-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Norges Bank Tightens Again

MNI US MARKETS ANALYSIS - Norges Bank Tightens Again

Highlights

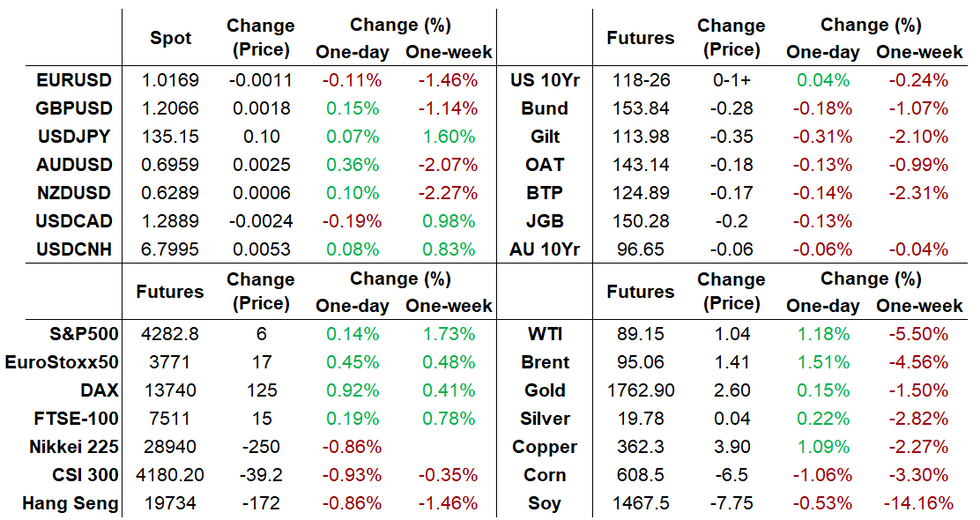

- European bonds continue to trade lower while equities stage a relief rally.

- The Norges Bank has hiked 50bp as expected and has indicated that a further increase is likely in September.

- The ECB's Martins Kazaks has vowed to continue hiking rates

US TSYS SUMMARY: An Eventual Mild Bull Flattening With Solid Docket Ahead

- A mixed overnight session for Treasuries, firming a touch through Asia hours with Sino-U.S. worries back at the fore on confirmation that the U.S. & Taiwan will enter formal trade discussions before cheapening as Europe came in. European hours have included an expected 50bp hike from the Norges Bank with “most likely” a further increase in Sept and the ECB’s Schnabel suggesting she favours another large rate hike in Sept.

- Xi saying China will persist with opening up its economy drew a brief further cheapening below quickly retracing, with the aforementioned Sino-U.S. tension potentially behind Tsy outperformance to European sovereigns on the day.

- 2YY -0.8bps at 3.277%, 5YY -0.7bps at 3.044%, 10YY -1.5bps at 2.882%, 30YY -1.7bps at 3.135%, leaving 2s10s keeping to the week’s rough range of -40 to -45bps.

- TYU2 sits almost unchanged at 118-25+ on modestly above soft seasonal volumes at the low end of yesterday’s range. The outlook is seen as bearish with yesterday’s low of 118-17+ forming initial support after which it would eye 118-05 (50% retrace of Jun 14 – Aug 2 bull cycle).

- Fedspeak: George (’22 voter) at 1320ET before Kashkari (’23) at 1345ET

- Data: A variety of second tier but still important data releases with initial claims for a payrolls reference week, activity surveys after the huge miss in August Empire and existing home sales with another large decline of circa 5% M/M expected.

- Bond issuance: US Tsy $8B 30Y TIPS auction re-open (912810TE8) – 1300ET

- Bill issuance: US Tsy $55B 4W, $50B 8W bill auctions – 1130ET

STIR FUTURES: Fed Hikes Keep To Post-Minutes Dip

- Fed Funds implies hikes have gyrated overnight but currently sit close to levels seen after the FOMC minutes.

- There is 62bps priced for the Sept 21 FOMC with one more CPI and payrolls still to come. It’s followed with a cumulative 120bps to 3.53% at year-end and 136bps to a terminal 3.69% in Mar’23 having unwound the hit from last week’s CPI miss, before 40bps of cuts to end’23.

- George (’22 voter) and Kashkari (’23) speak at 1320ET and 1345ET. George, a 50bp dissenter in June but not July, last spoke on Jul 11 when the terminal was seen just below 3.60% with large swings between then, whilst Kashkari recently pushed back on rate cuts after last week’s CPI miss.

FOMC-dated Fed Funds implied rateSource: Bloomberg

FOMC-dated Fed Funds implied rateSource: Bloomberg

EGB/GILT SUMMARY: Norges Bank Hikes Again

European government bonds have continued to trade lower following yesterday's losses, while equities enjoy a modest relief rally.

