-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Counting Down To The Fed Minutes

EXECUTIVE SUMMARY:

- UK CPI SLOWS BUT FACTORY PRICES RISE

- FEDERAL RESERVE JULY MON POL MEETING MINUTES RELEASED TODAY

- PELOSI, WHITE HOUSE OFFICIALS PLOT INFRASTRUCTURE PATH (AXIOS)

- BIDEN ADMINISTRATION EXPECTED TO ANNOUNCE CALL FOR COVID BOOSTER SHOT

- RBNZ "ON COURSE" TO TIGHTEN DESPITE LOCKDOWN, SAYS GOV. ORR

Fig. 1: UK Inflation Surprises To The Downside In July

NEWS:

U.S. / INFRASTRUCTURE (AXIOS): House Speaker Nancy Pelosi and senior White House officials met for 90 minutes on Tuesday to strategize how to ensure passage of major infrastructure spending, people familiar with the discussions tell Axios. With the president's top legislative priority facing resistance among a Democratic caucus that's divided about how to proceed, top Biden aides and Pelosi (D-Calif.) are seeking to present a unified front.

U.S. / COVID (WSJ): The Biden administration is expected to call for a third Covid-19 shot for Americans who were fully vaccinated with the two-shot regimen, citing the threat from the highly contagious Delta variant and heightened concerns over data showing initial immunity wanes over time. The announcement on Wednesday is likely to cover the more than 155 million people in the U.S. who have been fully vaccinated with messenger RNA vaccines from Pfizer Inc. and partner BioNTech SE or from Moderna Inc., according to people familiar with the planning. The booster shot would be administered about eight months after the second dose of the vaccine.

RBNZ: Reserve Bank of New Zealand Governor Adrian Orr said there is a "clear direction" is to tighten monetary policy despite a surprise move on Wednesday to leave interest rates on hold. The RBNZ was widely expected to hike rates today from the record of 0.25%, but the discovery of a single COVID-19 case yesterday has put the country back into a state of lockdown. The cluster grew to seven cases on Wednesday. Speaking at a press conference after the decision, Orr said that although the bank's inclination was to tighten policy, the RBNZ had taken "time to pause while we observe the outcomes of the next few days and weeks."

NORGES BANK (MNI MARKETS PREVIEW): With inflation, growth and the progression of the pandemic & vaccinationdrive well within the Norges Bank's confidence bands, the Bank are likely todouble down on the September meeting for rate lift-off. This leaves August's decision as a final pause before an extended tightening cycle. Read more in MNI's full preview

NORWAY (BBG): Norway's sovereign wealth fund gained 9.4% in 1H, Norges Bank Investment Management says in statement on its website. That's equivalent to a gain of NOK990b, or $111b.

UK DATA: UK House price surged by an annual rate of 13.2% in June, accelerating from the 9.8% increase in May, the highest rate since November of 2004, the Office for National Statistics said Wednesday. That takes the average price of a UK home to a record-high 266,000.

DATA:

MNI DATA BRIEF: UK CPI Slows As Recreation Costs Slip

UK CPI slowed to an annual 2.0% in July from 2.5% in June, slowing at a faster rate than the 2.3% forecast by City analysts. Prices fell in nine of the 12 major categories, the Office for National Statistics said, with the volatile recreation and culture category (which includes computer games and package holidays) shaving 0.23 percentage points from the change in CPI.

Second hand cars continue to lift CPI, rising 7% between June and July, adding 0.14 percentage points to the change in the index.

However, that was countered by computational effects, due to 55 items in the basket becoming available in July last year; half of those items of still being imputed in the index this year, shaving 0.14 percentage points from the change in CPI. Despite the fall in CPI, private analysts are unlikely to change forecasts of CPI hitting 4% later this year.

MNI DATA BRIEF: UK July Factory Prices Rise, Higher CPI Ahead

Intermediate UK inflation topped analysts expectations in July, with output PPI rising by 4.9%, well above the forecast 4.5%, the fastest pace since April 2005. Core input PPI jumped to an annual rate of 3.9%, from 3.1% in June, the highest since August of 2011, the ONS said.

Transport equipment provided the second-biggest upward influence on input PPI, despite falling on an annual basis. However, transport equipment accounts for a larger share of the PPI basket than in 2020; after a reweighting earlier this year, transport equipment has become the second biggest category in the index, up from third last year.

