-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Gearing Up For ECB And US CPI

EXECUTIVE SUMMARY:

- CORE FI IS A LITTLE SOFTER HEADING INTO ECB AND US CPI REPORT

- PRESIDENT BIDEN EXPRESSES CONCERN OVER NI PROTOCOL DURING UK VISIT

- G7 LEADERS TO CALL FOR NEW INVESTIGATION BY WHO INTO ORIGINS OF THE CORONAVIRUS

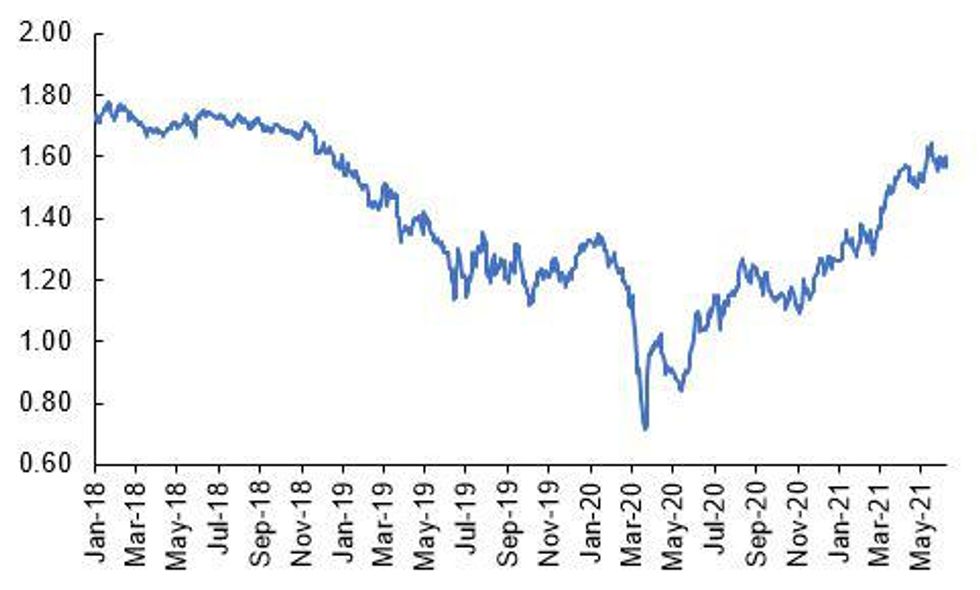

Source: MNI, Bloomberg

NEWS

US-UK (FT): Joe Biden will meet Boris Johnson in person for the first time on Thursday, with hopes over a new US-UK 'Atlantic Charter' undermined by "deep" concerns in Washington over the post-Brexit situation in Northern Ireland. Biden's anxiety was conveyed directly to London earlier this month by America's most senior diplomat in Britain, who warned the UK to stop inflaming tensions in Northern Ireland over new Brexit trading rules.

G7 (GUARDIAN): Leaders at the G7 summit will call for a new, transparent investigation by the World Health Organization into the origins of the coronavirus, according to a leaked draft communique for the meeting. The call was initiated by Joe Biden's administration and follows the US president's decision to expand the American investigation into the origins of the pandemic, with one intelligence agency leaning towards the theory that it escaped from a Wuhan laboratory. The broad consensus among scientific experts remains that the most likely explanation is that Covid-19 jumped to humans from an animal host in a natural event. An on-the-ground investigation by WHO experts earlier this year concluded t it was "extremely unlikely" the pandemic began in a laboratory.

INDIA (REUTERS): An Indian state has raised its COVID-19 death toll sharply higher after the discovery of thousands of unreported cases, lending weight to suspicion that India's overall death tally is significantly more than the official figure. Indian hospitals ran out of beds and life-saving oxygen during a devastating second wave of coronavirus in April and May and people died in parking lots outside hospitals and at their homes. Many of those deaths were not recorded in COVID-19 tallies, doctors and health experts say. India has the second-highest tally of COVID-19 infections in the world after the United States, with 29.2 million cases and 359,676 deaths, according to health ministry data.