- The Norges Bank hiked the deposit rate by 50bp to 1.75% as expected and indicated that the policy rate will "most likely be raised further in September".

- The ECBs Martins Kazaks earlier stated that policy rates would continue to move higher to slow inflation. His remarks come amid mounting evidence from leading indicators which point towards a broad slowdown in economic activity across the euro area.

- Gilts have progressively edged lower through the morning with cash yields now up 2-3bp on the day.

- Bunds sold off early into the session before starting to reclaim lost ground. Yields are now broadly 3-6bp higher across the curve, although the very long end trades close to flat on the day.

- OAT yields are up 1-3bp with the belly of the curve slightly underperforming.

- The BTP curve has flattened with the 2s30s spread narrowing 6bp.

- Supply this morning came from France (OATs, EUR6.0bn & Linkers EUR1bn).

- Focus now shifts to US initial jobless claims data and the lastest Philly Fed Business Outlook update later today.

EUROPE ISSUANCE UPDATE

FRANCE: MEDIUM-TERM OATS

| 0.50% May-25 OAT | 0.75% Feb-28 OAT | |

| ISIN | FR0012517027 | FR001400AIN5 |

| Amount | E2.20bln | E3.80bln |

| Previous | E3.51bln | |

| Avg yield | 0.98% | 1.27% |

| Previous | 1.47% | |

| Bid-to-cover | 3.60x | 2.57x |

| Previous | 2.69x | |

| Price | 98.71 | 97.24 |

| Previous | 96.18 | |

| Pre-auction mid | 98.642 | 97.123 |

| Previous | 96.083 | |

| Previous date | Jun 17, 2021 | Jul 21, 2022 |

FRANCE: INFLATION-LINKED OATS

| 1.85% Jul-27 OATei | 3.15% Jul-32 OATei | 0.10% Mar-32 OATi | |

| ISIN | FR0011008705 | FR0000188799 | FR0014003N51 |

| Amount | E650mln | E249mln | E101mln |

| Previous | E730mln | E527mln | |

| Avg yield | -1.87% | -1.02% | -0.93 |

| Previous | -0.79% | -1.11% | |

| Bid-to-cover | 2.14x | 2.83x | 4.59x |

| Previous | 2.56x | 2.47x | |

| Price | 119.37 | 143.76 | 110.33 |

| Previous | 113.78 | 112.55 | |

| Pre-auction mid | 119.188 | 143.338 | 110.067 |

| Previous | 113.654 | 112.315 | |

| Previous date | Jun 16, 2022 | May 19, 2022 |

EUROPE OPTION FLOW SUMMARY

OEU2 125.50/124.00ps bought for 35 in 6k vs ~2k at 125.72

ERZ2 98.50/98.375/98.25/98.125p condor, bought for 1.5 in 12k

ERZ2 99.00/99.125/99.50 broken call ladder 1x1x0.5, sold at 2.5 in 10k

ERM3 99.00/99.12/99.87c ladder with ERU3 98.87/99.12/99.75c ladder sold the strip at 1 in 2k

ERM3/ERU3 98.75/99.00/99.25c fly strip sold at 3.75 in 16k

0RU2 98.62/98.75cs bought for 1.75 in 15k

SFIU2 97.50/97.60/97.70c fly, bought for 1.75 in 5k

SX7E (16th Sep) 75 put, trades 0.55 in 12k

FOREX: USD Fades, Norges Bank Delivers

- The Dollar was in the green against all the majors, a continuation from the overnight session.

- The Greenback extended gains on the European Govie open, with selling going through in Equity futures.

- Cross assets have since reversed some of the early price action, and the bounce in Equity, has seen market participants fading some of the USD strength.

- Main early event for the Norges bank rate decision, which saw the expected 50bps hike to 1.75%.

- Part of the Policy statement: "Based on the Committee’s current assessment of the outlook and balance of risks, the policy rate will most likely be raised further in September".

- Broader base of NOK buying went through, and USDNOK has fully reversed the initial move higher, to trade through the session low.

- USDNOK is nonetheless still trading yesterday's range and off the lows at the time of typing.

- Looking ahead, US Existing home sales and Leading index are the economic releases.

- Fed George and Kashkari are the scheduled speakers.

Price Signal Summary - FI Space Remains Vulnerable

- In the equity space, the trend condition in S&P E-Minis remains up and short-term pullbacks are considered corrective. The focus is on 4345.75 next, 2.00 projection of the Jun 17 - 28 - Jul 14 price swing and potentially 4400.00 further out. On the downside, initial firm support is at 4144.39, the 20-day EMA. The short-term uptrend in EUROSTOXX 50 futures remains intact and yesterday’s pullback is considered corrective. Attention is on resistance at 3840.00, the Jun 6 high. A break of this hurdle would strengthen bullish conditions. On the downside, initial firm support is seen at the 20-day EMA which intersects at 3701.10.