The rise in input PPI was more muted, increasing to an annual rate of 9.9%, from 9.7% in June, but still below the precent peak of 10.4% touched in May. However, input PPI rose by 8.7%, from 7.8% in June, the fastest pace since December of 2008

MNI DATA BRIEF: UK July RPI Elevated, Even as CPI Retreats

The UK's Retail Price Index (RPI) retreated only modestly in July to an annual rate of 3.8% from 3.9% a month earlier, exceeding analysts' expectations. Much of the elevated RPI derives from the recent appreciation in house prices, although insurance and the cost of second-hand cars also have a higher weight in the RPI than in the CPI, according to an ONS official.

RPI excluding mortgage interest payments steadied at an annual rate of 3.9% last month, matching the highest rate since January of 2018. The July RPI data -- this month's -- is traditionally used as a benchmark for annual increases for items such as next year rail fare increases.

Eurozone Inflation Confirmed At 2.2%, Core Falls

- Eurozone HICP jumped to 2.2% in July from 1.9% in June, confirming the earlier flash estimate, taking inflation to its highest level since October 2018. However, inflation declined by 0.1% between June and July, Eurostat said Wednesday.

- Energy costs rose by an annual rate of 14.3%, adding 1.34 percentage point to inflation.

- Excluding food, energy, alcohol and tobacco, core inflation declined by 0.4% m/m in July, pushing the annual rate to 0.7%, down from 0.9% a month earlier, and well below the ECB's new target of 2.0%.

- ECB President Christine Lagarde has been relaxed about the rise in inflation, stressing that HICP is expected to fall to an annual rate of 1.4% by the end of the Bank's forecast period in 2023.

- However, national central banks, not least the Bundesbank, may be a bit more anxious about rising prices. German inflation rose by 3.1%, up from 2.1% in June, matching the flash estimate.

- French inflation declined to 1.5% from 1.9%, while Italian inflation fell to 1.0% (+1.3% in June) and Spanish prices rose by 2.9% (+2.5% in June).

FIXED INCOME: FOMC Minutes in focus later

Core fixed income has drifted higher through the European morning session but remains within yesterday's ranges and Treasuries, Bunds and gilts all remain below the levels seen prior to yesterday's retail sales data (which saw fixed income sell-off despite coming in below consensus expectations).

- The highlight of the morning session was UK inflation data that saw headline CPI and core CPI both come in two tenths below expectations, but RPI came in two tenths above expectations. There has been little market reaction to the release, with inflation still expected to pick up later this year. Even UK inflation breakevens have not risen on the back of higher RPI data.

- Looking ahead, the FOMC Minutes will be the highlight later today, with some market participants looking for hints as to whether Jackson Hole will bring tapering talk, or if that decision is to be pushed later into the year (or even next year).

- TY1 futures are down -0-1+ today at 134-07 with 10y UST yields up 0.3bp at 1.266% and 2y yields down -0.3bp at 0.212%.

- Bund futures are up 0.22 today at 177.02 with 10y Bund yields down -1.5bp at -0.487% and Schatz yields down -0.8bp at -0.749%.

- Gilt futures are up 0.15 today at 130.01 with 10y yields down -1.4bp at 0.547% and 2y yields down -1.5bp at 0.129%.

FOREX: NZD Downside in Focus as RBNZ Blink in Face of COVID Spread

- Following further confirmation of COVID spread in New Zealand, the RBNZ opted against any change to policy, keeping rates unchanged at 0.25%. This prompted broad selling pressure in NZD/USD down to 0.6870, but this losses were swiftly reversed as the bank pointed toward October as the next meeting at which rates will likely be raised.

- The USD traded softer overnight, but ranges have been relatively contained - typified by EUR/USD's 20 pip bounce off the overnight lows of 1.1702. The low print in the pair is worth watching, showing signs that markets are putting key support at 1.1704/02 under pressure. A break through here in European or US hours would be more notable, opening losses toward 1.1603 and putting the pair at the lowest level since November last year.

- UK inflation data was mixed, with CPI coming in below forecast while RPI beat expectations. Most CPI measures missed by 0.2ppts or so, pressing GBP/USD toward the overnight lows, but the weakness has largely been erased ahead of the NY crossover.

