)

Price Signal Summary - USDJPY Resumes Its Primary Uptrend

- In the equity space, S&P E-Minis remain bearish despite a recovery from yesterday’s low of 4375.50. The contract has recently breached the 50-day EMA, which intersects at 4452.17 and this reinforces a bearish threat. The move below 4400.00 signals scope for weakness towards 4362.63 next, 50.0% of the Feb 24 - Mar 29 rally. EUROSTOXX 50 futures are consolidating. The contract traded lower yesterday and remains bearish. Price has recently moved below the 20- and 50-day EMAs and breached support at 3735.00, Mar 18 low. This opens 3626.50, 50.0% of the Mar 7 - 29 rally.

- In FX, EURUSD remains vulnerable and is inching towards key support. The recent failure at 1.1185, Mar 31 high, highlights a bearish threat and attention is on 1.0806, the Mar 7 low and a bear trigger. A break would confirm a resumption of the primary downtrend and open 1.0767, the May 7 2020 low. The GBPUSD outlook remains bearish and support at 1.3000, Mar 15 low, remains under pressure. The focus is on 1.2954, 1.764 projection of the Jan 13 - 27 - Feb 10 price swing. Resistance is at 1.3114, the 20-day EMA. USDJPY maintains its firmer tone and has this morning resumed its uptrend and traded to a fresh cycle high. The pair has also cleared the 126.00 handle. The focus is on 126.71, 3.50 projection of the Dec 3 ‘21 - Jan 4 -24 price swing.

- On the commodity front, Gold has traded higher this week and has breached resistance at $1966.1, Mar 24 high. This highlights a range breakout and suggests scope for an extension of short-term gains. The focus is on $1980.3 initially, 50.0% retracement of the Mar 8 - 29 downleg. In the Oil space, WTI futures remain bearish despite yesterday’s gains. The print below the 50-day EMA suggests scope for a continuation lower and attention is on the next key support at $92.20, Mar 15 low. Initial firm resistance has been defined at $105.59, the Apr 5 high.

- Trend conditions in the FI space remain bearish. Bund futures traded lower once again Tuesday, confirming a resumption of the primary downtrend. The next objective is the 154.00 handle. Gilts remain in a downtrend. The focus is on 118.05, 0.618 projection of the Mar 1 - 28 - Apr 4 price swing.

Financials Due to Set The Tone After Volatile Quarter

- US Earnings season begins in earnest this week, with financials the early highlight. JPM and BlackRock are due to set the tone on Wednesday, before Citigroup, GS, MS and WFC follow later in the week.

- Full schedule with timings and EPS & Revenue expectations here:

- https://marketnews.com/mni-us-earnings-schedule-ba...

COMMODITIES: Metals Lead Early Gains

- WTI Crude up $0.13 or +0.13% at $100.66

- Natural Gas up $0.01 or +0.15% at $6.687

- Gold spot up $7.51 or +0.38% at $1973.89

- Copper up $0.3 or +0.06% at $471.4

- Silver up $0.27 or +1.07% at $25.6305

- Platinum up $16.15 or +1.67% at $985.66

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/04/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/04/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/04/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 13/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/04/2022 | 1630/1230 |  | US | Richmond Fed's Thomas Barkin | |

| 13/04/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 14/04/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 14/04/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 14/04/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/04/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 14/04/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/04/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/04/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/04/2022 | 1230/0830 | *** |  | US | PPI |

| 14/04/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/04/2022 | 1230/1430 |  | EU | ECB President Lagarde Post-meet presser | |

| 14/04/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/04/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 14/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/04/2022 | 1920/1520 |  | US | Cleveland Fed's Loretta Mester | |

| 14/04/2022 | 2200/1800 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.