-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI US MARKETS ANALYSIS - Risk Recovery Contained as Russia Cut Flows

Highlights:

- Risk recovery contained as Gazprom cut supplies to Poland, Bulgaria

- Equity futures modestly higher on solid earnings

- Treasury curve sits higher ahead of 2y FRN and 5y bond sales

US TSYS SUMMARY: Demand Fears Ease, Double Note Auction Day

- Volatility continues as cash Tsys sell off through Asia and Europe sessions after yesterday’s rally saw 2YY down 15bps.

- Demand fears take a step back on signs of stabilisation in China’s Covid outbreaks despite German and French consumer confidence sliding further.

- Continued clashing headlines on the extent of European countries paying in RUB for Russian gas but the net impact is likely inflationary – the US may have limited direct linkages but modestly higher breakevens lead the move higher in nominal yields.

- 2YY +4.4bps at 2.553%, 5YY +5.0bps at 2.783%, 10YY +4.4bps at 2.763%, 30YY +3.2bps at 2.860%.

- TYM2 sits within yesterday’s range at 120-04, up just 2+ ticks having seen a rally and then subsequent unwind since yesterday’s settlement. Volumes remain close to average.

- Light data docket with MBA mortgage data and wholesale inventories the more important.

- Bill issuance: US Tsy $30B 119D bills at 1130ET

- Bond issuance: US Tsy $24B 2Y FRN note auction (91282CEL1) at 1130ET after yesterday’s decent 2Y Note auction, followed US Tsy 49B 5Y Note auction (91282CEN7) at 1300ET

STIR FUTURES: Fed Pricing Back Up Near Yesterday AM Levels

- Pricing a 51bp hike for the May meeting, 106bp for June, 192bp for Sep and 238bp to year-end.

- Light data docket but the MBA mortgage data could be of note after the 30Y contract rate last week touched the highest since Apr-2010 at 5.20%.

- The Senate confirmed Brainard as Vice Chair yesterday (52-43) as expected but the vote for the three other nominees could be delayed with Covid absences preventing Democrats from proceeding with Cook’s vote.

Source: Bloomberg

Source: Bloomberg

EGB/GILT SUMMARY: Gazprom Supply Cut Further Fuels Inflation Concerns

European government bonds have lacked strong direction this morning while equities have broadly pushed higher.

- Gazprom's decision to cut gas supplies to Poland and Bulgaria has provided a further jolt for energy prices.

- German and French consumer confidence data for May and April, respectively, came in lower than expected as price pressures continue to intensify.

- Gilts have traded lower with yields up 2-4bp and the curve slightly bear flattening.

- The bund curve has twist flattened with the 2s30s spread narrowing 3bp.

- OATs have traced out a similar path with the curve flattening 3bp.

- BTPs have traded weaker across the curve with cash yields up 2-3bp.

- Supply this morning came from Germany (Bund, EUR1.704bn allotted), Italy (BOTs, EUR5bn) and Greece (GTBs, EUR625mn). In addition, the UK sold GBP1.8bn of the 0.125% Mar-73 via syndication with an order book in excess of GBP20.5bn.

EUROPE ISSUANCE UPDATE:

Germany allots E1.704bln 1.00% May-38 Bund, Avg yield 0.99% (Prev. 0.37%), Bid-to-cover 1.20x (Prev. 2.32x)

GILT SYNDICATION: 0.125% Mar-73 linker Final terms

- Tap Size set at GBP1.8bln (MNI had expected GBP1.5-1.6bln, so a bit larger than expected)

- Final orderbook in excess of GBP20.5bln

- Spread set earlier at 0.125% Mar-2068 linker -5.75bps (guidance was-5.75/-5.25bps)

Spread set at MS+110bps (guidance was MS +115 bps area)

Orderbooks over E5.8bln (inc E325mln JLM interest)

EUROPE OPTION FLOW SUMMARY

Eurozone:

OEM2 128.50/129.50cs 1x2, bought for 6.5 in 2.5k

OEM2 128.00/127.00/126.00p ladder, sold at 23 in 2k

ERM2 100.25/100.375cs sold at 5.25 in 2.5k

SX7E (17th June) 105/110cs, bought for 0.10 in 8k

US:

TYM2 118.5p, bought for '29 in 6k

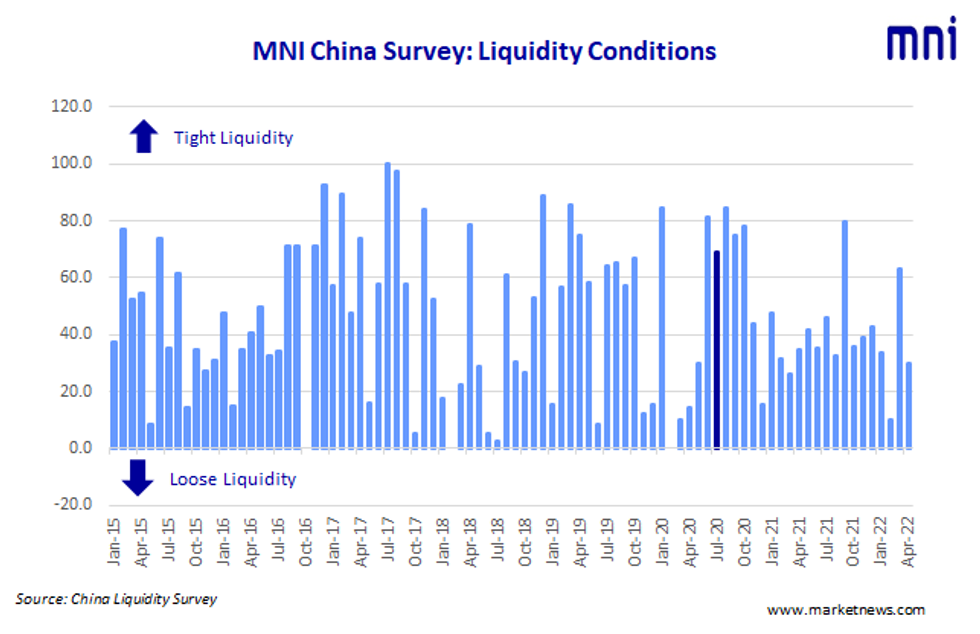

MNI China Liquidity Index™– Falls To 30.0 in April

Liquidity conditions across China’s interbank markets eased in April, boosted by the central bank cutting banks’ reserve requirement ratio in order to boost a slowing economy, the latest MNI Liquidity Condition Index shows.

The Liquidity Condition Index stood at 30.0 in April, easing from 63.3 in March, with 40.0% of traders reporting an improvement in conditions. The higher the index reading, the tighter liquidity appears to survey participants.

- The Economy Condition Index stood at 26.7, recovering from March's slide to 21.7, despite Covid concerns.

- The PBOC Policy Bias Index remained below 50 for an 10th consecutive month.

- The Guidance Clarity Index was little changed, as respondents again claim to understand the signals from the PBOC.

The MNI survey collected the opinions of 30 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions.

Interviews were conducted April 11 – April 22.

Click below for the full press release:

MNI China Liquidity Index -2022-04 presser.pdf

For full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.com

FOREX: Gas Flow Fallout Contained to Regional FX So Far

- Gas flows across eastern Europe have been the focus of trade so far after reports late yesterday that Poland had been cut off from Russian gas supply proved true this morning, with Bulgarian access also being severed as the countries refused to pay RUB for Russian energy exports. The development has prompted an emergency meeting of EU energy ministers, who are set to debate the current sanctions rules that may prompt more nations to drop Russian supply entirely ahead of the next payment deadlines on May 15th.

- For now, the market response has been contained to regional currencies (PLN holds the bulk of yesterday's sharp losses), with AUD, NZD and SEK mildly firmer this morning, while JPY, EUR trade lower.

- GBPUSD traded to a fresh cycle low this morning, clearing 1.2974, Apr 13 low, as well as 1.2676 last printed in September 2020. The trend is in technically oversold territory: the 14d RSI is now at 22 - the lowest point since March 2020 and the initial wave of lockdowns that followed COVID.

- In a reversal of yesterday's outperformance, JPY is the poorest performing currency in G10, helping USD/JPY climb back toward the Y128.00 level. USDJPY remains in an overarching consolidation phase as bulls pause after the recent rally. This sideways activity highlights the formation of a bull flag, reinforcing bullish conditions with the uptrend still intact. The focus on 129.44 next, a Fibonacci projection.

- US trade balance data and pending home sales numbers for March are the data highlights Wednesday. Central bank speakers include ECB's Lagarde and Bank of Canada's Macklem after the market close.

FX OPTIONS: Expiries for Apr27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E1.2bln), $1.0700-10(E1.0bln), $1.0800(E1.5bln), $1.0900(E1.4bln)

- USD/JPY: Y126.75($540mln)

- GBP/USD: $1.2900(Gbp1.1bln)

- AUD/USD: $0.7450(A$1.9bln)

- NZD/USD: $0.6735(N$1.4bln), $0.6835(N$1.8bln)

- USD/CNY: Cny6.5000($700mln)

Price Signal Summary - USD Continues To Appreciate

- In the equity space, S&P E-Minis remain vulnerable and yesterday’s sell–off reinforces the current bearish theme. The focus is on; 4129.50, Mar 15 low and 4094.25, Feb 24 and a bear trigger. A break of the latter support would represent an important technical break and strengthen bearish conditions. EUROSTOXX 50 futures remain vulnerable and yesterday’s weakness reinforces the bearish threat. MA studies continue to highlight a bearish trend condition. The focus is on 3551,60 the 61.8% retracement of the Mar 7 - 29 rally.