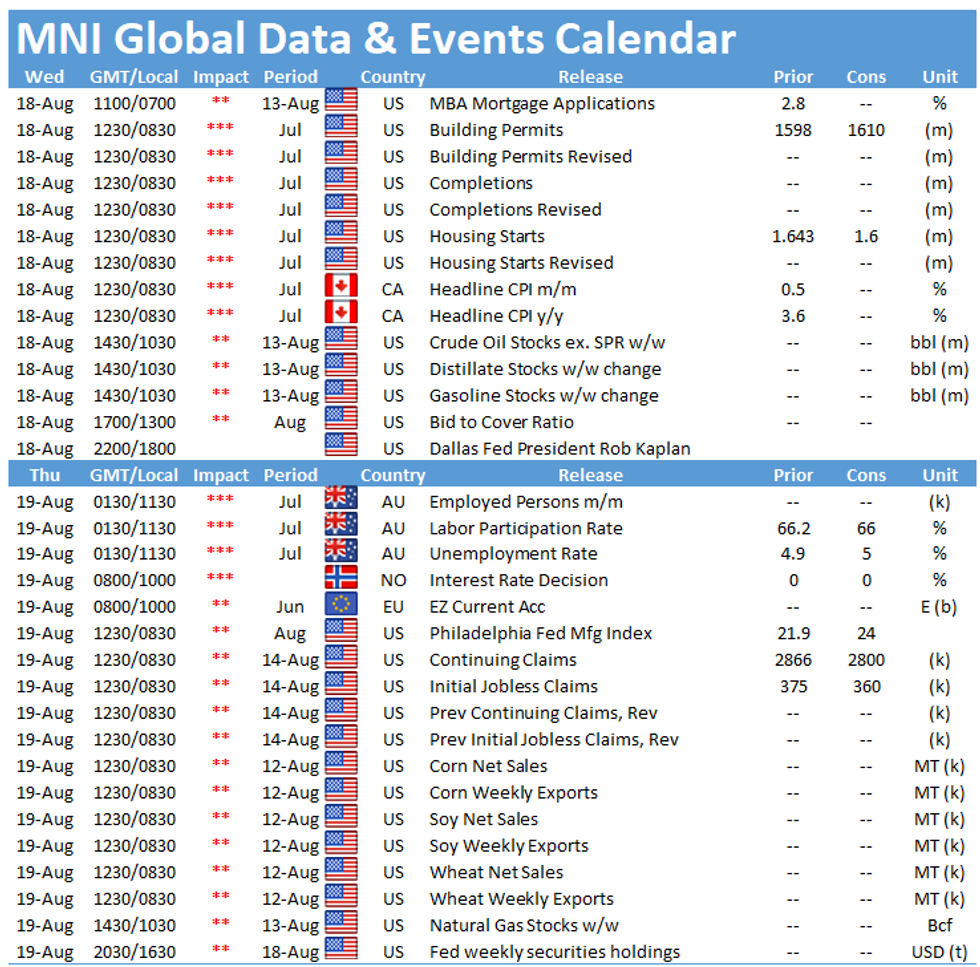

- US housing starts, building permits & Canadian CPI are the data highlights. FOMC minutes are also due.

EQUITIES: Europe Fades After Asia Rebound

- Asian stocks closed higher, with Japan's NIKKEI up 161.44 pts or +0.59% at 27585.91 and the TOPIX up 8.34 pts or +0.44% at 1923.97. China's SHANGHAI closed up 38.31 pts or +1.11% at 3485.286 and the HANG SENG ended 121.14 pts higher or +0.47% at 25867.01

- European equities have faded earlier intraday highs, with the German Dax down 38.22 pts or -0.24% at 15897.26, FTSE 100 down 28.61 pts or -0.4% at 7185.94, CAC 40 down 24.49 pts or -0.36% at 6818.69 and Euro Stoxx 50 down 11.14 pts or -0.27% at 4185.22.

- U.S. futures are weaker, with the Dow Jones mini down 65 pts or -0.18% at 35194, S&P 500 mini down 4.75 pts or -0.11% at 4438.75, NASDAQ mini down 7.75 pts or -0.05% at 14989.75.

COMMODITIES: Broad Gains As Dollar Slips

- WTI Crude up $0.26 or +0.39% at $66.97

- Natural Gas down $0.01 or -0.31% at $3.81

- Gold spot up $1.49 or +0.08% at $1792.94

- Copper up $0.9 or +0.21% at $422.75

- Silver up $0.08 or +0.34% at $23.7951

- Platinum up $8.65 or +0.87% at $1011.08

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.