-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI US MARKETS ANALYSIS - Renewed China COVID Fears Prompt Risk Selling

Highlights:

- Renewed China COVID fears prompt further wave of risk selling

- EUR/USD remains in range of parity

- No data of note, keeping focus on BoE, ECB, Fed speakers

US TSYS SUMMARY: Tentative Bull Steepening, 3Y Auction Headlines

- Tight ranges through Asian hours gave way to on balance a small bull steepening through the European morning, although it makes little inroads on Friday’s post-payrolls sell-off as it lags a larger rally in European sovereigns.

- Tsy yields are close to last week’s highs but remain well within a 20-day range, whilst 2s5s and 2s10s straddle either side of inversion.

- 2YY -3.3bps at 3.072%, 5YY -2.2bps at 3.101%, 10YY -1.7bps at 3.064%, 30YY -0.4bps at 3.239%.

- TYU2 trades 8 ticks higher at 117-28 on soft volumes, maintaining a softer tone following last week’s pullback from 120-16+ (Jul 6 high) that now forms a bull trigger. Support is eyed at 117-12 (50% retrace of Jun 14-Jul 6 rally), under which lies a key near-term support at 116-11 (Jun 28 low).

- No data of note today and Fedspeak limited to a potentially technical discussion on the Libor transition from NY Fed’s Williams at 1400ET, leaving issuance firmly in focus.

- Bond issuance: US Tsy $43B 3Y Note auction (91282CEY3) – 1300ET

- Bill issuance: US Tsy $51M 13W, $42B 26W bill auctions – 1130ET

STIR FUTURES: Fed Hikes Holding Onto Post-Payrolls Increase

- Implied hikes are little changed from Friday’s close for upcoming meetings, with 74bp for Jul and 130bp for Sep.

- They’ve softened further out, with 186bp to Dec (-3bps) and a peak 196bps to Mar’23 (-4bps) but still keep at least half the increase from Friday’s payrolls report. It sees the curve modestly more inverted thereafter, with 55bp of cuts to end-2023.

- Fedspeak: NY Fed’s Williams is scheduled to speak on the Libor transition at 1400ET in what should see limited mon pol discussion, but in any case, he repeated on Friday that he sees a July rate hike of 50bp or 75bp as the right positioning and a year-end rate of 3-3.5% remains the right thing to do. A US recession is not his base case, but tighter financial conditions are starting to have an effect and he will closely watch data over the next 3-6 months for a better read.

Cumulative hikes implied by FOMC-dated Fed FundsSource: Bloomberg

Cumulative hikes implied by FOMC-dated Fed FundsSource: Bloomberg

EGB/GILT SUMMARY: Risk-Off Start To The Week

European government bonds have started the week on a firm footing while equities and oil have inched lower.

- Concerns over rising Covid infections are further compounded recession fears. The European Centre for Disease Prevention and Control and the European Medicines Agency called for Covid-19 boosters in a statement published today.

- The race to replace outgoing UK Prime Minister Boris Johnson has heated up with 11 candidates now declared. While former Chancellor of the Exchequer Rishi Sunak is seen as the front runner for now, high-profile challengers such as Sajid Javid, Liz Truss and Jeremy Hunt have sought to differentiate themselves from Sunak and appeal to the wider party by arguing in favour of tax cuts.

- Gilts opened higher at the beginning of the week with cash yields 3-4bp lower.

- Bunds opened higher and rallied early into the session before giving back some gains. Yields are now down 3-6bp.

- OATs have traded in a similar fashion with yields 4-6bp lower.

- BTPs have slightly underperformed core EGBs with yields down 1-4bp.

- Supply this morning came from Germany (Bubills, EUR2.408bn allotted) and Greece (GGB, EUR500mn). Later today France will offer EUR4.5-6.1bn)

EUROZONE ISSUANCE UPDATE:

Greece sells E500mln 1.75% Jun-32 GGBs, Avg yield 3.67% (Prev. 1.836%), Bid-to-cover 3.87x