DATA

ITALY: Industrial Output Exceeds Pre-Pandemic Levels in April

- Apr SA ind. output +1.8% m/m (Mar revised up + 0.3% m/m), WDA +79.5% y/y

- Apr'21 m/m SA industrial output rose for 5th consecutive month--Istat says

- Apr'21 SA industrial output exceeded pre-pandemic Feb'20 level--Istat says

- Apr SA m/m consumer goods, intermed., capital gds, energy rose—Istat says

- Apr WDA y/y consumer, intermed., capital gds., energy rose--Istat says

- See details MNI main wire for more details.

FIXED INCOME: ECB and US CPI eagerly awaited with core FI a little soft

Cored fixed income is generally a little softer this morning ahead of the week's key events (the ECB policy decision and US CPI release).

- As we note in the MNI ECB Preview, the baseline scenario will see the ECB reaffirm its commitment to conduct PEPP at a higher pace, but could moderate the language from "significantly higher". Staff macroeconomic projections show a modest uptick in the growth and inflation forecasts, with the latter still below target over the medium term and the risk assessment considered 'balanced'. As recently as a couple of weeks ago the market had started to position for a potential slowdown in purchases but price action over the past few days suggests there has been some decent position squaring ahead of today's meeting.

- In terms of US CPI, April's upside inflation surprise is unlikely to be repeated in the May data due today at 13:30BST/8:30ET, at least on a month-on-month basis. But U.S. CPI is set to grow 0.5% following a 0.8% gain in April, according to the Bloomberg survey. From a year earlier, CPI is forecast to increase 4.7% - the fastest since 2008 (and up from 4.2% in April).

- Gilts are outperforming Bunds and Treasuries this morning after more focus on the Northern Ireland trade debate between the EU and UK (with Biden potentially getting involved at the G7).

- TY1 futures are down -0-3+ today at 132-21 with 10y UST yields up 0.5bp at 1.497% and 2y yields up 0.2bp at 0.158%.

- Bund futures are down -0.13 today at 172.43 with 10y Bund yields up 0.3bp at -0.242% and Schatz yields down -0.1bp at -0.683%.

- Gilt futures are down -0.01 today at 127.92 with 10y yields up 0.1bp at 0.731% and 2y yields up 0.5bp at 0.058%.

FOREX: NOK Drops as CPI Slips One Week Ahead of Rate Projections

- Major G10 FX are largely rangebound early Thursday, with markets sitting on the sidelines ahead of tier 1 data releases and the ECB decision later today.

- EUR/USD has inched further off the Wednesday high, but remains above 1.2150 and nearby support. The 50-day EMA undercuts at 1.2108 and marks the first major downside level ahead of the Jun 4 low at 1.2104.

- The Norwegian policy mix became slightly more complicated this morning on the release of a set of lower than expected inflation numbers. This comes ahead of next week's Norges Bank decision, at which the bank are expected to provide their thoughts on whether a rate hike could occur as soon as September. EUR/NOK has rallied sharply following the release, with the cross narrowing in on the Friday high of 10.1784.

- Focus turns to the ECB rate decision. While no major policy changes are expected, markets will likely pay very close attention to any language surrounding the use of the bank's PEPP asset purchase programme,. Traders look to gauge just how and when the Bank will wean markets off extraordinary monetary policy.

EQUITIES: LEVELS UPDATE: Only minor movements this morning

- Japan's NIKKEI up 97.76 pts or +0.34% at 28958.56 and the TOPIX down 0.41 pts or -0.02% at 1956.73

- China's SHANGHAI closed up 19.463 pts or +0.54% at 3610.859 and the HANG SENG ended 3.75 pts lower or -0.01% at 28738.88

- with the German Dax down 6.07 pts or -0.04% at 15574.8, FTSE 100 up 21.38 pts or +0.3% at 7102.7, CAC 40 down 11.47 pts or -0.17% at 6551.12 and Euro Stoxx 50 down 1.52 pts or -0.04% at 4095.59.

- Dow Jones mini up 42 pts or +0.12% at 34478, S&P 500 mini up 2 pts or +0.05% at 4220, NASDAQ mini down 24.75 pts or -0.18% at 13787.75.

COMMODITIES: Copper lower while natgas higher

- WTI Crude up $0.02 or +0.03% at $69.92

- Natural Gas up $0.03 or +1.02% at $3.16

- Gold spot down $6.35 or -0.34% at $1882.55

- Copper down $7.55 or -1.67% at $445.3

- Silver down $0.08 or -0.28% at $27.694

- Platinum down $8.67 or -0.75% at $1144.85

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.