- In FX, EURUSD remains in a clear downtrend and is trading lower again, today. Recent weakness has resulted in a break of 1.0758, the Apr 14 low and a short-term bear trigger. This confirmed a resumption of the downtrend and opens 1.0577 next, the lower band of the 2.0% 10-dma envelope. GBPUSD remains under pressure following the recent impulsive move lower. The focus is on 1.2495 next, 61.8% retracement of the Mar 2020 - Jan 21 bull leg. USDJPY is unchanged and trend conditions remain bullish. Recent consolidation appears to be a bull flag formation. The focus is on 129.44 next, 0.764 projection of the Feb 24 - Mar 28 - 31 price swing. Sights are also on the psychological 130.00 handle. The DXY remains in a clear uptrend and suggests the USD is likely to appreciate further in the near-term. The recent breach of 100.00 was a positive development and bulls haven’t looked back. Furthermore moving average studies are in a bull-mode, highlighting current sentiment. The daily condition is overbought, however this is not affecting the trend - for now. The focus is on the next key resistance at 102.99, the Mar 20 2020 high.

- On the commodity front, Gold remains vulnerable. The pullback from last week’s high of $1998.4 (Apr 18), highlights a bearish threat and attention is on key support that lies at $1890.2, the Mar 29 low. This has been probed, a break would open $1878.4, the Feb 24 low. In the Oil space, WTI futures recovered from Monday’s low of $95.28. Futures remain vulnerable despite these gains and a resumption of weakness would open $92.60, the Apr 11 low.

- The broader trend condition in the FI space remains bearish. Bund futures potential is for a test, and break, of the 153.00 handle next. Recent gains are considered corrective. Resistance is at 156.29, the 20-day EMA. Gilts traded higher again Tuesday. This suggests scope for a stronger recovery near-term. Futures traded and closed above the 20-day EMA yesterday. Furthermore, price has also breached a trendline resistance drawn from the Mar 1 high. An extension would open the 120.00 handle and 121.11, the 50-day EMA. Initial supp is 118.27, Apr 25 low.

EQUITIES: Limited Bounce After Tuesday's Rout

- Asian equities closed mixed: Japan's NIKKEI closed down 313.48 pts or -1.17% at 26386.63 and the TOPIX ended 17.75 pts lower or -0.94% at 1860.76. China's SHANGHAI closed up 71.856 pts or +2.49% at 2958.282 and the HANG SENG ended 11.65 pts higher or +0.06% at 19946.36

- European stocks are a little higher, with the German Dax up 32.86 pts or +0.24% at 13792.02, FTSE 100 up 17.92 pts or +0.24% at 7403.09, CAC 40 up 9.58 pts or +0.15% at 6421.85 and Euro Stoxx 50 up 12.25 pts or +0.33% at 3733.34.

- U.S. futures are a little higher but still well below Tuesday's open: Dow Jones mini up 324 pts or +0.98% at 33484, S&P 500 mini up 34.5 pts or +0.83% at 4205.25, NASDAQ mini up 110.5 pts or +0.85% at 13127.

COMMODITIES: Energy Prices Rise As Russia-EU Gas Tensions Flare

- WTI Crude up $0.7 or +0.69% at $102.4

- Natural Gas up $0.02 or +0.28% at $6.869

- Gold spot down $11.49 or -0.6% at $1893.78

- Copper up $4.6 or +1.03% at $451.1

- Silver up $0.01 or +0.04% at $23.4873

- Platinum down $7.42 or -0.8% at $916.73

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/04/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/04/2022 | - |  | JP | Bank of Japan policy meeting | |

| 27/04/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/04/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/04/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 27/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 27/04/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/04/2022 | 2230/1830 |  | CA | BOC's Macklem testifies at Senate | |

| 28/04/2022 | 0130/1130 | ** |  | AU | Trade price indexes |

| 28/04/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/04/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/04/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/04/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/04/2022 | 0700/0900 |  | EU | ECB de Guindos Presents Annual Report 2021 | |

| 28/04/2022 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 28/04/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/04/2022 | 0800/1000 |  | EU | ECB publishes May economic bulletin | |

| 28/04/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/04/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/04/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/04/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/04/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 28/04/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/04/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/04/2022 | - |  | JP | Bank of Japan policy meeting | |

| 28/04/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/04/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/04/2022 | 1400/1600 |  | EU | ECB Elderson Panels ECOSOC UN Forum | |

| 28/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 28/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/04/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.