-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

USD/CNH Edges Off Recent Highs, But Volatility Remains Very Low

CNH marginally underperformed the dollar pull back post the Asia close on Wednesday. We sit near 7.3350 in early Thursday dealings, with Wednesday NY session dips sub 7.3300 supported. CNH finished the session a touch stronger (while the BBDXY slipped 0.18%). USD/CNY closed at 7.3160, still wedged under 7.3200. The CNY NEER (J.P. Morgan Index) firmed a touch to 123.77 (+0.10%). Overall yuan volatility remains very low.

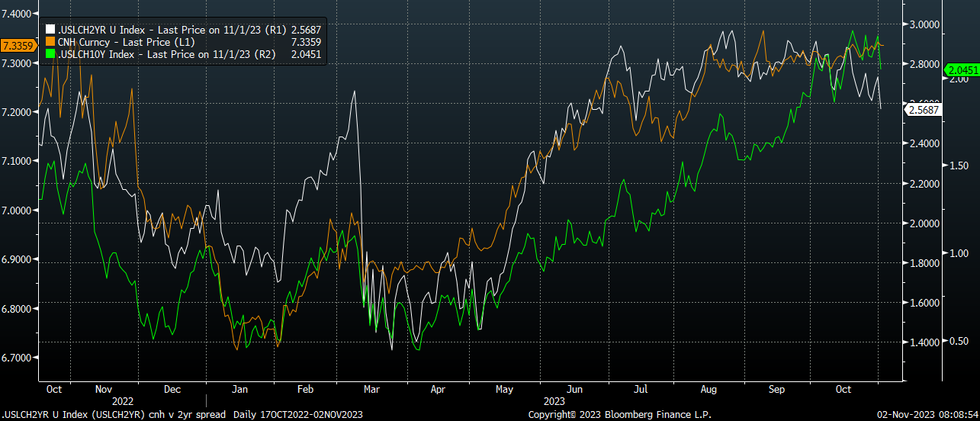

- USD/CNH looks too elevated relative to the sharp pull in US-CH yield differentials (see the chart below), with US yields slumping post data misses (ISM and ADP) and after Fed Chair Powell stating that the central bank had come a long way in terms of the current tightening cycle.

- Some offset is coming from the weaker run of PMIs this week. This has arguably dragged on local equity performance. The Golden Dragon Index lost 1.43% in Wednesday US trade. This comes after relatively flat closes for onshore equities yesterday.

- Data yesterday also revealed that outstanding property loans contracted (on an annual basis) for the first time. The PBoC did note the slowdown is stabilizing (see this BBG link).

- The local data calendar is empty today, with the Caixin services PMI out tomorrow, along with current account data for Q3.

- A reported meeting between President Xi and US President Biden is scheduled for November, although the China Foreign Minister stated yesterday that the path to such a meeting "cannot rely on autopilot" (see this BBG link).

Fig 1: USD/CNH Versus US-CH 2yr and 10yr Interest Rate Differentials

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.