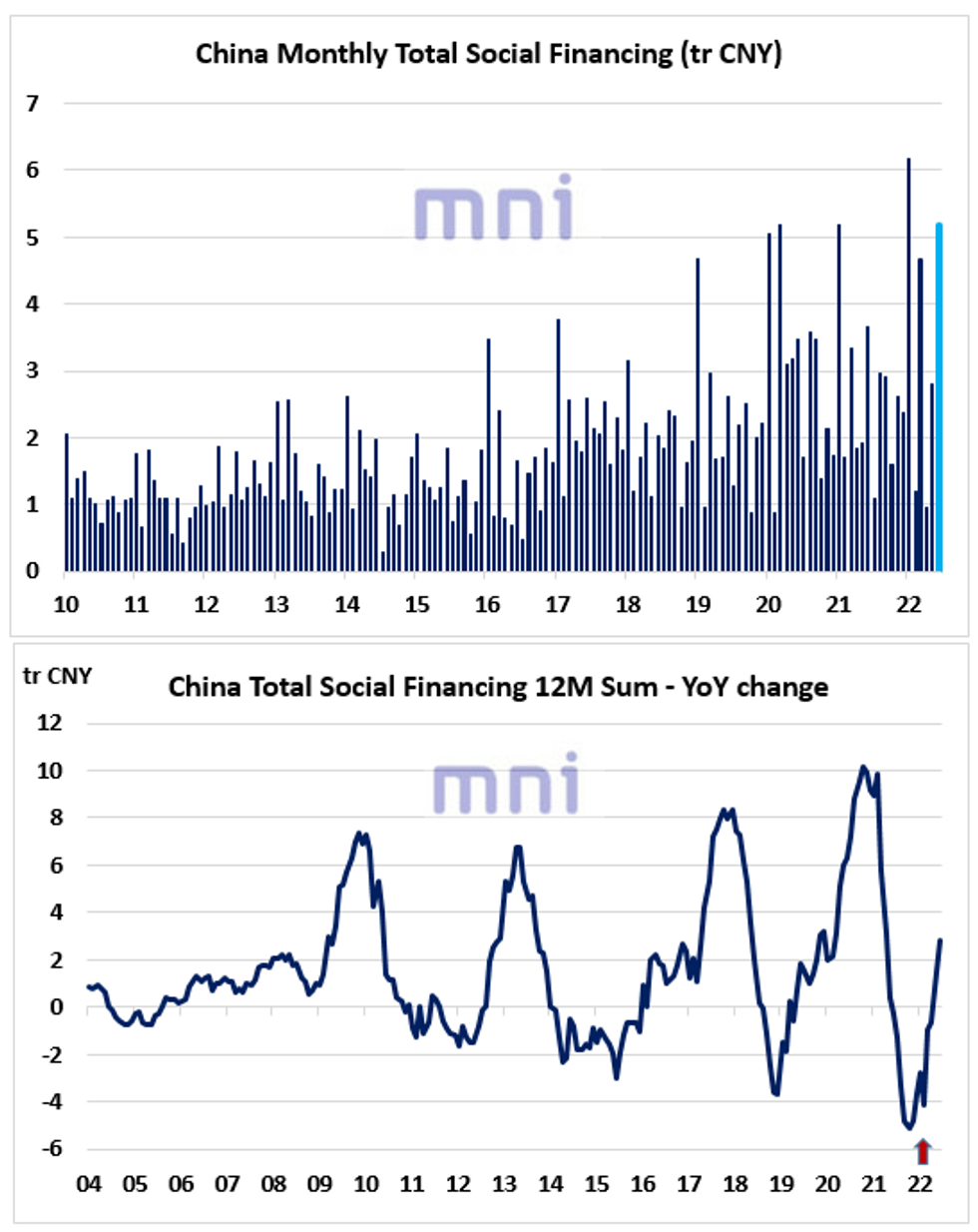

CHINA: Aggregate Financing Rises Sharply In June, Liquidity Continues To Recovers Strongly

- The PBoC reported this morning that aggregate financing rose by 5.17tr CNY in June, significantly above expectations of 4.2tr CNY with new yuan loans rising by 2.81tr CNY (2.4tr CNY exp.).

- Hence, China ‘liquidity’ metric, computed as the annual change in China Total Social Financing (TSF) continues to rise, now up 2.8tr USD in the past year.

- Even though a recovery in liquidity has historically had a positive impact on domestic risky assets and some China-sensitive commodities (i.e. copper) or currencies (i.e. AUD), the easing conditions (policy and liquidity) have been barely enough to limit the downside risk on the real economy.

- Growth expectations in China have been constantly revised to the downside this year due to the strict ‘zero-Covid’ policy, which has been weighing on the domestic economy.

- In addition, the new surge in covid cases recently has been fueling fears of another lockdown in China; Macao recently announced to shut down all its non-essential business including casinos.

- Hang Seng Index has been retracing lower in the past two weeks, finding support at its 50DMA (21,011) on Monday; next support to watch on the downside stands at 20,000.

- On the topside, first resistance to watch stands at 21,475 (100DMA).

Source: Bloomberg/MNI

FOREX: China COVID Concerns Trigger Renewed Risk-Off Wave

- The greenback has resumed its incline Monday, rising against all others in G10, although Friday's highs remain out of reach for now. A break above 107.786 for the USD Index puts the dollar at its strongest levels since 2002.

- Stock futures globally are lower, with US markets indicating a negative open on Wall Street later today. The renewed wave of risk-off has been triggered by a surge in COVID-19 cases found in Shanghai, with a new subvariant detected and raising concerns of fresh lockdown pressures across China.

- The dollar strength keeps EUR/USD within range of the key psychological parity level which, if broken, puts the pair below 1.0000 for the first time in two decades.

- Soft commodities prices are adding to the risk-off pressure, with industrial metals from steel rebar to iron ore offered after weakness in local Chinese markets. Lower oil markets are working against commodity-tied currencies, putting NOK at the bottom of the G10 table ahead of the NY crossover.