- In FX, EURUSD remains below last week’s 1.0368 high (Aug 10). The recent move down appears to be a short-term reversal and means that the pair has failed to clear channel resistance. The bear channel is drawn from the Feb 10 high and intersects at 1.0299. Attention is on support at 1.0123, Aug 3 low. A break would strengthen the bearish theme. Key resistance is at 1.0368. Aug 10 high. Recent price action GBPUSD highlights two important short-term directional triggers; resistance at 1.2293, the Aug 1 high and support at 1.2004, the Aug 5 low. The short-term trend outlook is bullish but a break of 1.2293 is required to reinforce this theme. A clear break below 1.2004 would be bearish - this level has been tested today. USDJPY traded higher Wednesday, extending the bounce off Monday’s 132.56 low. Firm short-term resistance is unchanged at 135.58, Aug 8 high. The Aug 10 sell-off continues to highlight a potential reversal of the recent Aug 2 - 8 correction. A resumption of weakness would open 130.41, the Aug 2 low. A breach of 135.58 would instead expose 135.96, 61.8% retracement of the Jul 14 - Aug 2 downleg.

- On the commodity front, Gold traded lower yesterday, extending the pullback from last week’s high of $1807.9 (Aug 10). Recent gains saw price trade above trendline resistance drawn from the Mar 8 high. The break potentially represents an important technical breach. On the downside, a stronger pullback however would threaten the bullish theme. Watch support at $1754.4 Aug 3 low. The bull trigger is $1807.9. In the Oil space, WTI futures remain vulnerable. This week’s move down has resulted in a print below support at $87.01, the Aug 5 low. The weakness reinforces bearish conditions and a clear break of $87.01 would confirm a resumption of the downtrend. Attention is on $85.37, the Mar 15 low. Key short-term resistance has been defined at $95.05, the Aug 11 high.

- In the FI space, Bund futures traded lower Wednesday, extending the pullback from the Aug 2 high of 159.70. Attention is on the 50-day EMA which intersects at 153.85. This has been pierced and a clear break would signal scope for a deeper pullback. This would open 152.43 next,38.2% retracement of the Jun 16 - Aug 2 rally. Gilts remain vulnerable and yesterday’s sharp sell-off reinforces the current bearish climate. Attention is on 113.69, 61.8% of the Jun 16 - Aug 2 upleg. A clear break would signal scope for a continuation lower and open 113.03, the Jun 30 low.

EQUITIES

- Asia Closing Levels: Japan's NIKKEI closed down 280.63 pts or -0.96% at 28942.14 and the TOPIX ended 16.49 pts lower or -0.82% at 1990.5. China's SHANGHAI closed down 14.982 pts or -0.46% at 3277.544 and the HANG SENG ended 158.54 pts lower or -0.8% at 19763.91.

- Europe: German Dax up 117.12 pts or +0.86% at 13847.56, FTSE 100 down 2.77 pts or -0.04% at 7521.73, CAC 40 up 32.82 pts or +0.5% at 6573.53 and Euro Stoxx 50 up 17.18 pts or +0.46% at 3795.33.

- U.S. Futures: Dow Jones mini up 50 pts or +0.15% at 34013, S&P 500 mini up 7.5 pts or +0.18% at 4284.25, NASDAQ mini up 22 pts or +0.16% at 13515.25.

COMMODITIES

- WTI Crude up $1.07 or +1.21% at $86.35

- Natural Gas up $0.07 or +0.71% at $9.234

- Gold spot up $8.24 or +0.47% at $1774.56

- Copper up $3.8 or +1.06% at $358

- Silver up $0.04 or +0.2% at $19.7124

- Platinum up $3.53 or +0.38% at $922.3

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/08/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 18/08/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 18/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 18/08/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/08/2022 | 1400/1000 | * |  | US | Services Revenues |

| 18/08/2022 | 1400/1000 | ** |  | US | leading indicators |

| 18/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 18/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 18/08/2022 | 1715/1915 |  | EU | ECB Schnabel Presentation at IHK Reception | |

| 18/08/2022 | 1720/1320 |  | US | Kansas City Fed's Esther George | |

| 18/08/2022 | 1745/1345 |  | US | Minneapolis Fed's Neel Kashkari | |

| 19/08/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 19/08/2022 | 2330/0830 |  | JP | Natl CPI | |

| 19/08/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 19/08/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 19/08/2022 | 0600/0800 | ** |  | DE | PPI |

| 19/08/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 19/08/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/08/2022 | 1300/0900 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.