- There are no notable data releases due Monday, with focus remaining on the central bank speaker slate. ECB's de Cos and Nagel speak as well as BoE's Bailey and Fed's Williams.

FX OPTIONS: Expiries for Jul11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0050(E897mln), $1.0225(E559mln), $1.0250(E1.3bln), $1.0300(E1.2bln), $1.0400(E1.0bln)

- USD/JPY: Y133.50($1.6bln), Y136.50($855mln)

- AUD/USD: $0.6250(A$1.0bln)

- USD/CNY: Cny6.5484($1.4bln)

Price Signal Summary - EURUSD Bear Cycle Extends

- In the equity space, S&P E-Minis recovered last week and continue to trade above recent lows. Trend conditions are bearish though and a resumption of weakness would open 3735.00, the Jun 23 low. A break of this level would expose key support at 3639.00, the Jun 17 low and bear trigger. Clearance of 3950.00, Jun 28 high is required to instead suggest scope for a stronger recovery. EUROSTOXX 50 futures remain above last Tuesday’s low of 3343.00. Gains are considered corrective and the trend outlook remains bearish. Last week’s breach of support at 3384.00, Jun 16 low, reinforces bearish conditions and confirms a resumption of the broader downtrend. The focus is on 3321.30, 50.0% of the major 2020 - 2021 upleg. Key short-term resistance is unchanged at 3584.00, the Jun 27 high.

- In FX, EURUSD remains vulnerable following last week’s resumption of the downtrend and extension lower within the bear channel drawn from the Feb 10 high. The focus is on 1.0009, the channel base. Sights are also set on parity. GBPUSD remains vulnerable and the recent consolidation appears to be a bear flag formation. A resumption of weakness would open 1.1795, 0.764 projection of the Mar 23 - May 13 - 27 price swing. USDJPY has started the week on a firm note, trading above 137.00 resistance and resuming the primary uptrend. The focus is on 137.30 next, 1.50 projection of the Feb 24 - Mar 28 - 31 price swing, ahead of 138.00.

- On the commodity front, Gold remains vulnerable following last week’s move lower that resulted in a breach of the bear trigger at $1787.00, May 16 low. The break confirmed a resumption of the broader downtrend and has opened $1706.3 next, 1.618 projection of the Mar 8 - 29 - Apr 18 price swing. In the Oil space, WTI futures remain vulnerable following last week’s move lower and break of support at $101.53, the Jun 22 low. Potential is for weakness towards $93.45 next. Short-term gains are considered corrective.

- In the FI space, a short-term bull cycle in Bund futures remains in play. The focus is on 153.36, May 31 high. Gilts trend conditions remain bullish and the focus is on a climb towards 117.48, 1.236 projection of the Jun 16 - 24 - 29 price swing.

EQUITIES: Defensive Stocks Outperforming To Start The Week

- Asian markets closed mixed: Japan's NIKKEI closed up 295.11 pts or +1.11% at 26812.3 and the TOPIX ended 27.23 pts higher or +1.44% at 1914.66. China's SHANGHAI closed down 42.494 pts or -1.27% at 3313.584 and the HANG SENG ended 601.58 pts lower or -2.77% at 21124.2.

- European stocks are weaker, with materials / energy names leading the way lower (defensives including utilities are outperforming): the German Dax down 128.22 pts or -0.99% at 12790.44, FTSE 100 down 57.91 pts or -0.8% at 7177.74, CAC 40 down 65.35 pts or -1.08% at 5974.07 and Euro Stoxx 50 down 36.31 pts or -1.04% at 3458.99.

- U.S. futures are a little weaker, with the Dow Jones mini down 177 pts or -0.57% at 31133, S&P 500 mini down 25.25 pts or -0.65% at 3876, NASDAQ mini down 97.75 pts or -0.8% at 12054.25.

COMMODITIES: Oil, Copper Dip But Off Session's Lows

- WTI Crude down $2.3 or -2.19% at $104.9

- Natural Gas up $0.3 or +4.89% at $6.188

- Gold spot down $3.89 or -0.22% at $1735.94

- Copper down $4.8 or -1.36% at $352.5

- Silver up $0.04 or +0.21% at $19.3064

- Platinum down $6.16 or -0.69% at $894.99

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/07/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 11/07/2022 | 1415/1515 |  | UK | BOE Bailey Treasury Select Committee on FS Report | |

| 11/07/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/07/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/07/2022 | 1800/1400 |  | US | New York Fed's John Williams | |

| 12/07/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 12/07/2022 | 0800/0900 |  | UK | BOE Cunliffe on Crypto Markets | |

| 12/07/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/07/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/07/2022 | 0900/1000 |  | UK | BOE Bailey Speaks at OMFIF | |

| 12/07/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/07/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 12/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/07/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/07/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 12/07/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/07/2022 | 1630/1230 |  | US | Richmond Fed's Tom Barkin | |

| 12/07/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.